Key Insights

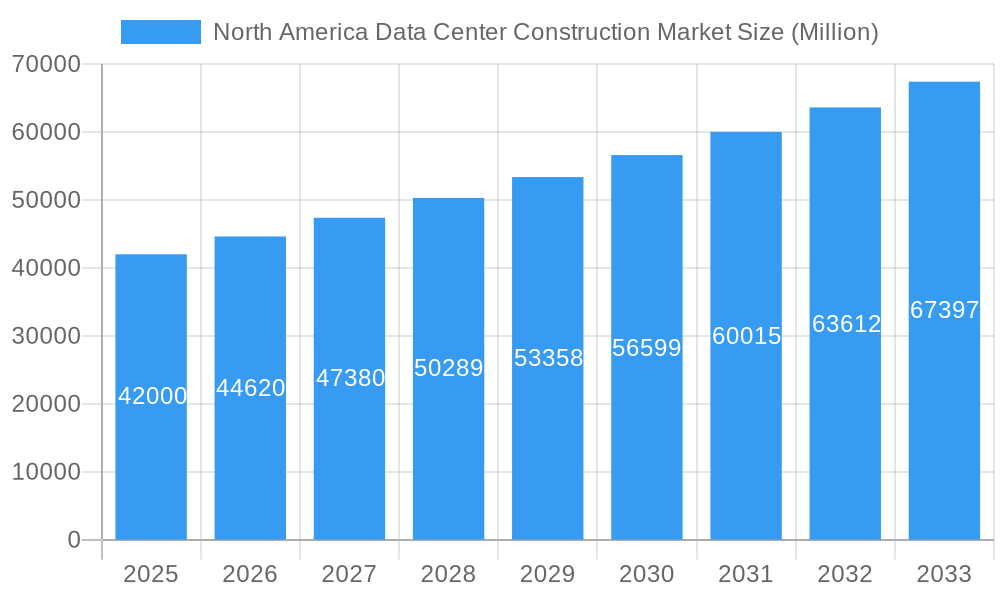

The North American data center construction market is projected to reach $23.03 billion by 2025, with a CAGR of 9.3% anticipated through 2033. This significant growth is fueled by the escalating demand for cloud computing, big data analytics, AI, and IoT. The burgeoning digital economy necessitates advanced, high-density data center facilities. Key growth drivers include electrical infrastructure (PDUs, transfer switches, switchgear) and power backup solutions (UPS, generators), emphasizing reliability. Advanced cooling systems like immersion and direct-to-chip cooling are also gaining traction due to rising power densities.

North America Data Center Construction Market Market Size (In Billion)

Evolving infrastructure needs are driving a shift towards Tier-III and Tier-IV facilities for enhanced uptime and resilience. The IT & telecommunications, BFSI, and government/defense sectors are leading end-users, investing in data center modernization. The United States leads the market geographically, followed by Canada and Mexico. Emerging trends like green data center initiatives and sustainable construction practices are influencing methodologies and material choices. Market players are addressing challenges such as rising costs, labor shortages, and complex regulations through strategic partnerships and innovation.

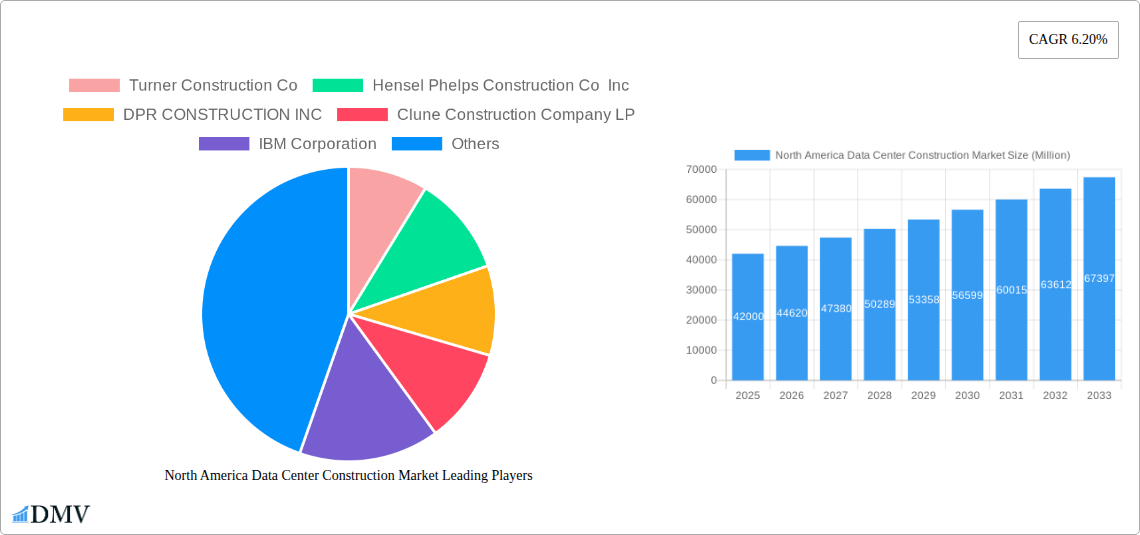

North America Data Center Construction Market Company Market Share

This report offers an exhaustive analysis of the North America Data Center Construction Market, providing critical insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, the study meticulously segments the market by Electrical Infrastructure, Mechanical Infrastructure, General Construction, Tier Type, End User, and Geography, delivering granular data for informed decision-making.

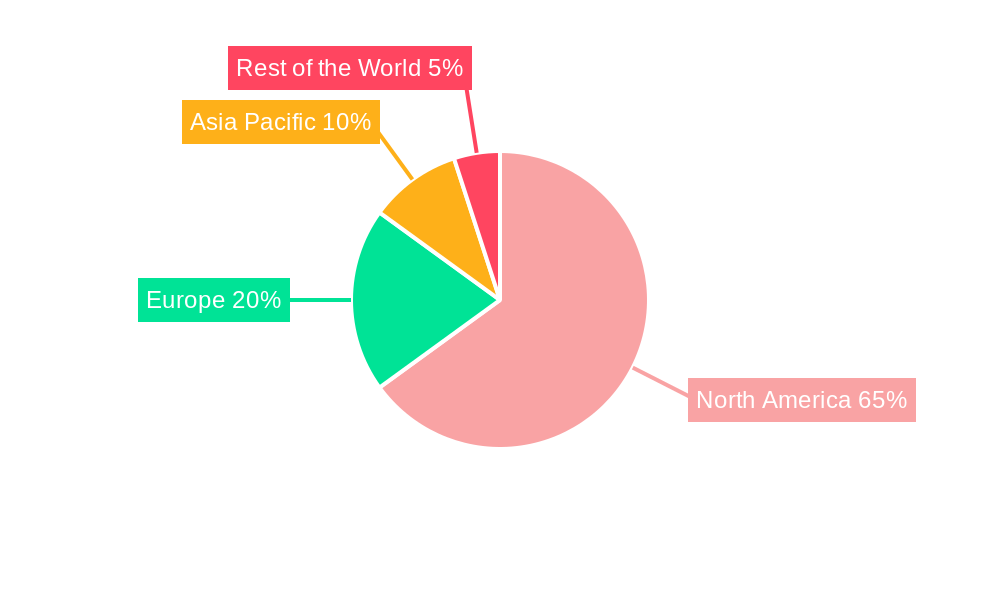

North America Data Center Construction Market Market Composition & Trends

The North America Data Center Construction Market exhibits a dynamic and evolving composition, driven by relentless technological innovation and escalating demand for digital infrastructure. Market concentration is influenced by the significant investments made by major hyperscale cloud providers and colocation operators, alongside a growing number of specialized construction firms. Innovation catalysts include the push for higher density computing, increased energy efficiency, and the adoption of AI and machine learning workloads, necessitating advanced cooling solutions and robust power delivery systems. Regulatory landscapes, while generally supportive of data center development, can introduce complexities in permitting and environmental compliance. Substitute products are limited in core construction, but advancements in modular data center designs and pre-fabricated components are altering traditional construction methodologies. End-user profiles are diversifying, with IT and Telecommunications, Banking, Financial Services, and Insurance (BFSI), and Healthcare sectors leading the charge in data center expansion. Mergers and acquisitions (M&A) activities are a significant trend, with major construction and technology companies consolidating their market positions. For instance, significant M&A deals in recent years, collectively valued in the tens of billions of dollars, underscore this consolidation. The market share distribution is currently led by specialized electrical and mechanical infrastructure providers, with general construction playing a foundational role.

North America Data Center Construction Market Industry Evolution

The North America Data Center Construction Market has witnessed a remarkable industry evolution, characterized by a significant CAGR of XX% projected from 2025 to 2033, a stark contrast to the XX% growth observed during the historical period of 2019-2024. This growth trajectory is primarily fueled by the insatiable demand for digital services, cloud computing adoption, and the burgeoning data generated by artificial intelligence, the Internet of Things (IoT), and big data analytics. Technological advancements have been pivotal in shaping this evolution. The shift towards higher power densities per rack, from an average of 10-15 kW to an estimated 30-50 kW and beyond, necessitates sophisticated cooling solutions like immersion cooling and direct-to-chip cooling, experiencing adoption rates of XX% and YY% respectively in new builds. Power backup solutions have also seen considerable upgrades, with UPS systems increasing in efficiency and capacity to meet the demands of critical workloads, reaching an estimated XX% penetration in new Tier-III and Tier-IV facilities. The market is witnessing a transition from basic infrastructure to highly integrated and intelligent systems. This includes smart PDUs with advanced metering and switching capabilities becoming standard in XX% of new constructions, enabling better power management and reducing operational costs. The increasing adoption of automation in construction processes, driven by companies like Turner Construction Co and Hensel Phelps Construction Co Inc, is also contributing to faster build times and improved quality. Shifting consumer demands, particularly for low latency and high availability, are compelling data center operators to invest in geographically distributed edge data centers, a segment projected to grow by XX% annually. Furthermore, the focus on sustainability is driving the integration of renewable energy sources and energy-efficient designs, influencing the choice of mechanical and electrical infrastructure.

Leading Regions, Countries, or Segments in North America Data Center Construction Market

The North America Data Center Construction Market is undeniably dominated by the United States, accounting for an estimated XX% of the total market value in 2025. This supremacy is propelled by a confluence of factors including robust economic growth, a mature technology ecosystem, significant private and public sector investments, and a concentrated demand for digital services across various industries. The IT and Telecommunications sector stands as the leading end-user segment, contributing an estimated XX% to the market's overall value, driven by hyperscale cloud providers and the continuous expansion of network infrastructure.

Key Drivers and Dominance Factors:

- Investment Trends: The United States attracts substantial capital investment, with billions of dollars poured into new data center construction projects annually. Major hyperscalers like IBM Corporation and technology giants are consistently expanding their footprint.

- Regulatory Support & Incentives: While regulations exist, many states and municipalities offer incentives for data center development, such as tax abatements and streamlined permitting processes, fostering a favorable investment climate.

- Technological Hubs: The presence of major technology hubs across the US (e.g., Silicon Valley, Northern Virginia) creates dense concentrations of demand for data center services.

- Infrastructure Development: The availability of reliable power grids and high-speed fiber optic networks is crucial. Electrical infrastructure, particularly Power Distribution Solutions like PDU – Basic & Smart – Metered & Switched solutions, Transfer Switches (ATS), and Switchgear (Low-Voltage, Medium-Voltage), are experiencing immense demand, estimated at XX% of the total infrastructure spend.

- Mechanical Infrastructure Advancements: The growing demand for high-density computing is driving the adoption of advanced cooling systems such as In-Row and In-Rack Cooling, projected to see a CAGR of XX% within the US market.

- Tier Type Dominance: Tier-III data centers constitute a significant portion of the market, estimated at XX% of new builds due to their balance of uptime and cost-effectiveness. However, Tier-IV facilities are gaining traction for mission-critical applications.

- Geographic Concentration: While the US leads, Canada and Mexico are emerging as significant markets, with Canada experiencing a strong growth rate of XX% due to its stable economy and access to renewable energy. Mexico's market is driven by its growing digital economy and proximity to the US.

- General Construction & Specialized Services: Companies like Holder Construction Company and AECOM are instrumental in the general construction aspect, while specialized firms focus on the intricate electrical and mechanical installations. The service segment, encompassing design, build, and maintenance, is also experiencing robust growth, estimated at XX% of the market.

North America Data Center Construction Market Product Innovations

Product innovation in the North America Data Center Construction Market is sharply focused on enhancing efficiency, sustainability, and scalability. Advanced cooling systems, including liquid immersion cooling and direct-to-chip cooling solutions, are emerging as critical advancements to manage the heat generated by high-performance computing. These technologies are achieving cooling efficiencies that significantly surpass traditional air cooling, with some solutions boasting PUE (Power Usage Effectiveness) ratios as low as 1.1. Furthermore, the integration of AI-powered monitoring and management systems into electrical infrastructure, such as smart PDUs and switchgear, offers predictive maintenance and real-time optimization, reducing downtime and operational costs. The development of modular and prefabricated data center components is also a key innovation, enabling faster deployment and greater flexibility for businesses.

Propelling Factors for North America Data Center Construction Market Growth

Several key factors are propelling the growth of the North America Data Center Construction Market. The relentless surge in data generation from the Internet of Things (IoT), Big Data analytics, and AI/ML applications necessitates expanded data storage and processing capabilities. The widespread adoption of cloud computing services by businesses of all sizes continues to drive demand for hyperscale and enterprise data centers. Government initiatives promoting digital transformation and cybersecurity further bolster market expansion. Economic stability in the United States and Canada, coupled with strategic investments by technology giants and infrastructure funds, provides the financial impetus for new construction and upgrades. Furthermore, the increasing demand for edge computing to reduce latency for applications like autonomous vehicles and real-time analytics is spurring the development of smaller, distributed data centers.

Obstacles in the North America Data Center Construction Market Market

Despite robust growth, the North America Data Center Construction Market faces several obstacles. Stringent environmental regulations and the increasing focus on sustainability can lead to complex permitting processes and higher construction costs due to the need for energy-efficient designs and renewable energy integration. Supply chain disruptions, particularly for critical components like semiconductors and specialized cooling equipment, can cause project delays and cost overruns. The escalating costs of raw materials and skilled labor also present significant challenges. Furthermore, the competitive landscape is intensifying, with a growing number of players vying for market share, potentially leading to pricing pressures. The cybersecurity risks associated with data centers also necessitate substantial investments in security infrastructure and protocols, adding to overall project expenses.

Future Opportunities in North America Data Center Construction Market

Emerging opportunities within the North America Data Center Construction Market are abundant. The burgeoning demand for AI and machine learning infrastructure presents a significant growth avenue, requiring specialized high-density computing facilities. The expansion of the edge data center market, driven by the need for low-latency applications, opens up opportunities for smaller, distributed facilities. Increased investment in renewable energy sources and sustainable data center designs presents a key opportunity for companies offering green building solutions and energy-efficient technologies. The growing healthcare sector's reliance on digital health records and advanced medical imaging also creates a sustained demand for data center capacity. Furthermore, the modernization of existing data centers to incorporate newer technologies and improve efficiency offers substantial upgrade opportunities for construction firms and equipment providers.

Major Players in the North America Data Center Construction Market Ecosystem

- Turner Construction Co

- Hensel Phelps Construction Co Inc

- DPR CONSTRUCTION INC

- Clune Construction Company LP

- IBM Corporation

- Holder Construction Company

- Fortis Construction Inc

- Nabholz Construction Corporation

- Rittal GMBH & Co KG

- Hitachi Corporation

- AECOM

- HITT Contrating Inc

- Schneider Electric SE

Key Developments in North America Data Center Construction Market Industry

- 2024: Increased investment in liquid immersion cooling technologies by hyperscale providers, aiming for higher heat dissipation densities.

- 2024: Launch of new modular data center solutions by several key players, enabling faster deployment for edge computing needs.

- 2023: Significant expansion of renewable energy sourcing agreements by major data center operators to meet sustainability goals.

- 2023: Acquisition of a specialized electrical contracting firm by a leading construction company to enhance service offerings.

- 2022: Introduction of AI-powered predictive maintenance systems for data center infrastructure, improving uptime and reducing operational costs.

- 2022: Growing trend of hyperscale data center development in secondary markets to diversify risk and tap into new talent pools.

- 2021: Enhanced focus on cybersecurity integrated design practices in new data center builds.

- 2021: Increased adoption of automated construction techniques to address labor shortages and improve project timelines.

- 2020: Resurgence in demand for colocation services as businesses focus on core competencies and reduce capital expenditure.

- 2019: Growing interest in smart PDUs and advanced power management solutions for enhanced operational efficiency.

Strategic North America Data Center Construction Market Market Forecast

The North America Data Center Construction Market is poised for sustained and robust growth in the forecast period (2025-2033), driven by the exponential increase in data consumption, the pervasive adoption of cloud computing, and the transformative impact of AI and IoT technologies. Significant investments in new hyperscale facilities, coupled with the rapid expansion of edge data centers, will be key growth catalysts. The increasing emphasis on energy efficiency and sustainability will further drive innovation in cooling solutions and power management systems. The ongoing digital transformation across sectors like BFSI, Healthcare, and Government will ensure a consistent demand for state-of-the-art data center infrastructure, positioning the market for substantial future potential.

North America Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Others

-

1.1.2. Power Back up Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Others

-

2.2. Power Back up Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Others

-

4. Power Back up Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier-I and II

- 11.2. Tier-III

- 11.3. Tier-IV

- 12. Tier-I and II

- 13. Tier-III

- 14. Tier-IV

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

-

21. Geography

- 21.1. United States

- 21.2. Canada

- 21.3. Mexico

- 22. United States

- 23. Canada

- 24. Mexico

North America Data Center Construction Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Data Center Construction Market Regional Market Share

Geographic Coverage of North America Data Center Construction Market

North America Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Cloud Applications

- 3.2.2 AI

- 3.2.3 and Big Data; Growing Adoption of Hyperscale Data Centers in Large Enterprises; Advent Green Data Center

- 3.3. Market Restrains

- 3.3.1 High CaPex

- 3.3.2 OpEx & TCO for building Data Center

- 3.4. Market Trends

- 3.4.1. United States of America to hold major market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Others

- 5.1.1.2. Power Back up Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Others

- 5.2.2. Power Back up Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Power Back up Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier-I and II

- 5.11.2. Tier-III

- 5.11.3. Tier-IV

- 5.12. Market Analysis, Insights and Forecast - by Tier-I and II

- 5.13. Market Analysis, Insights and Forecast - by Tier-III

- 5.14. Market Analysis, Insights and Forecast - by Tier-IV

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Geography

- 5.21.1. United States

- 5.21.2. Canada

- 5.21.3. Mexico

- 5.22. Market Analysis, Insights and Forecast - by United States

- 5.23. Market Analysis, Insights and Forecast - by Canada

- 5.24. Market Analysis, Insights and Forecast - by Mexico

- 5.25. Market Analysis, Insights and Forecast - by Region

- 5.25.1. United States

- 5.25.2. Canada

- 5.25.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. United States North America Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6.1.1. Market Segmentation - By Electrical Infrastructure

- 6.1.1.1. Power Distribution Solution

- 6.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 6.1.1.1.2. Transfer Switches

- 6.1.1.1.2.1. Static

- 6.1.1.1.2.2. Automatic (ATS)

- 6.1.1.1.3. Switchgear

- 6.1.1.1.3.1. Low-Voltage

- 6.1.1.1.3.2. Medium-Voltage

- 6.1.1.1.4. Power Panels and Components

- 6.1.1.1.5. Others

- 6.1.1.2. Power Back up Solutions

- 6.1.1.2.1. UPS

- 6.1.1.2.2. Generators

- 6.1.1.3. Service

- 6.1.1.1. Power Distribution Solution

- 6.1.2. Market Segmentation - By Mechanical Infrastructure

- 6.1.2.1. Cooling Systems

- 6.1.2.1.1. Immersion Cooling

- 6.1.2.1.2. Direct-To-Chip Cooling

- 6.1.2.1.3. Rear Door Heat Exchanger

- 6.1.2.1.4. In-Row and In-Rack Cooling

- 6.1.2.2. Racks

- 6.1.2.3. Other Mechanical Infrastructure

- 6.1.2.1. Cooling Systems

- 6.1.3. General Construction

- 6.1.1. Market Segmentation - By Electrical Infrastructure

- 6.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 6.2.1. Power Distribution Solution

- 6.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 6.2.1.2. Transfer Switches

- 6.2.1.2.1. Static

- 6.2.1.2.2. Automatic (ATS)

- 6.2.1.3. Switchgear

- 6.2.1.3.1. Low-Voltage

- 6.2.1.3.2. Medium-Voltage

- 6.2.1.4. Power Panels and Components

- 6.2.1.5. Others

- 6.2.2. Power Back up Solutions

- 6.2.2.1. UPS

- 6.2.2.2. Generators

- 6.2.3. Service

- 6.2.1. Power Distribution Solution

- 6.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 6.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 6.3.2. Transfer Switches

- 6.3.2.1. Static

- 6.3.2.2. Automatic (ATS)

- 6.3.3. Switchgear

- 6.3.3.1. Low-Voltage

- 6.3.3.2. Medium-Voltage

- 6.3.4. Power Panels and Components

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Power Back up Solutions

- 6.4.1. UPS

- 6.4.2. Generators

- 6.5. Market Analysis, Insights and Forecast - by Service

- 6.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 6.6.1. Cooling Systems

- 6.6.1.1. Immersion Cooling

- 6.6.1.2. Direct-To-Chip Cooling

- 6.6.1.3. Rear Door Heat Exchanger

- 6.6.1.4. In-Row and In-Rack Cooling

- 6.6.2. Racks

- 6.6.3. Other Mechanical Infrastructure

- 6.6.1. Cooling Systems

- 6.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 6.7.1. Immersion Cooling

- 6.7.2. Direct-To-Chip Cooling

- 6.7.3. Rear Door Heat Exchanger

- 6.7.4. In-Row and In-Rack Cooling

- 6.8. Market Analysis, Insights and Forecast - by Racks

- 6.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 6.10. Market Analysis, Insights and Forecast - by General Construction

- 6.11. Market Analysis, Insights and Forecast - by Tier Type

- 6.11.1. Tier-I and II

- 6.11.2. Tier-III

- 6.11.3. Tier-IV

- 6.12. Market Analysis, Insights and Forecast - by Tier-I and II

- 6.13. Market Analysis, Insights and Forecast - by Tier-III

- 6.14. Market Analysis, Insights and Forecast - by Tier-IV

- 6.15. Market Analysis, Insights and Forecast - by End User

- 6.15.1. Banking, Financial Services, and Insurance

- 6.15.2. IT and Telecommunications

- 6.15.3. Government and Defense

- 6.15.4. Healthcare

- 6.15.5. Other End Users

- 6.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 6.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 6.18. Market Analysis, Insights and Forecast - by Government and Defense

- 6.19. Market Analysis, Insights and Forecast - by Healthcare

- 6.20. Market Analysis, Insights and Forecast - by Other End Users

- 6.21. Market Analysis, Insights and Forecast - by Geography

- 6.21.1. United States

- 6.21.2. Canada

- 6.21.3. Mexico

- 6.22. Market Analysis, Insights and Forecast - by United States

- 6.23. Market Analysis, Insights and Forecast - by Canada

- 6.24. Market Analysis, Insights and Forecast - by Mexico

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure

- 7. Canada North America Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure

- 7.1.1. Market Segmentation - By Electrical Infrastructure

- 7.1.1.1. Power Distribution Solution

- 7.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 7.1.1.1.2. Transfer Switches

- 7.1.1.1.2.1. Static

- 7.1.1.1.2.2. Automatic (ATS)

- 7.1.1.1.3. Switchgear

- 7.1.1.1.3.1. Low-Voltage

- 7.1.1.1.3.2. Medium-Voltage

- 7.1.1.1.4. Power Panels and Components

- 7.1.1.1.5. Others

- 7.1.1.2. Power Back up Solutions

- 7.1.1.2.1. UPS

- 7.1.1.2.2. Generators

- 7.1.1.3. Service

- 7.1.1.1. Power Distribution Solution

- 7.1.2. Market Segmentation - By Mechanical Infrastructure

- 7.1.2.1. Cooling Systems

- 7.1.2.1.1. Immersion Cooling

- 7.1.2.1.2. Direct-To-Chip Cooling

- 7.1.2.1.3. Rear Door Heat Exchanger

- 7.1.2.1.4. In-Row and In-Rack Cooling

- 7.1.2.2. Racks

- 7.1.2.3. Other Mechanical Infrastructure

- 7.1.2.1. Cooling Systems

- 7.1.3. General Construction

- 7.1.1. Market Segmentation - By Electrical Infrastructure

- 7.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 7.2.1. Power Distribution Solution

- 7.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 7.2.1.2. Transfer Switches

- 7.2.1.2.1. Static

- 7.2.1.2.2. Automatic (ATS)

- 7.2.1.3. Switchgear

- 7.2.1.3.1. Low-Voltage

- 7.2.1.3.2. Medium-Voltage

- 7.2.1.4. Power Panels and Components

- 7.2.1.5. Others

- 7.2.2. Power Back up Solutions

- 7.2.2.1. UPS

- 7.2.2.2. Generators

- 7.2.3. Service

- 7.2.1. Power Distribution Solution

- 7.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 7.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 7.3.2. Transfer Switches

- 7.3.2.1. Static

- 7.3.2.2. Automatic (ATS)

- 7.3.3. Switchgear

- 7.3.3.1. Low-Voltage

- 7.3.3.2. Medium-Voltage

- 7.3.4. Power Panels and Components

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Power Back up Solutions

- 7.4.1. UPS

- 7.4.2. Generators

- 7.5. Market Analysis, Insights and Forecast - by Service

- 7.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 7.6.1. Cooling Systems

- 7.6.1.1. Immersion Cooling

- 7.6.1.2. Direct-To-Chip Cooling

- 7.6.1.3. Rear Door Heat Exchanger

- 7.6.1.4. In-Row and In-Rack Cooling

- 7.6.2. Racks

- 7.6.3. Other Mechanical Infrastructure

- 7.6.1. Cooling Systems

- 7.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 7.7.1. Immersion Cooling

- 7.7.2. Direct-To-Chip Cooling

- 7.7.3. Rear Door Heat Exchanger

- 7.7.4. In-Row and In-Rack Cooling

- 7.8. Market Analysis, Insights and Forecast - by Racks

- 7.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 7.10. Market Analysis, Insights and Forecast - by General Construction

- 7.11. Market Analysis, Insights and Forecast - by Tier Type

- 7.11.1. Tier-I and II

- 7.11.2. Tier-III

- 7.11.3. Tier-IV

- 7.12. Market Analysis, Insights and Forecast - by Tier-I and II

- 7.13. Market Analysis, Insights and Forecast - by Tier-III

- 7.14. Market Analysis, Insights and Forecast - by Tier-IV

- 7.15. Market Analysis, Insights and Forecast - by End User

- 7.15.1. Banking, Financial Services, and Insurance

- 7.15.2. IT and Telecommunications

- 7.15.3. Government and Defense

- 7.15.4. Healthcare

- 7.15.5. Other End Users

- 7.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 7.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 7.18. Market Analysis, Insights and Forecast - by Government and Defense

- 7.19. Market Analysis, Insights and Forecast - by Healthcare

- 7.20. Market Analysis, Insights and Forecast - by Other End Users

- 7.21. Market Analysis, Insights and Forecast - by Geography

- 7.21.1. United States

- 7.21.2. Canada

- 7.21.3. Mexico

- 7.22. Market Analysis, Insights and Forecast - by United States

- 7.23. Market Analysis, Insights and Forecast - by Canada

- 7.24. Market Analysis, Insights and Forecast - by Mexico

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure

- 8. Mexico North America Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure

- 8.1.1. Market Segmentation - By Electrical Infrastructure

- 8.1.1.1. Power Distribution Solution

- 8.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 8.1.1.1.2. Transfer Switches

- 8.1.1.1.2.1. Static

- 8.1.1.1.2.2. Automatic (ATS)

- 8.1.1.1.3. Switchgear

- 8.1.1.1.3.1. Low-Voltage

- 8.1.1.1.3.2. Medium-Voltage

- 8.1.1.1.4. Power Panels and Components

- 8.1.1.1.5. Others

- 8.1.1.2. Power Back up Solutions

- 8.1.1.2.1. UPS

- 8.1.1.2.2. Generators

- 8.1.1.3. Service

- 8.1.1.1. Power Distribution Solution

- 8.1.2. Market Segmentation - By Mechanical Infrastructure

- 8.1.2.1. Cooling Systems

- 8.1.2.1.1. Immersion Cooling

- 8.1.2.1.2. Direct-To-Chip Cooling

- 8.1.2.1.3. Rear Door Heat Exchanger

- 8.1.2.1.4. In-Row and In-Rack Cooling

- 8.1.2.2. Racks

- 8.1.2.3. Other Mechanical Infrastructure

- 8.1.2.1. Cooling Systems

- 8.1.3. General Construction

- 8.1.1. Market Segmentation - By Electrical Infrastructure

- 8.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 8.2.1. Power Distribution Solution

- 8.2.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 8.2.1.2. Transfer Switches

- 8.2.1.2.1. Static

- 8.2.1.2.2. Automatic (ATS)

- 8.2.1.3. Switchgear

- 8.2.1.3.1. Low-Voltage

- 8.2.1.3.2. Medium-Voltage

- 8.2.1.4. Power Panels and Components

- 8.2.1.5. Others

- 8.2.2. Power Back up Solutions

- 8.2.2.1. UPS

- 8.2.2.2. Generators

- 8.2.3. Service

- 8.2.1. Power Distribution Solution

- 8.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 8.3.1. PDU - Basic & Smart - Metered & Switched solutions

- 8.3.2. Transfer Switches

- 8.3.2.1. Static

- 8.3.2.2. Automatic (ATS)

- 8.3.3. Switchgear

- 8.3.3.1. Low-Voltage

- 8.3.3.2. Medium-Voltage

- 8.3.4. Power Panels and Components

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Power Back up Solutions

- 8.4.1. UPS

- 8.4.2. Generators

- 8.5. Market Analysis, Insights and Forecast - by Service

- 8.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 8.6.1. Cooling Systems

- 8.6.1.1. Immersion Cooling

- 8.6.1.2. Direct-To-Chip Cooling

- 8.6.1.3. Rear Door Heat Exchanger

- 8.6.1.4. In-Row and In-Rack Cooling

- 8.6.2. Racks

- 8.6.3. Other Mechanical Infrastructure

- 8.6.1. Cooling Systems

- 8.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 8.7.1. Immersion Cooling

- 8.7.2. Direct-To-Chip Cooling

- 8.7.3. Rear Door Heat Exchanger

- 8.7.4. In-Row and In-Rack Cooling

- 8.8. Market Analysis, Insights and Forecast - by Racks

- 8.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 8.10. Market Analysis, Insights and Forecast - by General Construction

- 8.11. Market Analysis, Insights and Forecast - by Tier Type

- 8.11.1. Tier-I and II

- 8.11.2. Tier-III

- 8.11.3. Tier-IV

- 8.12. Market Analysis, Insights and Forecast - by Tier-I and II

- 8.13. Market Analysis, Insights and Forecast - by Tier-III

- 8.14. Market Analysis, Insights and Forecast - by Tier-IV

- 8.15. Market Analysis, Insights and Forecast - by End User

- 8.15.1. Banking, Financial Services, and Insurance

- 8.15.2. IT and Telecommunications

- 8.15.3. Government and Defense

- 8.15.4. Healthcare

- 8.15.5. Other End Users

- 8.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 8.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 8.18. Market Analysis, Insights and Forecast - by Government and Defense

- 8.19. Market Analysis, Insights and Forecast - by Healthcare

- 8.20. Market Analysis, Insights and Forecast - by Other End Users

- 8.21. Market Analysis, Insights and Forecast - by Geography

- 8.21.1. United States

- 8.21.2. Canada

- 8.21.3. Mexico

- 8.22. Market Analysis, Insights and Forecast - by United States

- 8.23. Market Analysis, Insights and Forecast - by Canada

- 8.24. Market Analysis, Insights and Forecast - by Mexico

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Turner Construction Co

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Hensel Phelps Construction Co Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DPR CONSTRUCTION INC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Clune Construction Company LP

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 IBM Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Holder Construction Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Fortis Construction Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Nabholz Construction Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Rittal GMBH & Co KG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Hitachi Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 AECOM

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 HITT Contrating Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Schneider Electric SE

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 Turner Construction Co

List of Figures

- Figure 1: North America Data Center Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: North America Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 2: North America Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 3: North America Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 4: North America Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 5: North America Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 6: North America Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 7: North America Data Center Construction Market Revenue billion Forecast, by Power Back up Solutions 2020 & 2033

- Table 8: North America Data Center Construction Market Volume K Unit Forecast, by Power Back up Solutions 2020 & 2033

- Table 9: North America Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: North America Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 11: North America Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 12: North America Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 13: North America Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 14: North America Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 15: North America Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 16: North America Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 17: North America Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 18: North America Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 19: North America Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 20: North America Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 21: North America Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 22: North America Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 23: North America Data Center Construction Market Revenue billion Forecast, by Tier-I and II 2020 & 2033

- Table 24: North America Data Center Construction Market Volume K Unit Forecast, by Tier-I and II 2020 & 2033

- Table 25: North America Data Center Construction Market Revenue billion Forecast, by Tier-III 2020 & 2033

- Table 26: North America Data Center Construction Market Volume K Unit Forecast, by Tier-III 2020 & 2033

- Table 27: North America Data Center Construction Market Revenue billion Forecast, by Tier-IV 2020 & 2033

- Table 28: North America Data Center Construction Market Volume K Unit Forecast, by Tier-IV 2020 & 2033

- Table 29: North America Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 30: North America Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: North America Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 32: North America Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 33: North America Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 34: North America Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 35: North America Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 36: North America Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 37: North America Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 38: North America Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 39: North America Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 40: North America Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 41: North America Data Center Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 42: North America Data Center Construction Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 43: North America Data Center Construction Market Revenue billion Forecast, by United States 2020 & 2033

- Table 44: North America Data Center Construction Market Volume K Unit Forecast, by United States 2020 & 2033

- Table 45: North America Data Center Construction Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 46: North America Data Center Construction Market Volume K Unit Forecast, by Canada 2020 & 2033

- Table 47: North America Data Center Construction Market Revenue billion Forecast, by Mexico 2020 & 2033

- Table 48: North America Data Center Construction Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 49: North America Data Center Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 50: North America Data Center Construction Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 51: North America Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 52: North America Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 53: North America Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 54: North America Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 55: North America Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 56: North America Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 57: North America Data Center Construction Market Revenue billion Forecast, by Power Back up Solutions 2020 & 2033

- Table 58: North America Data Center Construction Market Volume K Unit Forecast, by Power Back up Solutions 2020 & 2033

- Table 59: North America Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 60: North America Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 61: North America Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 62: North America Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 63: North America Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 64: North America Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 65: North America Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 66: North America Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 67: North America Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 68: North America Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 69: North America Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 70: North America Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 71: North America Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 72: North America Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 73: North America Data Center Construction Market Revenue billion Forecast, by Tier-I and II 2020 & 2033

- Table 74: North America Data Center Construction Market Volume K Unit Forecast, by Tier-I and II 2020 & 2033

- Table 75: North America Data Center Construction Market Revenue billion Forecast, by Tier-III 2020 & 2033

- Table 76: North America Data Center Construction Market Volume K Unit Forecast, by Tier-III 2020 & 2033

- Table 77: North America Data Center Construction Market Revenue billion Forecast, by Tier-IV 2020 & 2033

- Table 78: North America Data Center Construction Market Volume K Unit Forecast, by Tier-IV 2020 & 2033

- Table 79: North America Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 80: North America Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 81: North America Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 82: North America Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 83: North America Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 84: North America Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 85: North America Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 86: North America Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 87: North America Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 88: North America Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 89: North America Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 90: North America Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 91: North America Data Center Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 92: North America Data Center Construction Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 93: North America Data Center Construction Market Revenue billion Forecast, by United States 2020 & 2033

- Table 94: North America Data Center Construction Market Volume K Unit Forecast, by United States 2020 & 2033

- Table 95: North America Data Center Construction Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 96: North America Data Center Construction Market Volume K Unit Forecast, by Canada 2020 & 2033

- Table 97: North America Data Center Construction Market Revenue billion Forecast, by Mexico 2020 & 2033

- Table 98: North America Data Center Construction Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 99: North America Data Center Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 100: North America Data Center Construction Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 101: North America Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 102: North America Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 103: North America Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 104: North America Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 105: North America Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 106: North America Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 107: North America Data Center Construction Market Revenue billion Forecast, by Power Back up Solutions 2020 & 2033

- Table 108: North America Data Center Construction Market Volume K Unit Forecast, by Power Back up Solutions 2020 & 2033

- Table 109: North America Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 110: North America Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 111: North America Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 112: North America Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 113: North America Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 114: North America Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 115: North America Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 116: North America Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 117: North America Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 118: North America Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 119: North America Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 120: North America Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 121: North America Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 122: North America Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 123: North America Data Center Construction Market Revenue billion Forecast, by Tier-I and II 2020 & 2033

- Table 124: North America Data Center Construction Market Volume K Unit Forecast, by Tier-I and II 2020 & 2033

- Table 125: North America Data Center Construction Market Revenue billion Forecast, by Tier-III 2020 & 2033

- Table 126: North America Data Center Construction Market Volume K Unit Forecast, by Tier-III 2020 & 2033

- Table 127: North America Data Center Construction Market Revenue billion Forecast, by Tier-IV 2020 & 2033

- Table 128: North America Data Center Construction Market Volume K Unit Forecast, by Tier-IV 2020 & 2033

- Table 129: North America Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 130: North America Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 131: North America Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 132: North America Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 133: North America Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 134: North America Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 135: North America Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 136: North America Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 137: North America Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 138: North America Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 139: North America Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 140: North America Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 141: North America Data Center Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 142: North America Data Center Construction Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 143: North America Data Center Construction Market Revenue billion Forecast, by United States 2020 & 2033

- Table 144: North America Data Center Construction Market Volume K Unit Forecast, by United States 2020 & 2033

- Table 145: North America Data Center Construction Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 146: North America Data Center Construction Market Volume K Unit Forecast, by Canada 2020 & 2033

- Table 147: North America Data Center Construction Market Revenue billion Forecast, by Mexico 2020 & 2033

- Table 148: North America Data Center Construction Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 149: North America Data Center Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 150: North America Data Center Construction Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 151: North America Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 152: North America Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 153: North America Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 154: North America Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 155: North America Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 156: North America Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 157: North America Data Center Construction Market Revenue billion Forecast, by Power Back up Solutions 2020 & 2033

- Table 158: North America Data Center Construction Market Volume K Unit Forecast, by Power Back up Solutions 2020 & 2033

- Table 159: North America Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 160: North America Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 161: North America Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 162: North America Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 163: North America Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 164: North America Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 165: North America Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 166: North America Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 167: North America Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 168: North America Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 169: North America Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 170: North America Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 171: North America Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 172: North America Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 173: North America Data Center Construction Market Revenue billion Forecast, by Tier-I and II 2020 & 2033

- Table 174: North America Data Center Construction Market Volume K Unit Forecast, by Tier-I and II 2020 & 2033

- Table 175: North America Data Center Construction Market Revenue billion Forecast, by Tier-III 2020 & 2033

- Table 176: North America Data Center Construction Market Volume K Unit Forecast, by Tier-III 2020 & 2033

- Table 177: North America Data Center Construction Market Revenue billion Forecast, by Tier-IV 2020 & 2033

- Table 178: North America Data Center Construction Market Volume K Unit Forecast, by Tier-IV 2020 & 2033

- Table 179: North America Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 180: North America Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 181: North America Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 182: North America Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 183: North America Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 184: North America Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 185: North America Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 186: North America Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 187: North America Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 188: North America Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 189: North America Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 190: North America Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 191: North America Data Center Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 192: North America Data Center Construction Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 193: North America Data Center Construction Market Revenue billion Forecast, by United States 2020 & 2033

- Table 194: North America Data Center Construction Market Volume K Unit Forecast, by United States 2020 & 2033

- Table 195: North America Data Center Construction Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 196: North America Data Center Construction Market Volume K Unit Forecast, by Canada 2020 & 2033

- Table 197: North America Data Center Construction Market Revenue billion Forecast, by Mexico 2020 & 2033

- Table 198: North America Data Center Construction Market Volume K Unit Forecast, by Mexico 2020 & 2033

- Table 199: North America Data Center Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 200: North America Data Center Construction Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Data Center Construction Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the North America Data Center Construction Market?

Key companies in the market include Turner Construction Co, Hensel Phelps Construction Co Inc, DPR CONSTRUCTION INC, Clune Construction Company LP, IBM Corporation, Holder Construction Company, Fortis Construction Inc, Nabholz Construction Corporation, Rittal GMBH & Co KG, Hitachi Corporation, AECOM, HITT Contrating Inc, Schneider Electric SE.

3. What are the main segments of the North America Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Back up Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier-I and II, Tier-III, Tier-IV, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users, Geography, United States, Canada, Mexico.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Cloud Applications. AI. and Big Data; Growing Adoption of Hyperscale Data Centers in Large Enterprises; Advent Green Data Center.

6. What are the notable trends driving market growth?

United States of America to hold major market share.

7. Are there any restraints impacting market growth?

High CaPex. OpEx & TCO for building Data Center.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Data Center Construction Market?

To stay informed about further developments, trends, and reports in the North America Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence