Key Insights

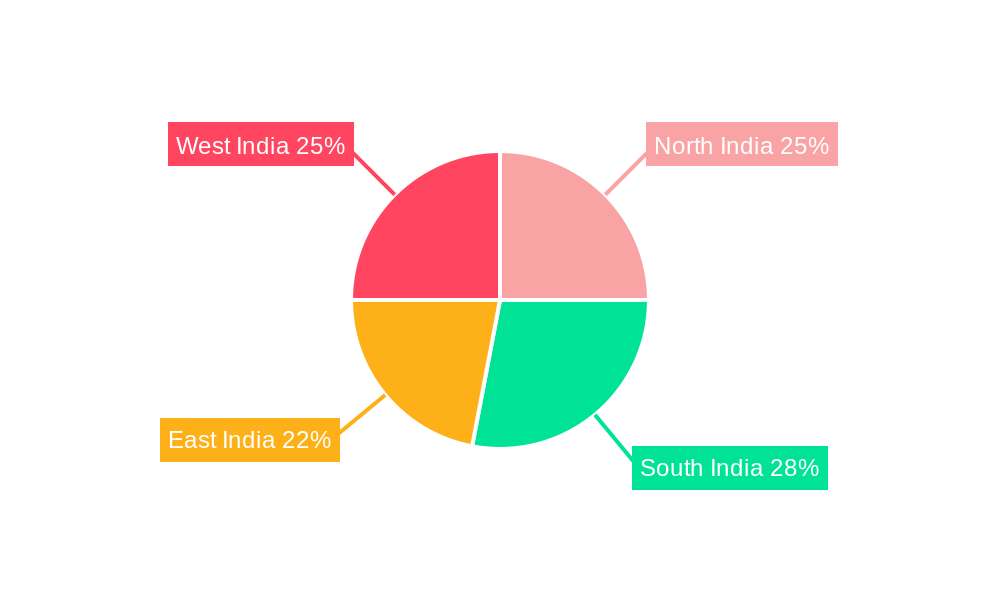

The Indian plastic industry, valued at ₹46.48 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.5% from 2025 to 2033. This growth is fueled by several key drivers. Increased infrastructure development, particularly in construction and transportation, significantly boosts demand for plastic products. The rising disposable income and burgeoning middle class fuel consumer spending on plastic-based household goods and packaging materials. Furthermore, advancements in plastic technology, such as the adoption of bioplastics and improved recycling methods, contribute to market expansion while addressing environmental concerns. However, the industry faces challenges. Stringent government regulations concerning plastic waste management and growing environmental consciousness necessitate sustainable practices. Fluctuations in raw material prices, primarily crude oil derivatives, also pose a significant risk to profitability. The industry is segmented by type (traditional plastics, engineering plastics, bioplastics), technology (blow molding, extrusion, injection molding), and application (packaging, electrical & electronics, building & construction, automotive, housewares, furniture). Key players include established companies like Cello, Nilkamal, Mayur Uniquoters, and VIP Industries, along with others catering to diverse segments. Regional variations exist, with potential for growth across all regions (North, South, East, and West India) depending on infrastructure development and consumer demand.

The forecast for the Indian plastic industry points to a substantial increase in market size by 2033. This projection is supported by continued economic growth and urbanization in India. The rising adoption of lightweight and durable plastic components in the automotive and construction sectors will continue to drive demand. The growing focus on sustainable practices is creating opportunities for bioplastics and recycled plastic materials, although this segment may initially exhibit slower growth compared to traditional plastics. Competitive pressures among manufacturers will likely intensify, pushing innovation in product design, manufacturing processes, and sustainable solutions. Companies will need to adapt by investing in advanced technologies, optimizing supply chains, and promoting eco-friendly practices to sustain their market share and navigate the evolving regulatory landscape. Strategic partnerships and mergers and acquisitions might become more frequent as companies seek to expand their market reach and capabilities.

India Plastic Industry Market Composition & Trends

The India Plastic Industry is characterized by a mix of established players and emerging innovators, with a market concentration that leans towards a few dominant companies. The top five companies, including Wim Plast Ltd (Cello), Nilkamal Ltd, and Supreme Industries Ltd, hold approximately 35% of the market share. The industry is driven by continuous innovation, spurred by technological advancements and the need for sustainable materials. Regulatory landscapes are evolving, with recent policies focusing on reducing plastic waste and promoting recycling. Substitute products, such as bioplastics, are gaining traction, particularly in packaging and consumer goods sectors. End-user profiles vary widely, from packaging and automotive industries to construction and electronics, each demanding specific types of plastics.

- Market Share Distribution: Top 5 companies control 35%.

- Innovation Catalysts: Technological advancements, sustainability demands.

- Regulatory Landscapes: Emphasis on recycling and waste reduction.

- Substitute Products: Growing adoption of bioplastics.

- End-User Profiles: Diverse, including packaging, automotive, construction, electronics.

- M&A Activities: Notable deals in the past year totaled approximately USD 150 Million, aimed at expanding market reach and technological capabilities.

India Plastic Industry Industry Evolution

The Indian plastic industry has experienced remarkable growth from 2019 to 2024, boasting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. This trajectory is projected to continue, with forecasts indicating a CAGR of 7.2% extending through 2033. This expansion is fueled by a confluence of factors: a burgeoning demand for plastic packaging (both traditional and bioplastics), driven by the rising consumption and e-commerce sectors; significant advancements in manufacturing technologies such as injection molding and extrusion, leading to improved efficiency and product quality; and a growing consumer preference for sustainable and eco-friendly alternatives. The automotive and construction industries also represent key drivers, increasingly utilizing high-performance engineering plastics. This dynamic landscape is shaping the industry's future, demanding innovation and adaptability from players across the value chain.

Leading Regions, Countries, or Segments in India Plastic Industry

The India Plastic Industry showcases distinct leadership in various segments, with traditional plastics dominating due to their widespread use across multiple applications. The packaging segment remains the largest consumer, driven by the need for efficient and cost-effective solutions.

- Traditional Plastics: Dominate due to versatility and cost-effectiveness.

- Bioplastics: Growing segment, driven by sustainability trends and regulatory support.

- Packaging: Largest application, with significant investments in innovation.

- Injection Molding: Preferred technology due to its precision and efficiency.

In-depth analysis reveals that traditional plastics continue to lead due to their established infrastructure and widespread application across industries. The packaging segment's dominance is fueled by continuous investments in research and development to meet the evolving needs of consumers and regulators. Bioplastics, while still a smaller segment, are gaining ground rapidly, supported by government initiatives aimed at reducing environmental impact. Injection molding technology remains a key driver due to its ability to produce complex and high-quality products efficiently. The automotive and construction sectors also play a crucial role, with engineering plastics being favored for their strength and durability, contributing to the overall growth and dominance of these segments within the industry.

India Plastic Industry Product Innovations

Innovation within the Indian plastic industry is heavily focused on sustainability and enhanced performance characteristics. Key developments include the emergence of advanced bioplastics offering superior biodegradability and strength, suitable for a wider range of packaging and consumer goods applications. Simultaneously, the adoption of engineering plastics with improved heat resistance and durability is transforming sectors such as automotive and electronics. This drive towards eco-friendly, high-performance materials is spearheaded by leading industry players like Nilkamal Ltd and Supreme Industries Ltd, who are actively investing in research and development to maintain their competitive edge.

Propelling Factors for India Plastic Industry Growth

The India Plastic Industry is propelled by several key growth drivers:

- Technological Advancements: Innovations in injection molding and extrusion technologies enhance production efficiency.

- Economic Growth: Rising demand from sectors like packaging, automotive, and construction fuels market expansion.

- Regulatory Support: Government policies promoting sustainable materials encourage the adoption of bioplastics.

These factors collectively contribute to the industry's robust growth trajectory, with companies continuously investing in new technologies and sustainable practices.

Obstacles in the India Plastic Industry Market

The India Plastic Industry faces several obstacles that may impede growth:

- Regulatory Challenges: Stricter environmental regulations increase compliance costs and limit traditional plastic usage.

- Supply Chain Disruptions: Global supply chain issues affect raw material availability and pricing.

- Competitive Pressures: Intense competition from both domestic and international players impacts market share and profitability.

These barriers require strategic planning and innovation to mitigate their impact on the industry.

Future Opportunities in India Plastic Industry

The Indian plastic industry presents a wealth of future opportunities:

- Market Expansion: Untapped markets in sectors like renewable energy and healthcare offer significant potential for growth.

- Technological Advancements: Continued breakthroughs in bioplastics and recycling technologies will unlock new avenues for sustainable development and resource efficiency.

- Sustainable Consumption: The increasing consumer demand for eco-conscious products presents a powerful catalyst for innovation and market expansion.

- Circular Economy Initiatives: Government policies promoting waste reduction and recycling will create new opportunities for businesses focused on sustainable practices.

- Infrastructure Development: India's ongoing infrastructure projects create a strong demand for plastic materials in construction and related sectors.

These opportunities underscore the considerable potential for companies that proactively embrace innovation and adapt to evolving market demands.

Major Players in the India Plastic Industry Ecosystem

- Wim Plast Ltd (Cello)

- Nilkamal Ltd

- Mayur Uniquoters Ltd

- VIP Industries Ltd

- Responsive Industries Ltd

- Plastiblends India Ltd

- Supreme Industries Ltd

- Jain Irrigation Systems Ltd

- Kingfa Science & Technology India Ltd

- Safari Industries India Ltd

Key Developments in India Plastic Industry Industry

- December 2022: Nilkamal's strategic partnership with Haptik significantly enhanced customer experience through automated WhatsApp commerce, improved order tracking, and streamlined product discovery. This move demonstrates a commitment to leveraging technology to improve customer satisfaction and market reach.

- June 2022: The merger of Jain Irrigation's irrigation business with Rivulis created a global leader in irrigation and climate solutions. This USD 750 Million entity, operating across six continents and 35 countries, exemplifies the industry's consolidation and its focus on innovation, digital solutions, and sustainable practices.

- [Add other relevant recent key developments here with dates and brief descriptions]

Strategic India Plastic Industry Market Forecast

The strategic forecast for the Indian plastic industry paints a picture of sustained robust growth. This positive outlook is supported by several factors: continuous technological advancements; India's ongoing economic expansion; and the rising consumer preference for sustainable materials. The market is poised to capitalize on emerging opportunities in diverse applications and geographical regions, with a particular focus on bioplastics and recycling technologies. The packaging and automotive sectors remain key drivers of growth, further fueled by the increasing consumer demand for eco-friendly products. Companies that strategically prioritize innovation and adapt to the evolving market dynamics will be best positioned to successfully navigate this growth trajectory and capitalize on the significant market potential through 2033 and beyond.

India Plastic Industry Segmentation

-

1. Type

- 1.1. Traditional Plastics

- 1.2. Engineering Plastics

- 1.3. Bioplastics

-

2. Technology

- 2.1. Blow Molding

- 2.2. Extrusion

- 2.3. Injection Molding

- 2.4. Other Technologies

-

3. Applicatiopn

- 3.1. Packaging

- 3.2. Electrical and Electronics

- 3.3. Building and Construction

- 3.4. Automotive and Transportation

- 3.5. Housewares

- 3.6. Furniture and Bedding

- 3.7. Other Applications

India Plastic Industry Segmentation By Geography

- 1. India

India Plastic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in E-Commerce is driving the market growth

- 3.3. Market Restrains

- 3.3.1. Envirnomental Concerns and Regulatory Pressures

- 3.4. Market Trends

- 3.4.1. Packaging Segment Holds the Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plastic Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Plastics

- 5.1.2. Engineering Plastics

- 5.1.3. Bioplastics

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Blow Molding

- 5.2.2. Extrusion

- 5.2.3. Injection Molding

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Applicatiopn

- 5.3.1. Packaging

- 5.3.2. Electrical and Electronics

- 5.3.3. Building and Construction

- 5.3.4. Automotive and Transportation

- 5.3.5. Housewares

- 5.3.6. Furniture and Bedding

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Plastic Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Plastic Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Plastic Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Plastic Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Wim Plast Ltd (Cello)**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nilkamal Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mayur Uniquoters Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 VIP Industries Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Responsive Industries Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Plastiblends India Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Supreme Industries Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Jain Irrigation Systems Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kingfa Science & Technology India Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Safari Industries India Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Wim Plast Ltd (Cello)**List Not Exhaustive

List of Figures

- Figure 1: India Plastic Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Plastic Industry Share (%) by Company 2024

List of Tables

- Table 1: India Plastic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Plastic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Plastic Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: India Plastic Industry Revenue Million Forecast, by Applicatiopn 2019 & 2032

- Table 5: India Plastic Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Plastic Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Plastic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Plastic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Plastic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Plastic Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Plastic Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Plastic Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: India Plastic Industry Revenue Million Forecast, by Applicatiopn 2019 & 2032

- Table 14: India Plastic Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plastic Industry?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the India Plastic Industry?

Key companies in the market include Wim Plast Ltd (Cello)**List Not Exhaustive, Nilkamal Ltd, Mayur Uniquoters Ltd, VIP Industries Ltd, Responsive Industries Ltd, Plastiblends India Ltd, Supreme Industries Ltd, Jain Irrigation Systems Ltd, Kingfa Science & Technology India Ltd, Safari Industries India Ltd.

3. What are the main segments of the India Plastic Industry?

The market segments include Type, Technology, Applicatiopn.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in E-Commerce is driving the market growth.

6. What are the notable trends driving market growth?

Packaging Segment Holds the Highest Share in the Market.

7. Are there any restraints impacting market growth?

Envirnomental Concerns and Regulatory Pressures.

8. Can you provide examples of recent developments in the market?

December 2022: Nilkamal Partnered with Haptik to Deliver a seamless customer experience across platforms. The Haptik-Nilkamal partnership does not only automate WhatsApp commerce at a granular level but also helps customers track their order status and the status of their refund requests and add product discovery as part of their shopping experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plastic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plastic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plastic Industry?

To stay informed about further developments, trends, and reports in the India Plastic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence