Key Insights

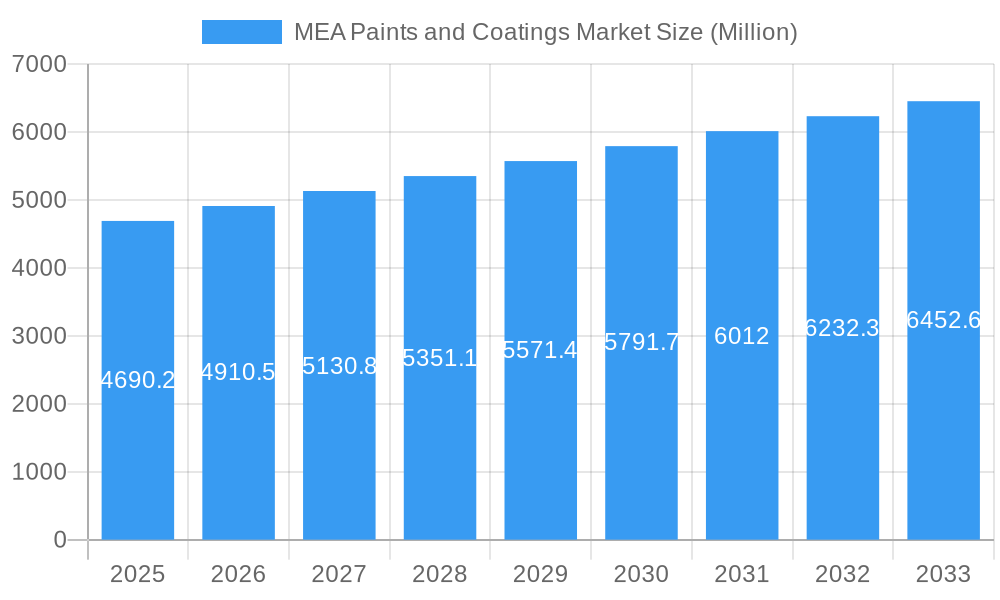

The Middle East and Africa (MEA) paints and coatings market is poised for robust growth, projected to reach an estimated USD 4,690.2 million by 2025. This expansion is driven by a confluence of factors, including significant infrastructure development across the region, a burgeoning construction sector fueled by urbanization and population growth, and increasing demand from the automotive and industrial segments. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.7% from 2025 to 2033, indicating sustained positive momentum. Emerging economies in Africa, particularly Nigeria and South Africa, along with the GCC countries like Saudi Arabia and the UAE, are anticipated to be key contributors to this growth due to ongoing mega-projects and rising disposable incomes. Furthermore, the increasing preference for eco-friendly and sustainable solutions is steering the market towards water-borne and radiation-cure technologies, reflecting a global trend towards environmental consciousness.

MEA Paints and Coatings Market Market Size (In Billion)

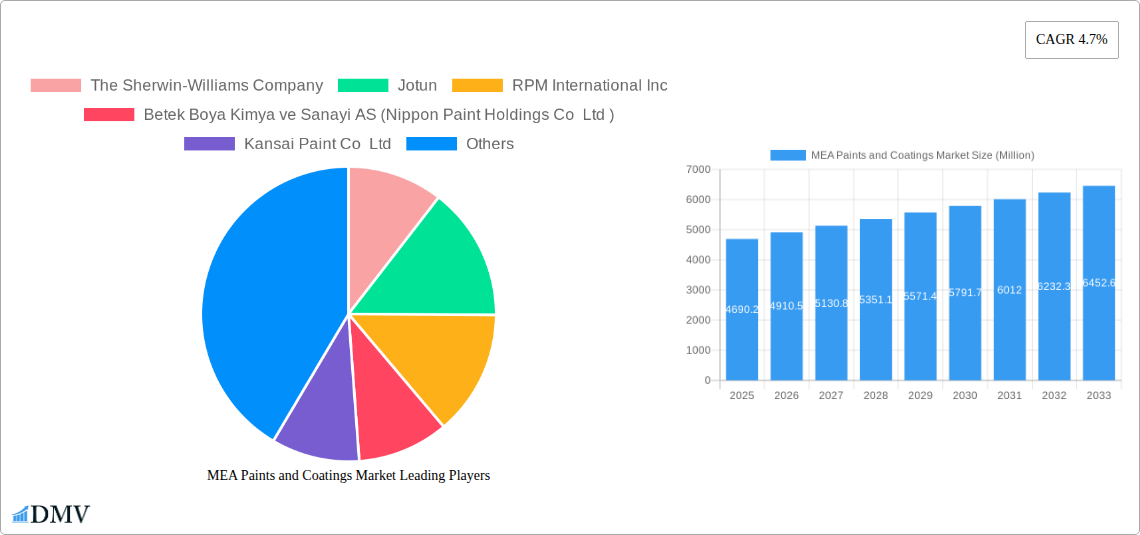

The competitive landscape is characterized by the presence of both global giants and strong regional players, including The Sherwin-Williams Company, Jotun, Akzo Nobel NV, and PPG Industries Inc, alongside established local brands like Jazeera Paints and Asian Paints BERGER. These companies are actively investing in research and development to innovate product offerings and expand their market reach. Key trends influencing the market include the adoption of advanced coating technologies for enhanced durability, corrosion resistance, and aesthetic appeal, particularly in harsh environmental conditions prevalent in parts of the MEA region. While the market presents significant opportunities, challenges such as fluctuating raw material prices, intense competition, and evolving regulatory landscapes related to VOC emissions, will require strategic navigation by market participants. The dominance of acrylic and epoxy resin types, coupled with the growing adoption of water-borne coatings, underscores the evolving preferences within the MEA paints and coatings industry.

MEA Paints and Coatings Market Company Market Share

This in-depth report delivers an exhaustive analysis of the Middle East and Africa (MEA) Paints and Coatings Market, providing critical insights into market dynamics, growth trajectories, and future potential. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. We dissect the market by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Other Resin Types), Technology (Water-borne, Solvent-borne, Radiation Cure, Other Technologies), and End-user Industry (Architectural, Automotive, Wood, Industrial, Other End-user Industries). Geographically, the analysis spans key markets including Saudi Arabia, Qatar, Kuwait, United Arab Emirates, Iran, Iraq, Nigeria, South Africa, Turkey, Tanzania, Kenya, Algeria, Morocco, Egypt, and the Rest of Middle-East and Africa.

MEA Paints and Coatings Market Market Composition & Trends

The MEA paints and coatings market is characterized by a moderately concentrated landscape, with a mix of global giants and strong regional players vying for market share. Innovation catalysts are primarily driven by a burgeoning demand for sustainable and high-performance coatings, fueled by significant infrastructure development and increasing consumer awareness regarding environmental impact. Regulatory landscapes, while evolving, are increasingly focused on VOC reduction and product safety, influencing technology adoption towards water-borne and low-VOC formulations. Substitute products, though present in specific niche applications, generally struggle to match the comprehensive performance and aesthetic benefits offered by advanced paint and coating solutions. End-user profiles are diverse, ranging from large-scale construction projects to individual homeowners and specialized industrial applications. Mergers and acquisitions (M&A) activity, valued in the hundreds of millions, is a key trend, enabling companies to expand their geographic reach, technological capabilities, and product portfolios. For instance, the PPG Industries Inc. acquisition of Arsonsisi's Powder Coatings Manufacturing Business signals a strategic move to bolster its EMEA powder coatings presence, a segment witnessing robust growth in specialty finishes.

MEA Paints and Coatings Market Industry Evolution

The MEA paints and coatings industry has witnessed a remarkable evolution, driven by robust economic growth, substantial investments in infrastructure, and a growing urbanization trend across the region. From 2019 to the estimated year 2025, the market has experienced consistent expansion, with projected Compound Annual Growth Rates (CAGRs) in the range of 4% to 6%. This growth is underpinned by a significant increase in construction activities, particularly in the GCC countries, for residential, commercial, and industrial projects. The architectural segment, constituting approximately 55% to 60% of the market share, remains the dominant end-user industry. Technological advancements are a pivotal factor in this evolution. The shift towards water-borne coatings has accelerated, driven by stringent environmental regulations and a growing preference for eco-friendly products. Adoption rates for water-borne technologies have risen from around 30% in 2019 to an estimated 45% by 2025, displacing traditional solvent-borne alternatives in numerous applications. Radiation-cure technologies are also gaining traction in specialized industrial segments, offering faster curing times and enhanced durability. Consumer demands are increasingly sophisticated, with a greater emphasis on aesthetic appeal, durability, and specialized functionalities like anti-microbial coatings, heat-reflective paints, and low-VOC formulations. The automotive and industrial coatings sectors are also witnessing steady growth, supported by increasing vehicle production and manufacturing output in key economies. The competitive landscape is dynamic, with both global players like Akzo Nobel NV, The Sherwin-Williams Company, and PPG Industries Inc., alongside strong regional manufacturers such as Jazeera Paints and Asian Paints BERGER, continuously innovating and expanding their market presence.

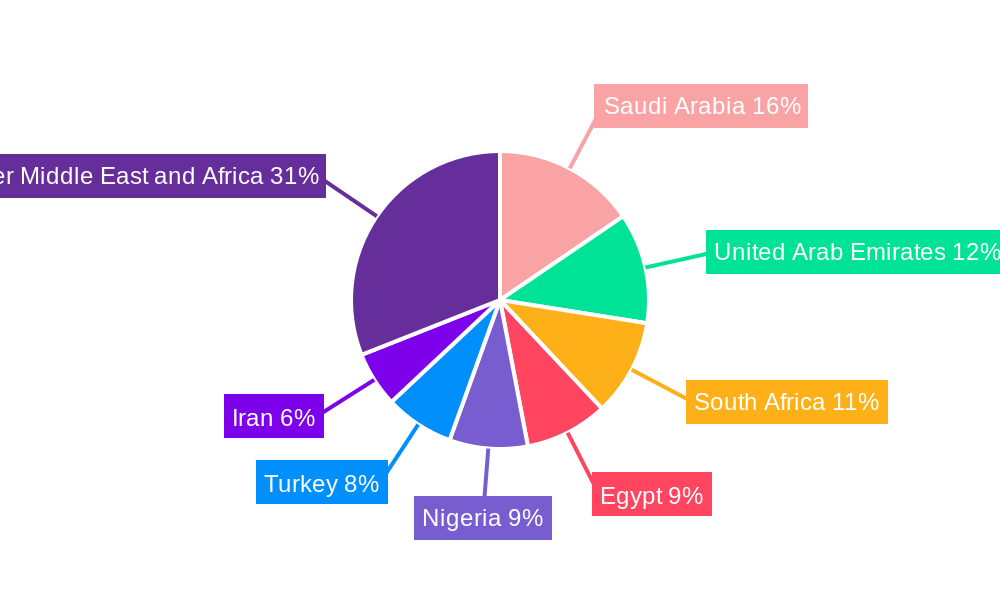

Leading Regions, Countries, or Segments in MEA Paints and Coatings Market

The United Arab Emirates (UAE) stands as a leading market within the MEA paints and coatings landscape, driven by its robust infrastructure development, burgeoning tourism sector, and a sustained demand for high-quality architectural and industrial coatings. Its strategic location and progressive economic policies foster a conducive environment for investment and growth. Within the UAE, the architectural segment is overwhelmingly dominant, accounting for over 65% of the local paints and coatings market. This is fueled by continuous new construction, extensive renovation projects, and a growing expatriate population that drives demand for diverse aesthetic and functional finishes.

Key Drivers for Dominance:

- Mega-Infrastructure Projects: Ongoing and planned mega-projects, including commercial complexes, residential towers, and urban developments, consistently require vast quantities of architectural coatings, driving volume and value. For example, significant investments in smart city initiatives and tourism infrastructure create a perpetual demand for sophisticated paint solutions.

- Regulatory Support and Sustainability Focus: The UAE has been proactive in implementing regulations that favor environmentally friendly coatings, such as those with low Volatile Organic Compounds (VOCs) and water-borne technologies. This has spurred innovation and adoption of advanced coating solutions, aligning with global sustainability trends. Investment trends show a clear inclination towards manufacturers offering certified eco-friendly products.

- Disposable Income and Consumer Preferences: A high disposable income and a sophisticated consumer base in the UAE translate into a demand for premium and specialized paints that offer enhanced aesthetics, durability, and unique functionalities. Consumers are willing to invest in coatings that provide long-term value and contribute to property aesthetics.

- Technological Advancements and Product Innovation: The presence of leading global and regional paint manufacturers in the UAE fosters a competitive environment that drives product innovation. Technologies like water-borne coatings are widely adopted, with market penetration estimated to be over 50% in the architectural segment. Acrylic resins are the most prevalent resin type due to their versatility and performance in architectural applications.

- Industrial Growth: Beyond architecture, the UAE's expanding industrial sector, including manufacturing, oil and gas, and marine industries, creates significant demand for protective and specialized industrial coatings. This diversifies the market beyond purely construction-related applications.

The Saudi Arabia market is also a significant contributor, driven by the ambitious Vision 2030 initiatives, which involve substantial investments in infrastructure, tourism, and residential development, further bolstering the architectural coatings segment. Turkey represents another critical hub, benefiting from its large population, diversified industrial base, and strategic geographical position connecting Europe and Asia. Nigeria and South Africa are pivotal in the African sub-region, with growing populations and increasing urbanization driving demand for construction and industrial coatings.

MEA Paints and Coatings Market Product Innovations

Product innovation in the MEA paints and coatings market is increasingly focused on enhancing performance, sustainability, and user experience. Leading companies are developing advanced formulations such as anti-microbial coatings for healthcare and residential settings, heat-reflective paints to combat extreme climates and reduce energy consumption, and self-cleaning coatings that minimize maintenance. The adoption of water-borne technologies is a prime example of innovation, offering reduced VOC emissions without compromising on durability or finish. Furthermore, advancements in UV-curable coatings are enabling faster application and enhanced scratch resistance for wood and industrial applications. These innovations, coupled with a wider spectrum of color palettes and special effect finishes, cater to the evolving demands of the construction, automotive, and industrial sectors.

Propelling Factors for MEA Paints and Coatings Market Growth

Several key factors are propelling the growth of the MEA paints and coatings market. Significant government investments in infrastructure development and smart city initiatives across the region, particularly in the UAE and Saudi Arabia, are driving demand for architectural and protective coatings. The increasing urbanization and rising disposable incomes, especially in emerging economies like Nigeria and Egypt, are boosting demand for residential and commercial construction, consequently increasing paint consumption. Furthermore, a growing environmental consciousness and stricter regulations regarding VOC emissions are accelerating the adoption of eco-friendly water-borne coatings and sustainable technologies. The expansion of manufacturing and automotive industries also contributes to the demand for specialized industrial and automotive coatings.

Obstacles in the MEA Paints and Coatings Market Market

Despite the robust growth, the MEA paints and coatings market faces several obstacles. Fluctuations in raw material prices, particularly those linked to petrochemicals, can impact manufacturing costs and profitability. Supply chain disruptions, exacerbated by geopolitical instability and logistical challenges in certain regions, can hinder timely delivery and increase operational expenses. Stringent and sometimes inconsistent regulatory frameworks across different countries can pose compliance challenges for manufacturers. Intense competition from both global and local players can lead to price wars and pressure on profit margins. Furthermore, the reliance on traditional solvent-borne coatings in certain applications and regions, due to cost considerations or established practices, can slow down the transition to more sustainable alternatives.

Future Opportunities in MEA Paints and Coatings Market

The MEA paints and coatings market is ripe with future opportunities. The ongoing infrastructure boom in countries like Saudi Arabia, with projects like NEOM, presents immense potential for architectural and specialty coatings. The growing middle class and increasing urbanization in African nations such as Nigeria, Egypt, and Kenya will continue to fuel demand for residential and commercial construction paints. The expansion of the automotive manufacturing sector in countries like Morocco and Turkey offers significant prospects for automotive coatings. Furthermore, the increasing demand for sustainable and eco-friendly products will create opportunities for manufacturers investing in R&D for water-borne coatings, bio-based paints, and low-VOC formulations. The development of smart coatings with advanced functionalities like self-healing and anti-corrosion properties also represents a significant untapped market.

Major Players in the MEA Paints and Coatings Market Ecosystem

- The Sherwin-Williams Company

- Jotun

- RPM International Inc

- Betek Boya Kimya ve Sanayi AS (Nippon Paint Holdings Co Ltd )

- Kansai Paint Co Ltd

- Akzo Nobel NV

- Jazeera Paints

- Asian Paints BERGER

- PPG Industries Inc

- Crown Paints Kenya PLC

- Scib Paints

- Beckers Group

- BASF SE

- PACHIN

- Terraco Holdings Limited

- Thermilate Middle East

- Basco Paints

- DAW SE (Caparol)

- ATLAS Peintures

- Hempel AS

- National Paint Factories Co Ltd

- Saba Shimi Aria

- Wacker Chemie AG

- Al-Tabieaa Company

Key Developments in MEA Paints and Coatings Market Industry

- August 2022: Jazeera Paints opened its sixth showroom in Iraq, expanding its reach for high-quality paints and construction solutions in the region.

- February 2022: PPG agreed to buy Arsonsisi's Powder Coatings Manufacturing Business, aiming to enhance its powder coatings offering in EMEA, particularly in metallic bonding for automotive and industrial applications.

Strategic MEA Paints and Coatings Market Market Forecast

The MEA paints and coatings market is poised for sustained growth driven by a confluence of factors, including aggressive infrastructure development, rapid urbanization, and a growing demand for sustainable solutions. The forecast period (2025-2033) anticipates a continued shift towards advanced technologies like water-borne coatings, with increasing market penetration across various end-user industries. Government initiatives aimed at economic diversification and housing development in key countries will act as significant growth catalysts. Opportunities in emerging African markets, coupled with the increasing adoption of smart and functional coatings, present substantial avenues for market expansion. Strategic investments in R&D for eco-friendly products and a focus on expanding distribution networks will be crucial for players aiming to capture market share in this dynamic and promising region.

MEA Paints and Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Radiation Cure

- 2.4. Other Technologies

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Industrial

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. Qatar

- 4.3. Kuwait

- 4.4. United Arab Emirates

- 4.5. Iran

- 4.6. Iraq

- 4.7. Nigeria

- 4.8. South Africa

- 4.9. Turkey

- 4.10. Tanzania

- 4.11. Kenya

- 4.12. Algeria

- 4.13. Morocco

- 4.14. Egypt

- 4.15. Rest of Middle-East and Africa

MEA Paints and Coatings Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Kuwait

- 4. United Arab Emirates

- 5. Iran

- 6. Iraq

- 7. Nigeria

- 8. South Africa

- 9. Turkey

- 10. Tanzania

- 11. Kenya

- 12. Algeria

- 13. Morocco

- 14. Egypt

- 15. Rest of Middle East and Africa

MEA Paints and Coatings Market Regional Market Share

Geographic Coverage of MEA Paints and Coatings Market

MEA Paints and Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Tourism and Construction in the Middle-East; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Slowdown in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Architectural Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Radiation Cure

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. Qatar

- 5.4.3. Kuwait

- 5.4.4. United Arab Emirates

- 5.4.5. Iran

- 5.4.6. Iraq

- 5.4.7. Nigeria

- 5.4.8. South Africa

- 5.4.9. Turkey

- 5.4.10. Tanzania

- 5.4.11. Kenya

- 5.4.12. Algeria

- 5.4.13. Morocco

- 5.4.14. Egypt

- 5.4.15. Rest of Middle-East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. Qatar

- 5.5.3. Kuwait

- 5.5.4. United Arab Emirates

- 5.5.5. Iran

- 5.5.6. Iraq

- 5.5.7. Nigeria

- 5.5.8. South Africa

- 5.5.9. Turkey

- 5.5.10. Tanzania

- 5.5.11. Kenya

- 5.5.12. Algeria

- 5.5.13. Morocco

- 5.5.14. Egypt

- 5.5.15. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Saudi Arabia MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Acrylic

- 6.1.2. Alkyd

- 6.1.3. Polyurethane

- 6.1.4. Epoxy

- 6.1.5. Polyester

- 6.1.6. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-borne

- 6.2.2. Solvent-borne

- 6.2.3. Radiation Cure

- 6.2.4. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Architectural

- 6.3.2. Automotive

- 6.3.3. Wood

- 6.3.4. Industrial

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. Qatar

- 6.4.3. Kuwait

- 6.4.4. United Arab Emirates

- 6.4.5. Iran

- 6.4.6. Iraq

- 6.4.7. Nigeria

- 6.4.8. South Africa

- 6.4.9. Turkey

- 6.4.10. Tanzania

- 6.4.11. Kenya

- 6.4.12. Algeria

- 6.4.13. Morocco

- 6.4.14. Egypt

- 6.4.15. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Qatar MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Acrylic

- 7.1.2. Alkyd

- 7.1.3. Polyurethane

- 7.1.4. Epoxy

- 7.1.5. Polyester

- 7.1.6. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-borne

- 7.2.2. Solvent-borne

- 7.2.3. Radiation Cure

- 7.2.4. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Architectural

- 7.3.2. Automotive

- 7.3.3. Wood

- 7.3.4. Industrial

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. Qatar

- 7.4.3. Kuwait

- 7.4.4. United Arab Emirates

- 7.4.5. Iran

- 7.4.6. Iraq

- 7.4.7. Nigeria

- 7.4.8. South Africa

- 7.4.9. Turkey

- 7.4.10. Tanzania

- 7.4.11. Kenya

- 7.4.12. Algeria

- 7.4.13. Morocco

- 7.4.14. Egypt

- 7.4.15. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Kuwait MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Acrylic

- 8.1.2. Alkyd

- 8.1.3. Polyurethane

- 8.1.4. Epoxy

- 8.1.5. Polyester

- 8.1.6. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-borne

- 8.2.2. Solvent-borne

- 8.2.3. Radiation Cure

- 8.2.4. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Architectural

- 8.3.2. Automotive

- 8.3.3. Wood

- 8.3.4. Industrial

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. Qatar

- 8.4.3. Kuwait

- 8.4.4. United Arab Emirates

- 8.4.5. Iran

- 8.4.6. Iraq

- 8.4.7. Nigeria

- 8.4.8. South Africa

- 8.4.9. Turkey

- 8.4.10. Tanzania

- 8.4.11. Kenya

- 8.4.12. Algeria

- 8.4.13. Morocco

- 8.4.14. Egypt

- 8.4.15. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. United Arab Emirates MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Acrylic

- 9.1.2. Alkyd

- 9.1.3. Polyurethane

- 9.1.4. Epoxy

- 9.1.5. Polyester

- 9.1.6. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water-borne

- 9.2.2. Solvent-borne

- 9.2.3. Radiation Cure

- 9.2.4. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Architectural

- 9.3.2. Automotive

- 9.3.3. Wood

- 9.3.4. Industrial

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. Qatar

- 9.4.3. Kuwait

- 9.4.4. United Arab Emirates

- 9.4.5. Iran

- 9.4.6. Iraq

- 9.4.7. Nigeria

- 9.4.8. South Africa

- 9.4.9. Turkey

- 9.4.10. Tanzania

- 9.4.11. Kenya

- 9.4.12. Algeria

- 9.4.13. Morocco

- 9.4.14. Egypt

- 9.4.15. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Iran MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Acrylic

- 10.1.2. Alkyd

- 10.1.3. Polyurethane

- 10.1.4. Epoxy

- 10.1.5. Polyester

- 10.1.6. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water-borne

- 10.2.2. Solvent-borne

- 10.2.3. Radiation Cure

- 10.2.4. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Architectural

- 10.3.2. Automotive

- 10.3.3. Wood

- 10.3.4. Industrial

- 10.3.5. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. Qatar

- 10.4.3. Kuwait

- 10.4.4. United Arab Emirates

- 10.4.5. Iran

- 10.4.6. Iraq

- 10.4.7. Nigeria

- 10.4.8. South Africa

- 10.4.9. Turkey

- 10.4.10. Tanzania

- 10.4.11. Kenya

- 10.4.12. Algeria

- 10.4.13. Morocco

- 10.4.14. Egypt

- 10.4.15. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Iraq MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 11.1.1. Acrylic

- 11.1.2. Alkyd

- 11.1.3. Polyurethane

- 11.1.4. Epoxy

- 11.1.5. Polyester

- 11.1.6. Other Resin Types

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Water-borne

- 11.2.2. Solvent-borne

- 11.2.3. Radiation Cure

- 11.2.4. Other Technologies

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Architectural

- 11.3.2. Automotive

- 11.3.3. Wood

- 11.3.4. Industrial

- 11.3.5. Other End-user Industries

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Saudi Arabia

- 11.4.2. Qatar

- 11.4.3. Kuwait

- 11.4.4. United Arab Emirates

- 11.4.5. Iran

- 11.4.6. Iraq

- 11.4.7. Nigeria

- 11.4.8. South Africa

- 11.4.9. Turkey

- 11.4.10. Tanzania

- 11.4.11. Kenya

- 11.4.12. Algeria

- 11.4.13. Morocco

- 11.4.14. Egypt

- 11.4.15. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 12. Nigeria MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 12.1.1. Acrylic

- 12.1.2. Alkyd

- 12.1.3. Polyurethane

- 12.1.4. Epoxy

- 12.1.5. Polyester

- 12.1.6. Other Resin Types

- 12.2. Market Analysis, Insights and Forecast - by Technology

- 12.2.1. Water-borne

- 12.2.2. Solvent-borne

- 12.2.3. Radiation Cure

- 12.2.4. Other Technologies

- 12.3. Market Analysis, Insights and Forecast - by End-user Industry

- 12.3.1. Architectural

- 12.3.2. Automotive

- 12.3.3. Wood

- 12.3.4. Industrial

- 12.3.5. Other End-user Industries

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Saudi Arabia

- 12.4.2. Qatar

- 12.4.3. Kuwait

- 12.4.4. United Arab Emirates

- 12.4.5. Iran

- 12.4.6. Iraq

- 12.4.7. Nigeria

- 12.4.8. South Africa

- 12.4.9. Turkey

- 12.4.10. Tanzania

- 12.4.11. Kenya

- 12.4.12. Algeria

- 12.4.13. Morocco

- 12.4.14. Egypt

- 12.4.15. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 13. South Africa MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Resin Type

- 13.1.1. Acrylic

- 13.1.2. Alkyd

- 13.1.3. Polyurethane

- 13.1.4. Epoxy

- 13.1.5. Polyester

- 13.1.6. Other Resin Types

- 13.2. Market Analysis, Insights and Forecast - by Technology

- 13.2.1. Water-borne

- 13.2.2. Solvent-borne

- 13.2.3. Radiation Cure

- 13.2.4. Other Technologies

- 13.3. Market Analysis, Insights and Forecast - by End-user Industry

- 13.3.1. Architectural

- 13.3.2. Automotive

- 13.3.3. Wood

- 13.3.4. Industrial

- 13.3.5. Other End-user Industries

- 13.4. Market Analysis, Insights and Forecast - by Geography

- 13.4.1. Saudi Arabia

- 13.4.2. Qatar

- 13.4.3. Kuwait

- 13.4.4. United Arab Emirates

- 13.4.5. Iran

- 13.4.6. Iraq

- 13.4.7. Nigeria

- 13.4.8. South Africa

- 13.4.9. Turkey

- 13.4.10. Tanzania

- 13.4.11. Kenya

- 13.4.12. Algeria

- 13.4.13. Morocco

- 13.4.14. Egypt

- 13.4.15. Rest of Middle-East and Africa

- 13.1. Market Analysis, Insights and Forecast - by Resin Type

- 14. Turkey MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Resin Type

- 14.1.1. Acrylic

- 14.1.2. Alkyd

- 14.1.3. Polyurethane

- 14.1.4. Epoxy

- 14.1.5. Polyester

- 14.1.6. Other Resin Types

- 14.2. Market Analysis, Insights and Forecast - by Technology

- 14.2.1. Water-borne

- 14.2.2. Solvent-borne

- 14.2.3. Radiation Cure

- 14.2.4. Other Technologies

- 14.3. Market Analysis, Insights and Forecast - by End-user Industry

- 14.3.1. Architectural

- 14.3.2. Automotive

- 14.3.3. Wood

- 14.3.4. Industrial

- 14.3.5. Other End-user Industries

- 14.4. Market Analysis, Insights and Forecast - by Geography

- 14.4.1. Saudi Arabia

- 14.4.2. Qatar

- 14.4.3. Kuwait

- 14.4.4. United Arab Emirates

- 14.4.5. Iran

- 14.4.6. Iraq

- 14.4.7. Nigeria

- 14.4.8. South Africa

- 14.4.9. Turkey

- 14.4.10. Tanzania

- 14.4.11. Kenya

- 14.4.12. Algeria

- 14.4.13. Morocco

- 14.4.14. Egypt

- 14.4.15. Rest of Middle-East and Africa

- 14.1. Market Analysis, Insights and Forecast - by Resin Type

- 15. Tanzania MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Resin Type

- 15.1.1. Acrylic

- 15.1.2. Alkyd

- 15.1.3. Polyurethane

- 15.1.4. Epoxy

- 15.1.5. Polyester

- 15.1.6. Other Resin Types

- 15.2. Market Analysis, Insights and Forecast - by Technology

- 15.2.1. Water-borne

- 15.2.2. Solvent-borne

- 15.2.3. Radiation Cure

- 15.2.4. Other Technologies

- 15.3. Market Analysis, Insights and Forecast - by End-user Industry

- 15.3.1. Architectural

- 15.3.2. Automotive

- 15.3.3. Wood

- 15.3.4. Industrial

- 15.3.5. Other End-user Industries

- 15.4. Market Analysis, Insights and Forecast - by Geography

- 15.4.1. Saudi Arabia

- 15.4.2. Qatar

- 15.4.3. Kuwait

- 15.4.4. United Arab Emirates

- 15.4.5. Iran

- 15.4.6. Iraq

- 15.4.7. Nigeria

- 15.4.8. South Africa

- 15.4.9. Turkey

- 15.4.10. Tanzania

- 15.4.11. Kenya

- 15.4.12. Algeria

- 15.4.13. Morocco

- 15.4.14. Egypt

- 15.4.15. Rest of Middle-East and Africa

- 15.1. Market Analysis, Insights and Forecast - by Resin Type

- 16. Kenya MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Resin Type

- 16.1.1. Acrylic

- 16.1.2. Alkyd

- 16.1.3. Polyurethane

- 16.1.4. Epoxy

- 16.1.5. Polyester

- 16.1.6. Other Resin Types

- 16.2. Market Analysis, Insights and Forecast - by Technology

- 16.2.1. Water-borne

- 16.2.2. Solvent-borne

- 16.2.3. Radiation Cure

- 16.2.4. Other Technologies

- 16.3. Market Analysis, Insights and Forecast - by End-user Industry

- 16.3.1. Architectural

- 16.3.2. Automotive

- 16.3.3. Wood

- 16.3.4. Industrial

- 16.3.5. Other End-user Industries

- 16.4. Market Analysis, Insights and Forecast - by Geography

- 16.4.1. Saudi Arabia

- 16.4.2. Qatar

- 16.4.3. Kuwait

- 16.4.4. United Arab Emirates

- 16.4.5. Iran

- 16.4.6. Iraq

- 16.4.7. Nigeria

- 16.4.8. South Africa

- 16.4.9. Turkey

- 16.4.10. Tanzania

- 16.4.11. Kenya

- 16.4.12. Algeria

- 16.4.13. Morocco

- 16.4.14. Egypt

- 16.4.15. Rest of Middle-East and Africa

- 16.1. Market Analysis, Insights and Forecast - by Resin Type

- 17. Algeria MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - by Resin Type

- 17.1.1. Acrylic

- 17.1.2. Alkyd

- 17.1.3. Polyurethane

- 17.1.4. Epoxy

- 17.1.5. Polyester

- 17.1.6. Other Resin Types

- 17.2. Market Analysis, Insights and Forecast - by Technology

- 17.2.1. Water-borne

- 17.2.2. Solvent-borne

- 17.2.3. Radiation Cure

- 17.2.4. Other Technologies

- 17.3. Market Analysis, Insights and Forecast - by End-user Industry

- 17.3.1. Architectural

- 17.3.2. Automotive

- 17.3.3. Wood

- 17.3.4. Industrial

- 17.3.5. Other End-user Industries

- 17.4. Market Analysis, Insights and Forecast - by Geography

- 17.4.1. Saudi Arabia

- 17.4.2. Qatar

- 17.4.3. Kuwait

- 17.4.4. United Arab Emirates

- 17.4.5. Iran

- 17.4.6. Iraq

- 17.4.7. Nigeria

- 17.4.8. South Africa

- 17.4.9. Turkey

- 17.4.10. Tanzania

- 17.4.11. Kenya

- 17.4.12. Algeria

- 17.4.13. Morocco

- 17.4.14. Egypt

- 17.4.15. Rest of Middle-East and Africa

- 17.1. Market Analysis, Insights and Forecast - by Resin Type

- 18. Morocco MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 18.1. Market Analysis, Insights and Forecast - by Resin Type

- 18.1.1. Acrylic

- 18.1.2. Alkyd

- 18.1.3. Polyurethane

- 18.1.4. Epoxy

- 18.1.5. Polyester

- 18.1.6. Other Resin Types

- 18.2. Market Analysis, Insights and Forecast - by Technology

- 18.2.1. Water-borne

- 18.2.2. Solvent-borne

- 18.2.3. Radiation Cure

- 18.2.4. Other Technologies

- 18.3. Market Analysis, Insights and Forecast - by End-user Industry

- 18.3.1. Architectural

- 18.3.2. Automotive

- 18.3.3. Wood

- 18.3.4. Industrial

- 18.3.5. Other End-user Industries

- 18.4. Market Analysis, Insights and Forecast - by Geography

- 18.4.1. Saudi Arabia

- 18.4.2. Qatar

- 18.4.3. Kuwait

- 18.4.4. United Arab Emirates

- 18.4.5. Iran

- 18.4.6. Iraq

- 18.4.7. Nigeria

- 18.4.8. South Africa

- 18.4.9. Turkey

- 18.4.10. Tanzania

- 18.4.11. Kenya

- 18.4.12. Algeria

- 18.4.13. Morocco

- 18.4.14. Egypt

- 18.4.15. Rest of Middle-East and Africa

- 18.1. Market Analysis, Insights and Forecast - by Resin Type

- 19. Egypt MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 19.1. Market Analysis, Insights and Forecast - by Resin Type

- 19.1.1. Acrylic

- 19.1.2. Alkyd

- 19.1.3. Polyurethane

- 19.1.4. Epoxy

- 19.1.5. Polyester

- 19.1.6. Other Resin Types

- 19.2. Market Analysis, Insights and Forecast - by Technology

- 19.2.1. Water-borne

- 19.2.2. Solvent-borne

- 19.2.3. Radiation Cure

- 19.2.4. Other Technologies

- 19.3. Market Analysis, Insights and Forecast - by End-user Industry

- 19.3.1. Architectural

- 19.3.2. Automotive

- 19.3.3. Wood

- 19.3.4. Industrial

- 19.3.5. Other End-user Industries

- 19.4. Market Analysis, Insights and Forecast - by Geography

- 19.4.1. Saudi Arabia

- 19.4.2. Qatar

- 19.4.3. Kuwait

- 19.4.4. United Arab Emirates

- 19.4.5. Iran

- 19.4.6. Iraq

- 19.4.7. Nigeria

- 19.4.8. South Africa

- 19.4.9. Turkey

- 19.4.10. Tanzania

- 19.4.11. Kenya

- 19.4.12. Algeria

- 19.4.13. Morocco

- 19.4.14. Egypt

- 19.4.15. Rest of Middle-East and Africa

- 19.1. Market Analysis, Insights and Forecast - by Resin Type

- 20. Rest of Middle East and Africa MEA Paints and Coatings Market Analysis, Insights and Forecast, 2020-2032

- 20.1. Market Analysis, Insights and Forecast - by Resin Type

- 20.1.1. Acrylic

- 20.1.2. Alkyd

- 20.1.3. Polyurethane

- 20.1.4. Epoxy

- 20.1.5. Polyester

- 20.1.6. Other Resin Types

- 20.2. Market Analysis, Insights and Forecast - by Technology

- 20.2.1. Water-borne

- 20.2.2. Solvent-borne

- 20.2.3. Radiation Cure

- 20.2.4. Other Technologies

- 20.3. Market Analysis, Insights and Forecast - by End-user Industry

- 20.3.1. Architectural

- 20.3.2. Automotive

- 20.3.3. Wood

- 20.3.4. Industrial

- 20.3.5. Other End-user Industries

- 20.4. Market Analysis, Insights and Forecast - by Geography

- 20.4.1. Saudi Arabia

- 20.4.2. Qatar

- 20.4.3. Kuwait

- 20.4.4. United Arab Emirates

- 20.4.5. Iran

- 20.4.6. Iraq

- 20.4.7. Nigeria

- 20.4.8. South Africa

- 20.4.9. Turkey

- 20.4.10. Tanzania

- 20.4.11. Kenya

- 20.4.12. Algeria

- 20.4.13. Morocco

- 20.4.14. Egypt

- 20.4.15. Rest of Middle-East and Africa

- 20.1. Market Analysis, Insights and Forecast - by Resin Type

- 21. Competitive Analysis

- 21.1. Market Share Analysis 2025

- 21.2. Company Profiles

- 21.2.1 The Sherwin-Williams Company

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Jotun

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 RPM International Inc

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 Betek Boya Kimya ve Sanayi AS (Nippon Paint Holdings Co Ltd )

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 Kansai Paint Co Ltd

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 Akzo Nobel NV

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.7 Jazeera Paints

- 21.2.7.1. Overview

- 21.2.7.2. Products

- 21.2.7.3. SWOT Analysis

- 21.2.7.4. Recent Developments

- 21.2.7.5. Financials (Based on Availability)

- 21.2.8 Asian Paints BERGER

- 21.2.8.1. Overview

- 21.2.8.2. Products

- 21.2.8.3. SWOT Analysis

- 21.2.8.4. Recent Developments

- 21.2.8.5. Financials (Based on Availability)

- 21.2.9 PPG Industries Inc

- 21.2.9.1. Overview

- 21.2.9.2. Products

- 21.2.9.3. SWOT Analysis

- 21.2.9.4. Recent Developments

- 21.2.9.5. Financials (Based on Availability)

- 21.2.10 Crown Paints Kenya PLC

- 21.2.10.1. Overview

- 21.2.10.2. Products

- 21.2.10.3. SWOT Analysis

- 21.2.10.4. Recent Developments

- 21.2.10.5. Financials (Based on Availability)

- 21.2.11 Scib Paints

- 21.2.11.1. Overview

- 21.2.11.2. Products

- 21.2.11.3. SWOT Analysis

- 21.2.11.4. Recent Developments

- 21.2.11.5. Financials (Based on Availability)

- 21.2.12 Beckers Group

- 21.2.12.1. Overview

- 21.2.12.2. Products

- 21.2.12.3. SWOT Analysis

- 21.2.12.4. Recent Developments

- 21.2.12.5. Financials (Based on Availability)

- 21.2.13 BASF SE

- 21.2.13.1. Overview

- 21.2.13.2. Products

- 21.2.13.3. SWOT Analysis

- 21.2.13.4. Recent Developments

- 21.2.13.5. Financials (Based on Availability)

- 21.2.14 PACHIN

- 21.2.14.1. Overview

- 21.2.14.2. Products

- 21.2.14.3. SWOT Analysis

- 21.2.14.4. Recent Developments

- 21.2.14.5. Financials (Based on Availability)

- 21.2.15 Terraco Holdings Limited

- 21.2.15.1. Overview

- 21.2.15.2. Products

- 21.2.15.3. SWOT Analysis

- 21.2.15.4. Recent Developments

- 21.2.15.5. Financials (Based on Availability)

- 21.2.16 Thermilate Middle East

- 21.2.16.1. Overview

- 21.2.16.2. Products

- 21.2.16.3. SWOT Analysis

- 21.2.16.4. Recent Developments

- 21.2.16.5. Financials (Based on Availability)

- 21.2.17 Basco Paints

- 21.2.17.1. Overview

- 21.2.17.2. Products

- 21.2.17.3. SWOT Analysis

- 21.2.17.4. Recent Developments

- 21.2.17.5. Financials (Based on Availability)

- 21.2.18 DAW SE (Caparol)

- 21.2.18.1. Overview

- 21.2.18.2. Products

- 21.2.18.3. SWOT Analysis

- 21.2.18.4. Recent Developments

- 21.2.18.5. Financials (Based on Availability)

- 21.2.19 ATLAS Peintures

- 21.2.19.1. Overview

- 21.2.19.2. Products

- 21.2.19.3. SWOT Analysis

- 21.2.19.4. Recent Developments

- 21.2.19.5. Financials (Based on Availability)

- 21.2.20 Hempel AS

- 21.2.20.1. Overview

- 21.2.20.2. Products

- 21.2.20.3. SWOT Analysis

- 21.2.20.4. Recent Developments

- 21.2.20.5. Financials (Based on Availability)

- 21.2.21 National Paint Factories Co Ltd

- 21.2.21.1. Overview

- 21.2.21.2. Products

- 21.2.21.3. SWOT Analysis

- 21.2.21.4. Recent Developments

- 21.2.21.5. Financials (Based on Availability)

- 21.2.22 Saba Shimi Aria

- 21.2.22.1. Overview

- 21.2.22.2. Products

- 21.2.22.3. SWOT Analysis

- 21.2.22.4. Recent Developments

- 21.2.22.5. Financials (Based on Availability)

- 21.2.23 Wacker Chemie AG

- 21.2.23.1. Overview

- 21.2.23.2. Products

- 21.2.23.3. SWOT Analysis

- 21.2.23.4. Recent Developments

- 21.2.23.5. Financials (Based on Availability)

- 21.2.24 Al-Tabieaa Company

- 21.2.24.1. Overview

- 21.2.24.2. Products

- 21.2.24.3. SWOT Analysis

- 21.2.24.4. Recent Developments

- 21.2.24.5. Financials (Based on Availability)

- 21.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: MEA Paints and Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Paints and Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 9: MEA Paints and Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: MEA Paints and Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 13: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 15: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 17: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 19: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 22: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 23: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 25: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 29: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 32: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 33: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 34: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 35: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 37: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 42: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 43: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 45: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 49: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 51: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 52: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 53: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 54: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 55: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 56: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 57: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 59: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 62: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 63: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 65: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 66: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 67: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 68: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 69: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 71: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 72: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 73: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 74: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 75: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 76: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 77: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 78: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 79: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 82: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 83: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 84: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 85: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 86: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 87: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 88: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 89: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 91: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 92: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 93: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 94: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 95: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 96: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 97: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 98: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 99: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 100: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 101: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 102: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 103: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 104: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 105: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 106: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 107: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 108: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 109: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 110: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 111: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 112: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 113: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 114: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 115: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 116: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 117: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 118: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 119: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 120: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 121: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 122: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 123: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 124: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 125: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 126: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 127: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 128: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 129: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 130: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 131: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 132: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 133: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 134: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 135: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 136: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 137: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 138: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 139: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 140: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 141: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 142: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 143: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 144: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 145: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 146: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 147: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 148: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 149: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 150: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 151: MEA Paints and Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 152: MEA Paints and Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 153: MEA Paints and Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 154: MEA Paints and Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 155: MEA Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 156: MEA Paints and Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 157: MEA Paints and Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 158: MEA Paints and Coatings Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 159: MEA Paints and Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 160: MEA Paints and Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Paints and Coatings Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the MEA Paints and Coatings Market?

Key companies in the market include The Sherwin-Williams Company, Jotun, RPM International Inc, Betek Boya Kimya ve Sanayi AS (Nippon Paint Holdings Co Ltd ), Kansai Paint Co Ltd, Akzo Nobel NV, Jazeera Paints, Asian Paints BERGER, PPG Industries Inc, Crown Paints Kenya PLC, Scib Paints, Beckers Group, BASF SE, PACHIN, Terraco Holdings Limited, Thermilate Middle East, Basco Paints, DAW SE (Caparol), ATLAS Peintures, Hempel AS, National Paint Factories Co Ltd, Saba Shimi Aria, Wacker Chemie AG, Al-Tabieaa Company.

3. What are the main segments of the MEA Paints and Coatings Market?

The market segments include Resin Type, Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4,690.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Tourism and Construction in the Middle-East; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Architectural Sector.

7. Are there any restraints impacting market growth?

Slowdown in Automotive Sector.

8. Can you provide examples of recent developments in the market?

In August 2022, Jazeera Paints, a manufacturer of paints, colors, and construction solutions in the Middle East and North Africa, opened its sixth showroom in Iraq. The new showroom will serve its needs for high-quality paints and construction solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Paints and Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Paints and Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Paints and Coatings Market?

To stay informed about further developments, trends, and reports in the MEA Paints and Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence