Key Insights

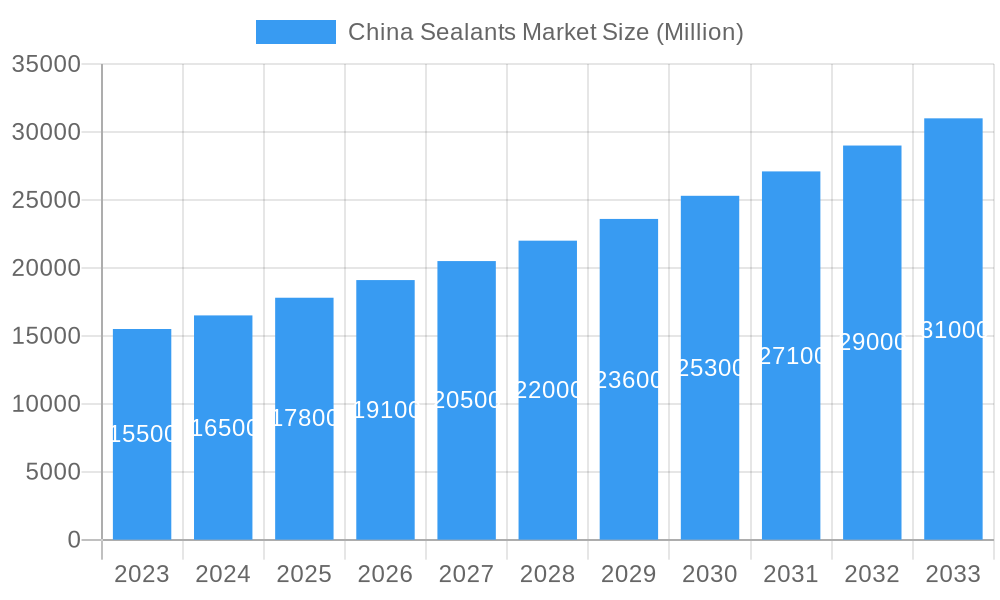

The China Sealants Market is projected for significant expansion, expected to reach $6.68 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is driven by increasing demand in aerospace, automotive, and construction sectors. The healthcare industry's expansion and emerging applications also contribute to market dynamism.

China Sealants Market Market Size (In Billion)

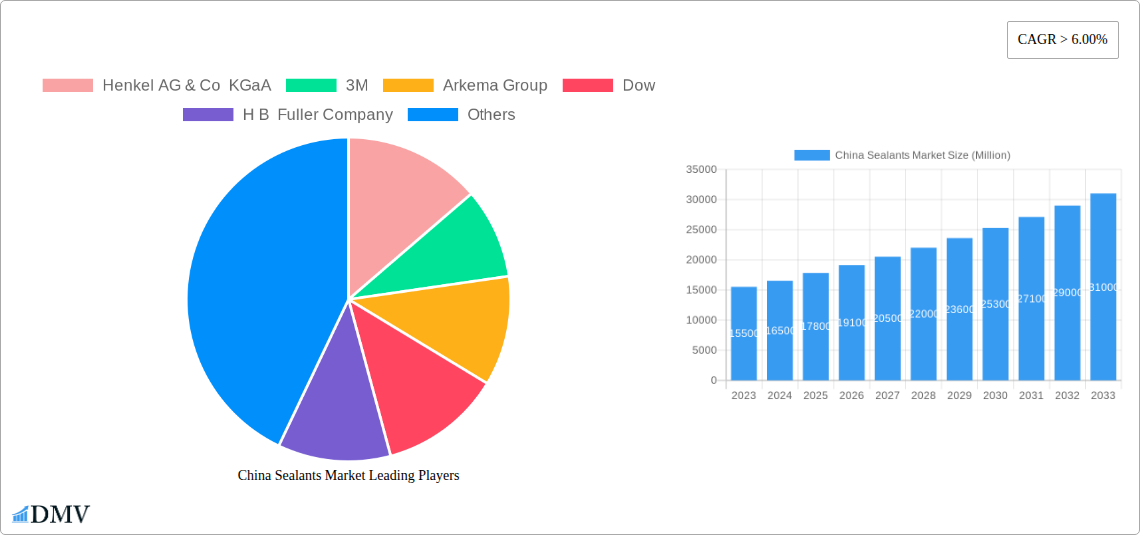

Advancements in sealant resin technology, including acrylic, epoxy, polyurethane, and silicone, are propelling market growth. Innovations in formulation and application address stringent environmental and performance standards. Key market players include Henkel AG & Co KGaA, 3M, Arkema Group, Dow, H B Fuller Company, Guangzhou Baiyun Chemical Industry Co ltd, and Hangzhou Zhijiang Advanced Material Co ltd. Challenges include fluctuating raw material prices and competing technologies.

China Sealants Market Company Market Share

This report provides a definitive analysis of the China Sealants Market, exploring dynamics, key players, and projections from 2019 to 2033. The study offers actionable insights, examining market composition, industry evolution, regional dominance, product innovations, growth drivers, challenges, and emerging opportunities. The report forecasts substantial market expansion driven by robust demand and material science advancements.

China Sealants Market Market Composition & Trends

The China Sealants Market is characterized by a moderate to high degree of concentration, with a mix of global giants and increasingly capable domestic manufacturers vying for market share. Innovation serves as a critical catalyst, fueled by substantial R&D investments in developing advanced formulations for specific applications and stringent environmental regulations pushing for sustainable and low-VOC (Volatile Organic Compound) products. The regulatory landscape is dynamic, with evolving standards for building safety, automotive emissions, and industrial hygiene influencing product development and market access. Substitute products, while present, often fall short of the specialized performance and durability offered by high-quality sealants. End-user profiles are diverse, ranging from large-scale infrastructure projects and automotive manufacturers to specialized healthcare and aerospace applications, each with unique material requirements and quality expectations. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and distribution networks. Notable M&A activities are expected to contribute to market consolidation and strategic partnerships, driving innovation and competitive intensity within the China Sealants Market. The market share distribution reveals a competitive environment where established players maintain a strong presence, but agile local firms are rapidly gaining traction, particularly in specialized segments.

- Market Concentration: Moderately high, with both global and domestic players.

- Innovation Catalysts: R&D investments, stringent environmental regulations, demand for high-performance materials.

- Regulatory Landscapes: Evolving standards for safety, emissions, and sustainability.

- Substitute Products: Exist, but often lack specialized performance and durability.

- End-User Profiles: Diverse, including aerospace, automotive, building & construction, healthcare, and others.

- M&A Activities: Increasing trend for consolidation and strategic partnerships.

China Sealants Market Industry Evolution

The China Sealants Market has witnessed a transformative evolution over the historical period (2019-2024) and is poised for continued robust growth throughout the forecast period (2025-2033). Driven by accelerated urbanization, significant infrastructure development, and a burgeoning automotive industry, the demand for advanced sealing solutions has surged. Technological advancements in material science have been pivotal, leading to the development of novel sealant chemistries offering superior adhesion, flexibility, durability, and environmental resistance. Polyurethane and silicone-based sealants, in particular, have seen increased adoption due to their excellent performance characteristics in demanding applications. The Building and Construction sector remains a dominant end-user industry, benefiting from energy efficiency mandates and the demand for weatherproofing and structural integrity in modern architecture. The automotive sector is another key growth engine, with increasing stringent safety and emission standards necessitating the use of high-performance sealants in vehicle assembly. The China Sealants Market is also experiencing a shift towards sustainability, with manufacturers investing in eco-friendly formulations, including water-based and low-VOC sealants, to comply with stricter environmental regulations and meet growing consumer demand for greener products. Digitalization and automation in manufacturing processes are also contributing to improved product quality and efficiency. The market growth trajectory is projected to be significantly positive, with an estimated Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. Key adoption metrics indicate a rising preference for specialized sealants tailored to specific industry needs, replacing generic solutions. Consumer demand is increasingly driven by performance requirements such as enhanced thermal insulation, acoustic dampening, and resistance to extreme environmental conditions, all of which are being addressed by continuous product innovation.

Leading Regions, Countries, or Segments in China Sealants Market

The China Sealants Market is a multifaceted landscape with distinct regional strengths and segment dominance. Within the End User Industry segmentation, Building and Construction consistently emerges as the largest and most influential segment. This dominance is driven by China's ongoing urbanization, massive infrastructure projects, and a growing emphasis on energy-efficient and sustainable building practices. The sheer volume of construction activity, from residential complexes and commercial spaces to public infrastructure like bridges and tunnels, necessitates a vast quantity of high-performance sealants for weatherproofing, sealing joints, and ensuring structural integrity. Investment trends in this sector are substantial, with government initiatives and private sector capital pouring into urban development and infrastructure upgrades, directly fueling demand for sealants. Regulatory support for green building standards and enhanced safety regulations further solidifies the position of sealants in this industry.

Among the Resin types, Silicone and Polyurethane sealants are experiencing remarkable growth and commanding significant market share. Silicone sealants are favored for their exceptional UV resistance, flexibility across a wide temperature range, and durability, making them ideal for exterior applications, façade sealing, and high-performance window installations. Polyurethane sealants, on the other hand, offer excellent adhesion to a variety of substrates, good mechanical strength, and paintability, making them versatile for both construction and automotive applications. Acrylic sealants also hold a considerable share, especially in interior applications and for their cost-effectiveness.

In terms of geographical dominance, the Eastern China region, encompassing major economic hubs like Shanghai, Jiangsu, and Zhejiang, is the leading market for sealants. This is attributed to its high concentration of manufacturing industries, extensive construction activities, significant foreign investment, and a well-developed logistics infrastructure that facilitates efficient distribution. The presence of major automotive manufacturers, electronics industries, and large-scale construction projects in this region creates a consistent and substantial demand for a wide array of sealant products.

- Dominant End User Industry: Building and Construction

- Key Drivers: Urbanization, infrastructure development, energy efficiency mandates, stringent safety regulations.

- Analysis: Continuous demand from residential, commercial, and public infrastructure projects requiring weatherproofing, joint sealing, and structural integrity.

- Leading Resin Segments: Silicone and Polyurethane

- Silicone Sealants: Superior UV resistance, temperature flexibility, and durability for exterior and high-performance applications.

- Polyurethane Sealants: Excellent adhesion, mechanical strength, and versatility for construction and automotive use.

- Leading Geographical Region: Eastern China

- Drivers: High concentration of manufacturing (automotive, electronics), extensive construction, foreign investment, robust logistics.

- Analysis: Hub for diverse sealant applications, supporting both domestic and international manufacturers.

China Sealants Market Product Innovations

Product innovation in the China Sealants Market is rapidly advancing, with a focus on enhanced performance, sustainability, and application-specific solutions. Manufacturers are developing advanced formulations that offer superior adhesion to diverse substrates, including challenging composite materials and treated surfaces. Innovations in silicone and polyurethane chemistries are yielding sealants with exceptional UV resistance, extreme temperature tolerance, and extended service life, crucial for demanding applications in aerospace and automotive. Furthermore, there is a significant push towards low-VOC and solvent-free sealants, aligning with stringent environmental regulations and growing consumer preference for eco-friendly products. Self-healing sealants and those with improved fire-retardant properties are also emerging, catering to the increasing safety requirements in the building and construction sectors. These advancements translate into longer-lasting structures, more reliable vehicles, and safer living environments, directly impacting the performance metrics and unique selling propositions of products in the market.

Propelling Factors for China Sealants Market Growth

Several key factors are propelling the growth of the China Sealants Market. The sustained economic development and rapid urbanization in China are driving massive investments in infrastructure projects, residential housing, and commercial real estate, all of which are significant consumers of sealants. The automotive industry's continuous expansion, coupled with the increasing stringency of safety and environmental regulations, necessitates the use of advanced sealing solutions. Technological advancements in sealant formulations, leading to improved performance characteristics like enhanced durability, flexibility, and adhesion, are expanding the application scope of these products. Moreover, a growing awareness and regulatory push for sustainable and eco-friendly building materials are fostering the demand for low-VOC and solvent-free sealants, creating new market opportunities. The government's supportive policies for manufacturing and construction sectors also contribute positively to market expansion.

Obstacles in the China Sealants Market Market

Despite robust growth, the China Sealants Market faces several obstacles. Intense competition, both from established global players and an increasing number of local manufacturers, can lead to price wars and pressure on profit margins. Fluctuations in raw material prices, particularly for key components like petrochemical derivatives, can impact production costs and product pricing. Stringent and evolving environmental regulations, while driving innovation, also present compliance challenges and necessitate significant investment in R&D and manufacturing process upgrades. Supply chain disruptions, exacerbated by geopolitical factors and logistics complexities, can affect the availability and timely delivery of raw materials and finished products. Furthermore, the presence of counterfeit products in some segments can erode market trust and impact sales for legitimate manufacturers.

Future Opportunities in China Sealants Market

The China Sealants Market presents numerous future opportunities for growth and innovation. The increasing adoption of smart buildings and sustainable construction practices will drive demand for advanced sealants with enhanced functionalities like thermal insulation, soundproofing, and fire resistance. The burgeoning electric vehicle (EV) market presents a significant opportunity for specialized sealants used in battery pack assembly, thermal management, and structural bonding. The aerospace sector, with its demand for high-performance, lightweight, and durable sealing solutions, also offers considerable potential. Furthermore, the expansion of the healthcare sector and the growing demand for sterile and biocompatible materials will open avenues for specialized sealants in medical devices and facilities. Emerging markets within China, beyond the major metropolitan areas, also represent untapped potential for market penetration.

Major Players in the China Sealants Market Ecosystem

- Henkel AG & Co KGaA

- 3M

- Arkema Group

- Dow

- H B Fuller Company

- Guangzhou Jointas Chemical Co Ltd

- Hangzhou Zhijiang Advanced Material Co Ltd

- Sika AG

- Guangzhou Baiyun Chemical Industry Co ltd

- Chengdu Guibao Science and Technology Co Ltd

Key Developments in China Sealants Market Industry

- May 2021: Henkel announced an investment of EUR 60 million to construct a new innovation center for its Adhesive Technologies unit in Shanghai to strengthen its footprint in China. This development underscores the company's commitment to expanding its presence and fostering innovation within the Chinese market, potentially leading to new product launches and enhanced market penetration.

- April 2021: Sika AG signed an agreement to acquire The Yokohama Rubber Co. Ltd's adhesives division, Hamatite, based in Japan. Hamatite offers polyurethanes, hot melts, and modified silicones technology adhesives and sealants for the automotive and construction industries. This strategic acquisition is expected to bolster Sika's product portfolio and expand its market reach, particularly in the automotive and construction segments within China, by integrating Hamatite's specialized technologies.

- January 2021: The company announced the expansion of its silicone sealants’ production capacity with the construction of a project to alleviate the pressure on its current capacity. This move indicates a strong demand for silicone sealants and the company's proactive approach to meet market needs, ensuring product availability and potentially leading to more competitive pricing due to economies of scale.

Strategic China Sealants Market Market Forecast

The China Sealants Market is projected for sustained and robust growth, driven by a confluence of powerful strategic factors. Continued urbanization and infrastructure development will ensure a consistent demand from the Building and Construction sector, while advancements in the Automotive industry, particularly the rapid adoption of electric vehicles, will create significant opportunities for high-performance sealants. Technological innovations are yielding more sustainable, durable, and application-specific sealant solutions, catering to evolving industry needs and stringent environmental regulations. Emerging markets and increasing consumer awareness of quality and performance will further propel market expansion. Strategic investments by leading players in R&D and production capacity, coupled with a dynamic M&A landscape, are set to shape a competitive yet opportunistic future for the China Sealants Market.

China Sealants Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Healthcare

- 1.5. Other End-user Industries

-

2. Resin

- 2.1. Acrylic

- 2.2. Epoxy

- 2.3. Polyurethane

- 2.4. Silicone

- 2.5. Other Resins

China Sealants Market Segmentation By Geography

- 1. China

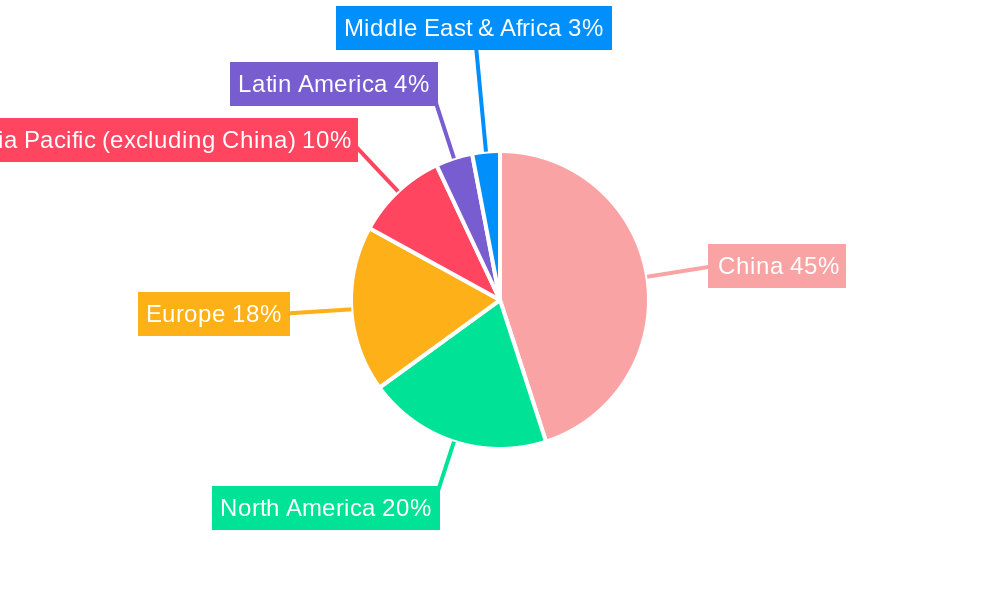

China Sealants Market Regional Market Share

Geographic Coverage of China Sealants Market

China Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from various End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations Regarding VOC Emissions; Impact of COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sealants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Healthcare

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin

- 5.2.1. Acrylic

- 5.2.2. Epoxy

- 5.2.3. Polyurethane

- 5.2.4. Silicone

- 5.2.5. Other Resins

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3M

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dow

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 H B Fuller Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Guangzhou Jointas Chemical Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hangzhou Zhijiang Advanced Material Co ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sika A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Guangzhou Baiyun Chemical Industry Co ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chengdu Guibao Science and Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: China Sealants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Sealants Market Share (%) by Company 2025

List of Tables

- Table 1: China Sealants Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: China Sealants Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 3: China Sealants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Sealants Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: China Sealants Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: China Sealants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sealants Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the China Sealants Market?

Key companies in the market include Henkel AG & Co KGaA, 3M, Arkema Group, Dow, H B Fuller Company, Guangzhou Jointas Chemical Co Ltd, Hangzhou Zhijiang Advanced Material Co ltd, Sika A, Guangzhou Baiyun Chemical Industry Co ltd, Chengdu Guibao Science and Technology Co Ltd.

3. What are the main segments of the China Sealants Market?

The market segments include End User Industry, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.68 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from various End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations Regarding VOC Emissions; Impact of COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

May 2021: Henkel announced an investment of EUR 60 million to construct a new innovation center for its Adhesive Technologies unit in Shanghai to strengthen its footprint in China.April 2021: Sika AG signed an agreement to acquire The Yokohama Rubber Co. Ltd's adhesives division, Hamatite, based in Japan. Hamatite offers polyurethanes, hot melts, and modified silicones technology adhesives and sealants for the automotive and construction industries.January 2021: The company announced the expansion of its silicone sealants’ production capacity with the construction of a project to alleviate the pressure on its current capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sealants Market?

To stay informed about further developments, trends, and reports in the China Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence