Key Insights

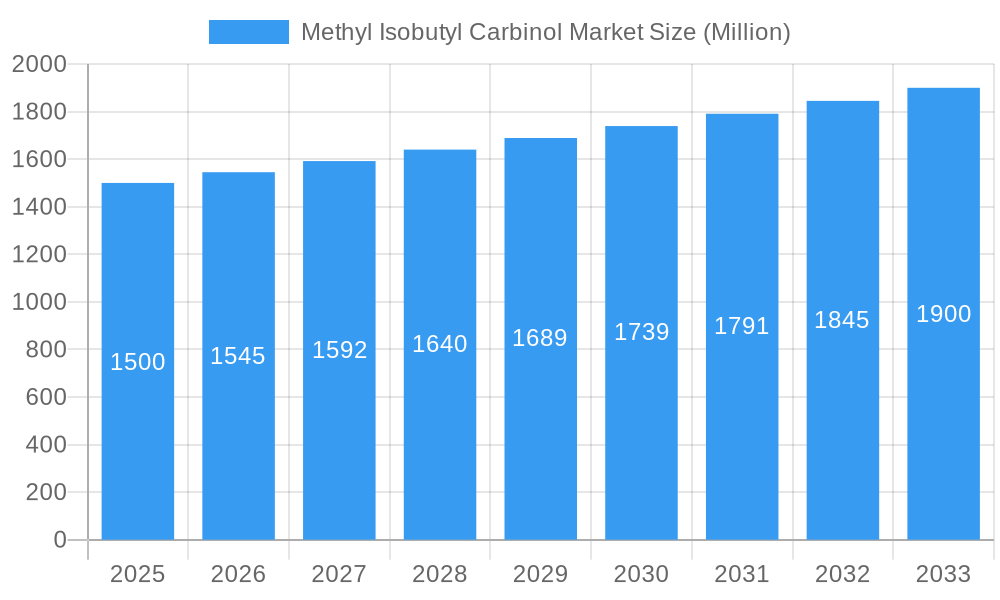

The Methyl Isobutyl Carbinol (MIBC) market is poised for steady growth, projected to exceed a market size of approximately $1.5 billion by 2025, driven by a CAGR greater than 3.00% through 2033. This expansion is primarily fueled by the increasing demand for MIBC as a crucial frother in the mining and mineral processing industry, particularly for the flotation of non-ferrous metals like copper and molybdenum. The construction sector also presents a significant growth avenue, with MIBC finding application as a solvent and additive in coatings and paints, enhancing their performance and durability. Furthermore, its role in the production of plasticizers, corrosion inhibitors, and specialty lubricants and hydraulic fluids contributes to its sustained market relevance. Emerging economies, especially in the Asia Pacific region, are anticipated to be key growth engines due to rapid industrialization and expanding infrastructure projects.

Methyl Isobutyl Carbinol Market Market Size (In Billion)

While the market demonstrates robust growth potential, certain factors warrant attention. Supply chain disruptions and volatility in raw material prices, such as acetone and hydrogen, can impact production costs and affect market equilibrium. Stringent environmental regulations concerning volatile organic compounds (VOCs) may also present a challenge for some MIBC applications, prompting the industry to focus on developing more sustainable alternatives and processes. However, ongoing research and development efforts aimed at improving MIBC's efficiency and environmental profile are expected to mitigate these concerns. Innovations in end-user industries, such as the growing adoption of electric vehicles and the demand for advanced materials in construction, will continue to shape the application landscape for MIBC, creating opportunities for diversified growth and market penetration.

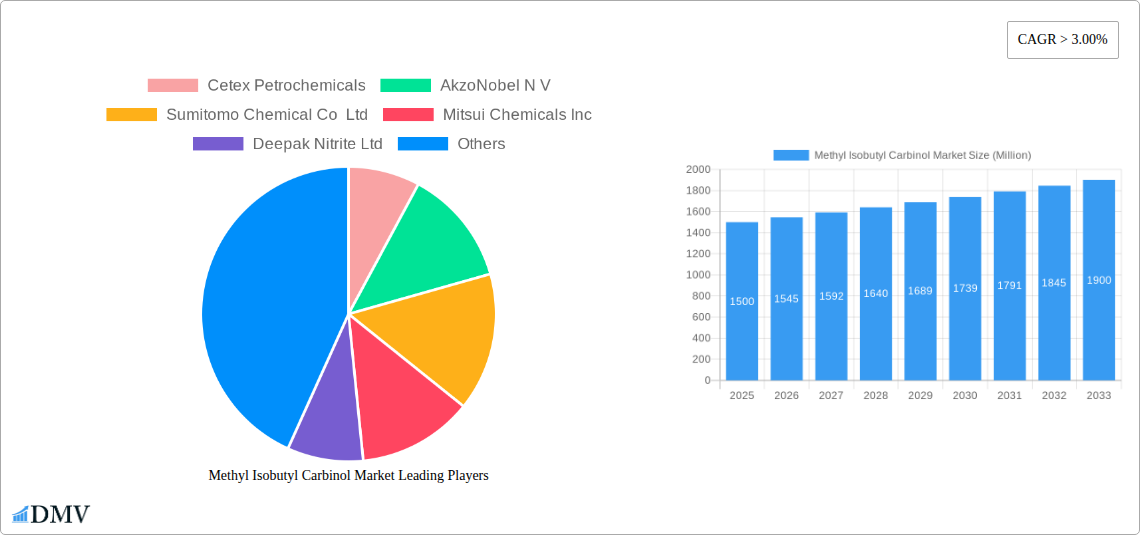

Methyl Isobutyl Carbinol Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Methyl Isobutyl Carbinol (MIBC) market, providing critical insights into market dynamics, growth drivers, challenges, and future opportunities. With a study period spanning from 2019 to 2033, and a base year of 2025, this report equips stakeholders with data-driven strategies for navigating the evolving MIBC industry. We delve into applications such as plasticizers, frothers, corrosion inhibitors, lube oils and hydraulic fluids, and various other applications, serving diverse end-user industries including construction, mining, automobile, rubber, and other end-user industries.

Methyl Isobutyl Carbinol Market Market Composition & Trends

The Methyl Isobutyl Carbinol market exhibits a moderate to high concentration, with a few key players holding significant market share. Innovation in MIBC production processes and product purity remains a crucial catalyst for growth, driven by stringent environmental regulations and the demand for high-performance chemicals. The regulatory landscape is characterized by evolving safety standards and emissions controls, influencing production methods and market access. Substitute products, though present in some niche applications, are unlikely to significantly disrupt the core demand for MIBC, given its unique properties. End-user profiles are diverse, with the mining sector's demand for frothers and the automotive and construction industries' need for plasticizers and corrosion inhibitors being particularly influential. Mergers and acquisitions (M&A) activity, while not extensive, has seen strategic consolidations aimed at expanding geographical reach and product portfolios. M&A deal values are projected to be in the range of several tens of millions of dollars, as larger entities seek to acquire specialized capabilities or market access. For instance, the consolidation of smaller regional players by global chemical giants is a recurring trend. The market's evolution is also shaped by the increasing emphasis on sustainable chemical production and the circular economy. Market share distribution is currently led by companies with integrated value chains and strong R&D capabilities.

- Market Concentration: Moderate to High

- Innovation Catalysts: Process Efficiency, Product Purity, Sustainability

- Regulatory Landscape: Evolving Safety & Environmental Standards

- Substitute Products: Limited threat in core applications

- End-User Profiles: Mining, Automotive, Construction, Rubber, Chemicals

- M&A Activity: Strategic Consolidation, Focus on Market Access and Technology

Methyl Isobutyl Carbinol Market Industry Evolution

The Methyl Isobutyl Carbinol market has witnessed consistent growth and evolution over the historical period (2019–2024) and is projected to maintain a robust trajectory through the forecast period (2025–2033). This growth is primarily propelled by the expanding applications of MIBC across various industrial sectors. The mining industry, a significant consumer of MIBC as a frother in mineral flotation processes, has experienced steady expansion due to increasing global demand for base metals and precious metals. This demand, coupled with advancements in mining technologies that enhance extraction efficiency, directly translates into higher MIBC consumption. Similarly, the automobile industry and construction sector are key drivers, utilizing MIBC in the production of plasticizers and corrosion inhibitors. The automotive sector's shift towards lighter materials and more durable components, alongside the construction industry's focus on sustainable and resilient infrastructure, fuels the demand for these chemical additives.

Technological advancements have played a pivotal role in shaping the MIBC industry. Improvements in synthesis processes have led to higher purity MIBC, reducing impurities and enhancing its performance in sensitive applications. Furthermore, the development of more efficient and environmentally friendly production methods has been a key area of innovation, aligning with global sustainability initiatives. Research and development efforts are continually exploring new applications for MIBC, potentially unlocking further market growth. For instance, its use as a solvent in specialized coatings and as an intermediate in the synthesis of other chemicals are areas of active investigation.

Shifting consumer demands and industry trends also influence market dynamics. The increasing emphasis on product performance, longevity, and environmental impact by end-users necessitates the use of high-quality chemical inputs like MIBC. The global push towards electrification in the automotive sector, while potentially altering the demand for certain traditional automotive chemicals, also creates new opportunities for MIBC in specialized battery component manufacturing and advanced material formulations. The construction industry's focus on energy-efficient buildings and durable materials further underpins the demand for MIBC-based plasticizers and protective coatings.

The global MIBC market is estimated to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. In 2025, the market size is projected to reach an estimated USD 1,200 million, driven by these interconnected factors. The historical growth from 2019 to 2024 has been approximately 4.0% CAGR, demonstrating a consistent upward trend. Adoption metrics for MIBC in its primary applications are high, with a penetration rate exceeding 85% in the froth flotation sector for targeted minerals. The demand for MIBC in lubricant and hydraulic fluid formulations is also on an upward trend, driven by the need for enhanced performance under extreme conditions.

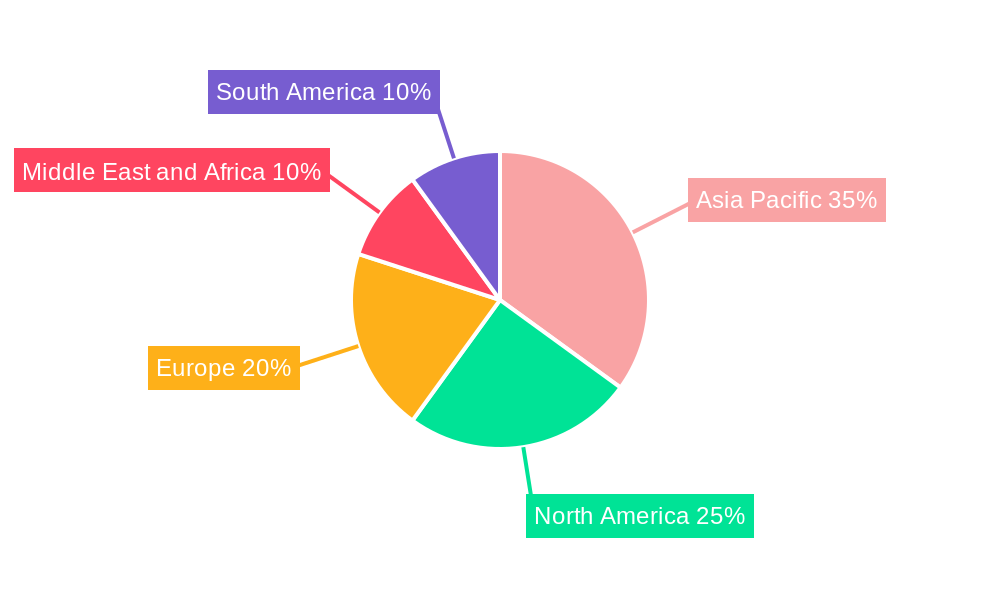

Leading Regions, Countries, or Segments in Methyl Isobutyl Carbinol Market

The Methyl Isobutyl Carbinol market is dominated by its application as frothers in the mining industry, with a significant contribution from Asia Pacific as a leading region. This dominance is underpinned by the region's vast mineral resources, substantial mining operations, and a growing demand for metals to fuel its rapidly industrializing economies. Countries like China, Australia, and India are major consumers of MIBC for froth flotation processes, crucial for extracting valuable minerals like copper, gold, and nickel. The mining sector's reliance on efficient mineral processing techniques makes MIBC an indispensable chemical.

Dominant Application: Frothers (in Mining)

- Key Driver: High global demand for base and precious metals.

- Impact: Drives significant consumption of MIBC for efficient mineral recovery in flotation circuits.

- Technological Relevance: MIBC's ability to create stable, selective froths is critical for optimizing yield and purity of mined ores.

Leading End-User Industry: Mining

- Key Driver: Continuous investment in exploration and extraction activities across resource-rich nations.

- Impact: Sustains and grows the demand for MIBC as a vital operational chemical.

- Regional Focus: Asia Pacific, North America, and South America are key mining hubs contributing to MIBC demand.

Dominant Region: Asia Pacific

- Key Driver: Rapid industrialization and infrastructure development, particularly in China and India, requiring increased metal consumption.

- Impact: Surging demand for metals translates directly to increased mining activity and MIBC consumption.

- Investment Trends: Significant capital investments in new mining projects and expansion of existing ones in countries like Indonesia, Philippines, and Mongolia.

- Regulatory Support: Government initiatives to boost domestic mining output and resource security contribute to market growth.

The construction industry also plays a crucial role, consuming MIBC in plasticizers and corrosion inhibitors. The burgeoning infrastructure development and urbanization across Asia Pacific, coupled with a robust construction sector in North America and Europe, contribute to this demand. The automobile industry's increasing production volumes and the demand for advanced materials further solidify MIBC's position.

- Emerging Applications: Plasticizers, Corrosion Inhibitors, Lube oils and Hydraulic Fluids.

- Impact: Diversifies the MIBC market beyond its traditional mining applications.

- Growth Factors: Need for enhanced material properties in automotive, construction, and industrial equipment.

The dominance of the frother application within the mining sector in the Asia Pacific region is a critical indicator of market dynamics. This segment is expected to continue its lead due to ongoing global demand for minerals essential for manufacturing, technology, and infrastructure development. Investment trends in new mining ventures and the expansion of existing operations, particularly in emerging economies, are expected to further amplify this dominance. The regulatory landscape in these regions often favors the extraction of natural resources, providing a supportive environment for the MIBC market.

Methyl Isobutyl Carbinol Market Product Innovations

Product innovations in the Methyl Isobutyl Carbinol market are primarily focused on enhancing purity, developing specialized grades for niche applications, and improving the sustainability of production processes. Manufacturers are actively investing in research to create MIBC variants with exceptionally low impurity profiles, crucial for sensitive applications in pharmaceuticals or advanced materials. For instance, advancements in distillation and purification technologies are enabling the production of MIBC with assay rates exceeding 99.5%. Furthermore, innovations are geared towards optimizing MIBC’s performance as a frother in mineral flotation, leading to the development of grades that offer superior bubble stability and selectivity, thereby increasing mineral recovery rates. Performance metrics such as improved yield by 2-5% and reduced reagent consumption are key selling propositions of these innovative products.

Propelling Factors for Methyl Isobutyl Carbinol Market Growth

The Methyl Isobutyl Carbinol market is propelled by several key growth drivers. The burgeoning mining industry globally, driven by increasing demand for metals and minerals essential for manufacturing and technology, remains a primary catalyst. Technological advancements in mineral processing, leading to enhanced efficiency in froth flotation, directly boost MIBC consumption. Furthermore, the robust growth in the automotive and construction sectors, where MIBC serves as a vital component in plasticizers and corrosion inhibitors, adds significant momentum. The increasing emphasis on high-performance lubricants and hydraulic fluids also contributes to demand. Regulatory support for resource extraction in key regions and ongoing R&D into novel applications further solidify the market's positive outlook.

- Global Mining Expansion: Increased demand for metals and minerals.

- Automotive & Construction Boom: Growing use in plasticizers and corrosion inhibitors.

- Technological Advancements: Improved efficiency in mineral processing and material science.

- Lubricant & Hydraulic Fluid Demand: Need for enhanced performance.

- R&D Investments: Exploration of new applications and sustainable production.

Obstacles in the Methyl Isobutyl Carbinol Market Market

Despite its growth prospects, the Methyl Isobutyl Carbinol market faces certain obstacles. Supply chain disruptions, particularly those related to the availability and price volatility of key raw materials, can impact production costs and lead times. Stringent environmental regulations in certain regions can increase compliance costs and necessitate investments in cleaner production technologies. Furthermore, the competitive landscape is intense, with established players and emerging manufacturers vying for market share, potentially leading to price pressures. Fluctuations in end-user industry demand, influenced by economic downturns or geopolitical events, can also pose a challenge.

- Raw Material Price Volatility: Affects production costs and stability.

- Stringent Environmental Regulations: Increases compliance and operational expenses.

- Intense Competition: Leads to price pressures and market share challenges.

- Economic Downturns: Impacts demand from key end-user industries.

- Geopolitical Instability: Can disrupt global supply chains and demand patterns.

Future Opportunities in Methyl Isobutyl Carbinol Market

Emerging opportunities in the Methyl Isobutyl Carbinol market lie in the continuous exploration of new applications and geographical expansion. The growing demand for specialty chemicals in developing economies presents significant untapped potential. Advancements in sustainable chemical production, including bio-based routes for MIBC synthesis, could open new market segments and appeal to environmentally conscious consumers. Furthermore, the increasing use of MIBC in high-performance coatings, adhesives, and specialty solvents offers avenues for diversification. The integration of digital technologies in supply chain management and production optimization can also unlock efficiencies and create competitive advantages.

- Emerging Markets: Untapped potential in developing economies for industrial chemicals.

- Sustainable Production: Bio-based MIBC and eco-friendly manufacturing processes.

- Specialty Applications: Growth in coatings, adhesives, and advanced solvents.

- Digital Transformation: Supply chain optimization and production efficiency.

Major Players in the Methyl Isobutyl Carbinol Market Ecosystem

- Cetex Petrochemicals

- AkzoNobel N V

- Sumitomo Chemical Co Ltd

- Mitsui Chemicals Inc

- Deepak Nitrite Ltd

- Hubei Jusheng Technology Co Ltd

- Mitsubishi Chemical Corporation

- Celanese Corporation

- Evonik Industries AG

- BASF SE

- Arkema Group

- Monument Chemical

- LG Chem

- Dow

- Eastman Chemical Company

- TORAY INDUSTRIES INC

Key Developments in Methyl Isobutyl Carbinol Market Industry

- May 2022: Deepak Nitrite announced its commitment towards a capital investment of INR 1500 crore (USD 201 million) over the next two years in the ongoing capex program for new upstream/downstream products, including methyl isobutyl carbinol. The commissioning of the project is expected to happen in the first quarter of 2023.

- September 2021: Celanese Corporation, a global chemical and specialty materials company, confirmed a declaration of force majeure for several acetyl chain and acetate tow products to its customers in the Western Hemisphere. The force majeure declaration comes from unanticipated interruptions in raw material supply to the Texas Gulf Coast. The products affected by this uplifting also included methyl isobutyl carbinol.

Strategic Methyl Isobutyl Carbinol Market Market Forecast

The strategic Methyl Isobutyl Carbinol market forecast indicates sustained growth driven by strong demand from the mining, automotive, and construction sectors. The increasing adoption of MIBC as a frother in mineral flotation, coupled with its expanding role in plasticizers and corrosion inhibitors, underpins this positive outlook. Investments in R&D for enhanced product performance and sustainable production methods will be crucial for market players. Furthermore, the exploration of novel applications in specialty chemicals and emerging economies presents significant future opportunities. The market's resilience is expected to be bolstered by the essential nature of MIBC in numerous industrial processes, even amidst global economic uncertainties. The forecast period, from 2025 to 2033, is projected to see the MIBC market grow substantially, reaching an estimated market value of over USD 1,800 million by 2033, exhibiting a healthy CAGR of approximately 4.5%.

Methyl Isobutyl Carbinol Market Segmentation

-

1. Application

- 1.1. Plasticizers

- 1.2. Frothers

- 1.3. Corrosion Inhibitors

- 1.4. Lube oils and Hydraulic Fluids

- 1.5. Other Applications

-

2. End-user Industry

- 2.1. Construction

- 2.2. Mining

- 2.3. Automobile

- 2.4. Rubber

- 2.5. Other End-user Industries

Methyl Isobutyl Carbinol Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Methyl Isobutyl Carbinol Market Regional Market Share

Geographic Coverage of Methyl Isobutyl Carbinol Market

Methyl Isobutyl Carbinol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Frothers in Copper and Molybdenum Sulfide Ores; Increasing Demand for Surface Coating Applications

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Toxic Effects of MIBC; Other Restraints

- 3.4. Market Trends

- 3.4.1. Mining Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Plasticizers

- 5.1.2. Frothers

- 5.1.3. Corrosion Inhibitors

- 5.1.4. Lube oils and Hydraulic Fluids

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Mining

- 5.2.3. Automobile

- 5.2.4. Rubber

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Plasticizers

- 6.1.2. Frothers

- 6.1.3. Corrosion Inhibitors

- 6.1.4. Lube oils and Hydraulic Fluids

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Mining

- 6.2.3. Automobile

- 6.2.4. Rubber

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Plasticizers

- 7.1.2. Frothers

- 7.1.3. Corrosion Inhibitors

- 7.1.4. Lube oils and Hydraulic Fluids

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Mining

- 7.2.3. Automobile

- 7.2.4. Rubber

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Plasticizers

- 8.1.2. Frothers

- 8.1.3. Corrosion Inhibitors

- 8.1.4. Lube oils and Hydraulic Fluids

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Mining

- 8.2.3. Automobile

- 8.2.4. Rubber

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Plasticizers

- 9.1.2. Frothers

- 9.1.3. Corrosion Inhibitors

- 9.1.4. Lube oils and Hydraulic Fluids

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Mining

- 9.2.3. Automobile

- 9.2.4. Rubber

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Methyl Isobutyl Carbinol Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Plasticizers

- 10.1.2. Frothers

- 10.1.3. Corrosion Inhibitors

- 10.1.4. Lube oils and Hydraulic Fluids

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Mining

- 10.2.3. Automobile

- 10.2.4. Rubber

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cetex Petrochemicals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AkzoNobel N V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sumitomo Chemical Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsui Chemicals Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deepak Nitrite Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubei Jusheng Technology Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Chemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Celanese Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evonik Industries AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arkema Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Monument Chemical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LG Chem

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dow

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Eastman Chemical Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TORAY INDUSTRIES INC *List Not Exhaustive

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Cetex Petrochemicals

List of Figures

- Figure 1: Global Methyl Isobutyl Carbinol Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Methyl Isobutyl Carbinol Market Volume Breakdown (liter , %) by Region 2025 & 2033

- Figure 3: Asia Pacific Methyl Isobutyl Carbinol Market Revenue (Million), by Application 2025 & 2033

- Figure 4: Asia Pacific Methyl Isobutyl Carbinol Market Volume (liter ), by Application 2025 & 2033

- Figure 5: Asia Pacific Methyl Isobutyl Carbinol Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Methyl Isobutyl Carbinol Market Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific Methyl Isobutyl Carbinol Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Methyl Isobutyl Carbinol Market Volume (liter ), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Methyl Isobutyl Carbinol Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Methyl Isobutyl Carbinol Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Methyl Isobutyl Carbinol Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Methyl Isobutyl Carbinol Market Volume (liter ), by Country 2025 & 2033

- Figure 13: Asia Pacific Methyl Isobutyl Carbinol Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Methyl Isobutyl Carbinol Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Methyl Isobutyl Carbinol Market Revenue (Million), by Application 2025 & 2033

- Figure 16: North America Methyl Isobutyl Carbinol Market Volume (liter ), by Application 2025 & 2033

- Figure 17: North America Methyl Isobutyl Carbinol Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Methyl Isobutyl Carbinol Market Volume Share (%), by Application 2025 & 2033

- Figure 19: North America Methyl Isobutyl Carbinol Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Methyl Isobutyl Carbinol Market Volume (liter ), by End-user Industry 2025 & 2033

- Figure 21: North America Methyl Isobutyl Carbinol Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Methyl Isobutyl Carbinol Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Methyl Isobutyl Carbinol Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Methyl Isobutyl Carbinol Market Volume (liter ), by Country 2025 & 2033

- Figure 25: North America Methyl Isobutyl Carbinol Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Methyl Isobutyl Carbinol Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Methyl Isobutyl Carbinol Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Methyl Isobutyl Carbinol Market Volume (liter ), by Application 2025 & 2033

- Figure 29: Europe Methyl Isobutyl Carbinol Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Methyl Isobutyl Carbinol Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Methyl Isobutyl Carbinol Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Europe Methyl Isobutyl Carbinol Market Volume (liter ), by End-user Industry 2025 & 2033

- Figure 33: Europe Methyl Isobutyl Carbinol Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Methyl Isobutyl Carbinol Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Methyl Isobutyl Carbinol Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Methyl Isobutyl Carbinol Market Volume (liter ), by Country 2025 & 2033

- Figure 37: Europe Methyl Isobutyl Carbinol Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Methyl Isobutyl Carbinol Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Methyl Isobutyl Carbinol Market Revenue (Million), by Application 2025 & 2033

- Figure 40: South America Methyl Isobutyl Carbinol Market Volume (liter ), by Application 2025 & 2033

- Figure 41: South America Methyl Isobutyl Carbinol Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: South America Methyl Isobutyl Carbinol Market Volume Share (%), by Application 2025 & 2033

- Figure 43: South America Methyl Isobutyl Carbinol Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: South America Methyl Isobutyl Carbinol Market Volume (liter ), by End-user Industry 2025 & 2033

- Figure 45: South America Methyl Isobutyl Carbinol Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Methyl Isobutyl Carbinol Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Methyl Isobutyl Carbinol Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Methyl Isobutyl Carbinol Market Volume (liter ), by Country 2025 & 2033

- Figure 49: South America Methyl Isobutyl Carbinol Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Methyl Isobutyl Carbinol Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue (Million), by Application 2025 & 2033

- Figure 52: Middle East and Africa Methyl Isobutyl Carbinol Market Volume (liter ), by Application 2025 & 2033

- Figure 53: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East and Africa Methyl Isobutyl Carbinol Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Methyl Isobutyl Carbinol Market Volume (liter ), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Methyl Isobutyl Carbinol Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Methyl Isobutyl Carbinol Market Volume (liter ), by Country 2025 & 2033

- Figure 61: Middle East and Africa Methyl Isobutyl Carbinol Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Methyl Isobutyl Carbinol Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 3: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Region 2020 & 2033

- Table 7: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 9: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Country 2020 & 2033

- Table 13: China Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 15: India Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 17: Japan Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 19: South Korea Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 23: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 25: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Country 2020 & 2033

- Table 29: United States Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 31: Canada Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 33: Mexico Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 35: Rest of North America Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of North America Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 37: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 39: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Country 2020 & 2033

- Table 43: Germany Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Germany Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 47: Italy Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 49: France Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 53: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 55: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 56: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 57: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Country 2020 & 2033

- Table 59: Brazil Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Brazil Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 61: Argentina Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Argentina Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 65: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Application 2020 & 2033

- Table 67: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 68: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 69: Global Methyl Isobutyl Carbinol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Methyl Isobutyl Carbinol Market Volume liter Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 73: South Africa Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Methyl Isobutyl Carbinol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Methyl Isobutyl Carbinol Market Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Methyl Isobutyl Carbinol Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Methyl Isobutyl Carbinol Market?

Key companies in the market include Cetex Petrochemicals, AkzoNobel N V, Sumitomo Chemical Co Ltd, Mitsui Chemicals Inc, Deepak Nitrite Ltd, Hubei Jusheng Technology Co Ltd, Mitsubishi Chemical Corporation, Celanese Corporation, Evonik Industries AG, BASF SE, Arkema Group, Monument Chemical, LG Chem, Dow, Eastman Chemical Company, TORAY INDUSTRIES INC *List Not Exhaustive.

3. What are the main segments of the Methyl Isobutyl Carbinol Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Frothers in Copper and Molybdenum Sulfide Ores; Increasing Demand for Surface Coating Applications.

6. What are the notable trends driving market growth?

Mining Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Awareness about the Toxic Effects of MIBC; Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: Deepak Nitrite announced its commitment towards a capital investment of INR 1500 crore (USD 201 million) over the next two years in the ongoing capex program for the new upstream/downstream products, including methyl isobutyl carbinol. The commissioning of the project is expected to happen in the first quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Methyl Isobutyl Carbinol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Methyl Isobutyl Carbinol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Methyl Isobutyl Carbinol Market?

To stay informed about further developments, trends, and reports in the Methyl Isobutyl Carbinol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence