Key Insights

The South America Commercial Vehicles Lubricants Market is projected for robust growth, expected to reach 3195.63 million by 2024, driven by a CAGR of 10.2. This expansion is fueled by escalating commercial vehicle demand across the region, spurred by e-commerce logistics, infrastructure development, and efficient goods transportation needs. Economic growth in nations like Brazil and Colombia will increase fleet sizes, boosting lubricant consumption. Increasingly stringent emission standards and a focus on vehicle longevity are prompting fleet operators to adopt advanced, high-quality lubricants for enhanced protection, fuel efficiency, and extended drain intervals. The rising preference for synthetic and semi-synthetic lubricants, offering superior performance in diverse South American climates, is a key growth catalyst.

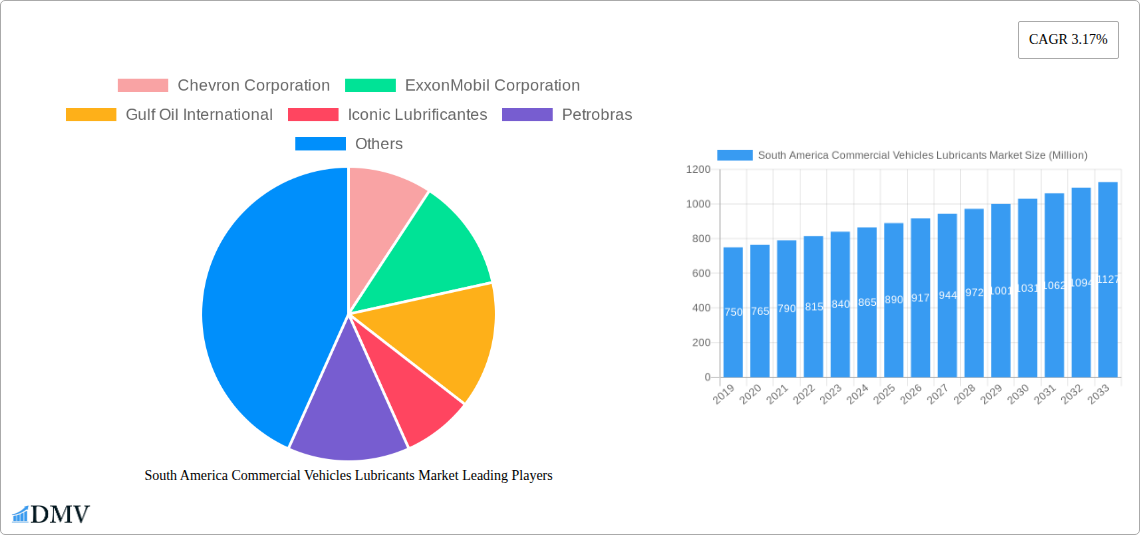

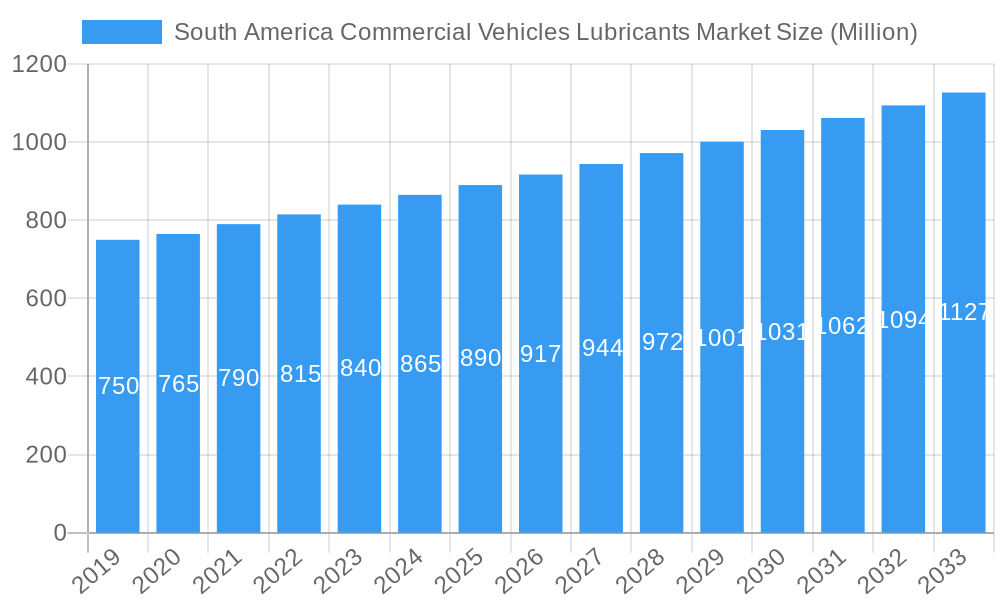

South America Commercial Vehicles Lubricants Market Market Size (In Billion)

Market challenges include volatility in crude oil prices, impacting manufacturing costs and pricing strategies. The unorganized sector, offering lower-priced alternatives, presents competition. However, growing operator awareness of premium lubricant benefits, such as reduced maintenance and improved efficiency, is mitigating this restraint. Key product segments include Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, with Engine Oils leading market share. Major players like Chevron, ExxonMobil, Shell, and Petrobras are innovating to meet regional commercial vehicle lubricant demands.

South America Commercial Vehicles Lubricants Market Company Market Share

This comprehensive report provides a strategic overview of the South America commercial vehicles lubricants market, detailing market dynamics, industry trends, regional analysis, product innovations, growth drivers, challenges, and future opportunities. The study covers the period from 2019 to 2033, with a base year of 2024 and a forecast period from 2024 to 2033, offering critical insights for stakeholders.

South America Commercial Vehicles Lubricants Market Market Composition & Trends

The South America commercial vehicles lubricants market is characterized by a moderate to high degree of concentration, with a few major global players and several regional entities vying for market share. Innovation catalysts include the increasing demand for fuel-efficient lubricants, extended drain intervals, and specialized formulations for diverse operating conditions prevalent across South America. The regulatory landscape is evolving, with a growing emphasis on environmental compliance and the adoption of advanced lubricant technologies to reduce emissions. Substitute products, primarily lower-grade mineral oils, pose a challenge but are increasingly being displaced by high-performance synthetic and semi-synthetic options. End-user profiles are diverse, ranging from large fleet operators and logistics companies to individual truck owners and construction firms, each with distinct lubricant requirements. Mergers and acquisitions (M&A) activities, though sporadic, play a crucial role in market consolidation and expansion. For instance, a hypothetical M&A deal in the region could be valued at over $XXX Million, significantly altering market share distribution.

- Market Share Distribution: Leading players command a significant portion of the market, with a competitive landscape driven by product quality and distribution networks.

- M&A Deal Values: Historically, M&A activities have been pivotal in consolidating market presence, with potential future deals impacting regional control.

- Innovation Drivers: Focus on eco-friendly formulations and enhanced performance to meet stringent emission standards and operational efficiency demands.

South America Commercial Vehicles Lubricants Market Industry Evolution

The South America commercial vehicles lubricants market has witnessed a significant evolutionary trajectory driven by robust economic activity and a burgeoning logistics sector. The historical period (2019-2024) saw steady growth, fueled by increasing commercial vehicle parc and a rising demand for reliable lubrication solutions. Technological advancements have been pivotal, with a noticeable shift towards synthetic and semi-synthetic lubricants offering superior performance, fuel economy, and extended drain intervals. This evolution aligns with global trends and is further accelerated by the introduction of advanced engine technologies in commercial vehicles that necessitate higher-spec lubricants. Consumer demand is increasingly leaning towards products that offer enhanced protection, reduced wear and tear, and lower maintenance costs. The base year (2025) stands as a crucial benchmark, reflecting the market's resilience and adaptability. The forecast period (2025-2033) is anticipated to experience a compounded annual growth rate (CAGR) of approximately XX%, projecting the market to reach an estimated value of $XXX Million by 2033. This growth is underpinned by ongoing infrastructure development, increasing inter-country trade, and government initiatives promoting industrial growth, all of which contribute to a higher demand for commercial vehicles and, consequently, their essential lubrication needs.

- Growth Trajectories: Consistent upward trend driven by economic expansion and increasing commercial vehicle sales.

- Technological Advancements: Transition from mineral-based to synthetic and semi-synthetic lubricants for enhanced performance and environmental benefits.

- Shifting Consumer Demands: Preference for lubricants offering improved fuel efficiency, extended service life, and superior engine protection.

- Market Size Projection: Expected to reach $XXX Million by 2033, with a CAGR of XX% during the forecast period.

Leading Regions, Countries, or Segments in South America Commercial Vehicles Lubricants Market

Brazil stands out as the dominant region within the South America commercial vehicles lubricants market, driven by its substantial economy, extensive road network, and the presence of a large commercial fleet. The Engine Oils segment within the Product Type category is particularly significant, accounting for a substantial market share due to the fundamental lubrication needs of all internal combustion engines in commercial vehicles. Investment trends in Brazil's logistics and transportation infrastructure, coupled with regulatory support for vehicle modernization and emission control, further bolster the demand for high-quality engine oils.

- Dominant Region: Brazil's vast geographical expanse and its position as an economic powerhouse in South America makes it a primary market for commercial vehicle lubricants.

- Key Drivers:

- Significant investment in logistics and transportation infrastructure.

- Strong presence of major commercial vehicle manufacturers and fleet operators.

- Government incentives for fleet modernization and emission reduction.

- High volume of freight movement across the country.

- Key Drivers:

- Leading Segment: Engine Oils dominate the product type landscape, reflecting the core requirement of every commercial vehicle.

- Dominance Factors:

- Essential for all commercial vehicle engines, from light-duty trucks to heavy-duty haulers.

- Continuous innovation in engine technology necessitates advanced engine oil formulations for optimal performance and protection.

- Strict emission standards drive the demand for high-performance, fuel-efficient engine oils.

- The vast number of commercial vehicles operating daily requires regular engine oil replenishment.

- Dominance Factors:

South America Commercial Vehicles Lubricants Market Product Innovations

Product innovations in the South America commercial vehicles lubricants market are primarily focused on enhancing performance, extending service life, and meeting stringent environmental regulations. Key advancements include the development of ultra-low viscosity synthetic engine oils that significantly improve fuel efficiency and reduce CO2 emissions, catering to the growing sustainability concerns among fleet operators. Furthermore, specialized hydraulic fluids with improved thermal stability and wear protection are emerging for heavy-duty construction and agricultural equipment. The introduction of biodegradable and bio-based lubricants is also gaining traction, addressing the demand for eco-friendly solutions. These innovations offer unique selling propositions by providing superior protection against extreme temperatures, extending component life, and reducing overall operating costs for commercial fleets.

Propelling Factors for South America Commercial Vehicles Lubricants Market Growth

Several key factors are propelling the growth of the South America commercial vehicles lubricants market. Economic expansion and increasing trade activities across the continent are driving demand for commercial transportation, thereby increasing the number of vehicles on the road. Technological advancements in commercial vehicle engines necessitate the use of higher-performance lubricants, leading to a shift towards premium synthetic and semi-synthetic formulations. Government initiatives focused on infrastructure development and road network expansion further stimulate the demand for logistics and freight services. Moreover, a growing awareness among fleet operators regarding the benefits of using advanced lubricants, such as improved fuel efficiency, reduced maintenance costs, and extended engine life, is a significant growth catalyst.

- Economic Growth & Trade: Rising inter-country commerce fuels the need for efficient transportation.

- Technological Advancements: Evolving engine designs demand superior lubricant performance.

- Infrastructure Development: Expansion of roads and logistics hubs increases commercial vehicle utilization.

- Operator Awareness: Fleet managers increasingly recognize the ROI of high-quality lubricants.

Obstacles in the South America Commercial Vehicles Lubricants Market Market

Despite the positive growth trajectory, the South America commercial vehicles lubricants market faces several obstacles. The presence of a significant informal sector and the availability of counterfeit lubricants pose a threat to genuine product sales and brand reputation. Fluctuations in crude oil prices directly impact the cost of base oils, leading to price volatility for finished lubricants. Regulatory complexities and varying compliance standards across different South American countries can hinder market entry and operational efficiency for global players. Additionally, supply chain disruptions, including logistical challenges and port congestion, can affect the timely availability of raw materials and finished products.

- Counterfeit Products: The proliferation of substandard lubricants erodes market integrity.

- Price Volatility: Fluctuations in crude oil prices directly impact lubricant costs.

- Regulatory Fragmentation: Diverse national regulations create market entry barriers.

- Supply Chain Issues: Logistical complexities can lead to product availability challenges.

Future Opportunities in South America Commercial Vehicles Lubricants Market

The South America commercial vehicles lubricants market presents several promising future opportunities. The increasing adoption of electric and hybrid commercial vehicles is creating a nascent market for specialized EV fluids and greases, offering a new avenue for innovation and growth. The growing emphasis on sustainability and environmental regulations is driving demand for biodegradable and low-emission lubricants. Furthermore, expanding into underserved regions and developing tailored product portfolios for specific local operating conditions can unlock significant market potential. Digitalization and the adoption of lubricant monitoring technologies offer opportunities for value-added services and improved customer engagement.

- EV Fluids & Greases: The emergence of electric and hybrid commercial vehicles opens new product segments.

- Sustainability Focus: Growing demand for eco-friendly and biodegradable lubricant solutions.

- Market Penetration: Untapped potential in emerging economies and remote regions.

- Digitalization: Opportunities in advanced monitoring and predictive maintenance services.

Major Players in the South America Commercial Vehicles Lubricants Market Ecosystem

- Chevron Corporation

- ExxonMobil Corporation

- Gulf Oil International

- Iconic Lubrificantes

- Petrobras

- Petronas Lubricants International

- Royal Dutch Shell Plc

- Terpel

- TotalEnergies

- YP

Key Developments in South America Commercial Vehicles Lubricants Market Industry

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions. This strategic restructuring aims to enhance operational efficiency and focus on key business areas, potentially influencing product development and market strategies in South America.

- October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network. This expansion of Texaco's reach through Ipiranga's extensive station network strengthens its market presence and accessibility for commercial vehicle operators in Brazil.

- July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers. This milestone signifies Gulf Oil's growing footprint and commitment to expanding its distribution network, providing greater access to its lubricant offerings for Argentine commercial vehicle users.

Strategic South America Commercial Vehicles Lubricants Market Market Forecast

The South America Commercial Vehicles Lubricants Market is poised for sustained growth, driven by a confluence of robust economic activity, evolving technological landscapes, and increasing environmental consciousness. The forecast period (2025–2033) is expected to witness a significant upward trajectory, with market expansion fueled by the continuous demand for efficient and durable commercial transportation solutions. Key growth catalysts include ongoing investments in infrastructure, the rise of e-commerce necessitating efficient logistics, and the gradual adoption of advanced vehicle technologies that require high-performance lubricants. The market will increasingly benefit from the shift towards sustainable lubricant formulations and the potential emergence of specialized fluids for the burgeoning electric and hybrid commercial vehicle segment, solidifying its promising future.

South America Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

South America Commercial Vehicles Lubricants Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of South America Commercial Vehicles Lubricants Market

South America Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Oil International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iconic Lubrificantes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petronas Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Terpel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: South America Commercial Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: Brazil South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Argentina South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Chile South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Colombia South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Peru South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Venezuela South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Ecuador South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Bolivia South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Paraguay South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Uruguay South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the South America Commercial Vehicles Lubricants Market?

Key companies in the market include Chevron Corporation, ExxonMobil Corporation, Gulf Oil International, Iconic Lubrificantes, Petrobras, Petronas Lubricants International, Royal Dutch Shell Plc, Terpel, TotalEnergies, YP.

3. What are the main segments of the South America Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3195.63 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network.July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the South America Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence