Key Insights

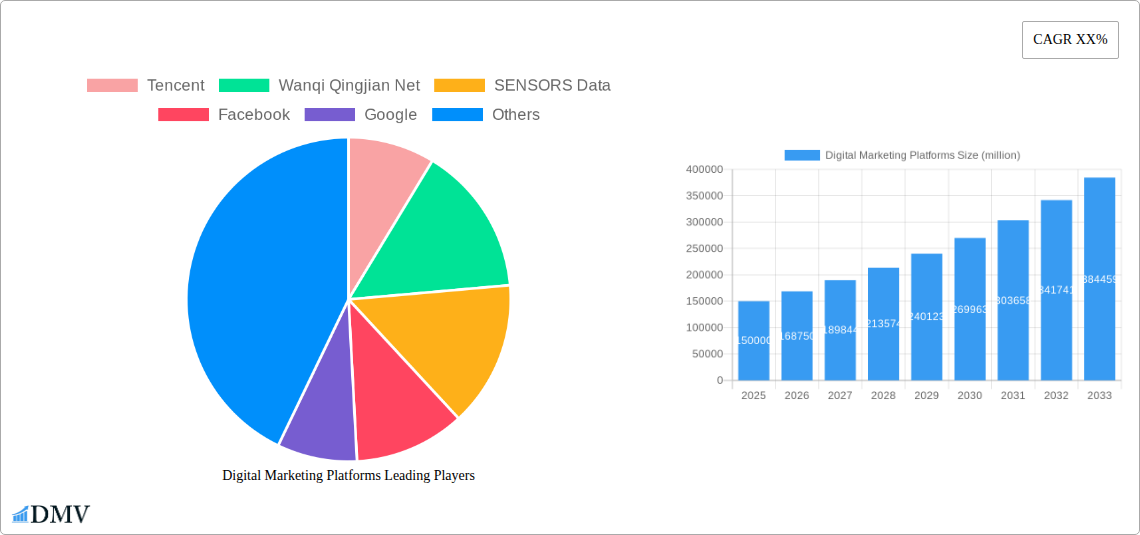

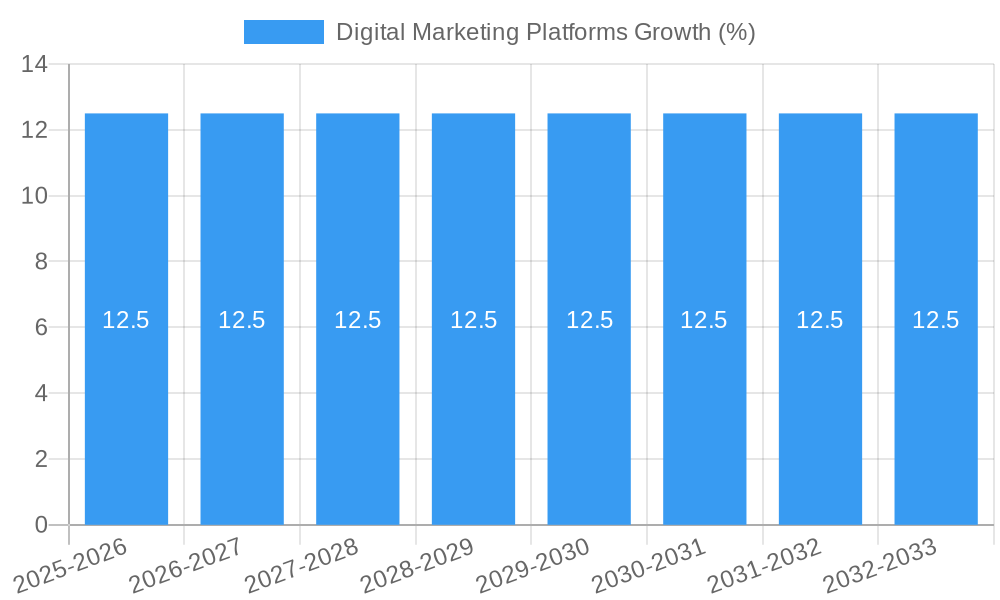

The global Digital Marketing Platforms market is poised for significant expansion, projected to reach a substantial market size. Driven by the escalating adoption of digital channels across all industries, the market is witnessing robust growth, fueled by an increasing demand for sophisticated tools that enhance customer engagement and campaign effectiveness. Key drivers include the continuous evolution of online advertising, the imperative for personalized marketing strategies, and the growing reliance on data analytics to optimize marketing spend. Businesses are increasingly investing in platforms that offer integrated solutions for search engine marketing, content marketing, email marketing, and social media management to achieve a unified customer journey. This sustained investment is expected to propel the market forward, with the compound annual growth rate (CAGR) reflecting a healthy upward trajectory.

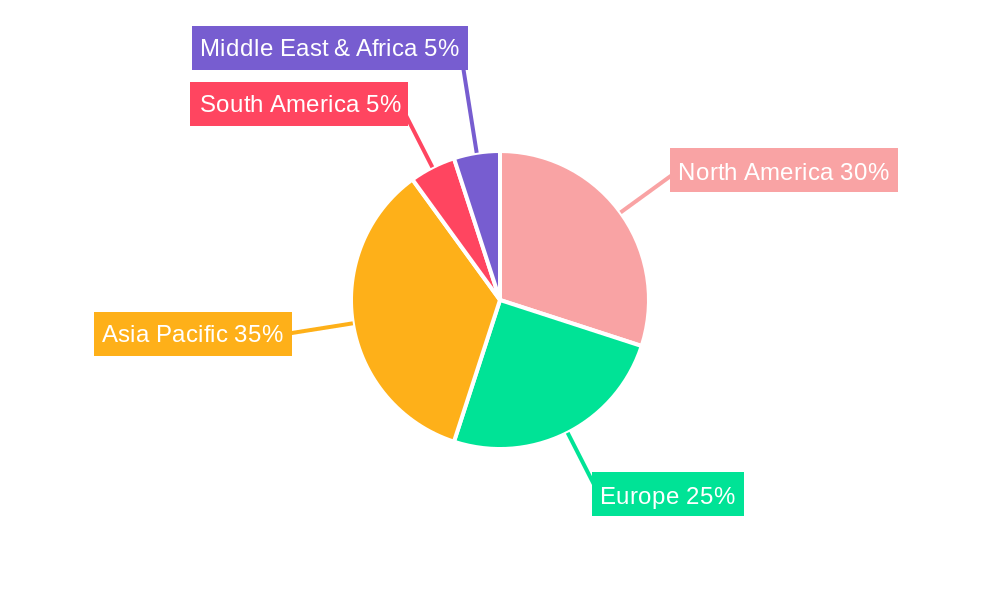

However, the market is not without its challenges. The intense competition among platform providers, coupled with the rising costs of customer acquisition and the need for constant adaptation to evolving algorithm changes and privacy regulations, presents significant restraints. Despite these hurdles, emerging trends such as the integration of AI and machine learning for predictive analytics, the rise of influencer marketing platforms, and the increasing focus on customer data platforms (CDPs) for a 360-degree customer view are shaping the future landscape. The Asia Pacific region, in particular, is expected to be a key growth engine, driven by rapid digitalization and a burgeoning e-commerce sector. North America and Europe will continue to be mature markets, focusing on advanced analytics and automation.

Here's an SEO-optimized, insightful report description for Digital Marketing Platforms, designed for immediate use without modification:

Digital Marketing Platforms Market Composition & Trends

The global Digital Marketing Platforms market is characterized by a dynamic and evolving landscape, with a growing number of companies vying for market share. Key players like Google and Facebook continue to dominate, leveraging vast user bases and advanced advertising technologies. Tencent, a Chinese technology giant, holds significant influence, particularly in Asian markets, while platforms such as AdRoll and Dotdigital cater to specific needs in performance marketing and customer engagement, respectively. The market concentration is moderately high, driven by continuous innovation and substantial R&D investments. Disruptors like Emfluence and Launch Digital Marketing are actively challenging established giants through specialized offerings and agile strategies. Innovation catalysts include the rise of AI-powered analytics, programmatic advertising evolution, and the increasing demand for personalized customer journeys. Regulatory landscapes, such as GDPR and CCPA, are shaping data privacy practices and influencing platform development, with compliance becoming a critical factor. Substitute products, while emerging, are largely confined to niche applications, with core digital marketing platform functionalities remaining indispensable for businesses. End-user profiles span a broad spectrum, from small and medium-sized enterprises (SMEs) to large enterprises across various sectors, including Food, Clothing, Automotive, and Financial services. Mergers and acquisitions (M&A) are a significant trend, with companies like Infosys and Techmagnate actively seeking strategic acquisitions to expand their service portfolios and market reach. For instance, M&A deal values in the digital marketing technology space have reached hundreds of millions, indicating strong investor confidence and consolidation efforts. Companies like SENSORS Data are contributing to this trend through strategic partnerships and technology integrations. The estimated market share distribution indicates a significant portion held by major technology providers, with a growing segment for specialized MarTech solutions. The current market value stands at approximately XXX million, with projections indicating substantial growth.

- Market Share Distribution: Leading platforms like Google and Facebook collectively hold an estimated 60% of the market share, with specialized players like Tencent, AdRoll, and Dotdigital capturing significant portions in their respective niches.

- M&A Deal Values: Recent M&A activities have seen deal values ranging from tens of millions to over a hundred million, driven by strategic acquisitions aimed at broadening technological capabilities and market penetration.

- Innovation Catalysts: AI-driven personalization, advanced analytics, predictive modeling, and cross-channel attribution are key drivers of innovation.

- Regulatory Impact: GDPR, CCPA, and other data privacy regulations are necessitating significant platform adaptations and influencing the development of privacy-centric marketing solutions.

- End-User Segmentation: While a broad range of industries benefit, the Food, Financial, and Automotive sectors are showing particularly high adoption rates due to the need for targeted customer engagement and performance tracking.

Digital Marketing Platforms Industry Evolution

The Digital Marketing Platforms industry has undergone a transformative evolution, characterized by rapid technological advancements and a significant shift in consumer behavior and expectations. From its nascent stages focused primarily on search engine marketing and basic email campaigns, the industry has burgeoned into a complex ecosystem of integrated solutions designed to manage every facet of the customer journey. The historical period from 2019 to 2024 witnessed substantial growth, driven by the increasing digitalization of businesses and the undeniable ROI associated with effective online marketing strategies. During this time, platforms like Google Ads and Facebook Ads solidified their dominance in paid advertising, while Sendinblue and Dotdigital emerged as leading contenders in email marketing and marketing automation. The year 2019 marked a pivotal point with increasing adoption of AI in ad targeting and content personalization. By 2021, the industry saw a surge in demand for integrated marketing clouds, with companies like Microsoft and Sprinklr investing heavily in comprehensive suites. The COVID-19 pandemic accelerated this trend, forcing businesses to pivot to digital channels, leading to an unprecedented increase in digital marketing spend. This period also saw the rise of specialized platforms catering to specific needs, such as Contently for content marketing and Act-On for inbound marketing. The adoption of data analytics and customer data platforms (CDPs) became crucial for understanding consumer behavior and delivering personalized experiences. The growth rate during this historical period averaged an impressive XX%, with investments pouring into areas like programmatic advertising and influencer marketing.

Looking towards the future, the industry is poised for continued exponential growth, propelled by emerging technologies and evolving consumer demands. The base year of 2025 signifies a crucial juncture where established trends are solidifying and new innovations are gaining traction. The forecast period from 2025 to 2033 anticipates a CAGR of approximately XX%, driven by the increasing adoption of AI and machine learning for predictive analytics, hyper-personalization, and automated campaign management. Technologies like augmented reality (AR) and virtual reality (VR) are expected to create new avenues for immersive advertising experiences, further expanding the scope of digital marketing platforms. The demand for privacy-compliant marketing solutions will continue to shape platform development, with an emphasis on consent management and transparent data usage. Companies like InMobi are at the forefront of mobile-first advertising innovations, while platforms like Optimizely are crucial for driving continuous experimentation and optimization of digital experiences. The increasing sophistication of content marketing, fueled by platforms like Techmagnate and their data-driven content strategies, will also play a vital role. The industry's evolution is a testament to its adaptability and its central role in modern business strategies. The integration of e-commerce functionalities within marketing platforms is another significant trend, blurring the lines between marketing and sales. The emphasis will increasingly be on creating seamless, end-to-end customer journeys, managed through intelligent and interconnected digital marketing platforms. The investment in MarTech solutions is projected to reach hundreds of millions annually, underscoring the industry's economic significance.

Leading Regions, Countries, or Segments in Digital Marketing Platforms

The global Digital Marketing Platforms market exhibits distinct leadership across various regions and segments, driven by a confluence of economic, technological, and demographic factors. Within the Application segment, the Financial sector stands out as a dominant force. This dominance is fueled by the high value of customer acquisition in financial services, the critical need for personalized and secure communication, and the sector's inherent reliance on digital channels for service delivery and customer engagement. Financial institutions are investing heavily in sophisticated digital marketing platforms to manage lead generation, customer onboarding, fraud prevention communication, and personalized financial product recommendations. For instance, banks and insurance companies are leveraging platforms for targeted advertising campaigns to reach specific demographic and psychographic profiles, and for automated email marketing sequences that guide customers through complex financial decisions. The overall investment in digital marketing for the financial sector is in the millions, reflecting its strategic importance.

In parallel, the Automotive sector is also a significant contributor to market growth. With the increasing complexity of car buying journeys and the rise of electric vehicles and connected car technologies, automotive brands are heavily reliant on digital marketing to reach potential buyers, build brand loyalty, and manage post-purchase engagement. Platforms are utilized for showcasing new models, promoting special offers, and facilitating online test drive bookings. The integration of CRM and marketing automation tools allows for personalized communication throughout the vehicle lifecycle.

When considering the Types of digital marketing platforms, Search Engine Marketing (SEM) continues to be a cornerstone, consistently showing high adoption rates across all industries. The ability to capture high-intent customers actively searching for products and services makes SEM an indispensable tool. Platforms like Google Ads, which is a key player, are integral to this segment. Content Marketing has also ascended in prominence, with platforms like Contently and services offered by companies like Shanghai Guangshu Network Technology Co.,Ltd enabling businesses to create, distribute, and measure engaging content. This is particularly relevant for industries that require extensive customer education and trust-building.

Key drivers for dominance in these segments include:

- Financial Sector:

- High ROI Potential: The significant lifetime value of financial customers incentivizes substantial marketing investment.

- Regulatory Compliance: Advanced platforms facilitate adherence to stringent financial regulations for communication and data handling.

- Personalization Demands: Customers expect tailored financial advice and product offerings, driving the need for sophisticated segmentation and personalization tools.

- Digital Transformation Initiatives: Financial institutions are prioritizing digital channels for customer acquisition and service, leading to increased platform adoption.

- Investment Trends: Billions of dollars are allocated annually to digital marketing within the financial services industry.

- Search Engine Marketing (SEM):

- Intent-Based Marketing: Captures users actively seeking solutions, leading to higher conversion rates.

- Measurable Performance: SEM offers robust analytics for tracking ROI and optimizing campaigns.

- Competitive Landscape: Intense competition drives continuous investment in SEM strategies and platforms.

- Evolution of Search: Advancements in AI and natural language processing are enhancing SEM capabilities.

- Content Marketing:

- Brand Building: Establishes thought leadership and fosters customer trust.

- Lead Nurturing: Guides potential customers through the sales funnel with valuable information.

- SEO Benefits: High-quality content improves search engine rankings.

- Increasing Content Consumption: Consumers are actively seeking informative and engaging content.

The Asia-Pacific region, particularly China, is a significant market for digital marketing platforms, with Tencent and Shanghai Guangshu Network Technology Co.,Ltd playing pivotal roles. North America and Europe remain mature markets with high adoption rates and continuous innovation from companies like Google, Facebook, and Microsoft. The growth in emerging economies is also substantial, driven by increasing internet penetration and smartphone usage, with platforms like Eskimi gaining traction in these markets.

Digital Marketing Platforms Product Innovations

Digital Marketing Platforms are continuously evolving through groundbreaking product innovations aimed at enhancing efficiency and effectiveness. Recent advancements include the integration of AI-powered predictive analytics, enabling platforms to forecast customer behavior and optimize campaign performance with unprecedented accuracy. For example, platforms are now offering automated content generation and personalized ad creative development, significantly reducing manual effort and improving engagement rates. Companies like Smart Insights are contributing to this by providing advanced analytics and strategic guidance. The emergence of sophisticated cross-channel attribution models allows for a more holistic understanding of customer journeys, with platforms like BetterGraph leading in this area. Furthermore, enhanced data integration capabilities, allowing seamless connection with various CRM and ERP systems, are a key selling proposition. These innovations empower businesses to achieve higher conversion rates, optimize marketing spend, and foster deeper customer relationships. The application of these innovations spans across the Food, Clothing, Automotive, and Financial industries, driving measurable improvements in key performance indicators.

Propelling Factors for Digital Marketing Platforms Growth

The robust growth of the Digital Marketing Platforms market is propelled by several key factors. Firstly, the pervasive digitalization of businesses across all sectors necessitates advanced online marketing strategies. Secondly, the escalating adoption of mobile devices and the ubiquitous presence of social media platforms create a fertile ground for digital advertising. Thirdly, the relentless advancements in artificial intelligence and machine learning are enabling platforms to offer hyper-personalized customer experiences and more efficient campaign management, leading to an estimated XX% increase in ROI for businesses leveraging these technologies. Fourthly, the increasing demand for data-driven decision-making empowers marketers to optimize their strategies for maximum impact. Finally, evolving consumer expectations for personalized and relevant interactions further fuel the adoption of sophisticated digital marketing solutions. The market size is projected to reach XXX million by 2033, demonstrating sustained growth.

Obstacles in the Digital Marketing Platforms Market

Despite the strong growth trajectory, the Digital Marketing Platforms market faces significant obstacles. Stringent data privacy regulations, such as GDPR and CCPA, continue to pose compliance challenges for platforms and marketers alike, demanding substantial investments in privacy-centric technologies and practices. Supply chain disruptions, particularly for hardware components used in advanced analytics and data processing, can impact platform development and deployment timelines, potentially costing millions in delays. Furthermore, intense competitive pressures among established players and emerging startups lead to price wars and necessitate continuous innovation, which can be costly. The increasing cost of customer acquisition in highly saturated digital channels also presents a challenge, requiring platforms to offer more efficient and cost-effective solutions. Overcoming these barriers requires strategic investment in compliance, robust supply chain management, and a focus on delivering demonstrable value.

Future Opportunities in Digital Marketing Platforms

The future of Digital Marketing Platforms is brimming with opportunities, driven by emerging trends and unmet needs. The burgeoning metaverse presents a vast, untapped frontier for immersive advertising experiences, opening up new avenues for brand engagement and customer interaction. Advancements in AI, particularly in generative AI, will revolutionize content creation and personalization, enabling highly tailored campaigns at scale. The increasing demand for ethical and transparent data usage will drive the development of privacy-preserving marketing technologies, creating opportunities for platforms focused on consent management and data security. Furthermore, the growth of the creator economy offers new avenues for influencer marketing integration and partnership opportunities. The expansion of e-commerce into new markets and the continuous demand for personalized customer journeys will ensure sustained growth for innovative digital marketing platforms.

Major Players in the Digital Marketing Platforms Ecosystem

- Tencent

- Wanqi Qingjian Net

- SENSORS Data

- AdRoll

- Smart Insights

- Emfluence

- BetterGraph

- Launch Digital Marketing

- Techmagnate

- Dotdigital

- Sprinklr

- Eskimi

- Sendinblue

- Microsoft

- Contently

- Infosys

- Act-On

- InMobi

- Optimizely

- Milestone

- Shanghai Guangshu Network Technology Co.,Ltd

Key Developments in Digital Marketing Platforms Industry

- 2019, Q2: Google introduces enhanced AI-powered targeting for Google Ads, improving campaign efficiency.

- 2020, Q1: Facebook launches new ad formats for the metaverse, anticipating future immersive experiences.

- 2020, Q3: Dotdigital acquires a leading CDP provider, strengthening its customer data management capabilities.

- 2021, Q2: Microsoft integrates advanced AI analytics into its Dynamics 365 Marketing platform, offering deeper insights.

- 2022, Q4: Sprinklr announces major expansion into APAC markets, catering to growing regional demand.

- 2023, Q1: Sendinblue rebrands to Brevo, signaling a broader vision for marketing, sales, and CRM solutions.

- 2023, Q3: Techmagnate showcases innovative AI-driven SEO strategies, boosting organic search visibility for clients.

- 2024, Q2: Eskimi expands its programmatic advertising reach into new emerging markets, leveraging mobile-first strategies.

- 2024, Q4: Infosys completes acquisition of a MarTech consulting firm, bolstering its digital transformation services.

- 2025, Q1: Optimizely enhances its A/B testing capabilities with advanced AI prediction models for faster optimization cycles.

Strategic Digital Marketing Platforms Market Forecast

The strategic outlook for Digital Marketing Platforms remains exceptionally positive, driven by a convergence of technological innovation and evolving business needs. The forecast period of 2025–2033 is expected to witness substantial growth, with the market size projected to reach over XXX million. Key growth catalysts include the accelerating adoption of AI and machine learning for hyper-personalization and predictive analytics, the exploration of new frontiers like the metaverse for immersive advertising, and the increasing demand for privacy-centric marketing solutions. The continuous digital transformation across industries, coupled with the inherent need for businesses to connect with their target audiences effectively, ensures a sustained demand for advanced digital marketing platforms. Strategic investments in R&D and a focus on integrating emerging technologies will be crucial for players to capture market share and capitalize on the immense opportunities ahead.

Digital Marketing Platforms Segmentation

-

1. Application

- 1.1. Food

- 1.2. Clothing

- 1.3. Automotive

- 1.4. Financial

- 1.5. Other

-

2. Types

- 2.1. Search Engine Marketing

- 2.2. Content Marketing

- 2.3. Email Marketing

- 2.4. Other

Digital Marketing Platforms Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Marketing Platforms REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.2. Clothing

- 5.1.3. Automotive

- 5.1.4. Financial

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Search Engine Marketing

- 5.2.2. Content Marketing

- 5.2.3. Email Marketing

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.2. Clothing

- 6.1.3. Automotive

- 6.1.4. Financial

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Search Engine Marketing

- 6.2.2. Content Marketing

- 6.2.3. Email Marketing

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.2. Clothing

- 7.1.3. Automotive

- 7.1.4. Financial

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Search Engine Marketing

- 7.2.2. Content Marketing

- 7.2.3. Email Marketing

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.2. Clothing

- 8.1.3. Automotive

- 8.1.4. Financial

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Search Engine Marketing

- 8.2.2. Content Marketing

- 8.2.3. Email Marketing

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.2. Clothing

- 9.1.3. Automotive

- 9.1.4. Financial

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Search Engine Marketing

- 9.2.2. Content Marketing

- 9.2.3. Email Marketing

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Marketing Platforms Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.2. Clothing

- 10.1.3. Automotive

- 10.1.4. Financial

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Search Engine Marketing

- 10.2.2. Content Marketing

- 10.2.3. Email Marketing

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tencent

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wanqi Qingjian Net

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SENSORS Data

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Facebook

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AdRoll

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Smart Insights

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Emfluence

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BetterGraph

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Launch Digital Marketing

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Techmagnate

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dotdigital

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sprinklr

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Eskimi

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sendinblue

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Microsoft

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Contently

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Infosys

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Act-On

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 InMobi

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Optimizely

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Milestone

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Shanghai Guangshu Network Technology Co.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Tencent

List of Figures

- Figure 1: Global Digital Marketing Platforms Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Marketing Platforms Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Marketing Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Marketing Platforms Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Marketing Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Marketing Platforms Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Marketing Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Marketing Platforms Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Marketing Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Marketing Platforms Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Marketing Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Marketing Platforms Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Marketing Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Marketing Platforms Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Marketing Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Marketing Platforms Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Marketing Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Marketing Platforms Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Marketing Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Marketing Platforms Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Marketing Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Marketing Platforms Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Marketing Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Marketing Platforms Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Marketing Platforms Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Marketing Platforms Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Marketing Platforms Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Marketing Platforms Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Marketing Platforms Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Marketing Platforms Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Marketing Platforms Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Marketing Platforms Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Marketing Platforms Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Marketing Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Marketing Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Marketing Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Marketing Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Marketing Platforms Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Marketing Platforms Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Marketing Platforms Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Marketing Platforms Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Marketing Platforms?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital Marketing Platforms?

Key companies in the market include Tencent, Wanqi Qingjian Net, SENSORS Data, Facebook, Google, AdRoll, Smart Insights, Emfluence, BetterGraph, Launch Digital Marketing, Techmagnate, Dotdigital, Sprinklr, Eskimi, Sendinblue, Microsoft, Contently, Infosys, Act-On, InMobi, Optimizely, Milestone, Shanghai Guangshu Network Technology Co., Ltd.

3. What are the main segments of the Digital Marketing Platforms?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Marketing Platforms," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Marketing Platforms report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Marketing Platforms?

To stay informed about further developments, trends, and reports in the Digital Marketing Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence