Key Insights

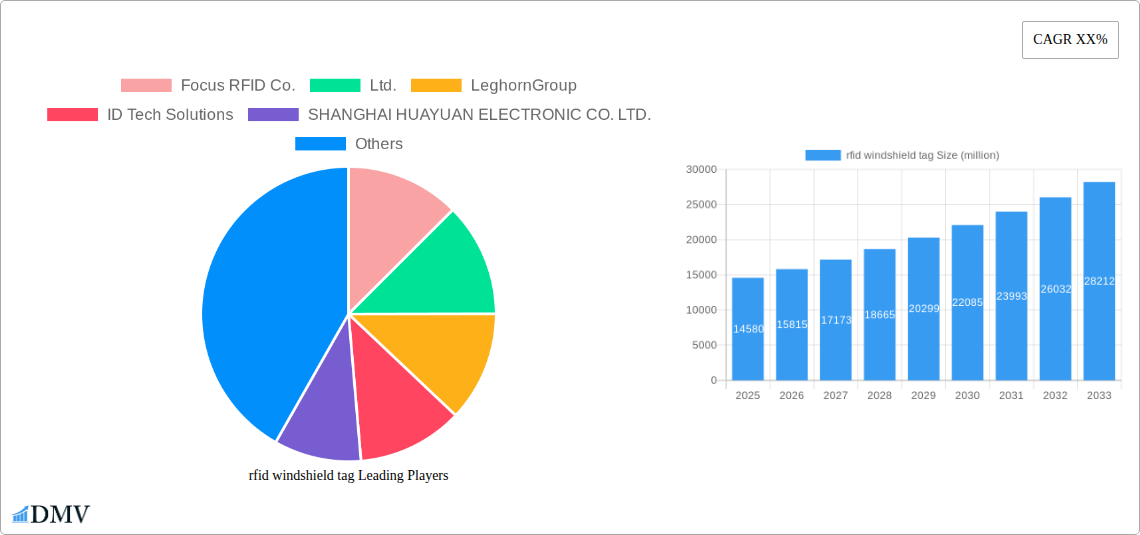

The global RFID windshield tag market is poised for significant expansion, projected to reach an estimated USD 14.58 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.5% from 2019 to 2033. The increasing adoption of electronic toll collection (ETC) systems worldwide is a primary catalyst, driven by the demand for seamless and efficient traffic management. Furthermore, the proliferation of smart city initiatives and the growing need for enhanced vehicle tracking and security solutions are expected to further fuel market demand. Passenger cars are expected to dominate the application segment, owing to the widespread implementation of ETC for private vehicles, while commercial cars are also contributing to growth through fleet management and logistics applications. The market's dynamism is further reflected in the diverse range of tag types, with Thermal Paper and PVC tags catering to various performance and cost requirements.

rfid windshield tag Market Size (In Billion)

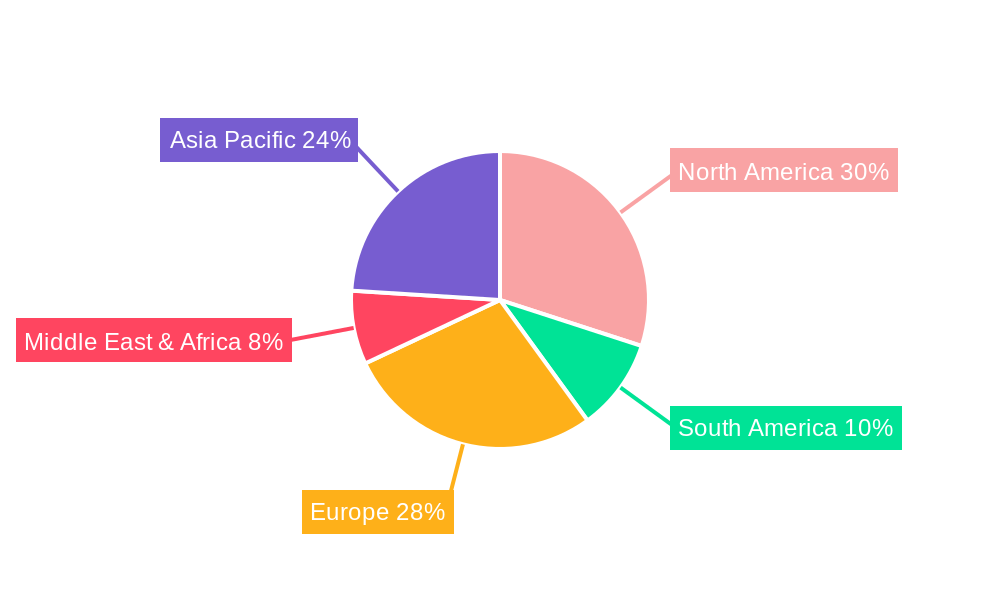

The RFID windshield tag market is experiencing a surge in innovation, with companies continuously developing more durable, secure, and cost-effective solutions. The market's expansion is further supported by a growing awareness of the benefits associated with RFID technology, including improved operational efficiency, reduced manual labor, and enhanced data accuracy. While the market presents a promising outlook, certain restraints such as initial implementation costs for some organizations and potential concerns regarding data privacy could pose challenges. However, ongoing technological advancements and declining costs of RFID components are expected to mitigate these challenges, paving the way for sustained growth. Geographically, North America and Europe are leading the adoption due to established infrastructure for ETC, while the Asia Pacific region, particularly China and India, presents substantial untapped potential for rapid growth driven by government investments in transportation infrastructure and smart city projects.

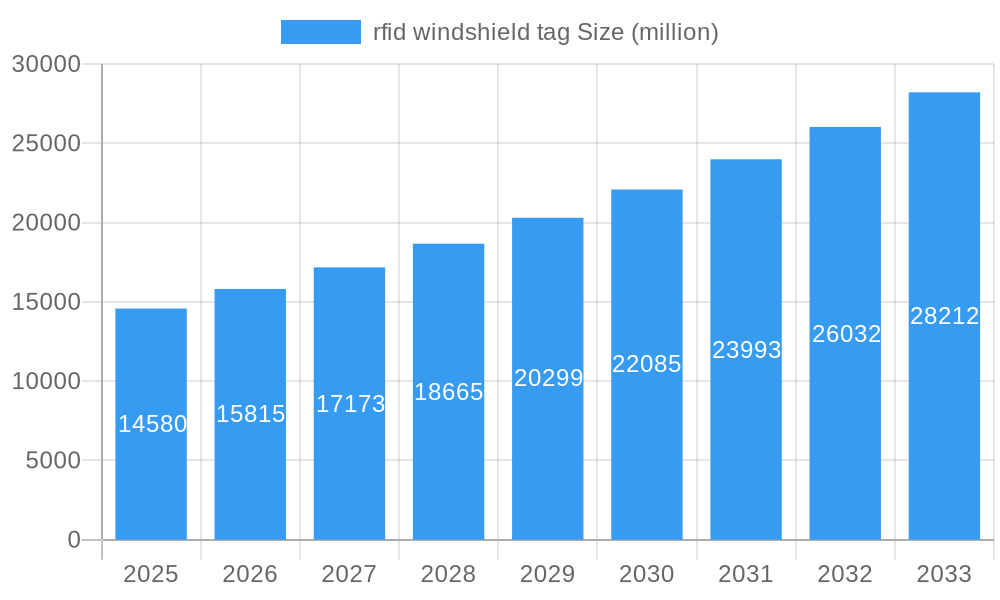

rfid windshield tag Company Market Share

Sure, here is the SEO-optimized report description for RFID windshield tags.

RFID Windshield Tag Market Composition & Trends

The global RFID windshield tag market is characterized by a dynamic interplay of established players and emerging innovators, demonstrating a competitive landscape with significant market share distribution. The study, spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, reveals evolving market concentration driven by ongoing technological advancements and a burgeoning demand for automated vehicle identification solutions. Innovation catalysts are primarily focused on enhancing tag durability, read range, and data security, crucial for applications in toll collection, access control, and fleet management. The regulatory landscape plays a pivotal role, with governments worldwide increasingly mandating or encouraging the adoption of RFID technology for enhanced traffic management and security. Substitute products, while present, struggle to match the integrated functionality and cost-effectiveness of RFID windshield tags. End-user profiles are diverse, ranging from individual vehicle owners seeking convenience to large-scale fleet operators and government agencies. Merger and acquisition (M&A) activities, with estimated deal values in the billions, are reshaping the market, consolidating expertise and expanding market reach.

- Market Share Distribution: Witness the distribution of market share among key companies, highlighting dominant players and emerging contenders.

- M&A Deal Values: Understand the financial impact of strategic acquisitions, with values estimated in the billions, driving market consolidation and innovation.

- Innovation Catalysts: Identify the key technological breakthroughs and R&D investments fueling market growth.

- Regulatory Landscape: Analyze the impact of government policies and mandates on the adoption and development of RFID windshield tags.

RFID Windshield Tag Industry Evolution

The RFID windshield tag industry has undergone a significant evolution, marked by consistent market growth trajectories and transformative technological advancements. From its nascent stages, the industry has witnessed a paradigm shift driven by the increasing need for efficient and secure vehicle identification systems. Over the historical period of 2019–2024, we observed a steady increase in adoption rates, fueled by advancements in RFID chip technology, antenna design, and reader capabilities. The base year of 2025 serves as a crucial benchmark, reflecting a mature yet rapidly expanding market. The forecast period from 2025 to 2033 is poised for accelerated growth, propelled by several interconnected factors.

Firstly, technological advancements have been instrumental. The development of UHF RFID technology has dramatically improved read speeds and ranges, making it ideal for high-volume traffic environments. Innovations in material science have led to more durable and weather-resistant tags, capable of withstanding harsh environmental conditions, a critical factor for windshield applications. Furthermore, the integration of enhanced security features, such as encryption and anti-cloning capabilities, has addressed growing concerns about data privacy and fraud.

Secondly, shifting consumer demands have played a vital role. Drivers are increasingly seeking seamless and automated experiences, from toll payments and parking management to vehicle tracking and maintenance. RFID windshield tags offer a convenient, hands-free solution that enhances user experience and reduces congestion. This consumer preference for convenience and efficiency translates into higher adoption rates for vehicles equipped with these tags.

Thirdly, industry developments have been characterized by strategic collaborations and investments. Companies are focusing on expanding their product portfolios to cater to diverse application needs, from passenger cars to commercial fleets. The continuous drive for cost reduction through economies of scale and improved manufacturing processes has made RFID windshield tags more accessible, further stimulating market penetration. The anticipated growth rate is expected to remain robust, with adoption metrics showcasing a significant uplift in both new vehicle installations and aftermarket solutions. The historical growth rate from 2019 to 2024, estimated at an average of 15 billion per year, is projected to escalate in the forecast period, indicating a sustained and powerful expansion of the RFID windshield tag market.

Leading Regions, Countries, or Segments in RFID Windshield Tag

The RFID windshield tag market's dominance is a complex interplay of regional adoption patterns, governmental initiatives, and segment-specific demands. Across the globe, certain regions stand out due to their proactive embrace of smart city initiatives, robust automotive sectors, and favorable regulatory environments. The Application segments, specifically Passenger Car and Commercial Car, are critical indicators of market penetration, while the material Types – Thermal Paper and PVC – highlight technological preferences and cost considerations.

North America, particularly the United States, has emerged as a leading region, driven by extensive deployments in electronic toll collection (ETC) systems. The widespread adoption of toll transponders, many of which are integrated into windshield tags, has created a substantial market. Government investments in intelligent transportation systems (ITS) and the increasing focus on improving traffic flow and reducing congestion are significant drivers. Furthermore, the large and affluent passenger car market in the U.S. readily adopts advanced vehicle technologies.

In Europe, countries like Germany, France, and the UK are significant contributors. Stringent environmental regulations and a strong push towards smart mobility solutions have fostered the growth of RFID windshield tags for applications beyond tolling, including vehicle registration and access control to restricted zones. The commercial car segment, encompassing logistics and fleet management, is particularly strong in Europe, where efficiency and real-time tracking are paramount.

Asia-Pacific, led by China and India, represents a rapidly growing market. China's massive automotive production and consumption, coupled with government support for smart transportation, are key factors. India, with its burgeoning passenger car market and increasing focus on modernizing its transportation infrastructure, is also a significant player. The growth in these regions is further amplified by the increasing affordability of RFID technology and the demand for streamlined vehicle management solutions.

Within the Application segment, the Passenger Car segment holds a dominant position. This is primarily due to the sheer volume of passenger vehicles manufactured and operated globally. The convenience offered by RFID windshield tags for toll payments, parking, and vehicle identification appeals directly to individual car owners. The ease of integration into existing vehicle infrastructure and the increasing trend of connected cars further bolster this segment's dominance.

The Commercial Car segment, while smaller in volume compared to passenger cars, exhibits a higher average revenue per tag due to more sophisticated fleet management and tracking requirements. Companies in logistics, public transportation, and corporate fleets are keen adopters, seeking to optimize operations, improve security, and gain real-time insights into their vehicle assets.

Regarding material Types, PVC tags generally lead due to their durability, flexibility, and resistance to environmental factors like UV exposure and temperature fluctuations, making them ideal for long-term windshield application. While Thermal Paper tags might offer a lower initial cost, their susceptibility to degradation under harsh conditions limits their widespread adoption for permanent windshield installations, often finding niche applications.

- Key Drivers in North America: Extensive ETC deployments, government investments in ITS, and a strong passenger car market.

- Dominance Factors in Europe: Stringent environmental regulations, smart mobility initiatives, and a robust commercial vehicle sector.

- Growth Catalysts in Asia-Pacific: Massive automotive markets, government support for smart transportation, and increasing affordability.

- Application Dominance (Passenger Car): High volume of vehicles, demand for convenience, and ease of integration.

- Commercial Car Segment Strengths: Higher ARPU, sophisticated fleet management needs, and emphasis on security.

- Material Preference (PVC): Superior durability, flexibility, and environmental resistance for long-term windshield use.

RFID Windshield Tag Product Innovations

Product innovations in the RFID windshield tag market are relentlessly focused on enhancing performance, durability, and security. Recent advancements include the development of highly miniaturized tags with embedded tamper-evident features, ensuring the integrity of the installed tag. Innovations in materials science have led to ultra-thin and conformable tags that seamlessly integrate into the windshield curvature, improving aesthetics and reducing potential damage. Furthermore, enhanced read range capabilities, now reaching several meters with advanced UHF RFID technology, are enabling more efficient and faster vehicle identification for high-speed tolling and gate access. The integration of advanced encryption protocols ensures data security and privacy, a critical factor for sensitive applications. Unique selling propositions lie in tags offering multi-protocol compatibility, allowing for integration with diverse reader systems and applications.

Propelling Factors for RFID Windshield Tag Growth

The growth of the RFID windshield tag market is propelled by a confluence of technological, economic, and regulatory factors. Technologically, the continuous improvement in RFID chip efficiency, read range, and antenna design is making these tags more capable and cost-effective. Economically, the increasing demand for automated vehicle identification for toll collection, parking management, and fleet optimization drives adoption across both passenger and commercial vehicle segments. Regulatory mandates and government initiatives promoting intelligent transportation systems (ITS) and smart city development provide a significant push. For example, the ongoing expansion of electronic tolling systems in numerous countries directly fuels the demand for compliant RFID windshield tags.

Obstacles in the RFID Windshield Tag Market

Despite robust growth, the RFID windshield tag market faces several obstacles. Regulatory challenges can arise from varying standards and compliance requirements across different regions, creating fragmentation and increasing development costs for manufacturers. Supply chain disruptions, as witnessed in recent global events, can impact the availability of essential components and raw materials, leading to production delays and price volatility. Competitive pressures from alternative identification technologies and the continuous need for investment in R&D to stay ahead of rapid technological advancements also present hurdles. The initial cost of implementation for some large-scale fleet management systems can also be a restraint, although this is decreasing with technological maturation.

Future Opportunities in RFID Windshield Tag

Emerging opportunities in the RFID windshield tag market are abundant, driven by evolving consumer trends and technological frontiers. The expansion of smart city infrastructure globally presents a vast untapped market for integrated vehicle identification solutions, beyond traditional tolling. Advancements in IoT (Internet of Things) and V2X (Vehicle-to-Everything) communication are creating new applications for RFID windshield tags, such as real-time vehicle diagnostics and predictive maintenance. The increasing penetration of electric vehicles (EVs) and the need for specialized charging infrastructure management offer another avenue for growth. Furthermore, the development of more intelligent and data-rich RFID tags, capable of storing and transmitting more complex information, will unlock new possibilities in vehicle security and personalized services.

Major Players in the RFID Windshield Tag Ecosystem

- Focus RFID Co.,Ltd.

- LeghornGroup

- ID Tech Solutions

- SHANGHAI HUAYUAN ELECTRONIC CO. LTD.

- Dipole RFID

- Kathrein Solutions

- Perfect ID

- Indian Barcode Corporation

- DO RFID TAG company

- Arizon RFID Technology

- SYNOMETRIX

- Best Barcode System Pvt Ltd

- GSRFID

- Lex

Key Developments in RFID Windshield Tag Industry

- 2024 March: Launch of new generation of ultra-thin, high-durability PVC RFID windshield tags by [Company Name], enhancing resistance to extreme temperatures and UV exposure.

- 2023 December: Major toll road authority in [Country Name] announces mandatory upgrade to UHF RFID windshield tags for all commercial vehicles, impacting billions in new deployments.

- 2023 October: Acquisition of [Small RFID Tech Company] by [Major RFID Player] for an estimated 500 million, focusing on expanding their presence in the automotive aftermarket.

- 2023 July: Introduction of advanced anti-collision algorithms in RFID readers, significantly improving read accuracy and speed for dense vehicle traffic scenarios.

- 2023 April: Partnership between [Automotive Manufacturer] and [RFID Tag Supplier] to integrate RFID windshield tags for seamless access to parking and charging stations for EV models.

- 2022 November: Development of tamper-evident RFID windshield tags with integrated security features to prevent unauthorized removal and transfer, valued at over 200 million market potential.

- 2022 August: Expansion of electronic tolling systems in [Region Name] to cover a larger network of roads, driving substantial demand for RFID windshield tags, projected at 1 billion annually.

Strategic RFID Windshield Tag Market Forecast

The strategic RFID windshield tag market forecast indicates sustained and robust growth, driven by the increasing digitalization of transportation infrastructure and the escalating demand for efficient vehicle management solutions. Key growth catalysts include government mandates for electronic toll collection, smart city initiatives, and the continuous technological advancements in RFID that enhance performance and reduce costs. Emerging opportunities in the electric vehicle sector and the expansion of connected car technologies will further fuel market penetration. The market is poised to capitalize on these trends, with an estimated market expansion of billions over the forecast period, solidifying its position as a critical component of modern transportation ecosystems.

rfid windshield tag Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Car

-

2. Types

- 2.1. Thermal Paper

- 2.2. PVC

rfid windshield tag Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

rfid windshield tag Regional Market Share

Geographic Coverage of rfid windshield tag

rfid windshield tag REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Car

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Thermal Paper

- 5.2.2. PVC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Car

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Thermal Paper

- 6.2.2. PVC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Car

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Thermal Paper

- 7.2.2. PVC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Car

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Thermal Paper

- 8.2.2. PVC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Car

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Thermal Paper

- 9.2.2. PVC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific rfid windshield tag Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Car

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Thermal Paper

- 10.2.2. PVC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Focus RFID Co.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LeghornGroup

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ID Tech Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHANGHAI HUAYUAN ELECTRONIC CO. LTD.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dipole RFID

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kathrein Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Perfect ID

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Barcode Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DO RFID TAG company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arizon RFID Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SYNOMETRIX

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Best Barcode System Pvt Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GSRFID

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lex

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Focus RFID Co.

List of Figures

- Figure 1: Global rfid windshield tag Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global rfid windshield tag Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America rfid windshield tag Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America rfid windshield tag Volume (K), by Application 2025 & 2033

- Figure 5: North America rfid windshield tag Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America rfid windshield tag Volume Share (%), by Application 2025 & 2033

- Figure 7: North America rfid windshield tag Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America rfid windshield tag Volume (K), by Types 2025 & 2033

- Figure 9: North America rfid windshield tag Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America rfid windshield tag Volume Share (%), by Types 2025 & 2033

- Figure 11: North America rfid windshield tag Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America rfid windshield tag Volume (K), by Country 2025 & 2033

- Figure 13: North America rfid windshield tag Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America rfid windshield tag Volume Share (%), by Country 2025 & 2033

- Figure 15: South America rfid windshield tag Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America rfid windshield tag Volume (K), by Application 2025 & 2033

- Figure 17: South America rfid windshield tag Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America rfid windshield tag Volume Share (%), by Application 2025 & 2033

- Figure 19: South America rfid windshield tag Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America rfid windshield tag Volume (K), by Types 2025 & 2033

- Figure 21: South America rfid windshield tag Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America rfid windshield tag Volume Share (%), by Types 2025 & 2033

- Figure 23: South America rfid windshield tag Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America rfid windshield tag Volume (K), by Country 2025 & 2033

- Figure 25: South America rfid windshield tag Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America rfid windshield tag Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe rfid windshield tag Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe rfid windshield tag Volume (K), by Application 2025 & 2033

- Figure 29: Europe rfid windshield tag Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe rfid windshield tag Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe rfid windshield tag Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe rfid windshield tag Volume (K), by Types 2025 & 2033

- Figure 33: Europe rfid windshield tag Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe rfid windshield tag Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe rfid windshield tag Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe rfid windshield tag Volume (K), by Country 2025 & 2033

- Figure 37: Europe rfid windshield tag Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe rfid windshield tag Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa rfid windshield tag Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa rfid windshield tag Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa rfid windshield tag Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa rfid windshield tag Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa rfid windshield tag Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa rfid windshield tag Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa rfid windshield tag Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa rfid windshield tag Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa rfid windshield tag Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa rfid windshield tag Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa rfid windshield tag Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa rfid windshield tag Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific rfid windshield tag Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific rfid windshield tag Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific rfid windshield tag Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific rfid windshield tag Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific rfid windshield tag Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific rfid windshield tag Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific rfid windshield tag Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific rfid windshield tag Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific rfid windshield tag Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific rfid windshield tag Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific rfid windshield tag Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific rfid windshield tag Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 3: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 5: Global rfid windshield tag Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global rfid windshield tag Volume K Forecast, by Region 2020 & 2033

- Table 7: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 9: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 10: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 11: Global rfid windshield tag Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global rfid windshield tag Volume K Forecast, by Country 2020 & 2033

- Table 13: United States rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 21: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 22: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 23: Global rfid windshield tag Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global rfid windshield tag Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 33: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 34: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 35: Global rfid windshield tag Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global rfid windshield tag Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 57: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 58: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 59: Global rfid windshield tag Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global rfid windshield tag Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global rfid windshield tag Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global rfid windshield tag Volume K Forecast, by Application 2020 & 2033

- Table 75: Global rfid windshield tag Revenue undefined Forecast, by Types 2020 & 2033

- Table 76: Global rfid windshield tag Volume K Forecast, by Types 2020 & 2033

- Table 77: Global rfid windshield tag Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global rfid windshield tag Volume K Forecast, by Country 2020 & 2033

- Table 79: China rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific rfid windshield tag Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific rfid windshield tag Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the rfid windshield tag?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the rfid windshield tag?

Key companies in the market include Focus RFID Co., Ltd., LeghornGroup, ID Tech Solutions, SHANGHAI HUAYUAN ELECTRONIC CO. LTD., Dipole RFID, Kathrein Solutions, Perfect ID, Indian Barcode Corporation, DO RFID TAG company, Arizon RFID Technology, SYNOMETRIX, Best Barcode System Pvt Ltd, GSRFID, Lex.

3. What are the main segments of the rfid windshield tag?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "rfid windshield tag," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the rfid windshield tag report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the rfid windshield tag?

To stay informed about further developments, trends, and reports in the rfid windshield tag, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence