Key Insights

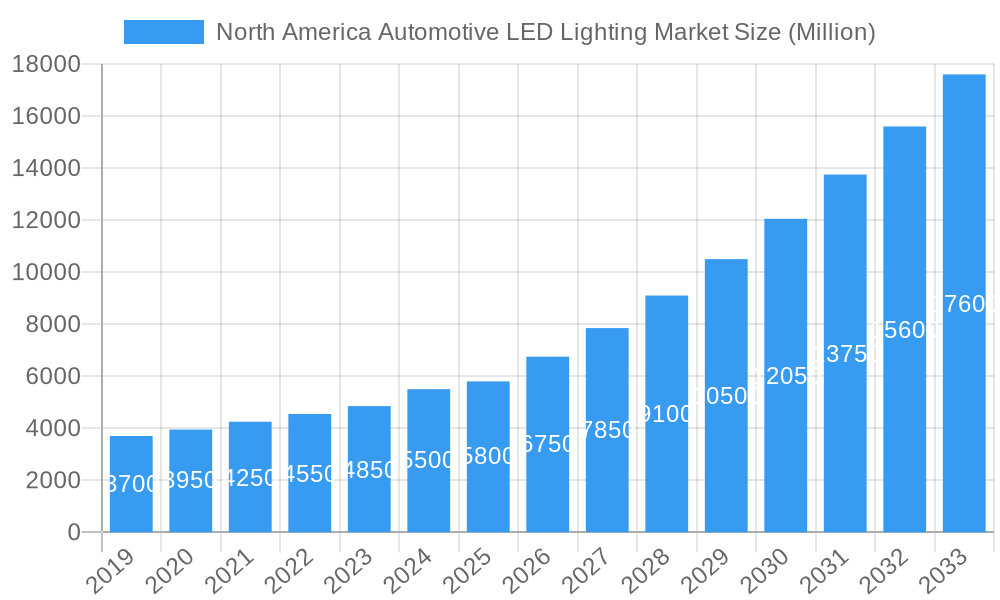

The North American automotive LED lighting market is projected to experience significant expansion. In 2025, the market size is estimated at $42.05 billion and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is driven by increasing consumer demand for advanced safety features, enhanced vehicle aesthetics, and the inherent advantages of LED technology, including superior energy efficiency, extended lifespan, and improved illumination. Regulatory requirements for Daytime Running Lights (DRL) and advanced braking systems also contribute significantly. The automotive utility lighting segment, comprising DRLs, directional signal lights, headlights, and stop lights, is anticipated to lead the market due to its crucial role in vehicle safety and compliance. Passenger cars will likely represent the largest vehicle segment, followed by commercial vehicles and two-wheelers.

North America Automotive LED Lighting Market Market Size (In Billion)

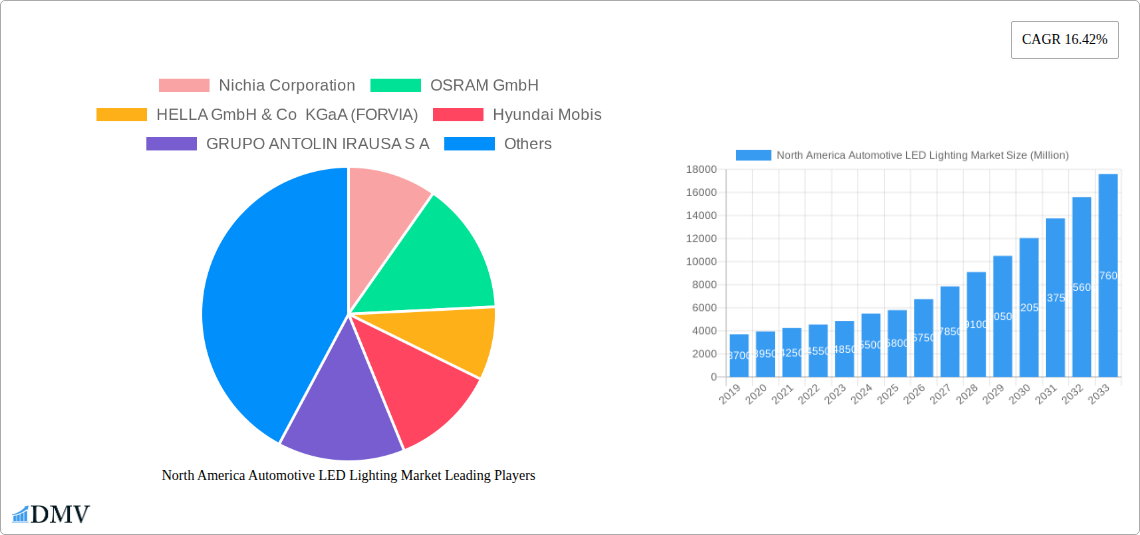

Technological advancements in automotive lighting, such as adaptive headlights, matrix LED technology, and customizable ambient lighting, further support market growth by enhancing both safety and the in-cabin experience. Key industry players like Nichia Corporation, OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), and Hyundai Mobis are actively investing in research and development to introduce innovative products and expand their North American manufacturing presence. Potential challenges include the initial higher cost of LED components compared to traditional lighting, though this gap is narrowing with increasing production volumes. Supply chain intricacies and the requirement for specialized manufacturing expertise may also present obstacles. Nevertheless, the substantial performance, efficiency, and design benefits of LED lighting solidify North America's position as a vital and rapidly developing center for automotive LED innovation.

North America Automotive LED Lighting Market Company Market Share

North America Automotive LED Lighting Market: A Comprehensive Analysis and Forecast (2019–2033)

Unlock the future of automotive illumination with this definitive report on the North America Automotive LED Lighting Market. This in-depth analysis delves into the dynamic landscape of LED lighting solutions, providing critical insights for stakeholders navigating this rapidly evolving sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers unparalleled market intelligence. We meticulously examine market composition, industry evolution, leading regional players, product innovations, growth drivers, obstacles, and future opportunities. With a focus on high-ranking SEO keywords like "automotive LED lighting," "North America market," "headlights," "DRL," "tail lights," and "vehicle lighting," this report is optimized for maximum visibility and stakeholder engagement.

North America Automotive LED Lighting Market Market Composition & Trends

The North America automotive LED lighting market is characterized by a moderate to high degree of market concentration, driven by the presence of established global players and increasing technological integration. Innovation is primarily fueled by advancements in LED chip technology, smart lighting features, and the demand for energy efficiency and enhanced safety. The regulatory landscape plays a pivotal role, with stringent safety standards and fuel economy mandates pushing automakers towards adopting more efficient and advanced lighting solutions. Substitute products, such as traditional halogen and HID lamps, are gradually being phased out due to their lower efficiency and shorter lifespan. End-user profiles are diverse, ranging from major Original Equipment Manufacturers (OEMs) to aftermarket suppliers, all seeking to enhance vehicle aesthetics and functionality. Mergers and acquisition (M&A) activities are anticipated to shape the market further, with estimated M&A deal values contributing to market consolidation.

- Market Share Distribution: Dominated by a few key players, with a growing number of specialized suppliers emerging.

- Innovation Catalysts: Energy efficiency, safety enhancements (e.g., adaptive headlights), design flexibility, and cost reduction.

- Regulatory Landscape: FMVSS, ECE regulations influencing performance and safety standards.

- Substitute Products: Halogen lamps, HID lamps are being displaced by LED technology.

- End-User Profiles: Automotive OEMs, Tier-1 suppliers, aftermarket manufacturers.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach.

North America Automotive LED Lighting Market Industry Evolution

The North America automotive LED lighting market has witnessed a profound evolution, transitioning from niche applications to becoming an indispensable component of modern vehicles. Historically, traditional lighting technologies like incandescent and halogen bulbs dominated the automotive sector. However, the inherent limitations of these technologies, including lower energy efficiency, shorter lifespan, and limited design flexibility, paved the way for the emergence and widespread adoption of Light Emitting Diodes (LEDs). The study period, from 2019 to the present, has seen a remarkable surge in LED penetration across various vehicle segments, driven by escalating consumer demand for enhanced aesthetics, improved safety features, and the pursuit of stricter automotive regulations.

The initial phase of LED adoption in vehicles was primarily observed in premium segments, where automakers leveraged their superior performance and design potential to differentiate their offerings. Early applications included sophisticated daytime running lights (DRLs), taillights, and interior lighting. As LED technology matured and manufacturing costs declined, their integration expanded to more mainstream applications, including headlights and signal lights. The base year, 2025, marks a significant point where LEDs have become a near-ubiquitous standard for new vehicle production, particularly in passenger cars and commercial vehicles.

Technological advancements have been a relentless engine of this evolution. The development of more powerful and efficient LED chips, coupled with innovations in thermal management and optical design, has enabled the creation of smaller, brighter, and more durable lighting systems. This has allowed for sleeker vehicle designs and has facilitated the integration of advanced features such as adaptive front-lighting systems (AFS) and matrix LED headlights, which can dynamically adjust the light beam to optimize visibility without dazzling other drivers. The shift towards electrification has also accelerated this trend, as the lower power consumption of LEDs complements the energy management strategies of electric vehicles (EVs), contributing to extended range.

Consumer demand has also played a crucial role. The aesthetic appeal of LED lighting, with its crisp white light and the ability to create distinctive light signatures, has become a significant design element that influences purchasing decisions. Furthermore, the safety benefits, such as faster illumination of brake lights and improved visibility in adverse weather conditions, are increasingly recognized and valued by consumers. The automotive utility lighting segment, encompassing DRLs, directional signal lights, headlights, reverse lights, stop lights, and taillights, has been at the forefront of this technological revolution, with continuous improvements in performance, durability, and energy efficiency driving market growth. The overall market growth trajectory has been consistently upward, with significant compound annual growth rates (CAGRs) anticipated throughout the forecast period (2025–2033).

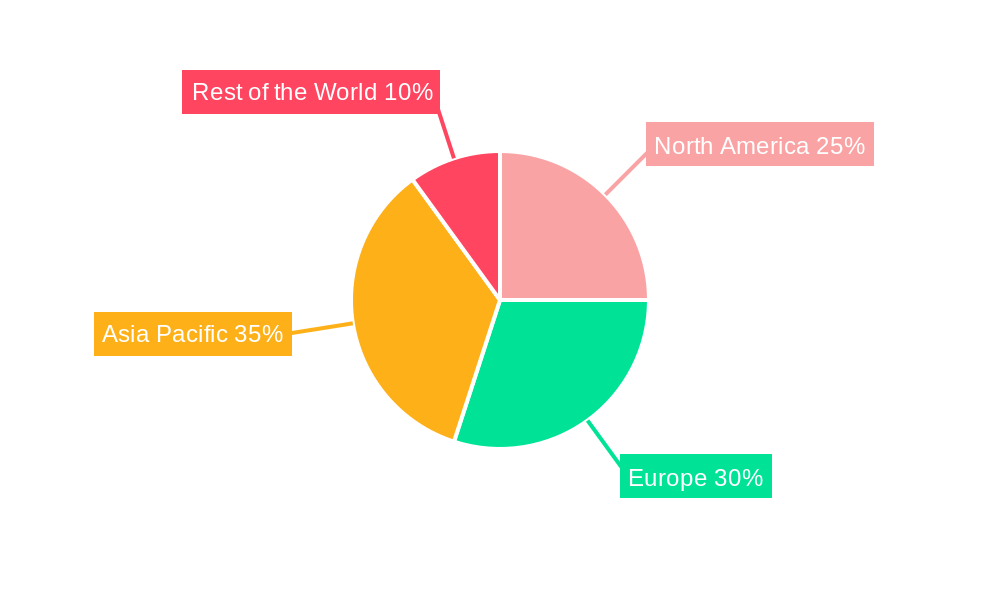

Leading Regions, Countries, or Segments in North America Automotive LED Lighting Market

The North America automotive LED lighting market is a dynamic arena with distinct regional strengths and dominant segments. While the entire continent exhibits robust growth, the United States stands out as the leading country due to its sheer market size, high vehicle production volumes, and a strong consumer appetite for advanced automotive features. Its mature automotive manufacturing ecosystem and significant disposable income further bolster demand for innovative LED lighting solutions.

Within the broader automotive LED lighting landscape, Automotive Vehicle Lighting, specifically Passenger Cars, represents the most dominant segment. This dominance is driven by several key factors:

- High Production Volumes: Passenger cars constitute the largest segment of vehicle sales in North America, naturally leading to higher demand for all their constituent components, including LED lighting.

- Consumer Preference for Aesthetics and Safety: Consumers in the passenger car segment are increasingly prioritizing vehicle aesthetics and advanced safety features. LED lighting offers both, with its ability to create distinctive light signatures and enhance visibility through technologies like adaptive headlights and advanced taillight designs.

- Regulatory Mandates for Safety: Increasingly stringent safety regulations, such as those pertaining to daytime running lights (DRLs) and improved braking visibility, directly benefit LED adoption as they offer superior performance in these areas compared to traditional lighting.

- Technological Integration: Automakers are actively integrating advanced LED lighting features into passenger cars as a differentiator, leading to higher adoption rates. This includes dynamic turn signals, customizable ambient lighting, and sophisticated headlight systems.

Conversely, the Automotive Utility Lighting segment also plays a critical role, with specific applications experiencing significant growth:

- Headlights: As the primary source of illumination for driving, headlights are a major area of innovation and adoption. Advanced LED headlights offer superior brightness, beam pattern control, and energy efficiency.

- Daytime Running Lights (DRL): DRLs are now a mandatory safety feature in many jurisdictions, and LEDs are the preferred technology due to their energy efficiency and distinct visual presence, enhancing vehicle conspicuity during daylight hours.

- Tail Lights: Modern taillight designs increasingly incorporate LED technology for their aesthetic appeal and improved signaling capabilities, especially for brake and turn signals.

While Commercial Vehicles and 2 Wheelers also contribute to the market, their adoption rates and feature sets often lag behind passenger cars due to differing cost considerations and regulatory priorities. However, advancements in LED technology and increasing awareness of safety benefits are gradually driving adoption in these segments as well. The investment trends in North America are heavily skewed towards passenger car platforms, reflecting the current market dynamics. Regulatory support for energy-efficient and safety-enhancing lighting technologies further solidifies the dominance of LED adoption in this segment.

North America Automotive LED Lighting Market Product Innovations

The North America automotive LED lighting market is a hotbed of innovation, with manufacturers continuously pushing the boundaries of performance and design. Key product innovations include the development of advanced Matrix LED headlights, offering unparalleled beam control for optimal night vision without dazzling other road users. Furthermore, the integration of OLED (Organic Light Emitting Diode) technology is emerging, particularly in taillight applications, enabling complex 3D designs and customizable animations for distinctive vehicle styling. The increasing adoption of micro-LED technology promises even greater precision, brightness, and energy efficiency for future headlight systems, as exemplified by joint developments aiming for high-definition lighting. These innovations are not only enhancing vehicle aesthetics but also significantly improving road safety through superior illumination and advanced signaling capabilities, setting new performance metrics for brightness, lifespan, and energy consumption.

Propelling Factors for North America Automotive LED Lighting Market Growth

Several key factors are propelling the growth of the North America automotive LED lighting market. Technological advancements in LED efficiency, brightness, and thermal management are making them more attractive and cost-effective. The increasing emphasis on vehicle safety regulations, such as mandates for DRLs and enhanced braking visibility, directly drives demand for reliable and high-performance LED solutions. Furthermore, the growing consumer preference for vehicle aesthetics and customization makes LED lighting a critical design element. The rising adoption of electric vehicles (EVs) also contributes, as the lower power consumption of LEDs complements EV energy management strategies. Finally, the consistent reduction in LED manufacturing costs makes them increasingly accessible across all vehicle segments.

Obstacles in the North America Automotive LED Lighting Market Market

Despite robust growth, the North America automotive LED lighting market faces certain obstacles. High initial investment costs for advanced LED systems can be a barrier, particularly for lower-cost vehicle segments and aftermarket applications. Complex supply chain management for specialized LED components and the potential for disruptions can also pose challenges. Furthermore, evolving regulatory standards can necessitate frequent product redesigns, adding to development costs and timelines. Intense competition among established players and emerging manufacturers can also put pressure on profit margins. Lastly, the disposal and recycling of LED components present an environmental challenge that needs to be addressed through sustainable practices.

Future Opportunities in North America Automotive LED Lighting Market

The future of the North America automotive LED lighting market is ripe with opportunities. The increasing demand for smart lighting solutions, such as adaptive headlights that respond to traffic and road conditions, presents a significant growth avenue. The integration of LiDAR and sensor technology with LED lighting systems for advanced driver-assistance systems (ADAS) offers further potential. The growing market for autonomous vehicles will necessitate highly sophisticated and reliable lighting systems, creating new demands. Furthermore, the expansion of the aftermarket segment with innovative and retrofittable LED solutions for older vehicles presents a substantial opportunity. The continued push for energy efficiency and sustainability will also drive the adoption of next-generation LED technologies.

Major Players in the North America Automotive LED Lighting Market Ecosystem

- Nichia Corporation

- OSRAM GmbH

- HELLA GmbH & Co KGaA (FORVIA)

- Hyundai Mobis

- GRUPO ANTOLIN IRAUSA S A

- Valeo

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- KOITO MANUFACTURING CO LTD

- ZKW Group

Key Developments in North America Automotive LED Lighting Market Industry

- March 2023: HELLA expanded its Black Magic auxiliary headlamp series with 32 new lightbars. This range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars specifically designed for off-road applications, enhancing product offerings for diverse automotive needs.

- January 2023: HELLA successfully introduced FlatLight technology into series production as a daytime running light. This innovative lighting concept, originally developed for rear combination lamps, has been effectively transferred to the front area of vehicles, with series production slated to commence in 2025, signaling advancements in design integration and functionality.

- January 2023: Nichia Corporation and Infineon Technologies AG announced a significant joint development: a high-definition (HD) light engine featuring over 16,000 micro-LEDs for advanced headlight applications. This collaboration underscores the industry's drive towards ultra-precise and high-performance lighting solutions.

Strategic North America Automotive LED Lighting Market Market Forecast

The strategic outlook for the North America automotive LED lighting market remains exceptionally positive, driven by an ongoing convergence of technological innovation, evolving regulatory demands, and shifting consumer preferences. The increasing sophistication of vehicle designs necessitates advanced lighting solutions that offer both aesthetic appeal and enhanced safety, with LEDs at the forefront of this trend. The forecast period anticipates sustained growth, fueled by the continued integration of smart lighting features such as adaptive headlights and dynamic signaling, which are becoming standard on an increasing number of new vehicle models. Furthermore, the accelerated adoption of electric vehicles will further propel demand for energy-efficient LED lighting. Emerging opportunities in autonomous driving systems and the aftermarket sector are expected to contribute significantly to market expansion, solidifying the indispensable role of LED technology in shaping the future of automotive illumination.

North America Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

North America Automotive LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive LED Lighting Market Regional Market Share

Geographic Coverage of North America Automotive LED Lighting Market

North America Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Security Issues Associated with Mobile Payments

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nichia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OSRAM GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HELLA GmbH & Co KGaA (FORVIA)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hyundai Mobis

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GRUPO ANTOLIN IRAUSA S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marelli Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stanley Electric Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KOITO MANUFACTURING CO LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZKW Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nichia Corporation

List of Figures

- Figure 1: North America Automotive LED Lighting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 2: North America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 3: North America Automotive LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 5: North America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 6: North America Automotive LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive LED Lighting Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the North America Automotive LED Lighting Market?

Key companies in the market include Nichia Corporation, OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), Hyundai Mobis, GRUPO ANTOLIN IRAUSA S A, Valeo, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, KOITO MANUFACTURING CO LTD, ZKW Grou.

3. What are the main segments of the North America Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Security Issues Associated with Mobile Payments.

8. Can you provide examples of recent developments in the market?

March 2023: HELLA expanded Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applicationsJanuary 2023: HELLA introduced FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.January 2023: Nichia Corporation and Infineon Technologies AG announced the joint development of a high-definition (HD) light engine with more than 16,000 micro-LEDs for headlight applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the North America Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence