Key Insights

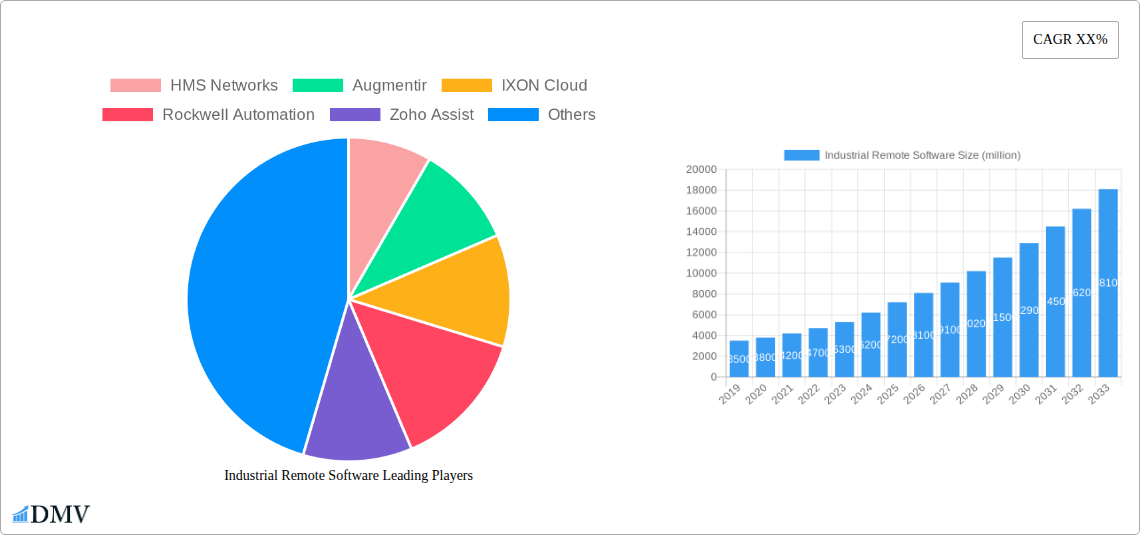

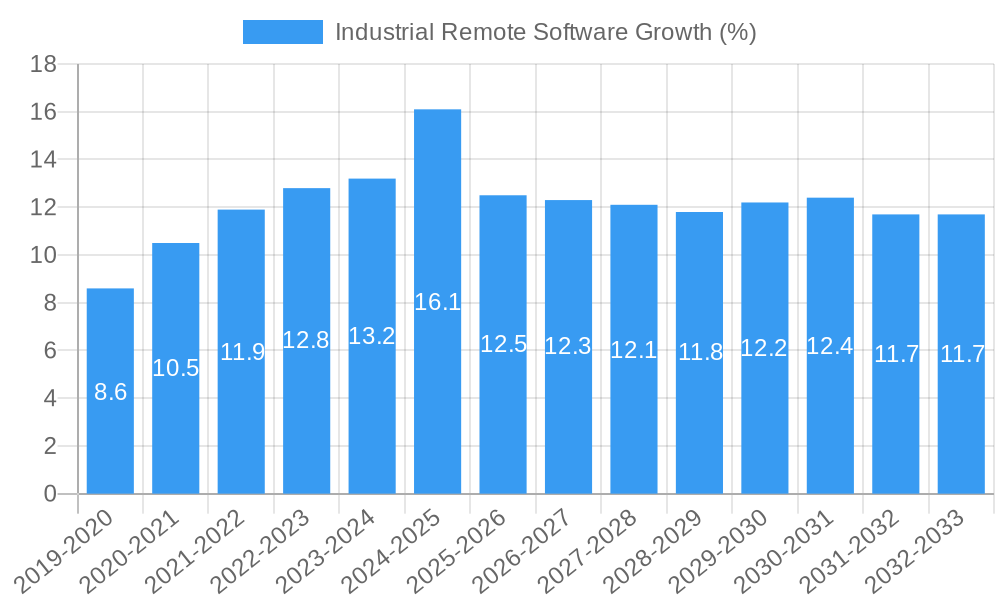

The Industrial Remote Software market is poised for significant expansion, projected to reach an estimated market size of $7,200 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 12.5%. This robust growth is fueled by the escalating adoption of Industrial Internet of Things (IIoT) solutions and the increasing demand for remote access and control capabilities across various industrial sectors. Key applications such as Industrial Automation, Smart Manufacturing, and Energy Management are spearheading this demand, as businesses seek to optimize operational efficiency, reduce downtime, and improve overall productivity. The shift towards digital transformation and the need for real-time data monitoring and analysis further bolster the market's upward trajectory. The COVID-19 pandemic also played a catalytic role, accelerating the adoption of remote work and management solutions, a trend that is expected to persist and contribute to sustained market growth. Companies are investing heavily in technologies that enable secure and efficient remote access for maintenance, troubleshooting, and operational oversight, recognizing its strategic importance in maintaining competitiveness.

Despite the promising outlook, certain factors could pose challenges to market expansion. High implementation costs, particularly for small and medium-sized enterprises, and concerns around cybersecurity and data privacy remain significant restraints. However, ongoing advancements in cloud computing, edge computing, and artificial intelligence are gradually mitigating these concerns by offering more secure, scalable, and cost-effective solutions. The market is characterized by a competitive landscape with key players like HMS Networks, Augmentir, Rockwell Automation, and Zoho Assist focusing on innovation, strategic partnerships, and product differentiation. The increasing emphasis on predictive maintenance and remote service offerings by these companies is set to redefine the industrial remote software landscape, creating new opportunities for growth and market penetration in the coming years. The market's trajectory indicates a future where seamless remote operations are integral to industrial success.

Industrial Remote Software Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a strategic analysis of the global Industrial Remote Software market, offering insights into its current composition, historical evolution, and projected trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. With an estimated market size in the multi-million dollar range and projected robust growth, this report offers actionable intelligence for manufacturers, solution providers, and end-users across key industrial sectors.

Industrial Remote Software Market Composition & Trends

The Industrial Remote Software market exhibits a dynamic and evolving landscape characterized by moderate concentration, driven by continuous innovation and a growing demand for enhanced operational efficiency and workforce collaboration. Key innovation catalysts include the imperative for real-time data access, predictive maintenance, and the increasing adoption of Industry 4.0 technologies. Regulatory landscapes, while varied across regions, are generally trending towards supporting secure remote access and data privacy, fostering market expansion. Substitute products, primarily traditional on-site support methods, are gradually being displaced by the cost-effectiveness and agility offered by remote software solutions. End-user profiles span a broad spectrum, from large-scale manufacturing plants and energy utility providers to smaller enterprises seeking to optimize their operational footprints. Merger and acquisition (M&A) activities are a significant factor, with deal values in the multi-million dollar range, indicating strategic consolidation and a drive to acquire cutting-edge technologies and expand market reach. The market share distribution reflects a blend of established players and emerging innovators, with a constant flux as new solutions gain traction.

Industrial Remote Software Industry Evolution

The Industrial Remote Software industry has undergone a significant transformation, evolving from basic remote access tools to sophisticated platforms enabling comprehensive remote operations and collaboration. Historically, the period from 2019 to 2024 saw a steady increase in adoption, fueled by the initial advantages of remote connectivity for troubleshooting and maintenance. The base year of 2025 marks a pivotal point, with the market poised for accelerated growth. Technological advancements have been the primary engine of this evolution. Early iterations relied heavily on protocols like Virtual Network Computing (VNC) and Remote Desktop Protocol (RDP), offering screen sharing and control capabilities. However, the industry has progressively embraced more secure and feature-rich solutions, including Virtual Private Network (VPN) integration for enhanced security and specialized industrial protocols tailored for operational technology (OT) environments. The increasing digitization of industrial processes, coupled with the growing need for remote diagnostics and support in sectors like Industrial Automation, Smart Manufacturing, and Energy Management, has significantly shaped market growth trajectories. Consumer demand has shifted towards solutions that offer seamless integration, robust security features, intuitive user interfaces, and the ability to support complex industrial machinery. This demand is further amplified by the global push for operational resilience and cost optimization. Growth rates, estimated to be in the XX% range annually during the forecast period of 2025–2033, are being propelled by the need for reduced downtime, improved engineer productivity, and the ability to manage distributed assets effectively. Adoption metrics, such as the number of connected devices and the percentage of industrial facilities utilizing remote access software, are projected to climb dramatically, reflecting the indispensable nature of these solutions in modern industrial operations. The proliferation of IoT devices and the growing complexity of industrial systems further underscore the critical role of industrial remote software in ensuring efficient and secure operations.

Leading Regions, Countries, or Segments in Industrial Remote Software

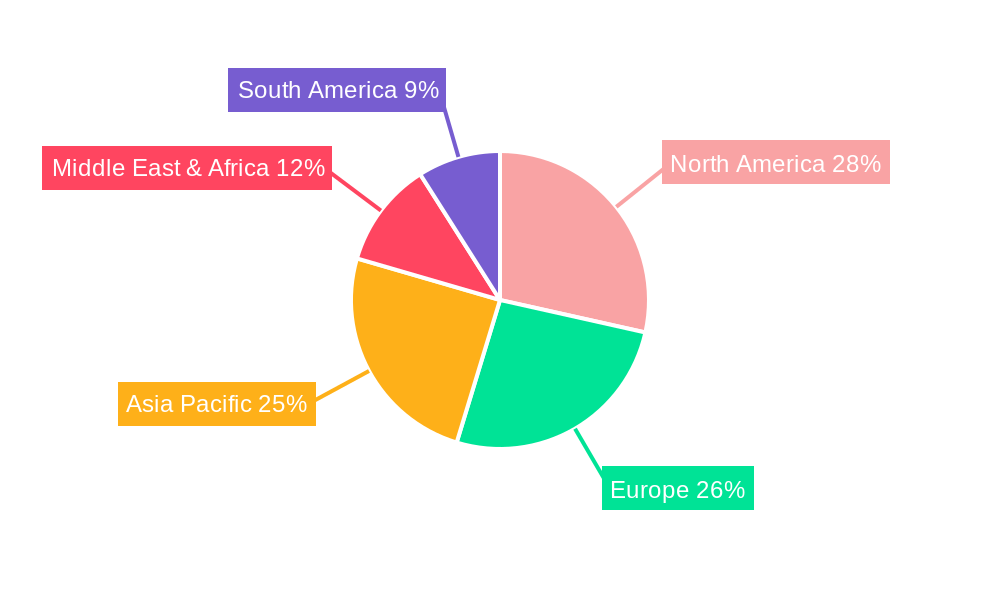

The Industrial Remote Software market's dominance is not monolithic but rather a confluence of regional strengths and segment-specific drivers. North America, particularly the United States, is a leading region, driven by its advanced manufacturing sector, substantial investments in smart manufacturing initiatives, and a strong emphasis on operational efficiency. The robust adoption of Industrial Automation and Energy Management applications within this region significantly contributes to its leadership. Europe, with countries like Germany and the UK, also exhibits strong market penetration, fueled by stringent regulatory frameworks promoting cybersecurity and data integrity in industrial settings, alongside a mature energy sector. Asia-Pacific, spearheaded by China and Japan, is emerging as a high-growth region, propelled by massive investments in smart manufacturing and the rapid expansion of its industrial base.

Within the Application segment, Industrial Automation stands out as a primary driver of market growth. The inherent need for remote monitoring, control, and maintenance of automated machinery in factories and production lines makes industrial remote software indispensable. This is closely followed by Smart Manufacturing, which leverages these solutions for real-time data analysis, predictive maintenance, and collaborative workflows across distributed manufacturing facilities. Energy Management also plays a crucial role, with remote software enabling the monitoring and optimization of energy grids, renewable energy installations, and industrial power consumption. Remote Office and Collaboration features are increasingly integrated, facilitating seamless communication and knowledge sharing among geographically dispersed engineering and support teams.

In terms of Types, Virtual Private Network (VPN) solutions are paramount, offering a secure tunnel for remote access to industrial networks, essential for protecting sensitive operational technology (OT) data. Virtual Network Computing (VNC) and Remote Desktop Protocol (RDP), while foundational, are increasingly being augmented with specialized industrial functionalities and enhanced security layers to meet the demands of critical infrastructure. The integration of VPN capabilities with VNC/RDP provides a comprehensive and secure remote access framework. Investment trends in cybersecurity for OT environments, coupled with government incentives for digital transformation in manufacturing, are key investment trends. Regulatory support for secure remote access, such as data localization laws and cybersecurity standards, further solidifies the dominance of these segments. The widespread implementation of Industry 4.0 principles across these leading regions and segments underscores the critical role of industrial remote software in achieving operational excellence and digital transformation goals.

Industrial Remote Software Product Innovations

Recent product innovations in Industrial Remote Software are revolutionizing operational capabilities. These advancements focus on enhanced cybersecurity, AI-driven diagnostics, and seamless integration with existing Industrial Internet of Things (IIoT) ecosystems. Solutions now offer real-time anomaly detection, predicting potential equipment failures before they occur, thereby minimizing downtime. Furthermore, augmented reality (AR) capabilities are being integrated, allowing remote engineers to visually guide on-site technicians through complex repairs. The performance metrics showcase significant improvements in connection stability, reduced latency, and enhanced data throughput, enabling more complex tasks to be performed remotely with high fidelity. Unique selling propositions include the ability to provide secure, one-click access to industrial assets, sophisticated user management for granular access control, and comprehensive audit trails for compliance. Technological advancements are pushing the boundaries of what is possible in remote industrial operations.

Propelling Factors for Industrial Remote Software Growth

Several key factors are propelling the growth of the Industrial Remote Software market. Technological advancements are at the forefront, with the proliferation of IoT devices and the increasing demand for real-time data analytics driving the need for robust remote connectivity. Economic considerations play a significant role; companies are recognizing the cost savings associated with reduced travel expenses for technicians and minimized downtime through proactive remote maintenance. Regulatory influences, such as stricter cybersecurity mandates and government initiatives promoting digital transformation in industries, are further accelerating adoption. For instance, mandates for secure remote access in critical infrastructure sectors are creating a strong demand.

Obstacles in the Industrial Remote Software Market

Despite its robust growth, the Industrial Remote Software market faces certain obstacles. Regulatory challenges, particularly varying data privacy laws and cybersecurity compliance standards across different jurisdictions, can hinder seamless global deployment. Supply chain disruptions, while easing, can still impact the availability of hardware components necessary for some remote solutions. Competitive pressures from numerous vendors offering similar functionalities can lead to pricing wars and the need for constant innovation to differentiate. Quantifiable impacts of these barriers are seen in longer deployment cycles and increased R&D investment required to navigate complex compliance landscapes.

Future Opportunities in Industrial Remote Software

Emerging opportunities in the Industrial Remote Software market are significant and multifaceted. The expansion of new markets, particularly in developing economies undergoing rapid industrialization, presents substantial growth potential. Advancements in new technologies such as 5G connectivity, edge computing, and advanced AI/ML algorithms are enabling more sophisticated remote operations, including real-time autonomous control. Consumer trends like the increasing demand for sustainable operations and predictive maintenance are also creating new avenues for specialized remote software solutions. The integration of digital twins with remote access capabilities is another area ripe for expansion.

Major Players in the Industrial Remote Software Ecosystem

- HMS Networks

- Augmentir

- IXON Cloud

- Rockwell Automation

- Zoho Assist

- TBA Group

- Westermo

- Digi International

- Secomea

- Moxa Inc

- Otorio Ltd

- Pics NV

- SecureLink

- Molex, LLC

- Remote Engineer BV

- HMS Industrial Networks

- IXON BV

- Welotec

Key Developments in Industrial Remote Software Industry

- 2023 Q4: Launch of enhanced cybersecurity protocols for industrial VPNs, addressing emerging OT threat vectors.

- 2024 Q1: Major player announces integration of AI-powered predictive maintenance analytics directly within their remote access platform, enabling proactive issue resolution.

- 2024 Q2: Strategic partnership formed between a leading IoT platform provider and an industrial remote software vendor to offer end-to-end connected factory solutions.

- 2024 Q3: Significant acquisition of a specialized remote support software company by a major automation solutions provider, consolidating market presence.

- 2024 Q4: Introduction of augmented reality (AR) capabilities in an industrial remote software solution, allowing for remote expert guidance during on-site maintenance.

Strategic Industrial Remote Software Market Forecast

The strategic forecast for the Industrial Remote Software market points towards continued robust growth, driven by the ongoing digital transformation across all industrial sectors. Key growth catalysts include the increasing adoption of Industry 4.0 technologies, the persistent need for operational efficiency and cost reduction, and the ever-growing imperative for secure and reliable remote access to critical industrial assets. Emerging opportunities in 5G-enabled remote operations and AI-driven predictive maintenance will further fuel market expansion. The market potential is immense, with a projected compound annual growth rate (CAGR) in the double-digit range over the forecast period, making industrial remote software an indispensable component of future industrial operations.

Industrial Remote Software Segmentation

-

1. Application

- 1.1. Industrial Automation

- 1.2. Remote Office and Collaboration

- 1.3. Smart Manufacturing

- 1.4. Energy Management

- 1.5. Others

-

2. Types

- 2.1. Virtual Private Network (VPN)

- 2.2. Virtual Network Computing (VNC)

- 2.3. Remote Desktop Protocol (RDP)

Industrial Remote Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial Remote Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Automation

- 5.1.2. Remote Office and Collaboration

- 5.1.3. Smart Manufacturing

- 5.1.4. Energy Management

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Virtual Private Network (VPN)

- 5.2.2. Virtual Network Computing (VNC)

- 5.2.3. Remote Desktop Protocol (RDP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial Automation

- 6.1.2. Remote Office and Collaboration

- 6.1.3. Smart Manufacturing

- 6.1.4. Energy Management

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Virtual Private Network (VPN)

- 6.2.2. Virtual Network Computing (VNC)

- 6.2.3. Remote Desktop Protocol (RDP)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial Automation

- 7.1.2. Remote Office and Collaboration

- 7.1.3. Smart Manufacturing

- 7.1.4. Energy Management

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Virtual Private Network (VPN)

- 7.2.2. Virtual Network Computing (VNC)

- 7.2.3. Remote Desktop Protocol (RDP)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial Automation

- 8.1.2. Remote Office and Collaboration

- 8.1.3. Smart Manufacturing

- 8.1.4. Energy Management

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Virtual Private Network (VPN)

- 8.2.2. Virtual Network Computing (VNC)

- 8.2.3. Remote Desktop Protocol (RDP)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial Automation

- 9.1.2. Remote Office and Collaboration

- 9.1.3. Smart Manufacturing

- 9.1.4. Energy Management

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Virtual Private Network (VPN)

- 9.2.2. Virtual Network Computing (VNC)

- 9.2.3. Remote Desktop Protocol (RDP)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial Remote Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial Automation

- 10.1.2. Remote Office and Collaboration

- 10.1.3. Smart Manufacturing

- 10.1.4. Energy Management

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Virtual Private Network (VPN)

- 10.2.2. Virtual Network Computing (VNC)

- 10.2.3. Remote Desktop Protocol (RDP)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HMS Networks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Augmentir

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IXON Cloud

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwell Automation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zoho Assist

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TBA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Westermo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Digi International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Secomea

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moxa Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Otorio Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pics NV

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SecureLink

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Molex

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Remote Engineer BV

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 HMS Industrial Networks

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 IXON BV

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Welotec

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 HMS Networks

List of Figures

- Figure 1: Global Industrial Remote Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Remote Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Industrial Remote Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Industrial Remote Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Industrial Remote Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Industrial Remote Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Industrial Remote Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Remote Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Industrial Remote Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Industrial Remote Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Industrial Remote Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Industrial Remote Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Industrial Remote Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Industrial Remote Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Industrial Remote Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Industrial Remote Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Industrial Remote Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Industrial Remote Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Industrial Remote Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Industrial Remote Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Industrial Remote Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Industrial Remote Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Industrial Remote Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Industrial Remote Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Industrial Remote Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Industrial Remote Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Industrial Remote Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Industrial Remote Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Industrial Remote Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Industrial Remote Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Industrial Remote Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Remote Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Industrial Remote Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Industrial Remote Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Industrial Remote Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Industrial Remote Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Industrial Remote Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Industrial Remote Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Remote Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Industrial Remote Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Industrial Remote Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Remote Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Industrial Remote Software?

Key companies in the market include HMS Networks, Augmentir, IXON Cloud, Rockwell Automation, Zoho Assist, TBA Group, Westermo, Digi International, Secomea, Moxa Inc, Otorio Ltd, Pics NV, SecureLink, Molex, LLC, Remote Engineer BV, HMS Industrial Networks, IXON BV, Welotec.

3. What are the main segments of the Industrial Remote Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Remote Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Remote Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Remote Software?

To stay informed about further developments, trends, and reports in the Industrial Remote Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence