Key Insights

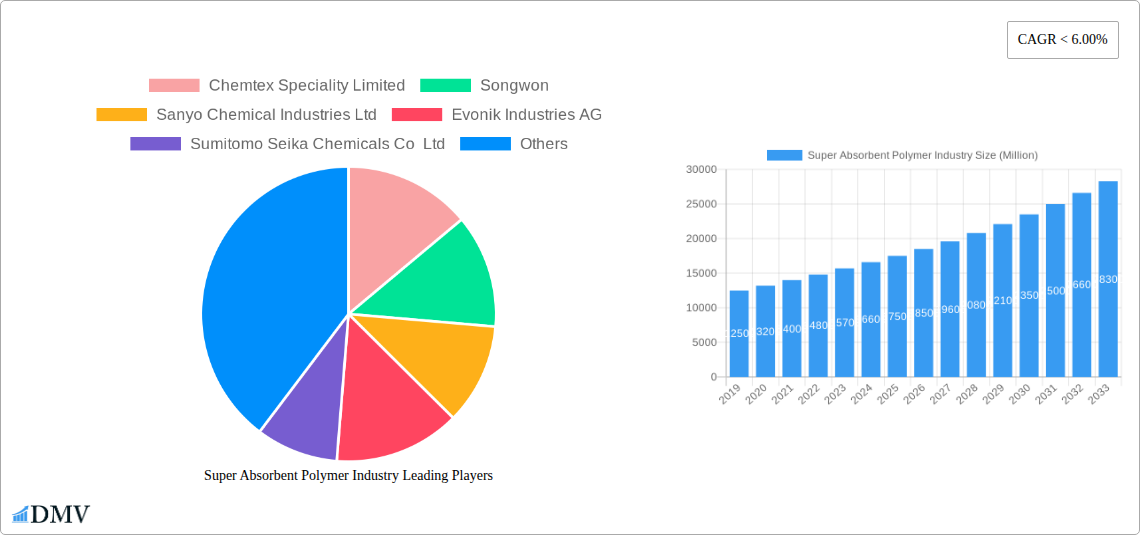

The Super Absorbent Polymer (SAP) market is exhibiting significant growth, propelled by escalating demand across multiple applications. With a projected market size of 9.7 billion in the base year 2025 and a compound annual growth rate (CAGR) of 5.4% over the study period, the industry is poised for substantial expansion. Key drivers include the expanding baby diaper and adult incontinence product markets, influenced by demographic shifts and rising disposable incomes in emerging economies. The agricultural sector's increasing adoption of SAP for soil water retention to combat drought and enhance crop yields represents a significant emerging trend. Industrial applications, such as in cable manufacturing and wastewater treatment, also contribute to the market's upward trajectory.

Super Absorbent Polymer Industry Market Size (In Billion)

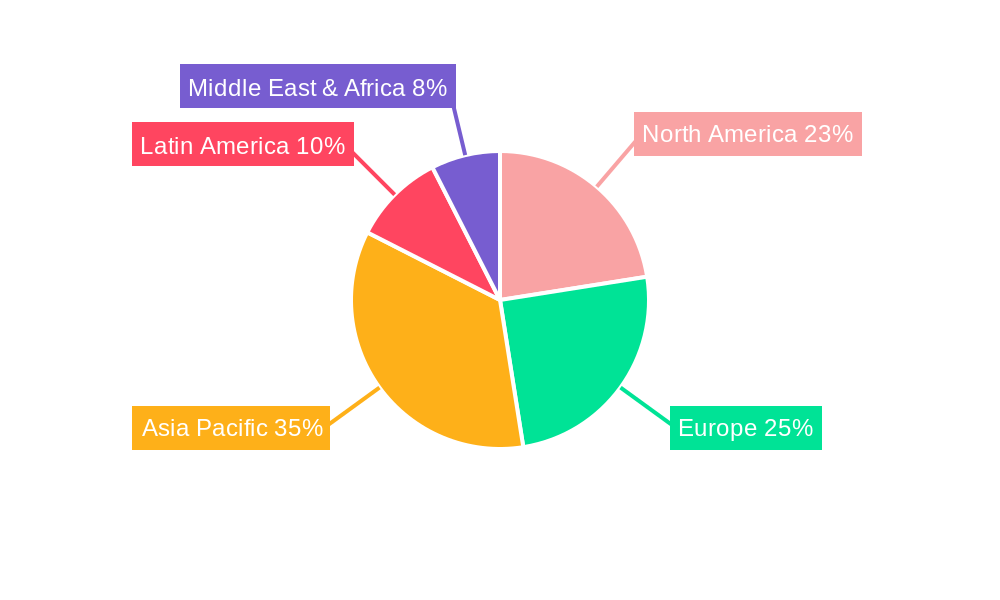

The forecast period (2025-2033) anticipates sustained expansion, driven by ongoing technological advancements in SAP, leading to improved absorbency, biodegradability, and cost-effectiveness. The growing emphasis on sustainable products is creating opportunities for bio-based SAPs. Geographically, the Asia Pacific region is expected to lead growth due to its large population, urbanization, and increasing healthcare expenditure. North America and Europe will remain key markets, supported by established demand for hygiene products and technological innovation.

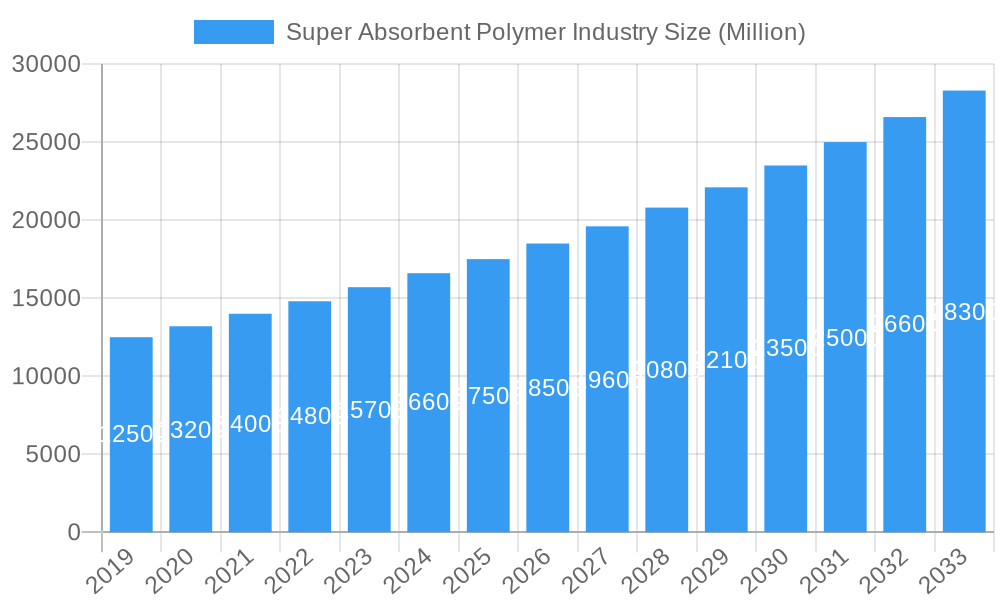

Super Absorbent Polymer Industry Company Market Share

This report offers an in-depth analysis of the Super Absorbent Polymer (SAP) industry. With an estimated market size of 9.7 billion in the base year 2025, and a projected CAGR of 5.4% through 2033, this analysis provides critical insights for stakeholders. The study period covers 2019-2033, with detailed historical data from 2019-2024 and a robust forecast for 2025-2033. The report examines market composition, trends, regional dynamics, product innovations, growth drivers, challenges, and opportunities within the high-performance polymer market. It also analyzes the roles of polyacrylamide and acrylic acid-based SAPs in key applications such as baby diapers, adult incontinence products, feminine hygiene, and agricultural support.

Super Absorbent Polymer Industry Market Composition & Trends

The Super Absorbent Polymer market exhibits a moderate level of concentration, with key players like BASF SE, Nippon Shokubai Co Ltd, Evonik Industries AG, and LG Chem dominating global production. Innovation catalysts are primarily driven by advancements in material science, focusing on enhanced absorbency, faster liquid uptake, and improved biodegradability. The regulatory landscape is increasingly influenced by environmental concerns, pushing for sustainable SAP production and disposal methods. Substitute products, such as cellulose-based materials, are present but generally fall short in performance for core SAP applications. End-user profiles vary significantly, from large-scale manufacturers of hygiene products to agricultural cooperatives seeking water retention solutions. Mergers and acquisitions (M&A) activities, with deal values estimated in the hundreds of millions, play a crucial role in market consolidation and expansion, exemplified by recent strategic moves by companies like Songwon and Wanhua Chemical Group Co Ltd. The market share distribution is heavily skewed towards acrylic acid-based SAPs, which constitute approximately 80% of the total market.

Super Absorbent Polymer Industry Industry Evolution

The Super Absorbent Polymer industry has witnessed remarkable growth and evolution, driven by persistent demand from the personal hygiene sector and emerging applications in agriculture and industrial solutions. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately 7.5%, fueled by rising disposable incomes in developing economies and an aging global population necessitating an increased demand for adult incontinence products. Technological advancements have been central to this evolution, with continuous research and development yielding SAPs with superior absorbency capacities, quicker wicking times, and enhanced gel strength. For instance, the development of cross-linking technologies has significantly improved the performance of acrylic acid-based SAPs, making them indispensable for modern diaper designs. The base year, 2025, sees the market valued at an estimated XXX Million, with current growth trajectories suggesting a sustained upward trend. Shifting consumer demands, particularly a growing preference for eco-friendly and biodegradable alternatives, are now prompting manufacturers to invest in sustainable SAP technologies. This includes exploring bio-based feedstocks and developing SAPs with reduced environmental impact. The market is also responding to the need for specialized SAPs tailored for specific agricultural conditions, such as water-scarce regions, where their water-retention capabilities offer significant benefits. The competitive landscape is characterized by strategic partnerships and continuous product differentiation, as companies like Sumitomo Seika Chemicals Co Ltd and Chemtex Speciality Limited vie for market leadership.

Leading Regions, Countries, or Segments in Super Absorbent Polymer Industry

Asia Pacific currently stands as the dominant region in the Super Absorbent Polymer industry, driven by its robust manufacturing base for hygiene products and a rapidly growing consumer market. Within this region, China is a leading country, contributing significantly to both production and consumption of SAPs. The Acrylic Acid Based segment, under Product Type, commands the largest market share, estimated at over 80%, owing to its superior absorbency and cost-effectiveness.

- Dominant Segments & Regions:

- Product Type Dominance: Acrylic Acid Based SAPs lead due to their performance and widespread adoption in core applications. Polyacrylamide-based SAPs are gaining traction in niche industrial and agricultural uses.

- Application Dominance: Baby Diapers represent the largest application segment, accounting for approximately 60% of the global SAP market. Adult Incontinence Products and Feminine Hygiene follow closely, driven by demographic shifts.

- Regional Leadership: Asia Pacific, particularly China and India, spearheads market growth due to increasing population, rising per capita income, and a burgeoning manufacturing sector for hygiene products. North America and Europe are mature markets with sustained demand driven by an aging population and technological innovation.

Key drivers for this dominance include substantial government support for manufacturing, increasing disposable incomes, and a large, young population in Asia Pacific countries, which fuels the demand for baby diapers. Investment trends in advanced SAP production facilities and research into sustainable alternatives are also significant factors. The regulatory support for innovative agricultural practices in regions like the Middle East and Africa, seeking to mitigate water scarcity, is also fostering growth in the Agriculture Support application segment, positioning it as a significant growth opportunity.

Super Absorbent Polymer Industry Product Innovations

Product innovation in the Super Absorbent Polymer industry is relentlessly focused on enhancing performance and sustainability. Companies are developing SAPs with significantly higher absorbency rates, allowing for thinner and more discreet hygiene products. Advancements in particle size control and surface modification are leading to SAPs with faster liquid wicking and reduced gel blocking, crucial for high-performance applications. The development of biodegradable SAPs, utilizing bio-based feedstocks and eco-friendly manufacturing processes, represents a major innovation push, addressing growing environmental concerns. These innovations are expanding the application range of SAPs beyond traditional hygiene products into areas like water management, drug delivery systems, and advanced agricultural soil amendments. For instance, Gel Frost Packs Kalyani Enterprises highlights the innovative use of SAPs in temperature-sensitive logistics.

Propelling Factors for Super Absorbent Polymer Industry Growth

The Super Absorbent Polymer industry is propelled by several key factors. The increasing global population, coupled with a rising birth rate in developing nations, directly fuels the demand for baby diapers. An aging global population is significantly boosting the market for adult incontinence products. Technological advancements in SAP manufacturing, leading to enhanced absorbency, quicker wicking, and improved gel strength, are critical for product development in the hygiene sector. Furthermore, the growing awareness of water scarcity issues globally is driving the adoption of SAPs in agriculture for soil conditioning and water retention, a segment with substantial untapped potential. Economic growth in emerging markets translates to increased disposable incomes, enabling greater consumer spending on premium hygiene products.

Obstacles in the Super Absorbent Polymer Industry Market

Despite robust growth, the Super Absorbent Polymer market faces several obstacles. Fluctuations in the prices of raw materials, primarily acrylic acid and its derivatives, can impact production costs and profit margins for manufacturers like Songwon and LG Chem. Stringent environmental regulations concerning the disposal of SAP-containing products and a growing demand for truly biodegradable alternatives present significant challenges, necessitating substantial investment in research and development for sustainable solutions. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of key raw materials and finished products. Intense competition among major players, including BASF SE and Nippon Shokubai Co Ltd, can lead to price pressures.

Future Opportunities in Super Absorbent Polymer Industry

Emerging opportunities in the Super Absorbent Polymer industry are diverse and promising. The expanding agricultural sector, particularly in arid and semi-arid regions, presents a significant opportunity for SAPs as soil conditioners to improve water retention and reduce irrigation needs. Innovations in bio-based and biodegradable SAPs are opening new markets driven by consumer demand for sustainable products. Advancements in medical applications, such as wound dressings and drug delivery systems, offer substantial growth potential. The increasing focus on industrial applications, including their use in oil and gas exploration and construction materials, also presents a burgeoning avenue for market expansion. Furthermore, the development of smart SAPs with responsive properties for specific applications is an area ripe for future innovation.

Major Players in the Super Absorbent Polymer Industry Ecosystem

- Chemtex Speciality Limited

- Songwon

- Sanyo Chemical Industries Ltd

- Evonik Industries AG

- Sumitomo Seika Chemicals Co Ltd

- Chase Corp

- BASF SE

- LG Chem

- Nippon Shokubai Co Ltd

- Wanhua Chemical Group Co Ltd

- Gel Frost Packs Kalyani Enterprises

Key Developments in Super Absorbent Polymer Industry Industry

- 2023: BASF SE launched a new generation of biodegradable SAPs, targeting agricultural and industrial applications, signaling a strong commitment to sustainability.

- 2023: Nippon Shokubai Co Ltd announced plans for a significant capacity expansion of its acrylic acid and SAP production in Japan, anticipating continued growth in the hygiene sector.

- 2022: Evonik Industries AG acquired a key SAP technology provider, enhancing its portfolio and expanding its market reach in specialized applications.

- 2022: Sumitomo Seika Chemicals Co Ltd introduced a novel SAP with ultra-fast absorption capabilities, aimed at revolutionizing high-performance diaper designs.

- 2021: Wanhua Chemical Group Co Ltd made significant investments in R&D for novel SAP formulations to address environmental concerns and enhance performance in niche markets.

- 2020: Sanyo Chemical Industries Ltd unveiled a bio-based SAP derived from renewable resources, catering to the growing demand for eco-friendly solutions.

Strategic Super Absorbent Polymer Industry Market Forecast

The Super Absorbent Polymer industry is poised for sustained, robust growth, driven by fundamental demographic shifts and increasing technological sophistication. The persistent demand from the core hygiene sector, particularly for baby diapers and adult incontinence products, coupled with the burgeoning potential in agricultural water management solutions, forms the bedrock of this optimistic outlook. Emerging applications in healthcare and industrial sectors, alongside a significant push towards bio-based and biodegradable SAPs, will further diversify and expand market opportunities. Strategic investments in research and development focused on enhancing absorbency, sustainability, and cost-effectiveness will be critical for market leaders. The forecast indicates a positive trajectory, supported by innovation and evolving consumer preferences towards performance and environmental responsibility, ensuring a dynamic and expanding market landscape.

Super Absorbent Polymer Industry Segmentation

-

1. Product Type

- 1.1. Polyacrylamide

- 1.2. Acrylic Acid Based

- 1.3. Other Product Types

-

2. Application

- 2.1. Baby Diapers

- 2.2. Adult Incontinence Products

- 2.3. Feminine Hygiene

- 2.4. Agriculture Support

- 2.5. Other Applications

Super Absorbent Polymer Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 2. Rest of Asia Pacific

-

3. North America

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

-

4. Europe

- 4.1. Germany

- 4.2. United Kingdom

- 4.3. Italy

- 4.4. France

- 4.5. Rest of Europe

-

5. Rest of the World

- 5.1. South America

- 5.2. Middle East

Super Absorbent Polymer Industry Regional Market Share

Geographic Coverage of Super Absorbent Polymer Industry

Super Absorbent Polymer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Hygiene Awareness; Growing Infant and Aging Population in Emerging Economies

- 3.3. Market Restrains

- 3.3.1. ; High Raw Material Cost and Availability of Raw Material; Other Restraints

- 3.4. Market Trends

- 3.4.1. Baby Diapers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Polyacrylamide

- 5.1.2. Acrylic Acid Based

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Baby Diapers

- 5.2.2. Adult Incontinence Products

- 5.2.3. Feminine Hygiene

- 5.2.4. Agriculture Support

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Rest of Asia Pacific

- 5.3.3. North America

- 5.3.4. Europe

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Polyacrylamide

- 6.1.2. Acrylic Acid Based

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Baby Diapers

- 6.2.2. Adult Incontinence Products

- 6.2.3. Feminine Hygiene

- 6.2.4. Agriculture Support

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Rest of Asia Pacific Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Polyacrylamide

- 7.1.2. Acrylic Acid Based

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Baby Diapers

- 7.2.2. Adult Incontinence Products

- 7.2.3. Feminine Hygiene

- 7.2.4. Agriculture Support

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Polyacrylamide

- 8.1.2. Acrylic Acid Based

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Baby Diapers

- 8.2.2. Adult Incontinence Products

- 8.2.3. Feminine Hygiene

- 8.2.4. Agriculture Support

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Europe Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Polyacrylamide

- 9.1.2. Acrylic Acid Based

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Baby Diapers

- 9.2.2. Adult Incontinence Products

- 9.2.3. Feminine Hygiene

- 9.2.4. Agriculture Support

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of the World Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Polyacrylamide

- 10.1.2. Acrylic Acid Based

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Baby Diapers

- 10.2.2. Adult Incontinence Products

- 10.2.3. Feminine Hygiene

- 10.2.4. Agriculture Support

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chemtex Speciality Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Songwon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sanyo Chemical Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evonik Industries AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sumitomo Seika Chemicals Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chase Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LG Chem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nippon Shokubai Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wanhua Chemical Group Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gel Frost Packs Kalyani Enterprises

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Chemtex Speciality Limited

List of Figures

- Figure 1: Global Super Absorbent Polymer Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Rest of Asia Pacific Super Absorbent Polymer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Super Absorbent Polymer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: North America Super Absorbent Polymer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: North America Super Absorbent Polymer Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: North America Super Absorbent Polymer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Super Absorbent Polymer Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: North America Super Absorbent Polymer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Super Absorbent Polymer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Europe Super Absorbent Polymer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Super Absorbent Polymer Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Super Absorbent Polymer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Super Absorbent Polymer Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Super Absorbent Polymer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Super Absorbent Polymer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of the World Super Absorbent Polymer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Super Absorbent Polymer Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of the World Super Absorbent Polymer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Super Absorbent Polymer Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of the World Super Absorbent Polymer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 16: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United States Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Mexico Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Germany Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Middle East Super Absorbent Polymer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Super Absorbent Polymer Industry?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Super Absorbent Polymer Industry?

Key companies in the market include Chemtex Speciality Limited, Songwon, Sanyo Chemical Industries Ltd, Evonik Industries AG, Sumitomo Seika Chemicals Co Ltd, Chase Corp, BASF SE, LG Chem, Nippon Shokubai Co Ltd, Wanhua Chemical Group Co Ltd*List Not Exhaustive, Gel Frost Packs Kalyani Enterprises.

3. What are the main segments of the Super Absorbent Polymer Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.7 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Hygiene Awareness; Growing Infant and Aging Population in Emerging Economies.

6. What are the notable trends driving market growth?

Baby Diapers to Dominate the Market.

7. Are there any restraints impacting market growth?

; High Raw Material Cost and Availability of Raw Material; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Super Absorbent Polymer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Super Absorbent Polymer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Super Absorbent Polymer Industry?

To stay informed about further developments, trends, and reports in the Super Absorbent Polymer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence