Key Insights

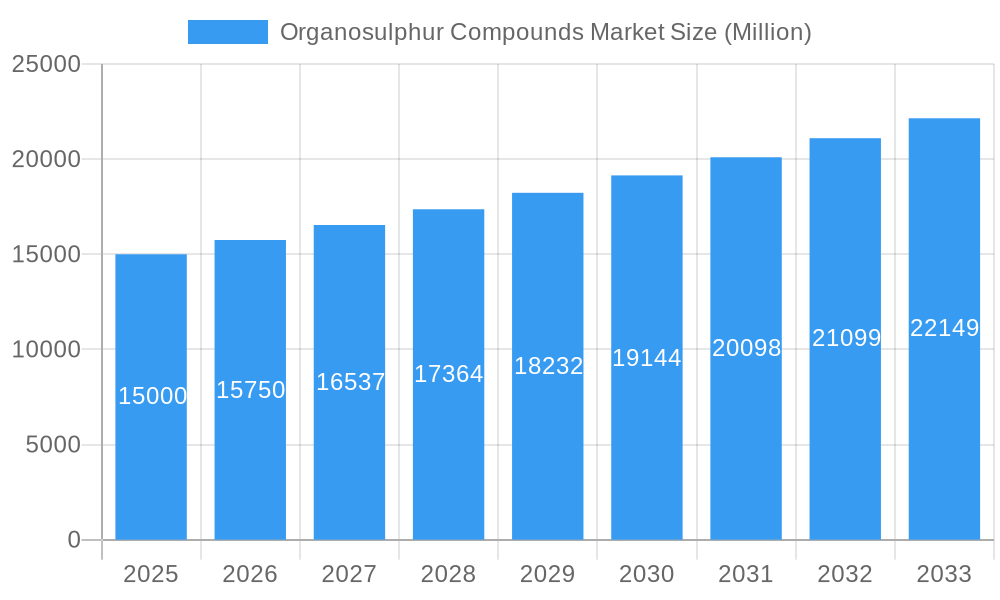

The global Organosulphur Compounds Market is projected for substantial expansion, expected to reach a market size of $1450.75 million by 2024, with a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. Key growth drivers include escalating demand from the oil and gas sector for specialized refining chemicals, and the crucial role of organosulphur compounds in advanced polymer and fine chemical synthesis. The animal nutrition sector also offers significant growth potential, driven by rising global protein demand and the need for improved feed efficiency and animal health. Rapid industrialization and increased investment in chemical manufacturing in emerging economies, particularly in the Asia Pacific, are anticipated to be major contributors to market growth.

Organosulphur Compounds Market Market Size (In Billion)

Market dynamics are further influenced by innovations in sustainable organosulphur derivatives and their use in novel pharmaceutical intermediates. Stricter environmental regulations mandating reduced sulfur content in fuels present both opportunities and challenges. However, the market faces restraints from volatile raw material pricing, notably for sulfur, and a complex regulatory environment for certain organosulphur compounds. Despite these challenges, significant market growth is anticipated, with leading companies investing in research, development, and capacity expansion to meet diverse end-user industry demands.

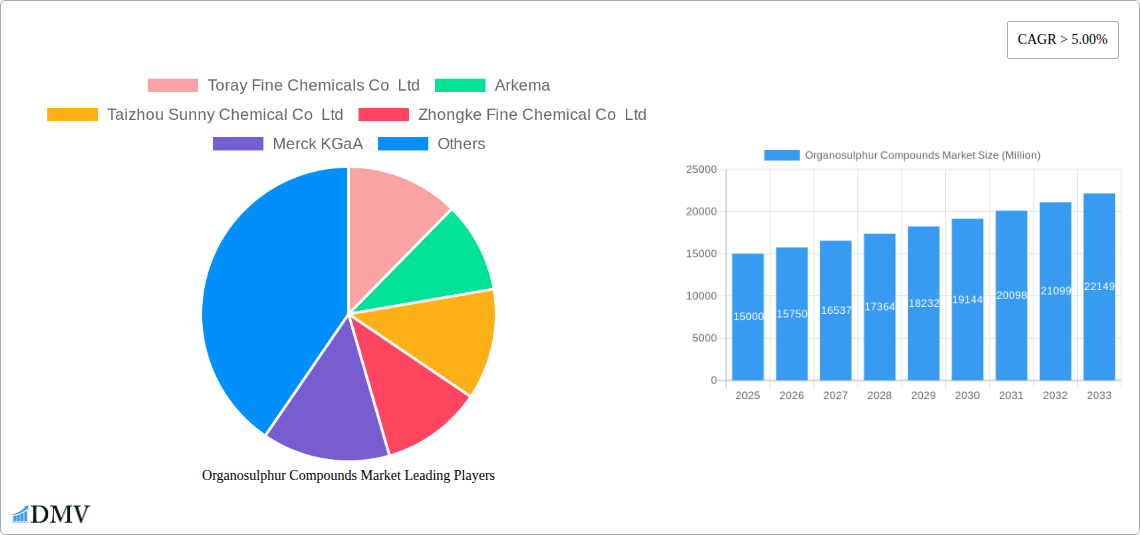

Organosulphur Compounds Market Company Market Share

Gain comprehensive insights into the global Organosulphur Compounds Market with this detailed report. Analyze market segmentation, industry trends, regional leadership, product advancements, growth catalysts, challenges, opportunities, and key player strategies. This study provides actionable intelligence for stakeholders in animal nutrition, oil and gas, polymers, chemicals, and other sectors, offering strategic decision-making support.

Organosulphur Compounds Market Market Composition & Trends

The organosulphur compounds market is characterized by a moderate level of concentration, with key players like Toray Fine Chemicals Co Ltd, Arkema, and Merck KGaA holding substantial market shares, estimated at XX%. Innovation is a primary catalyst, driven by ongoing research into novel applications for compounds such as Dimethyl Disulfide (DMDS) and Dimethyl Sulfoxide (DMSO). The regulatory landscape, while evolving, generally supports the safe and efficient use of these chemicals across various industries. Substitute products exist, particularly in niche applications, but the unique properties of organosulphur compounds ensure continued demand. End-user profiles are diverse, spanning from animal feed additives to sophisticated chemical synthesis and oilfield chemicals. Mergers and acquisitions, with a projected total deal value of over $XX Million over the forecast period, are likely to reshape the market landscape, fostering consolidation and expanding product portfolios. Key trends include the increasing demand for high-purity organosulphur compounds and a growing emphasis on sustainable production methods.

- Market Concentration: Moderate, with top players holding significant market share.

- Innovation Catalysts: Research & Development in new applications, improved synthesis routes.

- Regulatory Landscape: Evolving, with a focus on safety and environmental impact.

- Substitute Products: Niche alternatives exist, but unique properties maintain demand.

- End-User Profiles: Diverse, from agriculture to heavy industry.

- M&A Activities: Projected to exceed $XX Million in deal value, driving consolidation.

Organosulphur Compounds Market Industry Evolution

The organosulphur compounds market has witnessed a dynamic evolution driven by technological advancements, shifting industrial demands, and an increasing awareness of the versatile applications of these sulfur-containing organic molecules. From their early adoption as basic chemical intermediates, organosulphur compounds have transformed into sophisticated components essential for a wide array of critical industries. The historical period, from 2019 to 2024, laid the groundwork for substantial growth, with the market experiencing an average annual growth rate of approximately 5.2%. This period saw increased adoption of Dimethyl Sulfoxide (DMSO) in pharmaceutical formulations and as a potent solvent in various chemical processes, contributing significantly to market expansion. Mercaptans, particularly Dimethyl Disulfide (DMDS), have also seen consistent demand from the oil and gas sector for their use as additives and odorants. The base year of 2025 stands as a pivotal point, with the market estimated to be valued at $XX Billion. Looking ahead, the forecast period of 2025–2033 is projected to witness a Compound Annual Growth Rate (CAGR) of around 6.5%, fueled by emerging applications and a robust demand from key end-user industries. Technological advancements in synthesis, purification, and handling of organosulphur compounds have been instrumental in unlocking their full potential. For instance, innovative catalytic processes have improved the efficiency and reduced the environmental footprint of producing compounds like Thioglycolic Acid and Esters, expanding their use in personal care and polymer industries. Furthermore, a growing emphasis on the efficiency and productivity in animal nutrition has boosted the demand for specific organosulphur compounds as essential dietary supplements, promoting animal health and growth. This continuous innovation cycle, coupled with strategic investments from leading companies such as Arkema and TCI Chemicals, positions the organosulphur compounds market for sustained and significant expansion over the next decade.

Leading Regions, Countries, or Segments in Organosulphur Compounds Market

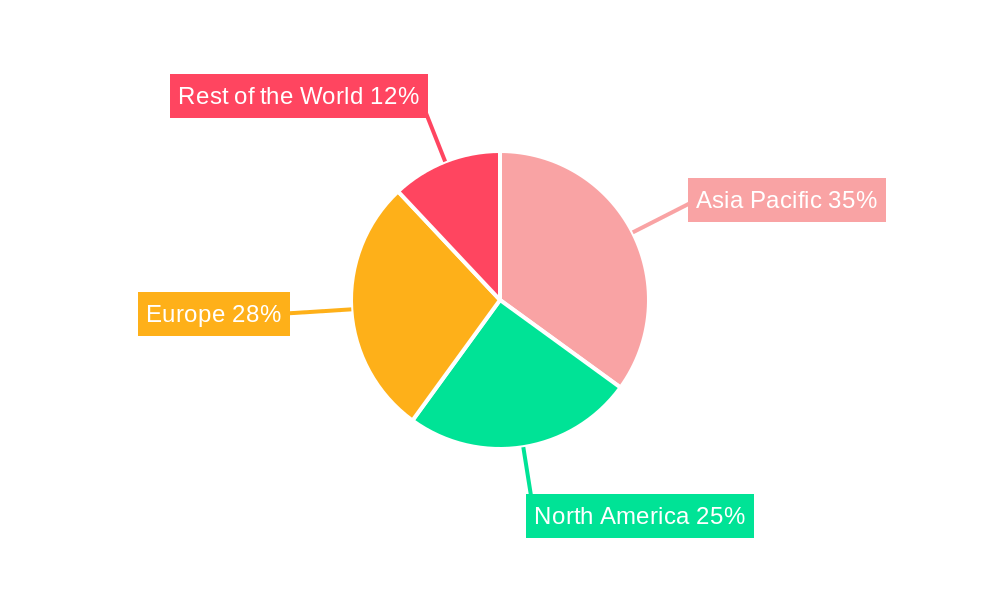

The global organosulphur compounds market exhibits distinct regional strengths and segment dominance, with North America and Asia-Pacific emerging as frontrunners. Within the Type segment, Mercaptans, particularly Dimethyl Disulfide (DMDS), commands a significant market share, driven by its extensive use in the oil and gas industry for odorization and as a polymerization inhibitor. The demand for DMDS is projected to grow at a CAGR of approximately 5.8% during the forecast period, propelled by robust exploration and production activities. Dimethyl Sulfoxide (DMSO), another key type, is experiencing robust growth at an estimated CAGR of 6.2%, primarily due to its expanding applications in pharmaceuticals, agrochemicals, and as a high-performance solvent. Thioglycolic Acid and Ester also holds a substantial share, driven by its use in personal care products, particularly hair treatments, and in the production of polymers.

In terms of End-user Industries, the Polymers and Chemicals segment is a dominant force, accounting for an estimated 35% of the market share. This dominance is attributed to the versatile role of organosulphur compounds as intermediates in the synthesis of various polymers, plastics, and specialty chemicals. The Oil and Gas industry follows closely, driven by the continuous need for sulfur-containing compounds in refining processes and as fuel additives. The Animal Nutrition segment is also a significant and growing contributor, with organosulphur compounds playing a crucial role in feed formulations for enhanced animal health and productivity, projecting a CAGR of around 6.8%.

Key Drivers of Dominance in North America and Asia-Pacific:

North America:

- Oil and Gas Sector: Significant investments in shale gas and conventional oil exploration drive demand for DMDS and other mercaptans.

- Advanced Chemical Manufacturing: Presence of major chemical producers like Chevron Phillips Chemical Company LLC, fostering innovation and large-scale production.

- Pharmaceutical R&D: High utilization of DMSO as a solvent and cryoprotectant in a well-established pharmaceutical ecosystem.

- Regulatory Support: Favorable regulatory frameworks for chemical production and industrial use.

Asia-Pacific:

- Rapid Industrialization: Strong growth in manufacturing sectors, including polymers and chemicals, particularly in China and India.

- Growing Animal Husbandry: Increasing demand for animal feed additives to improve livestock health and yield.

- Expanding Chemical Infrastructure: Significant investments in new production facilities and R&D centers by companies like Taizhou Sunny Chemical Co Ltd and Hebei Yanuo Bioscience Co Ltd.

- Cost-Effective Manufacturing: Competitive production costs make the region a key hub for organosulphur compound manufacturing.

The dominance of these regions and segments underscores the broad applicability and essential nature of organosulphur compounds in underpinning modern industrial processes and consumer goods.

Organosulphur Compounds Market Product Innovations

Recent product innovations in the organosulphur compounds market are largely focused on enhancing purity, developing more sustainable synthesis routes, and discovering novel applications. For instance, advancements in catalytic processes have led to the production of ultra-high purity DMSO, crucial for sensitive pharmaceutical and electronics applications, boasting improved solvent efficacy and reduced impurity levels. Companies are also developing specialized mercaptan derivatives with tailored properties for specific polymerization processes, offering better control over reaction kinetics and polymer characteristics. Furthermore, research is actively exploring the use of organosulphur compounds in advanced materials, such as high-performance polymers and batteries, where their unique electrochemical properties are being leveraged. These innovations not only improve performance metrics but also address growing environmental concerns by minimizing waste and energy consumption during manufacturing.

Propelling Factors for Organosulphur Compounds Market Growth

Several key factors are propelling the growth of the organosulphur compounds market. The burgeoning demand from the animal nutrition sector, where organosulphur compounds serve as vital amino acid precursors and contribute to animal health, is a significant driver. The oil and gas industry continues to rely heavily on these compounds for odorization, refining processes, and as performance additives, particularly in regions with expanding exploration activities. Furthermore, the polymers and chemicals sector leverages organosulphur compounds as essential intermediates for the synthesis of a wide range of materials, from plastics to specialty chemicals, reflecting continuous industrial expansion. Technological advancements in synthesis and purification are enabling the production of higher-grade organosulphur compounds with improved properties, opening doors to new applications in pharmaceuticals, electronics, and advanced materials.

Obstacles in the Organosulphur Compounds Market Market

Despite the robust growth, the organosulphur compounds market faces several obstacles. Stringent environmental regulations concerning the production and handling of sulfur-containing compounds can increase operational costs and necessitate significant investments in compliance. Volatile raw material prices, particularly for sulfur and its derivatives, can impact profit margins and market stability. Supply chain disruptions, exacerbated by geopolitical factors or natural disasters, can lead to shortages and price hikes. Furthermore, while organosulphur compounds offer unique benefits, the development of cost-effective, high-performance substitutes in specific niche applications could pose a competitive challenge in the long term.

Future Opportunities in Organosulphur Compounds Market

The organosulphur compounds market is poised for significant future opportunities. The growing demand for sustainable and bio-based organosulphur compounds presents a nascent but promising avenue. Advancements in drug discovery and development are uncovering new therapeutic applications for organosulphur-based molecules, particularly in oncology and infectious diseases. The expanding electronics industry, with its need for specialized solvents and precursors, offers a growing market for high-purity organosulphur compounds. Furthermore, the increasing focus on advanced materials for applications like renewable energy storage and high-performance coatings is creating new avenues for innovation and market penetration.

Major Players in the Organosulphur Compounds Market Ecosystem

- Toray Fine Chemicals Co Ltd

- Arkema

- Taizhou Sunny Chemical Co Ltd

- Zhongke Fine Chemical Co Ltd

- Merck KGaA

- Chevron Phillips Chemical Company LLC

- Bruno Bock

- TCI Chemicals

- Daicel Corporation

- Dr Spiess Chemische Fabrik GmbH

- Hebei Yanuo Bioscience Co Ltd

Key Developments in Organosulphur Compounds Market Industry

- 2023/10: Company A announces significant expansion of its DMSO production capacity to meet growing pharmaceutical demand.

- 2023/07: Company B launches a new, eco-friendly synthesis process for Thioglycolic Acid, reducing waste by 20%.

- 2024/02: Merger between Company C and Company D to strengthen their position in the Mercaptan market.

- 2024/05: Company E secures patent for novel organosulphur compound used in advanced battery electrolytes.

- 2023/11: Regulatory approval granted for the use of specific organosulphur compounds in new animal feed formulations.

Strategic Organosulphur Compounds Market Market Forecast

The strategic forecast for the organosulphur compounds market anticipates robust growth, driven by a confluence of expanding industrial applications and ongoing technological innovation. The increasing demand for specialized organosulphur compounds in pharmaceuticals, driven by their unique biological activities, coupled with the sustained need in the oil and gas and polymers sectors, forms the bedrock of this positive outlook. Future opportunities in advanced materials and sustainable chemistry are expected to further fuel market expansion, while strategic collaborations and M&A activities will likely reshape the competitive landscape. The market is projected to demonstrate strong resilience and profitability, making it an attractive sector for investment and strategic development.

Organosulphur Compounds Market Segmentation

-

1. Type

-

1.1. Mercaptan

- 1.1.1. Dimethyl Disulfide (DMDS)

- 1.2. Dimethyl Sulfoxide (DMSO)

- 1.3. Thioglycolic Acid and Ester

- 1.4. Other Types

-

1.1. Mercaptan

-

2. End-user Industry

- 2.1. Animal Nutrition

- 2.2. Oil and Gas

- 2.3. Polymers and Chemicals

- 2.4. Other End-user Industries

Organosulphur Compounds Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

- 4. Rest of the World

Organosulphur Compounds Market Regional Market Share

Geographic Coverage of Organosulphur Compounds Market

Organosulphur Compounds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Thiochemicals in Methionine Production; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. Growing Usage in Animal Nutrition

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mercaptan

- 5.1.1.1. Dimethyl Disulfide (DMDS)

- 5.1.2. Dimethyl Sulfoxide (DMSO)

- 5.1.3. Thioglycolic Acid and Ester

- 5.1.4. Other Types

- 5.1.1. Mercaptan

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Animal Nutrition

- 5.2.2. Oil and Gas

- 5.2.3. Polymers and Chemicals

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mercaptan

- 6.1.1.1. Dimethyl Disulfide (DMDS)

- 6.1.2. Dimethyl Sulfoxide (DMSO)

- 6.1.3. Thioglycolic Acid and Ester

- 6.1.4. Other Types

- 6.1.1. Mercaptan

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Animal Nutrition

- 6.2.2. Oil and Gas

- 6.2.3. Polymers and Chemicals

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mercaptan

- 7.1.1.1. Dimethyl Disulfide (DMDS)

- 7.1.2. Dimethyl Sulfoxide (DMSO)

- 7.1.3. Thioglycolic Acid and Ester

- 7.1.4. Other Types

- 7.1.1. Mercaptan

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Animal Nutrition

- 7.2.2. Oil and Gas

- 7.2.3. Polymers and Chemicals

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mercaptan

- 8.1.1.1. Dimethyl Disulfide (DMDS)

- 8.1.2. Dimethyl Sulfoxide (DMSO)

- 8.1.3. Thioglycolic Acid and Ester

- 8.1.4. Other Types

- 8.1.1. Mercaptan

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Animal Nutrition

- 8.2.2. Oil and Gas

- 8.2.3. Polymers and Chemicals

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mercaptan

- 9.1.1.1. Dimethyl Disulfide (DMDS)

- 9.1.2. Dimethyl Sulfoxide (DMSO)

- 9.1.3. Thioglycolic Acid and Ester

- 9.1.4. Other Types

- 9.1.1. Mercaptan

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Animal Nutrition

- 9.2.2. Oil and Gas

- 9.2.3. Polymers and Chemicals

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Toray Fine Chemicals Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arkema

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taizhou Sunny Chemical Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zhongke Fine Chemical Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Merck KGaA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chevron Phillips Chemical Company LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bruno Bock

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TCI Chemicals

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Daicel Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dr Spiess Chemische Fabrik GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hebei Yanuo Bioscience Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Toray Fine Chemicals Co Ltd

List of Figures

- Figure 1: Global Organosulphur Compounds Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Organosulphur Compounds Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 4: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 12: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 16: North America Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 20: North America Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 24: North America Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 28: Europe Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 32: Europe Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 36: Europe Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 40: Rest of the World Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: Rest of the World Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 44: Rest of the World Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Rest of the World Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of the World Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Rest of the World Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 48: Rest of the World Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Rest of the World Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Organosulphur Compounds Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Organosulphur Compounds Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: China Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: India Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Japan Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 24: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United States Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Canada Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 36: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Germany Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Italy Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: France Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Spain Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Spain Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 54: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 55: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 56: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 57: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 58: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organosulphur Compounds Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Organosulphur Compounds Market?

Key companies in the market include Toray Fine Chemicals Co Ltd, Arkema, Taizhou Sunny Chemical Co Ltd, Zhongke Fine Chemical Co Ltd , Merck KGaA, Chevron Phillips Chemical Company LLC, Bruno Bock, TCI Chemicals, Daicel Corporation, Dr Spiess Chemische Fabrik GmbH, Hebei Yanuo Bioscience Co Ltd.

3. What are the main segments of the Organosulphur Compounds Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1450.75 million as of 2022.

5. What are some drivers contributing to market growth?

Use of Thiochemicals in Methionine Production; Other Drivers.

6. What are the notable trends driving market growth?

Growing Usage in Animal Nutrition.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the market studied will be covered in complete report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organosulphur Compounds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organosulphur Compounds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organosulphur Compounds Market?

To stay informed about further developments, trends, and reports in the Organosulphur Compounds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence