Key Insights

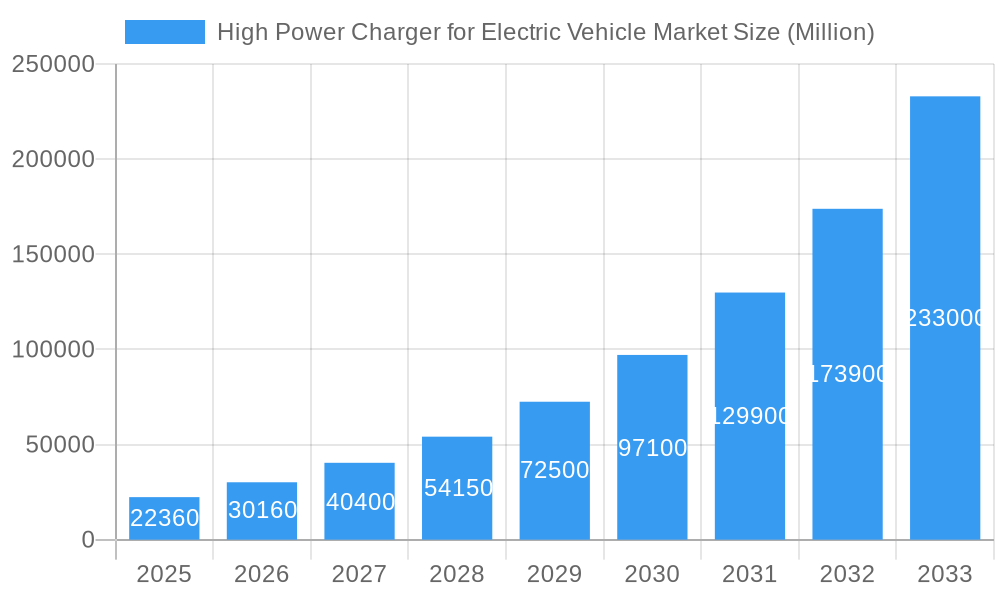

The High Power Charger for Electric Vehicle Market is experiencing phenomenal growth, projected to reach a substantial USD 22.36 billion by 2025. This surge is driven by an exceptional Compound Annual Growth Rate (CAGR) exceeding 33.30%, underscoring the rapid adoption and expansion of electric mobility worldwide. The primary catalysts for this explosive growth include escalating environmental concerns, government initiatives and subsidies promoting EV adoption, declining battery costs, and significant advancements in charging infrastructure technology. The increasing demand for faster charging solutions to alleviate range anxiety and improve the overall EV ownership experience is a critical factor, directly benefiting the high power charging segment. Furthermore, the expansion of public charging networks and the integration of smart charging solutions are further propelling market expansion.

High Power Charger for Electric Vehicle Market Market Size (In Billion)

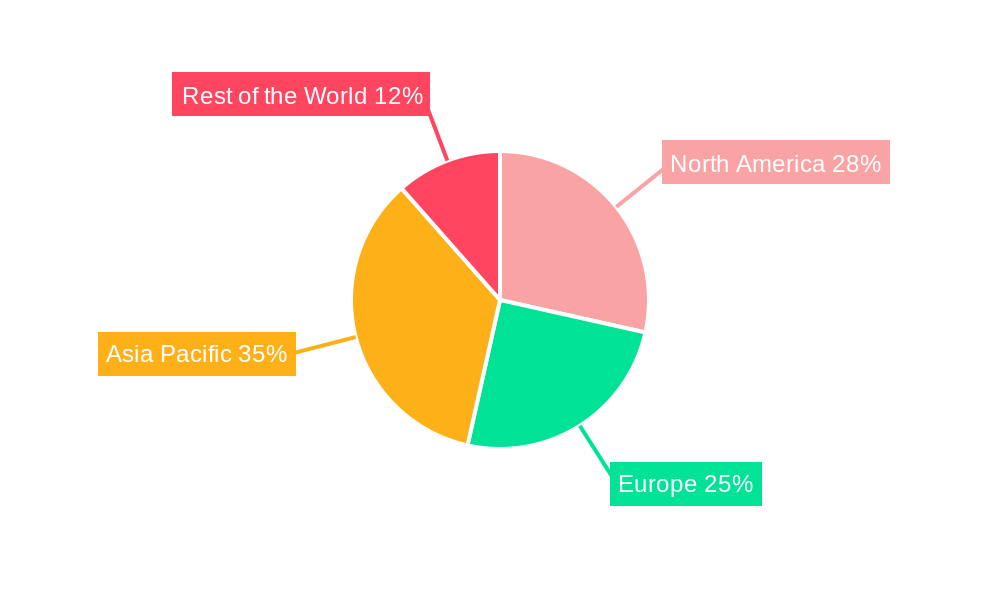

The market is segmented across various power output types, including 50 kW - Less than 150 kW, 150 kW - 350 kW, and 350 kW and Above. The "350 kW and Above" segment is anticipated to witness the fastest growth, driven by the development of next-generation EVs with larger battery capacities and the urgent need for ultra-fast charging solutions. Passenger cars currently dominate the vehicle type segment, but commercial vehicles, such as electric buses and trucks, are emerging as significant growth avenues due to fleet electrification initiatives. CHAdeMO, SAE Combo Charging System, Supercharger, and GB/T represent key connector types, with SAE Combo and GB/T expected to see increased adoption due to their widespread integration into new EV models. Public charging applications are leading the market, fueled by the continuous expansion of charging networks, while private charging solutions are also gaining traction. Geographically, Asia Pacific, led by China, is expected to be the largest and fastest-growing market, followed by North America and Europe. Key players like ABB Ltd, Siemens AG, Tesla Inc., and Royal Dutch Shell PLC (with its acquisition of NewMotion) are actively investing in R&D and expanding their charging infrastructure to capitalize on this burgeoning market.

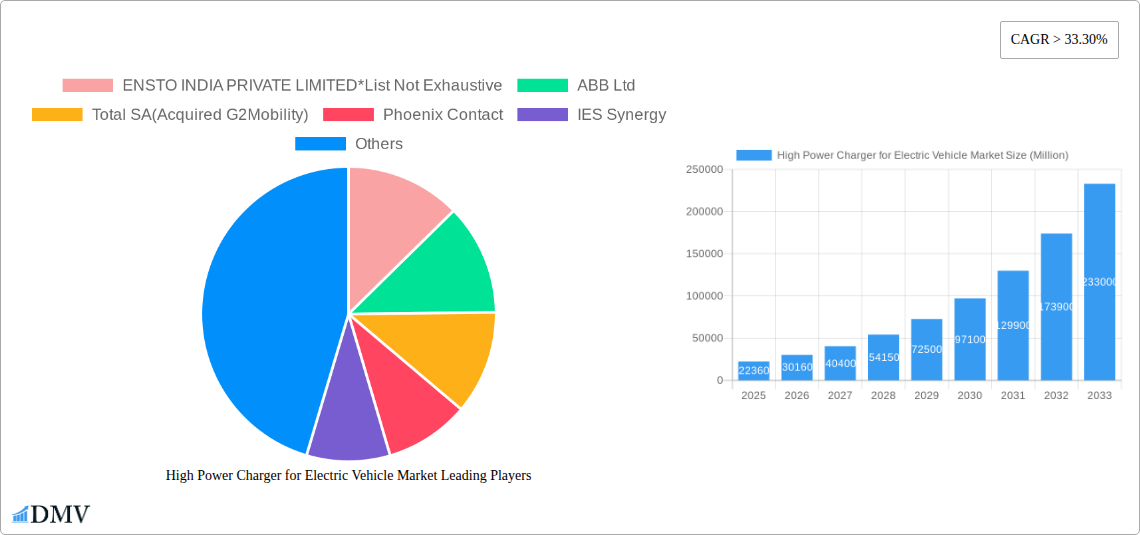

High Power Charger for Electric Vehicle Market Company Market Share

High Power Charger for Electric Vehicle Market: A Comprehensive Market Analysis & Forecast (2019-2033)

This in-depth report provides a panoramic view of the global High Power Charger for Electric Vehicle market, meticulously analyzing its trajectory from 2019 to 2033. With the electric vehicle (EV) revolution accelerating, the demand for robust and ultra-fast charging infrastructure has never been more critical. This report delves into the intricate dynamics of the high-power EV charging segment, offering actionable insights for stakeholders across the value chain. We present a detailed market composition, industry evolution, regional dominance, product innovations, growth drivers, market obstacles, and future opportunities, all underpinned by a robust forecast for the period 2025-2033. With a focus on DC fast charging solutions, Level 3 EV chargers, and the burgeoning electric mobility infrastructure, this report is an indispensable resource for understanding the present and future landscape of high-power EV charging.

High Power Charger for Electric Vehicle Market Market Composition & Trends

The High Power Charger for Electric Vehicle market is characterized by a moderate to high concentration, driven by significant capital investments and the need for advanced technological expertise. Innovation catalysts include the relentless pursuit of faster charging times, increased charging station density, and the integration of smart grid technologies. Regulatory landscapes are evolving rapidly, with governments worldwide incentivizing the deployment of public EV charging stations and setting standards for charger interoperability. Substitute products, while emerging, primarily focus on slower charging speeds or different vehicle types, thus not directly impacting the high-power segment significantly. End-user profiles are diverse, encompassing individual passenger car owners seeking convenience, fleet operators of commercial vehicles requiring efficient turnaround times, and industrial applications demanding high-throughput charging solutions. Merger and acquisition (M&A) activities are on the rise as established energy companies and automotive giants seek to secure their position in this growth sector. For instance, the acquisition of NewMotion by Royal Dutch Shell PLC and G2Mobility by Total SA underscore this trend, with aggregate deal values projected to reach XX Million within the forecast period, reflecting strategic consolidation and market expansion. The market share distribution is dynamic, with key players continuously investing in R&D to capture a larger segment of the ultra-fast EV charging market.

High Power Charger for Electric Vehicle Market Industry Evolution

The High Power Charger for Electric Vehicle market has witnessed exponential growth and transformation, mirroring the broader adoption of electric vehicles. From its nascent stages, the industry has rapidly evolved from providing basic DC charging capabilities to offering sophisticated, high-output solutions that redefine the EV ownership experience. Throughout the historical period (2019-2024), a compound annual growth rate (CAGR) of approximately XX% was observed, driven by early adopters and increasing government mandates. The base year, 2025, is projected to see a significant acceleration in market penetration, with an estimated XX Million charging points to be operational globally. This growth trajectory is propelled by continuous technological advancements. Initially, chargers focused on power outputs of around 50 kW, but the market has swiftly shifted towards higher denominations. The introduction of 150 kW - 350 kW chargers has become a standard, and a growing segment now offers 350 kW and Above charging capabilities, significantly reducing charging times for vehicles equipped with compatible battery technology. Consumer demand has been a critical evolutionary force. As range anxiety diminishes with longer EV battery ranges and the availability of widespread charging infrastructure, consumers are increasingly prioritizing charging speed and convenience. This has spurred manufacturers to develop more efficient, reliable, and user-friendly EV charging solutions. The proliferation of electric vehicle models across all segments, from compact passenger cars to heavy-duty commercial vehicles, further fuels the demand for a diverse range of high-power charging options. The industry is moving towards standardized connector types, with SAE Combo Charging System and Supercharger gaining prominence, alongside continued development in GB/T for specific regions. This evolution signifies a maturation of the market, moving beyond early adoption to widespread integration into the global transportation ecosystem. The market is projected to expand at a CAGR of XX% during the forecast period (2025-2033), reaching a market size of approximately XX Million by 2033.

Leading Regions, Countries, or Segments in High Power Charger for Electric Vehicle Market

The dominance within the High Power Charger for Electric Vehicle Market is a dynamic interplay of regional ambition, technological adoption, and specific segment needs. Europe, particularly Northern Europe, currently leads in terms of EV charging infrastructure deployment and high-power charger penetration. Countries like Norway, Sweden, and Germany have proactively implemented supportive policies, including generous subsidies for EV purchases and charging infrastructure development, leading to a significant concentration of public charging stations equipped with 150 kW - 350 kW and 350 kW and Above chargers. This strong regulatory support, coupled with a high consumer uptake of EVs, particularly passenger cars, has positioned these regions as pioneers.

In terms of Power Output Type, the 150 kW - 350 kW segment is currently the most dominant, driven by the sweet spot it offers for rapid charging of most passenger EVs without over-specifying for current battery capabilities. However, the 350 kW and Above segment is experiencing the fastest growth, fueled by advancements in vehicle battery technology and the increasing demand for ultra-fast charging for both passenger and commercial vehicles.

For Vehicle Type, Passenger Cars represent the largest segment due to their sheer volume. However, the Commercial Vehicles segment, including electric trucks and buses, is poised for substantial growth. The higher energy demands and operational requirements of commercial fleets necessitate the rapid deployment of high-power charging solutions, driving significant investment in this area.

Regarding Connector Type, the SAE Combo Charging System (CCS) has emerged as the de facto standard in Europe and North America, witnessing widespread adoption by major automakers. The Supercharger connector, proprietary to Tesla, also commands a significant presence due to Tesla's market share. While GB/T is dominant in China, the global market is increasingly leaning towards interoperable standards.

The Application segment sees Public charging stations leading in deployment volume, driven by the need for accessible charging for all EV owners. However, the Private segment, including charging solutions for workplaces and residential complexes, is rapidly expanding, particularly with the integration of smart charging and grid services. Investment trends in these leading regions are heavily skewed towards expanding public charging networks, incentivizing fast-charging hub development, and ensuring grid stability to accommodate the increasing load from high-power chargers. Regulatory support, such as emission reduction targets and EV adoption mandates, acts as a crucial catalyst, encouraging manufacturers and energy providers to invest heavily in these dominant segments and regions. The market size for these leading segments is projected to be XX Million in 2025, with a projected CAGR of XX% over the forecast period.

High Power Charger for Electric Vehicle Market Product Innovations

Product innovations in the High Power Charger for Electric Vehicle market are centered on enhancing charging speed, reliability, and user experience. Leading manufacturers are introducing chargers with modular designs, allowing for flexible power configurations and future upgrades. Advanced thermal management systems are crucial for sustained high-power delivery, ensuring optimal performance and longevity of both the charger and the EV battery. Innovations in grid integration and smart charging capabilities are enabling chargers to communicate with the grid, optimizing energy consumption, and participating in demand-response programs. The development of bidirectional charging capabilities is also gaining traction, allowing EVs to not only draw power but also feed energy back into the grid or a home, further enhancing their utility. Performance metrics are continuously being pushed, with new models achieving charging speeds that can add hundreds of miles of range in mere minutes. Unique selling propositions include enhanced uptime through robust industrial-grade components, seamless payment integration via contactless and app-based systems, and intelligent load balancing for multi-vehicle charging.

Propelling Factors for High Power Charger for Electric Vehicle Market Growth

Several key factors are propelling the High Power Charger for Electric Vehicle Market forward. The accelerating global adoption of electric vehicles, driven by environmental concerns and government incentives, is the primary catalyst. Advancements in battery technology have led to longer EV ranges and faster charging capabilities, creating a demand for commensurate charging infrastructure. Supportive government policies, including subsidies for charging station deployment, tax credits for EV purchases, and ambitious emission reduction targets, are creating a favorable ecosystem. The increasing investment from both public and private sectors in developing robust charging networks, particularly in urban areas and along major transportation routes, is crucial. Furthermore, the growing awareness among consumers about the economic benefits of EVs, such as lower fuel and maintenance costs, is also contributing to market expansion. The development of smart grid technologies and the integration of renewable energy sources with EV charging further enhance the appeal and sustainability of high-power charging solutions.

Obstacles in the High Power Charger for Electric Vehicle Market Market

Despite the robust growth, the High Power Charger for Electric Vehicle Market faces several obstacles. High upfront installation costs for high-power charging infrastructure, including grid upgrades and transformer installations, can be a significant barrier, especially for smaller operators. Regulatory complexities and differing standards across regions can hinder seamless deployment and interoperability. Supply chain disruptions, particularly for critical components like semiconductors, can impact production timelines and increase costs. The significant energy demand of high-power chargers necessitates substantial grid capacity and upgrades, which can be a bottleneck in certain locations. Intense competition among manufacturers and charging service providers can also lead to price pressures. Furthermore, the need for ongoing maintenance and servicing of complex high-power charging systems requires specialized expertise, contributing to operational expenses.

Future Opportunities in High Power Charger for Electric Vehicle Market

Emerging opportunities in the High Power Charger for Electric Vehicle Market are vast and promising. The expansion of charging infrastructure into underserved rural areas and developing economies presents a significant growth avenue. Advancements in battery technology will likely enable even faster charging speeds, necessitating the development of next-generation ultra-high-power chargers. The integration of chargers with Vehicle-to-Grid (V2G) technology opens up new revenue streams and grid stabilization opportunities. The growing demand for electric commercial vehicles, including trucks and buses, will drive the need for dedicated high-power charging hubs. Furthermore, innovations in wireless charging technology, while still in early stages for high-power applications, could revolutionize charging convenience. Partnerships between energy providers, automakers, and technology companies will be crucial for unlocking new market segments and delivering integrated mobility solutions.

Major Players in the High Power Charger for Electric Vehicle Market Ecosystem

- ENSTO INDIA PRIVATE LIMITED

- ABB Ltd

- Total SA

- Phoenix Contact

- IES Synergy

- Garo AB

- EVgo Services LLC

- Fastned BV

- Siemens AG

- XCharge Inc

- Tesla Inc

- Royal Dutch Shell PLC

- Allego BV

- EVBOX

Key Developments in High Power Charger for Electric Vehicle Market Industry

- December 2023: Lincoln Electric Holdings Inc. introduced the Velion DC Fast Charger for electric vehicles. This Level 3 DC fast charger platform is engineered with industrial-grade components, delivering rapid charging speeds with exceptional reliability for optimal performance and extended uptime.

- April 2023: ABB E-mobility announced an investment in Switch, a London-based deep-tech start-up. This partnership aims to enhance ABB E-mobility's comprehensive smart EV charging solutions and innovate the EV charging experience for both operators and drivers, creating a seamless ecosystem. Financial terms were not disclosed.

Strategic High Power Charger for Electric Vehicle Market Market Forecast

The strategic forecast for the High Power Charger for Electric Vehicle Market is overwhelmingly positive, driven by sustained growth in EV adoption and continuous technological innovation. The increasing demand for faster charging solutions, particularly for passenger cars and the burgeoning electric commercial vehicle segment, will fuel market expansion. Supportive government policies and substantial investments in charging infrastructure will continue to be critical growth catalysts. Opportunities in emerging markets and the integration of smart grid technologies, including V2G capabilities, will unlock new revenue streams and enhance the value proposition of high-power charging. While challenges related to grid infrastructure and installation costs persist, the market's inherent momentum, coupled with ongoing R&D and strategic partnerships, points towards a robust and dynamic future for high-power EV charging solutions. The market is projected to reach an estimated value of XX Million by 2033.

High Power Charger for Electric Vehicle Market Segmentation

-

1. Power Output Type

- 1.1. 50 kW - Less than 150 kW

- 1.2. 150 kW - 350 kW

- 1.3. 350 kW and Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Connector Type

- 3.1. CHAdeMO

- 3.2. SAE Combo Charging System

- 3.3. Supercharger

- 3.4. GB/T

-

4. Application

- 4.1. Public

- 4.2. Private

High Power Charger for Electric Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Netherlands

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

High Power Charger for Electric Vehicle Market Regional Market Share

Geographic Coverage of High Power Charger for Electric Vehicle Market

High Power Charger for Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 33.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. 50-150 kW Power Type Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Power Charger for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Output Type

- 5.1.1. 50 kW - Less than 150 kW

- 5.1.2. 150 kW - 350 kW

- 5.1.3. 350 kW and Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Connector Type

- 5.3.1. CHAdeMO

- 5.3.2. SAE Combo Charging System

- 5.3.3. Supercharger

- 5.3.4. GB/T

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Public

- 5.4.2. Private

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Power Output Type

- 6. North America High Power Charger for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Output Type

- 6.1.1. 50 kW - Less than 150 kW

- 6.1.2. 150 kW - 350 kW

- 6.1.3. 350 kW and Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Connector Type

- 6.3.1. CHAdeMO

- 6.3.2. SAE Combo Charging System

- 6.3.3. Supercharger

- 6.3.4. GB/T

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Public

- 6.4.2. Private

- 6.1. Market Analysis, Insights and Forecast - by Power Output Type

- 7. Europe High Power Charger for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Output Type

- 7.1.1. 50 kW - Less than 150 kW

- 7.1.2. 150 kW - 350 kW

- 7.1.3. 350 kW and Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Connector Type

- 7.3.1. CHAdeMO

- 7.3.2. SAE Combo Charging System

- 7.3.3. Supercharger

- 7.3.4. GB/T

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Public

- 7.4.2. Private

- 7.1. Market Analysis, Insights and Forecast - by Power Output Type

- 8. Asia Pacific High Power Charger for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Output Type

- 8.1.1. 50 kW - Less than 150 kW

- 8.1.2. 150 kW - 350 kW

- 8.1.3. 350 kW and Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Connector Type

- 8.3.1. CHAdeMO

- 8.3.2. SAE Combo Charging System

- 8.3.3. Supercharger

- 8.3.4. GB/T

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Public

- 8.4.2. Private

- 8.1. Market Analysis, Insights and Forecast - by Power Output Type

- 9. Rest of the World High Power Charger for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Output Type

- 9.1.1. 50 kW - Less than 150 kW

- 9.1.2. 150 kW - 350 kW

- 9.1.3. 350 kW and Above

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Connector Type

- 9.3.1. CHAdeMO

- 9.3.2. SAE Combo Charging System

- 9.3.3. Supercharger

- 9.3.4. GB/T

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Public

- 9.4.2. Private

- 9.1. Market Analysis, Insights and Forecast - by Power Output Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ENSTO INDIA PRIVATE LIMITED*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Total SA(Acquired G2Mobility)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Phoenix Contact

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 IES Synergy

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Garo AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EVgo Services LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fastned BV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Siemens AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 XCharge Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Tesla Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Royal Dutch Shell PLC (Acquired NewMotion)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Allego BV

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 EVBOX

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 ENSTO INDIA PRIVATE LIMITED*List Not Exhaustive

List of Figures

- Figure 1: Global High Power Charger for Electric Vehicle Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Power Charger for Electric Vehicle Market Revenue (Million), by Power Output Type 2025 & 2033

- Figure 3: North America High Power Charger for Electric Vehicle Market Revenue Share (%), by Power Output Type 2025 & 2033

- Figure 4: North America High Power Charger for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America High Power Charger for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America High Power Charger for Electric Vehicle Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 7: North America High Power Charger for Electric Vehicle Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 8: North America High Power Charger for Electric Vehicle Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America High Power Charger for Electric Vehicle Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America High Power Charger for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America High Power Charger for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe High Power Charger for Electric Vehicle Market Revenue (Million), by Power Output Type 2025 & 2033

- Figure 13: Europe High Power Charger for Electric Vehicle Market Revenue Share (%), by Power Output Type 2025 & 2033

- Figure 14: Europe High Power Charger for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe High Power Charger for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe High Power Charger for Electric Vehicle Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 17: Europe High Power Charger for Electric Vehicle Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 18: Europe High Power Charger for Electric Vehicle Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe High Power Charger for Electric Vehicle Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe High Power Charger for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe High Power Charger for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million), by Power Output Type 2025 & 2033

- Figure 23: Asia Pacific High Power Charger for Electric Vehicle Market Revenue Share (%), by Power Output Type 2025 & 2033

- Figure 24: Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 25: Asia Pacific High Power Charger for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 26: Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 27: Asia Pacific High Power Charger for Electric Vehicle Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 28: Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific High Power Charger for Electric Vehicle Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific High Power Charger for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World High Power Charger for Electric Vehicle Market Revenue (Million), by Power Output Type 2025 & 2033

- Figure 33: Rest of the World High Power Charger for Electric Vehicle Market Revenue Share (%), by Power Output Type 2025 & 2033

- Figure 34: Rest of the World High Power Charger for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Rest of the World High Power Charger for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Rest of the World High Power Charger for Electric Vehicle Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 37: Rest of the World High Power Charger for Electric Vehicle Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 38: Rest of the World High Power Charger for Electric Vehicle Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Rest of the World High Power Charger for Electric Vehicle Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World High Power Charger for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World High Power Charger for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Power Output Type 2020 & 2033

- Table 2: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 4: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Power Output Type 2020 & 2033

- Table 7: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 9: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Power Output Type 2020 & 2033

- Table 14: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 16: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Germany High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Netherlands High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Power Output Type 2020 & 2033

- Table 24: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 26: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Power Output Type 2020 & 2033

- Table 33: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 35: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global High Power Charger for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South America High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Middle East High Power Charger for Electric Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Power Charger for Electric Vehicle Market?

The projected CAGR is approximately > 33.30%.

2. Which companies are prominent players in the High Power Charger for Electric Vehicle Market?

Key companies in the market include ENSTO INDIA PRIVATE LIMITED*List Not Exhaustive, ABB Ltd, Total SA(Acquired G2Mobility), Phoenix Contact, IES Synergy, Garo AB, EVgo Services LLC, Fastned BV, Siemens AG, XCharge Inc, Tesla Inc, Royal Dutch Shell PLC (Acquired NewMotion), Allego BV, EVBOX.

3. What are the main segments of the High Power Charger for Electric Vehicle Market?

The market segments include Power Output Type, Vehicle Type, Connector Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

50-150 kW Power Type Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

December 2023: Lincoln Electric Holdings Inc., the Velion DC Fast Charger for electric vehicles. The charger, designed with industrial-grade components, is a Level 3 DC fast charger platform that delivers fast charging speeds with unparalleled reliability for ultimate performance and uptime.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Power Charger for Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Power Charger for Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Power Charger for Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the High Power Charger for Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence