Key Insights

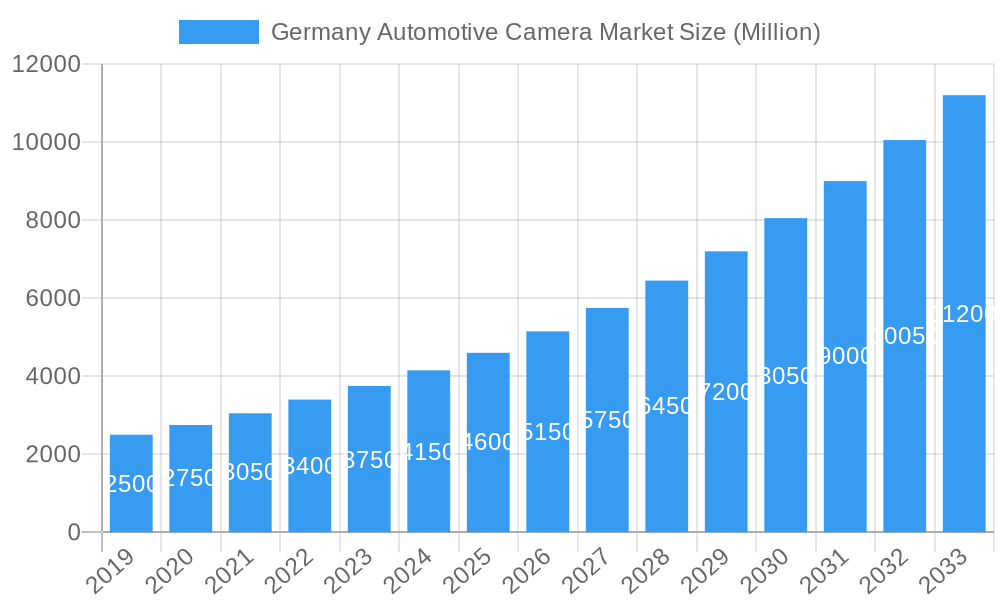

The German automotive camera market is projected for substantial growth, expected to reach $8.4 billion by 2025, with a CAGR of 9% through 2033. This expansion is driven by increasing demand for Advanced Driver-Assistance Systems (ADAS) and the pursuit of autonomous driving. Key factors include regulatory mandates for safety features like automatic emergency braking and lane departure warning, alongside consumer preference for enhanced safety and convenience. Technological advancements, including AI and machine learning for image processing and object recognition, coupled with the adoption of higher-resolution cameras, are further propelling market evolution.

Germany Automotive Camera Market Market Size (In Billion)

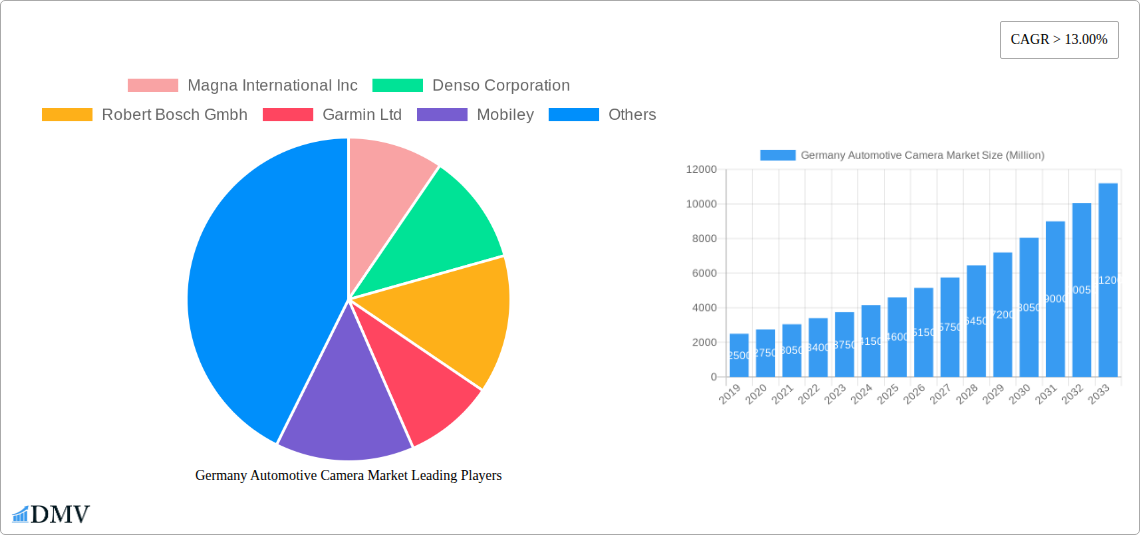

The market is segmented into Viewing Cameras and Sensing Cameras, both experiencing significant demand. Viewing cameras support features such as surround-view and rearview systems, while sensing cameras, often integrated with radar and lidar, are critical for ADAS and autonomous driving functionalities. Passenger cars dominate vehicle segment adoption, but Commercial Vehicles are rapidly emerging as fleet operators identify benefits in safety, efficiency, and cost reduction. Leading companies like Magna International Inc., Denso Corporation, Robert Bosch GmbH, and Continental AG are actively investing in research and development and strategic partnerships to secure market share and foster innovation in Germany's advanced automotive sector.

Germany Automotive Camera Market Company Market Share

This report offers a detailed analysis of the Germany Automotive Camera Market, examining its current state, historical performance, and future growth potential from 2019 to 2033, with 2025 as the base year. It provides essential insights into market dynamics, technological trends, and strategic opportunities for stakeholders in this dynamic industry. The report covers automotive camera types, including Viewing Cameras and Sensing Cameras, across Passenger Cars and Commercial Vehicles, delivering precise data and actionable intelligence.

Germany Automotive Camera Market Market Composition & Trends

The Germany Automotive Camera Market is characterized by a concentrated yet dynamic competitive landscape, with leading players such as Robert Bosch GmbH, Continental AG, and Magna International Inc. driving innovation and market share. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies serves as a significant innovation catalyst. Regulatory mandates, particularly those pertaining to vehicle safety standards, are continuously shaping the market, favoring the integration of sophisticated camera systems. While direct substitutes are limited, advancements in sensor fusion and alternative sensing technologies pose potential competitive threats. End-user profiles are increasingly sophisticated, with automotive OEMs demanding higher resolution, enhanced durability, and seamless integration of camera solutions. Mergers and acquisitions (M&A) activities, with an estimated total deal value of XXX Million in the historical period, underscore the strategic importance of consolidating expertise and expanding product portfolios within this segment. The market concentration ratio is estimated at XX%, indicating a significant presence of top players.

Germany Automotive Camera Market Industry Evolution

The Germany Automotive Camera Market has witnessed substantial evolution driven by a confluence of technological innovation, stringent safety regulations, and shifting consumer preferences towards enhanced vehicle safety and convenience. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately XX%, a trend expected to accelerate to XX% during the forecast period (2025-2033). This growth is fundamentally underpinned by the burgeoning demand for ADAS features like lane departure warning, adaptive cruise control, and automated parking, all of which rely heavily on advanced automotive camera systems.

Technological advancements have been rapid, moving from basic rearview cameras to sophisticated surround-view systems and object-recognition cameras equipped with artificial intelligence (AI) and machine learning algorithms. The integration of image processing capabilities directly within the camera module has further reduced latency and improved real-time performance. Consumer demand has also pivoted, with a growing awareness of the safety benefits and a desire for a more intuitive and assisted driving experience. This has led to increased OEM investment in camera technology as a key differentiator in their product offerings.

Furthermore, the pursuit of higher levels of autonomous driving (Levels 3, 4, and 5) necessitates more robust and multi-functional camera solutions, including a wider field of view, enhanced low-light performance, and resistance to adverse weather conditions. The projected market size for 2025 is estimated at XXX Million, with projections indicating a significant expansion to XXX Million by 2033. Adoption metrics for essential camera-based ADAS features are already exceeding XX% in new passenger vehicle registrations, a figure expected to climb further as these technologies become standard. The continuous pursuit of miniaturization, cost reduction, and improved data processing power will continue to shape the industry's trajectory.

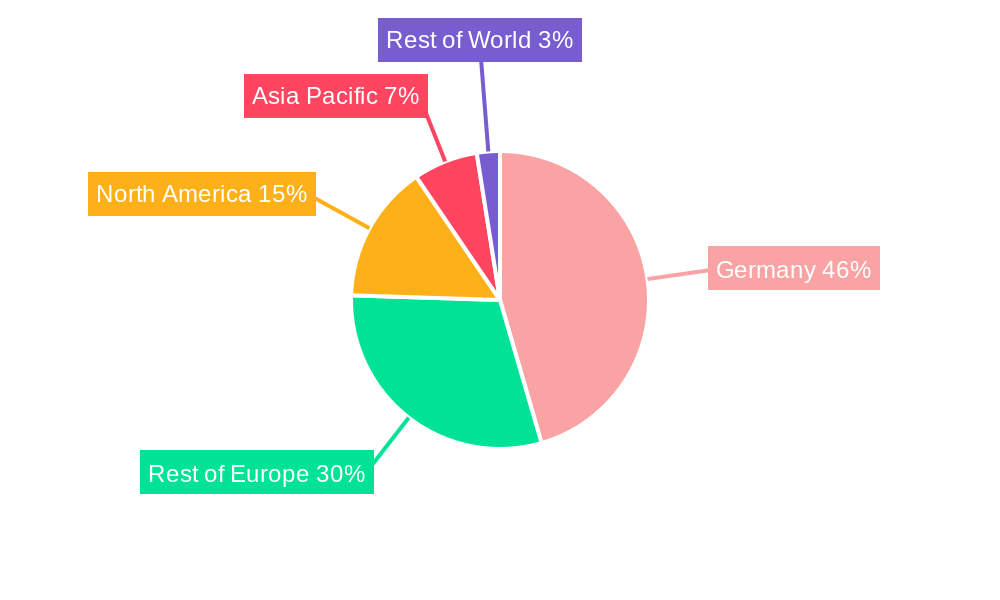

Leading Regions, Countries, or Segments in Germany Automotive Camera Market

Within the Germany Automotive Camera Market, Passenger Cars emerge as the dominant vehicle type segment, commanding an estimated XX% market share in the base year 2025. This dominance is attributed to several interconnected factors. The strong automotive manufacturing base in Germany, particularly for premium and mid-range passenger vehicles, inherently creates a substantial demand for integrated camera systems.

- Investment Trends: German automotive OEMs, including Volkswagen Group, BMW Group, and Mercedes-Benz Group AG, are consistently investing billions of Euros annually in the research and development of ADAS and autonomous driving technologies. A significant portion of this investment is channeled towards advanced camera solutions, including Sensing Cameras for advanced safety features and Viewing Cameras for enhanced driver and passenger experience.

- Regulatory Support: Germany, as a leading member of the European Union, adheres to stringent safety regulations that mandate or strongly encourage the adoption of safety-critical ADAS features. These regulations, such as those related to mandatory emergency braking systems and lane-keeping assist, directly drive the demand for sophisticated camera technologies.

- Consumer Demand: German consumers, known for their appreciation of safety and technological innovation, are increasingly seeking vehicles equipped with advanced camera-based features. The perceived enhancement in driving safety and convenience offered by technologies like 360-degree parking assist and blind-spot monitoring contributes significantly to the uptake of these systems in passenger cars.

While Commercial Vehicles represent a growing segment, particularly with the increasing adoption of telematics and driver monitoring systems, the sheer volume of passenger car production and the higher penetration of advanced ADAS features in this segment solidify its leading position. The Viewing Camera segment within passenger cars, used for parking assistance, rearview, and even in-cabin monitoring, also holds a substantial share, often complementing the functionalities of Sensing Cameras which are crucial for autonomous driving functions. The synergistic integration of both camera types is a key trend driving the overall market.

Germany Automotive Camera Market Product Innovations

Product innovation in the Germany Automotive Camera Market is aggressively focused on enhancing resolution, widening fields of view, and improving performance under challenging environmental conditions. Key innovations include the development of high-dynamic-range (HDR) cameras capable of capturing clear images in extreme light contrast, and low-light cameras that maintain clarity in darkness. Advanced AI-powered image processing is being integrated directly into camera modules for real-time object recognition, classification, and tracking, crucial for ADAS and autonomous driving. Furthermore, the industry is seeing advancements in thermal imaging cameras for enhanced pedestrian and animal detection at night and in fog, as well as the development of in-cabin monitoring cameras that utilize AI to detect driver drowsiness or distraction. The unique selling proposition often lies in the miniaturization, power efficiency, and robust environmental sealing of these advanced camera systems, ensuring reliability in automotive applications.

Propelling Factors for Germany Automotive Camera Market Growth

The Germany Automotive Camera Market is experiencing robust growth driven by several key factors. Technological advancements in AI, machine learning, and sensor fusion are enabling more sophisticated and reliable camera functionalities. Stringent automotive safety regulations globally and within the EU, mandating features like automatic emergency braking and lane-keeping assist, are significant catalysts. The increasing consumer demand for enhanced vehicle safety, comfort, and the burgeoning interest in autonomous driving technologies are also critical drivers. Furthermore, the strategic investments by major automotive OEMs in developing next-generation vehicles equipped with advanced driver-assistance systems (ADAS) and autonomous driving capabilities directly fuel the demand for cutting-edge automotive cameras. The expanding application of cameras beyond driver assistance, such as for interior monitoring and driver behavior analysis, also contributes to market expansion.

Obstacles in the Germany Automotive Camera Market Market

Despite its growth trajectory, the Germany Automotive Camera Market faces several obstacles. High development and integration costs for advanced camera systems and their associated software can be a barrier, particularly for smaller OEMs and aftermarket suppliers. Stringent validation and testing requirements for safety-critical automotive components add to the development time and expense. Supply chain disruptions, as experienced globally in recent years, can impact the availability and pricing of key components, including image sensors and processors. Furthermore, cybersecurity concerns related to connected vehicle systems and potential vulnerabilities in camera data transmission present a growing challenge that requires ongoing attention and robust security measures. The market also grapples with the need for standardization in camera performance across different manufacturers to ensure interoperability and consumer trust.

Future Opportunities in Germany Automotive Camera Market

Emerging opportunities in the Germany Automotive Camera Market are abundant. The continued push towards higher levels of autonomous driving (Levels 3, 4, and 5) will necessitate the integration of more advanced and redundant camera systems, including 3D and thermal imaging. The expansion of in-cabin monitoring systems for driver attention detection and passenger safety presents a significant growth avenue. Opportunities also lie in the development of cost-effective camera solutions for entry-level vehicles, democratizing advanced safety features. Furthermore, the growing trend of vehicle-to-everything (V2X) communication offers potential for cameras to share data and collaborate with other vehicle sensors and infrastructure, opening up new application possibilities. The increasing adoption of cameras in commercial vehicle fleets for safety and efficiency monitoring also represents a substantial untapped market.

Major Players in the Germany Automotive Camera Market Ecosystem

- Magna International Inc

- Denso Corporation

- Robert Bosch GmbH

- Garmin Ltd

- Mobileye

- Continental AG

- Autoliv Inc

- Valeo SA

- Hella KGaA Hueck & Co

- Panasonic Corporation

- ZF Friedrichshafen AG

Key Developments in Germany Automotive Camera Market Industry

- 2023/09: Robert Bosch GmbH announces a new generation of AI-powered image processing chips for automotive cameras, enabling enhanced object recognition and faster response times.

- 2024/01: Continental AG showcases its advanced surround-view camera system with integrated lidar fusion capabilities at CES 2024, enhancing 3D environmental perception.

- 2024/03: Magna International Inc. secures a significant long-term supply agreement with a major European OEM for its advanced driver-assistance camera systems, expected to commence in 2025.

- 2024/06: Valeo SA expands its portfolio with the introduction of a new compact, high-resolution automotive camera designed for seamless integration into vehicle exteriors.

- 2024/08: ZF Friedrichshafen AG announces a strategic partnership with a leading AI software provider to accelerate the development of its autonomous driving camera solutions.

Strategic Germany Automotive Camera Market Market Forecast

The Germany Automotive Camera Market is poised for substantial growth, driven by the indispensable role of cameras in the evolution of vehicle safety and autonomy. The forecast period (2025–2033) will witness an accelerated adoption of sophisticated camera technologies in both passenger and commercial vehicles, propelled by regulatory mandates and increasing consumer demand for advanced driver-assistance and autonomous driving features. Strategic investments by key players in AI integration, higher resolution imaging, and robust performance under adverse conditions will continue to shape product development. Emerging opportunities in in-cabin monitoring and V2X communication further underscore the market's significant future potential, ensuring sustained expansion and innovation in the coming years.

Germany Automotive Camera Market Segmentation

-

1. Type

- 1.1. Viewing Camera

- 1.2. Sensing Camera

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Germany Automotive Camera Market Segmentation By Geography

- 1. Germany

Germany Automotive Camera Market Regional Market Share

Geographic Coverage of Germany Automotive Camera Market

Germany Automotive Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of On Board Chargers Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Sensing Camera to Experience a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Viewing Camera

- 5.1.2. Sensing Camera

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch Gmbh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Garmin Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mobiley

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autoliv Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valeo SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hella KGaA Hueck & Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ZF Friedrichshafen AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: Germany Automotive Camera Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive Camera Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Automotive Camera Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Germany Automotive Camera Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive Camera Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Automotive Camera Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Germany Automotive Camera Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive Camera Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Germany Automotive Camera Market?

Key companies in the market include Magna International Inc, Denso Corporation, Robert Bosch Gmbh, Garmin Ltd, Mobiley, Continental AG, Autoliv Inc, Valeo SA, Hella KGaA Hueck & Co, Panasonic Corporation, ZF Friedrichshafen AG.

3. What are the main segments of the Germany Automotive Camera Market?

The market segments include Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Sensing Camera to Experience a Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of On Board Chargers Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive Camera Market?

To stay informed about further developments, trends, and reports in the Germany Automotive Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence