Key Insights

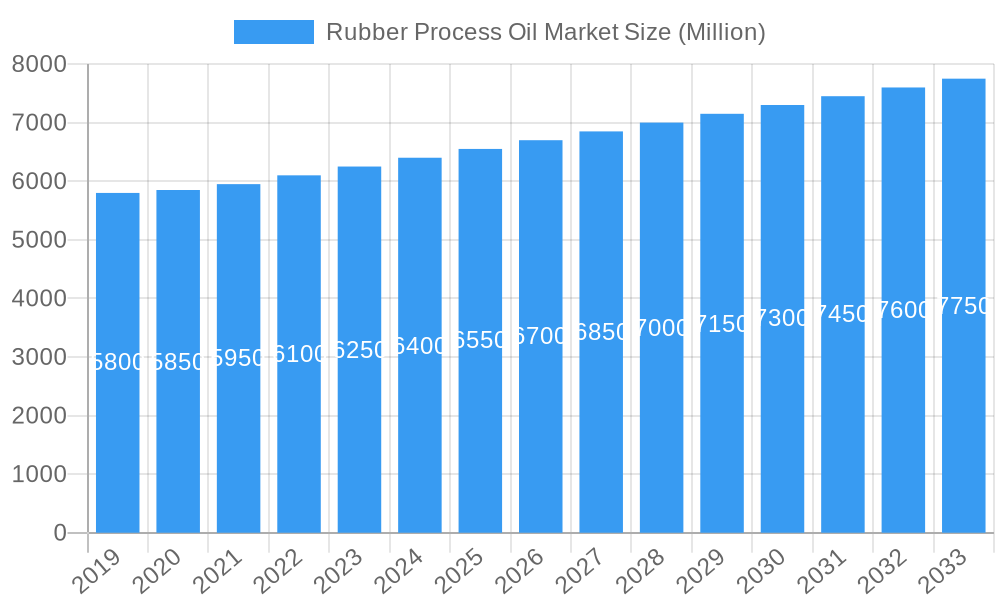

The global Rubber Process Oil market is poised for steady expansion, projected to reach a significant valuation of approximately $6,800 million by 2033, growing at a Compound Annual Growth Rate (CAGR) of 2.85% from its estimated 2025 value. This sustained growth is primarily fueled by the robust demand from the polymers industry, which utilizes rubber process oils extensively as plasticizers and extenders to enhance the processability and performance of various rubber compounds. The burgeoning automotive sector, with its increasing production of tires and other rubber components, acts as a significant driver for this demand. Furthermore, the personal care segment, particularly in the formulation of emollients and lubricants, is contributing to market expansion. Emerging economies in the Asia Pacific region, driven by rapid industrialization and a burgeoning middle class, are expected to witness the most substantial growth opportunities.

Rubber Process Oil Market Market Size (In Billion)

While the market demonstrates a positive trajectory, certain factors may present challenges. Fluctuations in crude oil prices, a key raw material for rubber process oils, can impact pricing and profitability. Moreover, increasing environmental regulations and the growing preference for sustainable and bio-based alternatives in certain applications could pose a restraint. However, continuous innovation in developing advanced rubber process oils with improved performance characteristics and a reduced environmental footprint is expected to mitigate these concerns. The market is characterized by a competitive landscape with major players like Shell PLC, Exxon Mobil Corporation, and Chevron Corporation investing in research and development to cater to evolving industry needs and expand their global presence across key regions such as North America, Europe, and Asia Pacific.

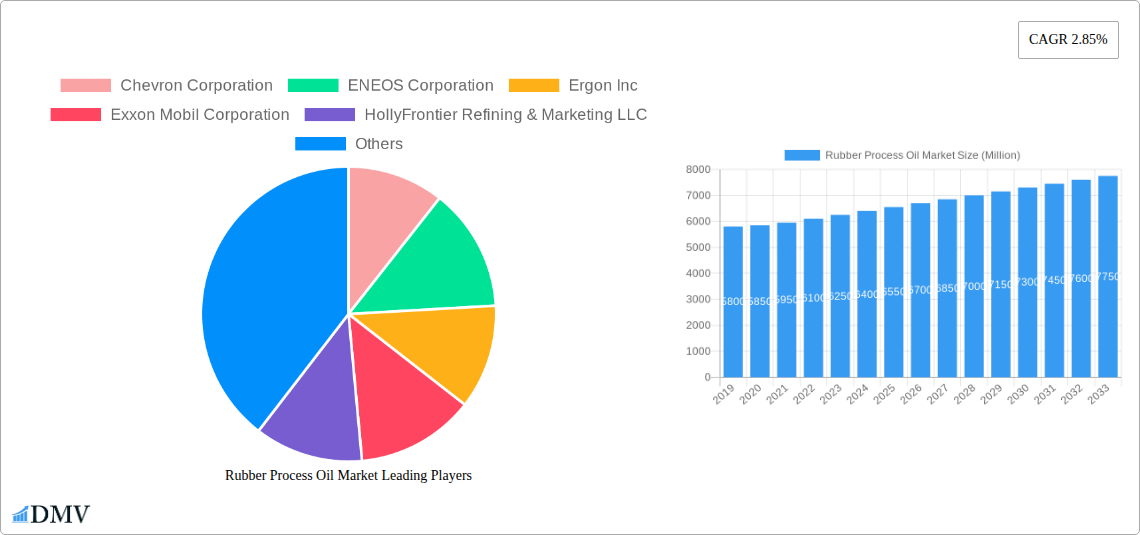

Rubber Process Oil Market Company Market Share

Here's your SEO-optimized and insightful report description for the Rubber Process Oil Market:

This in-depth rubber process oil market report offers a definitive guide to understanding the dynamics, trends, and future trajectory of this vital industrial lubricant sector. Covering the historical period of 2019–2024, the base year of 2025, and an extensive forecast period from 2025–2033, this analysis provides actionable insights for stakeholders seeking to navigate the evolving rubber processing chemicals landscape. Explore critical segments like aromatic rubber process oil, paraffinic rubber process oil, and naphthenic rubber process oil, alongside key applications in polymers, personal care, and other diverse industries. Discover how major players like Chevron Corporation, ENEOS Corporation, Ergon Inc, Exxon Mobil Corporation, and Shell PLC are shaping the market through strategic investments and innovation.

Rubber Process Oil Market Market Composition & Trends

The rubber process oil market exhibits a moderate to highly concentrated structure, with leading players accounting for a significant portion of the global market share. Innovation is primarily driven by the demand for enhanced tire performance, reduced environmental impact, and improved processing efficiency for rubber compounds. Regulatory landscapes, particularly concerning emissions and sustainability, are increasingly influencing product development and market entry. Substitute products, while present, often fall short in delivering the specific performance characteristics required in high-demand rubber applications. End-user profiles range from large-scale tire manufacturers and industrial rubber goods producers to niche segments within the automotive and construction industries. Merger and acquisition (M&A) activities, while not always involving direct rubber process oil manufacturers, indicate strategic consolidation and supply chain integration within the broader petrochemical and lubricant industries. For instance, the December 2022 acquisition by Royal Dutch Shell plc highlights a trend towards sustainability and recycling infrastructure. The market share distribution is expected to see subtle shifts, with aromatic oils maintaining a strong position due to their processing advantages, while paraffinnic and naphthenic oils gain traction for their specific performance benefits and environmental profiles.

Rubber Process Oil Market Industry Evolution

The rubber process oil market has undergone significant evolution, marked by consistent growth trajectories fueled by the expanding automotive industry and the increasing demand for rubber-based products globally. Technological advancements have played a pivotal role, with manufacturers continuously refining production processes to yield oils with improved solvency, lower volatility, and better compatibility with various rubber formulations. This evolution is directly linked to the development of higher-performance tires, requiring advanced tread compounds that necessitate specialized process oils to achieve desired characteristics like grip, durability, and fuel efficiency. Consumer demand is increasingly leaning towards sustainable and environmentally friendly products, influencing the adoption of rubber process oil types with lower aromatic content and improved biodegradability. Historical data from 2019–2024 indicates a steady upward trend in consumption, driven by infrastructure development and a growing middle class in emerging economies, which translates to higher vehicle production and tire replacement rates. The adoption of advanced refining techniques has enabled the production of highly refined oils that meet stringent quality standards, further propelling market growth. The forecast period of 2025–2033 anticipates continued expansion, albeit with a growing emphasis on eco-friendly alternatives and circular economy principles within the rubber chemical supply chain. The oil industry’s shift towards bio-based feedstocks, as exemplified by Chevron's ventures, is a testament to this evolving landscape.

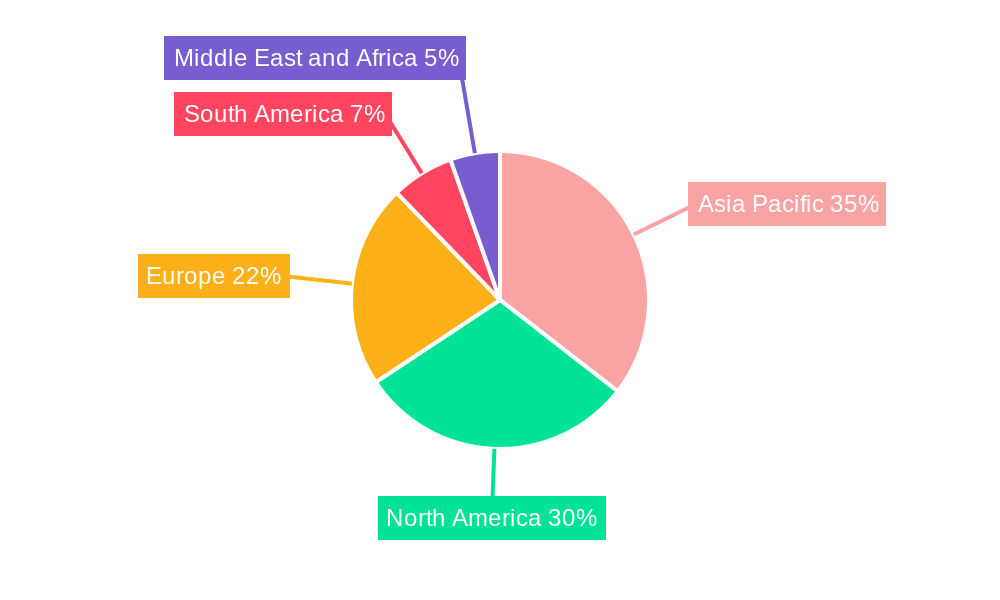

Leading Regions, Countries, or Segments in Rubber Process Oil Market

Asia-Pacific stands as the dominant region in the rubber process oil market, driven by its robust manufacturing base for tires and industrial rubber products, coupled with substantial investments in automotive production and infrastructure development. Countries like China, India, and Southeast Asian nations are major consumers and producers, benefiting from lower manufacturing costs and a burgeoning domestic market. Within the rubber process oil segments, the aromatic rubber process oil segment continues to hold a significant market share due to its excellent solvency and compatibility with a wide range of elastomers, making it indispensable for many tire applications. However, the paraffinic rubber process oil and naphthenic rubber process oil segments are experiencing robust growth, particularly in regions with stricter environmental regulations.

Key Drivers in Asia-Pacific:

- High Tire Production Volume: The region accounts for a substantial percentage of global tire manufacturing, creating a consistent demand for process oils.

- Automotive Industry Growth: Rapid expansion of the automotive sector, both in production and sales, directly fuels rubber consumption.

- Industrialization and Infrastructure Projects: Growing demand for rubber in construction, mining, and other industrial applications.

- Government Support and Investment: Favorable policies encouraging manufacturing and investment in related sectors.

Dominance Factors in Segments:

- Aromatic Oils: Their cost-effectiveness and broad applicability in traditional rubber formulations provide a strong market foundation. Their superior processing aid capabilities for carbon black dispersion are highly valued.

- Paraffinic Oils: Gaining traction due to their lower aromatic content, contributing to improved worker safety and reduced environmental impact. They offer good compatibility with synthetic rubbers and are increasingly used in high-performance tires and non-tire applications where reduced staining is critical.

- Naphthenic Oils: Their excellent low-temperature properties and good solvency make them suitable for specific applications requiring flexibility in cold climates and good tackifying properties.

The dominance of the Asia-Pacific region, coupled with the sustained demand for aromatic oils and the growing preference for less harmful paraffinic and naphthenic alternatives, defines the current and future landscape of the rubber process oil market.

Rubber Process Oil Market Product Innovations

Recent product innovations in the rubber process oil market focus on developing oils with reduced environmental footprints and enhanced performance characteristics. Manufacturers are increasingly offering low-PAH (Polycyclic Aromatic Hydrocarbons) rubber process oils, meeting stringent regulatory demands and consumer preferences for safer products. Innovations also include tailor-made formulations that optimize compatibility with specific polymers and curing systems, leading to improved physical properties of the final rubber products, such as enhanced abrasion resistance and reduced rolling resistance in tires. Performance metrics are being refined to showcase superior dispersion of fillers like carbon black and silica, leading to more uniform rubber compounds and extended product lifespan. These advancements ensure that rubber processing chemicals contribute directly to the efficiency and quality of modern rubber manufacturing.

Propelling Factors for Rubber Process Oil Market Growth

The rubber process oil market is propelled by several key factors. The sustained global demand for tires, driven by the expanding automotive industry and replacement market, remains a primary growth engine. Increasing industrialization and infrastructure development worldwide create a consistent need for various rubber-based products, from conveyor belts to hoses, further boosting consumption. Technological advancements in rubber compounding and manufacturing processes necessitate the use of specialized rubber process oil grades that offer improved performance and processing efficiency. Furthermore, evolving regulatory landscapes, particularly those emphasizing reduced emissions and improved worker safety, are driving the adoption of more environmentally friendly and low-PAH rubber processing chemicals. The oil and gas industry's continuous efforts in developing cleaner and more sustainable refining processes also contribute positively to market expansion.

Obstacles in the Rubber Process Oil Market Market

Despite its robust growth, the rubber process oil market faces several obstacles. Fluctuations in crude oil prices can significantly impact the cost of rubber process oil production, leading to price volatility and affecting profit margins for manufacturers and purchasing power for end-users. Stringent environmental regulations, particularly concerning the high aromatic content in some traditional process oils, pose challenges and necessitate investment in developing and adopting alternative, more sustainable options. Supply chain disruptions, as witnessed in recent global events, can lead to raw material shortages and increased lead times, impacting production schedules. Intense competition among existing players and the emergence of new entrants can also exert downward pressure on prices. Moreover, the development and adoption of new rubber formulations that require entirely different processing aids could potentially displace traditional rubber processing chemicals.

Future Opportunities in Rubber Process Oil Market

The rubber process oil market is poised for future opportunities driven by several emerging trends. The growing emphasis on sustainability presents a significant opportunity for manufacturers of eco-friendly rubber process oils, including those derived from bio-based feedstocks or with low aromatic content. The expansion of electric vehicle (EV) production is creating new demands for specialized tires and rubber components, requiring advanced rubber processing chemicals for improved performance and durability. Emerging economies in Asia and Africa continue to offer untapped market potential due to ongoing industrialization and infrastructure development. Furthermore, advancements in recycling technologies for rubber products could create new pathways for material utilization and influence the demand for specific rubber processing chemicals in the recycling process.

Major Players in the Rubber Process Oil Market Ecosystem

- Chevron Corporation

- ENEOS Corporation

- Ergon Inc

- Exxon Mobil Corporation

- HollyFrontier Refining & Marketing LLC

- HP Lubricants

- Idemitsu Kosan Co Ltd

- LUKOIL

- Nynas AB

- ORGKHIM Biochemical Holding

- Panama Petrochem Ltd

- PetroChina

- PETRONAS Lubricants International

- Phillips 66 Company

- Repsol

- Shell PLC

- TotalEnergies

Key Developments in Rubber Process Oil Market Industry

- December 2022: Royal Dutch Shell plc acquired a 49% stake in Blue Tide Environmental LLC via its Pennzoil-Quaker State subsidiary, signaling a move towards establishing a global network of lubricant recycling facilities and embracing circular economy principles within the broader oil industry.

- February 2022: In alignment with Chevron's strategic goals, Bunge will finalize a USD 600 million joint venture to strategically process soybean oil, aiming to enhance Chevron's operations by doubling current daily production to 14,000 tons by the end of 2024. This refined oil will serve as a sustainable feedstock for low-carbon diesel or jet fuel, reflecting a significant industry shift towards sustainable feedstocks and reduced carbon footprints within petrochemicals.

Strategic Rubber Process Oil Market Market Forecast

The strategic forecast for the rubber process oil market anticipates continued robust growth, driven by the expanding global automotive sector and the consistent demand for high-performance tires. The increasing adoption of sustainable and low-PAH rubber processing chemicals will be a defining trend, presenting significant opportunities for innovation and market differentiation. Emerging economies will continue to be key growth engines, fueled by ongoing industrialization and infrastructure development. Investments in bio-based feedstocks and advanced refining technologies by major players like Chevron and Shell underscore a strategic shift towards environmentally conscious solutions, ensuring the market's long-term viability and expansion. The forecast period of 2025–2033 is expected to witness a market value exceeding USD XX Billion.

Rubber Process Oil Market Segmentation

-

1. Type

- 1.1. Aromatic

- 1.2. Paraffinic

- 1.3. Naphthenic

-

2. Application

- 2.1. Polymers

- 2.2. Personal Care

- 2.3. Other Applications

Rubber Process Oil Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rubber Process Oil Market Regional Market Share

Geographic Coverage of Rubber Process Oil Market

Rubber Process Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Polymer Production; Surge in the Use of Rubber Oils; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Polymer Production; Surge in the Use of Rubber Oils; Other Drivers

- 3.4. Market Trends

- 3.4.1. Rubber Applications to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Aromatic

- 5.1.2. Paraffinic

- 5.1.3. Naphthenic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Polymers

- 5.2.2. Personal Care

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Aromatic

- 6.1.2. Paraffinic

- 6.1.3. Naphthenic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Polymers

- 6.2.2. Personal Care

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Aromatic

- 7.1.2. Paraffinic

- 7.1.3. Naphthenic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Polymers

- 7.2.2. Personal Care

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Aromatic

- 8.1.2. Paraffinic

- 8.1.3. Naphthenic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Polymers

- 8.2.2. Personal Care

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Aromatic

- 9.1.2. Paraffinic

- 9.1.3. Naphthenic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Polymers

- 9.2.2. Personal Care

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Rubber Process Oil Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Aromatic

- 10.1.2. Paraffinic

- 10.1.3. Naphthenic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Polymers

- 10.2.2. Personal Care

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chevron Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ENEOS Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ergon Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HollyFrontier Refining & Marketing LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP Lubricants

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Idemitsu Kosan Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LUKOIL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nynas AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ORGKHIM Biochemical Holding

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panama Petrochem Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PetroChina

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 PETRONAS Lubricants International

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Phillips 66 Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Repsol

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Shell PLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 TotalEnergies*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Chevron Corporation

List of Figures

- Figure 1: Global Rubber Process Oil Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Rubber Process Oil Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Rubber Process Oil Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Rubber Process Oil Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Rubber Process Oil Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Rubber Process Oil Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Rubber Process Oil Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Rubber Process Oil Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Rubber Process Oil Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Rubber Process Oil Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Rubber Process Oil Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Rubber Process Oil Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Rubber Process Oil Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Rubber Process Oil Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Rubber Process Oil Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Rubber Process Oil Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Rubber Process Oil Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Rubber Process Oil Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Rubber Process Oil Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Rubber Process Oil Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Rubber Process Oil Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Rubber Process Oil Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Rubber Process Oil Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Rubber Process Oil Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Rubber Process Oil Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Rubber Process Oil Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Rubber Process Oil Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Rubber Process Oil Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Rubber Process Oil Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Rubber Process Oil Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Rubber Process Oil Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Rubber Process Oil Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Rubber Process Oil Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Rubber Process Oil Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Rubber Process Oil Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Rubber Process Oil Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Rubber Process Oil Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Rubber Process Oil Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Rubber Process Oil Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Rubber Process Oil Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rubber Process Oil Market?

The projected CAGR is approximately 2.85%.

2. Which companies are prominent players in the Rubber Process Oil Market?

Key companies in the market include Chevron Corporation, ENEOS Corporation, Ergon Inc, Exxon Mobil Corporation, HollyFrontier Refining & Marketing LLC, HP Lubricants, Idemitsu Kosan Co Ltd, LUKOIL, Nynas AB, ORGKHIM Biochemical Holding, Panama Petrochem Ltd, PetroChina, PETRONAS Lubricants International, Phillips 66 Company, Repsol, Shell PLC, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Rubber Process Oil Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Polymer Production; Surge in the Use of Rubber Oils; Other Drivers.

6. What are the notable trends driving market growth?

Rubber Applications to Dominate the Market.

7. Are there any restraints impacting market growth?

Rising Polymer Production; Surge in the Use of Rubber Oils; Other Drivers.

8. Can you provide examples of recent developments in the market?

December 2022: Royal Dutch Shell plc acquired a 49% stake in Blue Tide Environmental LLC via its Pennzoil-Quaker State subsidiary. Blue Tide Environmental LLC is a company looking to establish a global network of lubricant recycling facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rubber Process Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rubber Process Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rubber Process Oil Market?

To stay informed about further developments, trends, and reports in the Rubber Process Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence