Key Insights

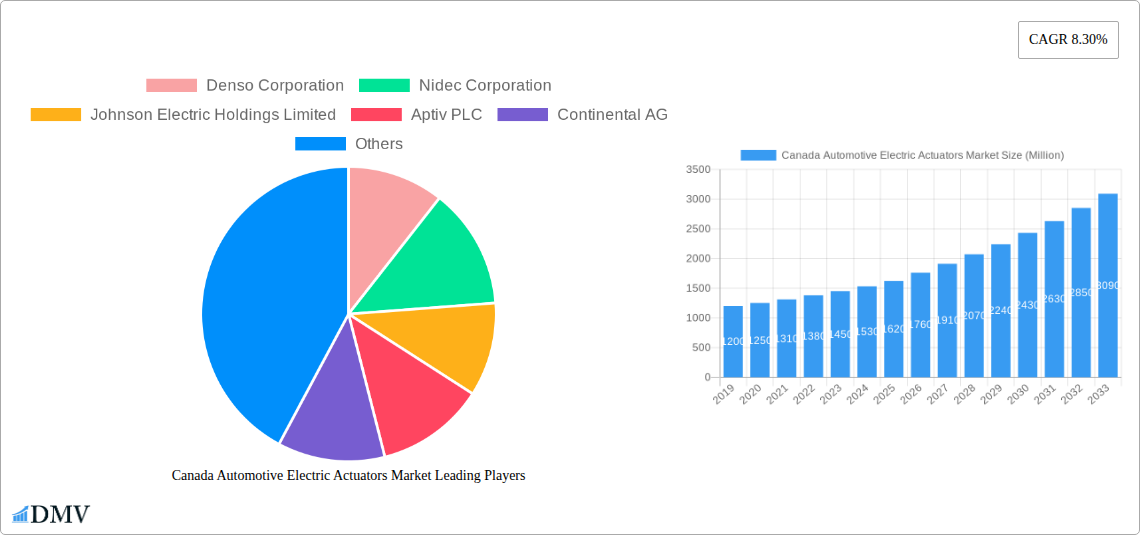

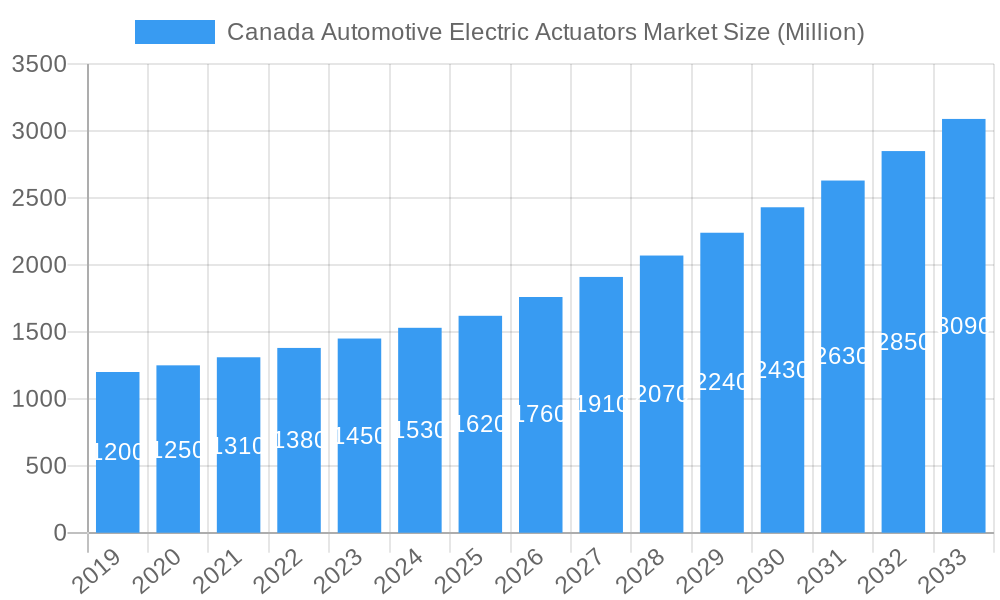

The Canadian automotive electric actuators market is poised for substantial growth, projected to reach approximately USD 2,500 million by 2033, with a robust Compound Annual Growth Rate (CAGR) of 8.30% from 2025 to 2033. This expansion is primarily fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and the burgeoning electric vehicle (EV) segment. As consumer demand for enhanced safety features, comfort, and fuel efficiency continues to rise, the integration of electric actuators in various vehicle functions such as throttle control, seat adjustment, and braking systems becomes indispensable. The Canadian government's supportive policies for EV adoption and its commitment to emission reduction targets further bolster the market's upward trajectory. Furthermore, the continuous innovation in actuator technology, leading to more compact, efficient, and reliable solutions, is a key driver for market penetration. Key players are actively investing in research and development to cater to the evolving needs of the automotive industry in Canada.

Canada Automotive Electric Actuators Market Market Size (In Billion)

The market is segmented into Passenger Cars and Commercial Vehicles, with passenger cars likely holding a dominant share due to higher sales volumes. Within applications, throttle actuators and seat adjustment actuators are expected to witness significant demand, driven by performance enhancement and luxury features respectively. Brake actuators are gaining prominence with the increasing sophistication of safety systems like electronic stability control and regenerative braking in EVs. While the market exhibits strong growth potential, challenges such as the initial high cost of electric actuator integration and the need for robust charging infrastructure for EVs could present some restraints. However, the long-term outlook remains highly positive, with ongoing technological advancements and increasing environmental consciousness driving the widespread adoption of electric actuators across the Canadian automotive landscape.

Canada Automotive Electric Actuators Market Company Market Share

This comprehensive report offers an in-depth analysis of the Canada automotive electric actuators market, providing critical insights into its composition, trends, evolution, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this research is an essential resource for stakeholders seeking to understand the dynamics of this rapidly growing sector. With the increasing integration of advanced technologies in vehicles, the demand for sophisticated automotive electric actuators is set to surge.

Canada Automotive Electric Actuators Market Market Composition & Trends

The Canada automotive electric actuators market is characterized by a dynamic interplay of innovation, regulatory influences, and evolving consumer preferences. Market concentration is moderate, with key players actively investing in research and development to gain a competitive edge. Innovation catalysts include the growing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), driving the demand for precise and efficient actuator solutions. The regulatory landscape, particularly concerning vehicle emissions and safety standards, indirectly fuels the adoption of electric actuators for their energy efficiency and enhanced control capabilities. Substitute products, while present in some basic applications, are increasingly being outpaced by the superior performance and integration potential of electric actuators in modern automotive designs. End-user profiles range from major Original Equipment Manufacturers (OEMs) to Tier 1 and Tier 2 suppliers, all seeking to enhance vehicle performance, comfort, and safety. Mergers and acquisitions (M&A) activities are a significant feature, with deal values expected to grow as companies consolidate to leverage synergies and expand their product portfolios. For instance, anticipated M&A deal values in the coming years are projected to reach several hundred million dollars, reflecting the strategic importance of this segment.

Canada Automotive Electric Actuators Market Industry Evolution

The Canada automotive electric actuators market has witnessed a remarkable evolutionary journey, driven by technological advancements and shifting consumer demands. Over the historical period of 2019–2024, the market experienced steady growth, propelled by the increasing sophistication of automotive systems. The base year of 2025 marks a pivotal point, with projected market growth rates indicating an accelerated expansion in the forecast period of 2025–2033. This growth is intrinsically linked to the burgeoning automotive industry in Canada, particularly the robust development in the passenger car segment, which constitutes a significant portion of the market. Furthermore, the growing adoption of electric and hybrid vehicles has significantly boosted the demand for specialized electric actuators, such as those used in thermal management systems and battery pack components.

Technological advancements have been a cornerstone of this evolution. Early iterations of electric actuators primarily focused on basic functions like seat adjustment. However, the industry has seen a rapid transition towards more complex and integrated solutions. The advent of sophisticated throttle actuators with precise electronic control has become standard in modern internal combustion engines, while their role in electric powertrains for managing power delivery is expanding. Similarly, the development of advanced brake actuators, crucial for electronic stability control (ESC) and regenerative braking systems in EVs, has been a key innovation. The increasing emphasis on vehicle safety and comfort has also spurred innovation in closure actuators for doors, tailgates, and other access points, offering convenience and enhanced functionality.

Consumer demand has mirrored these technological shifts. Drivers and passengers now expect a higher level of automation, comfort, and personalized experience within vehicles. This translates into a greater need for electric actuators that can provide seamless and responsive control over various vehicle functions. The trend towards autonomous driving features further necessitates highly reliable and precise electric actuators for steering, braking, and throttle control. The Canadian market, with its discerning consumer base and strong focus on automotive innovation, is at the forefront of this demand. The anticipated Compound Annual Growth Rate (CAGR) for the Canada automotive electric actuators market is expected to be in the high single digits, underscoring the robust growth trajectory driven by these intertwined factors of technological progress and evolving consumer expectations. The integration of electric actuators is no longer a luxury but a fundamental requirement for contemporary vehicle design and performance.

Leading Regions, Countries, or Segments in Canada Automotive Electric Actuators Market

The Canada automotive electric actuators market exhibits distinct regional and segmental dominance, with the passenger car segment overwhelmingly leading in terms of market share and growth potential. This dominance is underpinned by several key drivers. Firstly, the sheer volume of passenger car production and sales in Canada significantly outpaces that of commercial vehicles, naturally leading to a higher demand for all automotive components, including electric actuators. This segment consistently accounts for an estimated 60-70% of the overall market.

Within the passenger car segment, the throttle actuator application is a critical component, crucial for modern engine management systems, optimizing fuel efficiency and emissions. With the continuous push for improved performance and reduced environmental impact, the demand for advanced electronic throttle control systems is robust. Following closely are seat adjustment actuators, which have evolved from basic power adjustments to sophisticated memory functions and ergonomic controls, significantly enhancing passenger comfort and perceived vehicle luxury. The adoption of these comfort-enhancing features is prevalent in a wide array of passenger vehicles, from entry-level to premium segments.

The brake actuator segment is experiencing rapid growth, particularly driven by the increasing integration of safety features such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and the emerging demand for advanced braking systems in electric and hybrid vehicles. These systems rely heavily on the precise and rapid actuation provided by electric brake actuators for optimal performance and safety.

While the commercial vehicle segment is smaller in comparison, it presents a significant growth opportunity. The increasing electrification of commercial fleets and the adoption of autonomous driving technologies in trucking are creating new avenues for electric actuator applications, particularly in steering, suspension, and advanced braking systems. However, the current market landscape is heavily skewed towards passenger car applications.

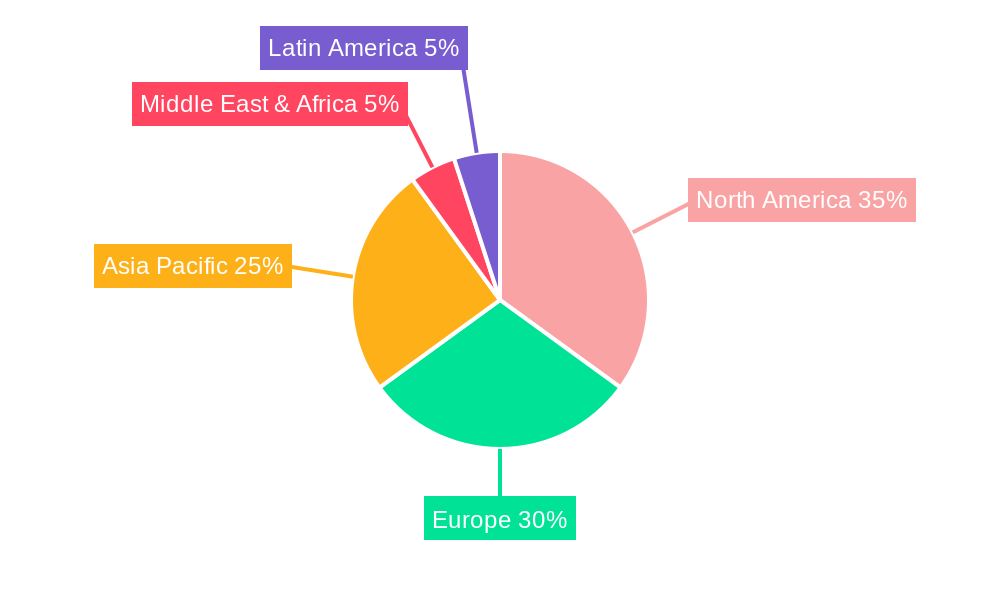

Geographically, the Ontario region, being the automotive manufacturing hub of Canada, naturally dominates the Canada automotive electric actuators market. This dominance is driven by the presence of major automotive manufacturing plants, research and development centers, and a well-established supply chain ecosystem. Investment trends in this region are consistently high, with automotive manufacturers and Tier 1 suppliers investing heavily in new technologies and production facilities. Regulatory support for the automotive industry in Ontario, coupled with its proximity to the United States market, further solidifies its leading position. The concentration of automotive OEMs and their direct demand for electric actuators makes Ontario the undisputed epicenter of this market in Canada.

Canada Automotive Electric Actuators Market Product Innovations

Product innovations in the Canada automotive electric actuators market are primarily focused on enhancing precision, efficiency, and integration. Manufacturers are developing smaller, lighter, and more energy-efficient actuators that can seamlessly integrate into increasingly complex vehicle architectures. Key advancements include the development of actuators with higher torque density, faster response times, and improved reliability, crucial for applications like advanced driver-assistance systems (ADAS) and autonomous driving functionalities. The integration of advanced sensor technologies within actuators allows for real-time feedback and adaptive control, improving performance and safety. For instance, smart actuators with embedded microcontrollers are now capable of performing self-diagnostics and communicating wirelessly, offering unique selling propositions in a competitive market.

Propelling Factors for Canada Automotive Electric Actuators Market Growth

Several key growth drivers are propelling the Canada automotive electric actuators market. The increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a primary catalyst, as these powertrains necessitate a greater number and variety of electric actuators for thermal management, battery control, and regenerative braking systems. The continuous evolution of advanced driver-assistance systems (ADAS) and the pursuit of autonomous driving capabilities also mandate the use of highly precise and responsive electric actuators for steering, braking, and acceleration control. Stringent government regulations aimed at improving vehicle safety and reducing emissions further encourage the adoption of electric actuators due to their efficiency and control benefits. Economic factors, including rising disposable incomes and consumer preference for premium features like comfort and convenience, also contribute to the demand for advanced electric actuator applications such as powered seats and advanced door closure systems.

Obstacles in the Canada Automotive Electric Actuators Market Market

Despite the robust growth, the Canada automotive electric actuators market faces several obstacles. The high cost of advanced electric actuator technologies, particularly for specialized applications, can be a deterrent for some manufacturers and consumers, especially in the cost-sensitive segments of the market. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of essential raw materials and components, leading to production delays and increased prices. Furthermore, the technical complexity of integrating these actuators into existing vehicle platforms can pose engineering challenges, requiring significant investment in research and development and skilled personnel. The evolving regulatory landscape, while often a driver of growth, can also present challenges in terms of compliance with rapidly changing standards and certifications for new actuator technologies. Competitive pressures from established global players and emerging regional manufacturers also necessitate continuous innovation and cost optimization to maintain market share.

Future Opportunities in Canada Automotive Electric Actuators Market

The Canada automotive electric actuators market is ripe with future opportunities. The ongoing transition towards full electrification of vehicles presents a significant expansion opportunity for all types of electric actuators. The development and widespread adoption of Level 4 and Level 5 autonomous driving technologies will create unprecedented demand for highly sophisticated and fail-safe electric actuators, particularly for steering, braking, and suspension systems. Emerging trends like in-cabin personalization and enhanced user experience will drive innovation in actuators for dynamic seating adjustments, advanced climate control, and interactive interior features. The growing focus on lightweighting vehicles to improve fuel efficiency and EV range will also spur demand for compact and high-performance actuators. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in automotive systems will open new possibilities for smart actuators that can predict and adapt to driving conditions, further enhancing safety and efficiency.

Major Players in the Canada Automotive Electric Actuators Market Ecosystem

- Denso Corporation

- Nidec Corporation

- Johnson Electric Holdings Limited

- Aptiv PLC

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Hitachi Ltd

- Stoneridge Inc

- Mitsubishi Electric

Key Developments in Canada Automotive Electric Actuators Market Industry

- 2023/05: A leading automotive supplier announced a new generation of compact and highly efficient throttle actuators, designed for the latest generation of hybrid and electric vehicles, aimed at improving powertrain response and fuel economy.

- 2023/11: A major automotive OEM revealed its plans to significantly increase investment in advanced driver-assistance systems (ADAS) for its upcoming vehicle models, which will require a substantial uptake of sophisticated electric actuators for steering and braking.

- 2024/01: A key player in the automotive actuator market reported a successful partnership with a Canadian EV startup to develop customized seat adjustment actuators for enhanced passenger comfort in electric SUVs.

- 2024/04: Regulatory bodies in Canada released updated safety standards for vehicle braking systems, emphasizing the need for advanced electronic actuation, thereby signaling increased demand for electric brake actuators.

- 2024/07: A significant merger was announced between two Tier 1 automotive component manufacturers, consolidating their expertise in electric actuation technology and expanding their product offerings in the North American market.

Strategic Canada Automotive Electric Actuators Market Market Forecast

The Canada automotive electric actuators market is poised for substantial growth, driven by the accelerating shift towards vehicle electrification and the continuous integration of advanced driver-assistance and autonomous driving features. The forecast period of 2025–2033 is expected to witness a robust expansion, fueled by ongoing technological innovations that enhance actuator precision, efficiency, and integration capabilities. The increasing demand for comfort and convenience features in passenger cars, coupled with the growing adoption of these technologies in commercial vehicles, will further bolster market penetration. Strategic investments in research and development by major players, alongside supportive government regulations, will continue to drive innovation and market expansion. The overall market potential remains significant, making it an attractive segment for stakeholders in the automotive supply chain.

Canada Automotive Electric Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Other

Canada Automotive Electric Actuators Market Segmentation By Geography

- 1. Canada

Canada Automotive Electric Actuators Market Regional Market Share

Geographic Coverage of Canada Automotive Electric Actuators Market

Canada Automotive Electric Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electrification of Vehicles

- 3.3. Market Restrains

- 3.3.1. Precise Testing and Validation

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Electric Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Electric Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stoneridge Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Canada Automotive Electric Actuators Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Electric Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Electric Actuators Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Electric Actuators Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Canada Automotive Electric Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Johnson Electric Holdings Limited, Aptiv PLC, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Hitachi Lt, Stoneridge Inc, Mitsubishi Electric.

3. What are the main segments of the Canada Automotive Electric Actuators Market?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electrification of Vehicles.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Precise Testing and Validation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Electric Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Electric Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Electric Actuators Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Electric Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence