Key Insights

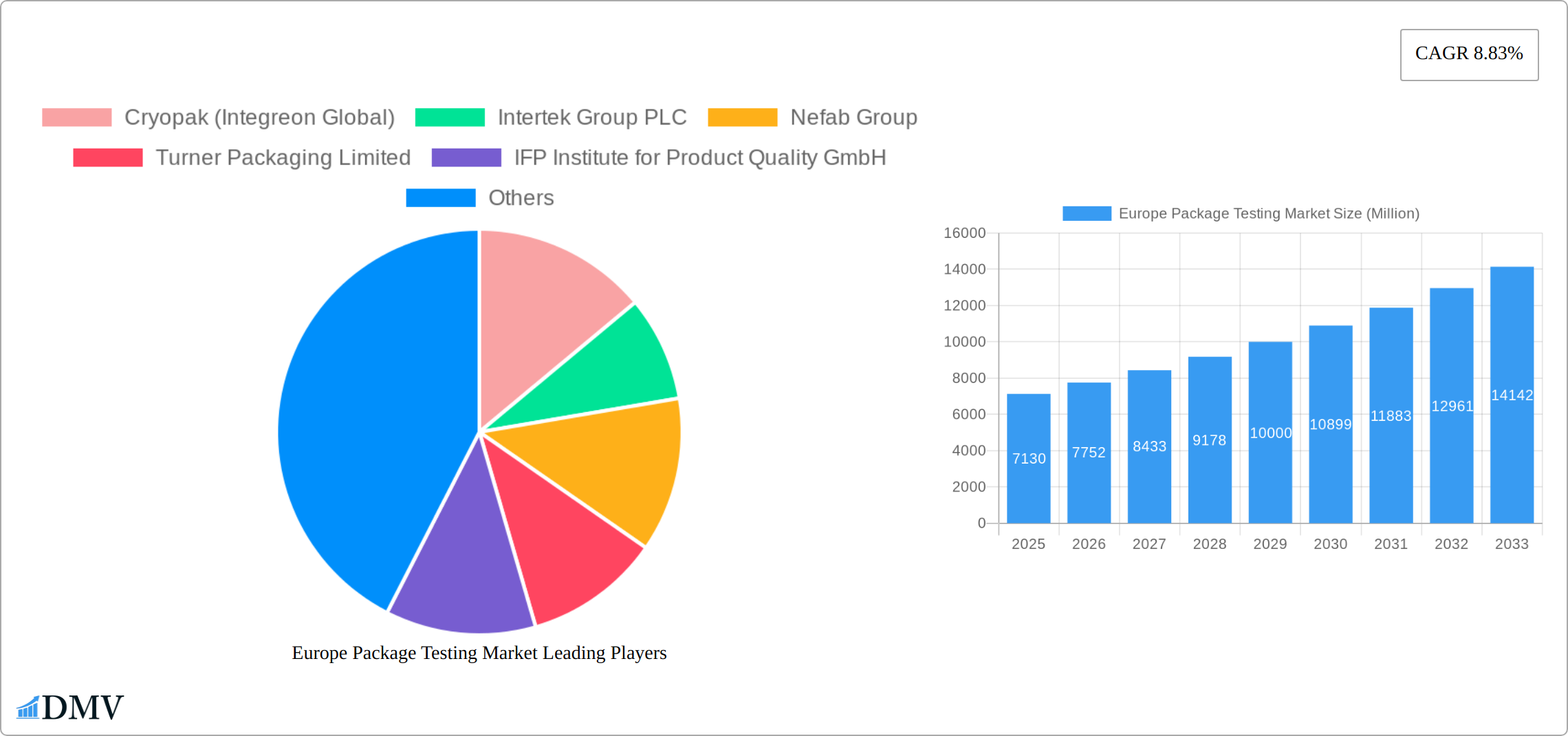

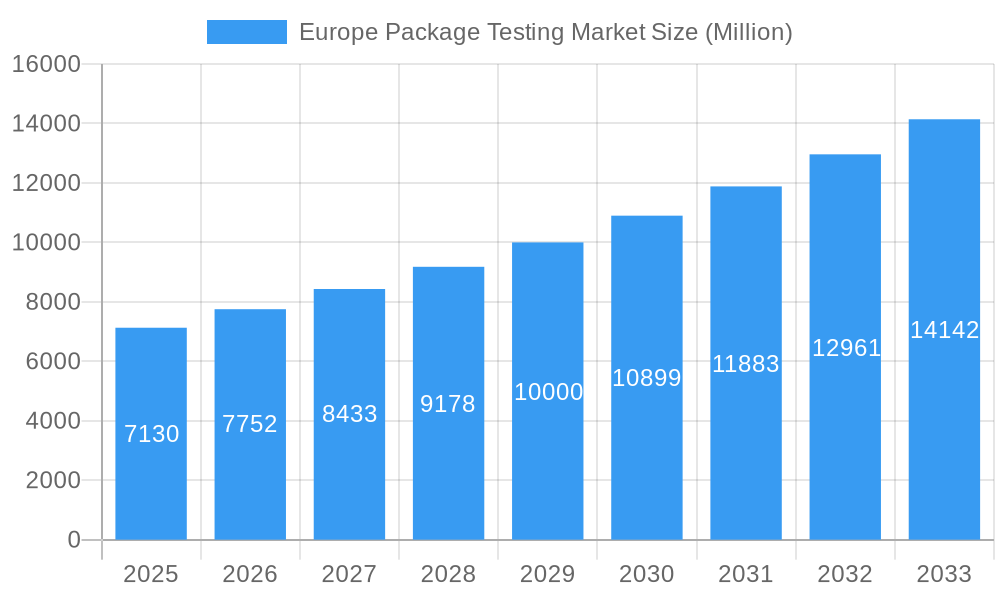

The European package testing market, valued at €7.13 billion in 2025, is projected to experience robust growth, driven by increasing regulatory scrutiny, heightened consumer demand for product safety and sustainability, and the expansion of e-commerce. The market's Compound Annual Growth Rate (CAGR) of 8.83% from 2025 to 2033 indicates a significant expansion, reaching an estimated €14.5 billion by 2033. Key drivers include the stringent regulations surrounding food safety and environmental impact, necessitating comprehensive testing procedures across various package materials (glass, paper, plastic, metal) and testing types (physical performance, chemical, environmental). The growing food and beverage, healthcare, and industrial sectors are significant contributors to market demand, demanding rigorous quality control and compliance throughout the supply chain. Furthermore, the increasing adoption of sustainable packaging solutions is fostering innovation in testing methodologies, further fueling market growth.

Europe Package Testing Market Market Size (In Billion)

The market segmentation reveals a diverse landscape. While physical performance testing currently holds the largest share, the demand for chemical and environmental testing is rapidly expanding, driven by eco-conscious consumers and stricter environmental regulations. Within end-user verticals, the food and beverage industry dominates, followed by healthcare and industrial sectors, each exhibiting unique testing needs and contributing to the market's overall expansion. Leading players like Intertek, SGS, and Bureau Veritas are leveraging their established networks and expertise to capture significant market shares. However, the presence of smaller, specialized testing firms indicates opportunities for niche players catering to specific packaging types and end-user requirements. The European market, particularly in countries like Germany, the UK, and France, is expected to maintain its leading position due to stringent regulatory frameworks and advanced industrial infrastructure. Expansion into Eastern European markets presents significant growth potential in the coming years.

Europe Package Testing Market Company Market Share

Europe Package Testing Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe Package Testing market, offering valuable insights into market dynamics, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The market size in 2025 is estimated at xx Million.

Europe Package Testing Market Market Composition & Trends

The European package testing market presents a moderately fragmented landscape, with numerous key players competing for market share. Market concentration is influenced by factors such as service specialization, geographic reach, technological capabilities, and the complexities of varying national regulatory landscapes. Innovation is a key driver, fueled by advancements in testing methodologies, materials science, and evolving regulatory requirements across the EU. The diverse regulatory environment across European nations impacts testing standards and compliance costs significantly. Substitute products and alternative packaging materials indirectly influence market demand, creating both challenges and opportunities for established players. End-user profiles are highly diverse, encompassing sectors like food and beverage, healthcare, cosmetics, e-commerce, and industrial manufacturing, each with distinct testing needs and priorities. The market has experienced notable mergers and acquisitions (M&A) activity, with transactions totaling xx Million in value contributing to market consolidation and expansion of service offerings.

- Market Share Distribution (2025, Estimated): Intertek Group PLC (xx%), SGS SA (xx%), Bureau Veritas SA (xx%), Eurofins Scientific SE (xx%), Others (xx%). (Note: Percentages are estimates and may vary depending on the source and methodology.)

- Significant M&A Activity (2019-2024): XX Million in total deal value across xx transactions, indicating a trend towards industry consolidation and expansion into new geographical markets and service verticals.

Europe Package Testing Market Industry Evolution

The Europe Package Testing market has witnessed robust growth over the past few years, driven by increasing consumer demand for safe and sustainable packaging, stringent regulatory compliance requirements, and technological advancements in testing methodologies. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of xx%, reaching xx Million in 2024. This growth trajectory is projected to continue, with a forecast CAGR of xx% from 2025 to 2033, resulting in a market size of xx Million by 2033. This upward trend is fueled by several key factors, including: the rising adoption of advanced testing techniques, such as non-destructive testing methods; the growing focus on sustainable packaging solutions; and increased investments in research and development to improve testing accuracy and efficiency. The shift in consumer preferences toward eco-friendly packaging is also significantly impacting the market, as businesses seek to ensure their packaging meets sustainability standards.

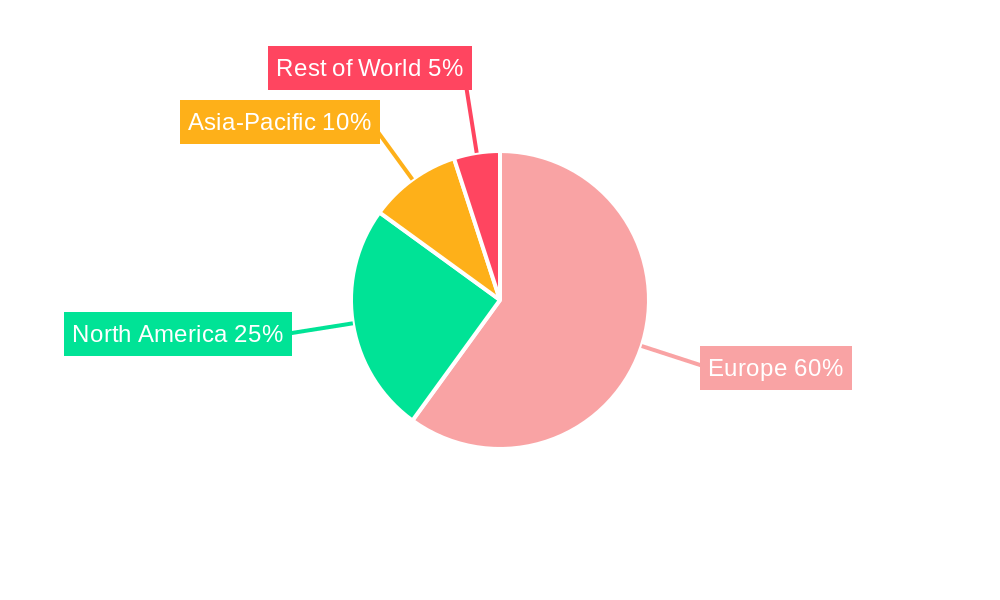

Leading Regions, Countries, or Segments in Europe Package Testing Market

Western Europe dominates the European package testing market, driven by stringent regulatory compliance standards, substantial manufacturing activities, and well-developed testing infrastructure. Germany, France, and the United Kingdom lead within this region due to their robust economies, sophisticated packaging industries, and heightened consumer awareness regarding product quality and safety. However, growth is also expected from Central and Eastern European countries as their economies and manufacturing sectors develop.

Dominant Segments:

- Primary Material: Plastic remains the largest segment due to its widespread use across numerous end-user verticals. However, growth is anticipated in sustainable and biodegradable alternatives.

- Type of Testing: Physical performance testing consistently exhibits the highest demand, emphasizing the crucial role of assessing product durability and functionality for various applications.

- End-user Vertical: Food and beverage remains the largest end-user sector, driven by stringent safety and quality regulations. However, growth in e-commerce and the healthcare sectors is expected to significantly impact the demand for specialized testing services.

Key Drivers:

- Stringent regulatory frameworks emphasizing packaging safety, sustainability, and compliance with EU directives.

- Heightened consumer awareness and demand for high-quality, safe, and ethically sourced products.

- Significant investments in advanced testing infrastructure and technologies, including automation and data analytics.

- The growing adoption of sustainable and eco-friendly packaging materials, driving the need for specialized testing to verify their performance and compliance.

- Increased emphasis on supply chain transparency and traceability, requiring robust quality control measures.

Europe Package Testing Market Product Innovations

Recent innovations in the Europe Package Testing market include the development of advanced analytical techniques, such as hyperspectral imaging and mass spectrometry, allowing for faster, more accurate, and comprehensive testing. Miniaturized testing devices offer portability and on-site testing capabilities. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is improving data analysis and predictive modeling for efficient testing processes and improved accuracy. These innovations enhance the effectiveness and efficiency of testing, driving market growth.

Propelling Factors for Europe Package Testing Market Growth

The European package testing market's growth is driven by a confluence of factors. Stringent regulatory compliance requirements necessitate rigorous testing protocols, fueling demand for specialized services. Growing consumer awareness of product safety and quality further reinforces the demand for reliable testing and certification. The rise of e-commerce, expanding supply chains, and increasing product complexity necessitate robust quality control measures, boosting demand for testing services across the entire supply chain. Simultaneously, technological advancements in testing methods and instrumentation continuously improve efficiency and accuracy, further driving market growth.

Obstacles in the Europe Package Testing Market

The Europe Package Testing market faces challenges such as the high cost of advanced testing equipment and skilled labor, limiting market accessibility for smaller players. Fluctuations in raw material prices can affect the affordability of testing services. Intense competition among existing players creates price pressures and necessitates continuous innovation. Supply chain disruptions, especially prevalent in recent years, can impact the availability of testing materials and equipment.

Future Opportunities in Europe Package Testing Market

Future opportunities abound in the expansion of testing services for sustainable and eco-friendly packaging materials. The increasing demand for specialized testing services to meet the needs of emerging technologies and industries, particularly in biotechnology, pharmaceuticals, and medical devices, presents significant growth potential. The adoption of digital technologies, such as blockchain for enhanced traceability and AI-powered predictive maintenance, will create new opportunities for improved testing services, data analysis, and predictive modeling of packaging performance.

Major Players in the Europe Package Testing Market Ecosystem

Key Developments in Europe Package Testing Market Industry

- August 2020: ePac Holdings Europe established two new locations for its digital-only production plants in Lyon, France, and Wrocław, Poland.

- December 2020: Berlin Packaging acquired Newpack, marking its tenth European acquisition since 2016.

Strategic Europe Package Testing Market Market Forecast

The Europe Package Testing market is poised for continued growth, driven by increasing demand for reliable and efficient testing services in response to stringent regulations, rising consumer awareness, and the adoption of innovative testing technologies. The market's future is bright, with significant opportunities in emerging areas like sustainable packaging and specialized testing for new technologies. The projected growth rates indicate a substantial market expansion, making it an attractive sector for investment and growth.

Europe Package Testing Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Verticals

Europe Package Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Package Testing Market Regional Market Share

Geographic Coverage of Europe Package Testing Market

Europe Package Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Package Testing

- 3.4. Market Trends

- 3.4.1. Glass Usage in Packaging Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cryopak (Integreon Global)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nefab Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turner Packaging Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFP Institute for Product Quality GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Campden BRI

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glass Technology Services*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TUV SUD AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SGS SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bureau Veritas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurofins Scientific SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cryopak (Integreon Global)

List of Figures

- Figure 1: Europe Package Testing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Package Testing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 3: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Europe Package Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 7: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Package Testing Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Europe Package Testing Market?

Key companies in the market include Cryopak (Integreon Global), Intertek Group PLC, Nefab Group, Turner Packaging Limited, IFP Institute for Product Quality GmbH, Campden BRI, Glass Technology Services*List Not Exhaustive, TUV SUD AG, SGS SA, Bureau Veritas SA, Eurofins Scientific SE.

3. What are the main segments of the Europe Package Testing Market?

The market segments include Primary Material, Type of Testing, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Usage in Packaging Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Package Testing.

8. Can you provide examples of recent developments in the market?

December 2020 - Berlin Packaging acquired Newpack and is it's tenth European acquisition since 2016. This step confirmsBerlin Packaging's commitment to supplying packaging across all geographies, substrates, and market verticals in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Package Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Package Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Package Testing Market?

To stay informed about further developments, trends, and reports in the Europe Package Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence