Key Insights

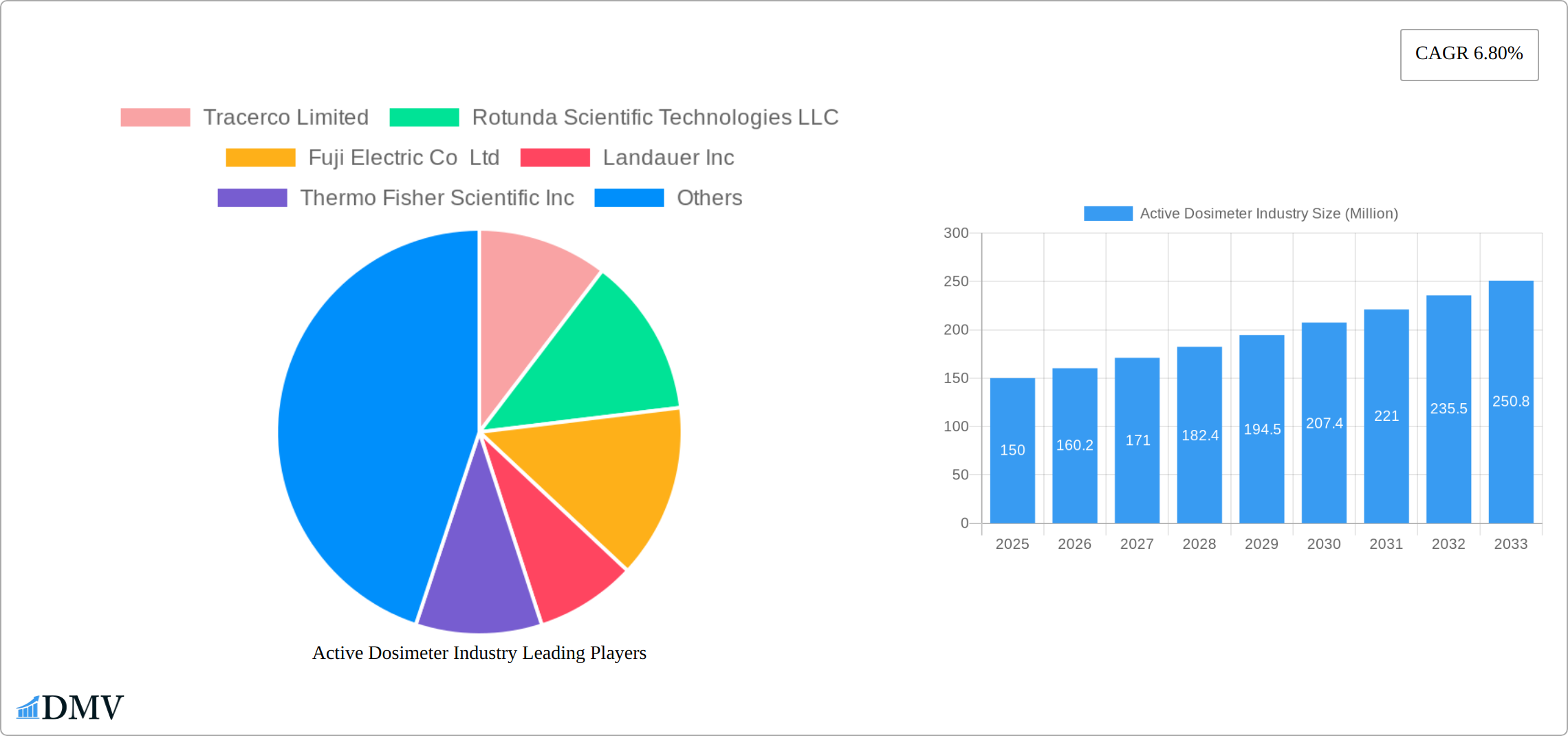

The active dosimeter market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033. This expansion is fueled by several key factors. Increasing regulatory requirements for radiation safety across various sectors, including healthcare, industrial applications (particularly oil & gas and mining), and military/homeland security, are significant drivers. Furthermore, advancements in dosimeter technology, leading to smaller, lighter, and more accurate devices with enhanced data logging capabilities, are boosting market adoption. The growing awareness of the potential health risks associated with radiation exposure, coupled with the increasing demand for real-time monitoring solutions, further propels market growth. While the market faces some restraints, such as the high initial investment costs associated with purchasing and maintaining active dosimeters and potential supply chain disruptions, the overall positive outlook for the market remains strong due to the imperative for reliable radiation safety across a broad range of industries.

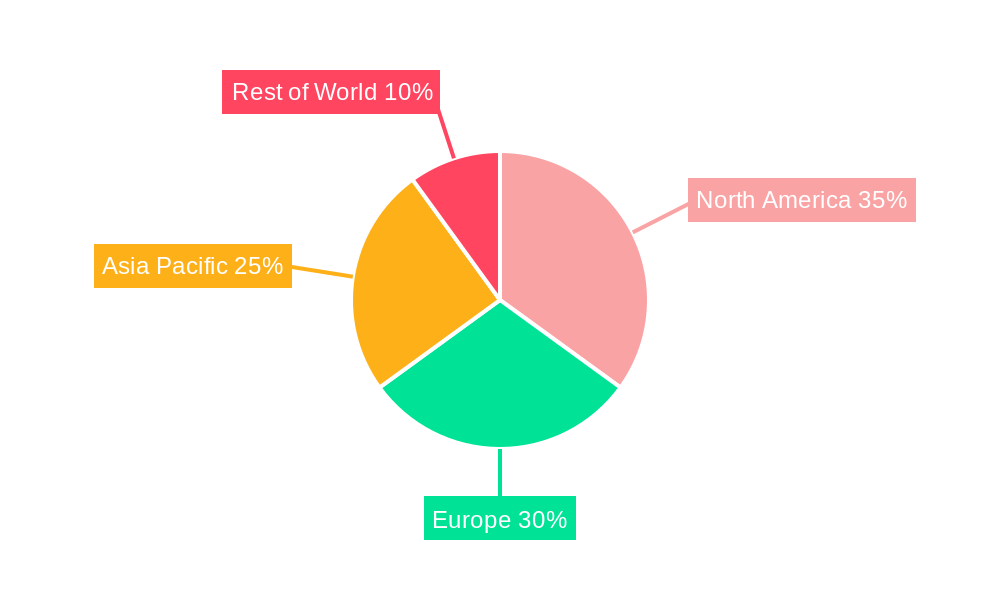

The market segmentation reveals a diverse landscape. The medical sector is a major application area, owing to the prevalent use of radiation in diagnostic and therapeutic procedures. Industrial applications, especially in the oil and gas and mining industries, represent a significant growth opportunity given the inherent radiation risks in these sectors. The military and homeland security segment presents a robust market due to the frequent exposure of personnel to ionizing radiation. The power and energy sector also contributes substantially as nuclear power generation and related activities necessitate rigorous radiation monitoring. Key players in the market include Tracerco Limited, Rotunda Scientific Technologies LLC, Fuji Electric Co Ltd, Landauer Inc, Thermo Fisher Scientific Inc, and others, continually innovating to meet the evolving needs of various end-users. Geographic growth is expected to be distributed across regions, with North America and Europe holding significant market shares initially, while the Asia-Pacific region shows promising growth potential due to increasing industrialization and infrastructure development.

Active Dosimeter Industry Market Composition & Trends

The Active Dosimeter Industry is a dynamic market shaped by several key factors. Market concentration is relatively high, with leading players like Thermo Fisher Scientific Inc. and Mirion Technologies Inc. commanding significant shares. These industry giants, along with other key players such as Tracerco Limited and Fuji Electric Co. Ltd., are driving innovation through robust R&D investments and strategic collaborations. The regulatory landscape plays a crucial role, particularly within the healthcare and military sectors, where stringent safety standards are paramount. While substitute products like passive dosimeters exist, active dosimeters maintain a strong preference due to their real-time monitoring capabilities, offering immediate feedback crucial for safety and operational efficiency.

- Market Share Distribution: Thermo Fisher Scientific Inc. holds an estimated 25% market share, while Mirion Technologies Inc. holds approximately 20%. The remaining market share is distributed among numerous other competitors, indicating a fragmented landscape beyond the leading players.

- Innovation Catalysts: Significant R&D investments (estimated at $XX Million annually) are fueling the development of more precise, reliable, and user-friendly active dosimeters. This continuous innovation is a major driver of market growth.

- Regulatory Landscapes: Strict regulations within the healthcare and defense sectors create a consistently high demand for compliant dosimeters, ensuring a stable market foundation.

- Substitute Products: Passive dosimeters represent a viable alternative; however, their delayed data reporting limits their appeal compared to the real-time advantages offered by active dosimeters.

- End-User Profiles: The primary end-users include healthcare facilities, industrial sites (particularly in oil & gas and mining), and military installations, reflecting diverse applications across multiple sectors.

- M&A Activities: Significant mergers and acquisitions (M&A) activity, with deals exceeding $100 million, demonstrate strategic efforts to expand product portfolios and geographical reach, further consolidating market power.

Active Dosimeter Industry Industry Evolution

The evolution of the Active Dosimeter Industry has been marked by significant growth trajectories, driven by technological advancements and shifting consumer demands. From 2019 to 2024, the industry experienced a compound annual growth rate (CAGR) of approximately 5%, with projections indicating a rise to 7% from 2025 to 2033. Technological advancements, such as the integration of IoT and AI, have enhanced the accuracy and functionality of dosimeters, making them more appealing to end-users. The medical segment has seen the highest adoption rate, with hospitals and clinics increasingly relying on real-time radiation monitoring to ensure patient and staff safety. Similarly, the industrial sector, particularly in oil & gas and mining, has embraced active dosimeters to monitor worker exposure to radiation. Consumer demands are shifting towards more portable, user-friendly, and cost-effective solutions, prompting manufacturers to innovate and diversify their offerings.

Leading Regions, Countries, or Segments in Active Dosimeter Industry

Market dominance in the Active Dosimeter Industry varies significantly across regions, countries, and application segments. North America, especially the United States, leads the market due to its advanced healthcare infrastructure and rigorous regulatory environment. Europe follows closely, driven by high adoption rates in industrial settings and the military sector. The medical segment is the most dominant application area, largely due to the critical need for accurate radiation monitoring in various healthcare procedures.

Key Drivers in North America:

Substantial investment in healthcare infrastructure, exceeding $XX Million annually.

Robust regulatory frameworks supporting compliance with radiation safety standards.

Key Drivers in Europe:

Significant investment in industrial safety measures, notably within the oil & gas and mining sectors.

Strong demand driven by military and homeland security applications, influenced by geopolitical factors.

Dominance Factors in Medical Segment: The medical segment's dominance stems from the crucial need for real-time radiation monitoring during cancer treatment and other medical procedures. The increasing adoption of active dosimeters by hospitals and clinics reflects a commitment to patient safety and regulatory compliance. Technological advancements offering improved accuracy and ease of use further propel this segment's growth.

Active Dosimeter Industry Product Innovations

Recent product innovations have prioritized enhancing accuracy, portability, and user-friendliness. Companies such as Thermo Fisher Scientific Inc. and Mirion Technologies Inc. have introduced cutting-edge dosimeters integrating IoT and AI technologies. This integration enables real-time data analysis and remote monitoring capabilities, not only improving device performance but also catering to the increasing demand for advanced and efficient radiation monitoring solutions.

Propelling Factors for Active Dosimeter Industry Growth

The growth of the Active Dosimeter Industry is propelled by several key factors:

- Technological Advancements: Integration of IoT and AI technologies enhances device functionality and user experience.

- Economic Influences: Increasing investments in healthcare and industrial safety, with annual investments surpassing $xx Million.

- Regulatory Influences: Stringent safety regulations in healthcare and industrial sectors drive demand for compliant dosimeters.

Obstacles in the Active Dosimeter Industry Market

Despite its growth, the Active Dosimeter Industry faces several obstacles:

- Regulatory Challenges: Compliance with varying international standards can be complex and costly.

- Supply Chain Disruptions: Global events like pandemics can interrupt the supply of critical components, impacting production.

- Competitive Pressures: Intense competition from both established players and new entrants can lead to price wars and reduced margins.

Future Opportunities in Active Dosimeter Industry

The Active Dosimeter Industry is poised for considerable future growth, driven by several key opportunities:

- New Markets: Expansion into developing economies experiencing growth in their healthcare and industrial sectors presents significant untapped potential.

- Technological Innovations: Further development of sophisticated, AI-powered dosimeters will enhance monitoring capabilities and overall safety standards.

- Consumer Trends: The rising demand for portable and user-friendly devices will broaden the range of applications and increase market accessibility.

Major Players in the Active Dosimeter Industry Ecosystem

- Tracerco Limited

- Rotunda Scientific Technologies LLC

- Fuji Electric Co Ltd

- Landauer Inc

- Thermo Fisher Scientific Inc

- Raeco Rents LLC *List Not Exhaustive

- Mirion Technologies Inc

- Far West Technology Inc

- Polimaster Inc

- ATOMTEX SPE

- Unfors RaySafe AB

Key Developments in Active Dosimeter Industry Industry

- September 2022: Thermo Fisher Scientific announced an investment of $160 Million to expand bioproduction capacity in Greater Boston. The new 85,000-square-foot facility aims to meet the growing demand for biological materials needed for vaccines and therapies for cancer and other diseases, impacting the medical segment of the Active Dosimeter Industry.

- April 2022: Mirion Technologies, Inc, through its subsidiary Sun Nuclear, introduced a new SaaS option for its Sun Check Quality Management platform. This development streamlines radiation therapy QA workflows, enhancing patient safety in cancer care and offering scalability and operational efficiencies for health systems.

Strategic Active Dosimeter Industry Market Forecast

The Active Dosimeter Industry is set to experience robust growth from 2025 to 2033, driven by technological advancements, increasing demand for real-time radiation monitoring, and expanding applications across various sectors. The integration of AI and IoT technologies will continue to enhance device capabilities, opening new opportunities in healthcare, industrial safety, and military applications. The market's potential is further bolstered by rising investments in safety infrastructure and the global push for enhanced regulatory compliance, positioning the industry for significant expansion in the coming years.

Active Dosimeter Industry Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Industrial (Oil & Gas, Mining)

- 1.3. Military and Homeland Security

- 1.4. Power & Energy

- 1.5. Other Applications

Active Dosimeter Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Active Dosimeter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector

- 3.3. Market Restrains

- 3.3.1. High cost of device; Sensitivity toward Mechanical Instability

- 3.4. Market Trends

- 3.4.1. Medical Application is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Industrial (Oil & Gas, Mining)

- 5.1.3. Military and Homeland Security

- 5.1.4. Power & Energy

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Industrial (Oil & Gas, Mining)

- 6.1.3. Military and Homeland Security

- 6.1.4. Power & Energy

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Industrial (Oil & Gas, Mining)

- 7.1.3. Military and Homeland Security

- 7.1.4. Power & Energy

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Industrial (Oil & Gas, Mining)

- 8.1.3. Military and Homeland Security

- 8.1.4. Power & Energy

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Industrial (Oil & Gas, Mining)

- 9.1.3. Military and Homeland Security

- 9.1.4. Power & Energy

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Tracerco Limited

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Rotunda Scientific Technologies LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Fuji Electric Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Landauer Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Thermo Fisher Scientific Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Raeco Rents LLC *List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Mirion Technologies Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Far West Technology Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Polimaster Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ATOMTEX SPE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Unfors RaySafe AB

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Tracerco Limited

List of Figures

- Figure 1: Global Active Dosimeter Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Rest of the World Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Rest of the World Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Active Dosimeter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Active Dosimeter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active Dosimeter Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Active Dosimeter Industry?

Key companies in the market include Tracerco Limited, Rotunda Scientific Technologies LLC, Fuji Electric Co Ltd, Landauer Inc, Thermo Fisher Scientific Inc, Raeco Rents LLC *List Not Exhaustive, Mirion Technologies Inc, Far West Technology Inc, Polimaster Inc, ATOMTEX SPE, Unfors RaySafe AB.

3. What are the main segments of the Active Dosimeter Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector.

6. What are the notable trends driving market growth?

Medical Application is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

High cost of device; Sensitivity toward Mechanical Instability.

8. Can you provide examples of recent developments in the market?

September 2022 - Thermo Fisher Scientific has announced its Investment of $160 Million to Expand the Bioproduction Capacity in Greater Boston; the 85,000-square-foot facility will help meet the growing demand for the biological materials needed to produce vaccines and breakthrough therapies for cancer and other diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active Dosimeter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active Dosimeter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active Dosimeter Industry?

To stay informed about further developments, trends, and reports in the Active Dosimeter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence