Key Insights

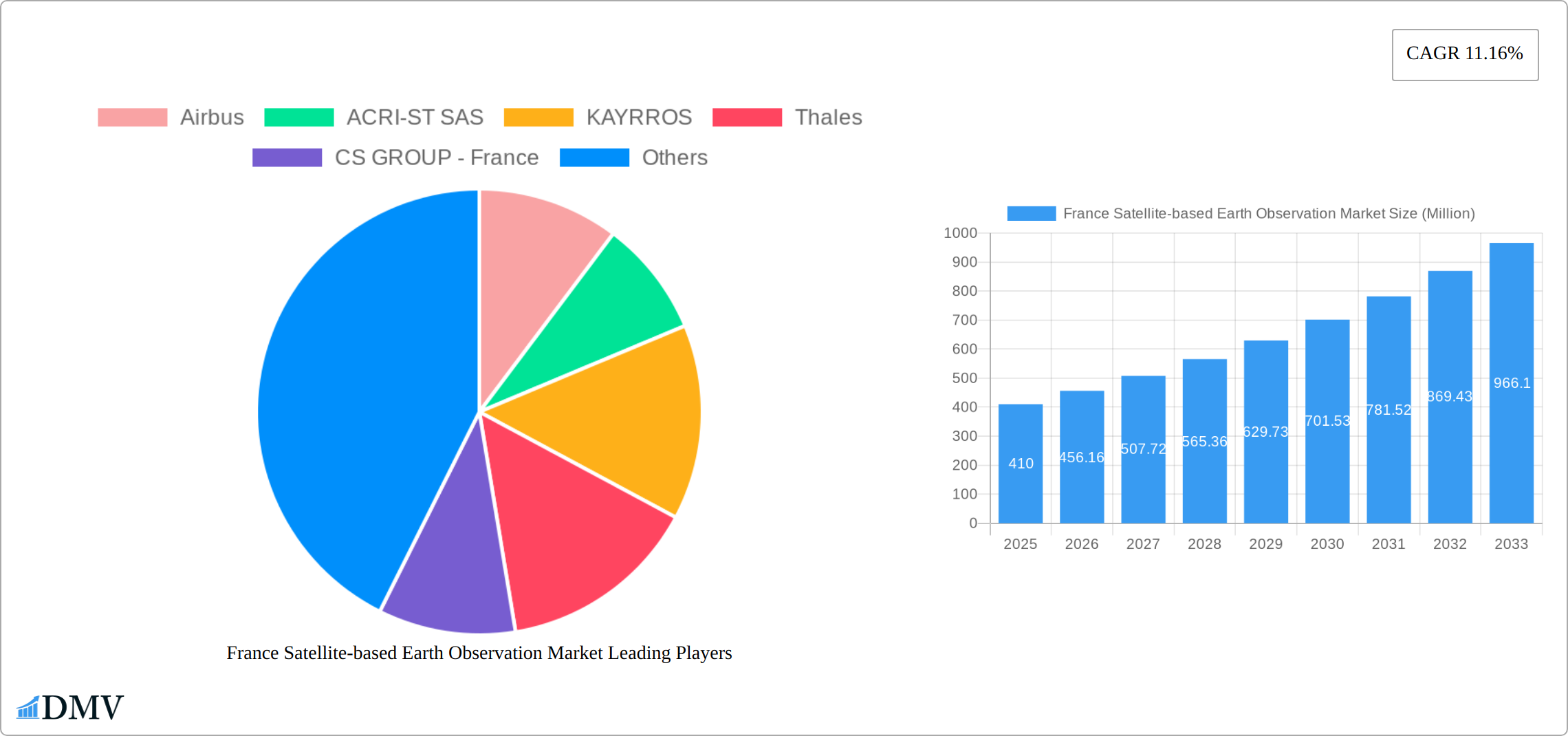

The France satellite-based Earth observation market, valued at €410 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.16% from 2025 to 2033. This robust expansion is driven by increasing government initiatives promoting sustainable development and precision agriculture, coupled with the rising adoption of advanced analytics for deriving actionable insights from satellite imagery. Key market segments include Earth observation data and value-added services, with applications spanning urban development, agriculture, climate monitoring, and infrastructure management. The Low Earth Orbit (LEO) segment currently dominates due to its high-resolution imagery capabilities, although Medium Earth Orbit (MEO) and Geostationary Orbit (GEO) segments are expected to witness substantial growth fueled by advancements in satellite technology and decreasing launch costs. Leading players like Airbus, Thales, and CLS sàrl are leveraging their technological expertise and partnerships to cater to the growing demand. The market's growth is further supported by the French government's focus on space innovation and its commitment to utilizing satellite data for various national priorities.

The market's restraints primarily involve the high initial investment costs associated with satellite technology and data processing, as well as potential challenges related to data security and regulatory compliance. However, these challenges are being mitigated by the emergence of cloud-based data processing platforms, enhanced data accessibility, and collaborative industry initiatives focused on standardization and interoperability. Future growth will be significantly influenced by the development of advanced analytical tools and AI-powered applications that unlock the full potential of satellite data for various sectors, enhancing efficiency and decision-making. The increasing availability of affordable high-resolution imagery and the growing awareness of the benefits of Earth observation are projected to further accelerate market expansion in the coming years. The continued focus on sustainable practices and environmental monitoring will strongly underpin demand across key application sectors.

France Satellite-based Earth Observation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the France satellite-based Earth observation market, covering the period 2019-2033. With a focus on market dynamics, technological advancements, and key players, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and projects the market's trajectory from 2025-2033. The total market value is expected to reach xx Million by 2033.

France Satellite-based Earth Observation Market Market Composition & Trends

The French satellite-based Earth observation market is a dynamic landscape shaped by intense competition, rapid innovation, and a supportive regulatory environment. This section provides a detailed analysis of the market's competitive structure, key innovation drivers, and the regulatory framework influencing its growth trajectory. We analyze market concentration, pinpoint key players and their respective market shares, and delve into the innovative forces shaping the sector. This includes advancements in sensor technology (e.g., hyperspectral imaging, SAR), data analytics (AI/ML driven solutions), and the miniaturization of satellite platforms enabling the proliferation of smaller, more agile constellations. The regulatory landscape, encompassing government policies and initiatives aimed at fostering space technology development and data accessibility, is critically examined for its impact on market expansion. The competitive dynamics are further enriched by an analysis of substitute products and their market influence, coupled with detailed end-user profiles across diverse sectors. Finally, we scrutinize M&A activities, including deal values and their implications for market consolidation and future strategic direction.

- Market Concentration: A detailed competitive analysis reveals the market concentration level in France, identifying dominant players such as Airbus Defence and Space and Thales Alenia Space, alongside emerging competitors. The precise market share distribution of key participants, including the contribution of smaller, specialized companies, is meticulously detailed within the full report. This includes an assessment of their market strategies and competitive advantages.

- Innovation Catalysts: Advancements in high-resolution imaging (panchromatic and multispectral), advanced Synthetic Aperture Radar (SAR) capabilities, AI-powered data analytics (including machine learning for automated feature extraction and predictive modeling), and the miniaturization of satellite technology (leading to lower launch costs and greater accessibility) are key innovation drivers. Specific examples of innovative technologies and their market impact are highlighted.

- Regulatory Landscape: The French government's strategic initiatives promoting space technology development, data sharing, and accessibility significantly influence market growth. A thorough review of pertinent regulations, including those concerning data privacy, security, and intellectual property rights, is included, along with an assessment of their impact on market players and investment decisions.

- Substitute Products: A comparative analysis of alternative technologies and data sources that might compete with satellite-based Earth observation is presented. This includes an evaluation of their strengths, weaknesses, and overall market penetration. The analysis considers factors such as cost, accessibility, and data quality.

- End-User Profiles: The report provides in-depth profiles of end-users across key sectors, including agriculture (precision farming), urban development (infrastructure monitoring, urban planning), environmental monitoring (deforestation, pollution tracking), defense & security, and resource management. These profiles highlight specific needs, adoption rates, and the drivers influencing their utilization of satellite-derived data and services.

- M&A Activities: A comprehensive review of completed and pending mergers and acquisitions (M&A) within the French satellite-based Earth observation market is included. The analysis considers deal values (presented in the full report), strategic rationale behind these transactions, and their implications for market consolidation, technological innovation, and overall market competitiveness.

France Satellite-based Earth Observation Market Industry Evolution

This section presents a historical and prospective analysis of the evolution of the French satellite-based Earth observation market, tracing its growth trajectory and identifying key inflection points. We explore the historical trends, technological advancements (such as improved sensor resolution and data processing capabilities), and evolving consumer demands that have shaped the market. The analysis forecasts future growth rates, considering the influence of technological innovations, shifting end-user needs, and the broader macroeconomic context. Specific data points, including historical growth rates, adoption metrics for various technologies (e.g., adoption of AI-powered analytics), and projected Compound Annual Growth Rates (CAGRs) for the forecast period (e.g., 2025-2033), are presented. The impact of new business models and emerging applications on market expansion is also considered.

Leading Regions, Countries, or Segments in France Satellite-based Earth Observation Market

This section identifies the dominant segments within the French satellite-based Earth observation market, analyzed by type (Earth Observation Data, Value-Added Services), satellite orbit (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit), and end-use (Agriculture, Urban Development, etc.). We will identify the leading segments and provide a detailed analysis of the factors contributing to their dominance.

- By Type: [Analysis of market share and growth drivers for Earth Observation Data and Value-Added Services. Include projected values in Millions for 2025 and 2033]

- By Satellite Orbit: [Analysis of market share and growth drivers for Low Earth Orbit, Medium Earth Orbit, and Geostationary Orbit. Include projected values in Millions for 2025 and 2033]

- By End-use: [Analysis of market share and growth drivers for each end-use segment (Agriculture, Urban Development and Cultural Heritage, Climate Services, Energy and Raw Materials, Infrastructure, Others). Include projected values in Millions for 2025 and 2033. Highlight the leading segment and its key drivers]. For example, the Agriculture sector is expected to dominate due to [specific reasons].

Key Drivers:

- [Bullet points detailing investment trends, regulatory support, and other significant drivers for each leading segment].

France Satellite-based Earth Observation Market Product Innovations

This section showcases recent and impactful product innovations within the French satellite-based Earth observation market. It highlights the unique selling propositions (USPs) and technological advancements of these new products and services, providing concrete examples of their applications and performance metrics. We examine innovations in various aspects, including sensor technology (e.g., hyperspectral imaging for enhanced spectral resolution and precision agriculture), satellite platforms (e.g., smaller, more agile satellites enabling the creation of constellations for improved data acquisition frequency), and data analytics platforms (e.g., cloud-based platforms offering scalable data processing and analysis capabilities). The performance advantages of these new solutions over existing technologies are analyzed in detail, emphasizing their contribution to market growth and increased user adoption.

Propelling Factors for France Satellite-based Earth Observation Market Growth

The growth of the French satellite-based Earth observation market is driven by a confluence of factors. Technological advancements, including improved sensor technology (e.g., increased spatial and spectral resolution), AI-driven data analytics (enabling automated feature extraction, classification, and predictive modeling), and cost-effective satellite platforms, are key drivers. Government initiatives and policies designed to foster space technology development, promote data accessibility, and encourage private sector investment play a crucial role. Furthermore, the increasing demand for environmental monitoring (e.g., climate change mitigation, pollution detection), resource management (e.g., precision agriculture, sustainable forestry), and infrastructure development (e.g., urban planning, disaster response) across various sectors significantly fuels market expansion.

Obstacles in the France Satellite-based Earth Observation Market Market

Despite significant growth potential, the French satellite-based Earth observation market faces challenges. Regulatory hurdles surrounding data access and privacy, potential supply chain disruptions impacting the availability of critical components, and intense competition from both domestic and international players are significant constraints. The report will quantify the impact of these obstacles on market growth.

Future Opportunities in France Satellite-based Earth Observation Market

The French satellite-based Earth observation market presents significant future opportunities driven by emerging applications and technological advancements. This includes opportunities in smart cities (e.g., infrastructure monitoring, urban planning), precision agriculture (e.g., yield prediction, crop health monitoring), climate change mitigation (e.g., deforestation tracking, carbon sequestration monitoring), and disaster response (e.g., flood and wildfire monitoring). Advancements in nanosatellite and constellation technologies offer possibilities for improved data acquisition and increased data frequency. The increasing sophistication of AI and machine learning techniques for enhanced data analytics presents considerable market potential for generating actionable insights from satellite data.

Major Players in the France Satellite-based Earth Observation Market Ecosystem

- Airbus

- ACRI-ST SAS

- KAYRROS

- Thales

- CS GROUP - France

- EUTELSAT COMMUNICATIONS SA

- EarthDaily Agro

- TerraNIS

- E-Space SAS

- CLS sàrl

Key Developments in France Satellite-based Earth Observation Market Industry

- June 2023: E-space successfully completed a feasibility study commissioned by CNES, validating its satellite system and business model, opening avenues for future collaborations within the French space ecosystem.

- March 2023: Airbus Defence and Space secured an agreement to manufacture Angeo-1, Angola's first high-performance Earth observation satellite, strengthening Franco-Angolan collaboration in the space sector.

Strategic France Satellite-based Earth Observation Market Market Forecast

The French satellite-based Earth observation market is poised for substantial growth, driven by technological advancements, increasing government support, and rising demand across various sectors. The market's future trajectory is positive, with significant opportunities arising from emerging applications and innovative technologies. The report provides a detailed forecast, outlining the key drivers and potential challenges influencing market growth over the forecast period (2025-2033).

France Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

France Satellite-based Earth Observation Market Segmentation By Geography

- 1. France

France Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth in the French Government's investment in the space sector; Growing Need to Generate Big Data to Offer Accurate Insights into Earth Observation

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Personnel

- 3.4. Market Trends

- 3.4.1. Agriculture Segment is Anticipated to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Airbus

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ACRI-ST SAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KAYRROS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CS GROUP - France

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EUTELSAT COMMUNICATIONS SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EarthDaily Agro*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TerraNIS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E-Space SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CLS sàrl

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Airbus

List of Figures

- Figure 1: France Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: France Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: France Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: France Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 5: France Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: France Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: France Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 9: France Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 10: France Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Satellite-based Earth Observation Market?

The projected CAGR is approximately 11.16%.

2. Which companies are prominent players in the France Satellite-based Earth Observation Market?

Key companies in the market include Airbus, ACRI-ST SAS, KAYRROS, Thales, CS GROUP - France, EUTELSAT COMMUNICATIONS SA, EarthDaily Agro*List Not Exhaustive, TerraNIS, E-Space SAS, CLS sàrl.

3. What are the main segments of the France Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.41 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth in the French Government's investment in the space sector; Growing Need to Generate Big Data to Offer Accurate Insights into Earth Observation.

6. What are the notable trends driving market growth?

Agriculture Segment is Anticipated to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Personnel.

8. Can you provide examples of recent developments in the market?

June 2023 - E-space, the company bridging Earth and space to enable hyper-scaled deployments of Internet of Things (IoT) solutions and services, announced the completion of a five-month feasibility study commissioned by the French Space Agency CNES. The study sought to evaluate and validate the technical capabilities of the E-Space satellite system (communication payload, space platform, guidance, navigation, and control (GNC), and user terminal), as well as the long-term feasibility of the company's underlying business model. The research also revealed technological prospects for future collaborations between CNES, E-Space, and the French space ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the France Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence