Key Insights

The global tungsten carbide powder market is projected for substantial growth, with an estimated market size of $9.84 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 12.77% from 2019 to 2033. This expansion is primarily driven by escalating demand in key industrial sectors. Significant contributors include the increasing need for high-performance cutting tools and wear-resistant components within the machine tools industry, spurred by advancements in manufacturing and automation. The aerospace & defense sector's requirement for durable, heat-resistant materials in aircraft and weaponry also substantially fuels market momentum. Continuous exploration and production activities in the oil & gas industry, necessitating robust drilling equipment, further stimulate market growth. Emerging applications in specialized fields such as electronics and premium sporting goods are also contributing to the tungsten carbide powder market's diversified growth trajectory.

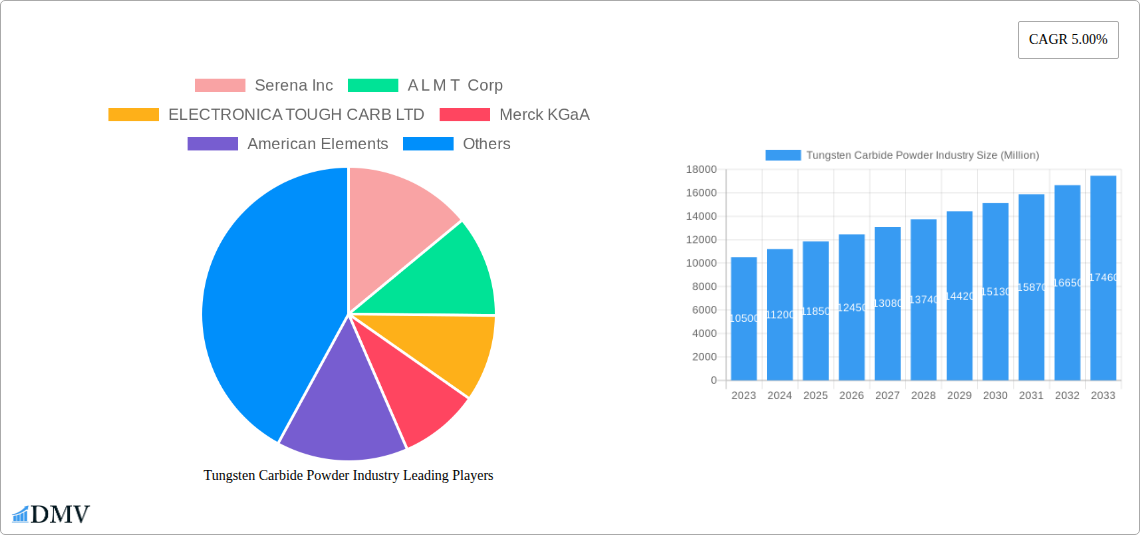

Tungsten Carbide Powder Industry Market Size (In Billion)

Key market trends influencing its evolution include a rising emphasis on ultra-fine and nano-sized tungsten carbide powders, which offer superior hardness and wear resistance, making them ideal for advanced applications. Innovations in powder production technologies, focused on enhancing purity, particle size distribution, and morphology, are critical for market players seeking a competitive advantage. Geographically, the Asia Pacific region, particularly China and India, is anticipated to lead market growth owing to its substantial manufacturing base and increasing industrialization. Challenges such as volatile raw material prices (tungsten ore) and stringent environmental regulations related to processing may present restraints. The development of alternative materials in certain applications also poses a restraint, although tungsten carbide's unique properties often render it indispensable. The market is highly competitive, with established and emerging companies concentrating on product innovation and strategic collaborations to secure market share.

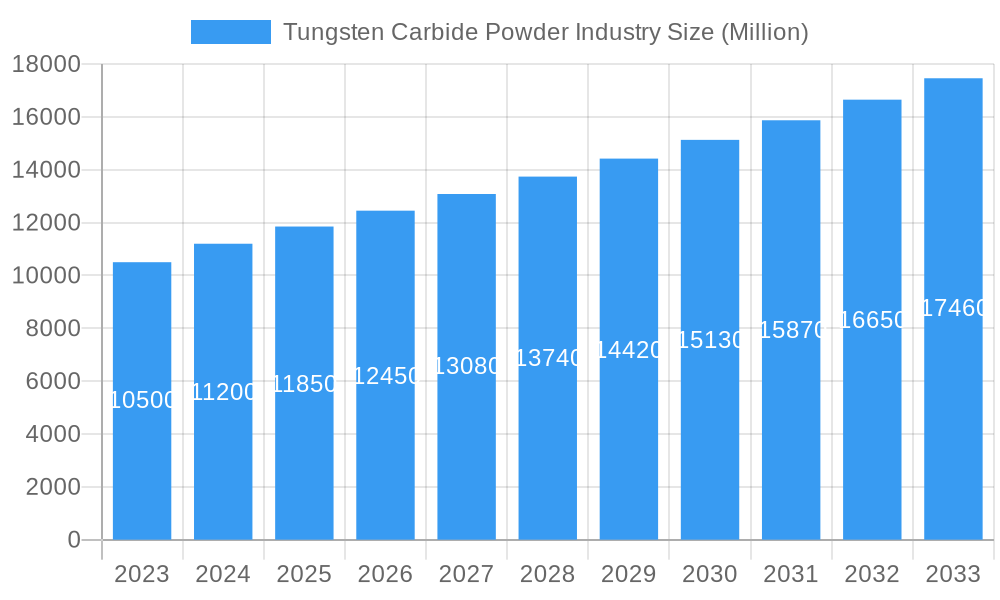

Tungsten Carbide Powder Industry Company Market Share

This comprehensive, SEO-optimized report offers critical insights into the tungsten carbide powder market's dynamics, growth trends, and strategic opportunities. It is designed for stakeholders seeking a competitive advantage, utilizing high-ranking keywords such as "tungsten carbide powder market," "carbide powder applications," "mining and construction materials," "aerospace and defense components," and "wear-resistant materials" to maximize search visibility. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis serves as a definitive guide to navigating this vital industrial sector.

Tungsten Carbide Powder Industry Market Composition & Trends

The tungsten carbide powder market exhibits a moderate to highly concentrated composition, with key players strategically positioned to influence global supply and innovation. Notable companies like Serena Inc, A L M T Corp, ELECTRONICA TOUGH CARB LTD, Merck KGaA, American Elements, Global Tungsten & Powders, Kennametal Inc, Atlantic Equipment Engineers, Edgetech Industries LLC, Buffalo Tungsten, Metaltech, Umicore Cobalt & Specialty Materials (list not exhaustive), ChinaTungsten, JAPAN NEW METALS CO LTD, CNPC POWDER © GROUP CO LTD, and Ganzhou CF Tungsten Co LTD are instrumental in shaping market trends through their extensive product portfolios and ongoing research and development. Innovation catalysts are primarily driven by the demand for superior performance in extreme conditions, particularly within the mining & construction and aerospace & defense sectors. The regulatory landscape, while generally stable, sees evolving environmental compliance standards influencing production processes. Substitute products, such as ceramics and advanced polymers, pose a competitive threat, but the unique hardness and wear resistance of tungsten carbide powder maintain its dominance in critical applications. End-user profiles are diverse, ranging from heavy industrial machinery operators to specialized manufacturers in the transportation, oil & gas, and healthcare industries. Merger and acquisition (M&A) activities, while not overly frequent, are strategic in nature, aimed at consolidating market share, acquiring new technologies, or expanding geographical reach. Recent M&A deals, valued in the tens of Million, underscore the strategic importance of acquiring robust tungsten carbide powder capabilities. Market share distribution among the top five players is estimated to be around 60-70%, indicative of a moderately concentrated market.

Tungsten Carbide Powder Industry Industry Evolution

The tungsten carbide powder industry has witnessed a remarkable evolution, driven by persistent demand for high-performance materials and continuous technological advancements. Over the historical period (2019-2024) and into the projected forecast period (2025-2033), the market growth trajectory has been characterized by a steady upward trend, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5-7%. This growth is intrinsically linked to the increasing industrialization and infrastructure development across emerging economies, where mining & construction applications are paramount. Technological advancements have focused on enhancing the purity of tungsten carbide powders, improving particle size distribution, and developing novel synthesis methods to achieve tailor-made properties for specific applications. For instance, innovations in powder metallurgy and advanced sintering techniques have enabled the production of more intricate and durable tungsten carbide components. Shifting consumer demands are also playing a significant role. The burgeoning aerospace & defense sector requires lighter, stronger, and more wear-resistant materials for critical components, pushing the boundaries of tungsten carbide powder development. Similarly, the transportation industry, with its focus on fuel efficiency and durability, is increasingly adopting tungsten carbide in engine parts and braking systems. The oil & gas sector’s need for robust tools capable of withstanding extreme pressures and abrasive environments further fuels demand. Even in niche sectors like healthcare (for surgical instruments) and electronics (for precision tooling), the unique properties of tungsten carbide are finding new applications. The adoption of advanced tungsten carbide powders in these diverse end-user industries is projected to accelerate, supported by ongoing research into new alloy compositions and improved manufacturing processes. The estimated year of 2025 is expected to see continued robust demand, building on the momentum of previous years.

Leading Regions, Countries, or Segments in Tungsten Carbide Powder Industry

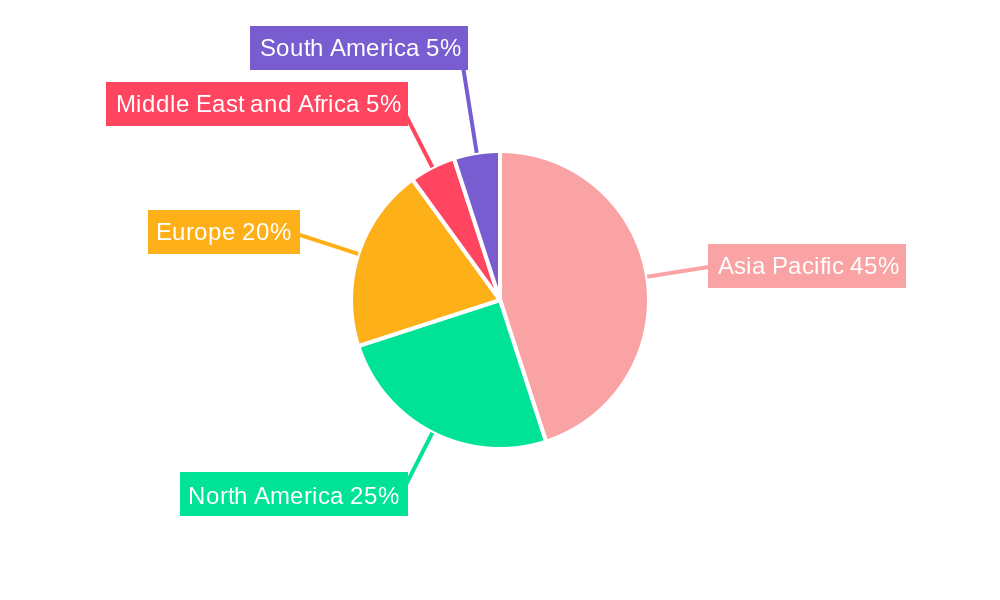

The tungsten carbide powder industry is dominated by regions and countries that possess significant industrial bases and strong demand from key end-user industries. Asia-Pacific, particularly China, stands out as the leading region due to its substantial manufacturing capabilities and its pivotal role in the global supply chain for tungsten resources. China's extensive mining & construction activities, coupled with its burgeoning manufacturing sector, drive a significant portion of the global demand for tungsten carbide powder. Key drivers in this region include massive infrastructure projects, government initiatives supporting industrial growth, and a well-established network of tungsten carbide powder manufacturers.

Dominant Segments:

Application:

- Machine Tools: This segment remains a cornerstone of the tungsten carbide powder market, driven by the need for precision, durability, and high-performance cutting and forming tools in various manufacturing processes. The increasing complexity of industrial manufacturing and the demand for faster production cycles contribute to the sustained growth of this application.

- Wear & Die Parts: The inherent hardness and wear resistance of tungsten carbide make it indispensable for wear-resistant components and dies used in stamping, forging, and extrusion processes. Industries like automotive manufacturing and metal fabrication rely heavily on these components for longevity and efficiency.

- Mining & Construction: This is a major end-user industry driving demand for tungsten carbide powder. Drill bits, cutting tools, and wear parts for heavy machinery used in mining operations and infrastructure development are critical applications. The ongoing global investment in infrastructure projects, particularly in developing economies, fuels this segment.

End-user Industry:

- Mining & Construction: As mentioned, this is a primary driver due to the extensive use of tungsten carbide in excavation, drilling, and material processing equipment. Investment trends in global infrastructure projects directly correlate with the demand from this sector. Regulatory support for resource extraction and construction activities further bolsters this segment.

- Aerospace & Defense: The aerospace and defense sectors are critical for high-grade tungsten carbide powder used in engine components, cutting tools for aerospace manufacturing, and various defense applications requiring extreme durability and performance under harsh conditions. Technological advancements in aircraft and defense systems necessitate the use of advanced materials like tungsten carbide.

- Transportation: This segment encompasses automotive, rail, and marine industries, where tungsten carbide powder finds applications in engine parts, braking systems, and wear-resistant components. The drive for fuel efficiency and longer-lasting vehicle parts is a key factor.

Country-Specific Dominance:

- China: As the largest producer and consumer of tungsten carbide powder, China's dominance is multifaceted. Its vast tungsten ore reserves, coupled with a highly developed industrial ecosystem, provide a significant competitive advantage. The country's strong manufacturing base across various sectors ensures consistent demand.

- United States: A significant consumer driven by its advanced manufacturing, aerospace, defense, and energy sectors. Investment trends in R&D and technological innovation are key drivers.

- Germany: A leading European market, driven by its strong automotive, machinery, and industrial manufacturing sectors. High demand for precision engineering and wear-resistant components fuels its market share.

The dominance of these regions and segments is further reinforced by strong investment trends in R&D for improved material properties, supportive regulatory frameworks for industrial expansion, and a growing awareness of the benefits of utilizing high-performance materials in critical applications.

Tungsten Carbide Powder Industry Product Innovations

Product innovation in the tungsten carbide powder industry is a continuous process, focusing on enhancing material performance and expanding application versatility. Recent advancements include the development of nano-sized tungsten carbide powders, offering superior hardness and wear resistance for cutting tools and specialized coatings. Innovations in powder morphology and particle size distribution control enable tailored properties for specific end-uses, such as improved toughness in wear & die parts or enhanced stiffness in machine tools. Furthermore, research into composite tungsten carbide powders, incorporating elements like cobalt or nickel in precise ratios, has yielded materials with optimized ductility and fracture toughness, crucial for demanding applications in aerospace & defense and oil & gas. These technological advancements are crucial for maintaining a competitive edge and meeting the ever-increasing performance requirements across diverse industrial sectors.

Propelling Factors for Tungsten Carbide Powder Industry Growth

The growth of the tungsten carbide powder industry is propelled by a confluence of technological, economic, and regulatory factors. Technologically, the relentless pursuit of materials with superior hardness, wear resistance, and high-temperature strength is a primary driver. Economic expansion, particularly in developing nations, fuels demand from the mining & construction and transportation sectors. The increasing sophistication of manufacturing processes, requiring precision tooling and durable components, also significantly contributes. Regulatory initiatives promoting industrial efficiency and sustainability indirectly benefit tungsten carbide due to its longevity and reduced need for frequent replacement, thus lowering lifecycle costs. For example, stricter regulations on mining efficiency and infrastructure durability necessitate the use of robust tungsten carbide tools and components.

Obstacles in the Tungsten Carbide Powder Industry Market

Despite robust growth, the tungsten carbide powder market faces several obstacles. Volatility in raw material prices, particularly tungsten ore, can impact production costs and profitability, leading to unpredictable price fluctuations. Stringent environmental regulations related to mining and processing can increase operational expenses and necessitate investment in advanced pollution control technologies. Supply chain disruptions, exacerbated by geopolitical factors or logistical challenges, can affect the availability and timely delivery of raw materials and finished products. Furthermore, the development and adoption of alternative materials, such as advanced ceramics, in certain applications pose a competitive threat, especially where cost-effectiveness or specific performance characteristics are prioritized over extreme hardness.

Future Opportunities in Tungsten Carbide Powder Industry

Emerging opportunities in the tungsten carbide powder industry are abundant, driven by evolving technological landscapes and new market demands. The expanding applications in advanced manufacturing, including additive manufacturing (3D printing) of tungsten carbide parts, present a significant growth avenue. The increasing demand for high-performance materials in the healthcare sector for precision surgical instruments and implants also offers considerable potential. Furthermore, the development of novel tungsten carbide composites and coatings with enhanced properties, such as increased corrosion resistance or improved biocompatibility, will unlock new market segments. The growing focus on sustainable technologies and the circular economy may also create opportunities for recycling and repurposing tungsten carbide materials.

Major Players in the Tungsten Carbide Powder Industry Ecosystem

- Serena Inc

- A L M T Corp

- ELECTRONICA TOUGH CARB LTD

- Merck KGaA

- American Elements

- Global Tungsten & Powders

- Kennametal Inc

- Atlantic Equipment Engineers

- Edgetech Industries LLC

- Buffalo Tungsten

- Metaltech

- Umicore Cobalt & Specialty Materials

- ChinaTungsten

- JAPAN NEW METALS CO LTD

- CNPC POWDER © GROUP CO LTD

- Ganzhou CF Tungsten Co LTD

Key Developments in Tungsten Carbide Powder Industry Industry

- 2023/Early 2024: Increased investment in R&D for nano-structured tungsten carbide powders to enhance wear resistance in cutting tools.

- 2023: Launch of new grades of tungsten carbide powders with improved toughness and fracture resistance for aerospace applications.

- 2022: Strategic partnerships formed to secure raw material supply chains and optimize production efficiency.

- 2021: Advancements in powder metallurgy enabling the production of more complex tungsten carbide components through additive manufacturing.

- 2020: Focus on developing more environmentally friendly production processes to meet evolving regulatory standards.

Strategic Tungsten Carbide Powder Industry Market Forecast

The strategic tungsten carbide powder industry market forecast indicates continued robust growth driven by innovation and expanding applications. The increasing demand for high-performance materials in key sectors like mining & construction, aerospace & defense, and transportation will sustain market expansion. Technological advancements, particularly in nano-particle technology and additive manufacturing, are poised to unlock new product functionalities and market segments. Economic development in emerging markets and a global emphasis on industrial efficiency will further propel demand. Stakeholders can anticipate significant opportunities by focusing on R&D for specialized grades, optimizing supply chains, and exploring emerging applications in niche industries, ensuring sustained profitability and market leadership.

Tungsten Carbide Powder Industry Segmentation

-

1. Application

- 1.1. Machine Tools

- 1.2. Ammunition

- 1.3. Wear & Die Parts

- 1.4. Others

-

2. End-user Industry

- 2.1. Mining & Construction

- 2.2. Aerospace & Defense

- 2.3. Transportation

- 2.4. Oil &Gas

- 2.5. Healthcare

- 2.6. Others (Jewelry, Sports, Electronics, etc.,)

Tungsten Carbide Powder Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Tungsten Carbide Powder Industry Regional Market Share

Geographic Coverage of Tungsten Carbide Powder Industry

Tungsten Carbide Powder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Industrial Machine Tools; Superior Properties of Tungsten Carbide Powder

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Higher Costs and Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Mining & Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Machine Tools

- 5.1.2. Ammunition

- 5.1.3. Wear & Die Parts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Mining & Construction

- 5.2.2. Aerospace & Defense

- 5.2.3. Transportation

- 5.2.4. Oil &Gas

- 5.2.5. Healthcare

- 5.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Machine Tools

- 6.1.2. Ammunition

- 6.1.3. Wear & Die Parts

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Mining & Construction

- 6.2.2. Aerospace & Defense

- 6.2.3. Transportation

- 6.2.4. Oil &Gas

- 6.2.5. Healthcare

- 6.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Machine Tools

- 7.1.2. Ammunition

- 7.1.3. Wear & Die Parts

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Mining & Construction

- 7.2.2. Aerospace & Defense

- 7.2.3. Transportation

- 7.2.4. Oil &Gas

- 7.2.5. Healthcare

- 7.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Machine Tools

- 8.1.2. Ammunition

- 8.1.3. Wear & Die Parts

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Mining & Construction

- 8.2.2. Aerospace & Defense

- 8.2.3. Transportation

- 8.2.4. Oil &Gas

- 8.2.5. Healthcare

- 8.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Machine Tools

- 9.1.2. Ammunition

- 9.1.3. Wear & Die Parts

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Mining & Construction

- 9.2.2. Aerospace & Defense

- 9.2.3. Transportation

- 9.2.4. Oil &Gas

- 9.2.5. Healthcare

- 9.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Tungsten Carbide Powder Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Machine Tools

- 10.1.2. Ammunition

- 10.1.3. Wear & Die Parts

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Mining & Construction

- 10.2.2. Aerospace & Defense

- 10.2.3. Transportation

- 10.2.4. Oil &Gas

- 10.2.5. Healthcare

- 10.2.6. Others (Jewelry, Sports, Electronics, etc.,)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Serena Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A L M T Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ELECTRONICA TOUGH CARB LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Elements

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Global Tungsten & Powders

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kennametal Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlantic Equipment Engineers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Edgetech Industries LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Buffalo Tungsten

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Metaltech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Umicore Cobalt & Specialty Materials*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ChinaTungsten

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 JAPAN NEW METALS CO LTD

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CNPC POWDER © GROUP CO LTD

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ganzhou CF Tungsten Co LTD

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Serena Inc

List of Figures

- Figure 1: Global Tungsten Carbide Powder Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Tungsten Carbide Powder Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific Tungsten Carbide Powder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Tungsten Carbide Powder Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Tungsten Carbide Powder Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Tungsten Carbide Powder Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Tungsten Carbide Powder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Tungsten Carbide Powder Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Tungsten Carbide Powder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Tungsten Carbide Powder Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Tungsten Carbide Powder Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Tungsten Carbide Powder Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Tungsten Carbide Powder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Tungsten Carbide Powder Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Tungsten Carbide Powder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Tungsten Carbide Powder Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Tungsten Carbide Powder Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Tungsten Carbide Powder Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Tungsten Carbide Powder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Tungsten Carbide Powder Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: South America Tungsten Carbide Powder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Tungsten Carbide Powder Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Tungsten Carbide Powder Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Tungsten Carbide Powder Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Tungsten Carbide Powder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tungsten Carbide Powder Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Middle East and Africa Tungsten Carbide Powder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Tungsten Carbide Powder Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Tungsten Carbide Powder Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Tungsten Carbide Powder Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Tungsten Carbide Powder Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Tungsten Carbide Powder Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Tungsten Carbide Powder Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tungsten Carbide Powder Industry?

The projected CAGR is approximately 12.77%.

2. Which companies are prominent players in the Tungsten Carbide Powder Industry?

Key companies in the market include Serena Inc, A L M T Corp, ELECTRONICA TOUGH CARB LTD, Merck KGaA, American Elements, Global Tungsten & Powders, Kennametal Inc, Atlantic Equipment Engineers, Edgetech Industries LLC, Buffalo Tungsten, Metaltech, Umicore Cobalt & Specialty Materials*List Not Exhaustive, ChinaTungsten, JAPAN NEW METALS CO LTD, CNPC POWDER © GROUP CO LTD, Ganzhou CF Tungsten Co LTD.

3. What are the main segments of the Tungsten Carbide Powder Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.84 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Industrial Machine Tools; Superior Properties of Tungsten Carbide Powder.

6. What are the notable trends driving market growth?

Growing Demand from Mining & Construction Industry.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Higher Costs and Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tungsten Carbide Powder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tungsten Carbide Powder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tungsten Carbide Powder Industry?

To stay informed about further developments, trends, and reports in the Tungsten Carbide Powder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence