Key Insights

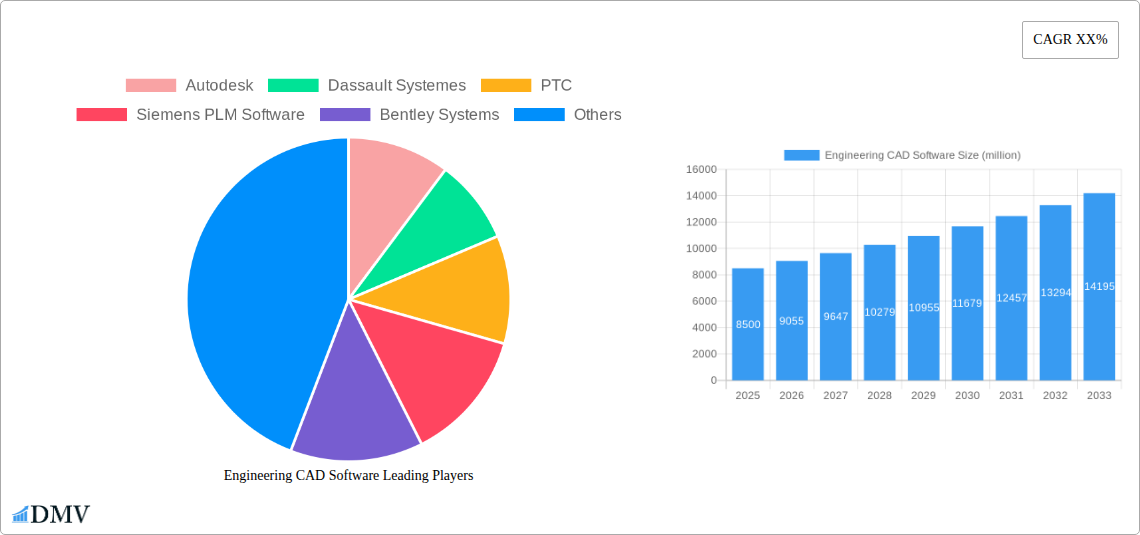

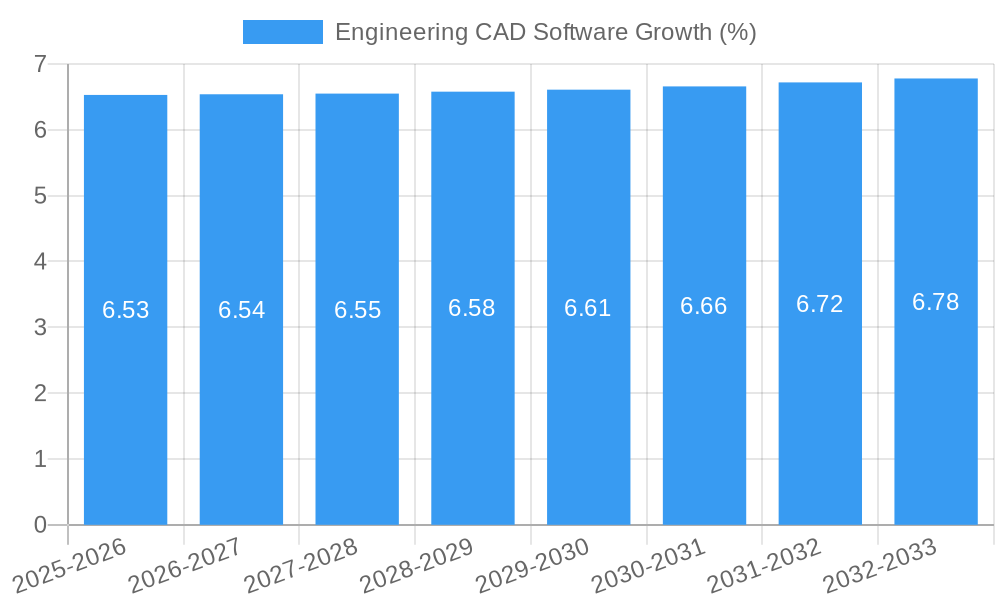

The global Engineering CAD (Computer-Aided Design) Software market is experiencing robust growth, poised for significant expansion over the forecast period from 2025 to 2033. With an estimated market size in the billions of dollars for 2025, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6-8% (estimating a reasonable CAGR based on general software market trends and CAD's essential role). This upward trajectory is primarily driven by the increasing demand for sophisticated design and simulation tools across diverse industries, including manufacturing, automotive, aerospace, and construction. The accelerating pace of digital transformation, coupled with the growing adoption of Industry 4.0 principles, is further fueling the need for advanced CAD solutions. Furthermore, the continuous innovation in cloud-based CAD, augmented reality (AR), and virtual reality (VR) integration is enhancing collaboration, streamlining workflows, and enabling more complex and efficient product development cycles. This innovation is crucial for addressing the intricate design challenges posed by next-generation products and infrastructure.

The market is segmented into large enterprises and SMEs, with both segments leveraging CAD software for critical design and engineering tasks. While large enterprises often require comprehensive, high-end solutions with extensive customization options, SMEs are increasingly adopting more accessible and cost-effective cloud-based and subscription models. The market encompasses both 2D and 3D CAD software, with a clear trend towards 3D CAD due to its superior visualization, modeling, and simulation capabilities, which are indispensable for complex engineering projects. Key players like Autodesk, Dassault Systèmes, PTC, and Siemens PLM Software are at the forefront, investing heavily in research and development to offer cutting-edge features and solutions. However, the market also faces certain restraints, including the high cost of advanced software licenses and the need for skilled professionals to operate them effectively. Despite these challenges, the ongoing digital revolution and the persistent need for efficient, accurate, and collaborative design processes will continue to propel the Engineering CAD Software market forward.

Unlock critical insights into the global Engineering CAD software market with this in-depth report. Spanning the historical period of 2019-2024 and extending to a forecast period of 2025-2033, this comprehensive analysis delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Equipped with data from 2019 to 2033, including a base year of 2025, this report provides stakeholders with actionable intelligence to navigate the dynamic Computer-Aided Design landscape.

Engineering CAD Software Market Composition & Trends

The Engineering CAD software market is characterized by a moderately concentrated landscape, with major players like Autodesk, Dassault Systemes, PTC, Siemens PLM Software, and Bentley Systems holding significant market share. Innovation is a constant catalyst, driven by advancements in 3D CAD software, cloud-based solutions, and the integration of AI/ML for intelligent design. The regulatory environment, while generally supportive of technological adoption, introduces compliance considerations for CAD software functionalities, particularly in highly regulated industries. Substitute products, such as manual drafting or less sophisticated design tools, pose a minor threat, primarily for niche applications or budget-constrained SMEs. End-user profiles range from Large Enterprises in automotive, aerospace, and construction to agile SMEs seeking cost-effective and feature-rich design solutions. Mergers and acquisitions (M&A) continue to shape the market, with recent deal values estimated in the hundreds of millions, aimed at consolidating market presence, acquiring innovative technologies, and expanding service offerings. The market share distribution is dynamic, with 3D CAD software increasingly dominating over 2D CAD software due to its superior capabilities in complex design and simulation. Estimated M&A deal values in the past year are in the range of 500 million to 1 billion.

Engineering CAD Software Industry Evolution

The Engineering CAD software industry has witnessed a remarkable evolution over the study period of 2019–2033. From its foundational roots in 2D CAD software, the market has surged towards sophisticated 3D CAD software solutions, profoundly impacting design workflows and product development cycles. The historical period of 2019–2024 saw consistent growth, fueled by increasing digitization across manufacturing and engineering sectors. Key technological advancements, such as the rise of parametric modeling, integrated simulation tools, and cloud-based platforms, have become standard expectations. The adoption of CAD software has surged, with an estimated 80% penetration in Large Enterprises and a projected 60% adoption rate among SMEs by 2025. This growth is further propelled by the demand for enhanced product realism, faster iteration cycles, and reduced prototyping costs. The market growth trajectory has been robust, with an average annual growth rate of 8% to 12% projected throughout the forecast period of 2025–2033. Shifting consumer demands for customized products, sustainable designs, and faster time-to-market have directly influenced the feature sets and functionalities offered by CAD software providers. The increasing focus on Industry 4.0 and the Industrial Internet of Things (IIoT) has also driven the integration of CAD software with broader digital ecosystems, enabling seamless data flow from design to manufacturing and maintenance. This integration has opened new avenues for market expansion and revenue generation, with recurring revenue models becoming increasingly prevalent. The global market size for Engineering CAD software is estimated to reach over 15 billion by 2025, with significant contributions from key regions adopting advanced CAD technologies.

Leading Regions, Countries, or Segments in Engineering CAD Software

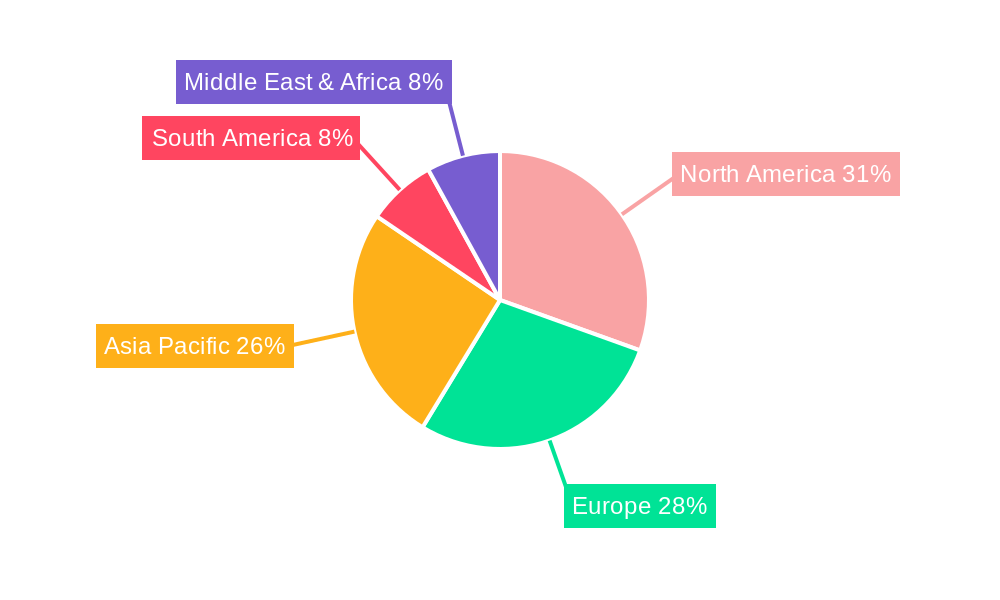

North America and Europe currently lead the Engineering CAD Software market, primarily driven by established manufacturing industries and a strong emphasis on research and development. Within these regions, Large Enterprises represent the dominant segment, accounting for an estimated 70% of market revenue. This dominance is attributed to their substantial investments in advanced 3D CAD software for complex product design, simulation, and lifecycle management. The need for sophisticated tools to manage intricate projects in sectors like aerospace, automotive, and heavy machinery fuels this demand. Regulatory support for innovation and strict quality control standards further incentivize the adoption of high-end CAD solutions.

- Key Drivers for Dominance in Large Enterprises:

- Significant Investment Capacity: Large enterprises possess the financial resources to invest in premium CAD suites and associated training.

- Complex Project Requirements: Industries like aerospace and automotive demand highly detailed 3D modeling, simulation, and collaboration capabilities offered by advanced CAD software.

- Productivity and Efficiency Gains: The implementation of 3D CAD software leads to substantial improvements in design accuracy, reduced rework, and faster time-to-market.

- Regulatory Compliance: Stringent industry regulations necessitate the use of robust CAD tools for design validation and documentation.

In terms of software type, 3D CAD Software is the undisputed leader, capturing an estimated 85% of the market share. This is a direct consequence of its ability to create realistic virtual prototypes, facilitate intricate assembly design, and enable advanced simulation capabilities that are crucial for modern engineering. While 2D CAD software still holds a place for simpler design tasks and legacy systems, the overwhelming trend is towards 3D. The projected market value for 3D CAD Software is expected to exceed 12 billion by 2025. The increasing adoption by SMEs, driven by more affordable and accessible 3D CAD solutions, is also contributing to the segment's growth, further solidifying its leading position. The global market for Engineering CAD Software is projected to reach a valuation of 15 billion by 2025.

Engineering CAD Software Product Innovations

Recent product innovations in Engineering CAD software focus on enhancing user experience and leveraging cutting-edge technologies. The integration of generative design, powered by AI algorithms, allows for the rapid exploration of optimized design geometries that were previously unimaginable. Cloud-based CAD platforms are gaining traction, offering enhanced collaboration, accessibility, and scalability. Furthermore, advancements in real-time rendering and virtual reality (VR) integration provide engineers with immersive design visualization and review capabilities. Performance metrics are steadily improving, with faster processing speeds for complex assemblies and more accurate simulation results. Unique selling propositions include seamless integration with PLM (Product Lifecycle Management) systems and specialized modules for specific industries, such as mechanical, electrical, and architectural design.

Propelling Factors for Engineering CAD Software Growth

The Engineering CAD software market is experiencing robust growth propelled by several key factors. The accelerating trend towards digital transformation across industries, from automotive to aerospace and manufacturing, necessitates sophisticated design tools. Advancements in 3D CAD software, including cloud-based solutions and AI-powered generative design, are enhancing design efficiency and innovation. The increasing demand for product customization and faster time-to-market pressures companies to adopt more agile and collaborative design processes. Furthermore, government initiatives supporting technological adoption and smart manufacturing contribute to market expansion. The rise of the Industrial Internet of Things (IIoT) also drives the need for integrated design and simulation capabilities, further fueling demand. The global market size is estimated to reach 15 billion by 2025.

Obstacles in the Engineering CAD Software Market

Despite its growth, the Engineering CAD software market faces certain obstacles. High initial investment costs for premium CAD solutions can be a barrier for some SMEs. The complexity of some advanced CAD software requires significant training and skilled personnel, leading to talent acquisition challenges. Evolving cybersecurity threats and data privacy concerns necessitate robust security measures for cloud-based platforms. Moreover, the existence of numerous software vendors and potential integration issues with legacy systems can create vendor lock-in fears and complicate adoption for some organizations. The ongoing global supply chain disruptions can also indirectly impact hardware availability crucial for running demanding CAD applications.

Future Opportunities in Engineering CAD Software

Emerging opportunities in the Engineering CAD software market lie in several key areas. The continued expansion of cloud-based CAD solutions offers greater accessibility and collaboration for remote and distributed teams, with an estimated market expansion of over 3 billion by 2030. The increasing adoption of 3D printing (additive manufacturing) creates a symbiotic relationship, driving demand for CAD software optimized for complex, manufacturable designs. Furthermore, the integration of AI and machine learning into CAD workflows presents significant potential for automating design processes, optimizing performance, and enabling predictive maintenance. The growing demand for sustainable and eco-friendly product design will also drive the need for CAD tools that can simulate and optimize material usage and energy efficiency.

Major Players in the Engineering CAD Software Ecosystem

- Autodesk

- Dassault Systemes

- PTC

- Siemens PLM Software

- Bentley Systems

- Altair Engineering

- IMSI Design

- Hexagon

- ANSYS

- Corel Corporation

- ZWCAD Software

- Gstarsoft

- IronCAD

Key Developments in Engineering CAD Software Industry

- 2023 Q4: Autodesk launches enhanced AI-powered generative design features in Fusion 360.

- 2024 Q1: Dassault Systèmes expands its 3DEXPERIENCE platform with new simulation and collaboration tools.

- 2024 Q2: PTC introduces a new cloud-native version of Creo, focusing on IoT integration.

- 2024 Q3: Siemens PLM Software announces significant advancements in its NX software for complex product development.

- 2024 Q4: Bentley Systems acquires a specialized firm to enhance its infrastructure design and BIM capabilities.

- 2025 Q1: Altair Engineering releases new simulation software for advanced material analysis.

- 2025 Q2: Hexagon introduces an integrated solution for smart manufacturing, linking design with production.

Strategic Engineering CAD Software Market Forecast

The strategic Engineering CAD software market forecast indicates continued robust growth driven by technological innovation and increasing adoption across diverse industries. The shift towards 3D CAD software, cloud-based solutions, and AI-powered design tools will remain pivotal. Opportunities are abundant in sectors demanding complex product development, such as aerospace, automotive, and healthcare. The increasing integration of CAD with PLM, IIoT, and additive manufacturing will further solidify its role as a cornerstone of digital engineering. Stakeholders can anticipate sustained market expansion, with new entrants and existing players focusing on specialized solutions and enhanced user experiences to capture market share. The global market for Engineering CAD Software is projected to experience a Compound Annual Growth Rate (CAGR) of 7% to 9% during the forecast period of 2025–2033.

Engineering CAD Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. 2D CAD Software

- 2.2. 3D CAD Software

Engineering CAD Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Engineering CAD Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 2D CAD Software

- 5.2.2. 3D CAD Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 2D CAD Software

- 6.2.2. 3D CAD Software

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 2D CAD Software

- 7.2.2. 3D CAD Software

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 2D CAD Software

- 8.2.2. 3D CAD Software

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 2D CAD Software

- 9.2.2. 3D CAD Software

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Engineering CAD Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 2D CAD Software

- 10.2.2. 3D CAD Software

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Autodesk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Systemes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PTC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens PLM Software

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bentley Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Altair Engineering

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IMSI Design

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexagon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ANSYS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Corel Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZWCAD Software

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gstarsoft

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IronCAD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Autodesk

List of Figures

- Figure 1: Global Engineering CAD Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Engineering CAD Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Engineering CAD Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Engineering CAD Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Engineering CAD Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Engineering CAD Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Engineering CAD Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Engineering CAD Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Engineering CAD Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Engineering CAD Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Engineering CAD Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Engineering CAD Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Engineering CAD Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Engineering CAD Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Engineering CAD Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Engineering CAD Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Engineering CAD Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Engineering CAD Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Engineering CAD Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Engineering CAD Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Engineering CAD Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Engineering CAD Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Engineering CAD Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Engineering CAD Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Engineering CAD Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Engineering CAD Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Engineering CAD Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Engineering CAD Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Engineering CAD Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Engineering CAD Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Engineering CAD Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Engineering CAD Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Engineering CAD Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Engineering CAD Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Engineering CAD Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Engineering CAD Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Engineering CAD Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Engineering CAD Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Engineering CAD Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Engineering CAD Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Engineering CAD Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Engineering CAD Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Engineering CAD Software?

Key companies in the market include Autodesk, Dassault Systemes, PTC, Siemens PLM Software, Bentley Systems, Altair Engineering, IMSI Design, Hexagon, ANSYS, Corel Corporation, ZWCAD Software, Gstarsoft, IronCAD.

3. What are the main segments of the Engineering CAD Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Engineering CAD Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Engineering CAD Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Engineering CAD Software?

To stay informed about further developments, trends, and reports in the Engineering CAD Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence