Key Insights

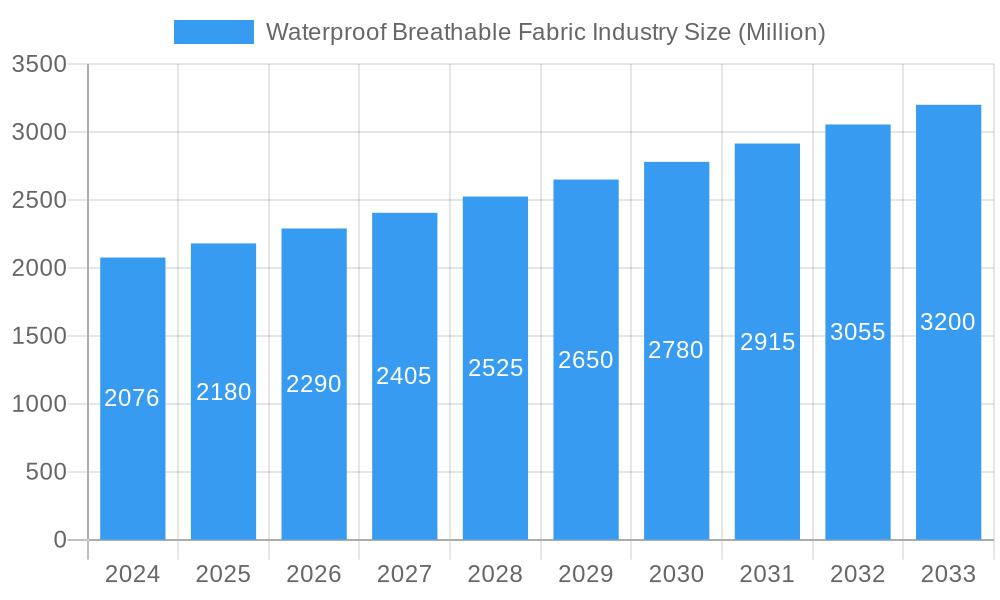

The global Waterproof Breathable Fabric market is poised for robust expansion, projected to reach a valuation of $2.18 billion and beyond, with a Compound Annual Growth Rate (CAGR) exceeding 5.00%. This significant growth is primarily fueled by the escalating demand for high-performance textiles across diverse applications. The sportswear and activewear sector stands out as a major consumer, driven by a global surge in health consciousness and outdoor recreational activities, necessitating apparel that offers both protection from the elements and comfort during strenuous exercise. Furthermore, the increasing need for durable and reliable protective and military gear, coupled with growing applications in general clothing and home textiles where enhanced durability and comfort are paramount, contributes substantially to market momentum. Innovations in raw material development, particularly advancements in Poly Tetra Fluoro Ethylene (PTFE) and Polyurethane technologies, are enabling manufacturers to create fabrics with superior waterproofing and breathability, thereby enhancing product performance and consumer appeal.

Waterproof Breathable Fabric Industry Market Size (In Billion)

Key market drivers include the growing consumer preference for sustainable and eco-friendly textiles, pushing innovation towards more environmentally conscious production methods and materials. The continuous development of advanced membrane technologies and specialized coating techniques are further enhancing the functional properties of waterproof breathable fabrics, making them indispensable in demanding environments. However, the market faces certain restraints, including the fluctuating costs of raw materials, which can impact manufacturing expenses and pricing strategies. Stringent environmental regulations related to chemical usage in textile production also present challenges, necessitating significant investment in compliance and greener manufacturing processes. Despite these hurdles, the overarching trend towards premium, performance-driven apparel and the expanding applications in niche sectors like specialized workwear and medical textiles suggest a promising and dynamic future for the waterproof breathable fabric industry.

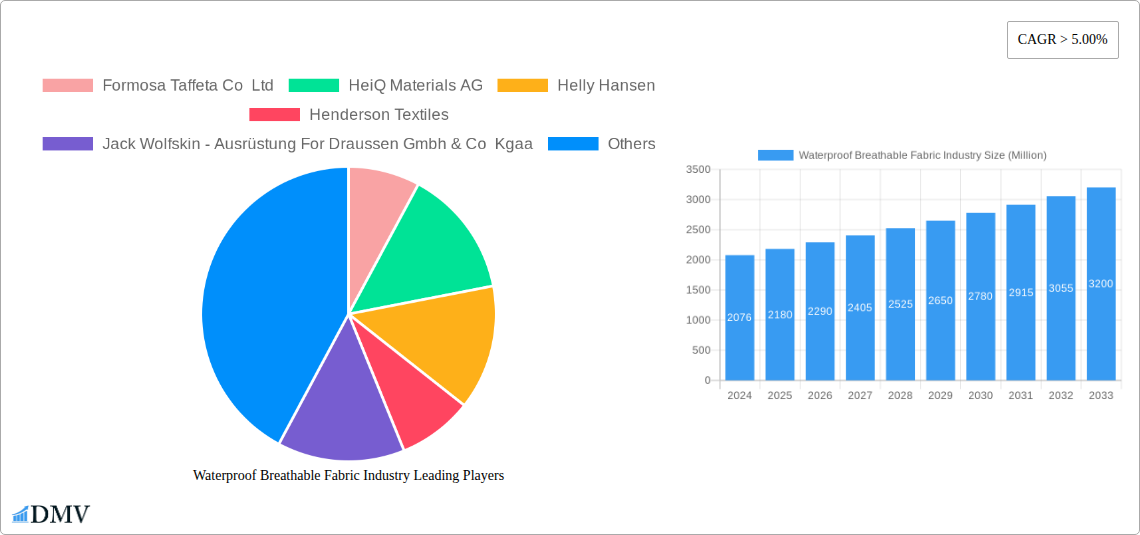

Waterproof Breathable Fabric Industry Company Market Share

Here is an SEO-optimized, insightful report description for the Waterproof Breathable Fabric Industry:

Waterproof Breathable Fabric Industry Market Composition & Trends

The Waterproof Breathable Fabric Industry is characterized by a dynamic market composition with significant innovation catalysts driving growth. Market concentration is influenced by the presence of established global players and the emergence of specialized technology providers. Innovation catalysts include advancements in polymer science, textile engineering, and sustainable manufacturing processes, all crucial for achieving the desired balance of impermeability and air permeability. The regulatory landscape primarily focuses on environmental compliance and material safety standards, impacting production methods and material sourcing. Substitute products such as conventional waterproof materials and specialized coatings are present but often lack the advanced breathability crucial for high-performance applications. End-user profiles span a wide spectrum, from elite athletes and outdoor enthusiasts to military personnel and everyday consumers seeking comfort and protection. M&A activities are strategically driven to acquire new technologies, expand market reach, and consolidate market share. The market share distribution is highly competitive, with key segments experiencing robust growth. M&A deal values are projected to reach approximately XXX Million USD, underscoring the industry's significant economic activity.

- Market Concentration Drivers: Technological superiority, brand reputation, and established distribution networks.

- Innovation Catalysts: Nanotechnology, advanced membrane manufacturing, and bio-based material research.

- Regulatory Focus: REACH compliance, bluesign® system certification, and PFC-free alternatives.

- Substitute Impact: Limited by performance trade-offs in breathability and durability.

- End-User Demographics: Athletes, outdoor adventurers, construction workers, healthcare professionals, and home furnishing consumers.

- M&A Objectives: Technology acquisition, market penetration, and product portfolio expansion.

Waterproof Breathable Fabric Industry Industry Evolution

The Waterproof Breathable Fabric Industry has undergone a significant industry evolution, driven by relentless technological advancements and a deepening understanding of consumer needs. Over the Study Period of 2019–2033, the market has witnessed a steady upward trajectory, with the Base Year of 2025 projecting a robust foundation for future expansion. The Forecast Period of 2025–2033 is anticipated to see an average annual growth rate of approximately 6.5%, translating to substantial market value increases. This growth is fueled by key technological advancements in membrane technology, such as the development of microporous and monolithic membranes, offering superior moisture vapor transmission rates (MVTR) and hydrostatic head ratings. The adoption of these technologies has been particularly pronounced in the sportswear and activewear segment, where performance and comfort are paramount. Shifting consumer demands are a critical factor, with a growing preference for sustainable, eco-friendly, and durable performance textiles. This has spurred research into recycled materials and PFC-free treatments. The Historical Period of 2019–2024 laid the groundwork for this evolution, with increasing awareness of the benefits of waterproof breathable fabrics in outdoor recreation and professional apparel. The market's ability to adapt to these evolving demands, coupled with continuous R&D efforts, ensures its sustained growth and relevance in numerous applications. The integration of smart textiles and embedded sensors within waterproof breathable fabrics also represents a nascent but promising area of evolution, catering to the demand for technologically enhanced apparel. Furthermore, the increasing emphasis on longevity and repairability of high-performance gear is also shaping product development and consumer perception.

Leading Regions, Countries, or Segments in Waterproof Breathable Fabric Industry

The Sportswear and Activewear segment stands out as the dominant force within the Waterproof Breathable Fabric Industry. This dominance is driven by several interconnected factors, including high consumer spending on athletic and outdoor gear, the critical need for performance-enhancing materials in these activities, and continuous innovation in design and functionality. The increasing global participation in outdoor sports, from hiking and running to skiing and mountaineering, directly fuels the demand for high-performance apparel incorporating these advanced textiles.

Dominant Segment: Sportswear and Activewear

- Key Drivers:

- Consumer Lifestyles: Growing global trend towards active and outdoor lifestyles.

- Performance Demands: Essential for comfort, protection, and thermoregulation during physical activities.

- Brand Innovation: Leading sportswear brands consistently invest in R&D for superior fabric technologies.

- Fashion Integration: Waterproof breathable fabrics are increasingly integrated into athleisure and lifestyle wear.

- Regional Popularity: Strong demand in North America, Europe, and Asia-Pacific due to developed outdoor recreation markets.

- In-depth Analysis: The sportswear segment benefits from a high perceived value of waterproof breathable fabrics. Consumers are willing to invest in premium garments that offer enhanced comfort, durability, and protection against the elements. This segment also sees the fastest adoption of new fabric technologies due to intense competition among brands and the pursuit of marginal performance gains. The widespread availability of diverse outdoor activities across various climates further solidifies its leading position.

- Key Drivers:

Key Raw Material Influence: Polyester remains a primary raw material due to its versatility, durability, and cost-effectiveness, forming the base for many waterproof breathable membranes and coatings. Poly Tetra Fluoro Ethylene (PTFE) is crucial for high-performance membranes, offering exceptional breathability and waterproofness, albeit at a higher cost.

- Investment Trends: Significant investment in advanced polyester and PTFE production technologies to meet growing demand and improve sustainability profiles.

- Regulatory Support: Focus on environmentally friendly raw material sourcing and production processes.

Dominant Textile Type: Membrane technology, particularly ePTFE and PU membranes, is pivotal. These membranes, when integrated into textiles, provide the essential waterproof and breathable properties.

- Technological Advancements: Ongoing development of thinner, more durable, and more breathable membrane structures.

- Adoption Metrics: Rapid adoption in high-performance apparel due to demonstrable improvements in user comfort and protection.

Emerging Applications: While sportswear dominates, the Protective and Military segment presents substantial growth potential due to the critical need for reliable protection in extreme environments.

- Market Drivers: Increased defense spending, demand for advanced soldier protection, and specialized industrial applications.

- Growth Projections: Expected to see a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period.

Waterproof Breathable Fabric Industry Product Innovations

Product innovations in the Waterproof Breathable Fabric Industry are continuously pushing the boundaries of performance and sustainability. Recent advancements include the development of ultra-thin, highly breathable membranes with superior microporous structures, enhanced durability through advanced coating techniques, and the integration of bio-based materials for a reduced environmental footprint. Innovations are also focusing on multi-functional fabrics that offer thermal regulation, enhanced stretch, and antimicrobial properties alongside waterproofing and breathability. For example, the use of recycled PET in fabric production and the development of biodegradable membranes are gaining traction, addressing growing consumer demand for eco-conscious products. These advancements are not just about improving existing capabilities but also about creating entirely new application possibilities, such as in medical textiles and high-performance workwear.

Propelling Factors for Waterproof Breathable Fabric Industry Growth

The Waterproof Breathable Fabric Industry is propelled by several key factors. Growing global participation in outdoor recreation and sports is a primary driver, increasing demand for high-performance apparel. Technological advancements in material science, particularly in membrane and coating technologies, enable the creation of fabrics with enhanced breathability, durability, and waterproofing. Economic factors, such as rising disposable incomes in emerging economies, allow for greater consumer spending on premium outdoor and activewear. Furthermore, increasing awareness of the benefits of staying dry and comfortable during physical activities, coupled with a growing emphasis on sustainability and ethical sourcing, are also significant growth catalysts.

- Technological Advancements: Development of thinner, more breathable, and eco-friendly membranes.

- Consumer Trends: Rising interest in outdoor activities and a demand for performance and sustainable apparel.

- Economic Growth: Increased disposable income leading to higher spending on premium activewear.

- Regulatory Support: Initiatives promoting sustainable manufacturing and material innovation.

Obstacles in the Waterproof Breathable Fabric Industry Market

Despite its robust growth, the Waterproof Breathable Fabric Industry faces several obstacles. High production costs associated with advanced manufacturing processes and specialized raw materials can limit affordability for some consumer segments. The complexity of supply chains, especially for specialized chemicals and manufacturing equipment, can lead to disruptions and price volatility. Intense competition among established players and new entrants can also put pressure on profit margins. Furthermore, environmental concerns surrounding the use of certain chemicals, like PFCs, necessitate ongoing research and development of sustainable alternatives, which can be costly and time-consuming. Balancing performance with cost and environmental impact remains a continuous challenge.

- Cost of Production: High expenses for advanced materials and manufacturing.

- Supply Chain Complexity: Vulnerability to disruptions and price fluctuations.

- Environmental Regulations: Pressure to adopt sustainable practices and reduce chemical usage.

- Market Saturation: Intense competition can affect pricing power.

Future Opportunities in Waterproof Breathable Fabric Industry

The future of the Waterproof Breathable Fabric Industry is ripe with opportunities. The growing athleisure trend presents a significant opportunity to expand into everyday fashion wear, not just high-performance gear. Emerging markets in Asia and South America, with their rapidly growing middle class and increasing interest in outdoor activities, offer substantial untapped potential. Advancements in smart textiles, integrating electronics for health monitoring or communication within waterproof breathable garments, represent a cutting-edge frontier. Furthermore, the increasing demand for sustainable and circular economy solutions, such as recycled fabrics and biodegradable alternatives, provides a strong avenue for innovation and market differentiation.

- Market Expansion: Tapping into emerging economies and the athleisure market.

- Technological Integration: Development of smart textiles and bio-based materials.

- Sustainability Focus: Capitalizing on the demand for eco-friendly and recycled fabrics.

- New Applications: Exploring potential in medical, industrial, and automotive sectors.

Major Players in the Waterproof Breathable Fabric Industry Ecosystem

- Formosa Taffeta Co Ltd

- HeiQ Materials AG

- Helly Hansen

- Henderson Textiles

- Jack Wolfskin - Ausrüstung For Draussen Gmbh & Co Kgaa

- Marmot Mountain LLC

- Pertex

- Polartec

- Schoeller Switzerland

- Stotz & Co AG

- Sympatex

- Teijin Limited

- The North Face A VF Company

- Toray Industries Inc

- W L Gore & Associates Inc

Key Developments in Waterproof Breathable Fabric Industry Industry

- February 2022: Moncler Grenoble and Polartec collaborated on a new collection. Moncler launched its apex award-winning Grenoble Day-namic collection, a new range of activewear. This line makes use of cutting-edge Polartec technology, notably Polartec Neoshell.

- February 2022: Ornot, the leading technical cycling clothes and accessories provider, collaborated with Polartec to launch the all-new Trail Magic Jacket. A combination of Polartec NeoShell and detachable Polartec Alpha Direct insulation is used in this Trail Magic Jacket.

Strategic Waterproof Breathable Fabric Industry Market Forecast

The strategic forecast for the Waterproof Breathable Fabric Industry indicates sustained and robust growth through 2033. Key growth catalysts include the persistent rise in global demand for outdoor and athletic apparel, driven by evolving consumer lifestyles and a greater emphasis on health and wellness. Technological innovation in membrane and fabric construction will continue to unlock new performance benchmarks and application possibilities, further stimulating market expansion. The increasing focus on sustainability and the development of eco-friendly alternatives will also play a pivotal role, appealing to environmentally conscious consumers and driving new product development. Emerging markets present significant untapped potential, poised to contribute substantially to overall market value. Strategic collaborations between material manufacturers and apparel brands will remain crucial for product innovation and market penetration, ensuring the industry's continued dynamism and profitability.

Waterproof Breathable Fabric Industry Segmentation

-

1. Raw Material

- 1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 1.2. Polyester

- 1.3. Polyurethane

- 1.4. Other Raw Materials

-

2. Textile

- 2.1. Densely Woven

- 2.2. Membrane

- 2.3. Coated

-

3. Application

- 3.1. Sportswear and Activewear

- 3.2. Protective and Military

- 3.3. General Clothing and Home Textile

- 3.4. Other Applications

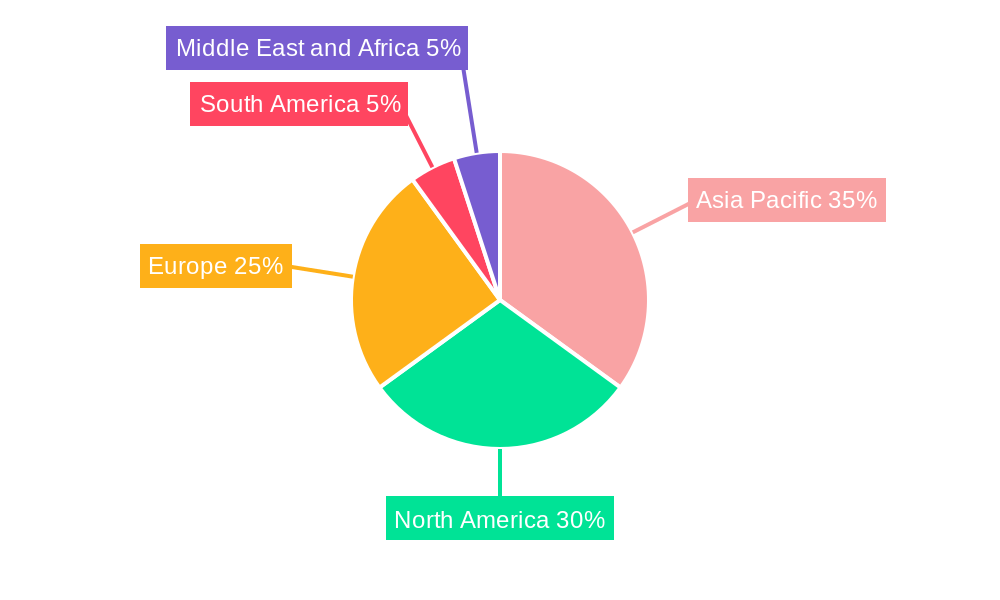

Waterproof Breathable Fabric Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Waterproof Breathable Fabric Industry Regional Market Share

Geographic Coverage of Waterproof Breathable Fabric Industry

Waterproof Breathable Fabric Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Waterproof Breathable Textiles as Protective Wear; Growing Demand from Sportswear and Activewear Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Waterproof Breathable Textiles as Protective Wear; Growing Demand from Sportswear and Activewear Industry

- 3.4. Market Trends

- 3.4.1. Sportswear and Activewear Segment Expected to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 5.1.2. Polyester

- 5.1.3. Polyurethane

- 5.1.4. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Textile

- 5.2.1. Densely Woven

- 5.2.2. Membrane

- 5.2.3. Coated

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Sportswear and Activewear

- 5.3.2. Protective and Military

- 5.3.3. General Clothing and Home Textile

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 6.1.2. Polyester

- 6.1.3. Polyurethane

- 6.1.4. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Textile

- 6.2.1. Densely Woven

- 6.2.2. Membrane

- 6.2.3. Coated

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Sportswear and Activewear

- 6.3.2. Protective and Military

- 6.3.3. General Clothing and Home Textile

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 7.1.2. Polyester

- 7.1.3. Polyurethane

- 7.1.4. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Textile

- 7.2.1. Densely Woven

- 7.2.2. Membrane

- 7.2.3. Coated

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Sportswear and Activewear

- 7.3.2. Protective and Military

- 7.3.3. General Clothing and Home Textile

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 8.1.2. Polyester

- 8.1.3. Polyurethane

- 8.1.4. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Textile

- 8.2.1. Densely Woven

- 8.2.2. Membrane

- 8.2.3. Coated

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Sportswear and Activewear

- 8.3.2. Protective and Military

- 8.3.3. General Clothing and Home Textile

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 9.1.2. Polyester

- 9.1.3. Polyurethane

- 9.1.4. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Textile

- 9.2.1. Densely Woven

- 9.2.2. Membrane

- 9.2.3. Coated

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Sportswear and Activewear

- 9.3.2. Protective and Military

- 9.3.3. General Clothing and Home Textile

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Waterproof Breathable Fabric Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Poly Tetra Fluoro Ethylene (PTFE)

- 10.1.2. Polyester

- 10.1.3. Polyurethane

- 10.1.4. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Textile

- 10.2.1. Densely Woven

- 10.2.2. Membrane

- 10.2.3. Coated

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Sportswear and Activewear

- 10.3.2. Protective and Military

- 10.3.3. General Clothing and Home Textile

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Formosa Taffeta Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HeiQ Materials AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Helly Hansen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henderson Textiles

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jack Wolfskin - Ausrüstung For Draussen Gmbh & Co Kgaa

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marmot Mountain LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pertex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Polartec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schoeller Switzerland

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stotz & Co AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sympatex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Teijin Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The North Face A VF Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Toray Industries Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 W L Gore & Associates Inc *List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Formosa Taffeta Co Ltd

List of Figures

- Figure 1: Global Waterproof Breathable Fabric Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Waterproof Breathable Fabric Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Waterproof Breathable Fabric Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Waterproof Breathable Fabric Industry Volume (Billion), by Raw Material 2025 & 2033

- Figure 5: Asia Pacific Waterproof Breathable Fabric Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: Asia Pacific Waterproof Breathable Fabric Industry Volume Share (%), by Raw Material 2025 & 2033

- Figure 7: Asia Pacific Waterproof Breathable Fabric Industry Revenue (Million), by Textile 2025 & 2033

- Figure 8: Asia Pacific Waterproof Breathable Fabric Industry Volume (Billion), by Textile 2025 & 2033

- Figure 9: Asia Pacific Waterproof Breathable Fabric Industry Revenue Share (%), by Textile 2025 & 2033

- Figure 10: Asia Pacific Waterproof Breathable Fabric Industry Volume Share (%), by Textile 2025 & 2033

- Figure 11: Asia Pacific Waterproof Breathable Fabric Industry Revenue (Million), by Application 2025 & 2033

- Figure 12: Asia Pacific Waterproof Breathable Fabric Industry Volume (Billion), by Application 2025 & 2033

- Figure 13: Asia Pacific Waterproof Breathable Fabric Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Asia Pacific Waterproof Breathable Fabric Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: Asia Pacific Waterproof Breathable Fabric Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Asia Pacific Waterproof Breathable Fabric Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: Asia Pacific Waterproof Breathable Fabric Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Waterproof Breathable Fabric Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Waterproof Breathable Fabric Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 20: North America Waterproof Breathable Fabric Industry Volume (Billion), by Raw Material 2025 & 2033

- Figure 21: North America Waterproof Breathable Fabric Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: North America Waterproof Breathable Fabric Industry Volume Share (%), by Raw Material 2025 & 2033

- Figure 23: North America Waterproof Breathable Fabric Industry Revenue (Million), by Textile 2025 & 2033

- Figure 24: North America Waterproof Breathable Fabric Industry Volume (Billion), by Textile 2025 & 2033

- Figure 25: North America Waterproof Breathable Fabric Industry Revenue Share (%), by Textile 2025 & 2033

- Figure 26: North America Waterproof Breathable Fabric Industry Volume Share (%), by Textile 2025 & 2033

- Figure 27: North America Waterproof Breathable Fabric Industry Revenue (Million), by Application 2025 & 2033

- Figure 28: North America Waterproof Breathable Fabric Industry Volume (Billion), by Application 2025 & 2033

- Figure 29: North America Waterproof Breathable Fabric Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: North America Waterproof Breathable Fabric Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: North America Waterproof Breathable Fabric Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: North America Waterproof Breathable Fabric Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: North America Waterproof Breathable Fabric Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Waterproof Breathable Fabric Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Waterproof Breathable Fabric Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 36: Europe Waterproof Breathable Fabric Industry Volume (Billion), by Raw Material 2025 & 2033

- Figure 37: Europe Waterproof Breathable Fabric Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 38: Europe Waterproof Breathable Fabric Industry Volume Share (%), by Raw Material 2025 & 2033

- Figure 39: Europe Waterproof Breathable Fabric Industry Revenue (Million), by Textile 2025 & 2033

- Figure 40: Europe Waterproof Breathable Fabric Industry Volume (Billion), by Textile 2025 & 2033

- Figure 41: Europe Waterproof Breathable Fabric Industry Revenue Share (%), by Textile 2025 & 2033

- Figure 42: Europe Waterproof Breathable Fabric Industry Volume Share (%), by Textile 2025 & 2033

- Figure 43: Europe Waterproof Breathable Fabric Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: Europe Waterproof Breathable Fabric Industry Volume (Billion), by Application 2025 & 2033

- Figure 45: Europe Waterproof Breathable Fabric Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Europe Waterproof Breathable Fabric Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Europe Waterproof Breathable Fabric Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Waterproof Breathable Fabric Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe Waterproof Breathable Fabric Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Waterproof Breathable Fabric Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Waterproof Breathable Fabric Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 52: South America Waterproof Breathable Fabric Industry Volume (Billion), by Raw Material 2025 & 2033

- Figure 53: South America Waterproof Breathable Fabric Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 54: South America Waterproof Breathable Fabric Industry Volume Share (%), by Raw Material 2025 & 2033

- Figure 55: South America Waterproof Breathable Fabric Industry Revenue (Million), by Textile 2025 & 2033

- Figure 56: South America Waterproof Breathable Fabric Industry Volume (Billion), by Textile 2025 & 2033

- Figure 57: South America Waterproof Breathable Fabric Industry Revenue Share (%), by Textile 2025 & 2033

- Figure 58: South America Waterproof Breathable Fabric Industry Volume Share (%), by Textile 2025 & 2033

- Figure 59: South America Waterproof Breathable Fabric Industry Revenue (Million), by Application 2025 & 2033

- Figure 60: South America Waterproof Breathable Fabric Industry Volume (Billion), by Application 2025 & 2033

- Figure 61: South America Waterproof Breathable Fabric Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: South America Waterproof Breathable Fabric Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: South America Waterproof Breathable Fabric Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Waterproof Breathable Fabric Industry Volume (Billion), by Country 2025 & 2033

- Figure 65: South America Waterproof Breathable Fabric Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Waterproof Breathable Fabric Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Waterproof Breathable Fabric Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 68: Middle East and Africa Waterproof Breathable Fabric Industry Volume (Billion), by Raw Material 2025 & 2033

- Figure 69: Middle East and Africa Waterproof Breathable Fabric Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 70: Middle East and Africa Waterproof Breathable Fabric Industry Volume Share (%), by Raw Material 2025 & 2033

- Figure 71: Middle East and Africa Waterproof Breathable Fabric Industry Revenue (Million), by Textile 2025 & 2033

- Figure 72: Middle East and Africa Waterproof Breathable Fabric Industry Volume (Billion), by Textile 2025 & 2033

- Figure 73: Middle East and Africa Waterproof Breathable Fabric Industry Revenue Share (%), by Textile 2025 & 2033

- Figure 74: Middle East and Africa Waterproof Breathable Fabric Industry Volume Share (%), by Textile 2025 & 2033

- Figure 75: Middle East and Africa Waterproof Breathable Fabric Industry Revenue (Million), by Application 2025 & 2033

- Figure 76: Middle East and Africa Waterproof Breathable Fabric Industry Volume (Billion), by Application 2025 & 2033

- Figure 77: Middle East and Africa Waterproof Breathable Fabric Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: Middle East and Africa Waterproof Breathable Fabric Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: Middle East and Africa Waterproof Breathable Fabric Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Waterproof Breathable Fabric Industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Waterproof Breathable Fabric Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Waterproof Breathable Fabric Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 4: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 5: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 10: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 11: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 12: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 13: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 28: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 29: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 30: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 31: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 33: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 35: United States Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United States Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Canada Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Canada Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Mexico Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Mexico Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 42: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 43: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 44: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 45: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 47: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Germany Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: France Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Italy Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Italy Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 60: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 61: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 62: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 63: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 64: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 65: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 67: Brazil Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Brazil Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Argentina Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Argentina Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 74: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 75: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Textile 2020 & 2033

- Table 76: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Textile 2020 & 2033

- Table 77: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 78: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 79: Global Waterproof Breathable Fabric Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Waterproof Breathable Fabric Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 81: Saudi Arabia Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Saudi Arabia Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: South Africa Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: South Africa Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Waterproof Breathable Fabric Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Waterproof Breathable Fabric Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waterproof Breathable Fabric Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Waterproof Breathable Fabric Industry?

Key companies in the market include Formosa Taffeta Co Ltd, HeiQ Materials AG, Helly Hansen, Henderson Textiles, Jack Wolfskin - Ausrüstung For Draussen Gmbh & Co Kgaa, Marmot Mountain LLC, Pertex, Polartec, Schoeller Switzerland, Stotz & Co AG, Sympatex, Teijin Limited, The North Face A VF Company, Toray Industries Inc, W L Gore & Associates Inc *List Not Exhaustive.

3. What are the main segments of the Waterproof Breathable Fabric Industry?

The market segments include Raw Material, Textile, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Waterproof Breathable Textiles as Protective Wear; Growing Demand from Sportswear and Activewear Industry.

6. What are the notable trends driving market growth?

Sportswear and Activewear Segment Expected to Witness High Growth.

7. Are there any restraints impacting market growth?

Increasing Demand for Waterproof Breathable Textiles as Protective Wear; Growing Demand from Sportswear and Activewear Industry.

8. Can you provide examples of recent developments in the market?

February 2022: Moncler Grenoble and Polartec collaborated on a new collection. Moncler launched its apex award-winning Grenoble Day-namic collection, a new range of activewear. This line makes use of cutting-edge Polartec technology, notably Polartec Neoshell.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waterproof Breathable Fabric Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waterproof Breathable Fabric Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waterproof Breathable Fabric Industry?

To stay informed about further developments, trends, and reports in the Waterproof Breathable Fabric Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence