Key Insights

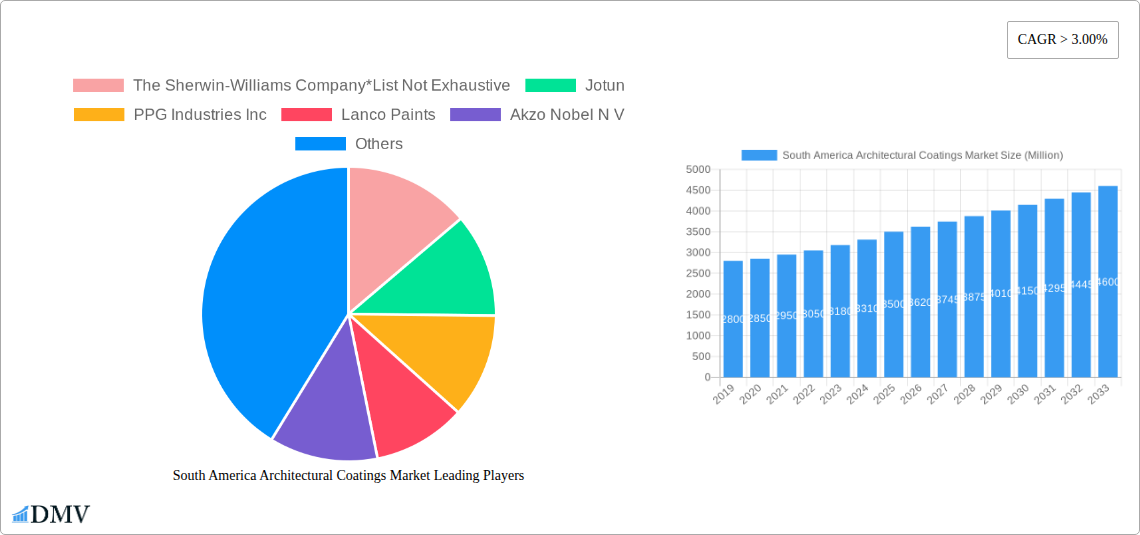

The South America architectural coatings market is projected for substantial growth, anticipated to reach a market size of USD 9,625.71 million by 2024, with a Compound Annual Growth Rate (CAGR) of 3% through 2033. This expansion is driven by increasing urbanization and a rising middle class in key economies such as Brazil, Colombia, and Argentina, fueling the construction sector. Demand for aesthetic and protective finishes in residential and commercial projects is escalating, creating significant opportunities. Growing consumer and professional awareness of high-performance, durable, and eco-friendly coatings further supports market penetration. The DIY segment is also experiencing uplift as homeowners undertake renovation projects.

South America Architectural Coatings Market Market Size (In Billion)

Technological advancements are significantly influencing the market, with a clear trend towards water-borne coatings due to their lower VOC emissions and enhanced sustainability, aligning with environmental regulations and consumer preferences. Vinyl acetate and pure acrylics are leading resin types, offering superior durability, adhesion, and weather resistance suited for South America’s varied climates. While market growth is robust, challenges like fluctuating raw material prices and the presence of unorganized players may pose localized restraints. However, sustained infrastructure investment and rising disposable income are expected to ensure a dynamic future for the South American architectural coatings market.

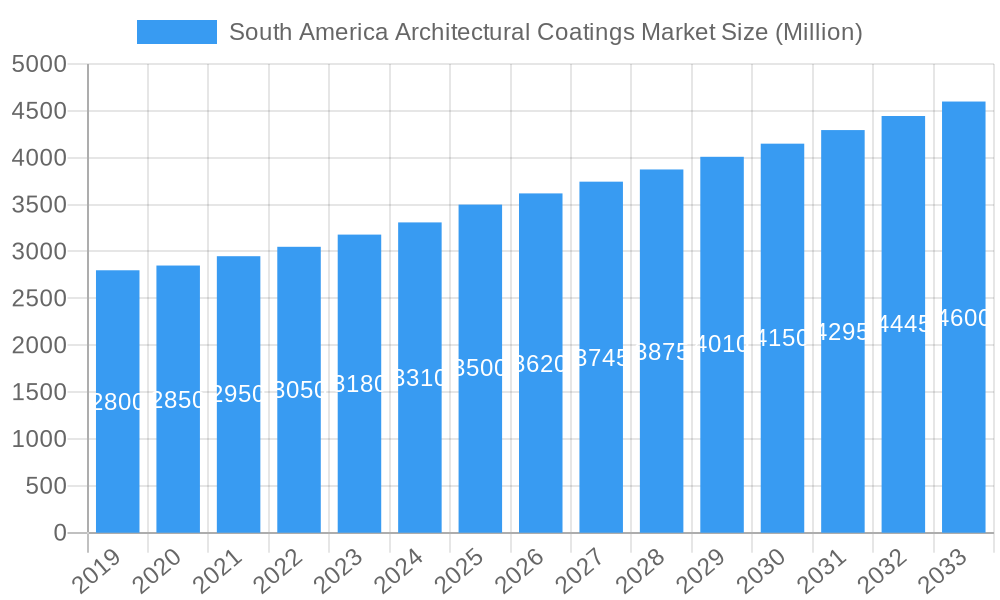

South America Architectural Coatings Market Company Market Share

South America Architectural Coatings Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the South America architectural coatings market, delving into its intricate composition, historical evolution, regional dominance, product innovations, growth catalysts, prevailing obstacles, and promising future opportunities. With a meticulous study period spanning from 2019 to 2033, and a base and estimated year of 2025, this research equips stakeholders with actionable intelligence to navigate and capitalize on this dynamic sector. We meticulously dissect market trends, identify leading players, and forecast market trajectories for the period 2025–2033, building upon historical data from 2019–2024.

South America Architectural Coatings Market Market Composition & Trends

The South America architectural coatings market exhibits a moderately consolidated landscape, with a few key players dominating a significant share. Innovation is primarily driven by the demand for sustainable and high-performance coatings, fueled by increasing environmental consciousness and stricter regulatory frameworks across the region. The regulatory environment, while evolving, emphasizes VOC reduction and the adoption of eco-friendly formulations, influencing product development and market entry strategies. Substitute products, such as wallpapers and decorative panels, present some competition, but the inherent durability, protective qualities, and aesthetic versatility of architectural coatings ensure their continued market relevance. End-user profiles range from large-scale professional contractors and developers focused on commercial and residential projects to the burgeoning do-it-yourself (DIY) segment, seeking ease of application and aesthetic appeal. Mergers and acquisitions (M&A) activity, while not overtly high, plays a crucial role in market consolidation and expansion, allowing larger entities to acquire innovative technologies or gain a stronger foothold in specific geographies. Anticipated M&A deal values in the coming years are projected to be in the range of xx Million, reflecting strategic investments in niche technologies and regional market penetration. Market share distribution is largely influenced by the product portfolios and geographical reach of leading companies, with Brazil often accounting for the largest segment of the market.

South America Architectural Coatings Market Industry Evolution

The South America architectural coatings market has undergone a significant transformation over the historical period (2019–2024) and is poised for substantial growth in the forecast period (2025–2033). Early trends indicate a steady upward trajectory, driven by urbanization, infrastructure development, and a growing emphasis on aesthetic enhancement in both new constructions and renovation projects. The industry has witnessed a pronounced shift towards water-borne coatings, driven by stringent environmental regulations and a growing consumer preference for low-VOC (Volatile Organic Compound) products. This technological evolution has spurred innovation in resin technology, with pure acrylics and styrene acrylics gaining prominence due to their superior durability, weather resistance, and color retention. The adoption of these advanced formulations has directly impacted application trends, with professional applicators increasingly specifying these eco-friendly options for high-end projects.

Consumer demand has also evolved, with a greater appreciation for functional coatings that offer benefits beyond mere aesthetics, such as anti-microbial properties, enhanced insulation, and improved air quality. The DIY segment is experiencing robust growth, fueled by e-commerce accessibility and a desire for personalization in home décor. Market growth rates, estimated to be around 5.5% annually during the forecast period, are underpinned by these intertwined factors. The penetration of advanced resin types like pure acrylics is projected to increase by 15% in the next five years, reflecting their superior performance and growing environmental acceptance. Furthermore, the burgeoning middle class and increasing disposable incomes across key South American nations are contributing to a heightened demand for high-quality, aesthetically pleasing architectural finishes, propelling the overall market expansion. The industry's evolution is a testament to its adaptability, responding effectively to both regulatory pressures and the dynamic needs of its diverse customer base.

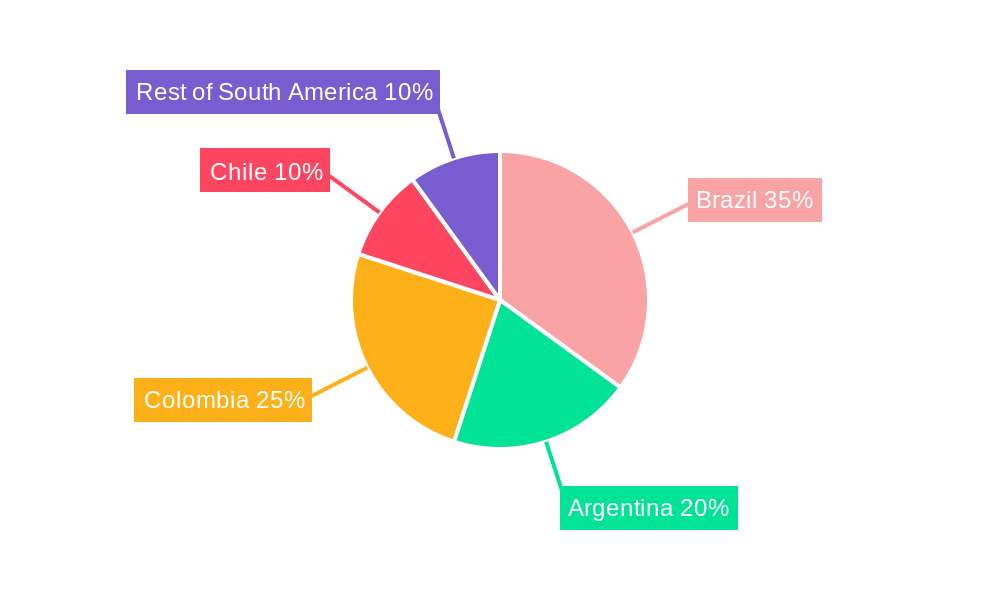

Leading Regions, Countries, or Segments in South America Architectural Coatings Market

Brazil stands out as the undisputed leader in the South America architectural coatings market, driven by its large population, robust construction industry, and significant urbanization trends. The country's substantial infrastructure development projects, coupled with a thriving residential and commercial construction sector, create a consistent demand for a wide array of architectural coatings. Investment trends in Brazil heavily favor sustainable and high-performance materials, aligning perfectly with the growing popularity of water-borne coatings. For instance, government initiatives promoting green building practices and energy efficiency indirectly boost the demand for eco-friendly paint solutions.

- Dominant Region: Brazil commands the largest market share, estimated to be around 40% of the total South American market value. This dominance is attributed to its economic scale and extensive construction activities.

- Key Drivers in Brazil:

- Urbanization and Infrastructure Development: Continuous expansion of cities and significant public infrastructure projects fuel demand for both new construction and renovation coatings.

- Growing Middle Class: Increased disposable income leads to higher spending on home improvement and aesthetic enhancements.

- Regulatory Support for Sustainable Coatings: Evolving environmental regulations are encouraging the adoption of water-borne and low-VOC formulations.

- Technology Dominance: Within Brazil and across South America, Water-borne coatings are progressively overtaking solvent-borne options due to environmental concerns and improved performance characteristics. Their market share is projected to reach 70% by 2030.

- Resin Type Trends: Pure Acrylics and Styrene Acrylics are the leading resin types, offering superior durability, UV resistance, and color fastness, essential for the varied climatic conditions across South America. The adoption of pure acrylics is expected to grow at an impressive CAGR of 6.2% from 2025 to 2033.

- Application Preference: The Professional segment continues to dominate applications, driven by large-scale construction projects. However, the DIY segment is experiencing rapid growth, particularly in urban centers, due to increasing home renovation activities and a growing interest in personalized home décor.

- Construction Sector: Both Commercial and Residential sectors are significant contributors. Commercial construction, encompassing office buildings, retail spaces, and hospitality venues, drives demand for premium and specialized coatings, while the residential sector fuels demand for a broader range of products, from basic paints to decorative finishes.

- Other Key Geographies: While Brazil leads, Colombia and Argentina represent significant emerging markets with substantial growth potential, driven by their own infrastructure development and expanding middle classes. Chile also shows consistent demand, particularly in its well-established construction sector.

South America Architectural Coatings Market Product Innovations

Recent product innovations in the South America architectural coatings market are centered around enhancing sustainability and performance. Manufacturers are increasingly focusing on developing low-VOC and zero-VOC formulations, aligning with global environmental trends and local regulations. Novel binders and additive technologies are enabling coatings with improved durability, faster drying times, and superior resistance to challenging climatic conditions prevalent in South America. Furthermore, the introduction of "smart" coatings with self-cleaning properties, enhanced UV protection, and anti-microbial capabilities is gaining traction, catering to a discerning customer base seeking added value. These advancements not only improve product longevity and aesthetics but also contribute to healthier indoor environments.

Propelling Factors for South America Architectural Coatings Market Growth

The growth of the South America architectural coatings market is propelled by several key factors. A significant driver is the ongoing urbanization and rapid infrastructure development across the continent, leading to increased demand for new construction and renovation projects. This is complemented by a rising disposable income and an expanding middle class, fostering greater investment in home improvement and aesthetically pleasing living spaces. Furthermore, a growing environmental consciousness among consumers and stricter government regulations promoting the use of eco-friendly and low-VOC (Volatile Organic Compound) coatings are accelerating the adoption of sustainable coating technologies. Technological advancements in resin formulations, offering enhanced durability, weather resistance, and aesthetic appeal, also play a crucial role in driving market expansion.

Obstacles in the South America Architectural Coatings Market Market

Despite the positive growth trajectory, the South America architectural coatings market faces several obstacles. Economic volatility and currency fluctuations in some countries can impact construction spending and, consequently, the demand for coatings. Fluctuations in raw material prices, particularly for key components like titanium dioxide and resins, can affect profit margins and lead to price increases, potentially dampening demand. Supply chain disruptions, exacerbated by logistical challenges and geopolitical factors, can lead to delayed deliveries and increased costs. Moreover, intense price competition among market players, especially in the more commoditized segments, can limit profitability. The presence of informal manufacturing sectors and the sale of counterfeit products also pose a challenge to legitimate market participants.

Future Opportunities in South America Architectural Coatings Market

The South America architectural coatings market presents numerous promising future opportunities. The increasing demand for sustainable and bio-based coatings offers a significant avenue for innovation and market differentiation. The growing trend of smart homes and buildings creates opportunities for the development of functional coatings with advanced properties, such as thermal insulation, air purification, and energy efficiency. The expansion of e-commerce platforms provides a direct channel to reach a wider customer base, particularly in the DIY segment, facilitating wider product accessibility. Furthermore, untapped markets within specific regions of South America, coupled with increasing investment in tourism and hospitality infrastructure, present substantial growth prospects for decorative and protective coatings.

Major Players in the South America Architectural Coatings Market Ecosystem

- The Sherwin-Williams Company

- Jotun

- PPG Industries Inc

- Lanco Paints

- Akzo Nobel N V

- BASF

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Axalta Coating Systems Ltd.

- Kansai Paint Co., Ltd.

- Tikkurila OYJ

Key Developments in South America Architectural Coatings Market Industry

- 2023/Q4: Launch of new range of low-VOC water-borne interior paints by [Company Name], focusing on enhanced air quality and durability.

- 2024/Q1: Strategic partnership announced between [Company A] and [Company B] to expand distribution network for architectural coatings in the Andean region.

- 2024/Q2: Introduction of an innovative range of facade coatings with self-cleaning properties by [Company Name] in response to increasing demand for low-maintenance exterior solutions.

- 2024/Q3: Acquisition of a regional specialty coatings manufacturer by [Major Player] to strengthen its product portfolio in industrial and protective architectural applications.

- 2024/Q4: Rollout of an eco-friendly primer series by [Company Name], emphasizing recycled content and reduced environmental impact.

Strategic South America Architectural Coatings Market Market Forecast

The strategic forecast for the South America architectural coatings market indicates a robust growth trajectory, driven by a confluence of favorable economic, demographic, and technological factors. The ongoing urbanization and significant infrastructure investments will continue to fuel demand for both new construction and renovation projects. The increasing consumer preference for sustainable and high-performance products, coupled with evolving regulatory landscapes, will accelerate the adoption of water-borne and eco-friendly coating solutions. Innovations in resin technology and the development of functional coatings will unlock new market segments and cater to the rising demand for value-added products. Market players focusing on product differentiation, expanding distribution networks, and embracing digital strategies are well-positioned to capitalize on the significant opportunities in this dynamic and expanding market.

South America Architectural Coatings Market Segmentation

-

1. Technology

- 1.1. Water-borne

- 1.2. Solvent-borne

-

2. Resin Type

- 2.1. Vinyl Acetate

- 2.2. Pure Acrylics

- 2.3. Acetates

- 2.4. Styrene Acrylics

- 2.5. Alkyd

- 2.6. Other Resin Types

-

3. Application

- 3.1. Professional

- 3.2. DIY

-

4. Construction Sector

- 4.1. Commercial

- 4.2. Residential

-

5. Geography

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Colombia

- 5.4. Chile

- 5.5. Rest of South America

South America Architectural Coatings Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Architectural Coatings Market Regional Market Share

Geographic Coverage of South America Architectural Coatings Market

South America Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Recovering Economy of Brazil and Argentina

- 3.3. Market Restrains

- 3.3.1. ; Rise in Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Rising Demand from Residential Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Water-borne

- 5.1.2. Solvent-borne

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Vinyl Acetate

- 5.2.2. Pure Acrylics

- 5.2.3. Acetates

- 5.2.4. Styrene Acrylics

- 5.2.5. Alkyd

- 5.2.6. Other Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Professional

- 5.3.2. DIY

- 5.4. Market Analysis, Insights and Forecast - by Construction Sector

- 5.4.1. Commercial

- 5.4.2. Residential

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Colombia

- 5.5.4. Chile

- 5.5.5. Rest of South America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Colombia

- 5.6.4. Chile

- 5.6.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Brazil South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Water-borne

- 6.1.2. Solvent-borne

- 6.2. Market Analysis, Insights and Forecast - by Resin Type

- 6.2.1. Vinyl Acetate

- 6.2.2. Pure Acrylics

- 6.2.3. Acetates

- 6.2.4. Styrene Acrylics

- 6.2.5. Alkyd

- 6.2.6. Other Resin Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Professional

- 6.3.2. DIY

- 6.4. Market Analysis, Insights and Forecast - by Construction Sector

- 6.4.1. Commercial

- 6.4.2. Residential

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Brazil

- 6.5.2. Argentina

- 6.5.3. Colombia

- 6.5.4. Chile

- 6.5.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Argentina South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Water-borne

- 7.1.2. Solvent-borne

- 7.2. Market Analysis, Insights and Forecast - by Resin Type

- 7.2.1. Vinyl Acetate

- 7.2.2. Pure Acrylics

- 7.2.3. Acetates

- 7.2.4. Styrene Acrylics

- 7.2.5. Alkyd

- 7.2.6. Other Resin Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Professional

- 7.3.2. DIY

- 7.4. Market Analysis, Insights and Forecast - by Construction Sector

- 7.4.1. Commercial

- 7.4.2. Residential

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Brazil

- 7.5.2. Argentina

- 7.5.3. Colombia

- 7.5.4. Chile

- 7.5.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Colombia South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Water-borne

- 8.1.2. Solvent-borne

- 8.2. Market Analysis, Insights and Forecast - by Resin Type

- 8.2.1. Vinyl Acetate

- 8.2.2. Pure Acrylics

- 8.2.3. Acetates

- 8.2.4. Styrene Acrylics

- 8.2.5. Alkyd

- 8.2.6. Other Resin Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Professional

- 8.3.2. DIY

- 8.4. Market Analysis, Insights and Forecast - by Construction Sector

- 8.4.1. Commercial

- 8.4.2. Residential

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Brazil

- 8.5.2. Argentina

- 8.5.3. Colombia

- 8.5.4. Chile

- 8.5.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Chile South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Water-borne

- 9.1.2. Solvent-borne

- 9.2. Market Analysis, Insights and Forecast - by Resin Type

- 9.2.1. Vinyl Acetate

- 9.2.2. Pure Acrylics

- 9.2.3. Acetates

- 9.2.4. Styrene Acrylics

- 9.2.5. Alkyd

- 9.2.6. Other Resin Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Professional

- 9.3.2. DIY

- 9.4. Market Analysis, Insights and Forecast - by Construction Sector

- 9.4.1. Commercial

- 9.4.2. Residential

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Brazil

- 9.5.2. Argentina

- 9.5.3. Colombia

- 9.5.4. Chile

- 9.5.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of South America South America Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Water-borne

- 10.1.2. Solvent-borne

- 10.2. Market Analysis, Insights and Forecast - by Resin Type

- 10.2.1. Vinyl Acetate

- 10.2.2. Pure Acrylics

- 10.2.3. Acetates

- 10.2.4. Styrene Acrylics

- 10.2.5. Alkyd

- 10.2.6. Other Resin Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Professional

- 10.3.2. DIY

- 10.4. Market Analysis, Insights and Forecast - by Construction Sector

- 10.4.1. Commercial

- 10.4.2. Residential

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. Brazil

- 10.5.2. Argentina

- 10.5.3. Colombia

- 10.5.4. Chile

- 10.5.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jotun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PPG Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lanco Paints

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Akzo Nobel N V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Paint Holdings Co. Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RPM International Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Axalta Coating Systems Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kansai Paint Co. Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tikkurila OYJ

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: South America Architectural Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 3: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 4: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 5: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 7: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 8: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 9: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 11: South America Architectural Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 12: South America Architectural Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 13: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 14: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 15: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 16: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 17: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 19: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 20: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 21: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 23: South America Architectural Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: South America Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 26: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 27: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 28: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 29: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 30: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 31: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 32: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 33: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 34: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 35: South America Architectural Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: South America Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 37: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 38: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 39: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 40: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 41: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 42: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 43: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 44: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 45: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 46: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 47: South America Architectural Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: South America Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 49: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 50: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 51: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 52: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 53: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 54: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 55: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 56: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 57: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 58: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 59: South America Architectural Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 60: South America Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 61: South America Architectural Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 62: South America Architectural Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 63: South America Architectural Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 64: South America Architectural Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 65: South America Architectural Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 66: South America Architectural Coatings Market Volume liter Forecast, by Application 2020 & 2033

- Table 67: South America Architectural Coatings Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 68: South America Architectural Coatings Market Volume liter Forecast, by Construction Sector 2020 & 2033

- Table 69: South America Architectural Coatings Market Revenue million Forecast, by Geography 2020 & 2033

- Table 70: South America Architectural Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 71: South America Architectural Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 72: South America Architectural Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Architectural Coatings Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the South America Architectural Coatings Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Jotun, PPG Industries Inc, Lanco Paints, Akzo Nobel N V, BASF, Nippon Paint Holdings Co., Ltd., RPM International Inc., Axalta Coating Systems Ltd., Kansai Paint Co., Ltd., Tikkurila OYJ.

3. What are the main segments of the South America Architectural Coatings Market?

The market segments include Technology, Resin Type, Application, Construction Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9625.71 million as of 2022.

5. What are some drivers contributing to market growth?

; Recovering Economy of Brazil and Argentina.

6. What are the notable trends driving market growth?

Rising Demand from Residential Construction.

7. Are there any restraints impacting market growth?

; Rise in Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the South America Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence