Key Insights

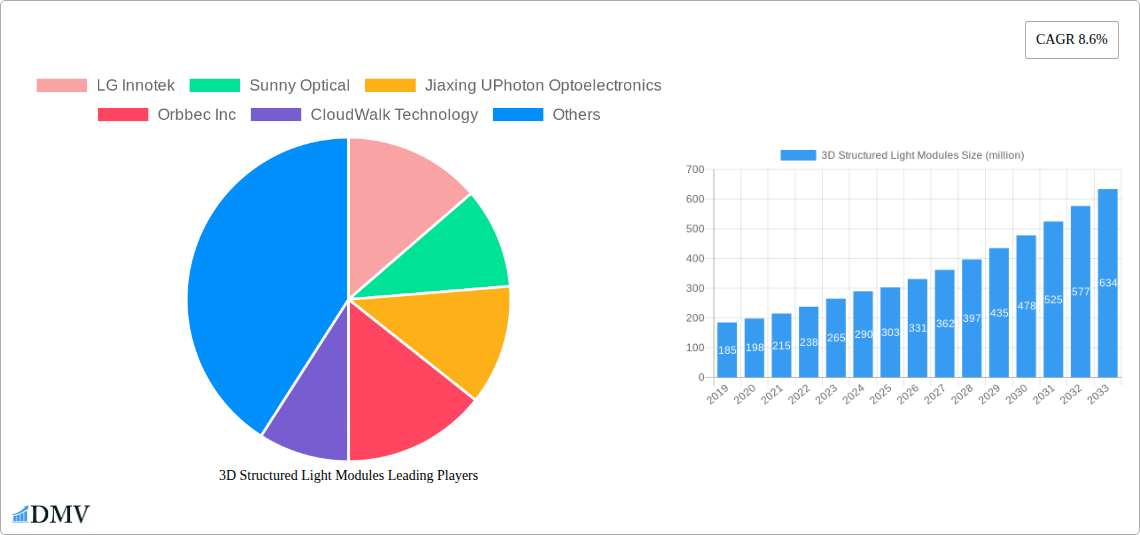

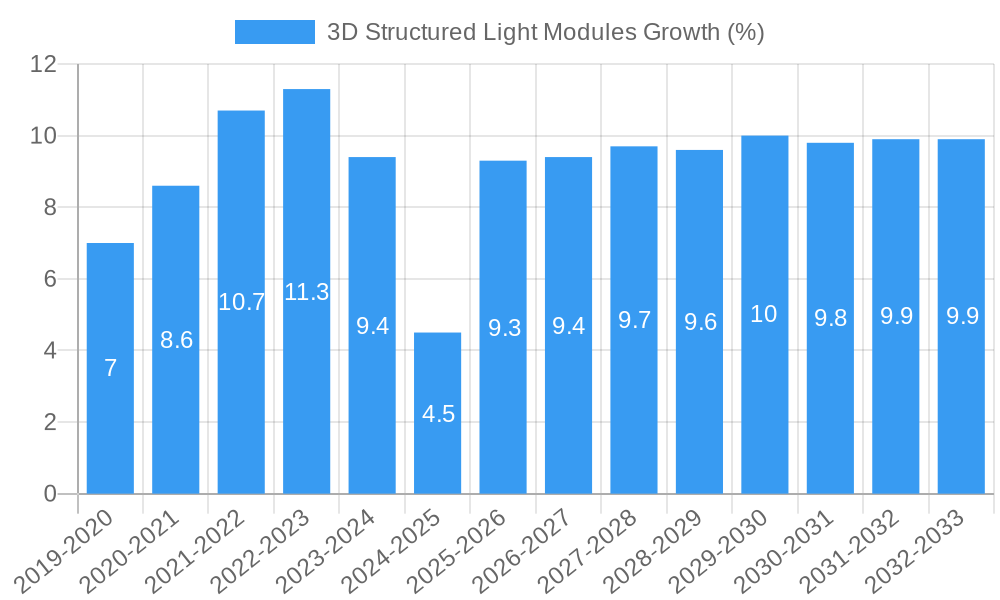

The global 3D Structured Light Modules market is poised for significant expansion, projected to reach approximately $303 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 8.6% throughout the forecast period of 2025-2033. This impressive growth trajectory is fueled by a confluence of powerful drivers, primarily the escalating demand for enhanced security and authentication solutions across diverse industries. Applications such as sophisticated access control and attendance terminals are increasingly integrating these modules for their superior accuracy and reliability compared to traditional methods. Furthermore, the burgeoning adoption of smartphones with advanced biometric features, coupled with the rapid evolution of financial payment systems seeking more secure transaction methods, are acting as substantial catalysts. The market's dynamism is also evident in its segmentation, with Monocular Structured Light Modules currently dominating due to their cost-effectiveness and wide applicability, while Binocular Structured Light Modules are gaining traction for their enhanced depth perception and precision in more demanding applications.

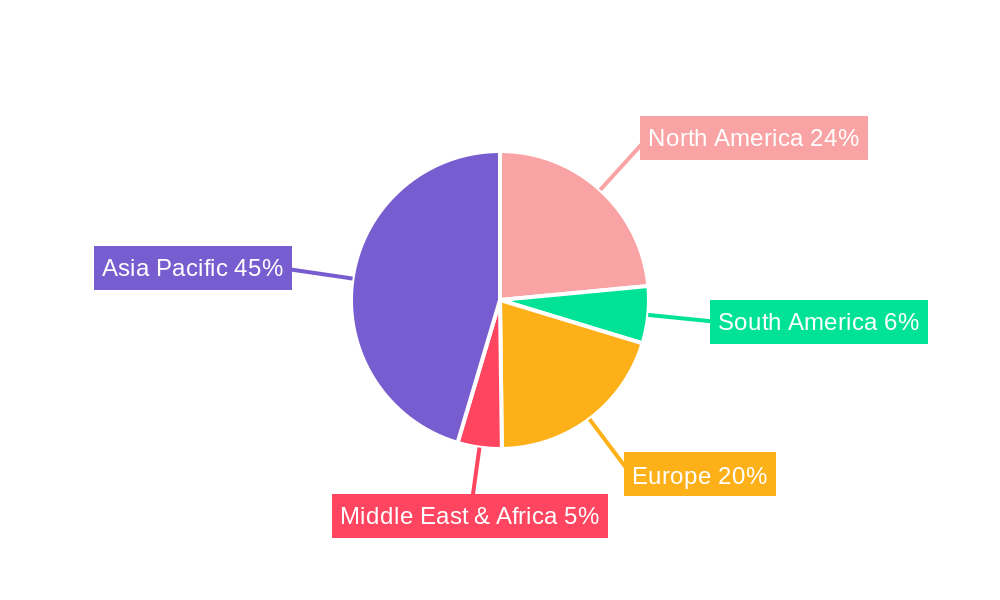

The market landscape is characterized by intense innovation and strategic collaborations among key players like LG Innotek, Sunny Optical, and Orbbec Inc. These companies are at the forefront of developing more compact, power-efficient, and cost-effective 3D Structured Light Modules to meet the growing needs of segments like Human ID Comparison, Smart Retail, and various other emerging applications. However, the market is not without its challenges. Restraints such as the relatively high initial cost of some advanced modules and the need for specialized integration expertise can temper immediate adoption rates in certain segments. Despite these hurdles, the overarching trend of digitalization and the continuous pursuit of more immersive and secure user experiences are expected to propel the 3D Structured Light Modules market forward, particularly in the Asia Pacific region, which is anticipated to be a major growth hub due to its large manufacturing base and rapidly expanding consumer electronics sector.

3D Structured Light Modules Market Composition & Trends

The global 3D structured light modules market is characterized by a dynamic interplay of innovation, strategic partnerships, and evolving end-user demands. Market concentration is moderately fragmented, with key players like LG Innotek, Sunny Optical, and Orbbec Inc. vying for significant market share. Innovation catalysts are primarily driven by advancements in sensor technology, miniaturization, and improved algorithmic processing, leading to enhanced accuracy and reduced form factors for devices. The regulatory landscape, while nascent in some regions, is gradually adapting to accommodate the widespread adoption of 3D sensing technologies, particularly concerning data privacy and security. Substitute products, such as Time-of-Flight (ToF) sensors and stereo vision, present a competitive challenge, although structured light modules continue to offer superior depth resolution and accuracy in specific applications. End-user profiles range from high-volume consumer electronics manufacturers demanding cost-effective and compact solutions for smartphones and access control, to specialized industrial and automotive sectors requiring robust and precise 3D imaging for complex tasks. Mergers and acquisitions (M&A) are becoming increasingly prevalent as companies seek to consolidate their market position, acquire critical intellectual property, and expand their technological capabilities. Notable M&A activities have seen deal values in the range of several hundred million, reflecting the strategic importance of 3D sensing technology. For instance, acquisitions aimed at integrating advanced image processing algorithms or securing proprietary optical designs are shaping the competitive landscape.

- Market Share Distribution: While precise figures are proprietary, leading companies hold market shares in the range of 10-20 million units annually in specific segments.

- M&A Deal Values: Recent transactions have ranged from tens of millions to several hundred million, indicating significant investment in the sector.

- Innovation Catalysts:

- Miniaturization of projection and imaging components.

- Development of AI-powered depth processing algorithms.

- Enhanced power efficiency for mobile applications.

- Increased robustness and environmental resistance for industrial use.

- End-User Segmentation:

- Consumer Electronics: High volume, cost sensitivity, focus on integration.

- Automotive: Safety-critical applications, high reliability, environmental resilience.

- Industrial Automation: Precision measurement, robotics, quality control.

- Healthcare: Medical imaging, surgical guidance, diagnostics.

3D Structured Light Modules Industry Evolution

The 3D structured light modules industry has witnessed a remarkable evolution, transitioning from niche laboratory applications to pervasive integration within a multitude of consumer and industrial devices. The study period from 2019 to 2033 encapsulates a significant growth trajectory, with the base year of 2025 serving as a pivotal point for current market analysis and the estimated year for immediate market assessments. The forecast period from 2025 to 2033 projects sustained and accelerated expansion, building upon the foundational growth observed during the historical period of 2019-2024. This evolution is intrinsically linked to the relentless pace of technological advancements. Early iterations of structured light technology were often bulky and power-intensive, limiting their widespread adoption. However, breakthroughs in micro-projector design, CMOS sensor technology, and computational imaging have enabled the creation of highly compact, energy-efficient, and cost-effective modules.

Market growth trajectories have been steep, driven by an increasing demand for immersive experiences and intelligent automation. The adoption of 3D sensing in smartphones for facial recognition and augmented reality (AR) has been a primary growth engine. This segment alone has seen adoption rates climb from approximately 20% of premium smartphone models in 2019 to an estimated 70% by 2025, with an anticipated growth of 15% year-on-year through 2030. Beyond smartphones, the application in access control and attendance terminals has surged, offering enhanced security and convenience, with market penetration projected to reach over 40% in enterprise settings by 2028. The financial payment sector is also recognizing the potential of 3D structured light for secure, contactless authentication, with an estimated market size of over 500 million units in the forecast period.

Consumer demands have shifted significantly, with users now expecting seamless and intuitive interactions with technology. 3D structured light modules fulfill this expectation by enabling natural interfaces, realistic virtual environments, and advanced personalization. The desire for more sophisticated smart retail experiences, where customers can virtually try on products or receive personalized recommendations based on their physical presence, further fuels this demand. The industry has responded by developing specialized modules tailored to these diverse applications, offering varying levels of resolution, accuracy, and field of view. For instance, monocular structured light modules, favored for their cost-effectiveness and smaller footprint, are prevalent in smartphones and basic access control systems, experiencing an average annual growth rate of 12%. Conversely, binocular structured light modules, offering enhanced depth perception and robustness, are increasingly found in industrial automation, robotics, and advanced AR/VR applications, with a projected CAGR of 18% during the forecast period. The continuous refinement of projection patterns, speckle reduction techniques, and phase-shifting algorithms has significantly improved the signal-to-noise ratio and depth accuracy, allowing for reliable performance even in challenging lighting conditions. The integration of these modules into edge computing platforms also facilitates real-time processing and analysis, opening up new avenues for AI-driven applications.

Leading Regions, Countries, or Segments in 3D Structured Light Modules

The global 3D structured light modules market is experiencing significant growth, with distinct regional dominance and segment leadership shaping its trajectory. Among the various Applications, Smartphones currently stand out as the leading segment, driven by the widespread adoption of facial recognition technology for secure unlocking and payment authentication, alongside the burgeoning demand for augmented reality (AR) and virtual reality (VR) experiences. By 2025, it is estimated that over 70% of premium smartphones will incorporate 3D sensing capabilities, contributing a substantial portion of the market's revenue, projected to exceed $5,000 million annually. The continuous innovation by smartphone manufacturers, such as the integration of advanced depth sensing for improved photography and intuitive gesture controls, further solidifies this leadership.

Asia Pacific, particularly China, has emerged as the dominant region in the 3D structured light modules market. This dominance is fueled by several key factors, including the presence of major consumer electronics manufacturers like LG Innotek and Sunny Optical, robust government support for technological innovation, and a massive domestic market for smartphones and smart devices. China's extensive manufacturing infrastructure also allows for cost-effective production and rapid scaling of 3D structured light modules, reaching an estimated annual production capacity of over 500 million units.

Within the Types of 3D structured light modules, Monocular Structured Light Modules are currently leading the market due to their cost-effectiveness, compact size, and suitability for a wide range of consumer applications, especially in smartphones. Their widespread integration is a primary driver of adoption, with an estimated market penetration of 80% in the smartphone segment by 2025. However, Binocular Structured Light Modules are experiencing a higher growth rate, driven by their superior accuracy and robustness in demanding applications such as industrial automation, robotics, and advanced human ID comparison systems, where precise depth perception is paramount. The market for binocular modules is projected to grow at a CAGR of approximately 18% through 2033.

- Dominant Application: Smartphones

- Key Drivers: Facial recognition for security and payments, AR/VR experiences, advanced camera features, consumer demand for enhanced mobile functionality.

- Market Size Projection (2025): Over $5,000 million.

- Adoption Rate: Expected to exceed 70% in premium smartphones by 2025.

- Dominant Region: Asia Pacific (especially China)

- Key Drivers: Presence of leading manufacturers (LG Innotek, Sunny Optical), strong government investment in R&D and manufacturing, vast consumer market, cost-efficient production capabilities.

- Annual Production Capacity: Estimated over 500 million units.

- Dominant Type (Current): Monocular Structured Light Modules

- Key Drivers: Cost-effectiveness, compact form factor, suitability for mass-market consumer devices, high integration in smartphones.

- Market Penetration (Smartphones): Projected at 80% by 2025.

- High Growth Type: Binocular Structured Light Modules

- Key Drivers: Superior accuracy, robustness for industrial and security applications, advanced human ID comparison, growing demand in robotics and autonomous systems.

- Projected CAGR (2025-2033): Approximately 18%.

- Emerging Application Segments:

- Access Control and Attendance Terminal: Enhanced security and efficiency in workplaces.

- Financial Payment: Secure and contactless authentication solutions.

- Smart Retail: Personalized shopping experiences, inventory management.

- Human ID Comparison: Advanced biometric authentication and security.

3D Structured Light Modules Product Innovations

Product innovations in 3D structured light modules are rapidly enhancing their capabilities and expanding their application reach. Manufacturers like LG Innotek and Sunny Optical are at the forefront, developing modules with unprecedented resolution and accuracy, achieving depth measurement precision down to xx micrometers. These innovations include the integration of advanced micro-projector technologies capable of projecting finer and more complex dot patterns, leading to richer point cloud data. Furthermore, miniaturization efforts are yielding modules with footprints as small as 10x10x5 mm, enabling seamless integration into even the most constrained devices. Performance metrics are seeing significant improvements, with frame rates reaching up to 120 frames per second for real-time 3D scanning applications. Unique selling propositions now include AI-accelerated depth processing capabilities directly on the module, reducing reliance on external processors and enabling faster, more responsive applications in areas like smart retail and autonomous navigation.

Propelling Factors for 3D Structured Light Modules Growth

Several key growth drivers are propelling the 3D structured light modules market forward. Technological advancements, particularly in micro-optics, sensor technology, and AI-driven algorithms, are leading to more accurate, compact, and power-efficient modules. The increasing demand for enhanced security and authentication solutions across various sectors, from smartphones to enterprise access control, directly fuels adoption. Economic factors, such as the growing disposable income in emerging markets and the continuous drive for automation in industries, further contribute to market expansion. Regulatory bodies are also indirectly supporting growth by emphasizing the need for robust biometric identification and data security. For instance, the push for secure financial transactions and stricter access controls in sensitive areas necessitates advanced 3D sensing capabilities.

- Technological Advancements: Miniaturization, higher resolution, improved accuracy, AI integration.

- Enhanced Security Demands: Facial recognition, biometric authentication, secure access.

- Automation Trends: Industrial robotics, smart manufacturing, logistics.

- Consumer Electronics Evolution: AR/VR integration, enhanced user experiences.

- Emerging Market Growth: Increased adoption in developing economies.

Obstacles in the 3D Structured Light Modules Market

Despite the robust growth, the 3D structured light modules market faces several obstacles. The initial cost of implementation for certain advanced modules can be prohibitive for some small and medium-sized enterprises, especially when compared to simpler 2D sensing technologies. Supply chain disruptions, as experienced in recent years, can impact the availability and cost of essential components, leading to production delays and increased prices. Intense competitive pressures among a growing number of players, including companies like Jiaxing UPhoton Optoelectronics and Orbbec Inc., can lead to price wars and reduced profit margins. Furthermore, evolving data privacy regulations in various regions can create compliance challenges for manufacturers and end-users, requiring significant investment in secure data handling practices and potentially limiting the scope of certain applications. The need for specialized expertise in integrating and calibrating these systems can also act as a barrier to adoption for less technically sophisticated users.

- High Initial Investment Costs: Particularly for high-precision or specialized modules.

- Supply Chain Volatility: Disruptions in component availability and price fluctuations.

- Intense Competition: Leading to price pressures and margin erosion.

- Data Privacy Concerns & Regulations: Compliance requirements and consumer trust.

- Integration Complexity: Need for specialized expertise for implementation.

Future Opportunities in 3D Structured Light Modules

The future of 3D structured light modules is brimming with opportunities. The expansion of the Internet of Things (IoT) ecosystem presents a significant avenue, with modules being integrated into smart home devices, appliances, and wearable technology for enhanced functionality and user interaction. The automotive industry's drive towards autonomous driving and advanced driver-assistance systems (ADAS) will create substantial demand for high-performance 3D sensing. Furthermore, the metaverse and the continued evolution of AR/VR technologies will necessitate more sophisticated and immersive 3D scanning and interaction capabilities, driving innovation in this space. The healthcare sector offers immense potential for applications in medical imaging, robotic surgery assistance, and patient monitoring. Lastly, the ongoing development of edge AI processing will enable more localized and real-time 3D data analysis, unlocking new use cases in smart cities and intelligent surveillance.

- IoT Integration: Smart homes, wearables, connected appliances.

- Automotive Advancements: ADAS, autonomous driving, in-cabin sensing.

- Metaverse & AR/VR Expansion: Immersive experiences, virtual collaboration.

- Healthcare Innovations: Medical imaging, robotic surgery, diagnostics.

- Edge AI Processing: Real-time 3D analysis for smart cities and surveillance.

Major Players in the 3D Structured Light Modules Ecosystem

- LG Innotek

- Sunny Optical

- Jiaxing UPhoton Optoelectronics

- Orbbec Inc.

- CloudWalk Technology

- Guangzhou Tuyu Technology

- Rockchip Electronics

- Goertek Optical Technology

- Wuxi V-Sensor Technology

- Angstrong Tech.

- Shenzhen DeepCam

- Q Technology Group

- Beijing Huajie Aimi Technology

- Suzhou Abham

- Deptrum

Key Developments in 3D Structured Light Modules Industry

- 2023 Q3: LG Innotek announces the development of a new generation of ultra-compact 3D structured light modules with xx% improved accuracy for smartphone integration.

- 2023 Q4: Sunny Optical showcases a binocular structured light module with advanced anti-interference capabilities for industrial robotics applications.

- 2024 Q1: Orbbec Inc. launches a new SDK enabling developers to easily integrate their structured light modules into AR/VR platforms, projecting a potential market expansion of 15%.

- 2024 Q2: Jiaxing UPhoton Optoelectronics secures significant funding of $50 million to scale up production of their cost-effective monocular structured light modules targeting the mass consumer market.

- 2024 Q3: CloudWalk Technology announces a strategic partnership with a major financial institution to deploy 3D structured light-based payment terminals, aiming for a deployment of over 1 million units by 2026.

Strategic 3D Structured Light Modules Market Forecast

The strategic outlook for the 3D structured light modules market remains exceptionally bright, driven by a confluence of technological innovation and escalating global demand for advanced sensing capabilities. Future growth will be significantly fueled by the widespread adoption of 3D structured light in emerging applications beyond smartphones, including advanced automotive systems, immersive AR/VR environments, and sophisticated industrial automation. The continuous pursuit of higher accuracy, smaller form factors, and enhanced power efficiency by key players like LG Innotek and Sunny Optical will unlock new market segments and reinforce existing ones. Strategic investments in research and development, coupled with potential mergers and acquisitions aimed at consolidating market share and acquiring critical intellectual property, will shape the competitive landscape. The market is poised for robust expansion, with an estimated compound annual growth rate (CAGR) of 15-20% through 2033, presenting substantial opportunities for stakeholders across the value chain.

3D Structured Light Modules Segmentation

-

1. Application

- 1.1. Access Control and Attendance Terminal

- 1.2. Smartphones

- 1.3. Financial Payment

- 1.4. Human ID Comparison

- 1.5. Smart Retail

- 1.6. Others

-

2. Types

- 2.1. Monocular Structured Light Modules

- 2.2. Binocular Structured Light Modules

3D Structured Light Modules Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

3D Structured Light Modules REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Access Control and Attendance Terminal

- 5.1.2. Smartphones

- 5.1.3. Financial Payment

- 5.1.4. Human ID Comparison

- 5.1.5. Smart Retail

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Monocular Structured Light Modules

- 5.2.2. Binocular Structured Light Modules

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Access Control and Attendance Terminal

- 6.1.2. Smartphones

- 6.1.3. Financial Payment

- 6.1.4. Human ID Comparison

- 6.1.5. Smart Retail

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Monocular Structured Light Modules

- 6.2.2. Binocular Structured Light Modules

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Access Control and Attendance Terminal

- 7.1.2. Smartphones

- 7.1.3. Financial Payment

- 7.1.4. Human ID Comparison

- 7.1.5. Smart Retail

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Monocular Structured Light Modules

- 7.2.2. Binocular Structured Light Modules

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Access Control and Attendance Terminal

- 8.1.2. Smartphones

- 8.1.3. Financial Payment

- 8.1.4. Human ID Comparison

- 8.1.5. Smart Retail

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Monocular Structured Light Modules

- 8.2.2. Binocular Structured Light Modules

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Access Control and Attendance Terminal

- 9.1.2. Smartphones

- 9.1.3. Financial Payment

- 9.1.4. Human ID Comparison

- 9.1.5. Smart Retail

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Monocular Structured Light Modules

- 9.2.2. Binocular Structured Light Modules

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 3D Structured Light Modules Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Access Control and Attendance Terminal

- 10.1.2. Smartphones

- 10.1.3. Financial Payment

- 10.1.4. Human ID Comparison

- 10.1.5. Smart Retail

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Monocular Structured Light Modules

- 10.2.2. Binocular Structured Light Modules

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LG Innotek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sunny Optical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jiaxing UPhoton Optoelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Orbbec Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CloudWalk Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangzhou Tuyu Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockchip Electronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goertek Optical Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wuxi V-Sensor Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Angstrong Tech.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shenzhen DeepCam

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Q Technology Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Beijing Huajie Aimi Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Suzhou Abham

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Deptrum

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 LG Innotek

List of Figures

- Figure 1: Global 3D Structured Light Modules Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 3D Structured Light Modules Revenue (million), by Application 2024 & 2032

- Figure 3: North America 3D Structured Light Modules Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 3D Structured Light Modules Revenue (million), by Types 2024 & 2032

- Figure 5: North America 3D Structured Light Modules Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America 3D Structured Light Modules Revenue (million), by Country 2024 & 2032

- Figure 7: North America 3D Structured Light Modules Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 3D Structured Light Modules Revenue (million), by Application 2024 & 2032

- Figure 9: South America 3D Structured Light Modules Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 3D Structured Light Modules Revenue (million), by Types 2024 & 2032

- Figure 11: South America 3D Structured Light Modules Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America 3D Structured Light Modules Revenue (million), by Country 2024 & 2032

- Figure 13: South America 3D Structured Light Modules Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 3D Structured Light Modules Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 3D Structured Light Modules Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 3D Structured Light Modules Revenue (million), by Types 2024 & 2032

- Figure 17: Europe 3D Structured Light Modules Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe 3D Structured Light Modules Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 3D Structured Light Modules Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 3D Structured Light Modules Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 3D Structured Light Modules Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 3D Structured Light Modules Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa 3D Structured Light Modules Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa 3D Structured Light Modules Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 3D Structured Light Modules Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 3D Structured Light Modules Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 3D Structured Light Modules Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 3D Structured Light Modules Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific 3D Structured Light Modules Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific 3D Structured Light Modules Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 3D Structured Light Modules Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 3D Structured Light Modules Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global 3D Structured Light Modules Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global 3D Structured Light Modules Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global 3D Structured Light Modules Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global 3D Structured Light Modules Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global 3D Structured Light Modules Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 3D Structured Light Modules Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 3D Structured Light Modules Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global 3D Structured Light Modules Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 3D Structured Light Modules Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Structured Light Modules?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the 3D Structured Light Modules?

Key companies in the market include LG Innotek, Sunny Optical, Jiaxing UPhoton Optoelectronics, Orbbec Inc, CloudWalk Technology, Guangzhou Tuyu Technology, Rockchip Electronics, Goertek Optical Technology, Wuxi V-Sensor Technology, Angstrong Tech., Shenzhen DeepCam, Q Technology Group, Beijing Huajie Aimi Technology, Suzhou Abham, Deptrum.

3. What are the main segments of the 3D Structured Light Modules?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 303 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Structured Light Modules," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Structured Light Modules report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Structured Light Modules?

To stay informed about further developments, trends, and reports in the 3D Structured Light Modules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence