Key Insights

The Turkey Passenger Vehicles Lubricants Market is projected for significant expansion, with an estimated market size of $1.58 billion in 2023. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 108% over the forecast period of 2023-2033. Key drivers include the increasing passenger vehicle fleet in Turkey, a growing focus on regular maintenance for optimal vehicle performance and longevity, and advancements in engine technology necessitating superior lubricant formulations. Rising disposable incomes and a burgeoning middle class are boosting vehicle ownership, directly impacting demand for high-quality automotive lubricants. The market also observes a clear trend towards synthetic and semi-synthetic lubricants, favored for their enhanced protection, efficiency, and extended drain intervals over conventional mineral oils. This shift is further supported by stringent environmental regulations promoting lubricants that improve fuel economy and reduce emissions.

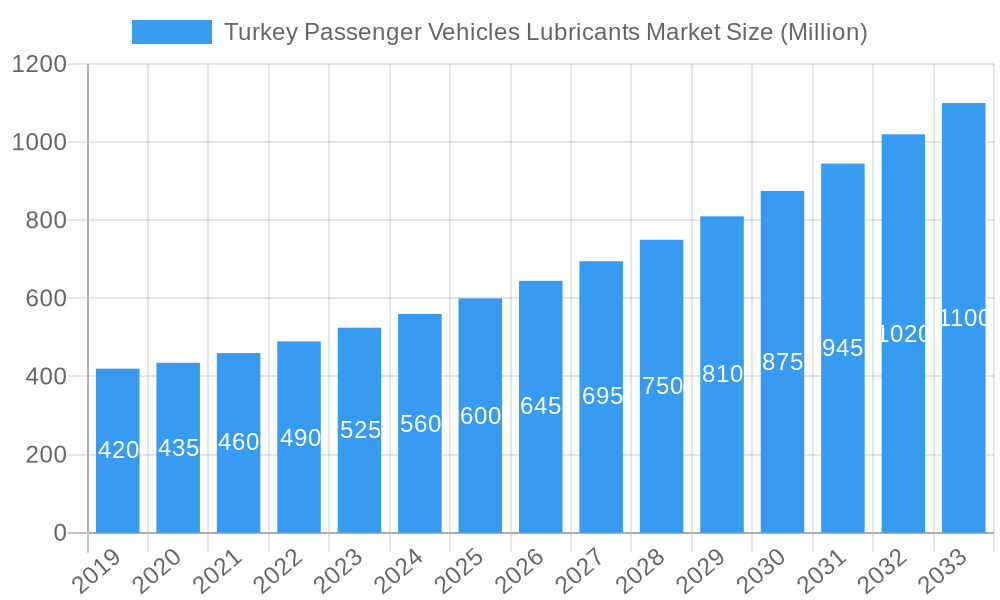

Turkey Passenger Vehicles Lubricants Market Market Size (In Billion)

Market segmentation indicates Engine Oils as the leading segment, crucial for passenger vehicle upkeep. Significant growth is also expected in Transmission & Gear Oils and Hydraulic Fluids due to the increasing complexity of modern vehicle powertrains and advanced hydraulic systems. While market growth is robust, potential challenges include fluctuations in crude oil prices, impacting production costs, and the accelerating adoption of electric vehicles (EVs), which require different lubrication solutions. Nevertheless, the substantial existing fleet of internal combustion engine (ICE) vehicles, alongside the gradual transition to EVs, ensures sustained demand for traditional lubricants. Major industry players, including ExxonMobil Corporation, BP PLC (Castrol), and Royal Dutch Shell PLC, are actively engaged, utilizing their global expertise and product offerings to secure market share and introduce innovative solutions aligned with the evolving needs of Turkish consumers and automotive manufacturers.

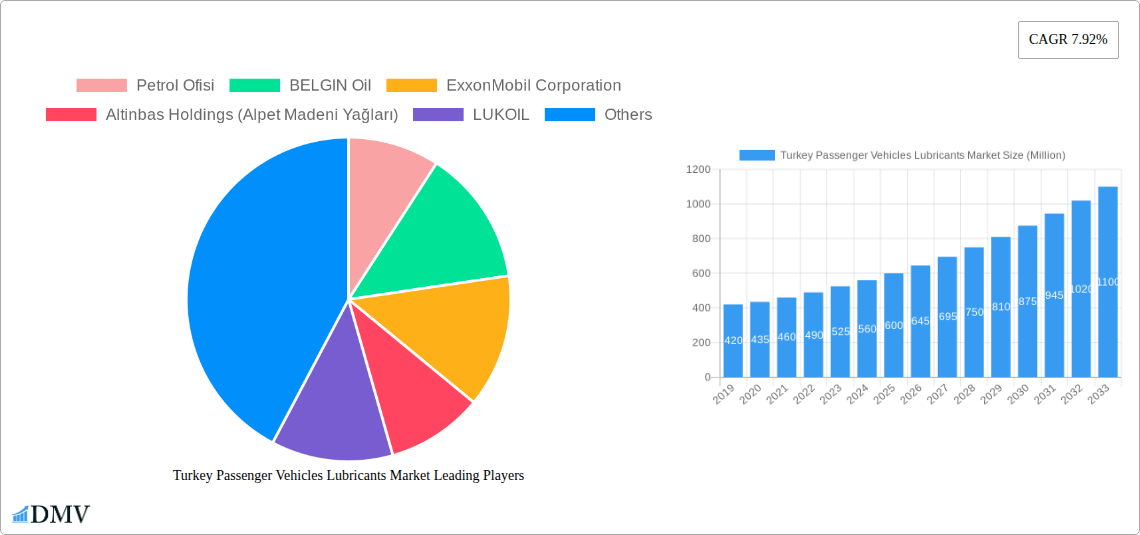

Turkey Passenger Vehicles Lubricants Market Company Market Share

Turkey Passenger Vehicles Lubricants Market Analysis and Forecast (2019-2033)

This comprehensive report offers in-depth insights into the dynamic Turkey passenger vehicles lubricants market. Covering historical data from 2019 to 2024 and a detailed forecast from 2025 to 2033, the analysis explores market structure, industry trends, product innovation, and strategic growth factors. It provides granular data, expert analysis, and actionable intelligence for stakeholders aiming to navigate and capitalize on opportunities within Turkey's expanding automotive sector. This report is an essential resource for understanding the competitive landscape, evolving consumer preferences, and technological advancements shaping the automotive lubricants market in Turkey.

Turkey Passenger Vehicles Lubricants Market Market Composition & Trends

The Turkey passenger vehicles lubricants market exhibits a moderate level of concentration, with a few dominant players vying for market share. Key innovation catalysts include the increasing adoption of advanced engine technologies and the growing demand for high-performance, fuel-efficient lubricants for passenger cars. The regulatory landscape, while evolving, primarily focuses on environmental standards and product quality certifications, influencing the formulation and marketing of automotive engine oils and other lubricant types. Substitute products, though less impactful in the core lubricant segment, are monitored, especially concerning bio-based alternatives. End-user profiles range from individual car owners to large fleet operators, each with distinct needs regarding performance, longevity, and cost-effectiveness. Mergers and acquisitions (M&A) are strategic tools employed by key companies to expand their product portfolios and market reach. For instance, a hypothetical M&A deal value of approximately $50 Million between a local lubricant manufacturer and an international player could significantly alter market share distribution, projected to shift by an estimated 5-10% for involved entities.

- Market Share Distribution: Leading companies like Petrol Ofisi and BELGIN Oil hold significant portions, with international giants such as ExxonMobil Corporation, Altinbas Holdings (Alpet Madeni Yağları), LUKOIL, BP PLC (Castrol), FUCHS, Demiroren (M Oil), TotalEnergie, Royal Dutch Shell PLC, and others comprising the remaining market.

- Innovation Catalysts: Advancements in engine technology, stringent emission norms, and the growing popularity of synthetic engine oils for passenger vehicles are driving innovation.

- Regulatory Landscape: Focus on environmental compliance, API (American Petroleum Institute) and ACEA (European Automobile Manufacturers' Association) standards, and local Turkish regulations.

- End-User Profiles: Individual vehicle owners, automotive workshops, and fleet management companies with diverse purchasing patterns.

- M&A Activities: Strategic consolidations aimed at enhancing product offerings and expanding geographical presence within the Turkish automotive aftermarket.

Turkey Passenger Vehicles Lubricants Market Industry Evolution

The Turkey passenger vehicles lubricants market has undergone a significant transformation driven by a confluence of technological advancements, shifting consumer preferences, and macroeconomic factors. Throughout the historical period (2019-2024), the market witnessed steady growth, fueled by a robust passenger car parc and increasing vehicle utilization. The demand for premium and synthetic engine oils has surged, mirroring global trends towards enhanced engine protection, improved fuel efficiency, and extended drain intervals. Technological evolution in automotive engineering, particularly the widespread adoption of turbocharging, direct injection, and advanced emission control systems, necessitates the use of sophisticated lubricants that can withstand higher operating temperatures and pressures. This has spurred manufacturers to invest heavily in research and development, leading to the introduction of innovative formulations.

The shift towards electric vehicles (EVs), while still in its nascent stages in Turkey, represents a significant future trend that will reshape the lubricant landscape. Initially, EVs require specialized e-fluids for their unique components, including e-gear oils and e-coolants. Companies are proactively developing these specialty lubricants to cater to this emerging segment. Consumer demand is increasingly influenced by factors beyond mere lubrication; performance enhancement, environmental impact, and brand reputation play crucial roles in purchasing decisions. The Turkish automotive aftermarket is becoming more discerning, with consumers actively seeking products that offer superior protection and contribute to vehicle longevity. The average annual growth rate for the engine oil segment in Turkey was approximately 5% during the historical period, a testament to its enduring importance. Adoption metrics for synthetic lubricants have risen by an estimated 15% over the past five years, indicating a clear preference for advanced formulations. The increasing penetration of higher-tier vehicles, which often come factory-filled with synthetic lubricants, further accelerates this trend. Furthermore, government initiatives promoting cleaner automotive technologies and stricter emission standards indirectly bolster the demand for high-quality automotive lubricants that facilitate compliance. The overall market trajectory is positive, with projections indicating continued expansion, driven by fleet growth, replacement demand, and the gradual integration of advanced vehicle technologies.

Leading Regions, Countries, or Segments in Turkey Passenger Vehicles Lubricants Market

Within the Turkey passenger vehicles lubricants market, the Engine Oils segment stands out as the dominant force, consistently capturing the largest market share. This dominance is attributed to the fundamental and continuous need for engine lubrication across the entire passenger vehicle parc, irrespective of powertrain technology. The sheer volume of passenger cars operating on Turkish roads, coupled with regular maintenance schedules, ensures a perpetual demand for high-quality engine oils. Factors contributing to this segment's leadership are manifold. Firstly, the increasing average age of the vehicle fleet in Turkey necessitates more frequent and diligent engine maintenance, including timely oil changes, directly benefiting the engine oil market. Secondly, the growing adoption of advanced engine technologies, such as turbocharging and direct injection, requires more sophisticated synthetic and semi-synthetic engine oils that offer superior protection and performance under demanding conditions. This has led to a higher consumption of premium engine oil formulations.

The regulatory support for stringent emission standards, such as Euro 6 and beyond, indirectly propels the engine oil market. Manufacturers are compelled to develop lubricants that facilitate cleaner combustion and reduce harmful emissions, thus driving innovation and demand for specific engine oil specifications. Investment trends are heavily skewed towards research and development for advanced engine oil formulations that meet these evolving environmental and performance benchmarks. For instance, investments in developing low-viscosity synthetic engine oils designed to improve fuel economy have been substantial. Furthermore, the aftermarket distribution network for engine oils is the most established and widespread across Turkey, ensuring accessibility for consumers in both urban and rural areas. This extensive reach, combined with aggressive marketing by leading brands, solidifies the preeminence of engine oils. While other segments like Transmission & Gear Oils, Hydraulic Fluids, and Greases are integral to vehicle maintenance, their replacement cycles are generally longer, and their application more specialized, thus limiting their overall market volume compared to engine oils. The estimated market share for Engine Oils is approximately 60-65% of the total passenger vehicle lubricants market in Turkey.

- Dominant Segment: Engine Oils

- Key Drivers:

- High volume of passenger cars in Turkey.

- Regular maintenance and replacement cycles.

- Increasing adoption of advanced engine technologies.

- Stringent emission standards driving demand for high-performance lubricants.

- Extensive aftermarket distribution and brand awareness.

- Analysis of Dominance: The fundamental role of engine oil in internal combustion engines, coupled with Turkey's substantial passenger vehicle parc, ensures a consistent and significant demand. The trend towards synthetic and premium engine oils further boosts the value of this segment.

- Key Drivers:

Turkey Passenger Vehicles Lubricants Market Product Innovations

The Turkey passenger vehicles lubricants market is witnessing a wave of product innovations focused on enhancing engine performance, fuel efficiency, and environmental sustainability. Manufacturers are continuously developing advanced synthetic engine oils with specialized additive packages to provide superior wear protection, reduce friction, and maintain optimal engine cleanliness under extreme operating conditions. Innovations extend to greases with improved thermal stability and water resistance for enhanced chassis and bearing lubrication. The emergence of electric vehicles is spurring the development of novel e-fluids, including specialized e-gear oils and e-coolants designed for the unique demands of electric powertrains. Performance metrics such as viscosity index, flash point, pour point, and TBN (Total Base Number) are continually being optimized to meet the increasingly stringent requirements of modern vehicle technologies.

Propelling Factors for Turkey Passenger Vehicles Lubricants Market Growth

The Turkey passenger vehicles lubricants market is propelled by several key factors, including a growing passenger car parc, increasing vehicle utilization, and the demand for enhanced vehicle performance and longevity. Technological advancements in automotive engineering necessitate the use of high-performance synthetic and semi-synthetic lubricants that offer superior protection against wear and tear, improved fuel efficiency, and extended drain intervals. Stringent emission regulations are also a significant driver, pushing manufacturers to develop lubricants that contribute to cleaner combustion and reduced environmental impact. Furthermore, the expanding automotive aftermarket services sector and a growing consumer awareness regarding the importance of regular maintenance play a crucial role in sustaining and driving the demand for quality automotive lubricants.

Obstacles in the Turkey Passenger Vehicles Lubricants Market Market

Despite the positive growth trajectory, the Turkey passenger vehicles lubricants market faces several obstacles. Intense competition among domestic and international players leads to price wars, impacting profit margins. The prevalence of counterfeit and substandard lubricants in the informal market poses a significant threat to genuine product sales and brand reputation. Supply chain disruptions, exacerbated by global economic uncertainties and logistical challenges, can lead to price volatility and availability issues for raw materials and finished products. Furthermore, the gradual shift towards electric vehicles, while an opportunity, also presents a long-term challenge to the traditional engine oil market.

Future Opportunities in Turkey Passenger Vehicles Lubricants Market

The Turkey passenger vehicles lubricants market is ripe with future opportunities. The burgeoning demand for electric vehicles presents a significant opportunity for the development and market penetration of specialized e-fluids, including e-gear oils, e-coolants, and e-greases. The increasing adoption of advanced engine technologies in internal combustion engine vehicles will continue to drive the demand for premium synthetic engine oils and high-performance transmission fluids. Furthermore, there is a growing consumer interest in environmentally friendly and sustainable lubricant options, creating a niche for bio-based and biodegradable products. Expanding the distribution network into underserved regions and focusing on value-added services, such as oil analysis and technical support, can also unlock new growth avenues.

Major Players in the Turkey Passenger Vehicles Lubricants Market Ecosystem

- Petrol Ofisi

- BELGIN Oil

- ExxonMobil Corporation

- Altinbas Holdings (Alpet Madeni Yağları)

- LUKOIL

- BP PLC (Castrol)

- FUCHS

- Demiroren (M Oil)

- TotalEnergie

- Royal Dutch Shell PLC

Key Developments in Turkey Passenger Vehicles Lubricants Market Industry

- September 2021: Total Turkey Pazarlama and Nissan Turkey signed a new arrangement under which Nissan Turkey will deliver Nissan Genuine Engine Oils to its Turkish clients for the next three years. Nissan Genuine Engine Oils are created with the help of TotalEnergies' lubricant expertise.

- March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.

- March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement, with a new focus on clean energy and carbon reduction, to help Hyundai continue its transformation as a Smart Mobility Solution Provider.

Strategic Turkey Passenger Vehicles Lubricants Market Market Forecast

The strategic forecast for the Turkey passenger vehicles lubricants market indicates sustained growth driven by a robust passenger car parc and the ongoing demand for high-performance engine oils and automotive lubricants. The increasing adoption of advanced vehicle technologies will fuel the demand for premium synthetic formulations, while the nascent but growing electric vehicle segment presents a significant opportunity for specialized e-fluids. Companies that focus on product innovation, particularly in the realm of electric mobility and environmentally friendly lubricants, will be well-positioned for future success. Strategic partnerships and a strong aftermarket presence will be crucial for capitalizing on emerging opportunities and navigating the evolving competitive landscape in this dynamic market.

Turkey Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Turkey Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. Turkey

Turkey Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Turkey Passenger Vehicles Lubricants Market

Turkey Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 108% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Environment-friendly Fuel and Raw Material Alternatives; Increasing Demand From Heat and Power Generation Sectors

- 3.3. Market Restrains

- 3.3.1 Problems Associated With Storage

- 3.3.2 Transportation

- 3.3.3 and Application of Pyrolysis Oil

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Petrol Ofisi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BELGIN Oil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Altinbas Holdings (Alpet Madeni Yağları)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LUKOIL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP PLC (Castrol)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FUCHS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Demiroren (M Oil)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Dutch Shell PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petrol Ofisi

List of Figures

- Figure 1: Turkey Passenger Vehicles Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey Passenger Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Turkey Passenger Vehicles Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Turkey Passenger Vehicles Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Turkey Passenger Vehicles Lubricants Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Turkey Passenger Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Turkey Passenger Vehicles Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 7: Turkey Passenger Vehicles Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Turkey Passenger Vehicles Lubricants Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 108%.

2. Which companies are prominent players in the Turkey Passenger Vehicles Lubricants Market?

Key companies in the market include Petrol Ofisi, BELGIN Oil, ExxonMobil Corporation, Altinbas Holdings (Alpet Madeni Yağları), LUKOIL, BP PLC (Castrol), FUCHS, Demiroren (M Oil), TotalEnergie, Royal Dutch Shell PLC.

3. What are the main segments of the Turkey Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Environment-friendly Fuel and Raw Material Alternatives; Increasing Demand From Heat and Power Generation Sectors.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Problems Associated With Storage. Transportation. and Application of Pyrolysis Oil.

8. Can you provide examples of recent developments in the market?

September 2021: Total Turkey Pazarlama and Nissan Turkey signed a new arrangement under which Nissan Turkey will deliver Nissan Genuine Engine Oils to its Turkish clients for the next three years. Nissan Genuine Engine Oils are created with the help of TotalEnergies' lubricant expertise.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement, with a new focus on clean energy and carbon reduction, to help Hyundai continue its transformation as a Smart Mobility Solution Provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Turkey Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence