Key Insights

Brazil's commercial vehicle lubricants market is projected for robust expansion, driven by economic recovery and increasing transportation demands. With an estimated market size of 445.1 million in 2025, the sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.31% through 2033. This growth is primarily attributed to the escalating volume of goods movement, necessitating greater commercial fleet utilization. Infrastructure development, alongside resurgent manufacturing and agricultural output, directly increases vehicle mileage and lubricant consumption. The aging vehicle parc further contributes to consistent demand through regular maintenance requirements.

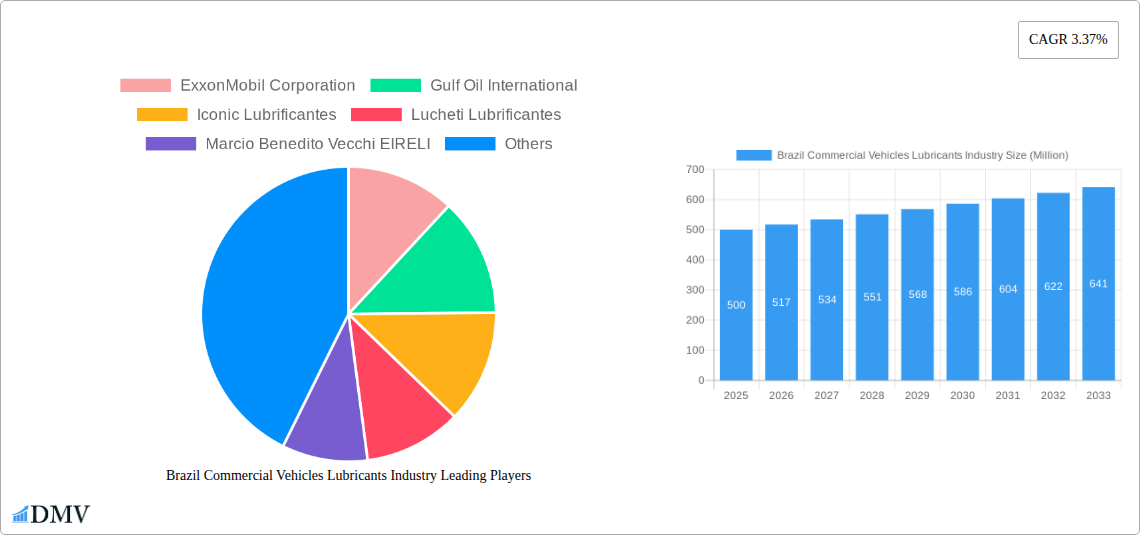

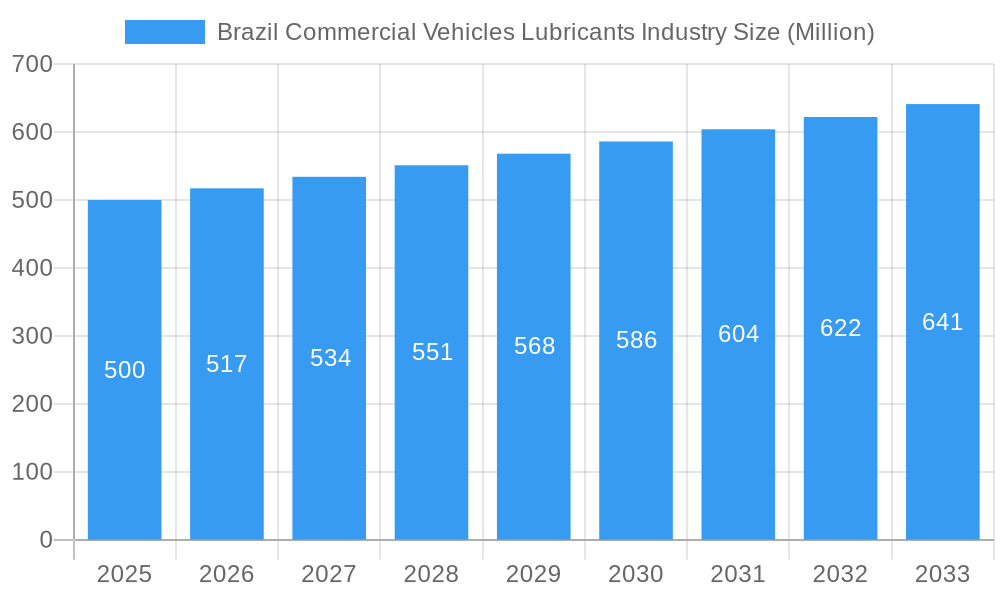

Brazil Commercial Vehicles Lubricants Industry Market Size (In Million)

The Brazilian lubricant sector is diversified, offering specialized products for commercial applications. Engine oils are paramount for heavy-duty vehicle engine performance and longevity. Greases minimize friction in moving parts, while hydraulic fluids are essential for construction equipment and specialized vehicles. Transmission and gear oils ensure efficient power transfer and drivetrain component protection. Leading companies such as ExxonMobil Corporation, Shell Plc, and Petrobras are actively enhancing their market presence through product innovation, strategic alliances, and expanded distribution. Their focus on high-performance, fuel-efficient lubricants compliant with environmental standards and evolving vehicle technologies fuels market growth.

Brazil Commercial Vehicles Lubricants Industry Company Market Share

This report offers a comprehensive analysis of the Brazil Commercial Vehicles Lubricants Industry, providing critical insights into market dynamics, growth drivers, and future trends. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines historical data (2019–2024) and forecasts (2025–2033) to deliver actionable intelligence. Explore key segments including engine oils, greases, hydraulic fluids, and transmission & gear oils within Brazil's dynamic automotive sector.

Brazil Commercial Vehicles Lubricants Industry Market Composition & Trends

The Brazil Commercial Vehicles Lubricants Industry exhibits a dynamic market composition, characterized by a moderately consolidated landscape with a few dominant players and a growing number of specialized and regional manufacturers. Innovation catalysts are primarily driven by the increasing demand for high-performance lubricants that enhance fuel efficiency, extend equipment life, and meet stringent environmental regulations. The regulatory landscape, influenced by evolving emissions standards and lubricant performance specifications, plays a pivotal role in shaping product development and market entry strategies. Substitute products, such as lower-grade oils or extended drain intervals through advanced formulations, pose a nuanced challenge, necessitating continuous product differentiation. End-user profiles range from large fleet operators and logistics companies to individual truck owners and construction firms, each with distinct lubrication needs and purchasing behaviors. Mergers and acquisitions (M&A) activities, valued at approximately $50 Million in the historical period, signal strategic consolidation and expansion within the sector.

- Market Concentration: Dominated by a few major international players, with a significant presence of national manufacturers.

- Innovation Catalysts: Fuel efficiency mandates, emissions reduction targets, extended drain intervals, and enhanced equipment protection.

- Regulatory Landscape: Adherence to ANP (Agência Nacional do Petróleo, Gás Natural e Biocombustíveis) standards and international OEM specifications.

- Substitute Products: Potential for lower-grade oils impacting market share for premium segments.

- End-User Profiles: Fleet managers, logistics companies, construction firms, agricultural operators, public transport providers.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach, with an estimated $50 Million in deal value for the historical period.

Brazil Commercial Vehicles Lubricants Industry Industry Evolution

The Brazil Commercial Vehicles Lubricants Industry has undergone significant evolution, driven by robust economic growth and an expanding transportation and logistics sector. The market growth trajectories have been consistently upward, albeit with fluctuations influenced by global economic conditions and domestic policy changes. Technological advancements in engine design and emissions control have necessitated the development of sophisticated lubricant formulations, leading to a shift towards synthetic and semi-synthetic engine oils and high-performance transmission & gear oils. Shifting consumer demands are increasingly focused on sustainability, with a growing preference for biodegradable lubricants and those that contribute to reduced carbon footprints. The Estimated Year of 2025 projects a market value of $2.5 Billion, with an anticipated compound annual growth rate (CAGR) of 6.2% during the Forecast Period (2025–2033). This growth is propelled by factors such as the increasing commercial vehicle parc, infrastructure development projects, and the ongoing need for efficient fleet operation. The historical period (2019-2024) saw a market size of $2.1 Billion, demonstrating steady expansion. Adoption metrics for synthetic lubricants have risen by approximately 20% over the past five years, reflecting the industry's embrace of advanced technologies. The continuous need for machinery maintenance and performance optimization across sectors like agriculture, mining, and construction further underpins the sustained demand for a diverse range of lubricant products.

Leading Regions, Countries, or Segments in Brazil Commercial Vehicles Lubricants Industry

Within the Brazil Commercial Vehicles Lubricants Industry, Engine Oils consistently emerge as the leading product segment, driven by the sheer volume of commercial vehicles requiring regular lubrication for their power units. This dominance is further amplified by the diverse operational needs of trucks, buses, and other heavy-duty vehicles that traverse Brazil's vast and varied terrain. The demand for advanced engine oils is directly linked to the increasing adoption of fuel-efficient and emissions-compliant engines, which necessitate specialized formulations to ensure optimal performance and longevity. Key drivers for the supremacy of Engine Oils include the substantial fleet sizes operating across the country, the continuous replacement cycle of vehicles, and the critical role of engine health in operational efficiency and cost management for transportation companies.

- Dominant Segment: Engine Oils: This segment accounts for approximately 45% of the total market share.

- Investment Trends: Significant R&D investment by major players into developing advanced synthetic and semi-synthetic formulations for enhanced performance and extended drain intervals.

- Regulatory Support: Increasing stringency of emissions standards indirectly promotes the use of higher-quality engine oils that facilitate compliance.

- Operational Necessity: The core function of engine protection and lubrication makes it an indispensable product for all commercial vehicles.

- Fleet Modernization: As fleets upgrade to newer, more efficient vehicles, the demand for compatible, high-performance engine oils escalates.

Following closely are Transmission & Gear Oils and Hydraulic Fluids, both critical for the smooth operation and longevity of complex commercial vehicle powertrains and hydraulic systems, respectively. The growth in construction, mining, and agricultural sectors, which heavily rely on specialized heavy machinery, fuels the demand for these fluid types. Greases, while a smaller segment, are vital for lubricating various chassis components and bearings, ensuring reduced friction and wear in demanding operational environments. The interplay between these segments, each catering to specific mechanical needs, contributes to the overall robustness and diversity of the Brazil Commercial Vehicles Lubricants Industry.

Brazil Commercial Vehicles Lubricants Industry Product Innovations

Product innovations in the Brazil Commercial Vehicles Lubricants Industry are rapidly advancing, focusing on enhanced performance, extended service intervals, and reduced environmental impact. Manufacturers are increasingly offering advanced synthetic and semi-synthetic engine oils designed for superior thermal stability, wear protection, and fuel economy, often exceeding OEM specifications. Innovations in hydraulic fluids emphasize biodegradability and high-pressure resistance for demanding off-road equipment, while novel transmission & gear oils focus on reduced friction for improved drivability and fuel efficiency in heavy-duty applications. Unique selling propositions often revolve around extended drain intervals, allowing fleets to reduce downtime and operational costs, and formulations that contribute to lower emissions and improved fuel economy, aligning with global sustainability trends.

Propelling Factors for Brazil Commercial Vehicles Lubricants Industry Growth

The Brazil Commercial Vehicles Lubricants Industry is propelled by a confluence of technological, economic, and regulatory factors. The increasing size and sophistication of the commercial vehicle fleet, driven by a growing economy and infrastructure development, directly translates to higher lubricant demand. Technological advancements in engine technology necessitate more advanced lubricant formulations to ensure optimal performance and longevity, thereby driving the adoption of premium products. Furthermore, evolving environmental regulations and the global push for sustainability are encouraging the development and adoption of eco-friendly and fuel-efficient lubricants. Economic growth, particularly in sectors like agriculture, mining, and logistics, creates sustained demand for reliable and high-performing lubricants to keep these crucial operations running smoothly.

Obstacles in the Brazil Commercial Vehicles Lubricants Industry Market

The Brazil Commercial Vehicles Lubricants Industry faces several obstacles that can temper its growth trajectory. Regulatory challenges, including complexities in compliance with evolving environmental and safety standards, can increase operational costs for manufacturers. Supply chain disruptions, exacerbated by global events or domestic logistical hurdles, can lead to price volatility and availability issues for raw materials and finished products. Intense competitive pressures from both domestic and international players, coupled with the presence of counterfeit products, can erode profit margins and impact market share. Additionally, economic downturns or political instability can significantly dampen demand for commercial vehicles, consequently affecting lubricant consumption.

Future Opportunities in Brazil Commercial Vehicles Lubricants Industry

Emerging opportunities in the Brazil Commercial Vehicles Lubricants Industry are abundant, driven by evolving market trends and technological advancements. The growing demand for bio-based and biodegradable lubricants presents a significant avenue for market expansion, catering to environmentally conscious fleets and businesses. The increasing adoption of electric and hybrid commercial vehicles, while initially posing a shift, will create new opportunities for specialized fluids and coolants designed for these advanced powertrains. Furthermore, advancements in lubricant technology for extended drain intervals and improved fuel efficiency will continue to attract fleet operators seeking cost savings and operational optimization. The expansion of e-commerce platforms also offers new channels for distribution and direct sales, reaching a wider customer base.

Major Players in the Brazil Commercial Vehicles Lubricants Industry Ecosystem

- ExxonMobil Corporation

- Gulf Oil International

- Iconic Lubrificantes

- Lucheti Lubrificantes

- Marcio Benedito Vecchi EIRELI

- Petrobras

- Petronas Lubricants International

- Royal Dutch Shell Plc

- TotalEnergies

- YP

Key Developments in Brazil Commercial Vehicles Lubricants Industry Industry

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions, indicating a strategic restructuring to address evolving energy landscapes and market demands.

- October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network, expanding brand reach and accessibility for a trusted lubricant marque.

- June 2021: Raízen signed an agreement with Shell to use the Shell trademark in the fuel distribution business and related activities for 13 years, signifying a strategic partnership aimed at enhancing fuel and lubricant offerings in the Brazilian market.

Strategic Brazil Commercial Vehicles Lubricants Industry Market Forecast

The strategic Brazil Commercial Vehicles Lubricants Industry market forecast indicates sustained growth driven by robust demand from the expanding logistics and transportation sectors, coupled with increasing governmental focus on infrastructure development. The ongoing adoption of advanced lubricant technologies, such as synthetic and semi-synthetic formulations, will be a key growth catalyst, offering enhanced performance, fuel efficiency, and extended drain intervals. Furthermore, the increasing emphasis on sustainability will foster opportunities for the development and market penetration of eco-friendly and bio-based lubricants. Strategic partnerships and M&A activities are expected to continue shaping the competitive landscape, allowing key players to consolidate market share and expand their product portfolios. The forecast projects a dynamic and evolving market, presenting significant opportunities for innovation and market leadership.

Brazil Commercial Vehicles Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Brazil Commercial Vehicles Lubricants Industry Segmentation By Geography

- 1. Brazil

Brazil Commercial Vehicles Lubricants Industry Regional Market Share

Geographic Coverage of Brazil Commercial Vehicles Lubricants Industry

Brazil Commercial Vehicles Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Commercial Vehicles Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gulf Oil International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iconic Lubrificantes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucheti Lubrificantes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marcio Benedito Vecchi EIRELI

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petrobras

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Petronas Lubricants International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Brazil Commercial Vehicles Lubricants Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Commercial Vehicles Lubricants Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Commercial Vehicles Lubricants Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Brazil Commercial Vehicles Lubricants Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Brazil Commercial Vehicles Lubricants Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Brazil Commercial Vehicles Lubricants Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Commercial Vehicles Lubricants Industry?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Brazil Commercial Vehicles Lubricants Industry?

Key companies in the market include ExxonMobil Corporation, Gulf Oil International, Iconic Lubrificantes, Lucheti Lubrificantes, Marcio Benedito Vecchi EIRELI, Petrobras, Petronas Lubricants International, Royal Dutch Shell Plc, TotalEnergies, YP.

3. What are the main segments of the Brazil Commercial Vehicles Lubricants Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 445.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network.June 2021: Raízen signed an agreement with Shell to use the Shell trademark in the fuel distribution business and related activities for 13 years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Commercial Vehicles Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Commercial Vehicles Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Commercial Vehicles Lubricants Industry?

To stay informed about further developments, trends, and reports in the Brazil Commercial Vehicles Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence