Key Insights

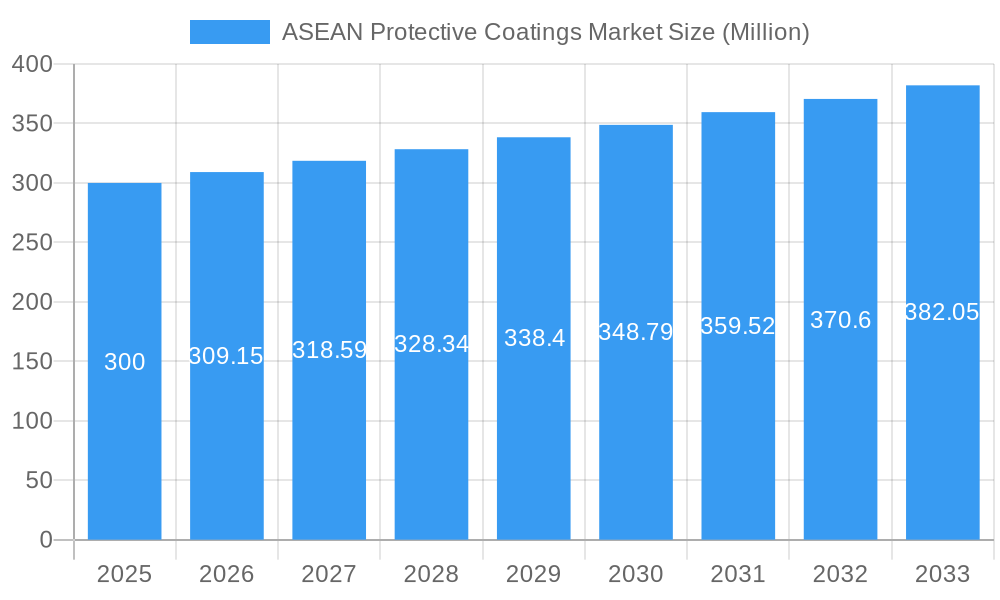

The ASEAN protective coatings market is poised for robust expansion, projected to reach a substantial market size of USD 300 million, driven by a significant Compound Annual Growth Rate (CAGR) exceeding 3.00% over the forecast period of 2025-2033. This growth is underpinned by escalating demand across critical end-user industries such as Oil & Gas, Mining, Power, and Infrastructure. These sectors are experiencing increased investment in new projects and maintenance of existing assets, necessitating high-performance protective coatings to safeguard against corrosion, weathering, and chemical degradation. The Oil and Gas industry, in particular, is a major consumer, with offshore platforms, pipelines, and refineries requiring specialized coatings for extreme environmental conditions. Similarly, the burgeoning infrastructure development across Southeast Asia, encompassing bridges, ports, and commercial buildings, further fuels the demand for durable and long-lasting protective solutions. The mining sector, with its aggressive operational environments, also presents a consistent demand for coatings that can withstand abrasion and chemical exposure.

ASEAN Protective Coatings Market Market Size (In Million)

The market's trajectory is further shaped by evolving technological advancements and shifting consumer preferences. Water-borne coatings are gaining traction due to their environmentally friendly profiles and reduced volatile organic compound (VOC) emissions, aligning with increasing regulatory pressures and a growing emphasis on sustainability. While solvent-borne coatings continue to hold a significant share, the demand for eco-conscious alternatives is on the rise. Powder coatings are also witnessing increased adoption, offering excellent durability and a wide range of aesthetic finishes with minimal environmental impact. Furthermore, UV-cured coatings are emerging as a niche but growing segment, particularly in applications where rapid curing and high performance are paramount. Geographically, the ASEAN region presents a dynamic landscape with countries like Indonesia, Malaysia, Thailand, Vietnam, and the Philippines leading the charge in consumption, fueled by their expanding industrial bases and ongoing infrastructure projects. Key market players are actively investing in research and development to innovate and cater to these evolving demands, focusing on developing coatings with enhanced performance, longevity, and environmental credentials.

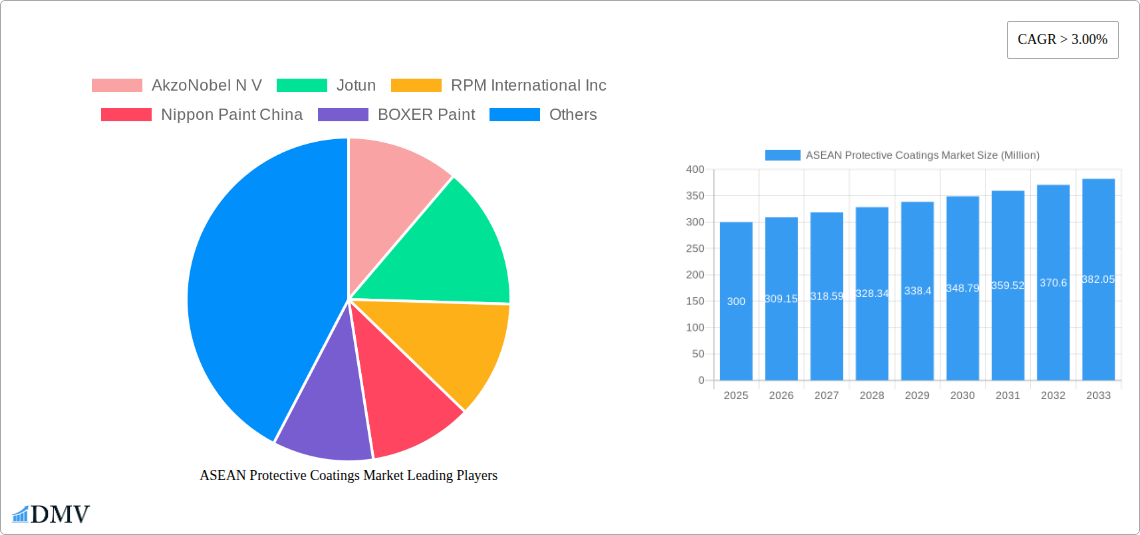

ASEAN Protective Coatings Market Company Market Share

ASEAN Protective Coatings Market: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report provides a panoramic view of the ASEAN Protective Coatings Market, a dynamic sector driven by infrastructure development, industrial expansion, and stringent environmental regulations. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis leverages cutting-edge market intelligence to equip stakeholders with actionable insights. Explore the intricate interplay of epoxy coatings, polyurethane coatings, water-borne coatings, and solvent-borne coatings across critical end-user industries such as oil and gas, mining, power, and infrastructure. Uncover the strategies of industry titans like AkzoNobel N.V., Jotun, and PPG Industries Inc. as they navigate evolving market landscapes.

ASEAN Protective Coatings Market Market Composition & Trends

The ASEAN Protective Coatings Market exhibits a moderate to high level of concentration, with key players like AkzoNobel N.V., Jotun, and PPG Industries Inc. holding significant market share. Innovation is primarily driven by the demand for eco-friendly solutions, leading to increased R&D in water-borne coatings and UV-cured coatings. Regulatory landscapes are becoming increasingly stringent, pushing manufacturers towards low-VOC formulations and sustainable practices. While substitute products exist, their performance and durability often fall short of specialized protective coatings in demanding environments. End-user profiles are diverse, ranging from large-scale industrial facilities in the oil and gas and mining sectors to burgeoning infrastructure projects across Indonesia, Malaysia, and Vietnam. Merger and acquisition activities, while present, are strategic and focused on expanding technological capabilities and geographical reach, with deal values ranging from xx Million to xx Million. Market share distribution is influenced by regional industrial strengths and project pipelines.

ASEAN Protective Coatings Market Industry Evolution

The ASEAN Protective Coatings Market has witnessed a consistent upward trajectory throughout the historical period (2019–2024), fueled by robust economic growth and substantial investments in infrastructure and industrial sectors across the region. The market size, estimated at XX Million in 2025, is projected to reach an impressive XX Million by 2033, exhibiting a compound annual growth rate (CAGR) of XX%. Technological advancements have been a cornerstone of this evolution. The shift towards water-borne coatings and UV-cured coatings has gained significant momentum, driven by increasing environmental awareness and tightening regulations on Volatile Organic Compounds (VOCs). Epoxy coatings, known for their superior chemical resistance and durability, continue to dominate, particularly in the oil and gas and infrastructure segments, with an estimated market share of XX% in 2025. Similarly, polyurethane coatings are gaining traction due to their excellent abrasion resistance and aesthetic appeal, especially in construction and automotive applications.

Consumer demand is increasingly polarized: while cost-effectiveness remains a consideration, there's a growing premium placed on long-term performance, sustainability, and application efficiency. This is evident in the adoption rates of advanced application technologies and the preference for coatings that offer extended service life, reducing maintenance costs and downtime. The mining industry, facing challenges of corrosion in harsh environments, is a significant driver for high-performance alkyd coatings and specialized resin formulations. The power sector, with its demanding operational conditions, necessitates protective coatings that can withstand extreme temperatures and corrosive elements, contributing to a stable demand for acrylic and polyester-based solutions.

The competitive landscape is characterized by both global giants and agile local players. Companies are investing heavily in R&D to develop coatings with enhanced properties, such as anti-corrosion, fire retardancy, and self-healing capabilities. The adoption metrics for new technologies are accelerating, with water-borne coatings expected to capture XX% of the market share by 2033, up from XX% in 2025. Powder coatings are also carving out a niche, particularly in the furniture and appliance sectors, due to their durability and environmental benefits. Overall, the industry evolution points towards a more specialized, sustainable, and technologically advanced future for protective coatings in ASEAN.

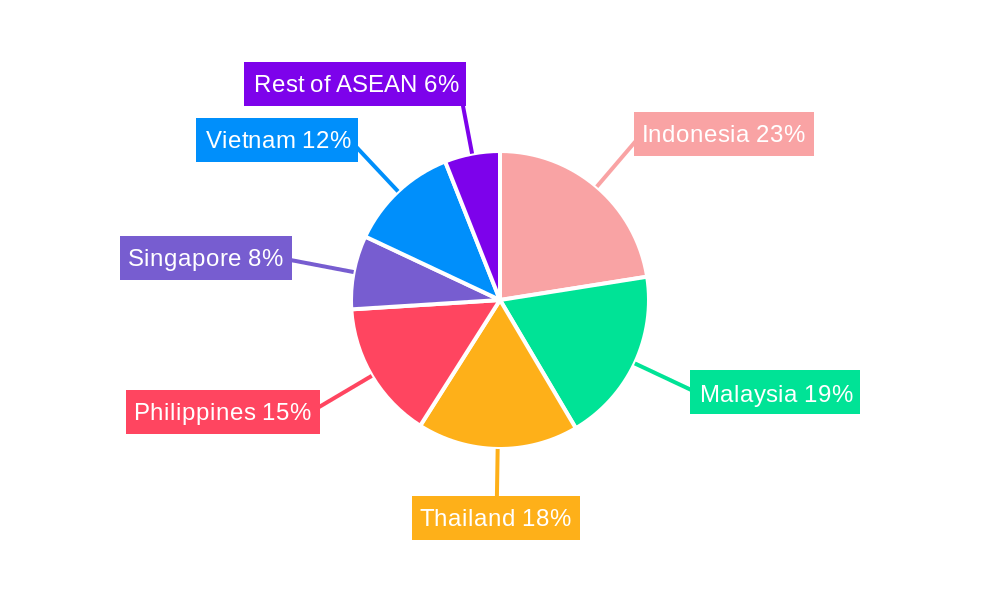

Leading Regions, Countries, or Segments in ASEAN Protective Coatings Market

The ASEAN Protective Coatings Market is a complex tapestry of regional strengths and segment-specific dominance. Among the Resin Types, Epoxy coatings are poised to maintain their leading position, driven by unparalleled chemical resistance and durability, making them indispensable for the Oil and Gas and Infrastructure sectors. Their market share is projected to be approximately XX% in 2025. Polyurethane coatings are experiencing robust growth, estimated at XX% CAGR, owing to their versatility in offering excellent UV resistance and aesthetic finishes, finding increasing application in construction and automotive refurbishment.

In terms of Technology, Solvent-Borne Coatings currently hold a significant market share due to their established performance and cost-effectiveness in certain applications. However, the market is witnessing a definitive shift towards Water-Borne Coatings, driven by stringent environmental regulations and a growing preference for sustainable solutions. Water-Borne Coatings are anticipated to witness a CAGR of XX% during the forecast period, capturing a substantial XX% market share by 2033. UV-Cured Coatings are also emerging as a niche but rapidly growing segment, offering fast curing times and superior performance for specialized applications.

Analyzing End User Industries, the Oil and Gas sector remains a cornerstone of demand for protective coatings, owing to the corrosive nature of its operational environment. Investments in offshore exploration and onshore infrastructure are key drivers. The Infrastructure segment, encompassing bridges, buildings, and transportation networks, is another significant contributor, with continuous development projects across the region. The Power sector, particularly renewable energy installations like wind turbines and solar farms, requires specialized coatings for longevity and performance. The Mining industry, despite its cyclical nature, presents consistent demand for robust anti-corrosion solutions.

Geographically, Indonesia and Malaysia are emerging as dominant players.

- Indonesia: Driven by extensive infrastructure development projects, including new roads, bridges, and industrial zones. A growing manufacturing base also contributes to the demand for protective coatings.

- Malaysia: Benefits from significant investments in the Oil and Gas sector, along with a well-established manufacturing and construction industry. Government initiatives promoting green building and sustainable infrastructure further boost the adoption of advanced coating technologies.

- Thailand: Shows steady growth in construction and manufacturing, with a particular focus on automotive and electronics industries, which require specialized protective finishes.

- Vietnam: A rapidly industrializing nation with substantial foreign direct investment, leading to burgeoning demand for protective coatings in manufacturing facilities and infrastructure projects.

- Singapore: A mature market with a focus on high-value, technologically advanced coatings for its sophisticated infrastructure and industrial facilities, particularly in shipbuilding and petrochemicals.

- Rest of ASEAN: Collectively represents a growing market with increasing industrialization and infrastructure development, offering significant untapped potential.

Key drivers for Indonesia and Malaysia's dominance include substantial government spending on infrastructure, supportive regulatory frameworks encouraging industrial growth, and a strong presence of key end-user industries like Oil and Gas and manufacturing. Investment trends favor sustainable and high-performance coating solutions.

ASEAN Protective Coatings Market Product Innovations

The ASEAN Protective Coatings Market is experiencing a surge in product innovations centered on enhanced durability, environmental compliance, and ease of application. Manufacturers are focusing on developing advanced epoxy and polyurethane formulations with superior anti-corrosion properties, extending asset life in harsh environments. A key trend is the development of low-VOC and zero-VOC water-borne coatings, meeting stringent environmental regulations while offering comparable performance to traditional solvent-borne counterparts. Innovations in UV-cured coatings are enabling faster curing times and reduced energy consumption in industrial applications. For instance, new nano-particle infused coatings are emerging, offering improved scratch resistance and self-cleaning properties for architectural and automotive segments. The performance metrics are being redefined by longer-term corrosion protection (exceeding XX years in accelerated testing) and enhanced adhesion to diverse substrates.

Propelling Factors for ASEAN Protective Coatings Market Growth

Several factors are propelling the growth of the ASEAN Protective Coatings Market. Robust economic expansion across the region fuels significant investments in infrastructure development, including transportation networks, commercial buildings, and industrial facilities. The burgeoning Oil and Gas sector, driven by increasing energy demands, necessitates high-performance protective coatings for offshore platforms and onshore pipelines to combat corrosion. Furthermore, stringent environmental regulations worldwide, pushing for the adoption of eco-friendly water-borne coatings and low-VOC formulations, are creating new market opportunities. Technological advancements, leading to more durable, efficient, and specialized coating solutions, also contribute significantly to market expansion. For example, the increasing demand for coatings with enhanced fire retardancy and chemical resistance in the mining and power sectors is a key growth catalyst.

Obstacles in the ASEAN Protective Coatings Market Market

Despite the positive growth trajectory, the ASEAN Protective Coatings Market faces certain obstacles. Volatile raw material prices, particularly for key components like resins and pigments, can impact profitability and lead to price fluctuations. Intense competition from both global and local players, coupled with the presence of substitute products, exerts downward pressure on margins. Stringent and evolving regulatory landscapes, while driving innovation, also impose compliance costs and require continuous adaptation by manufacturers. Supply chain disruptions, as experienced globally, can lead to production delays and affect the availability of essential raw materials. Furthermore, the initial high cost of advanced and sustainable coating technologies can be a barrier to adoption for some smaller end-users.

Future Opportunities in ASEAN Protective Coatings Market

The ASEAN Protective Coatings Market presents significant future opportunities driven by emerging trends and unmet needs. The continued expansion of renewable energy infrastructure, such as solar farms and wind turbines, will create substantial demand for specialized protective coatings designed for harsh environmental conditions. The growing focus on smart cities and sustainable urban development will fuel demand for high-performance architectural coatings with enhanced durability and aesthetic appeal. Advancements in material science are paving the way for innovative coatings with self-healing properties, antimicrobial functionalities, and improved energy efficiency. The increasing adoption of digitalization and IoT in manufacturing processes will also open avenues for intelligent coatings that can monitor asset health and predict maintenance needs. Emerging markets within the ASEAN region offer untapped potential for growth.

Major Players in the ASEAN Protective Coatings Market Ecosystem

- AkzoNobel N V

- Jotun

- RPM International Inc

- Nippon Paint China

- BOXER Paint

- PPG Industries Inc

- Dover Paints Manufacturing

- Axalta Coating Systems

- Hempel A/S

- PUTRAMATRAM

- The Sherwin Williams Company

- Helios Coatings

- IST Paint SDN BHD

- Kossan Paint

- Sino Polymer

- Noroo Paint

- Asian Paints

- Welda Paint

- Aplus Paints

Key Developments in ASEAN Protective Coatings Market Industry

- January 2024: AkzoNobel N.V. launched a new range of sustainable water-borne coatings for the marine industry, enhancing its eco-friendly product portfolio.

- December 2023: Jotun announced a significant expansion of its manufacturing facility in Malaysia to meet the growing demand for protective coatings in Southeast Asia.

- November 2023: PPG Industries Inc. acquired a regional player, strengthening its market presence in Thailand and expanding its product offerings in industrial coatings.

- October 2023: Axalta Coating Systems introduced an innovative UV-cured coating technology for the automotive refinish market, offering faster repair times and improved durability.

- September 2023: Hempel A/S partnered with a leading infrastructure developer in Indonesia to supply high-performance protective coatings for a major bridge construction project.

- August 2023: The Sherwin Williams Company expanded its distribution network in Vietnam, aiming to increase accessibility to its comprehensive range of industrial and architectural coatings.

- July 2023: Nippon Paint China unveiled a new line of anti-corrosive epoxy coatings for the Oil and Gas sector, designed for extreme operational conditions.

- June 2023: RPM International Inc. launched a new R&D center in Singapore focused on developing advanced polymer technologies for protective coatings.

- May 2023: Helios Coatings introduced a series of polyurethane coatings with enhanced weatherability for architectural applications in tropical climates.

- April 2023: IST Paint SDN BHD showcased its latest advancements in powder coatings at a regional industry expo, highlighting their environmental benefits and diverse applications.

Strategic ASEAN Protective Coatings Market Market Forecast

The ASEAN Protective Coatings Market is poised for robust and sustained growth, driven by a confluence of positive economic indicators, increasing industrialization, and a proactive regulatory environment. The forecast period (2025–2033) will witness a significant shift towards sustainable and high-performance coating solutions, with water-borne and UV-cured technologies gaining substantial market share. Continued infrastructure development across nations like Indonesia, Malaysia, and Vietnam will be a primary growth catalyst. The expansion of the Oil and Gas sector, coupled with advancements in the mining and power industries, will further solidify demand for specialized protective coatings. Strategic investments in R&D, coupled with potential M&A activities, will enable key players to enhance their competitive edge and capitalize on emerging opportunities, ensuring a dynamic and expanding market landscape.

ASEAN Protective Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resin Type

-

2. Technology

- 2.1. Water Borne Coatings

- 2.2. Solvent Borne Coatings

- 2.3. Powder Coatings

- 2.4. UV Cured Coatings

-

3. End User Industry

- 3.1. Oil and Gas

- 3.2. Mining

- 3.3. Power

- 3.4. Infrastructure

- 3.5. Other End User Industry

-

4. Geography

- 4.1. Indonesia

- 4.2. Malaysia

- 4.3. Thailand

- 4.4. Philippines

- 4.5. Singapore

- 4.6. Vietnam

- 4.7. Rest of ASEAN

ASEAN Protective Coatings Market Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Philippines

- 5. Singapore

- 6. Vietnam

- 7. Rest of ASEAN

ASEAN Protective Coatings Market Regional Market Share

Geographic Coverage of ASEAN Protective Coatings Market

ASEAN Protective Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Accelerating Demand from the Infrastructure sector; Increasing Demand for Protective Coatings in Malaysia

- 3.3. Market Restrains

- 3.3.1. Price Hikes of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Demand from Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resin Type

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water Borne Coatings

- 5.2.2. Solvent Borne Coatings

- 5.2.3. Powder Coatings

- 5.2.4. UV Cured Coatings

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Oil and Gas

- 5.3.2. Mining

- 5.3.3. Power

- 5.3.4. Infrastructure

- 5.3.5. Other End User Industry

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Philippines

- 5.4.5. Singapore

- 5.4.6. Vietnam

- 5.4.7. Rest of ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Malaysia

- 5.5.3. Thailand

- 5.5.4. Philippines

- 5.5.5. Singapore

- 5.5.6. Vietnam

- 5.5.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Indonesia ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Acrylic

- 6.1.3. Alkyd

- 6.1.4. Polyurethane

- 6.1.5. Polyester

- 6.1.6. Other Resin Type

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water Borne Coatings

- 6.2.2. Solvent Borne Coatings

- 6.2.3. Powder Coatings

- 6.2.4. UV Cured Coatings

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. Oil and Gas

- 6.3.2. Mining

- 6.3.3. Power

- 6.3.4. Infrastructure

- 6.3.5. Other End User Industry

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Malaysia

- 6.4.3. Thailand

- 6.4.4. Philippines

- 6.4.5. Singapore

- 6.4.6. Vietnam

- 6.4.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Malaysia ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Acrylic

- 7.1.3. Alkyd

- 7.1.4. Polyurethane

- 7.1.5. Polyester

- 7.1.6. Other Resin Type

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water Borne Coatings

- 7.2.2. Solvent Borne Coatings

- 7.2.3. Powder Coatings

- 7.2.4. UV Cured Coatings

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. Oil and Gas

- 7.3.2. Mining

- 7.3.3. Power

- 7.3.4. Infrastructure

- 7.3.5. Other End User Industry

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Malaysia

- 7.4.3. Thailand

- 7.4.4. Philippines

- 7.4.5. Singapore

- 7.4.6. Vietnam

- 7.4.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Thailand ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Acrylic

- 8.1.3. Alkyd

- 8.1.4. Polyurethane

- 8.1.5. Polyester

- 8.1.6. Other Resin Type

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water Borne Coatings

- 8.2.2. Solvent Borne Coatings

- 8.2.3. Powder Coatings

- 8.2.4. UV Cured Coatings

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. Oil and Gas

- 8.3.2. Mining

- 8.3.3. Power

- 8.3.4. Infrastructure

- 8.3.5. Other End User Industry

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Malaysia

- 8.4.3. Thailand

- 8.4.4. Philippines

- 8.4.5. Singapore

- 8.4.6. Vietnam

- 8.4.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Philippines ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Acrylic

- 9.1.3. Alkyd

- 9.1.4. Polyurethane

- 9.1.5. Polyester

- 9.1.6. Other Resin Type

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water Borne Coatings

- 9.2.2. Solvent Borne Coatings

- 9.2.3. Powder Coatings

- 9.2.4. UV Cured Coatings

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. Oil and Gas

- 9.3.2. Mining

- 9.3.3. Power

- 9.3.4. Infrastructure

- 9.3.5. Other End User Industry

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Malaysia

- 9.4.3. Thailand

- 9.4.4. Philippines

- 9.4.5. Singapore

- 9.4.6. Vietnam

- 9.4.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Singapore ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Epoxy

- 10.1.2. Acrylic

- 10.1.3. Alkyd

- 10.1.4. Polyurethane

- 10.1.5. Polyester

- 10.1.6. Other Resin Type

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water Borne Coatings

- 10.2.2. Solvent Borne Coatings

- 10.2.3. Powder Coatings

- 10.2.4. UV Cured Coatings

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. Oil and Gas

- 10.3.2. Mining

- 10.3.3. Power

- 10.3.4. Infrastructure

- 10.3.5. Other End User Industry

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Malaysia

- 10.4.3. Thailand

- 10.4.4. Philippines

- 10.4.5. Singapore

- 10.4.6. Vietnam

- 10.4.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Vietnam ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 11.1.1. Epoxy

- 11.1.2. Acrylic

- 11.1.3. Alkyd

- 11.1.4. Polyurethane

- 11.1.5. Polyester

- 11.1.6. Other Resin Type

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Water Borne Coatings

- 11.2.2. Solvent Borne Coatings

- 11.2.3. Powder Coatings

- 11.2.4. UV Cured Coatings

- 11.3. Market Analysis, Insights and Forecast - by End User Industry

- 11.3.1. Oil and Gas

- 11.3.2. Mining

- 11.3.3. Power

- 11.3.4. Infrastructure

- 11.3.5. Other End User Industry

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Indonesia

- 11.4.2. Malaysia

- 11.4.3. Thailand

- 11.4.4. Philippines

- 11.4.5. Singapore

- 11.4.6. Vietnam

- 11.4.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 12. Rest of ASEAN ASEAN Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 12.1.1. Epoxy

- 12.1.2. Acrylic

- 12.1.3. Alkyd

- 12.1.4. Polyurethane

- 12.1.5. Polyester

- 12.1.6. Other Resin Type

- 12.2. Market Analysis, Insights and Forecast - by Technology

- 12.2.1. Water Borne Coatings

- 12.2.2. Solvent Borne Coatings

- 12.2.3. Powder Coatings

- 12.2.4. UV Cured Coatings

- 12.3. Market Analysis, Insights and Forecast - by End User Industry

- 12.3.1. Oil and Gas

- 12.3.2. Mining

- 12.3.3. Power

- 12.3.4. Infrastructure

- 12.3.5. Other End User Industry

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Indonesia

- 12.4.2. Malaysia

- 12.4.3. Thailand

- 12.4.4. Philippines

- 12.4.5. Singapore

- 12.4.6. Vietnam

- 12.4.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 AkzoNobel N V

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Jotun

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 RPM International Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nippon Paint China

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BOXER Paint

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PPG Industries Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Dover Paints Manufacturing

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Axalta Coating Systems

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hempel A/S

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PUTRAMATARAM

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 The Sherwin Williams Company

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Helios Coatings

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 IST Paint SDN BHD

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Kossan Paint

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Sino Polymer

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Noroo Paint

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Asian Paints

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Welda Paint*List Not Exhaustive

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Aplus Paints

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.1 AkzoNobel N V

List of Figures

- Figure 1: Global ASEAN Protective Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ASEAN Protective Coatings Market Volume Breakdown (liter , %) by Region 2025 & 2033

- Figure 3: Indonesia ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 4: Indonesia ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 5: Indonesia ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 6: Indonesia ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 7: Indonesia ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 8: Indonesia ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 9: Indonesia ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Indonesia ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 11: Indonesia ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 12: Indonesia ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 13: Indonesia ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: Indonesia ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 15: Indonesia ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 16: Indonesia ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 17: Indonesia ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Indonesia ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 19: Indonesia ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 20: Indonesia ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 21: Indonesia ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Indonesia ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Malaysia ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 24: Malaysia ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 25: Malaysia ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 26: Malaysia ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 27: Malaysia ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 28: Malaysia ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 29: Malaysia ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Malaysia ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Malaysia ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 32: Malaysia ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 33: Malaysia ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 34: Malaysia ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 35: Malaysia ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 36: Malaysia ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 37: Malaysia ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 38: Malaysia ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 39: Malaysia ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Malaysia ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 41: Malaysia ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Malaysia ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Thailand ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 44: Thailand ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 45: Thailand ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 46: Thailand ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 47: Thailand ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 48: Thailand ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 49: Thailand ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 50: Thailand ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 51: Thailand ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 52: Thailand ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 53: Thailand ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 54: Thailand ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 55: Thailand ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: Thailand ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 57: Thailand ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Thailand ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: Thailand ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Thailand ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 61: Thailand ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Thailand ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Philippines ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 64: Philippines ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 65: Philippines ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 66: Philippines ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 67: Philippines ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: Philippines ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 69: Philippines ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Philippines ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: Philippines ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 72: Philippines ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 73: Philippines ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 74: Philippines ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 75: Philippines ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 76: Philippines ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 77: Philippines ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Philippines ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 79: Philippines ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Philippines ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 81: Philippines ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Philippines ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Singapore ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 84: Singapore ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 85: Singapore ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 86: Singapore ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 87: Singapore ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 88: Singapore ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 89: Singapore ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 90: Singapore ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 91: Singapore ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 92: Singapore ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 93: Singapore ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 94: Singapore ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 95: Singapore ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 96: Singapore ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 97: Singapore ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 98: Singapore ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 99: Singapore ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Singapore ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 101: Singapore ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Singapore ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 103: Vietnam ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 104: Vietnam ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 105: Vietnam ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 106: Vietnam ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 107: Vietnam ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 108: Vietnam ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 109: Vietnam ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 110: Vietnam ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 111: Vietnam ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 112: Vietnam ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 113: Vietnam ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 114: Vietnam ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 115: Vietnam ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 116: Vietnam ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 117: Vietnam ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 118: Vietnam ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 119: Vietnam ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 120: Vietnam ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 121: Vietnam ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 122: Vietnam ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 123: Rest of ASEAN ASEAN Protective Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 124: Rest of ASEAN ASEAN Protective Coatings Market Volume (liter ), by Resin Type 2025 & 2033

- Figure 125: Rest of ASEAN ASEAN Protective Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 126: Rest of ASEAN ASEAN Protective Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 127: Rest of ASEAN ASEAN Protective Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 128: Rest of ASEAN ASEAN Protective Coatings Market Volume (liter ), by Technology 2025 & 2033

- Figure 129: Rest of ASEAN ASEAN Protective Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 130: Rest of ASEAN ASEAN Protective Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 131: Rest of ASEAN ASEAN Protective Coatings Market Revenue (Million), by End User Industry 2025 & 2033

- Figure 132: Rest of ASEAN ASEAN Protective Coatings Market Volume (liter ), by End User Industry 2025 & 2033

- Figure 133: Rest of ASEAN ASEAN Protective Coatings Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 134: Rest of ASEAN ASEAN Protective Coatings Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 135: Rest of ASEAN ASEAN Protective Coatings Market Revenue (Million), by Geography 2025 & 2033

- Figure 136: Rest of ASEAN ASEAN Protective Coatings Market Volume (liter ), by Geography 2025 & 2033

- Figure 137: Rest of ASEAN ASEAN Protective Coatings Market Revenue Share (%), by Geography 2025 & 2033

- Figure 138: Rest of ASEAN ASEAN Protective Coatings Market Volume Share (%), by Geography 2025 & 2033

- Figure 139: Rest of ASEAN ASEAN Protective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 140: Rest of ASEAN ASEAN Protective Coatings Market Volume (liter ), by Country 2025 & 2033

- Figure 141: Rest of ASEAN ASEAN Protective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 142: Rest of ASEAN ASEAN Protective Coatings Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 7: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 9: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global ASEAN Protective Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 11: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 13: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 15: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 16: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 17: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 19: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 22: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 23: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 25: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 26: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 27: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 29: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 31: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 32: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 33: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 34: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 35: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 36: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 37: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 39: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 41: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 42: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 43: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 45: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 46: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 47: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 49: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 51: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 52: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 53: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 54: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 55: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 56: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 57: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 59: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 61: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 62: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 63: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 65: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 66: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 67: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 68: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 69: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 71: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 72: Global ASEAN Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 73: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 74: Global ASEAN Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 75: Global ASEAN Protective Coatings Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 76: Global ASEAN Protective Coatings Market Volume liter Forecast, by End User Industry 2020 & 2033

- Table 77: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 78: Global ASEAN Protective Coatings Market Volume liter Forecast, by Geography 2020 & 2033

- Table 79: Global ASEAN Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global ASEAN Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Protective Coatings Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the ASEAN Protective Coatings Market?

Key companies in the market include AkzoNobel N V, Jotun, RPM International Inc, Nippon Paint China, BOXER Paint, PPG Industries Inc, Dover Paints Manufacturing, Axalta Coating Systems, Hempel A/S, PUTRAMATARAM, The Sherwin Williams Company, Helios Coatings, IST Paint SDN BHD, Kossan Paint, Sino Polymer, Noroo Paint, Asian Paints, Welda Paint*List Not Exhaustive, Aplus Paints.

3. What are the main segments of the ASEAN Protective Coatings Market?

The market segments include Resin Type, Technology, End User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 300 Million as of 2022.

5. What are some drivers contributing to market growth?

Accelerating Demand from the Infrastructure sector; Increasing Demand for Protective Coatings in Malaysia.

6. What are the notable trends driving market growth?

Rising Demand from Infrastructure Sector.

7. Are there any restraints impacting market growth?

Price Hikes of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Protective Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Protective Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Protective Coatings Market?

To stay informed about further developments, trends, and reports in the ASEAN Protective Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence