Key Insights

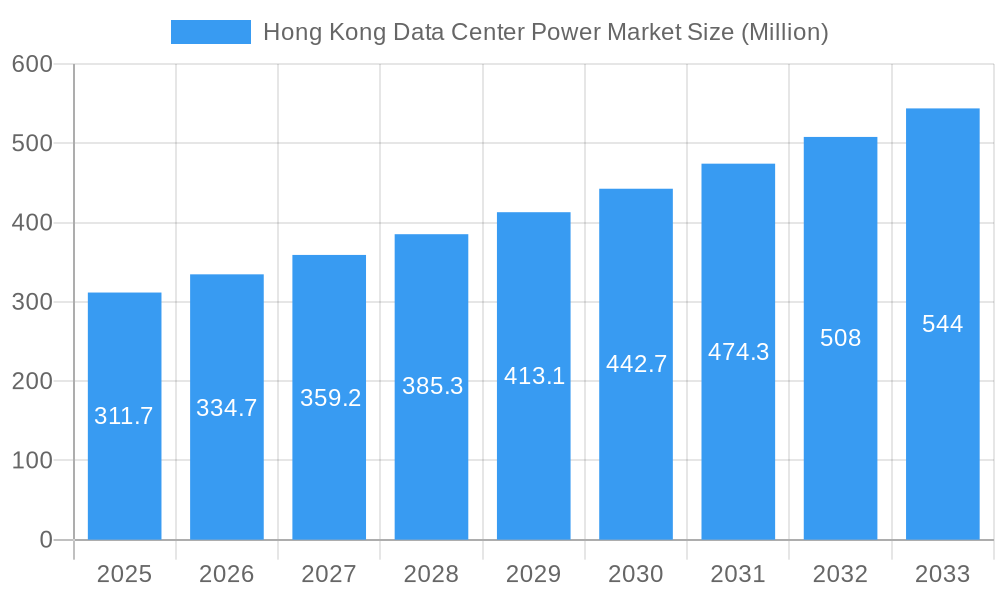

The Hong Kong Data Center Power Market is poised for significant growth, projected to expand from a current market size of approximately USD 311.70 million to reach substantial figures by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 7.20%. This expansion is primarily fueled by the insatiable demand for data storage and processing power across critical sectors. The escalating adoption of digital technologies, the surge in cloud computing services, and the burgeoning Internet of Things (IoT) ecosystem are key accelerators. Furthermore, Hong Kong's strategic position as a regional hub for finance and technology, coupled with supportive government initiatives to foster digital infrastructure, underpins this positive market trajectory. The increasing reliance on data centers for operations in sectors like IT & Telecommunication, BFSI, and Media & Entertainment directly translates to a heightened need for reliable and efficient power solutions.

Hong Kong Data Center Power Market Market Size (In Million)

The market is segmented across Power Infrastructure, Services, and various End Users, highlighting the comprehensive nature of the data center power ecosystem. Within Power Infrastructure, UPS Systems, Generators, and diverse Power Distribution Solutions, including PDUs, Switchgear, and Transfer Switches, are critical components. The service segment plays a vital role in ensuring the ongoing operational integrity and optimization of these power systems. Key players such as Eaton Corporation, Vertiv Group Corp, and Schneider Electric SE are actively shaping the market landscape through innovation and strategic expansions, catering to the evolving needs for high-density computing and enhanced power resilience. Addressing the challenges associated with increasing power consumption and the need for sustainable energy solutions will be crucial for sustained growth and market leadership in the coming years.

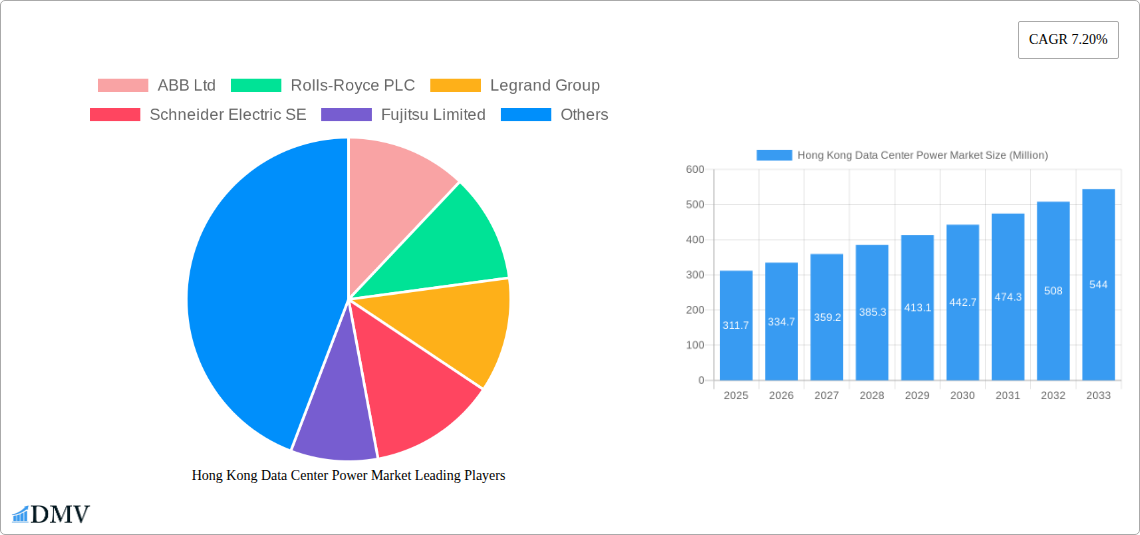

Hong Kong Data Center Power Market Company Market Share

Hong Kong Data Center Power Market: Comprehensive Analysis and Future Outlook (2019-2033)

Report Description:

Dive into the dynamic Hong Kong Data Center Power Market with this in-depth, SEO-optimized report. This comprehensive analysis covers the critical power infrastructure, services, and end-user segments driving the market's evolution from 2019 to 2033, with a base and estimated year of 2025. Uncover market composition, industry trends, technological advancements, leading players, and strategic forecasts essential for stakeholders in the booming digital infrastructure landscape.

Hong Kong Data Center Power Market Market Composition & Trends

The Hong Kong Data Center Power Market is characterized by a moderate level of concentration, with a few key players dominating the supply of critical power solutions. Innovation is a significant catalyst, driven by the relentless demand for higher power densities, increased energy efficiency, and enhanced reliability in data center operations. Regulatory landscapes, while generally supportive of infrastructure development, can introduce compliance requirements for power quality and environmental impact. Substitute products, such as localized renewable energy solutions or hybrid power systems, are gaining traction as the market seeks to reduce reliance on traditional grid power and backup generators. End-user profiles are diverse, with IT & Telecommunication and BFSI sectors being the primary drivers, followed by Government and Media & Entertainment, all demanding robust and scalable power solutions. Mergers and acquisitions (M&A) activities, while not excessively frequent, are strategic, aimed at consolidating market share, acquiring new technologies, or expanding service capabilities. The market share distribution for critical power infrastructure, including UPS systems, generators, and power distribution solutions, is influenced by the scale and specific needs of data center operators. M&A deal values are often substantial, reflecting the strategic importance of acquiring established market presence and technological expertise in this high-growth sector.

Hong Kong Data Center Power Market Industry Evolution

The Hong Kong Data Center Power Market has witnessed a profound evolution, propelled by the exponential growth of digital services and the increasing reliance on cloud computing, artificial intelligence, and big data analytics. This sustained demand for processing and storage has directly translated into an escalating need for robust, reliable, and increasingly energy-efficient power infrastructure. The market growth trajectory has been consistently upward, with a compound annual growth rate (CAGR) projected to remain strong throughout the forecast period. Technological advancements have been a cornerstone of this evolution. From the early adoption of traditional uninterruptible power supply (UPS) systems and diesel generators to the current focus on advanced modular UPS solutions, high-efficiency generators, and intelligent power distribution units (PDUs), the technology landscape is constantly shifting. The integration of smart grid technologies, predictive maintenance analytics, and the exploration of alternative energy sources like hydrogen fuel cells are reshaping the industry.

Consumer demand has also shifted significantly. Data center operators are no longer solely focused on basic power provision; they now prioritize sustainability, reduced operational expenditure (OPEX), and enhanced uptime guarantees. This has led to a surge in demand for energy-efficient power distribution solutions, including advanced switchgear with monitoring capabilities and critical power distribution systems designed for maximum reliability. The adoption metrics for these advanced solutions are rising, as companies recognize the long-term benefits of investing in superior power infrastructure. Furthermore, the increasing complexity of data center designs, with higher rack densities and specialized cooling requirements, necessitates power solutions that can adapt and scale seamlessly. The industry is responding with more flexible and scalable power architectures, ensuring that Hong Kong remains a competitive hub for data center development. The shift towards greener data centers is also influencing demand, with a growing interest in renewable energy integration and backup power solutions that minimize carbon footprints, further driving innovation in generator technologies and power management systems.

Leading Regions, Countries, or Segments in Hong Kong Data Center Power Market

Within the Hong Kong Data Center Power Market, the Power Infrastructure: Electrical Solution segment stands out as the dominant force, commanding the largest market share and driving significant investment. This dominance is underpinned by the fundamental need for reliable power delivery in all data center operations. Within this broad category, UPS Systems and Generators are paramount, serving as the bedrock of data center resilience. UPS systems ensure uninterrupted power supply during grid fluctuations or outages, while generators provide crucial backup power for extended durations. The market share distribution within this segment is influenced by the scale and tier rating of data centers, with hyperscale facilities requiring significantly larger and more sophisticated power solutions.

Power Distribution Solutions also play a critical role, encompassing a range of products essential for managing and delivering power efficiently. This includes PDUs, which distribute power to IT equipment; Switchgear, responsible for controlling and protecting electrical equipment; Critical Power Distribution systems designed for utmost reliability; Transfer Switches for seamless power source transitions; Remote Power Panels for localized power delivery; and Other Power Distribution Solutions catering to specialized needs. The increasing density of IT equipment and the need for granular power monitoring have fueled the growth of advanced PDUs and intelligent switchgear.

The IT & Telecommunication end-user segment is the primary driver of demand, as these organizations are at the forefront of digital transformation, requiring massive data processing and storage capabilities. The BFSI sector follows closely, driven by the stringent uptime requirements and regulatory mandates for financial data and transactions. Government agencies also contribute significantly, particularly for national security, public services, and smart city initiatives.

Key drivers for the dominance of the Power Infrastructure: Electrical Solution segment include:

- Ever-Increasing Demand for Data: The relentless growth of digital services, AI, IoT, and cloud computing necessitates continuous expansion of data center capacity, directly translating to higher demand for power infrastructure.

- High Uptime Requirements: Data centers operate on a 24/7 basis, and any downtime can result in substantial financial losses and reputational damage. This mandates significant investment in redundant and reliable power solutions.

- Technological Advancements: Innovations in UPS efficiency, generator capacity, and smart power distribution are driving upgrades and new installations.

- Regulatory Compliance: While specific regulations for power are less stringent than for some other sectors, general building codes and safety standards necessitate robust power infrastructure.

- Investment Trends: Significant investments in new data center builds and upgrades within Hong Kong ensure a consistent demand for power solutions.

The dominance of these segments is a direct reflection of the foundational role that reliable and efficient power plays in the existence and operation of modern data centers.

Hong Kong Data Center Power Market Product Innovations

The Hong Kong Data Center Power Market is witnessing a wave of innovation focused on enhancing efficiency, reliability, and sustainability. Advanced modular UPS systems are emerging, offering greater scalability and easier maintenance, allowing data centers to precisely match power capacity to evolving needs. High-efficiency generators are being developed with improved fuel economy and reduced emissions, aligning with increasing environmental consciousness. Furthermore, intelligent PDUs are integrating advanced monitoring and management capabilities, providing granular insights into power consumption and enabling predictive maintenance to prevent outages. Innovations in power distribution solutions are also addressing the challenge of higher power densities, with more robust switchgear and specialized distribution units designed to handle the demands of next-generation IT hardware. The exploration of hydrogen fuel cells as a sustainable backup power source represents a significant technological leap, promising a low-carbon alternative to traditional diesel generators. These product innovations are crucial for data center operators seeking to optimize OPEX, improve uptime, and meet their sustainability goals.

Propelling Factors for Hong Kong Data Center Power Market Growth

The Hong Kong Data Center Power Market is propelled by several interconnected factors. Technological advancements in areas like high-efficiency UPS systems, advanced generator technologies, and smart power distribution solutions are driving demand for upgraded and new infrastructure. The economic imperative for businesses to leverage cloud computing, big data, and AI fuels the continuous expansion of data center capacity. Increasing data generation and consumption globally necessitates more robust and scalable data center power solutions. Government initiatives supporting digital transformation and smart city development, while not directly regulating power supply, indirectly encourage data center growth. Furthermore, the growing demand for edge computing and the need for localized data processing also contribute to market expansion. Finally, the focus on sustainability and energy efficiency is pushing for greener power solutions, including exploring alternatives to traditional fossil-fuel-based backup power.

Obstacles in the Hong Kong Data Center Power Market Market

Despite its robust growth, the Hong Kong Data Center Power Market faces several obstacles. High real estate costs in Hong Kong can make site acquisition and expansion challenging and expensive, impacting the overall cost of data center development and, consequently, power infrastructure investment. Increasing energy prices and the rising cost of electricity can significantly impact operational expenditure for data centers, prompting a search for more energy-efficient solutions but also creating budget constraints for new investments. Supply chain disruptions, exacerbated by global events, can lead to delays in the procurement of critical power components and equipment, affecting project timelines and costs. Stringent environmental regulations related to emissions from generators, while pushing for cleaner technologies, can also increase upfront compliance costs. Lastly, fierce competition among data center providers and equipment manufacturers can lead to price pressures, potentially impacting profit margins and the willingness to invest in premium, albeit more advanced, power solutions.

Future Opportunities in Hong Kong Data Center Power Market

The Hong Kong Data Center Power Market presents numerous future opportunities. The expansion of hyperscale data centers to accommodate growing cloud demand continues to be a significant opportunity for providers of high-capacity UPS systems, generators, and advanced power distribution solutions. The rise of AI and machine learning applications will drive the need for more powerful and specialized data processing, requiring innovative power solutions capable of handling higher densities. The increasing adoption of edge computing presents an opportunity for smaller, modular, and highly resilient power solutions deployed closer to end-users. Furthermore, the growing emphasis on sustainability opens doors for providers of renewable energy integration solutions, battery storage systems, and low-carbon backup power technologies like hydrogen fuel cells. The upgrade and modernization of existing data centers also represents a substantial market for advanced power infrastructure and energy-efficient solutions.

Major Players in the Hong Kong Data Center Power Market Ecosystem

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Developments in Hong Kong Data Center Power Market Industry

- January 2024: Caterpillar Inc. partnered with Microsoft and Ballard Power Systems to test the use of large-format hydrogen fuel cells as a reliable and eco-friendly backup power source for multi-megawatt data centers. Hydrogen fuel cells are seen as a possible low-carbon alternative to diesel backup generators, which is expected to drive the growth of DC generators.

- March 2024: Schneider Electric announced the expansion of its US manufacturing facilities at two locations to support critical infrastructure of data centers and other industries. At both locations, the company planned to manufacture electrical switchgear and medium-voltage power distribution products.

Strategic Hong Kong Data Center Power Market Market Forecast

The Hong Kong Data Center Power Market is poised for continued robust growth, driven by an insatiable global appetite for digital services and the strategic importance of Hong Kong as a regional connectivity hub. Future opportunities lie in catering to the evolving needs of hyperscale, colocation, and enterprise data centers, with a particular focus on high-density power solutions and advanced cooling integration. The burgeoning demand for AI and edge computing will necessitate more sophisticated and resilient power architectures. Furthermore, the increasing emphasis on sustainability and carbon footprint reduction presents a significant opportunity for providers of renewable energy integration, advanced battery storage, and emerging low-carbon backup power technologies, such as hydrogen fuel cells. Strategic investments in upgrading existing infrastructure and adopting energy-efficient solutions will be paramount for market players aiming to capitalize on this dynamic and rapidly expanding sector.

Hong Kong Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Other Power Distribution Solutions

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

Hong Kong Data Center Power Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

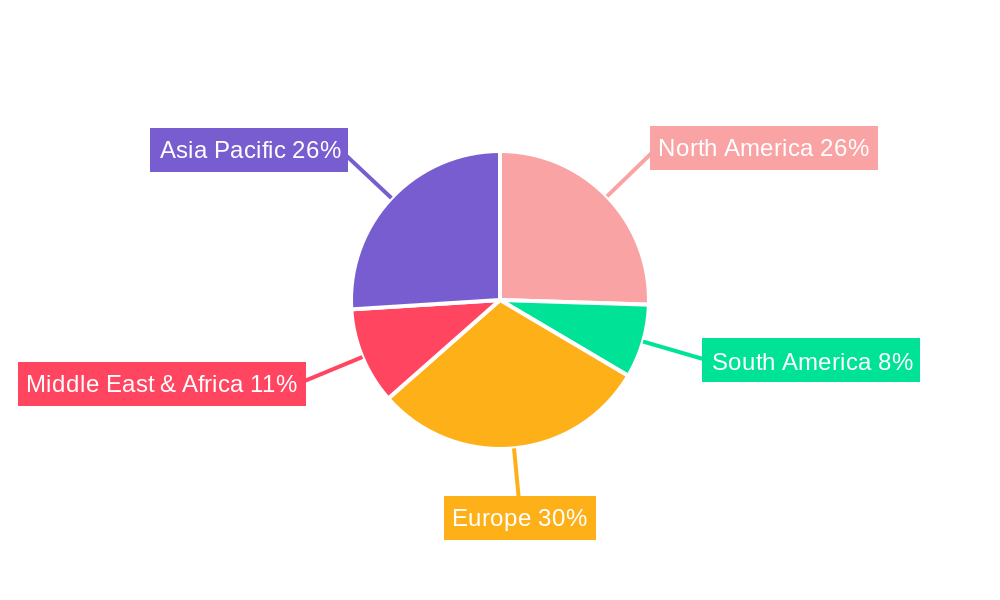

Hong Kong Data Center Power Market Regional Market Share

Geographic Coverage of Hong Kong Data Center Power Market

Hong Kong Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Other Power Distribution Solutions

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. North America Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6.1.1. Electrical Solution

- 6.1.1.1. UPS Systems

- 6.1.1.2. Generators

- 6.1.1.3. Power Distribution Solutions

- 6.1.1.3.1. PDU

- 6.1.1.3.2. Switchgear

- 6.1.1.3.3. Critical Power Distribution

- 6.1.1.3.4. Transfer Switches

- 6.1.1.3.5. Remote Power Panels

- 6.1.1.3.6. Other Power Distribution Solutions

- 6.1.2. Service

- 6.1.1. Electrical Solution

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 7. South America Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 7.1.1. Electrical Solution

- 7.1.1.1. UPS Systems

- 7.1.1.2. Generators

- 7.1.1.3. Power Distribution Solutions

- 7.1.1.3.1. PDU

- 7.1.1.3.2. Switchgear

- 7.1.1.3.3. Critical Power Distribution

- 7.1.1.3.4. Transfer Switches

- 7.1.1.3.5. Remote Power Panels

- 7.1.1.3.6. Other Power Distribution Solutions

- 7.1.2. Service

- 7.1.1. Electrical Solution

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 8. Europe Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 8.1.1. Electrical Solution

- 8.1.1.1. UPS Systems

- 8.1.1.2. Generators

- 8.1.1.3. Power Distribution Solutions

- 8.1.1.3.1. PDU

- 8.1.1.3.2. Switchgear

- 8.1.1.3.3. Critical Power Distribution

- 8.1.1.3.4. Transfer Switches

- 8.1.1.3.5. Remote Power Panels

- 8.1.1.3.6. Other Power Distribution Solutions

- 8.1.2. Service

- 8.1.1. Electrical Solution

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 9. Middle East & Africa Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 9.1.1. Electrical Solution

- 9.1.1.1. UPS Systems

- 9.1.1.2. Generators

- 9.1.1.3. Power Distribution Solutions

- 9.1.1.3.1. PDU

- 9.1.1.3.2. Switchgear

- 9.1.1.3.3. Critical Power Distribution

- 9.1.1.3.4. Transfer Switches

- 9.1.1.3.5. Remote Power Panels

- 9.1.1.3.6. Other Power Distribution Solutions

- 9.1.2. Service

- 9.1.1. Electrical Solution

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT & Telecommunication

- 9.2.2. BFSI

- 9.2.3. Government

- 9.2.4. Media & Entertainment

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 10. Asia Pacific Hong Kong Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 10.1.1. Electrical Solution

- 10.1.1.1. UPS Systems

- 10.1.1.2. Generators

- 10.1.1.3. Power Distribution Solutions

- 10.1.1.3.1. PDU

- 10.1.1.3.2. Switchgear

- 10.1.1.3.3. Critical Power Distribution

- 10.1.1.3.4. Transfer Switches

- 10.1.1.3.5. Remote Power Panels

- 10.1.1.3.6. Other Power Distribution Solutions

- 10.1.2. Service

- 10.1.1. Electrical Solution

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. IT & Telecommunication

- 10.2.2. BFSI

- 10.2.3. Government

- 10.2.4. Media & Entertainment

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Legrand Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schneider Electric SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caterpillar Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rittal GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cummins Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vertiv Group Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eaton Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Hong Kong Data Center Power Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 3: North America Hong Kong Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 4: North America Hong Kong Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Hong Kong Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Hong Kong Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hong Kong Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hong Kong Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 9: South America Hong Kong Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 10: South America Hong Kong Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America Hong Kong Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Hong Kong Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hong Kong Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hong Kong Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 15: Europe Hong Kong Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 16: Europe Hong Kong Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Hong Kong Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Hong Kong Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hong Kong Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hong Kong Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 21: Middle East & Africa Hong Kong Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 22: Middle East & Africa Hong Kong Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa Hong Kong Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Hong Kong Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hong Kong Data Center Power Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hong Kong Data Center Power Market Revenue (Million), by Power Infrastructure 2025 & 2033

- Figure 27: Asia Pacific Hong Kong Data Center Power Market Revenue Share (%), by Power Infrastructure 2025 & 2033

- Figure 28: Asia Pacific Hong Kong Data Center Power Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific Hong Kong Data Center Power Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Hong Kong Data Center Power Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hong Kong Data Center Power Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 2: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 5: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 11: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 17: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 29: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 38: Global Hong Kong Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Hong Kong Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hong Kong Data Center Power Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Data Center Power Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Hong Kong Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Hong Kong Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 311.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

January 2024: Caterpillar Inc. partnered with Microsoft and Ballard Power Systems to test the use of large-format hydrogen fuel cells as a reliable and eco-friendly backup power source for multi-megawatt data centers. Hydrogen fuel cells are seen as a possible low-carbon alternative to diesel backup generators, which is expected to drive the growth of DC generators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Data Center Power Market?

To stay informed about further developments, trends, and reports in the Hong Kong Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence