Key Insights

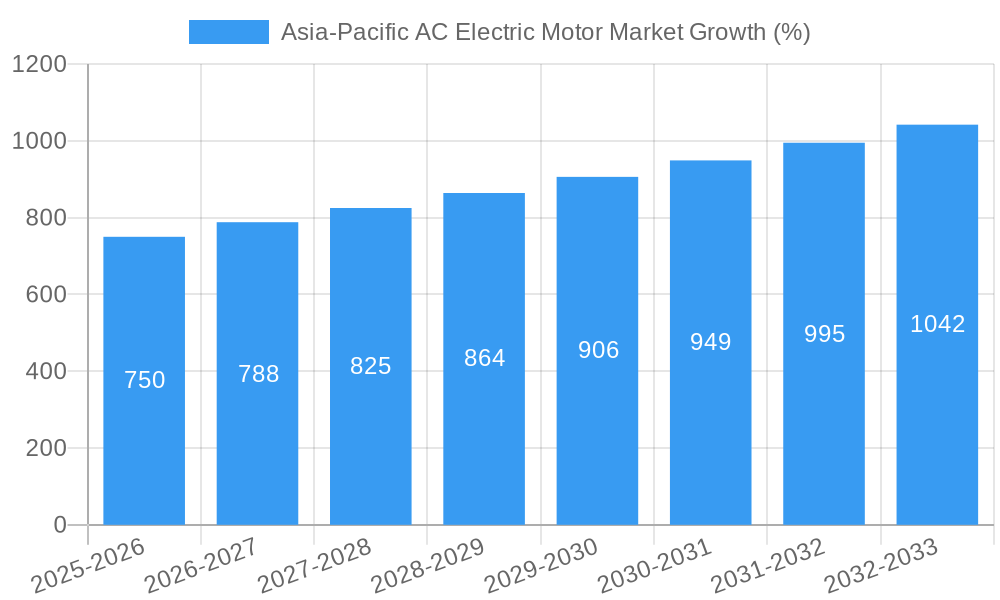

The Asia-Pacific AC electric motor market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing industrialization, rising energy efficiency standards, and the expanding adoption of automation across various sectors. A Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033 indicates a significant market expansion. Key drivers include the burgeoning demand for electric motors in the oil and gas, power generation, and water & wastewater industries. Furthermore, the increasing adoption of high-efficiency motors, particularly in countries like China and India, fuels market growth. While rising raw material costs and supply chain disruptions pose challenges, the long-term outlook remains positive, fueled by government initiatives promoting sustainable energy solutions and technological advancements in motor design and manufacturing. Growth is expected to be particularly strong in segments like high-voltage motors, catering to large-scale industrial applications, and AC synchronous motors, favored for their higher efficiency and precision control. The market is dominated by major players such as ABB Ltd, Siemens AG, and Nidec Corporation, which are continuously investing in R&D and expanding their product portfolios to meet the evolving demands of this dynamic market.

The market segmentation reveals significant opportunities within specific sub-sectors. China and India are expected to be the largest contributors to regional growth, driven by their expanding industrial bases and supportive government policies. While Japan and Australia represent more mature markets, they still contribute significant value. The market's growth is also influenced by technological advancements in motor design, leading to increased efficiency and reduced energy consumption. This trend is further amplified by stricter environmental regulations and a growing focus on sustainable practices across industries. The increasing demand for energy-efficient solutions across various end-user industries in the Asia-Pacific region is a major factor driving the growth of the AC electric motor market and paving the way for innovations in the technology.

Asia-Pacific AC Electric Motor Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific AC electric motor market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to navigate this dynamic market. The market is segmented by voltage (low, medium, high), motor type (AC induction/asynchronous, AC synchronous including PMAC), end-user industry (oil & gas, power generation, water & wastewater, food & beverage, other), and country (China, India, Japan, Australia & New Zealand, Rest of Asia-Pacific). The total market size is projected to reach xx Million by 2033.

Asia-Pacific AC Electric Motor Market Composition & Trends

This section delves into the competitive landscape of the Asia-Pacific AC electric motor market. We analyze market concentration, identifying the leading players and their respective market share. The report also explores innovation drivers, such as advancements in energy efficiency and smart motor technologies, and examines the influence of regulatory landscapes, including environmental regulations and safety standards. The impact of substitute products and the prevalence of mergers and acquisitions (M&A) are also analyzed. Key metrics, including market share distribution among top players (e.g., ABB Ltd. holding xx%, Siemens AG holding xx%, etc.) and M&A deal values (totaling xx Million in the last five years), are provided to offer a granular understanding of market dynamics. End-user profiles are analyzed to understand the specific demands and preferences of various industries.

- Market Concentration: High, with a few dominant players controlling a significant market share.

- Innovation Catalysts: Focus on energy efficiency, IoT integration, and advanced control systems.

- Regulatory Landscape: Stringent environmental regulations driving demand for energy-efficient motors.

- Substitute Products: Limited, but growing competition from alternative drive technologies.

- M&A Activity: Significant consolidation in recent years, with several large acquisitions shaping the market.

Asia-Pacific AC Electric Motor Market Industry Evolution

The Asia-Pacific AC electric motor market has witnessed a dynamic evolution, driven by a confluence of technological innovation, shifting industrial demands, and evolving regulatory landscapes. From 2019 to 2024, the market experienced robust growth, fueled by the escalating adoption of automation across manufacturing sectors and infrastructure development initiatives. Looking ahead, projections indicate a sustained and accelerated growth trajectory until 2033. Key technological advancements are redefining the market, with a notable surge in the adoption of Permanent Magnet AC Synchronous Motors (PMAC) owing to their superior efficiency and power density. The seamless integration of advanced control systems, including variable frequency drives (VFDs) and sophisticated digital interfaces, is further enhancing motor performance, energy management, and predictive maintenance capabilities. Concurrently, evolving consumer and industrial demands are steering the market towards greater energy efficiency and smart, digitally connected motor solutions. This includes a growing emphasis on motors with lower energy consumption, reduced carbon footprint, and the ability to integrate into the Industrial Internet of Things (IIoT) ecosystem. The report provides detailed growth rate projections, anticipating a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, alongside critical adoption metrics for various motor types, including induction motors, synchronous motors, and the increasingly prevalent PMAC motors. Factors significantly influencing market expansion vary across the diverse Asia-Pacific landscape. For instance, rapid industrial automation trends in countries like China and South Korea are driving demand for high-performance motors, while significant infrastructure development projects in Southeast Asian nations are creating substantial opportunities for standard industrial motor applications. The report further delves into the specific nuances of these regional and end-user industry dynamics.

Leading Regions, Countries, or Segments in Asia-Pacific AC Electric Motor Market

This section pinpoints the dominant regions, countries, and segments within the Asia-Pacific AC electric motor market. China is expected to remain the leading market, followed by India and Japan. Within the segments, the high-voltage AC induction motor segment is predicted to experience robust growth, driven by the expansion of the power generation and industrial sectors. Detailed analysis is provided for each key segment, along with factors influencing their dominance.

- Key Drivers for China: Rapid industrialization, government support for renewable energy, and robust infrastructure development.

- Key Drivers for India: Growing manufacturing sector, increasing urbanization, and rising electricity demand.

- Dominant Segment (Voltage): High Voltage – driven by large-scale industrial applications.

- Dominant Segment (Motor Type): AC Induction/Asynchronous – cost-effectiveness and wide applicability.

- Dominant Segment (End-User Industry): Power Generation – due to large-scale power plant installations.

Asia-Pacific AC Electric Motor Market Product Innovations

Recent years have witnessed significant product innovations in the Asia-Pacific AC electric motor market. Manufacturers are focusing on developing highly efficient motors with advanced features like integrated sensors, smart control systems, and improved thermal management. These innovations improve motor performance, reliability, and energy efficiency, leading to reduced operational costs and environmental impact. Unique selling propositions include enhanced durability, quieter operation, and improved connectivity for remote monitoring and diagnostics.

Propelling Factors for Asia-Pacific AC Electric Motor Market Growth

The growth of the Asia-Pacific AC electric motor market is propelled by several key factors. Firstly, strong economic growth in several countries within the region is driving increased industrial activity and infrastructure development, leading to higher demand for electric motors. Secondly, stringent government regulations promoting energy efficiency are driving the adoption of energy-efficient motors. Thirdly, technological advancements, particularly in motor control and design, are leading to improved performance and reduced costs.

Obstacles in the Asia-Pacific AC Electric Motor Market

Despite its promising growth, the Asia-Pacific AC electric motor market navigates a landscape marked by several significant challenges. Increasingly stringent environmental regulations and energy efficiency mandates, while crucial for sustainability, can present a hurdle for manufacturers. Compliance often necessitates substantial investment in research and development for more efficient designs and upgraded production processes, potentially leading to increased manufacturing costs and a longer compliance cycle. Furthermore, the intricate global supply chains for critical raw materials, such as rare earth magnets essential for PMAC motors, and specialized electronic components, remain susceptible to disruptions. Geopolitical factors, trade policies, and unforeseen events can impact material availability and price volatility, affecting production schedules and overall market stability. The competitive intensity within the Asia-Pacific region is exceptionally high, characterized by a large number of both established global players and agile domestic manufacturers. This fierce competition exerts considerable pressure on pricing strategies and can compress profit margins, particularly for commoditized motor segments.

Future Opportunities in Asia-Pacific AC Electric Motor Market

The Asia-Pacific AC electric motor market is poised to capitalize on a wealth of burgeoning opportunities, particularly in the realm of advanced and sustainable technologies. The rapid expansion of renewable energy sources, including solar and wind power, is creating a substantial demand for highly efficient and reliable electric motors for power generation and grid integration. The burgeoning electric vehicle (EV) sector across the region presents a significant growth avenue, necessitating specialized high-performance motors for traction systems and auxiliary functions. The modernization of power grids and the transition towards smart grids further amplify the need for advanced motor solutions that offer precise control and energy management capabilities. The pervasive drive towards Industry 4.0 and comprehensive automation across diverse industries, from automotive and electronics to food & beverage and pharmaceuticals, is creating substantial opportunities for sophisticated motor control systems, integrated robotics, and smart motor solutions that facilitate enhanced productivity, flexibility, and operational efficiency. Moreover, the untapped market potential within emerging economies in Southeast Asia, coupled with continued infrastructure development, presents a fertile ground for market expansion and increased adoption of AC electric motors across a broader spectrum of applications.

Major Players in the Asia-Pacific AC Electric Motor Market Ecosystem

- ABB Ltd

- Weg SA

- Nidec Corporation

- Siemens AG

- Wolong Electric Group

- Teco Electric & Machinery Co Ltd

- Toshiba Industrial Products and Systems Corporation

- Regal Beloit Corporation

Key Developments in Asia-Pacific AC Electric Motor Market Industry

- January 2024: Yaskawa Electric Corporation announced a strategic expansion of its production facility in Vietnam to cater to the growing demand for industrial automation solutions in Southeast Asia.

- November 2023: Mitsubishi Electric introduced its latest series of IE5 efficiency class induction motors, setting new benchmarks for energy conservation in industrial machinery.

- July 2023: A consortium of Chinese manufacturers unveiled a new sustainable sourcing initiative for rare earth materials, aiming to mitigate supply chain risks and enhance the circular economy within the electric motor industry.

- March 2023: Festo SE & Co. KG launched an innovative robotic arm equipped with advanced AC electric motors and AI-powered control, targeting the rapidly growing logistics and e-commerce sectors in the region.

- January 2023: ABB Ltd. launched a new range of energy-efficient motors for industrial applications, emphasizing reduced energy consumption and enhanced operational lifespan.

- March 2022: Siemens AG acquired a significant stake in an Indian electric motor manufacturer, further bolstering its presence and manufacturing capabilities in the burgeoning Indian market.

- June 2021: Nidec Corporation significantly increased its investment in research and development focused on high-efficiency Permanent Magnet AC Synchronous Motors (PMAC), anticipating their increased adoption in electric mobility and industrial applications. (Further details of specific developments with dates and impacts are provided in the full report.)

Strategic Asia-Pacific AC Electric Motor Market Forecast

The Asia-Pacific AC electric motor market is poised for continued growth, driven by sustained economic expansion, increasing industrialization, and a focus on energy efficiency. The adoption of advanced technologies, such as IoT-enabled motors and smart control systems, will further drive market expansion. The market’s potential is significant, with substantial growth opportunities across various segments and countries within the region.

Asia-Pacific AC Electric Motor Market Segmentation

-

1. Voltage

- 1.1. Low

- 1.2. Medium

- 1.3. High

-

2. Type of Motor

- 2.1. AC Induction/Asynchronous

- 2.2. AC Synchronous (including PMAC)

-

3. End User Industry

- 3.1. Oil & Gas

- 3.2. Power Generation

- 3.3. Water & Wastewater

- 3.4. Food & Beverage

- 3.5. Other End User Industries

Asia-Pacific AC Electric Motor Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific AC Electric Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for High Power Density and Higher Energy Efficiency; Increasing Awareness on PMAC Motors

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Low Voltage Segment is Expected to Grow at a Significant Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low

- 5.1.2. Medium

- 5.1.3. High

- 5.2. Market Analysis, Insights and Forecast - by Type of Motor

- 5.2.1. AC Induction/Asynchronous

- 5.2.2. AC Synchronous (including PMAC)

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Oil & Gas

- 5.3.2. Power Generation

- 5.3.3. Water & Wastewater

- 5.3.4. Food & Beverage

- 5.3.5. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. China Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific AC Electric Motor Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Weg SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nidec Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Siemens AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Wolong Electric Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Teco Electric & Machinery Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Toshiba Industrial Products and Systems Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Regal Beloit Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia-Pacific AC Electric Motor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific AC Electric Motor Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 4: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Voltage 2019 & 2032

- Table 5: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Type of Motor 2019 & 2032

- Table 6: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Type of Motor 2019 & 2032

- Table 7: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 8: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by End User Industry 2019 & 2032

- Table 9: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: China Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 28: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Voltage 2019 & 2032

- Table 29: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Type of Motor 2019 & 2032

- Table 30: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Type of Motor 2019 & 2032

- Table 31: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 32: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by End User Industry 2019 & 2032

- Table 33: Asia-Pacific AC Electric Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific AC Electric Motor Market Volume K Units Forecast, by Country 2019 & 2032

- Table 35: China Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: China Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Japan Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: South Korea Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: India Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Australia Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Australia Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: New Zealand Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: New Zealand Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Indonesia Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Indonesia Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Malaysia Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Malaysia Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Singapore Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Singapore Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 53: Thailand Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Thailand Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 55: Vietnam Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Vietnam Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 57: Philippines Asia-Pacific AC Electric Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Philippines Asia-Pacific AC Electric Motor Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific AC Electric Motor Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Asia-Pacific AC Electric Motor Market?

Key companies in the market include ABB Ltd, Weg SA, Nidec Corporation, Siemens AG, Wolong Electric Group, Teco Electric & Machinery Co Ltd, Toshiba Industrial Products and Systems Corporation, Regal Beloit Corporation.

3. What are the main segments of the Asia-Pacific AC Electric Motor Market?

The market segments include Voltage, Type of Motor, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for High Power Density and Higher Energy Efficiency; Increasing Awareness on PMAC Motors.

6. What are the notable trends driving market growth?

Low Voltage Segment is Expected to Grow at a Significant Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific AC Electric Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific AC Electric Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific AC Electric Motor Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific AC Electric Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence