Key Insights

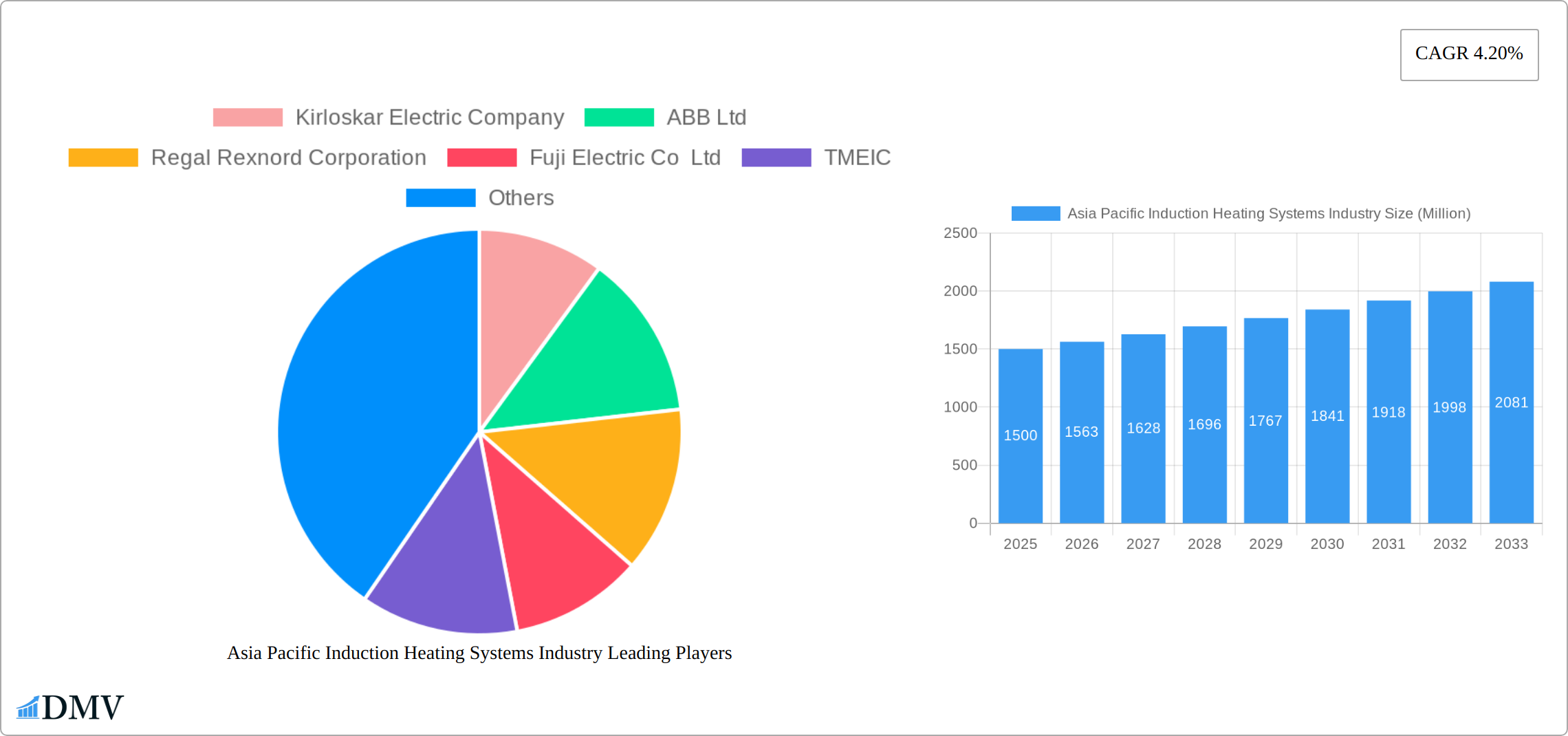

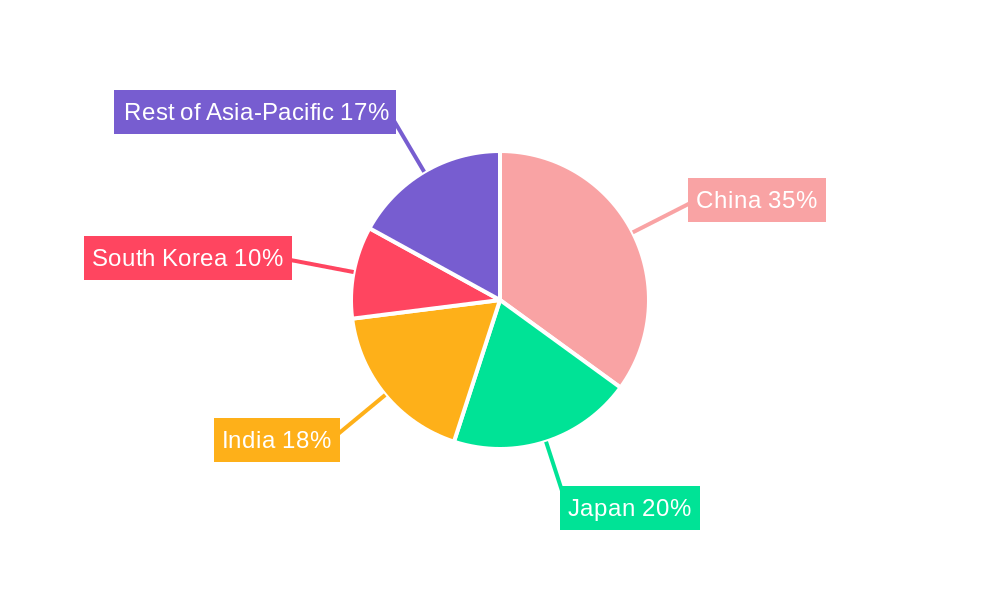

The Asia Pacific induction heating systems market is experiencing robust growth, driven by increasing automation across various industries and the inherent energy efficiency of induction heating compared to traditional methods. The market's Compound Annual Growth Rate (CAGR) of 4.20% from 2019 to 2024 indicates a steady expansion, projected to continue into the forecast period (2025-2033). Key drivers include the rising demand for precise temperature control in manufacturing processes, particularly within the automotive, food and beverage, and chemical sectors. Technological advancements leading to more compact, efficient, and cost-effective induction heating systems are further fueling market expansion. The strong presence of established players like ABB, Siemens, and Fuji Electric, coupled with the emergence of innovative startups, contributes to a competitive yet dynamic landscape. While the initial investment cost might act as a restraint for some smaller businesses, the long-term operational cost savings and improved product quality are compelling factors driving adoption. Segment-wise, the hardware component is expected to hold a significant market share, followed by software and services, catering to diverse customer requirements for customized solutions. Within the Asia Pacific region, countries like China, Japan, South Korea, and India are key contributors to market growth, reflecting their significant manufacturing bases and technological advancements. The continued expansion of these economies and their focus on industrial automation will further bolster the demand for induction heating systems.

The Asia Pacific market is segmented by type (hardware, software, services), end-user industry (food, tobacco, and beverage; automotive; chemical and petrochemical; energy and utilities; pharmaceutical; oil and gas; other), and country (UAE, Saudi Arabia, Israel, Oman, Rest of Middle East). Given the strong industrial growth in the Asia Pacific region, particularly in countries like China and India, we can project a substantial increase in market size. While precise figures for the market size in 2025 are not provided, leveraging the given CAGR of 4.20% and considering the projected growth in target industries, we can estimate a considerable increase from the 2024 market value. The robust growth trajectory is further substantiated by government initiatives promoting energy efficiency and automation in various sectors across the region. The "Rest of Asia-Pacific" segment is expected to show significant growth potential driven by emerging economies in Southeast Asia. The increasing adoption of automation in manufacturing across diverse industrial sectors continues to underpin the growth potential.

Asia Pacific Induction Heating Systems Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific induction heating systems industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report unveils key trends, growth drivers, and challenges shaping the industry's future. The study encompasses detailed market segmentation by type (Hardware, Software, Services), end-user industry (Food, Tobacco & Beverage, Automotive, Chemical & Petrochemical, Energy & Utilities, Pharmaceutical, Oil & Gas, Other), and key countries within the Asia Pacific region, including the United Arab Emirates, Saudi Arabia, Israel, Oman, and the Rest of the Middle East. The report includes an assessment of major players such as Kirloskar Electric Company, ABB Ltd, Regal Rexnord Corporation, Fuji Electric Co Ltd, TMEIC, SEALOCEAN, Nidec Corporation, WEG SA, and Siemens AG, and provides a robust forecast for the period 2025-2033.

Asia Pacific Induction Heating Systems Industry Market Composition & Trends

The Asia Pacific induction heating systems market presents a dynamic landscape shaped by competitive intensity, innovation, regulatory shifts, and evolving consumer needs. This section dissects the market's structure, identifying key players, assessing market concentration, and analyzing the impact of mergers and acquisitions (M&A) activity. We explore the influence of technological advancements, such as improvements in power electronics and control systems, and the role of evolving environmental regulations in driving market transformation. A detailed examination of substitute technologies, like conventional resistance heating, provides context for the competitive pressures shaping the industry. Finally, we profile key end-user segments, highlighting their specific requirements and preferences, to offer a comprehensive understanding of market demand.

- Market Concentration and Competitive Landscape: The Asia Pacific induction heating systems market exhibits a [Insert Degree of Concentration: e.g., moderately concentrated, highly fragmented] structure. In 2024, the top 5 players held approximately [Insert Percentage]% of the market share, indicating [Insert Analysis: e.g., a relatively high level of consolidation, significant opportunities for smaller players].

- Innovation Catalysts: Advancements in power electronics, particularly in [Specify Technologies: e.g., IGBTs, SiC MOSFETs], are enabling more efficient and precise induction heating solutions. Further innovation is driven by improvements in control systems, allowing for [Specify Improvements: e.g., real-time feedback loops, adaptive control algorithms] resulting in better process optimization and energy savings.

- Regulatory Landscape and Sustainability Concerns: Stringent environmental regulations, particularly those focused on [Specify Regulations: e.g., carbon emissions, energy efficiency], are significantly influencing the adoption of energy-efficient induction heating systems. This is further accelerated by growing consumer and corporate awareness of sustainability issues.

- Substitute Products and Competitive Threats: Conventional heating methods, such as resistance heating, remain competitive alternatives, particularly in applications requiring [Specify Applications: e.g., lower initial investment, simpler implementation]. However, the advantages of induction heating in terms of [Specify Advantages: e.g., efficiency, precision, and controllability] are driving its increasing adoption.

- M&A Activities and Market Dynamics: Between 2019 and 2024, the total value of M&A transactions in the industry reached approximately [Insert Updated Value] Million USD. These deals largely focused on [Specify Focus: e.g., expanding geographic reach, acquiring specialized technologies, consolidating market share], highlighting the strategic importance of the industry.

Asia Pacific Induction Heating Systems Industry Industry Evolution

The Asia Pacific induction heating systems market has witnessed substantial growth, driven by a confluence of factors. This section traces the industry's historical trajectory and projects its future expansion, analyzing key technological advancements, evolving consumer demand, and macroeconomic influences. We present detailed data, including historical and projected growth rates (CAGR), market size (in Million USD), and adoption rates of new technologies across various segments. The analysis incorporates both quantitative data and qualitative insights, providing a nuanced perspective on the industry's evolution. Key drivers identified include increasing industrial automation, the rising demand for energy-efficient solutions, and ongoing technological innovations in power electronics and control systems. The impact of macroeconomic factors, including economic growth and industrial output in key Asian economies, is also carefully evaluated.

Leading Regions, Countries, or Segments in Asia Pacific Induction Heating Systems Industry

This section pinpoints the dominant regions, countries, and segments within the Asia Pacific induction heating systems market. It offers a detailed analysis of the factors contributing to their dominance. Key drivers, such as investment trends, government support, and the presence of a strong manufacturing base are examined using bullet points, while the dominance factors are explored more thoroughly in paragraph format.

- By Type: The Hardware segment holds the largest market share, driven by the high demand for induction heating equipment.

- By End-User Industry: The Automotive industry is currently the largest end-user segment due to the extensive use of induction heating in various manufacturing processes.

- By Country: China is the leading market, driven by rapid industrialization and strong government support for technological advancements.

Key Drivers (examples):

- Significant investments in manufacturing infrastructure across several regions.

- Favorable government policies and incentives promoting energy-efficient technologies.

- Growing adoption of automation in industrial processes.

Asia Pacific Induction Heating Systems Industry Product Innovations

Innovation is a defining characteristic of the Asia Pacific induction heating systems market. Advancements in power electronics, control systems, and thermal management are leading to a new generation of induction heating systems with enhanced efficiency, precision, and reduced energy consumption. These improvements manifest in several key features: intelligent control systems providing real-time process optimization, advanced monitoring capabilities facilitating predictive maintenance, and user-friendly interfaces simplifying operation and integration. Consequently, key performance indicators such as heating speed, temperature accuracy, and energy efficiency are significantly improved, opening up new possibilities across a wide array of applications.

Propelling Factors for Asia Pacific Induction Heating Systems Industry Growth

The robust growth of the Asia Pacific induction heating systems market is underpinned by several converging factors. Technological advancements continue to deliver more efficient and precise heating solutions, addressing key industry needs. Strong economic growth in several Asian countries fuels demand across various sectors, from manufacturing to consumer goods. Furthermore, supportive government policies and regulations promoting energy efficiency are accelerating the adoption of induction heating as a cleaner and more sustainable alternative to traditional heating methods. Specific government initiatives such as [Mention Specific Policies or Programs: e.g., subsidies for energy-efficient equipment, stricter emission standards] are further stimulating market expansion.

Obstacles in the Asia Pacific Induction Heating Systems Industry Market

Despite the growth potential, the Asia Pacific induction heating systems market faces several challenges. Regulatory hurdles and stringent compliance requirements in certain countries can increase costs and complexity for businesses. Supply chain disruptions, particularly related to semiconductor components, can impact production and delivery times. Intense competition from established players and the emergence of new entrants further complicates market dynamics. These factors combined pose significant obstacles to sustained market growth.

Future Opportunities in Asia Pacific Induction Heating Systems Industry

The Asia Pacific induction heating systems market presents promising future opportunities. Expansion into new and emerging markets, such as developing economies with rapidly growing industries, offers significant potential. The development and adoption of advanced technologies such as IoT-enabled induction heating systems, along with innovations focused on improving energy efficiency and reducing emissions, are also key opportunities. Finally, changes in consumer behavior, such as a rising preference for energy-efficient products, offer further growth potential.

Major Players in the Asia Pacific Induction Heating Systems Industry Ecosystem

- Kirloskar Electric Company

- ABB Ltd

- Regal Rexnord Corporation

- Fuji Electric Co Ltd

- TMEIC

- SEALOCEAN

- Nidec Corporation

- WEG SA

- Siemens AG

Key Developments in Asia Pacific Induction Heating Systems Industry Industry

- December 2021: Nidec Global Appliance announced a USD 18 Million investment to expand production capacity by 1.5 Million units per year for variable speed motors used in HVAC systems. This signifies increased demand for components supporting induction heating applications.

Strategic Asia Pacific Induction Heating Systems Industry Market Forecast

The Asia Pacific induction heating systems market is projected to experience robust growth over the forecast period (2025-2033), with a compound annual growth rate (CAGR) of [Insert Projected CAGR]%. This sustained growth is driven by several factors: continuous technological innovation, increasing industrial automation across key sectors, and supportive government policies promoting energy efficiency. The emergence of new applications in diverse end-user industries, coupled with market expansion into new geographic regions, presents significant opportunities for growth. The long-term potential of the industry is reinforced by the ongoing global focus on energy efficiency and sustainability, making induction heating an increasingly attractive solution.

Asia Pacific Induction Heating Systems Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Induction Heating Systems Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Induction Heating Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Higher Energy Efficiency; Rising Need of Power Savings in Residential and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Industrial Applications to Register Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kirloskar Electric Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Regal Rexnord Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fuji Electric Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TMEIC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SEALOCEAN*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nidec Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 WEG SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Siemens AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Kirloskar Electric Company

List of Figures

- Figure 1: Asia Pacific Induction Heating Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Induction Heating Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Induction Heating Systems Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Asia Pacific Induction Heating Systems Industry?

Key companies in the market include Kirloskar Electric Company, ABB Ltd, Regal Rexnord Corporation, Fuji Electric Co Ltd, TMEIC, SEALOCEAN*List Not Exhaustive, Nidec Corporation, WEG SA, Siemens AG.

3. What are the main segments of the Asia Pacific Induction Heating Systems Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Higher Energy Efficiency; Rising Need of Power Savings in Residential and Industrial Sectors.

6. What are the notable trends driving market growth?

Industrial Applications to Register Significant Growth Rate.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

December 2021 - Nidec Global Appliance has initiated a substantial production capacity expansion. The additional capacity will support variable speed motors under the U.S Motors and Rescue brands, focused on heating, ventilation, and air conditioning (HVAC) systems. The investment of approximately USD 18 million will increase production capacity by 1.5 million units per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Induction Heating Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Induction Heating Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Induction Heating Systems Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Induction Heating Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence