Key Insights

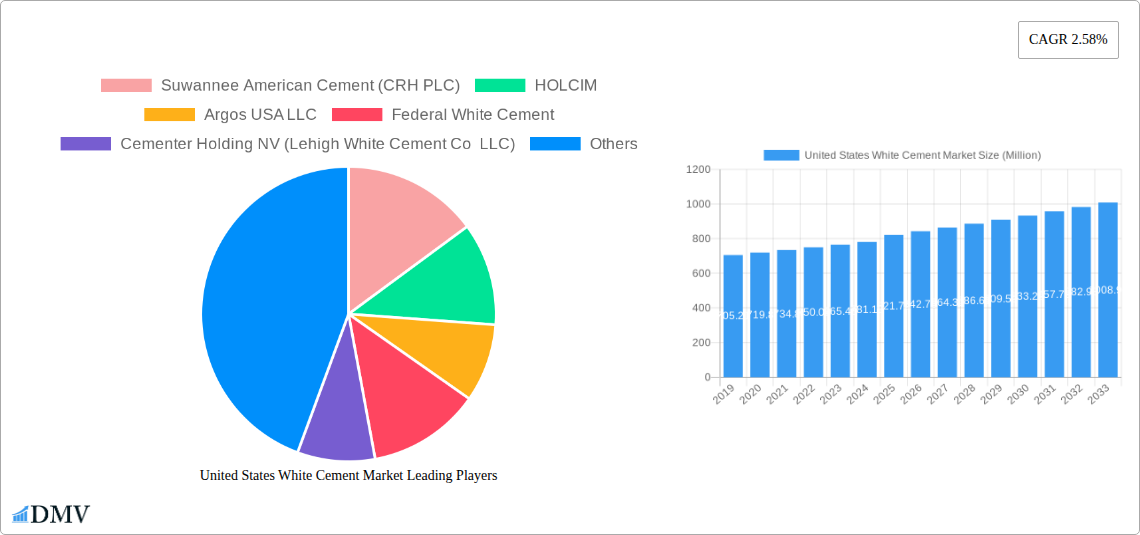

The United States White Cement Market is poised for steady growth, projected to reach a substantial market size of $821.79 million. This expansion is driven by a consistent Compound Annual Growth Rate (CAGR) of 2.58% over the study period. The market's vitality is fueled by the increasing demand for aesthetically pleasing and durable construction materials, particularly in the residential and infrastructure sectors. The growing preference for modern architectural designs that utilize white cement for its bright, clean finish, and its ability to enhance the visual appeal of concrete structures, is a significant driver. Furthermore, the expanding use of white cement in decorative concrete applications, precast elements, and its role as a binder in specialized mortars and grouts are contributing to its market penetration. The market is also benefiting from ongoing urbanization and infrastructure development projects across the nation, which require high-quality and visually appealing cementitious materials.

United States White Cement Market Market Size (In Million)

The market's trajectory, while positive, is influenced by several factors. The primary growth drivers include escalating construction activities, a rising trend in sustainable building practices where white cement's reflectivity can reduce heat island effects, and its application in specialized architectural projects. However, potential restraints such as the cost differential compared to ordinary Portland cement and the availability of alternative materials might pose challenges. Despite these, the market is segmented into various product types, including Type I Cement and Type III Cement, each catering to specific construction needs, and further bifurcated by applications such as Residential, Infrastructure, Commercial, Industrial, and Institutional. Leading companies like HOLCIM, CEMEX SAB De CV, and Heidelberg Materials are actively shaping the market landscape through product innovation and strategic investments, ensuring a robust supply chain and continued market development within the United States.

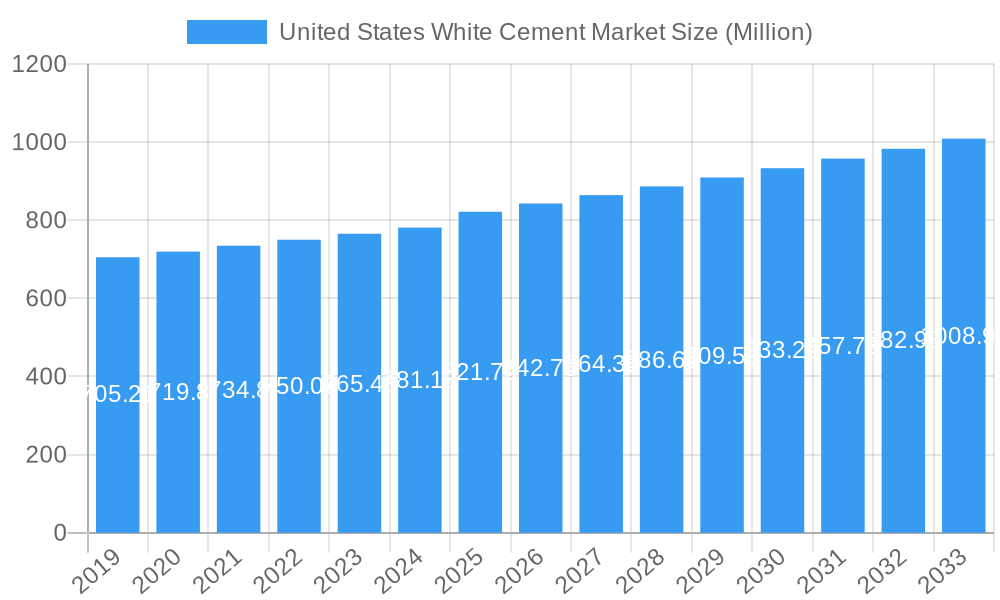

United States White Cement Market Company Market Share

This in-depth report provides an exhaustive analysis of the United States white cement market, forecasting its trajectory from 2019 to 2033 with a base year of 2025. Delve into market segmentation, competitive landscapes, industry evolution, and future opportunities, gaining critical insights for strategic decision-making. Understand the key players, product innovations, and growth drivers shaping this dynamic sector.

United States White Cement Market Market Composition & Trends

The United States white cement market, valued at an estimated $XXX Million in 2025, exhibits a moderate to consolidated market concentration. Key innovation catalysts include advancements in sustainable manufacturing processes and the development of specialized white cement formulations for aesthetic architectural applications. Regulatory landscapes, particularly environmental regulations governing emissions and material sourcing, play a significant role in shaping market dynamics. Substitute products, such as grey cement with decorative coatings or alternative building materials, present a competitive challenge, though white cement retains its premium appeal for specific design needs. End-user profiles span residential construction, commercial projects, infrastructure development, and industrial applications, with a growing emphasis on high-value aesthetic finishes. Merger and acquisition (M&A) activities, estimated at $XXX Million in deal values over the historical period, indicate strategic consolidation and expansion efforts by major players to enhance market share and product portfolios. The distribution of market share is influenced by production capacity, distribution networks, and product differentiation.

United States White Cement Market Industry Evolution

The United States white cement industry has undergone a substantial evolution between 2019 and 2024, with an estimated market size of $XXX Million in 2024. This evolution is characterized by steady market growth trajectories driven by a rising demand for visually appealing and durable construction materials. Technological advancements have focused on optimizing production efficiency, reducing energy consumption, and enhancing the purity and consistency of white cement. For instance, adoption metrics for advanced grinding technologies have shown a XX% increase over the historical period, leading to improved product quality. Shifting consumer demands, particularly from architects and developers, have pushed for more sustainable and aesthetically versatile building solutions, favoring white cement for its ability to create bright, clean finishes and its compatibility with various decorative elements. The industry has also witnessed a growing interest in specialized white cement for precast concrete applications, decorative concrete, and architectural facades, contributing to an estimated XX% compound annual growth rate (CAGR) projected for the forecast period. Furthermore, the integration of digital technologies in supply chain management and quality control has further streamlined operations and enhanced responsiveness to market needs. The market's resilience is further underscored by its ability to adapt to evolving building codes and sustainability standards.

Leading Regions, Countries, or Segments in United States White Cement Market

The Residential application segment is currently the dominant force in the United States white cement market, driven by a robust and sustained demand for aesthetic appeal in home construction and renovation projects. This segment is projected to maintain its leading position throughout the forecast period.

- Dominance Drivers for Residential Application:

- Aesthetic Demand: Homeowners and builders increasingly prioritize visually appealing exteriors and interiors, where white cement offers a clean, bright, and versatile base for various design styles.

- Renovation and Remodeling Trends: The significant activity in the residential renovation and remodeling sector fuels the demand for high-quality finishing materials like white cement.

- Growing Disposable Income: Increased disposable income among the middle-class population allows for greater investment in premium building materials that enhance property value and visual appeal.

The Type I Cement product type also holds a significant share, serving as a versatile option across multiple applications, including residential, commercial, and infrastructure projects. Its broad applicability contributes to its market dominance.

- Dominance Drivers for Type I Cement:

- Versatility: Type I cement is suitable for a wide range of general construction purposes, making it a go-to choice for many projects.

- Cost-Effectiveness: Compared to specialized types, Type I cement often presents a more cost-effective solution for projects where extreme performance characteristics are not paramount.

- Availability: Widespread production and distribution networks ensure the consistent availability of Type I cement across the United States.

While Infrastructure applications are also substantial, particularly for decorative elements in public spaces and bridges, the sheer volume and consistent demand from the residential sector currently place it as the second-largest application segment. Commercial and Industrial and Institutional segments contribute to the market, driven by specific project requirements for durability and aesthetics, but do not yet match the overarching influence of the residential sector. The Type III Cement product type, known for its high early strength, finds niche applications where rapid construction is critical, such as in precast concrete elements and emergency repairs, but its overall market share remains smaller than Type I.

United States White Cement Market Product Innovations

Product innovations in the United States white cement market are increasingly focused on enhancing sustainability and performance. Manufacturers are developing low-carbon white cement variants and exploring recycled raw materials to reduce environmental impact, with an estimated XX% reduction in CO2 emissions targeted by leading companies. Advancements in nanoparticle technology are leading to white cement with improved strength, durability, and resistance to weathering, extending the lifespan of structures. Furthermore, the development of specialized white cement formulations for precast concrete, decorative overlays, and rapid-setting applications cater to specific industry needs, offering unique selling propositions such as enhanced workability and reduced curing times. These innovations are crucial for meeting the evolving demands of the construction industry for both aesthetic excellence and environmental responsibility.

Propelling Factors for United States White Cement Market Growth

The United States white cement market growth is propelled by several key factors. A burgeoning demand for aesthetically pleasing and high-performance building materials in both residential and commercial construction projects is a primary driver. This is further amplified by increased government investments in infrastructure development, which often incorporate decorative concrete elements made with white cement. Technological advancements in cement production leading to more sustainable and energy-efficient processes also contribute to market expansion, aligning with growing environmental consciousness. Furthermore, the expanding use of white cement in niche applications like precast concrete and decorative finishes provides consistent avenues for growth, underpinning an estimated XX% CAGR in the coming years.

Obstacles in the United States White Cement Market Market

Despite its growth potential, the United States white cement market faces certain obstacles. Stringent environmental regulations concerning emissions and quarrying operations can increase production costs and necessitate significant capital investments in abatement technologies. Supply chain disruptions, including raw material availability and transportation challenges, can impact production schedules and pricing stability. The competitive pressure from alternative building materials and the price sensitivity of certain construction segments also pose challenges. Furthermore, the relatively higher cost of white cement compared to grey cement can limit its adoption in cost-critical projects, impacting market penetration.

Future Opportunities in United States White Cement Market

The United States white cement market is poised to benefit from several emerging opportunities. The increasing trend towards sustainable construction and green building certifications is creating a demand for low-carbon and eco-friendly white cement solutions. Innovations in smart construction technologies and prefabrication are opening up new avenues for specialized white cement applications. The growing demand for high-end architectural designs and urban regeneration projects in major metropolitan areas presents significant growth potential. Furthermore, exploring new markets within the infrastructure sector, such as durable and aesthetically pleasing public spaces, offers promising expansion opportunities, contributing to an estimated $XXX Million market value by 2033.

Major Players in the United States White Cement Market Ecosystem

- Suwannee American Cement (CRH PLC)

- HOLCIM

- Argos USA LLC

- Federal White Cement

- Cementer Holding NV (Lehigh White Cement Co LLC)

- CEMEX SAB De CV

- Almaty's Gmbh (OYAK)

- Royal El Minya Cement (SESCO Cement Corp )

- Royal White Cement Inc.

- Titan America LLC

- Heidelberg Materials

- CIMSA

Key Developments in United States White Cement Market Industry

- August 2023: Royal White Cement Inc. announced its plans to build a new cement terminal in Houston, Texas, to produce slag, grey cement, and white cement. The company has strengthened its market presence by expanding its footprint in Houston.

- March 2023: Argos USA LLC has been awarded the Energy Star certification from the US Environmental Protection Agency (EPA). The company has strengthened its market presence by reducing the electricity use and CO2 emissions from its manufacturing process.

Strategic United States White Cement Market Market Forecast

The strategic forecast for the United States white cement market anticipates continued robust growth, driven by a confluence of factors. The ongoing demand for premium aesthetic finishes in residential and commercial construction, coupled with significant government investments in infrastructure, will provide a strong foundational demand. Innovations in sustainable cement production and the development of specialized formulations will further enhance the market's appeal and competitive edge. As the industry embraces advancements in prefabrication and green building practices, new avenues for white cement application are expected to emerge, leading to an estimated market valuation of $XXX Million by 2033. The market's resilience and adaptability to evolving environmental regulations and consumer preferences position it for sustained expansion and profitability.

United States White Cement Market Segmentation

-

1. Product Type

- 1.1. Type I Cement

- 1.2. Type III Cement

- 1.3. Other Product Types

-

2. Application

- 2.1. Residential

- 2.2. Infrastructure

- 2.3. Commercial

- 2.4. Industrial and Institutional

United States White Cement Market Segmentation By Geography

- 1. United States

United States White Cement Market Regional Market Share

Geographic Coverage of United States White Cement Market

United States White Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential Construction in the Country; Increasing Investments in the Infrastructure Sector

- 3.3. Market Restrains

- 3.3.1. High Production Costs

- 3.4. Market Trends

- 3.4.1. Type I Cement to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States White Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Type I Cement

- 5.1.2. Type III Cement

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Infrastructure

- 5.2.3. Commercial

- 5.2.4. Industrial and Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Suwannee American Cement (CRH PLC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HOLCIM

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Argos USA LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Federal White Cement

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cementer Holding NV (Lehigh White Cement Co LLC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEMEX SAB De CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Almaty's Gmbh (OYAK)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal El Minya Cement (SESCO Cement Corp )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal White Cement Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Titan America LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Heidelberg Materials

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CIMSA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Suwannee American Cement (CRH PLC)

List of Figures

- Figure 1: United States White Cement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States White Cement Market Share (%) by Company 2025

List of Tables

- Table 1: United States White Cement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States White Cement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: United States White Cement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States White Cement Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: United States White Cement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States White Cement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: United States White Cement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States White Cement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: United States White Cement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: United States White Cement Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: United States White Cement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States White Cement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States White Cement Market?

The projected CAGR is approximately 2.58%.

2. Which companies are prominent players in the United States White Cement Market?

Key companies in the market include Suwannee American Cement (CRH PLC), HOLCIM, Argos USA LLC, Federal White Cement, Cementer Holding NV (Lehigh White Cement Co LLC), CEMEX SAB De CV, Almaty's Gmbh (OYAK), Royal El Minya Cement (SESCO Cement Corp ), Royal White Cement Inc, Titan America LLC, Heidelberg Materials, CIMSA.

3. What are the main segments of the United States White Cement Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 821.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential Construction in the Country; Increasing Investments in the Infrastructure Sector.

6. What are the notable trends driving market growth?

Type I Cement to Dominate the Market.

7. Are there any restraints impacting market growth?

High Production Costs.

8. Can you provide examples of recent developments in the market?

August 2023: Royal White Cement Inc. announced its plans to build a new cement terminal in Houston, Texas, to produce slag, grey cement, and white cement. The company has strengthened its market presence by expanding its footprint in Houston.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States White Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States White Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States White Cement Market?

To stay informed about further developments, trends, and reports in the United States White Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence