Key Insights

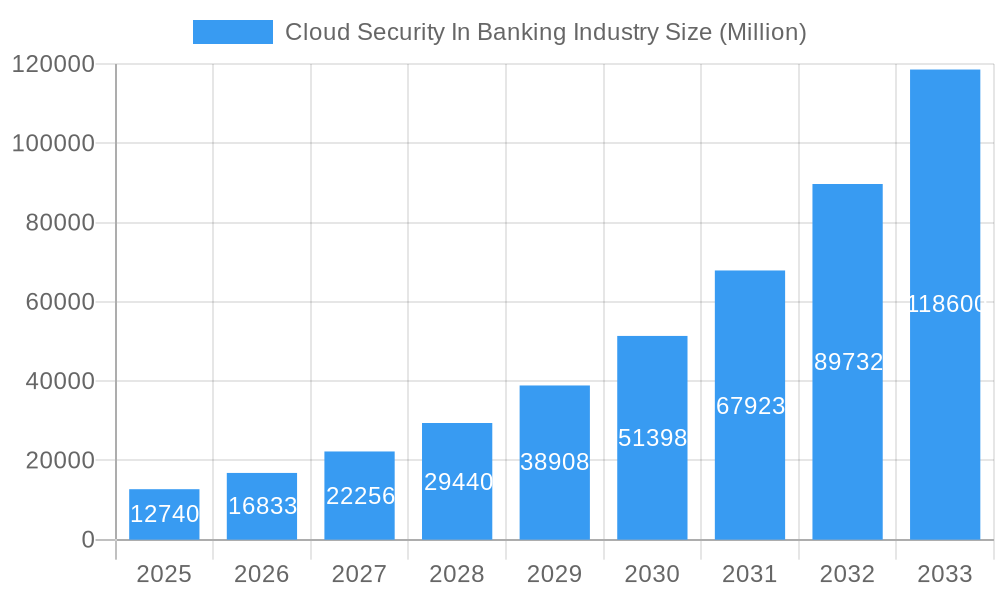

The Cloud Security in the Banking Industry is poised for explosive growth, with a remarkable market size of approximately $12,740 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 33.10% through 2033. This surge is primarily fueled by the escalating need for robust protection against sophisticated cyber threats that target sensitive financial data and critical infrastructure. The increasing adoption of cloud-based solutions by banks and financial institutions, driven by their inherent scalability, agility, and cost-efficiency, further propels this market. Key drivers include the growing volume of digital transactions, the proliferation of mobile banking, and the stringent regulatory compliance demands placed upon the financial sector. These factors compel institutions to invest heavily in advanced cloud security measures to safeguard customer information, maintain operational continuity, and prevent financial losses arising from data breaches and cyberattacks.

Cloud Security In Banking Industry Market Size (In Billion)

The market is segmenting rapidly, with Cloud Identity and Access Management (IAM) Software, Cloud Email Security Software, and Cloud Network Security Software emerging as critical components of a comprehensive cloud security strategy for financial institutions. The heightened awareness of ransomware, phishing attacks, and insider threats is driving significant demand for these solutions. While the market benefits from strong growth drivers, restraints such as the perceived complexity of cloud security integration, potential vendor lock-in, and the ongoing challenge of finding skilled cybersecurity professionals could temper the pace of adoption in certain areas. However, the overarching trend towards digital transformation within banking, coupled with the continuous evolution of cloud security technologies, ensures a highly dynamic and expanding market landscape. Key players like Google Cloud Platform, Microsoft Azure, and Salesforce are actively innovating, offering specialized cloud security solutions tailored to the unique needs of banks and financial institutions.

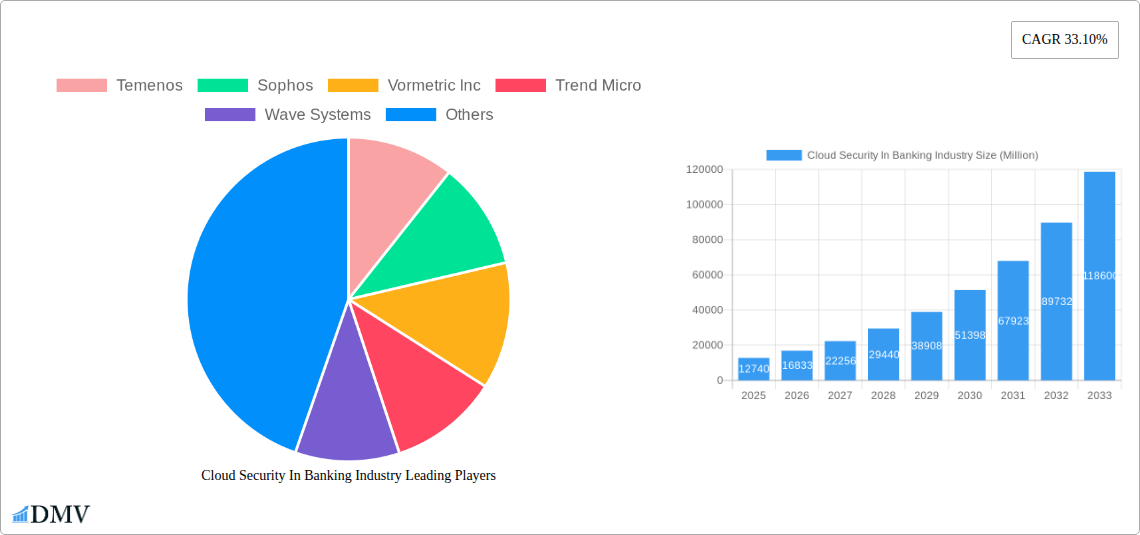

Cloud Security In Banking Industry Company Market Share

This comprehensive report, "Cloud Security In Banking Industry: Market Dynamics, Trends, and Forecast 2019-2033," offers a deep dive into the critical landscape of cybersecurity for financial institutions. With the banking sector increasingly migrating to cloud environments, understanding and implementing robust cloud security solutions is paramount. This analysis covers the study period from 2019 to 2033, with a base year of 2025, and a forecast period from 2025 to 2033, examining historical data from 2019-2024. We dissect the market's composition, identify key trends, and provide an in-depth forecast, equipping stakeholders with actionable insights.

Cloud Security In Banking Industry Market Composition & Trends

The cloud security market within the banking industry is characterized by a dynamic interplay of innovation, stringent regulatory oversight, and evolving threat landscapes. Market concentration varies across segments, with Cloud Identity and Access Management Software and Cloud Network Security Software exhibiting higher adoption rates and a more consolidated vendor presence. Innovation is largely driven by the imperative to combat sophisticated cyber threats and comply with evolving data privacy regulations like GDPR and CCPA. Substitute products, while numerous in the broader cybersecurity space, are increasingly being integrated into comprehensive cloud security platforms. End-user profiles primarily consist of Banks and Financial Institutions, each with unique security requirements and risk appetites. Merger and acquisition (M&A) activities are on the rise as larger players acquire specialized cloud security firms to enhance their offerings and market reach. For instance, M&A deal values in this sector are projected to reach XX Million by 2025, reflecting strategic consolidation.

- Market Share Distribution: Leading players in Cloud Identity and Access Management Software are estimated to hold approximately 60% of the segment's market share by 2025.

- Innovation Catalysts: The increasing sophistication of ransomware attacks and data breaches are key drivers for advancements in AI-powered threat detection.

- Regulatory Landscapes: Compliance with PCI DSS and Basel III directives significantly shapes product development and adoption strategies.

- Substitute Products: While traditional on-premise solutions exist, the agility and scalability of cloud-native security tools are leading to their phased replacement.

- End-User Profiles: Large multinational banks often require highly customized, enterprise-grade security solutions, while smaller financial institutions may opt for more integrated and cost-effective platforms.

- M&A Activities: Key M&A targets include companies specializing in cloud threat intelligence and secure cloud migration services.

Cloud Security In Banking Industry Industry Evolution

The evolution of cloud security within the banking industry has been a rapid and transformative journey, mirroring the broader digital acceleration experienced by financial institutions. From the early stages of simply migrating infrastructure to the cloud, the focus has shifted dramatically towards securing sensitive financial data and critical operations in these distributed environments. This evolution is characterized by a significant upward trajectory in market growth, driven by increasing cyber threats and the inherent advantages of cloud computing. Technological advancements have been relentless, with the adoption of Artificial Intelligence (AI) and Machine Learning (ML) becoming standard for anomaly detection and predictive security. Cloud Identity and Access Management (IAM) solutions have matured significantly, moving beyond basic authentication to offer sophisticated, context-aware access controls and granular permissions. Similarly, Cloud Intrusion Detection and Prevention Systems (IDPS) are now more adept at identifying and mitigating complex attack vectors in real-time, processing an estimated XX Million threat alerts per day.

The demand for enhanced security has been directly influenced by a series of high-profile cyberattacks on financial institutions, underscoring the vulnerabilities associated with inadequate cloud security. This has led to a surge in investment in advanced security solutions, with the global cloud security market for banking projected to reach a market size of XX Million by 2033. Adoption metrics for advanced cloud security solutions, such as Cloud Encryption Software and Cloud Email Security Software, have seen exponential growth, with an estimated XX Million new implementations in the last five years. The increasing reliance on cloud platforms for core banking functions, customer relationship management (CRM) systems like Salesforce, and data storage solutions from providers like Boxcryptor, further amplifies the need for robust cloud security. Furthermore, the rise of specialized cloud banking platforms like nCino necessitates tailored security strategies. The ongoing digital transformation of the banking sector, coupled with the proliferation of remote work and the use of cloud collaboration tools, has created a persistent demand for comprehensive cloud security solutions. The market is also witnessing a trend towards integrated security platforms offered by major cloud providers such as Google Cloud Platform and Microsoft Azure, alongside specialized cybersecurity vendors like Sophos, Temenos, and Trend Micro. This evolution reflects a proactive approach by financial institutions to safeguard their digital assets and maintain customer trust in an increasingly interconnected world, with an estimated XX Million dollars invested in cloud security by banks globally in 2024.

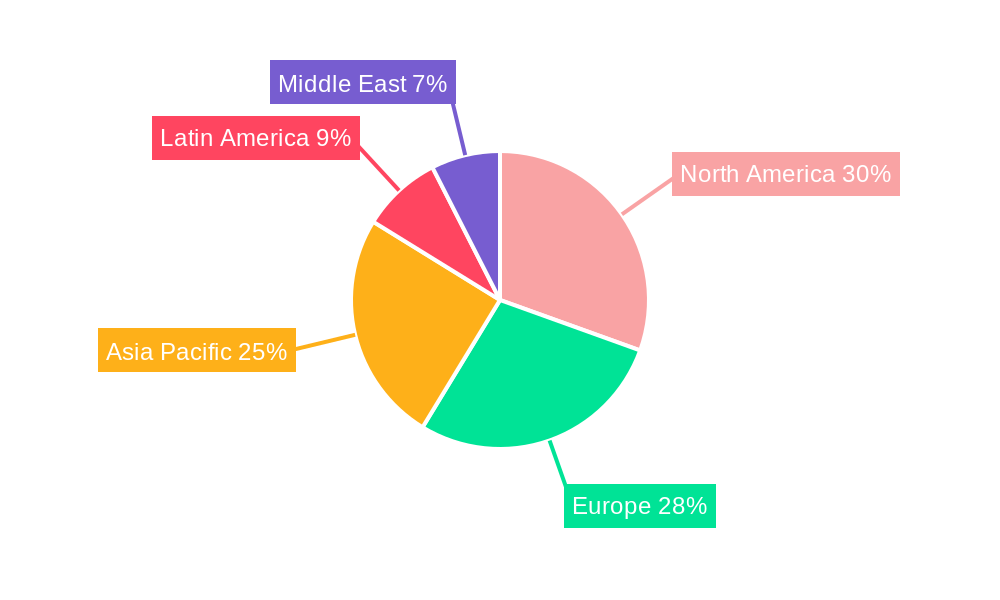

Leading Regions, Countries, or Segments in Cloud Security In Banking Industry

The dominance in the Cloud Security In Banking Industry is a multifaceted phenomenon, with specific segments and geographical regions exhibiting pronounced leadership due to a confluence of factors including investment trends, regulatory support, and the sheer volume of financial transactions. Among the Type of Software, Cloud Identity and Access Management Software consistently leads, driven by the critical need for stringent access controls and granular permissions to protect sensitive financial data. This segment is projected to capture approximately 35% of the overall market share by 2025, with an estimated market value of XX Million. The increasing complexity of user roles and the rise of remote banking necessitate robust IAM solutions. Following closely is Cloud Network Security Software, essential for safeguarding the vast and interconnected networks of financial institutions. The adoption of this software is expected to reach XX Million by 2033, reflecting its integral role in maintaining network integrity and preventing unauthorized access.

Geographically, North America, particularly the United States, stands out as the leading region. This dominance is fueled by several key drivers:

- High Financial Sector Investment: US banks and financial institutions consistently invest heavily in advanced technologies, including cutting-edge cloud security solutions. The total investment in cloud security by US financial institutions is estimated to exceed XX Million annually.

- Stringent Regulatory Environment: The presence of robust regulatory frameworks such as the Gramm-Leach-Bliley Act (GLBA) and the New York Department of Financial Services (NYDFS) Cybersecurity Regulation compels financial institutions to adopt advanced security measures, including sophisticated cloud security.

- Early Adoption of Cloud Technologies: North America has been at the forefront of cloud adoption across industries, including banking, creating a mature market for cloud security solutions.

- Concentration of Major Financial Institutions: The region hosts a significant number of global financial giants, which are early adopters and major purchasers of high-end cloud security products and services.

In terms of End-User Type, Banks represent the largest segment of consumers for cloud security solutions. Their inherent need to protect vast amounts of customer data, comply with strict financial regulations, and maintain operational continuity makes them prime targets and thus highly motivated buyers. The demand from Financial Institutions, encompassing credit unions, investment firms, and insurance companies, is also substantial and growing. These entities are increasingly leveraging cloud technologies to enhance efficiency and customer service, thereby increasing their exposure to cloud-based threats and consequently their demand for specialized cloud security. The market for Cloud Intrusion Detection and Prevention System is also a significant contributor, with an estimated market size of XX Million in 2025. While Cloud Email Security Software and Cloud Encryption Software are crucial components, their market size, while growing, is proportionally smaller compared to IAM and network security, reflecting their more specific application within the broader cloud security strategy. The overall market value for cloud security in banking is projected to reach XX Million by 2033, with North America alone accounting for an estimated XX Million of this value.

Cloud Security In Banking Industry Product Innovations

Product innovations in cloud security for banking are rapidly advancing, focusing on proactive threat detection, automated response, and seamless integration. Key advancements include AI-driven anomaly detection engines that can identify subtle deviations from normal user behavior, preventing insider threats and sophisticated attacks. Solutions like Sophos's Intercept X for Server offer advanced endpoint protection in cloud environments, while Vormetric Inc. (now Thales) continues to innovate in data encryption and key management. Companies are developing cloud-native security platforms that offer unified visibility and control across multi-cloud environments, addressing the complexities faced by financial institutions. Performance metrics such as reduced false positive rates for intrusion detection systems, achieving below 0.1%, and faster incident response times, often measured in minutes rather than hours, are key indicators of these technological leaps.

Propelling Factors for Cloud Security In Banking Industry Growth

Several critical factors are propelling the growth of the cloud security market in the banking industry. The ever-increasing sophistication and frequency of cyberattacks, including advanced persistent threats (APTs) and ransomware, create an urgent need for robust cloud security solutions. Furthermore, stringent regulatory compliance mandates from bodies like the SEC, FINRA, and global data protection authorities necessitate significant investment in secure cloud infrastructure. The widespread adoption of digital banking services and the migration of core banking functions to the cloud by institutions like nCino amplify the attack surface, driving demand for specialized cloud security. Economic factors such as the pursuit of operational efficiency and cost savings through cloud adoption also indirectly boost security investments, as secure cloud environments are fundamental to realizing these benefits.

Obstacles in the Cloud Security In Banking Industry Market

Despite the robust growth, the cloud security market in the banking industry faces significant obstacles. Regulatory complexity and evolving compliance requirements across different jurisdictions pose a substantial challenge, requiring continuous adaptation and investment. The shortage of skilled cybersecurity professionals, particularly those with expertise in cloud security, limits the ability of financial institutions to effectively implement and manage advanced security solutions, impacting an estimated XX Million potential projects. Supply chain risks, inherent in the interconnected nature of cloud services and third-party software providers like Temenos and Salesforce, can introduce vulnerabilities. Competitive pressures among cloud providers and security vendors, while fostering innovation, can also lead to market fragmentation and decision fatigue for financial institutions. The estimated financial impact of these obstacles, through delayed projects and increased operational overhead, is projected to be in the range of XX Million annually.

Future Opportunities in Cloud Security In Banking Industry

The future holds immense opportunities for cloud security in the banking industry. The expansion of cloud adoption into new areas, such as blockchain-based financial services and decentralized finance (DeFi), presents novel security challenges and demands innovative solutions. The increasing adoption of AI and machine learning for threat prediction and automated remediation offers a significant growth avenue. Furthermore, the growing demand for cloud-agnostic security solutions that provide consistent protection across hybrid and multi-cloud environments creates opportunities for specialized vendors. The burgeoning market for secure cloud migration services, assisting banks in their transition, also represents a substantial untapped potential, with an estimated market value of XX Million in the coming years.

Major Players in the Cloud Security In Banking Industry Ecosystem

- Temenos

- Sophos

- Vormetric Inc

- Trend Micro

- Wave Systems

- Google Cloud Platform

- Microsoft Azure

- Salesforce

- Boxcryptor

- nCino

Key Developments in Cloud Security In Banking Industry Industry

- 2023 Q4: Sophos launches advanced cloud workload protection capabilities, enhancing security for financial institutions running critical applications on AWS and Azure.

- 2024 Q1: Google Cloud Platform announces new compliance certifications specifically tailored for financial services, bolstering trust and security for banking clients.

- 2024 Q2: Trend Micro introduces a new AI-powered threat intelligence platform designed to proactively identify and neutralize emerging threats targeting financial networks.

- 2024 Q3: Temenos enhances its cloud security framework to meet the evolving compliance demands of global financial regulators.

- 2024 Q4: Microsoft Azure expands its security offerings with new data loss prevention (DLP) features for financial data stored in the cloud.

- 2025 Q1: nCino integrates advanced encryption features into its cloud-based lending platform, providing enhanced data protection for financial institutions.

- 2025 Q2: Boxcryptor announces strategic partnerships with leading cloud providers to offer seamless and secure cloud storage solutions for sensitive financial documents.

- 2025 Q3: Vormetric Inc. (Thales) unveils next-generation key management solutions for multi-cloud financial environments.

- 2025 Q4: Wave Systems announces a new secure identity management solution for the financial sector, leveraging advanced biometrics and multi-factor authentication.

- 2026 Q1: Major Banks initiate large-scale deployments of cloud intrusion detection systems, increasing market penetration to an estimated XX Million active deployments.

Strategic Cloud Security In Banking Industry Market Forecast

The strategic outlook for cloud security in the banking industry is exceptionally positive, driven by a confluence of accelerating digital transformation, escalating cyber threats, and increasingly stringent regulatory frameworks. The market is projected for robust growth, with key catalysts including the widespread adoption of AI and machine learning for predictive security analytics, the expansion of secure cloud services for emerging financial technologies like blockchain, and the continuous demand for integrated, multi-cloud security solutions. Financial institutions are expected to continue prioritizing investments in advanced Cloud Identity and Access Management Software and Cloud Network Security Software, with a growing emphasis on Zero Trust architectures. The forecast indicates a market expansion reaching an estimated XX Million by 2033, underscoring the indispensable role of cloud security in the future of banking.

Cloud Security In Banking Industry Segmentation

-

1. Type of Software

- 1.1. Cloud Identity and Access Management Software

- 1.2. Cloud Email Security Software

- 1.3. Cloud Intrusion Detection and Prevention System

- 1.4. Cloud Encryption Software

- 1.5. Cloud Network Security Software

-

2. End-User Type

- 2.1. Banks

- 2.2. Financial Institutions

Cloud Security In Banking Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Security In Banking Industry Regional Market Share

Geographic Coverage of Cloud Security In Banking Industry

Cloud Security In Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 33.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increase in Cyber Security Threat; Cost Reduction

- 3.2.2 Scalability

- 3.2.3 and Efficiency by Cloud Computing

- 3.3. Market Restrains

- 3.3.1. ; Vulnerability to Attacks

- 3.4. Market Trends

- 3.4.1. Cloud Email Security Software to Grow Significantly Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Software

- 5.1.1. Cloud Identity and Access Management Software

- 5.1.2. Cloud Email Security Software

- 5.1.3. Cloud Intrusion Detection and Prevention System

- 5.1.4. Cloud Encryption Software

- 5.1.5. Cloud Network Security Software

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Banks

- 5.2.2. Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Software

- 6. North America Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Software

- 6.1.1. Cloud Identity and Access Management Software

- 6.1.2. Cloud Email Security Software

- 6.1.3. Cloud Intrusion Detection and Prevention System

- 6.1.4. Cloud Encryption Software

- 6.1.5. Cloud Network Security Software

- 6.2. Market Analysis, Insights and Forecast - by End-User Type

- 6.2.1. Banks

- 6.2.2. Financial Institutions

- 6.1. Market Analysis, Insights and Forecast - by Type of Software

- 7. Europe Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Software

- 7.1.1. Cloud Identity and Access Management Software

- 7.1.2. Cloud Email Security Software

- 7.1.3. Cloud Intrusion Detection and Prevention System

- 7.1.4. Cloud Encryption Software

- 7.1.5. Cloud Network Security Software

- 7.2. Market Analysis, Insights and Forecast - by End-User Type

- 7.2.1. Banks

- 7.2.2. Financial Institutions

- 7.1. Market Analysis, Insights and Forecast - by Type of Software

- 8. Asia Pacific Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Software

- 8.1.1. Cloud Identity and Access Management Software

- 8.1.2. Cloud Email Security Software

- 8.1.3. Cloud Intrusion Detection and Prevention System

- 8.1.4. Cloud Encryption Software

- 8.1.5. Cloud Network Security Software

- 8.2. Market Analysis, Insights and Forecast - by End-User Type

- 8.2.1. Banks

- 8.2.2. Financial Institutions

- 8.1. Market Analysis, Insights and Forecast - by Type of Software

- 9. Latin America Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Software

- 9.1.1. Cloud Identity and Access Management Software

- 9.1.2. Cloud Email Security Software

- 9.1.3. Cloud Intrusion Detection and Prevention System

- 9.1.4. Cloud Encryption Software

- 9.1.5. Cloud Network Security Software

- 9.2. Market Analysis, Insights and Forecast - by End-User Type

- 9.2.1. Banks

- 9.2.2. Financial Institutions

- 9.1. Market Analysis, Insights and Forecast - by Type of Software

- 10. Middle East Cloud Security In Banking Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Software

- 10.1.1. Cloud Identity and Access Management Software

- 10.1.2. Cloud Email Security Software

- 10.1.3. Cloud Intrusion Detection and Prevention System

- 10.1.4. Cloud Encryption Software

- 10.1.5. Cloud Network Security Software

- 10.2. Market Analysis, Insights and Forecast - by End-User Type

- 10.2.1. Banks

- 10.2.2. Financial Institutions

- 10.1. Market Analysis, Insights and Forecast - by Type of Software

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Temenos

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sophos

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vormetric Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trend Micro

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wave Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Google Cloud Platform

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Azure

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Salesforce

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boxcryptor

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 nCino

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Temenos

List of Figures

- Figure 1: Global Cloud Security In Banking Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud Security In Banking Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Security In Banking Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 4: North America Cloud Security In Banking Industry Volume (K Unit), by Type of Software 2025 & 2033

- Figure 5: North America Cloud Security In Banking Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 6: North America Cloud Security In Banking Industry Volume Share (%), by Type of Software 2025 & 2033

- Figure 7: North America Cloud Security In Banking Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 8: North America Cloud Security In Banking Industry Volume (K Unit), by End-User Type 2025 & 2033

- Figure 9: North America Cloud Security In Banking Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 10: North America Cloud Security In Banking Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 11: North America Cloud Security In Banking Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Cloud Security In Banking Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Cloud Security In Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Cloud Security In Banking Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Cloud Security In Banking Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 16: Europe Cloud Security In Banking Industry Volume (K Unit), by Type of Software 2025 & 2033

- Figure 17: Europe Cloud Security In Banking Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 18: Europe Cloud Security In Banking Industry Volume Share (%), by Type of Software 2025 & 2033

- Figure 19: Europe Cloud Security In Banking Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 20: Europe Cloud Security In Banking Industry Volume (K Unit), by End-User Type 2025 & 2033

- Figure 21: Europe Cloud Security In Banking Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 22: Europe Cloud Security In Banking Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 23: Europe Cloud Security In Banking Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Cloud Security In Banking Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Cloud Security In Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Cloud Security In Banking Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Cloud Security In Banking Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 28: Asia Pacific Cloud Security In Banking Industry Volume (K Unit), by Type of Software 2025 & 2033

- Figure 29: Asia Pacific Cloud Security In Banking Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 30: Asia Pacific Cloud Security In Banking Industry Volume Share (%), by Type of Software 2025 & 2033

- Figure 31: Asia Pacific Cloud Security In Banking Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 32: Asia Pacific Cloud Security In Banking Industry Volume (K Unit), by End-User Type 2025 & 2033

- Figure 33: Asia Pacific Cloud Security In Banking Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 34: Asia Pacific Cloud Security In Banking Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 35: Asia Pacific Cloud Security In Banking Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Cloud Security In Banking Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Cloud Security In Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Cloud Security In Banking Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Cloud Security In Banking Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 40: Latin America Cloud Security In Banking Industry Volume (K Unit), by Type of Software 2025 & 2033

- Figure 41: Latin America Cloud Security In Banking Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 42: Latin America Cloud Security In Banking Industry Volume Share (%), by Type of Software 2025 & 2033

- Figure 43: Latin America Cloud Security In Banking Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 44: Latin America Cloud Security In Banking Industry Volume (K Unit), by End-User Type 2025 & 2033

- Figure 45: Latin America Cloud Security In Banking Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 46: Latin America Cloud Security In Banking Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 47: Latin America Cloud Security In Banking Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Cloud Security In Banking Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Cloud Security In Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Cloud Security In Banking Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Cloud Security In Banking Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 52: Middle East Cloud Security In Banking Industry Volume (K Unit), by Type of Software 2025 & 2033

- Figure 53: Middle East Cloud Security In Banking Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 54: Middle East Cloud Security In Banking Industry Volume Share (%), by Type of Software 2025 & 2033

- Figure 55: Middle East Cloud Security In Banking Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 56: Middle East Cloud Security In Banking Industry Volume (K Unit), by End-User Type 2025 & 2033

- Figure 57: Middle East Cloud Security In Banking Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 58: Middle East Cloud Security In Banking Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 59: Middle East Cloud Security In Banking Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Cloud Security In Banking Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East Cloud Security In Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Cloud Security In Banking Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 2: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 3: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 4: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 5: Global Cloud Security In Banking Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 8: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 9: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 11: Global Cloud Security In Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 14: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 15: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 16: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 17: Global Cloud Security In Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 20: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 21: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 22: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 23: Global Cloud Security In Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 26: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 27: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 28: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 29: Global Cloud Security In Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Cloud Security In Banking Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 32: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Type of Software 2020 & 2033

- Table 33: Global Cloud Security In Banking Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 34: Global Cloud Security In Banking Industry Volume K Unit Forecast, by End-User Type 2020 & 2033

- Table 35: Global Cloud Security In Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Cloud Security In Banking Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Security In Banking Industry?

The projected CAGR is approximately 33.10%.

2. Which companies are prominent players in the Cloud Security In Banking Industry?

Key companies in the market include Temenos, Sophos, Vormetric Inc, Trend Micro, Wave Systems, Google Cloud Platform, Microsoft Azure, Salesforce, Boxcryptor, nCino.

3. What are the main segments of the Cloud Security In Banking Industry?

The market segments include Type of Software, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Cyber Security Threat; Cost Reduction. Scalability. and Efficiency by Cloud Computing.

6. What are the notable trends driving market growth?

Cloud Email Security Software to Grow Significantly Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Vulnerability to Attacks.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Security In Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Security In Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Security In Banking Industry?

To stay informed about further developments, trends, and reports in the Cloud Security In Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence