Key Insights

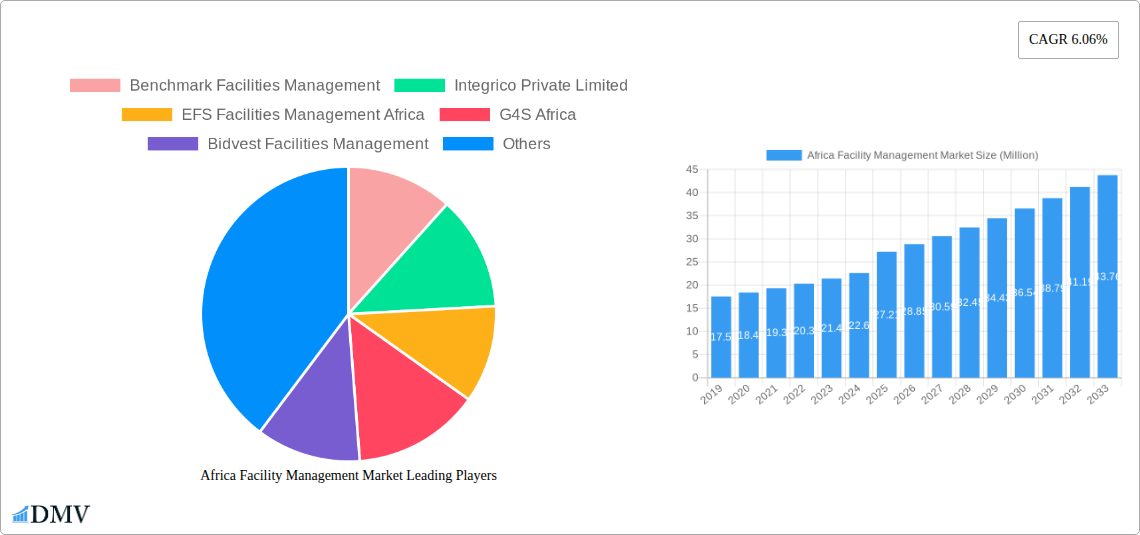

The African Facility Management (FM) market is poised for significant expansion, projected to reach a substantial $27.21 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.06% over the forecast period of 2025-2033. This growth is underpinned by a confluence of escalating infrastructure development across the continent, increasing foreign investment, and a growing awareness among businesses of the critical role integrated and bundled FM services play in operational efficiency and cost optimization. The demand for professional FM services is particularly pronounced in burgeoning commercial hubs and expanding industrial zones, where the complexity of managing large-scale facilities necessitates specialized expertise. Furthermore, governmental initiatives aimed at improving public infrastructure and institutional buildings are also contributing to the market's upward trajectory. The shift from single facility management to more comprehensive bundled and integrated solutions reflects a maturing market that values holistic service delivery, aiming to enhance building performance, occupant well-being, and overall asset value.

Africa Facility Management Market Market Size (In Million)

The market's dynamism is further illustrated by its segmentation, with commercial and industrial sectors representing key end-users. Emerging economies within Africa, such as Nigeria, South Africa, and Egypt, are at the forefront of this expansion, benefiting from rapid urbanization and a growing need for sophisticated building maintenance and management. While the market is predominantly driven by these macro-economic trends, challenges such as the availability of skilled labor and the initial investment required for advanced FM technologies could pose some restraints. However, these are being increasingly mitigated by training programs and the adoption of scalable, cloud-based FM solutions. The forecast period anticipates a sustained demand for a diverse range of FM services, from hard services like maintenance and security to soft services like cleaning and catering, all orchestrated through integrated platforms to ensure seamless operations and superior service quality across the African continent.

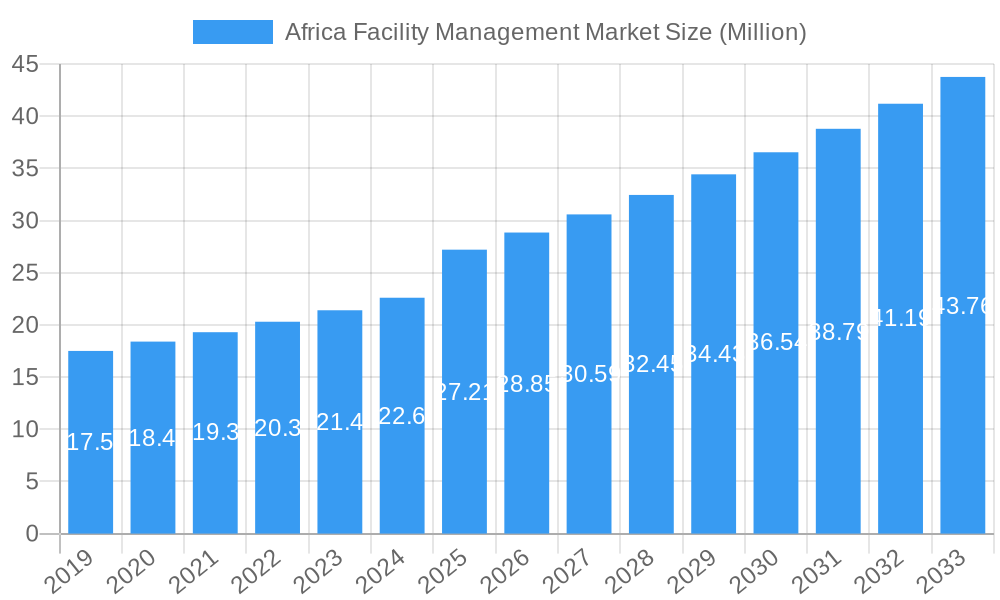

Africa Facility Management Market Company Market Share

Africa Facility Management Market Market Composition & Trends

The Africa Facility Management Market exhibits a dynamic and evolving landscape characterized by increasing consolidation and a growing emphasis on integrated service delivery. With a market size projected to reach XX Million by 2033, driven by a CAGR of XX% from 2025-2033, the concentration is shifting as key players vie for dominance. Innovation is being fueled by the adoption of smart technologies, sustainability initiatives, and a greater demand for cost-efficiency. The regulatory environment is progressively becoming more supportive of outsourcing facility management services, encouraging standardization and professionalism. Substitute products are less of a direct threat, as facility management encompasses a broad spectrum of services, but inefficient in-house management can act as an indirect alternative. End-user profiles are diverse, with Commercial and Infrastructural sectors leading the charge, followed by Institutional and Industrial segments. Mergers and acquisitions (M&A) are on the rise, with significant deal values being reported as larger entities seek to expand their geographic reach and service portfolios. For instance, key players like Bidvest Facilities Management and EFS Facilities Management Africa are actively involved in strategic acquisitions to bolster their market presence.

- Market Concentration: Moderate to High, with leading players expanding their share through M&A.

- Innovation Catalysts: Smart building technologies, energy efficiency solutions, and data analytics.

- Regulatory Landscapes: Increasingly favorable, with a focus on standardization and safety.

- Substitute Products: In-house management for smaller operations; not a direct substitute for comprehensive FM.

- End-User Profiles: Dominance of Commercial, Infrastructural, and Institutional sectors.

- M&A Activities: Significant, driving market consolidation and expansion of service offerings.

Africa Facility Management Market Industry Evolution

The Africa Facility Management Market has witnessed a significant transformation over the historical period of 2019-2024 and is poised for accelerated growth in the forecast period of 2025-2033. This evolution is intrinsically linked to the continent's rapid urbanization, burgeoning infrastructure development, and the increasing recognition by businesses of the strategic importance of efficient facility management in driving operational excellence and cost savings. Initially, the market was characterized by fragmented service providers offering predominantly single facility management solutions. However, a clear trend towards bundled and integrated facility management services has emerged, driven by the desire for a single point of accountability, streamlined operations, and enhanced cost efficiencies. This shift reflects a maturing market that is increasingly sophisticated in its demands.

Technological advancements have been a pivotal catalyst in this evolution. The adoption of Building Information Modeling (BIM), the Internet of Things (IoT) for predictive maintenance, and advanced data analytics are revolutionizing how facilities are managed. These technologies enable proactive rather than reactive maintenance, optimize energy consumption, improve space utilization, and enhance the overall occupant experience. For example, the use of IoT sensors to monitor building performance can lead to a XX% reduction in energy costs and a XX% improvement in maintenance response times. Consumer demands are also evolving, with a growing emphasis on sustainability, occupant well-being, and digital integration. Clients are no longer solely focused on cost reduction but also on creating healthier, more productive, and environmentally responsible workspaces. This has led to an increased demand for green facility management practices, waste reduction programs, and the implementation of smart building technologies that contribute to a sustainable future. The compound annual growth rate (CAGR) for the Africa Facility Management Market is projected to be XX% during the forecast period of 2025-2033, indicating a robust growth trajectory. This growth is supported by substantial investments in new commercial and infrastructural projects across key African nations, which directly translate into opportunities for facility management service providers. The historical data from 2019-2024 shows a steady upward trend, with market expansion averaging XX% year-on-year. The base year of 2025 is expected to see a market valuation of XX Million, setting the stage for significant expansion in the subsequent years.

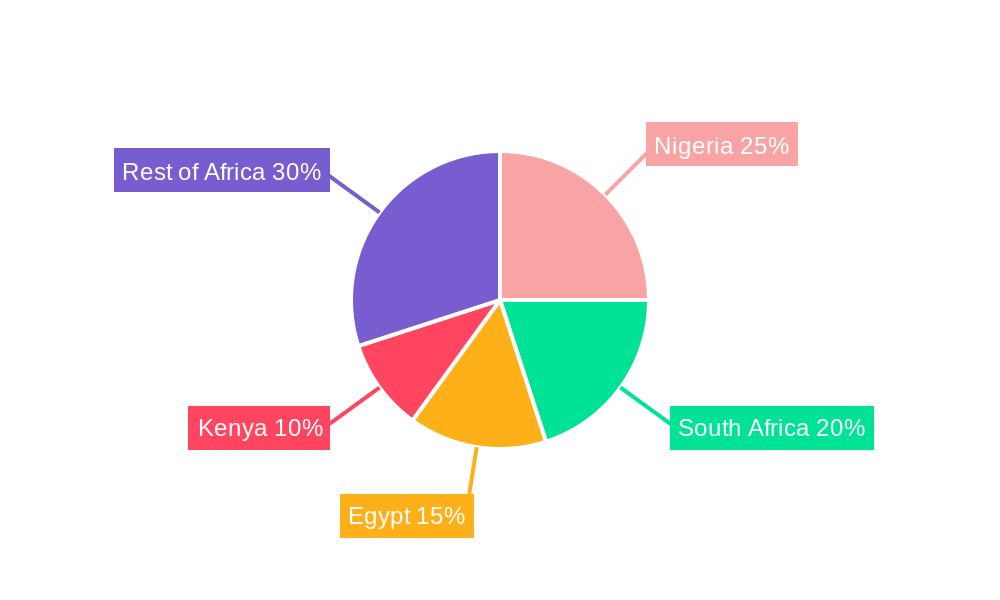

Leading Regions, Countries, or Segments in Africa Facility Management Market

The Africa Facility Management Market is witnessing dynamic shifts across its diverse segments and regions, with specific areas and service types demonstrating remarkable growth and dominance. Among the types of facility management, Integrated Facility Management is emerging as the frontrunner, driven by organizations seeking comprehensive solutions that streamline operations, enhance efficiency, and reduce costs through a single point of contact. This integrated approach allows for the seamless management of multiple services, from hard services like maintenance and security to soft services such as cleaning and catering, fostering a more holistic and effective operational environment.

The end-user segments are also showing distinct growth patterns. The Commercial sector, encompassing office buildings, retail spaces, and hospitality establishments, continues to be a dominant force. This is fueled by ongoing commercial real estate development, foreign investment, and the increasing recognition by businesses of the crucial role facility management plays in maintaining brand reputation, ensuring tenant satisfaction, and optimizing operational costs. The Infrastructural segment, which includes airports, public transportation hubs, and utilities, is another significant growth area. Government initiatives aimed at improving national infrastructure across the continent are directly contributing to the demand for specialized facility management services that ensure the safety, efficiency, and longevity of these critical assets.

Geographically, South Africa and Nigeria are consistently leading the Africa Facility Management Market. South Africa, with its more developed economy and established corporate landscape, has a mature facility management market. The country benefits from a strong regulatory framework and a high adoption rate of advanced facility management technologies. For instance, ongoing developments like the Boardwalk Mall project in Port Elizabeth, with an investment of USD 36.2 Million, underscore the continuous activity and demand for FM services in the commercial real estate sector. Nigeria, on the other hand, is experiencing rapid growth due to its large population, expanding economy, and significant investments in infrastructure and commercial projects. The country's burgeoning oil and gas sector, alongside growing urban centers, creates substantial demand for integrated and specialized facility management solutions.

- Dominant Type of Facility Management: Integrated Facility Management

- Key Drivers: Need for comprehensive solutions, cost reduction through single point of contact, enhanced operational efficiency.

- Leading End-User Segments:

- Commercial: Driven by real estate development, corporate expansion, and focus on tenant experience.

- Infrastructural: Fueled by government investment in public projects and the need for asset longevity.

- Leading Geographic Regions:

- South Africa: Mature market, strong regulatory environment, high technology adoption, consistent commercial development.

- Nigeria: Rapid growth driven by population, economic expansion, and infrastructure projects.

Africa Facility Management Market Product Innovations

Africa Facility Management Market is witnessing significant product innovations aimed at enhancing efficiency, sustainability, and occupant well-being. Companies are increasingly deploying smart building technologies, including IoT-enabled sensors for predictive maintenance, energy consumption monitoring, and space optimization. Software solutions are also evolving, offering integrated platforms for work order management, asset tracking, and real-time performance analytics. A notable innovation is the development of eco-friendly materials, such as IntegriCo's "IntegriTies" for railroad ties, which are made from recycled plastics and offer up to four times the lifespan of traditional wooden ties. This trend reflects a growing emphasis on sustainable facility management practices and the circular economy, aligning with global environmental goals and local resource management strategies.

Propelling Factors for Africa Facility Management Market Growth

Several key factors are propelling the growth of the Africa Facility Management Market. Increasing urbanization and infrastructure development across the continent are creating a substantial demand for sophisticated facility management services to maintain and operate new commercial, residential, and public facilities. Growing foreign direct investment (FDI) further fuels this demand as international companies establish their presence and require professional facility management to ensure operational efficiency and compliance. The increasing awareness among businesses about the cost-saving benefits and operational efficiencies derived from outsourcing facility management is a significant driver. Furthermore, government initiatives promoting infrastructure upgrades and the adoption of smart technologies are creating a conducive environment for market expansion. The rising focus on sustainability and green building practices is also pushing the demand for specialized FM services that can manage energy consumption, waste, and environmental impact effectively.

Obstacles in the Africa Facility Management Market Market

Despite the positive growth trajectory, the Africa Facility Management Market faces several obstacles. A shortage of skilled labor and trained professionals remains a significant challenge, impacting the quality and availability of specialized services. Inconsistent regulatory frameworks and bureaucratic hurdles across different countries can create complexities and delays for market participants. Economic instability and currency fluctuations in some regions can impact investment decisions and operational costs for both service providers and clients. Limited access to advanced technology and funding for smaller players can hinder their ability to compete with larger, established companies. Furthermore, resistance to outsourcing among some local businesses that prefer in-house management, coupled with potential security concerns and geopolitical instability in certain areas, can also pose challenges to market expansion.

Future Opportunities in Africa Facility Management Market

The Africa Facility Management Market is ripe with future opportunities. The continued expansion of smart cities and intelligent infrastructure projects across the continent will drive demand for advanced technological solutions in facility management. The growing focus on sustainability and renewable energy presents opportunities for FM providers to offer energy management, waste recycling, and green building certification services. The increasing demand for specialized FM services in niche sectors such as healthcare, education, and data centers, driven by their unique operational requirements, offers significant growth potential. Furthermore, partnerships and collaborations between local African companies and international FM giants can facilitate knowledge transfer, technological adoption, and market penetration into underserved regions. The digitalization of FM services, including the use of AI and machine learning for predictive analytics and automated operations, will also unlock new efficiencies and service offerings.

Major Players in the Africa Facility Management Market Ecosystem

- Benchmark Facilities Management

- Integrico Private Limited

- EFS Facilities Management Africa

- G4S Africa

- Bidvest Facilities Management

- Apleona GmbH

- Emdad Facility Management

- Contrack Facilities Management S A E

- Broll Nigeria

Key Developments in Africa Facility Management Market Industry

- September 2022: A brand-new shopping center called the Boardwalk Mall is being built within the Boardwalk district of Port Elizabeth, South Africa. A total of USD 36.2 million is being invested in the development of the new shopping center over two phases. Such advances are strengthening the nation's economy and are critical in creating growth prospects for facility management services.

- September 2022: IntegriCo has announced railroad ties are made either of wood treated with chemicals or of longer-lasting and more expensive concrete, according to Sarepta, Louisiana-based IntegriCo. The private equity-backed firm says a better and more eco-friendly way to make railroad ties is to use plastics that would otherwise end up in a landfill, and it works with recycling centers called Material Recovery Facilities (MRFs) to collect discarded recyclables like ketchup bottles, yogurt containers, margarine tubs, meat trays, egg cartons, and plastic cups and plates. The company then uses a special “low-heating” process that preserves the properties of those source items to create a tough, composite material. The resulting “IntegriTies” can extend the life of railroad ties by up to four times the lifespan of traditional wooden ties in high-rot areas.

Strategic Africa Facility Management Market Market Forecast

The strategic forecast for the Africa Facility Management Market anticipates robust growth, driven by a confluence of accelerating urbanization, significant infrastructure investments, and an increasing corporate recognition of the strategic value of professional facility management. The move towards integrated and technology-driven solutions will be a defining characteristic of the forecast period (2025-2033). Key growth catalysts include the expansion of smart building technologies, the demand for sustainable FM practices, and the increasing adoption of outsourcing models across diverse end-user segments. Furthermore, ongoing developments in sectors like commercial real estate and transportation infrastructure will continue to create substantial opportunities for market players. The market is projected to witness a significant uplift, with the base year valuation of XX Million in 2025 serving as a springboard for sustained expansion, fueled by both organic growth and strategic M&A activities, ultimately positioning the African continent as a key frontier for facility management innovation and service delivery.

Africa Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Single Facility Management

- 1.2. Bundled Facility Management

- 1.3. Integrated Facility Management

-

2. End User

- 2.1. Commercial

- 2.2. Infrastructural

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Other End-users

Africa Facility Management Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Facility Management Market Regional Market Share

Geographic Coverage of Africa Facility Management Market

Africa Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth

- 3.3. Market Restrains

- 3.3.1. High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations

- 3.4. Market Trends

- 3.4.1. Infrastructural Development Continue to Open Up new Opportunities for FM Vendors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Single Facility Management

- 5.1.2. Bundled Facility Management

- 5.1.3. Integrated Facility Management

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Infrastructural

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Benchmark Facilities Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Integrico Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EFS Facilities Management Africa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 G4S Africa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bidvest Facilities Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apleona GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emdad Facility Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Contrack Facilities Management S A E

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broll Nigeria

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Benchmark Facilities Management

List of Figures

- Figure 1: Africa Facility Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2020 & 2033

- Table 2: Africa Facility Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Africa Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2020 & 2033

- Table 5: Africa Facility Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Africa Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Facility Management Market?

The projected CAGR is approximately 6.06%.

2. Which companies are prominent players in the Africa Facility Management Market?

Key companies in the market include Benchmark Facilities Management, Integrico Private Limited, EFS Facilities Management Africa, G4S Africa, Bidvest Facilities Management, Apleona GmbH, Emdad Facility Management, Contrack Facilities Management S A E, Broll Nigeria.

3. What are the main segments of the Africa Facility Management Market?

The market segments include Type of Facility Management, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth.

6. What are the notable trends driving market growth?

Infrastructural Development Continue to Open Up new Opportunities for FM Vendors .

7. Are there any restraints impacting market growth?

High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations.

8. Can you provide examples of recent developments in the market?

September 2022: A brand-new shopping center called the Boardwalk Mall is being built within the Boardwalk district of Port Elizabeth, South Africa. A total of USD 36.2 million is being invested in the development of the new shopping center over two phases. Such advances are strengthening the nation's economy and are critical in creating growth prospects for facility management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Facility Management Market?

To stay informed about further developments, trends, and reports in the Africa Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence