Key Insights

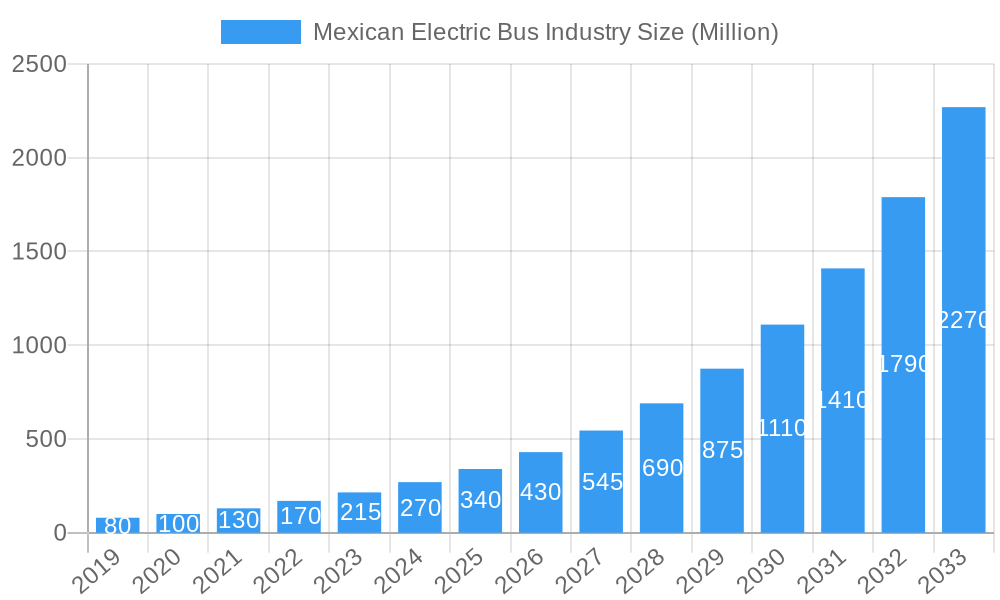

The Mexican electric bus market is poised for explosive growth, driven by a confluence of factors aimed at enhancing urban mobility and achieving environmental sustainability. With a current market size estimated at USD 280 million and a remarkable Compound Annual Growth Rate (CAGR) of 31.62%, the industry is set to experience a significant expansion through 2033. This rapid trajectory is primarily fueled by governmental initiatives promoting cleaner transportation, a growing awareness of the environmental benefits of electric vehicles, and the increasing demand for efficient and cost-effective public transport solutions. The Mexican government's commitment to reducing carbon emissions, coupled with incentives for adopting electric buses, is a pivotal driver. Furthermore, fleet owners and public transportation authorities are increasingly recognizing the long-term operational cost savings associated with electric buses, including lower fuel and maintenance expenses, which further bolsters market adoption. The transition to electric mobility is not just an environmental imperative but also an economic opportunity for Mexico.

Mexican Electric Bus Industry Market Size (In Million)

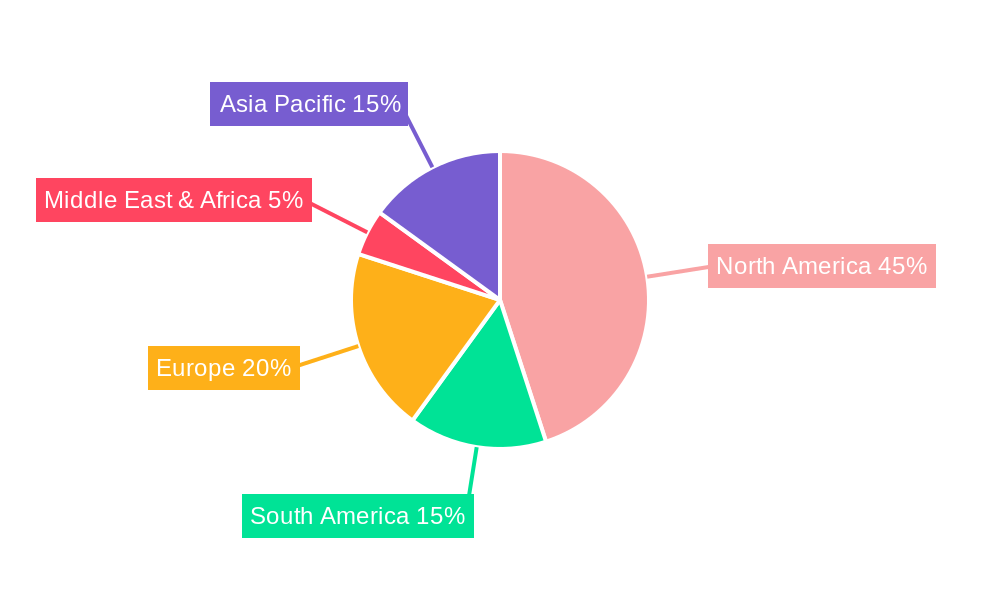

The market is segmented into Battery Electric Buses and Other Electric Buses, with a strong emphasis on Battery Electric Buses due to their zero-emission capabilities and advancing technological maturity. The primary consumer base consists of government entities and fleet owners, who are actively investing in modernizing their public transportation fleets. Geographically, North America, encompassing Mexico, is a crucial region for this growth, benefiting from established industrial capabilities and a receptive market for sustainable technologies. Key players like BYD, Yutong, and Volvo are actively participating in this evolving landscape, introducing advanced electric bus models and establishing manufacturing or assembly operations to cater to local demand. The forecast period from 2025 to 2033 indicates a sustained period of high growth, suggesting that electric buses will become an increasingly dominant feature of Mexico's urban transit systems, contributing significantly to cleaner air and more sustainable cities.

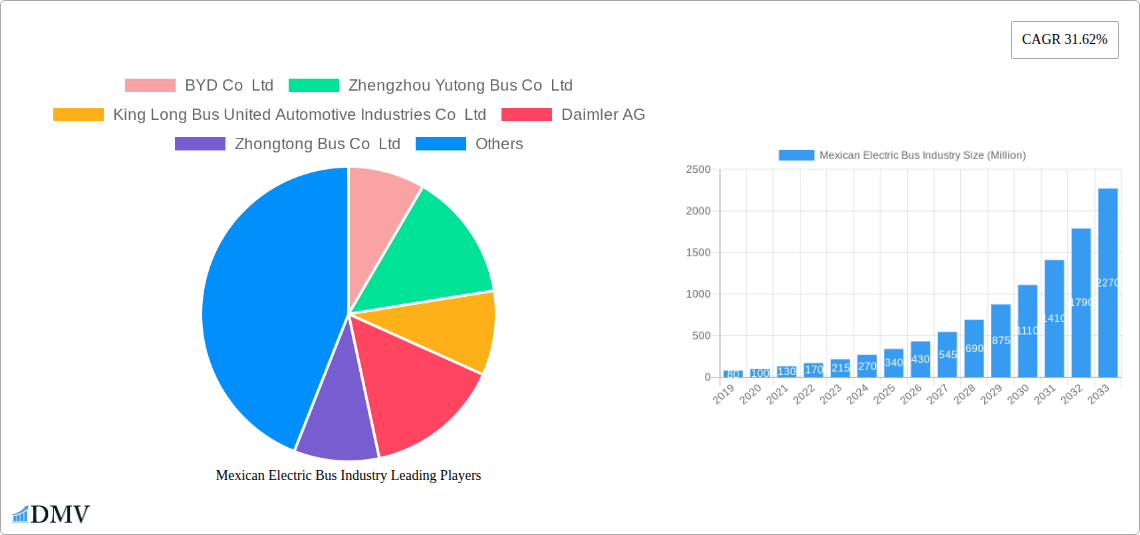

Mexican Electric Bus Industry Company Market Share

Mexican Electric Bus Industry Market Analysis Report: Forecast 2025-2033

This comprehensive report delves into the dynamic Mexican Electric Bus Industry, providing an in-depth analysis of market composition, trends, and future growth trajectories. Spanning the study period of 2019–2033, with a base year of 2025, this research offers critical insights for stakeholders seeking to navigate and capitalize on this rapidly evolving sector. We dissect the market into key segments, including Battery Electric Buses and Other Electric Buses, and analyze demand from primary consumer types: Government and Fleet Owners. Discover the strategic landscape, competitive environment, and innovation drivers shaping the future of sustainable public transportation in Mexico.

Mexican Electric Bus Industry Market Composition & Trends

The Mexican Electric Bus Industry exhibits a growing market concentration, increasingly influenced by innovation catalysts and a robust regulatory landscape. While established global players are making significant inroads, local manufacturing and partnerships are gaining momentum, evidenced by recent developments. The market is characterized by a strong demand from government entities and private fleet owners driven by sustainability mandates and operational cost savings. Substitute products, primarily traditional internal combustion engine buses, are steadily losing ground as electric alternatives demonstrate superior environmental performance and lower total cost of ownership. Understanding end-user profiles – including municipal transport authorities and large logistics companies – is crucial for strategic market entry and expansion. Mergers and acquisitions (M&A) activity, while still nascent, is projected to increase as companies seek to consolidate market share and access new technologies. M&A deal values are expected to rise, potentially reaching hundreds of millions of USD as strategic alliances form. The market share distribution is currently dynamic, with leading manufacturers like BYD Co Ltd and Zhengzhou Yutong Bus Co Ltd holding significant positions, but the entry of new players and localized production is set to reshape this landscape. The growing emphasis on green public transport solutions fuels the overall expansion.

Mexican Electric Bus Industry Industry Evolution

The Mexican Electric Bus Industry has embarked on a transformative journey, marked by significant market growth trajectories and accelerated technological advancements. Throughout the historical period of 2019–2024, we observed a nascent but determined push towards electrification, driven by pilot projects and initial government incentives. The forecast period of 2025–2033 is poised to witness exponential growth, with projected annual growth rates exceeding 15%, propelled by ambitious national decarbonization targets and increasing urbanization. Shifting consumer demands, particularly from environmentally conscious citizens and forward-thinking city administrations, are playing a pivotal role. The adoption metrics are rapidly improving, with the number of electric buses on Mexican roads expected to multiply from a few hundred in the historical period to tens of thousands by the end of the forecast period. This evolution is underpinned by substantial investments in charging infrastructure and battery technology, making electric buses a more viable and cost-effective solution for public and private transportation networks. Key milestones include the electrification of bus rapid transit (BRT) systems in major cities, which have become showcases for sustainable mobility solutions and a catalyst for broader market adoption. Furthermore, the integration of smart technologies, such as real-time tracking, passenger information systems, and efficient energy management, is enhancing the appeal and operational efficiency of electric buses. The industry's evolution is a testament to Mexico's commitment to modernizing its transportation sector and achieving its climate change mitigation goals, establishing electric buses as a cornerstone of its sustainable urban development strategy.

Leading Regions, Countries, or Segments in Mexican Electric Bus Industry

The Mexican Electric Bus Industry is witnessing a strong dominance from the Battery Electric Bus segment, driven by its superior environmental benefits and declining operational costs. Within consumer types, the Government segment emerges as the primary demand driver, actively procuring electric buses to meet national and international climate commitments, enhance urban air quality, and modernize public transportation fleets. This dominance is further amplified by the significant role of Fleet Owners in urban areas and intercity routes, who are increasingly recognizing the long-term economic advantages and the positive brand image associated with operating zero-emission vehicles.

Key Drivers for Dominance:

- Regulatory Support and Incentives: Government policies, including subsidies for electric vehicle procurement, tax exemptions, and preferential charging infrastructure development, are instrumental in fostering the growth of Battery Electric Buses. Federal and state governments are setting ambitious targets for fleet electrification, directly stimulating demand.

- Total Cost of Ownership (TCO) Advantage: While the initial purchase price of Battery Electric Buses can be higher, their lower operational costs, including reduced fuel expenses and maintenance, offer a compelling TCO advantage over traditional diesel buses. This financial incentive is particularly attractive for large fleet operators and government entities managing substantial vehicle portfolios.

- Technological Advancements and Infrastructure Development: Continuous improvements in battery technology have led to increased range, faster charging times, and enhanced durability, making Battery Electric Buses more practical for a wider range of applications. Simultaneously, significant investments are being made in building a robust charging infrastructure across major cities and transportation hubs, alleviating range anxiety.

- Urbanization and Environmental Concerns: Mexico's rapidly urbanizing landscape necessitates efficient and sustainable public transportation solutions. Growing public awareness and concern over air pollution and climate change are pressuring authorities to adopt cleaner mobility options, with Battery Electric Buses at the forefront.

- International Commitments and Global Trends: Mexico's participation in global climate accords and its alignment with international trends towards sustainable transportation are driving policy decisions and investment in the electric bus sector. This global momentum creates a favorable environment for the adoption of advanced electric mobility solutions.

In-depth analysis reveals that major metropolitan areas such as Mexico City, Guadalajara, and Monterrey are leading the charge in electric bus adoption due to higher population densities, more pronounced air quality issues, and more robust government support. The strategic procurement by these urban centers acts as a powerful testament to the viability and benefits of electric buses, encouraging other regions to follow suit. The continued focus on innovation and the expanding network of charging stations are expected to further solidify the dominance of Battery Electric Buses and the government and fleet owner segments in the coming years, shaping a cleaner and more sustainable transportation future for Mexico.

Mexican Electric Bus Industry Product Innovations

The Mexican Electric Bus Industry is witnessing a surge in product innovations focused on enhanced efficiency, extended range, and improved passenger experience. Leading manufacturers are introducing advanced battery management systems for optimal energy utilization and faster charging capabilities, reducing downtime for fleet operators. Innovations in lightweight materials are contributing to improved energy efficiency and greater payload capacity. Furthermore, the integration of smart technologies, such as AI-powered route optimization, predictive maintenance, and on-board passenger Wi-Fi and charging ports, is transforming the bus into a connected mobility solution. The development of specialized electric bus variants for different urban terrains and passenger needs, including low-floor designs for enhanced accessibility and higher-capacity models for BRT systems, is also a key area of advancement, offering unique selling propositions for diverse applications.

Propelling Factors for Mexican Electric Bus Industry Growth

The Mexican Electric Bus Industry's growth is propelled by a confluence of powerful factors. Technological advancements in battery technology, offering longer ranges and faster charging, are making electric buses increasingly practical and cost-effective. Economic incentives, including government subsidies, tax breaks for manufacturers and operators, and the long-term savings from reduced fuel and maintenance costs, are significant drivers. Stringent environmental regulations and national commitments to reduce carbon emissions are compelling municipalities and private entities to adopt cleaner transportation solutions. The increasing urbanization and the need for efficient public transport further fuel demand. Growing public awareness of the environmental benefits of electric mobility also contributes to the positive market sentiment.

Obstacles in the Mexican Electric Bus Industry Market

Despite its promising trajectory, the Mexican Electric Bus Industry faces several obstacles. High upfront capital costs for electric buses and charging infrastructure remain a significant barrier for some municipalities and smaller fleet owners. Limited availability of charging infrastructure in certain regions and the associated grid capacity challenges can hinder widespread adoption. Supply chain disruptions, particularly for critical battery components, can impact production timelines and costs. Technological obsolescence concerns and the need for skilled personnel for maintenance and repair also present challenges. Furthermore, regulatory uncertainties and policy inconsistencies across different states can create an unpredictable operating environment.

Future Opportunities in Mexican Electric Bus Industry

The Mexican Electric Bus Industry is ripe with future opportunities. The expanding market for urban mobility solutions in rapidly growing cities presents a vast potential. Opportunities exist in developing and implementing smart charging networks and vehicle-to-grid (V2G) technologies. The growing demand for intercity electric coaches and specialized electric buses (e.g., for school transportation or tourism) is another promising avenue. Collaborations between domestic and international manufacturers to foster local production and technology transfer can unlock significant growth. Furthermore, the development of innovative financing models to make electric buses more accessible to a wider range of consumers is a key opportunity.

Major Players in the Mexican Electric Bus Industry Ecosystem

- BYD Co Ltd

- Zhengzhou Yutong Bus Co Ltd

- King Long Bus United Automotive Industries Co Ltd

- Daimler AG

- Zhongtong Bus Co Ltd

- Higer Bus Co Ltd

- Volvo AB

Key Developments in Mexican Electric Bus Industry Industry

- May 2023: Dynacast Manufacturing Inc. inaugurated a new USD 4 million plant in Leon, Mexico, focusing on manufacturing commercial vehicles, including electric buses. This development signifies growing local manufacturing capabilities and supply chain localization.

- April 2023: Iochpe-Maxion Structural Components and Forsee Power announced a partnership to offer the integration of battery systems for electric vehicles and buses. This collaboration aims to streamline the supply of essential electric vehicle components, enhancing production efficiency and accessibility for manufacturers.

Strategic Mexican Electric Bus Industry Market Forecast

The Mexican Electric Bus Industry is on a robust growth trajectory, fueled by a strong push towards sustainability and modernization of public transportation. Key growth catalysts include escalating government support through favorable policies and subsidies, alongside the increasing economic viability of electric buses due to falling battery costs and operational efficiencies. The expanding charging infrastructure network and advancements in battery technology are further mitigating adoption barriers. Emerging opportunities in smart city initiatives, specialized vehicle segments, and domestic manufacturing alliances will solidify Mexico's position as a significant player in the regional electric bus market. The market is poised for substantial expansion, promising a cleaner and more efficient future for Mexican urban mobility.

Mexican Electric Bus Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Bus

- 1.2. Other Electric Bus

-

2. Consumer Type

- 2.1. Government

- 2.2. Fleet Owners

Mexican Electric Bus Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Electric Bus Industry Regional Market Share

Geographic Coverage of Mexican Electric Bus Industry

Mexican Electric Bus Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Electric Buses; Others

- 3.3. Market Restrains

- 3.3.1. Disturbances in Supply Chain; Others

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Electric Buses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Bus

- 5.1.2. Other Electric Bus

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Government

- 5.2.2. Fleet Owners

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Battery Electric Bus

- 6.1.2. Other Electric Bus

- 6.2. Market Analysis, Insights and Forecast - by Consumer Type

- 6.2.1. Government

- 6.2.2. Fleet Owners

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Battery Electric Bus

- 7.1.2. Other Electric Bus

- 7.2. Market Analysis, Insights and Forecast - by Consumer Type

- 7.2.1. Government

- 7.2.2. Fleet Owners

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Battery Electric Bus

- 8.1.2. Other Electric Bus

- 8.2. Market Analysis, Insights and Forecast - by Consumer Type

- 8.2.1. Government

- 8.2.2. Fleet Owners

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Battery Electric Bus

- 9.1.2. Other Electric Bus

- 9.2. Market Analysis, Insights and Forecast - by Consumer Type

- 9.2.1. Government

- 9.2.2. Fleet Owners

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Mexican Electric Bus Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Battery Electric Bus

- 10.1.2. Other Electric Bus

- 10.2. Market Analysis, Insights and Forecast - by Consumer Type

- 10.2.1. Government

- 10.2.2. Fleet Owners

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BYD Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhengzhou Yutong Bus Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 King Long Bus United Automotive Industries Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daimler AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhongtong Bus Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Higer Bus Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volvo AB*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 BYD Co Ltd

List of Figures

- Figure 1: Global Mexican Electric Bus Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mexican Electric Bus Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Mexican Electric Bus Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Mexican Electric Bus Industry Revenue (Million), by Consumer Type 2025 & 2033

- Figure 5: North America Mexican Electric Bus Industry Revenue Share (%), by Consumer Type 2025 & 2033

- Figure 6: North America Mexican Electric Bus Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Mexican Electric Bus Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Mexican Electric Bus Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: South America Mexican Electric Bus Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: South America Mexican Electric Bus Industry Revenue (Million), by Consumer Type 2025 & 2033

- Figure 11: South America Mexican Electric Bus Industry Revenue Share (%), by Consumer Type 2025 & 2033

- Figure 12: South America Mexican Electric Bus Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Mexican Electric Bus Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Mexican Electric Bus Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Mexican Electric Bus Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Mexican Electric Bus Industry Revenue (Million), by Consumer Type 2025 & 2033

- Figure 17: Europe Mexican Electric Bus Industry Revenue Share (%), by Consumer Type 2025 & 2033

- Figure 18: Europe Mexican Electric Bus Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Mexican Electric Bus Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Mexican Electric Bus Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Middle East & Africa Mexican Electric Bus Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Middle East & Africa Mexican Electric Bus Industry Revenue (Million), by Consumer Type 2025 & 2033

- Figure 23: Middle East & Africa Mexican Electric Bus Industry Revenue Share (%), by Consumer Type 2025 & 2033

- Figure 24: Middle East & Africa Mexican Electric Bus Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Mexican Electric Bus Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Mexican Electric Bus Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Mexican Electric Bus Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Mexican Electric Bus Industry Revenue (Million), by Consumer Type 2025 & 2033

- Figure 29: Asia Pacific Mexican Electric Bus Industry Revenue Share (%), by Consumer Type 2025 & 2033

- Figure 30: Asia Pacific Mexican Electric Bus Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Mexican Electric Bus Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 3: Global Mexican Electric Bus Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 6: Global Mexican Electric Bus Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 12: Global Mexican Electric Bus Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 18: Global Mexican Electric Bus Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 30: Global Mexican Electric Bus Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Mexican Electric Bus Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global Mexican Electric Bus Industry Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 39: Global Mexican Electric Bus Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Mexican Electric Bus Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Electric Bus Industry?

The projected CAGR is approximately 31.62%.

2. Which companies are prominent players in the Mexican Electric Bus Industry?

Key companies in the market include BYD Co Ltd, Zhengzhou Yutong Bus Co Ltd, King Long Bus United Automotive Industries Co Ltd, Daimler AG, Zhongtong Bus Co Ltd, Higer Bus Co Ltd, Volvo AB*List Not Exhaustive.

3. What are the main segments of the Mexican Electric Bus Industry?

The market segments include Vehicle Type, Consumer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Electric Buses; Others.

6. What are the notable trends driving market growth?

Increasing Adoption of Electric Buses.

7. Are there any restraints impacting market growth?

Disturbances in Supply Chain; Others.

8. Can you provide examples of recent developments in the market?

May 2023: Dynacast Manufacturing Inc. inaugurated a new USD 4 million plant in Leon, Mexico. The plant will focus on manufacturing commercial vehicles, including electric buses and etc.,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Electric Bus Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Electric Bus Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Electric Bus Industry?

To stay informed about further developments, trends, and reports in the Mexican Electric Bus Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence