Key Insights

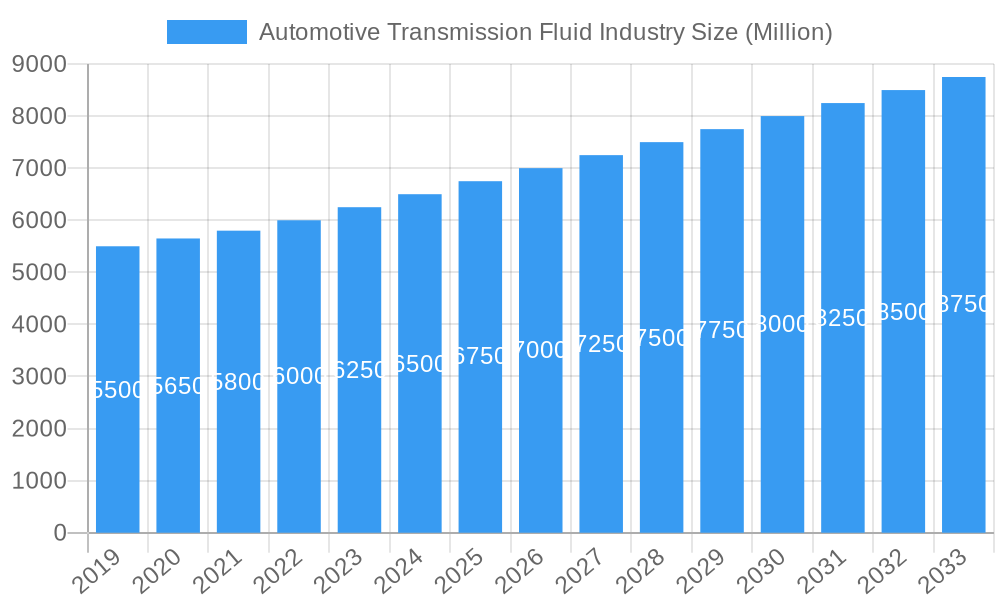

The global Automotive Transmission Fluid (ATF) market is poised for robust growth, projected to exceed $7,200 million by 2025 and maintain a Compound Annual Growth Rate (CAGR) of over 4.00% through 2033. This expansion is primarily fueled by the burgeoning automotive industry, which continues to witness increasing vehicle production and a growing demand for advanced transmission systems. Key market drivers include the rising adoption of automatic and dual-clutch transmissions, which necessitate specialized, high-performance ATFs to ensure optimal operation and longevity. Furthermore, the increasing emphasis on fuel efficiency and reduced emissions is pushing manufacturers to develop and utilize synthetic and semi-synthetic base oils, offering superior lubrication and thermal stability compared to traditional mineral oils. The aftermarket segment also plays a significant role, driven by the continuous need for fluid replacement and maintenance in the existing vehicle parc.

Automotive Transmission Fluid Industry Market Size (In Billion)

The market's growth trajectory is further supported by evolving automotive technologies, such as the increasing complexity of transmissions in electric and hybrid vehicles, which may require specialized fluid formulations. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to this growth due to rapid industrialization, rising disposable incomes, and a burgeoning middle class leading to higher vehicle sales. However, certain restraints, such as fluctuating raw material prices for base oils and the increasing adoption of direct-drive systems in some electric vehicles, could present challenges. The competitive landscape features prominent global players such as Exxon Mobil Corporation, Royal Dutch Shell plc, and China Petroleum & Chemical Corporation, alongside specialized lubricant manufacturers, all vying for market share through innovation, strategic partnerships, and expanding distribution networks.

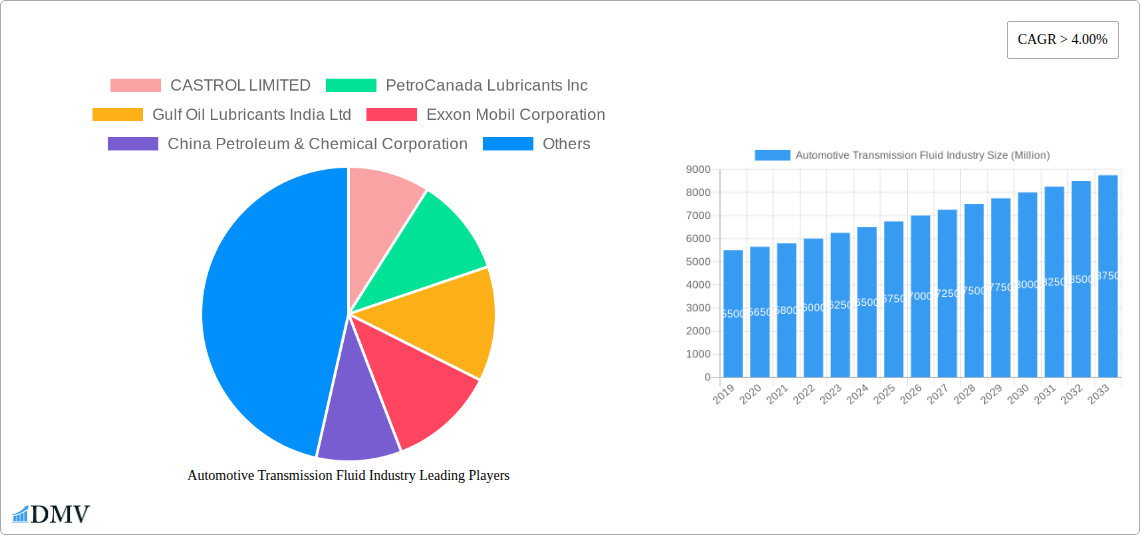

Automotive Transmission Fluid Industry Company Market Share

Automotive Transmission Fluid Industry: Comprehensive Market Analysis and 2033 Forecast

This in-depth report provides a comprehensive analysis of the global Automotive Transmission Fluid (ATF) market, a critical component for vehicle performance and longevity. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report offers invaluable insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Stakeholders will gain a strategic advantage through detailed market segmentation by ATF type (Automatic Transmission Fluid, Manual Transmission Fluid, Dual Clutch, Continuously Variable), base oil (Mineral, Synthetic, Semi-synthetic), and end-user industries (Automotive Industry, Construction, Mining, Industrial Machinery, Agriculture, Other End-user Industries). The report meticulously analyzes market dynamics, competitive landscapes, and forecasts for the period 2025–2033, building upon historical data from 2019–2024.

Automotive Transmission Fluid Industry Market Composition & Trends

The Automotive Transmission Fluid market exhibits a moderate to high level of concentration, driven by the significant presence of major lubricant manufacturers and automotive OEMs. Innovation catalysts include the increasing complexity of modern transmission systems, such as dual-clutch and continuously variable transmissions (CVTs), which demand specialized fluid formulations. Regulatory landscapes, particularly emissions standards and fuel efficiency mandates, indirectly influence ATF development by favoring lighter viscosity fluids and those with reduced friction properties. Substitute products are limited, as transmission fluids are highly specialized for their intended application, though some overlap exists between mineral and semi-synthetic formulations for older or less demanding vehicle types. End-user profiles are predominantly within the Automotive Industry, accounting for over 80% of the market share. However, the Construction, Mining, and Industrial Machinery sectors represent growing segments, requiring robust and high-performance ATFs for heavy-duty equipment. Mergers and acquisitions (M&A) activities are strategic, often aimed at expanding product portfolios, gaining market access in emerging economies, or acquiring advanced fluid technology. Deal values are projected to range from several million to hundreds of millions of dollars, depending on the strategic importance and market position of the acquired entity. For instance, the acquisition of a niche synthetic lubricant producer by a major player could command a premium of approximately $50-150 million. The overall market share distribution sees dominant players like Exxon Mobil Corporation and Royal Dutch Shell plc holding substantial portions, estimated at over 15% each, followed by China Petroleum & Chemical Corporation and Chevron Corporation, each around 10-12%.

Automotive Transmission Fluid Industry Industry Evolution

The Automotive Transmission Fluid Industry has undergone significant evolution, driven by technological advancements in vehicle powertrains and shifting consumer demands for enhanced fuel efficiency and performance. Over the historical period (2019-2024), the market witnessed a steady growth trajectory, with an average annual growth rate (AAGR) of approximately 4.5%. This growth was primarily fueled by the increasing global vehicle parc and the rising adoption of automatic transmissions, which require specialized ATFs. The transition from mineral-based to synthetic and semi-synthetic base oils has been a defining trend, driven by their superior thermal stability, oxidative resistance, and extended drain intervals. For example, the adoption rate of synthetic ATFs in new passenger vehicles has surged from an estimated 30% in 2019 to over 55% by 2024.

The introduction and widespread adoption of new transmission technologies, such as Dual Clutch Transmissions (DCTs) and Continuously Variable Transmissions (CVTs), have been major catalysts for innovation in ATF formulations. These advanced transmissions require fluids with specific frictional characteristics to ensure smooth gear changes and optimal power transfer, leading to the development of dedicated DCTF and CVT fluids. Market research indicates that the demand for DCTFs grew at an AAGR of over 8% during the historical period, while CVT fluids saw an AAGR of approximately 6%.

Shifting consumer demands, influenced by environmental consciousness and the desire for reduced maintenance costs, have further propelled the market. Consumers are increasingly looking for lubricants that offer extended drain intervals, contributing to lower lifetime ownership costs and reduced waste. This trend has incentivized manufacturers to invest heavily in research and development to create longer-lasting and more robust ATF formulations. The increasing average age of vehicles in operation globally also contributes to sustained demand for replacement ATFs. By 2025, the global Automotive Transmission Fluid market is projected to reach a valuation of over $20 billion. The forecast period (2025-2033) anticipates a continued upward trend, with an estimated AAGR of 5.2%, driven by the ongoing evolution of transmission technologies, increasing vehicle production in emerging markets, and a growing emphasis on sustainable and high-performance lubrication solutions.

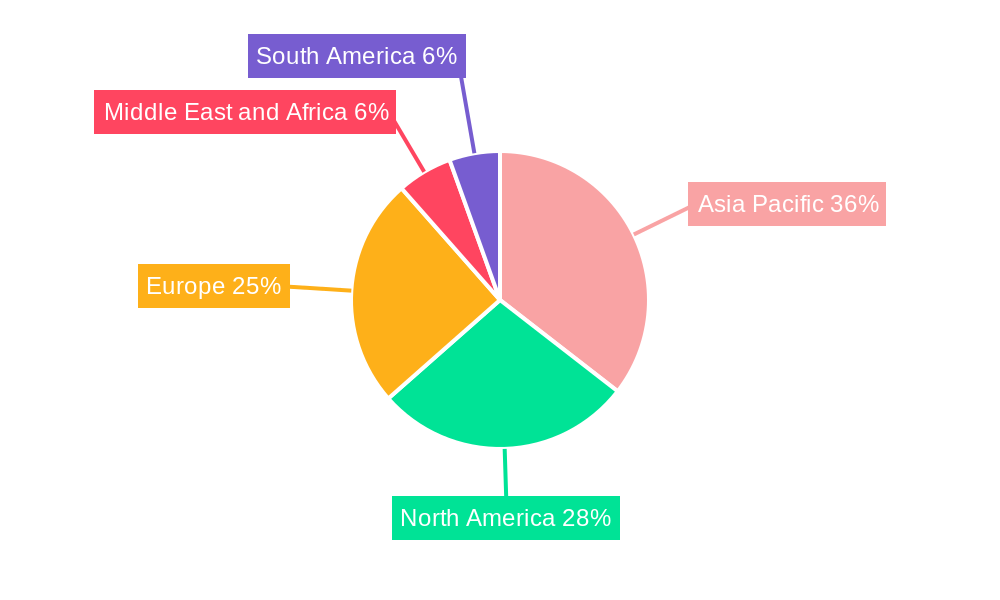

Leading Regions, Countries, or Segments in Automotive Transmission Fluid Industry

The Automotive Industry segment overwhelmingly dominates the global Automotive Transmission Fluid market, accounting for over 80% of the total demand. Within this dominant segment, the Automatic Transmission Fluid (ATF) sub-segment is the largest by volume and value, driven by the widespread adoption of automatic transmissions in passenger vehicles across the globe. Factors contributing to the dominance of ATFs include the growing preference for driver comfort and convenience, coupled with advancements in transmission technology that enhance fuel efficiency and performance. For instance, the market share of ATFs within the broader ATF market is estimated to be around 65-70%.

Geographically, Asia Pacific has emerged as the leading region for Automotive Transmission Fluid consumption and growth. This dominance is attributed to several key drivers:

- Massive Vehicle Production Hubs: Countries like China, India, Japan, and South Korea are major global centers for automotive manufacturing, leading to substantial demand for both original equipment manufacturer (OEM) and aftermarket ATFs. China alone accounts for over 30% of global vehicle production, making it a critical market.

- Increasing Vehicle Ownership: Rising disposable incomes and expanding middle-class populations in emerging economies within Asia Pacific are driving unprecedented growth in vehicle ownership, thus escalating the demand for transmission fluids.

- Technological Adoption: The region is rapidly adopting advanced transmission technologies, including DCTs and CVTs, which require specialized and higher-value ATFs. This shift is creating significant opportunities for premium synthetic fluid manufacturers.

- Favorable Regulatory Environment (for production): While environmental regulations are evolving, the sheer scale of production in the region, supported by government initiatives to boost manufacturing, creates a strong demand pull for lubricants.

Within the Base Oil segmentation, Synthetic base oils are rapidly gaining market share due to their superior performance characteristics, including enhanced thermal stability, oxidative resistance, and extended drain intervals. While Mineral base oils still hold a significant share, particularly in cost-sensitive markets and for older vehicle models, the trend is clearly shifting towards synthetic formulations. The market share of synthetic ATFs is projected to grow from approximately 45% in 2025 to over 60% by 2033.

The Continuously Variable Transmission (CVT) Fluid segment, while smaller than ATFs, is experiencing robust growth due to the increasing popularity of CVTs in fuel-efficient vehicles, particularly in compact and mid-size passenger cars. The market share for CVT fluids is expected to expand from roughly 10% in 2025 to over 15% by 2033.

Automotive Transmission Fluid Industry Product Innovations

Product innovation in the Automotive Transmission Fluid industry is characterized by the development of advanced formulations catering to increasingly sophisticated transmission systems. Key innovations focus on enhanced friction modifiers for optimal clutch engagement in DCTs, improved shear stability for CVTs, and extended drain intervals for all transmission types. Unique selling propositions include fluids that offer superior wear protection, reduced operating temperatures, and compatibility with a wider range of materials. Technological advancements are pushing the boundaries of fluid performance, with new additive packages designed to meet stringent OEM specifications and evolving environmental regulations. For instance, the development of low-viscosity synthetic ATFs is a significant trend, contributing to improved fuel economy by reducing parasitic losses. These innovations are crucial for extending the lifespan of transmissions and ensuring their efficient operation in diverse driving conditions, from stop-and-go city traffic to high-speed highway cruising.

Propelling Factors for Automotive Transmission Fluid Industry Growth

The Automotive Transmission Fluid Industry is propelled by a confluence of technological advancements, economic factors, and evolving consumer preferences. The increasing complexity of modern transmission systems, such as the proliferation of Dual Clutch Transmissions (DCTs) and Continuously Variable Transmissions (CVTs), necessitates the use of specialized, high-performance fluids. Economic growth in emerging markets is leading to a surge in vehicle ownership and production, directly translating into higher demand for transmission fluids. Furthermore, growing consumer awareness regarding vehicle maintenance and the desire for extended component lifespans are driving demand for premium, long-drain interval lubricants. Regulatory mandates aimed at improving fuel efficiency and reducing emissions also indirectly support the growth of synthetic and low-viscosity transmission fluids.

Obstacles in the Automotive Transmission Fluid Industry Market

Despite robust growth prospects, the Automotive Transmission Fluid Industry faces several significant obstacles. Evolving and increasingly stringent environmental regulations, particularly concerning chemical composition and biodegradability, can necessitate costly reformulation and R&D investments. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production costs and product availability, potentially affecting profit margins and delivery timelines by millions of dollars. Intense competition from established players and the threat of generic or counterfeit products can put pressure on pricing strategies and market share. Furthermore, the slow adoption of advanced transmission technologies in certain price-sensitive markets and the ongoing shift towards electric vehicles (EVs), which have different powertrain lubrication requirements, present long-term challenges for traditional ATF manufacturers.

Future Opportunities in Automotive Transmission Fluid Industry

The Automotive Transmission Fluid Industry is ripe with future opportunities. The burgeoning demand for specialized fluids for DCTs and CVTs in emerging economies presents a significant growth avenue. The increasing focus on sustainability is driving innovation in bio-based and eco-friendly transmission fluids, opening up new market segments. The aftermarket segment, particularly for older vehicle models, continues to offer steady demand. Furthermore, advancements in additive technology and base oil formulations can lead to the development of "smart" fluids with enhanced diagnostic capabilities, predicting potential transmission issues before they become critical, potentially adding millions to the value proposition. The growing trend of vehicle electrification, while presenting long-term challenges for traditional ATFs, also opens opportunities for specialized EV drivetrain fluids.

Major Players in the Automotive Transmission Fluid Industry Ecosystem

- CASTROL LIMITED

- PetroCanada Lubricants Inc

- Gulf Oil Lubricants India Ltd

- Exxon Mobil Corporation

- China Petroleum & Chemical Corporation

- Kemipex

- BASF SE

- Chevron Corporation

- Royal Dutch Shell plc

- CRP Industries Inc

- American Hitech Petroleum & Chemicals Inc

- BP PLC

- Amalie Oil Co

- Ford Motor Company

Key Developments in Automotive Transmission Fluid Industry Industry

- Q1 2023: Royal Dutch Shell plc launched a new line of synthetic automatic transmission fluids offering enhanced fuel efficiency and extended drain intervals, impacting market share by an estimated 1-2%.

- Q4 2022: Exxon Mobil Corporation announced a strategic partnership with a major Asian automotive OEM to develop next-generation transmission fluids, signaling a significant investment in R&D.

- Q2 2022: BASF SE introduced a novel additive package for CVT fluids, promising improved performance and reduced wear, with potential market adoption reaching 10% within three years.

- Q1 2022: PetroCanada Lubricants Inc expanded its distribution network in Eastern Europe, targeting a market segment previously underserved, aiming to capture 3-5% of regional growth.

- Q3 2021: China Petroleum & Chemical Corporation (Sinopec) invested several hundred million dollars in upgrading its lubricant production facilities, focusing on high-performance synthetic ATFs.

- Q4 2020: Gulf Oil Lubricants India Ltd acquired a smaller regional competitor, strengthening its position in the Indian aftermarket and estimating a 5% increase in domestic market share.

- Q1 2020: Ford Motor Company collaborated with a leading lubricant manufacturer to develop proprietary transmission fluids for its new line of electric vehicles, marking a shift in lubricant strategy.

Strategic Automotive Transmission Fluid Industry Market Forecast

The strategic Automotive Transmission Fluid market forecast for 2025–2033 anticipates sustained growth driven by the continued evolution of transmission technologies and increasing vehicle production, particularly in emerging economies. The market is projected to benefit from the ongoing demand for Automatic Transmission Fluids, alongside robust growth in specialized segments like Dual Clutch and Continuously Variable transmission fluids. Innovations in synthetic and semi-synthetic base oils, offering superior performance and extended drain intervals, will remain key growth catalysts. The industry will also see opportunities in developing specialized fluids for hybrid and electric vehicle powertrains, albeit with different formulation requirements. Emerging markets, coupled with a global push for enhanced fuel efficiency and reduced emissions, will further solidify the positive outlook for the Automotive Transmission Fluid market, with an estimated market size reaching over $25 billion by 2033.

Automotive Transmission Fluid Industry Segmentation

-

1. Type

- 1.1. Automatic Transmission Fluid

- 1.2. Manual Transmission Fluid

- 1.3. Dual Clutch

- 1.4. Continuously Variable

-

2. Base Oil

- 2.1. Mineral

- 2.2. Synthetic

- 2.3. Semi-synthetic

-

3. End-user Industry

- 3.1. Automotive Industry

- 3.2. Construction

- 3.3. Mining

- 3.4. Industrial Machinry

- 3.5. Agriculture

- 3.6. Other End-user Industries

Automotive Transmission Fluid Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Nigeria

- 5.3. Qatar

- 5.4. Egypt

- 5.5. United Arab Emirates

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Automotive Transmission Fluid Industry Regional Market Share

Geographic Coverage of Automotive Transmission Fluid Industry

Automotive Transmission Fluid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand of Transmission Fluid from Automotive Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Crude Oil Price; Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Growing Demand for Transmission Fluid from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automatic Transmission Fluid

- 5.1.2. Manual Transmission Fluid

- 5.1.3. Dual Clutch

- 5.1.4. Continuously Variable

- 5.2. Market Analysis, Insights and Forecast - by Base Oil

- 5.2.1. Mineral

- 5.2.2. Synthetic

- 5.2.3. Semi-synthetic

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive Industry

- 5.3.2. Construction

- 5.3.3. Mining

- 5.3.4. Industrial Machinry

- 5.3.5. Agriculture

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automatic Transmission Fluid

- 6.1.2. Manual Transmission Fluid

- 6.1.3. Dual Clutch

- 6.1.4. Continuously Variable

- 6.2. Market Analysis, Insights and Forecast - by Base Oil

- 6.2.1. Mineral

- 6.2.2. Synthetic

- 6.2.3. Semi-synthetic

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive Industry

- 6.3.2. Construction

- 6.3.3. Mining

- 6.3.4. Industrial Machinry

- 6.3.5. Agriculture

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automatic Transmission Fluid

- 7.1.2. Manual Transmission Fluid

- 7.1.3. Dual Clutch

- 7.1.4. Continuously Variable

- 7.2. Market Analysis, Insights and Forecast - by Base Oil

- 7.2.1. Mineral

- 7.2.2. Synthetic

- 7.2.3. Semi-synthetic

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive Industry

- 7.3.2. Construction

- 7.3.3. Mining

- 7.3.4. Industrial Machinry

- 7.3.5. Agriculture

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automatic Transmission Fluid

- 8.1.2. Manual Transmission Fluid

- 8.1.3. Dual Clutch

- 8.1.4. Continuously Variable

- 8.2. Market Analysis, Insights and Forecast - by Base Oil

- 8.2.1. Mineral

- 8.2.2. Synthetic

- 8.2.3. Semi-synthetic

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive Industry

- 8.3.2. Construction

- 8.3.3. Mining

- 8.3.4. Industrial Machinry

- 8.3.5. Agriculture

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automatic Transmission Fluid

- 9.1.2. Manual Transmission Fluid

- 9.1.3. Dual Clutch

- 9.1.4. Continuously Variable

- 9.2. Market Analysis, Insights and Forecast - by Base Oil

- 9.2.1. Mineral

- 9.2.2. Synthetic

- 9.2.3. Semi-synthetic

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive Industry

- 9.3.2. Construction

- 9.3.3. Mining

- 9.3.4. Industrial Machinry

- 9.3.5. Agriculture

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Transmission Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Automatic Transmission Fluid

- 10.1.2. Manual Transmission Fluid

- 10.1.3. Dual Clutch

- 10.1.4. Continuously Variable

- 10.2. Market Analysis, Insights and Forecast - by Base Oil

- 10.2.1. Mineral

- 10.2.2. Synthetic

- 10.2.3. Semi-synthetic

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive Industry

- 10.3.2. Construction

- 10.3.3. Mining

- 10.3.4. Industrial Machinry

- 10.3.5. Agriculture

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CASTROL LIMITED

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PetroCanada Lubricants Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gulf Oil Lubricants India Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Petroleum & Chemical Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemipex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chevron Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Royal Dutch Shell plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CRP Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 American Hitech Petroleum & Chemicals Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BP PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Amalie Oil Co

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ford Motor Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 CASTROL LIMITED

List of Figures

- Figure 1: Global Automotive Transmission Fluid Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Automotive Transmission Fluid Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Automotive Transmission Fluid Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: Asia Pacific Automotive Transmission Fluid Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Automotive Transmission Fluid Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Automotive Transmission Fluid Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Automotive Transmission Fluid Industry Revenue (undefined), by Base Oil 2025 & 2033

- Figure 8: Asia Pacific Automotive Transmission Fluid Industry Volume (K Tons), by Base Oil 2025 & 2033

- Figure 9: Asia Pacific Automotive Transmission Fluid Industry Revenue Share (%), by Base Oil 2025 & 2033

- Figure 10: Asia Pacific Automotive Transmission Fluid Industry Volume Share (%), by Base Oil 2025 & 2033

- Figure 11: Asia Pacific Automotive Transmission Fluid Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Automotive Transmission Fluid Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Automotive Transmission Fluid Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Automotive Transmission Fluid Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Automotive Transmission Fluid Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Asia Pacific Automotive Transmission Fluid Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Automotive Transmission Fluid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Transmission Fluid Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Automotive Transmission Fluid Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: North America Automotive Transmission Fluid Industry Volume (K Tons), by Type 2025 & 2033

- Figure 21: North America Automotive Transmission Fluid Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: North America Automotive Transmission Fluid Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: North America Automotive Transmission Fluid Industry Revenue (undefined), by Base Oil 2025 & 2033

- Figure 24: North America Automotive Transmission Fluid Industry Volume (K Tons), by Base Oil 2025 & 2033

- Figure 25: North America Automotive Transmission Fluid Industry Revenue Share (%), by Base Oil 2025 & 2033

- Figure 26: North America Automotive Transmission Fluid Industry Volume Share (%), by Base Oil 2025 & 2033

- Figure 27: North America Automotive Transmission Fluid Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: North America Automotive Transmission Fluid Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: North America Automotive Transmission Fluid Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: North America Automotive Transmission Fluid Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: North America Automotive Transmission Fluid Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: North America Automotive Transmission Fluid Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Automotive Transmission Fluid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Automotive Transmission Fluid Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Automotive Transmission Fluid Industry Revenue (undefined), by Type 2025 & 2033

- Figure 36: Europe Automotive Transmission Fluid Industry Volume (K Tons), by Type 2025 & 2033

- Figure 37: Europe Automotive Transmission Fluid Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe Automotive Transmission Fluid Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe Automotive Transmission Fluid Industry Revenue (undefined), by Base Oil 2025 & 2033

- Figure 40: Europe Automotive Transmission Fluid Industry Volume (K Tons), by Base Oil 2025 & 2033

- Figure 41: Europe Automotive Transmission Fluid Industry Revenue Share (%), by Base Oil 2025 & 2033

- Figure 42: Europe Automotive Transmission Fluid Industry Volume Share (%), by Base Oil 2025 & 2033

- Figure 43: Europe Automotive Transmission Fluid Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Europe Automotive Transmission Fluid Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Europe Automotive Transmission Fluid Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe Automotive Transmission Fluid Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe Automotive Transmission Fluid Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe Automotive Transmission Fluid Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Automotive Transmission Fluid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Automotive Transmission Fluid Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Automotive Transmission Fluid Industry Revenue (undefined), by Type 2025 & 2033

- Figure 52: South America Automotive Transmission Fluid Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: South America Automotive Transmission Fluid Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Automotive Transmission Fluid Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Automotive Transmission Fluid Industry Revenue (undefined), by Base Oil 2025 & 2033

- Figure 56: South America Automotive Transmission Fluid Industry Volume (K Tons), by Base Oil 2025 & 2033

- Figure 57: South America Automotive Transmission Fluid Industry Revenue Share (%), by Base Oil 2025 & 2033

- Figure 58: South America Automotive Transmission Fluid Industry Volume Share (%), by Base Oil 2025 & 2033

- Figure 59: South America Automotive Transmission Fluid Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 60: South America Automotive Transmission Fluid Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 61: South America Automotive Transmission Fluid Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South America Automotive Transmission Fluid Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South America Automotive Transmission Fluid Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: South America Automotive Transmission Fluid Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Automotive Transmission Fluid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Automotive Transmission Fluid Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Automotive Transmission Fluid Industry Revenue (undefined), by Type 2025 & 2033

- Figure 68: Middle East and Africa Automotive Transmission Fluid Industry Volume (K Tons), by Type 2025 & 2033

- Figure 69: Middle East and Africa Automotive Transmission Fluid Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Automotive Transmission Fluid Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Automotive Transmission Fluid Industry Revenue (undefined), by Base Oil 2025 & 2033

- Figure 72: Middle East and Africa Automotive Transmission Fluid Industry Volume (K Tons), by Base Oil 2025 & 2033

- Figure 73: Middle East and Africa Automotive Transmission Fluid Industry Revenue Share (%), by Base Oil 2025 & 2033

- Figure 74: Middle East and Africa Automotive Transmission Fluid Industry Volume Share (%), by Base Oil 2025 & 2033

- Figure 75: Middle East and Africa Automotive Transmission Fluid Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Automotive Transmission Fluid Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Automotive Transmission Fluid Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Automotive Transmission Fluid Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Automotive Transmission Fluid Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa Automotive Transmission Fluid Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Automotive Transmission Fluid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Automotive Transmission Fluid Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 4: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 5: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 12: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 13: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Malaysia Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Malaysia Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Thailand Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Thailand Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Vietnam Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Vietnam Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 38: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 39: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: United States Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United States Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Canada Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Canada Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Mexico Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Mexico Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 51: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 52: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 53: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Germany Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Germany Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: United Kingdom Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: United Kingdom Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: France Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: France Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Italy Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Italy Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Spain Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Spain Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: Turkey Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: Turkey Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Russia Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: Russia Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: NORDIC Countries Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: NORDIC Countries Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Europe Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Rest of Europe Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 76: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 77: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 78: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 79: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 80: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 81: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 82: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 83: Brazil Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Brazil Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Argentina Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Argentina Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 87: Colombia Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: Colombia Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 91: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 92: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 93: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Base Oil 2020 & 2033

- Table 94: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Base Oil 2020 & 2033

- Table 95: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 96: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 97: Global Automotive Transmission Fluid Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 98: Global Automotive Transmission Fluid Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 99: Saudi Arabia Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: Saudi Arabia Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 101: Nigeria Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Nigeria Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 103: Qatar Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Qatar Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 105: Egypt Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 106: Egypt Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 107: United Arab Emirates Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 108: United Arab Emirates Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 109: South Africa Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 110: South Africa Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 111: Rest of Middle East and Africa Automotive Transmission Fluid Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 112: Rest of Middle East and Africa Automotive Transmission Fluid Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Transmission Fluid Industry?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Automotive Transmission Fluid Industry?

Key companies in the market include CASTROL LIMITED, PetroCanada Lubricants Inc, Gulf Oil Lubricants India Ltd, Exxon Mobil Corporation, China Petroleum & Chemical Corporation, Kemipex, BASF SE, Chevron Corporation, Royal Dutch Shell plc, CRP Industries Inc, American Hitech Petroleum & Chemicals Inc, BP PLC, Amalie Oil Co, Ford Motor Company.

3. What are the main segments of the Automotive Transmission Fluid Industry?

The market segments include Type, Base Oil, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand of Transmission Fluid from Automotive Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for Transmission Fluid from the Automotive Industry.

7. Are there any restraints impacting market growth?

; Volatility in Crude Oil Price; Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Transmission Fluid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Transmission Fluid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Transmission Fluid Industry?

To stay informed about further developments, trends, and reports in the Automotive Transmission Fluid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence