Key Insights

The Indian Hydrogen Peroxide market is projected for significant expansion, anticipated to reach a market size of $5.8 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6% through 2033. This growth is propelled by increasing demand across key sectors. The pulp and paper industry is adopting hydrogen peroxide for its eco-friendly bleaching capabilities, replacing chlorine-based alternatives. The chemical synthesis sector utilizes it as a versatile oxidant in various reactions. Growing environmental regulations and awareness are fueling demand in wastewater treatment, where it serves as an effective disinfectant. The food & beverage industry's sanitization needs and the cosmetics & healthcare sector's demand for disinfectants also contribute to market growth.

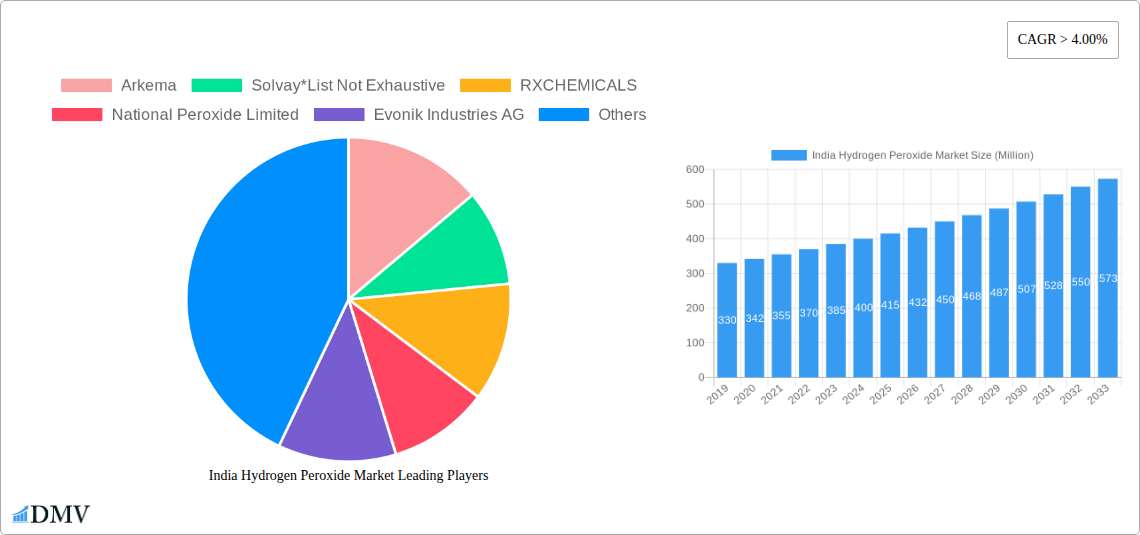

India Hydrogen Peroxide Market Market Size (In Billion)

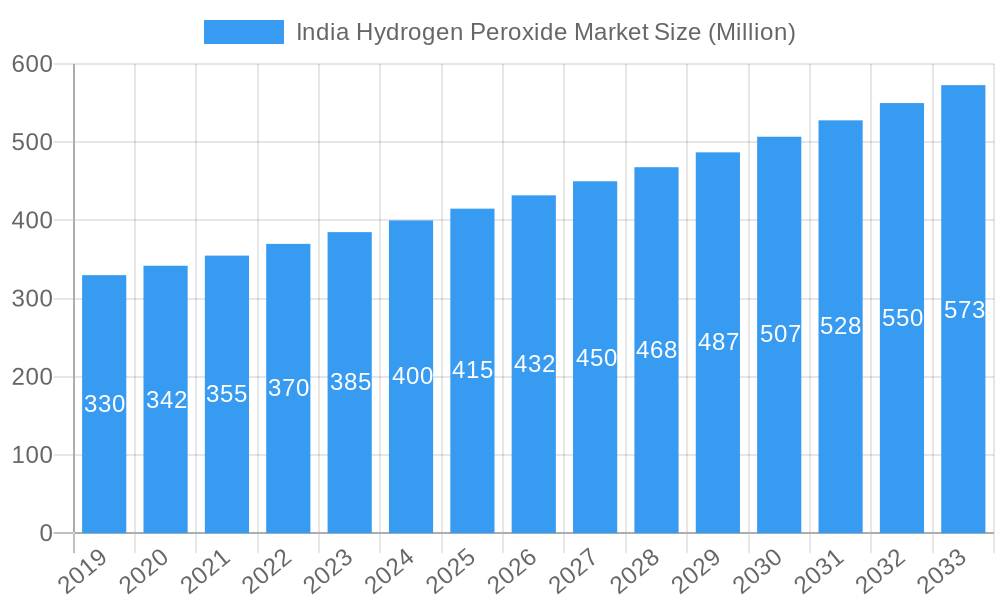

Key players like Arkema, Solvay, National Peroxide Limited, and Evonik Industries AG are shaping the market through capacity expansions, product quality improvements, and new application development. Innovations in sustainable and efficient production processes are also influential. Potential challenges include raw material price volatility and high capital investment for production. Nevertheless, the Indian Hydrogen Peroxide market outlook remains positive due to its essential role in diverse industries and its positioning as a sustainable alternative. A growing focus on sustainable industrial practices and domestic manufacturing will continue to drive market advancement.

India Hydrogen Peroxide Market Company Market Share

India Hydrogen Peroxide Market: Comprehensive Analysis and Growth Forecast (2019-2033)

Unlock the immense potential of India's burgeoning hydrogen peroxide market with this in-depth report. Discover critical market insights, emerging trends, and strategic growth opportunities in a rapidly evolving chemical landscape. This report provides a granular analysis of the India Hydrogen Peroxide Market, encompassing its historical trajectory, present dynamics, and a robust forecast spanning to 2033. Delve into the intricate workings of key segments, understand the impact of industry developments, and identify the major players shaping this vital sector. With detailed segmentation by product function and end-user industry, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the India Hydrogen Peroxide Market.

India Hydrogen Peroxide Market Market Composition & Trends

The India Hydrogen Peroxide Market is characterized by a moderate to highly concentrated structure, with a few key chemical manufacturers holding significant market share. Innovation is primarily driven by the demand for higher purity grades and eco-friendly production processes. Regulatory landscapes are progressively aligning with global environmental standards, influencing the adoption of sustainable chemical synthesis and wastewater treatment solutions. Substitute products, such as sodium hypochlorite, exist but often fall short in terms of efficacy and environmental impact for critical applications like disinfectant and bleaching in industries like pulp and paper and textiles. End-user profiles reveal a growing emphasis on safety and hygiene, boosting demand for hydrogen peroxide in cosmetics and healthcare and food and beverage processing. Merger and acquisition (M&A) activities are anticipated to consolidate the market further, with strategic partnerships aimed at expanding production capacities and geographical reach. For instance, acquisitions valued in the range of $50 Million to $200 Million are expected to reshape the competitive dynamics of the India Hydrogen Peroxide Market.

India Hydrogen Peroxide Market Industry Evolution

The India Hydrogen Peroxide Market has witnessed a remarkable growth trajectory, fueled by the nation's robust industrial expansion and increasing environmental consciousness. Over the study period (2019–2033), the market has transitioned from a foundational supplier of basic chemical inputs to a sophisticated provider of specialized solutions. Technological advancements have been central to this evolution, with the adoption of more efficient production methods like the anthraquinone process and the development of advanced purification techniques leading to higher purity grades of hydrogen peroxide. This has opened doors for its application in more sensitive sectors such as pharmaceuticals and electronics.

Consumer demand has also played a pivotal role. Growing awareness regarding hygiene and sanitation, particularly amplified post-pandemic, has significantly propelled the use of hydrogen peroxide as a powerful and eco-friendly disinfectant. Similarly, the pulp and paper industry's continuous pursuit of sustainable bleaching agents, moving away from chlorine-based alternatives, has been a consistent demand driver. The chemical synthesis sector continues to be a cornerstone, leveraging hydrogen peroxide as a versatile oxidant in the production of a wide array of chemicals.

The market has demonstrated an impressive compound annual growth rate (CAGR), projected to be between 6.0% and 8.0% during the forecast period (2025–2033). This growth is supported by increasing investments in infrastructure and manufacturing, leading to higher consumption in industries like wastewater treatment and mining, where it's used for oxidation and purification. The base year, 2025, represents a significant inflection point, with anticipated investments in new production facilities and capacity expansions by major players. The historical period (2019–2024) laid the groundwork for this expansion, showcasing a steady rise in demand driven by established industrial applications. The adoption of hydrogen peroxide for niche applications, such as in the food and beverage industry for aseptic packaging and in cosmetics and healthcare for sterilization and skin care products, further solidifies its market presence and indicates a trend towards broader end-user diversification.

Leading Regions, Countries, or Segments in India Hydrogen Peroxide Market

The Chemical Synthesis segment stands as a dominant force within the India Hydrogen Peroxide Market, consistently exhibiting the highest consumption volumes and growth potential. This is primarily attributed to the vast and expanding chemical manufacturing sector in India, which utilizes hydrogen peroxide as a crucial oxidant in the production of numerous organic and inorganic compounds. For instance, its role in producing epichlorohydrin, propylene oxide, and various organic peroxides is indispensable for downstream industries.

Within the Product Function segmentation, Oxidant applications are the primary revenue generators, followed closely by Bleaching and Disinfectant functions. The increasing emphasis on environmentally friendly chemical processes propels the demand for hydrogen peroxide as a cleaner oxidant.

In terms of End-user Industries, the Pulp and Paper sector remains a significant consumer, driven by the global shift towards eco-friendly bleaching practices. However, the Chemical Synthesis industry's voracious appetite for hydrogen peroxide solidifies its leading position. The Wastewater Treatment sector is also experiencing robust growth, with stringent environmental regulations compelling industries to adopt advanced oxidation processes, where hydrogen peroxide plays a critical role.

Key Drivers for Dominance:

- Investment Trends: Significant investments in new chemical manufacturing plants and expansions of existing facilities across India directly translate to increased demand for hydrogen peroxide as a key raw material and processing agent. Approximately $500 Million has been projected in new capital expenditures for the chemical synthesis sector over the next five years.

- Regulatory Support: Government initiatives promoting the "Make in India" campaign and a focus on sustainable manufacturing practices encourage the adoption of greener chemicals like hydrogen peroxide, especially in bleaching and wastewater treatment.

- Technological Advancements: Ongoing innovation in chemical synthesis processes that optimize the use of hydrogen peroxide, leading to higher yields and reduced by-products, further solidifies its adoption.

- Cost-Effectiveness and Efficiency: For many chemical reactions, hydrogen peroxide offers a more cost-effective and efficient alternative to other oxidants, particularly when considering its environmental benefits.

The Northern and Western regions of India are leading in terms of hydrogen peroxide consumption, driven by the presence of major chemical manufacturing hubs, extensive pulp and paper mills, and burgeoning pharmaceutical industries. States like Gujarat and Maharashtra are at the forefront, accounting for an estimated 40% of the total market demand. The increasing focus on industrial wastewater management across these densely populated and industrialized regions further amplifies the demand for hydrogen peroxide-based treatment solutions.

India Hydrogen Peroxide Market Product Innovations

Product innovations in the India Hydrogen Peroxide Market are increasingly focused on enhancing purity levels and developing specialized grades for niche applications. Companies are investing in advanced manufacturing techniques to produce ultra-high purity hydrogen peroxide, essential for the semiconductor and pharmaceutical industries. Furthermore, there's a growing trend towards developing stabilized formulations that offer improved shelf-life and ease of handling for disinfectant and cosmetics and healthcare applications. Performance metrics are being refined, with a focus on demonstrating superior efficacy in oxidative processes and a reduced environmental footprint. For example, new formulations are showing 20% increased efficacy in microbial inactivation compared to conventional solutions.

Propelling Factors for India Hydrogen Peroxide Market Growth

The India Hydrogen Peroxide Market is propelled by a confluence of robust industrial growth, increasing environmental consciousness, and supportive government policies. The burgeoning chemical synthesis sector, a primary consumer, relies heavily on hydrogen peroxide as a versatile oxidant. Furthermore, the global push for sustainable practices is driving the adoption of hydrogen peroxide as an eco-friendly alternative for bleaching in the pulp and paper and textiles industries, replacing harsher chemicals. Growing concerns about public health and hygiene are fueling demand for its disinfectant properties in cosmetics and healthcare and food and beverage applications. Stringent wastewater treatment regulations are also a significant catalyst, boosting its use in wastewater treatment processes. Investments in infrastructure and manufacturing further enhance its consumption across various end-user industries.

Obstacles in the India Hydrogen Peroxide Market Market

Despite its promising growth, the India Hydrogen Peroxide Market faces certain obstacles. Logistical challenges in transporting and storing the product, particularly in remote areas, can lead to increased costs and potential spoilage, impacting its overall supply chain. Fluctuations in the prices of raw materials, primarily natural gas and electricity required for production, can affect profitability and market competitiveness. While efforts are being made to adopt greener production, existing regulatory hurdles and the time required for approvals of new manufacturing units can slow down capacity expansion. Moreover, the presence of established substitute products in certain less demanding applications, coupled with the need for specialized handling expertise, presents ongoing competitive pressures. The estimated impact of logistical inefficiencies can lead to a 3-5% increase in operational costs for manufacturers.

Future Opportunities in India Hydrogen Peroxide Market

Emerging opportunities in the India Hydrogen Peroxide Market are significant, driven by advancements in technology and evolving consumer preferences. The increasing adoption of advanced oxidation processes (AOPs) for wastewater treatment presents a substantial growth avenue, with hydrogen peroxide being a key component. The growing demand for high-purity grades for the expanding electronics and semiconductor industries offers a lucrative niche. Furthermore, the rising awareness of hygiene and sanitation in the cosmetics and healthcare and food and beverage sectors will continue to fuel demand for safe and effective disinfectant applications. The potential for hydrogen peroxide in nascent sectors like textile printing and as a green propellant component also represents exciting future prospects. The projected market growth for AOPs is estimated to be around 10% annually.

Major Players in the India Hydrogen Peroxide Market Ecosystem

- Arkema

- Solvay

- RXCHEMICALS

- National Peroxide Limited

- Evonik Industries AG

- Chemplast Sanmar Limited

- Indian Peroxide Limited

- PCIPL (Prakash Chemicals International Private Limited)

- Hindustan Organic Chemicals Ltd (HOCL)

- Aditya Birla Chemicals

- Gujarat Alkalies and Chemical Limited

- Meghmani Finechem Limited (MFL)

- AkzoNobel NV

Key Developments in India Hydrogen Peroxide Market Industry

- 2023 (Q4): Meghmani Finechem Limited (MFL) announced plans for a significant expansion of its hydrogen peroxide production capacity by 50,000 TPA, aimed at catering to the growing demand from key end-user industries.

- 2023 (Q3): National Peroxide Limited introduced a new, highly stabilized formulation of hydrogen peroxide for the disinfectant market, focusing on enhanced shelf-life and user safety.

- 2023 (Q2): Gujarat Alkalies and Chemical Limited commissioned a new green hydrogen production facility, indirectly supporting the potential for more sustainable hydrogen peroxide manufacturing.

- 2022 (Q4): Chemplast Sanmar Limited reported increased utilization of its hydrogen peroxide facilities due to robust demand from the chemical synthesis sector.

- 2022 (Q1): Indian Peroxide Limited expanded its distribution network to cater to emerging markets in the southern regions of India, particularly for wastewater treatment applications.

Strategic India Hydrogen Peroxide Market Market Forecast

The strategic outlook for the India Hydrogen Peroxide Market is exceptionally strong, driven by sustained industrial expansion and an increasing focus on sustainable chemical solutions. Key growth catalysts include the robust demand from the chemical synthesis sector, the shift towards eco-friendly bleaching agents, and the heightened need for effective disinfectants. Investments in new production capacities, coupled with technological advancements leading to higher purity grades and specialized applications, will further solidify its market position. The growing emphasis on environmental compliance and the increasing adoption of advanced oxidation processes for wastewater treatment present significant opportunities. The market is poised for continued robust growth, with an estimated market value of $1,200 Million by 2033.

India Hydrogen Peroxide Market Segmentation

-

1. Product Function

- 1.1. Disinfectant

- 1.2. Bleaching

- 1.3. Oxidant

- 1.4. Other Pr

-

2. End-user Industry

- 2.1. Pulp and Paper

- 2.2. Chemical Synthesis

- 2.3. Wastewater Treatment

- 2.4. Mining

- 2.5. Food and Beverage

- 2.6. Cosmetics and Healthcare

- 2.7. Textiles

- 2.8. Other En

India Hydrogen Peroxide Market Segmentation By Geography

- 1. India

India Hydrogen Peroxide Market Regional Market Share

Geographic Coverage of India Hydrogen Peroxide Market

India Hydrogen Peroxide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints

- 3.4. Market Trends

- 3.4.1. Paper and Pulp Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 5.1.1. Disinfectant

- 5.1.2. Bleaching

- 5.1.3. Oxidant

- 5.1.4. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Pulp and Paper

- 5.2.2. Chemical Synthesis

- 5.2.3. Wastewater Treatment

- 5.2.4. Mining

- 5.2.5. Food and Beverage

- 5.2.6. Cosmetics and Healthcare

- 5.2.7. Textiles

- 5.2.8. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solvay*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RXCHEMICALS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Peroxide Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Evonik Industries AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chemplast Sanmar Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Peroxide Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCIPL (Prakash Chemicals International Private Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hindustan Organic Chemicals Ltd (HOCL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aditya Birla Chemicals

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gujarat Alkalies and Chemical Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Meghmani Finechem Limited (MFL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AkzoNobel NV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: India Hydrogen Peroxide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Hydrogen Peroxide Market Share (%) by Company 2025

List of Tables

- Table 1: India Hydrogen Peroxide Market Revenue billion Forecast, by Product Function 2020 & 2033

- Table 2: India Hydrogen Peroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Hydrogen Peroxide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Hydrogen Peroxide Market Revenue billion Forecast, by Product Function 2020 & 2033

- Table 5: India Hydrogen Peroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Hydrogen Peroxide Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hydrogen Peroxide Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the India Hydrogen Peroxide Market?

Key companies in the market include Arkema, Solvay*List Not Exhaustive, RXCHEMICALS, National Peroxide Limited, Evonik Industries AG, Chemplast Sanmar Limited, Indian Peroxide Limited, PCIPL (Prakash Chemicals International Private Limited), Hindustan Organic Chemicals Ltd (HOCL), Aditya Birla Chemicals, Gujarat Alkalies and Chemical Limited, Meghmani Finechem Limited (MFL), AkzoNobel NV.

3. What are the main segments of the India Hydrogen Peroxide Market?

The market segments include Product Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers.

6. What are the notable trends driving market growth?

Paper and Pulp Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hydrogen Peroxide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hydrogen Peroxide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hydrogen Peroxide Market?

To stay informed about further developments, trends, and reports in the India Hydrogen Peroxide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence