Key Insights

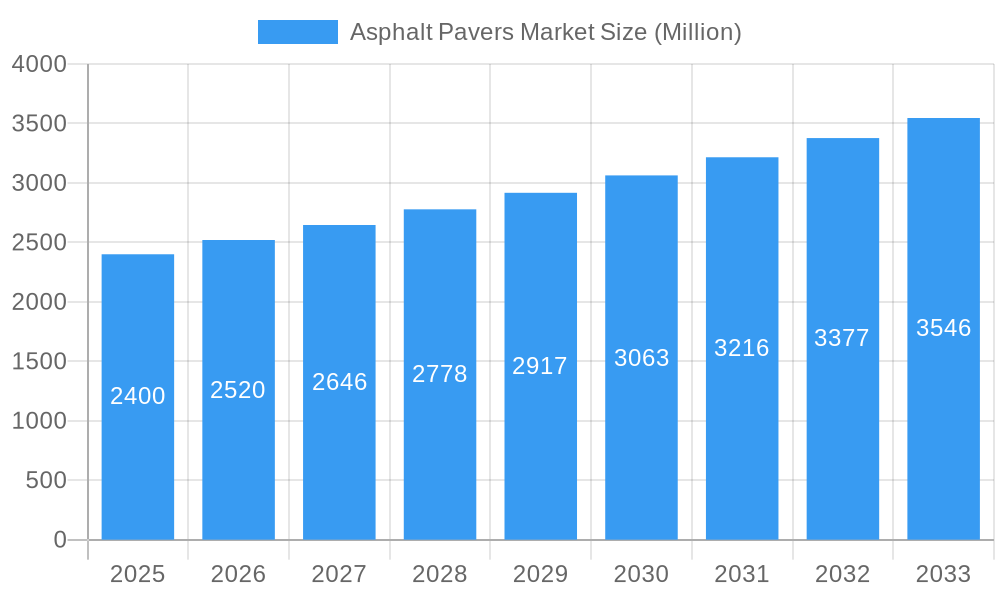

The global Asphalt Pavers Market is poised for robust growth, projected to reach a market size of $2,400 million by the base year 2025, and is anticipated to expand at a CAGR of 5.00% over the forecast period of 2025-2033. This expansion is primarily driven by escalating infrastructure development projects worldwide, including road construction, highway expansion, and urban development initiatives. Governments are increasingly investing in modernizing transportation networks to facilitate economic growth and improve connectivity, directly fueling the demand for efficient and advanced asphalt paving equipment. Furthermore, the growing emphasis on sustainable construction practices and the adoption of technologies that enhance paving quality and reduce material wastage are acting as significant catalysts for market growth. The increasing use of technologically advanced pavers with features like automated control systems and real-time performance monitoring contributes to operational efficiency and superior output, further bolstering market penetration.

Asphalt Pavers Market Market Size (In Billion)

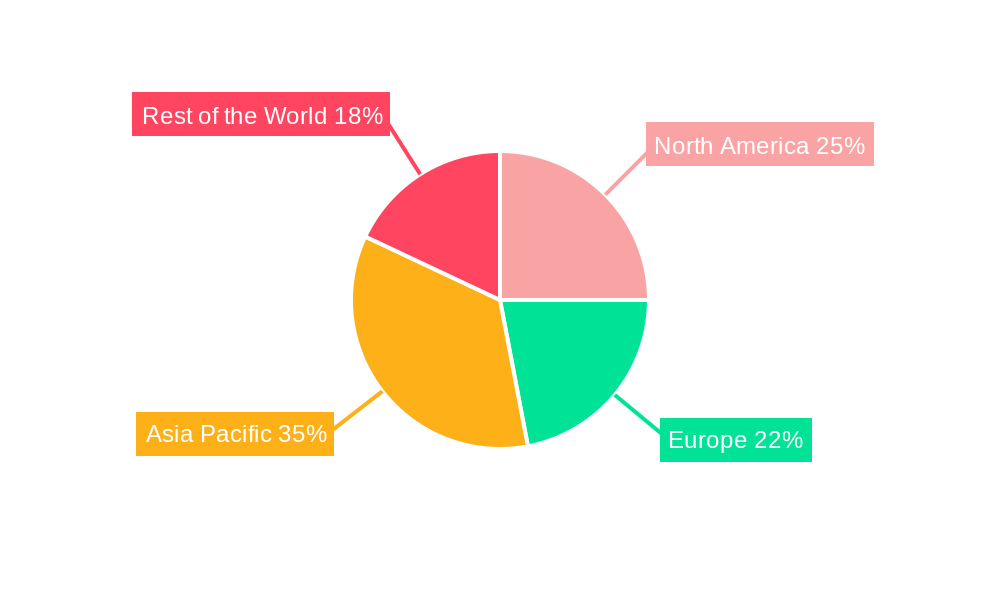

The market segmentation reveals a dynamic landscape. In terms of type, Tracked Pavers are expected to dominate due to their superior stability and tractive force for large-scale projects, while Wheeled Pavers cater to more versatile and smaller-scale applications. Screeds are essential components, and the paving range segments indicate a strong demand across all categories, with a notable focus on pavers with paving ranges of 1.5 m to 2.3 m and Above 2.55 m, reflecting the need for both specialized and large-capacity paving solutions. Geographically, Asia Pacific, led by China and India, is expected to emerge as a significant growth engine, driven by rapid urbanization and substantial government investments in infrastructure. North America and Europe also represent mature yet stable markets, with ongoing road maintenance and upgrades sustaining demand. Key industry players like Caterpillar Inc., Wirtgen America Inc., and Volvo Construction Equipment are actively innovating and expanding their product portfolios to capture this growing market.

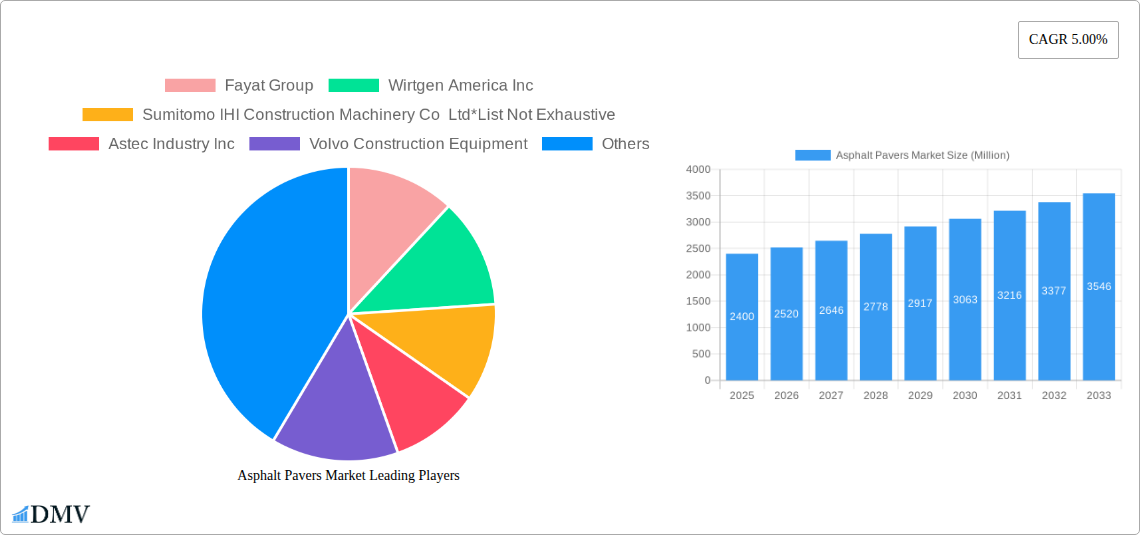

Asphalt Pavers Market Company Market Share

Unveiling the Global Asphalt Pavers Market: A Comprehensive Forecast (2019-2033)

This in-depth report provides a panoramic view of the global Asphalt Pavers Market, dissecting its intricate dynamics from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. Delve into the strategic landscape of this vital construction equipment sector, exploring market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, emerging opportunities, and the key players shaping its future. This report is meticulously crafted for stakeholders seeking a competitive edge, offering precise data and actionable insights into asphalt paving machines, road construction equipment, and heavy machinery for infrastructure development.

Asphalt Pavers Market Market Composition & Trends

The Asphalt Pavers Market exhibits a moderate level of concentration, with established global manufacturers vying for market share. Innovation remains a key catalyst, driven by the demand for enhanced fuel efficiency, precision paving, and advanced automation in asphalt laying equipment. Regulatory landscapes, particularly concerning emissions standards and construction safety, are increasingly influencing product development and adoption. Substitute products, such as cold-mix asphalt or alternative paving materials, present a minor challenge, yet the enduring superiority of hot-mix asphalt in many applications ensures robust demand for asphalt pavers. End-user profiles are diverse, spanning government infrastructure projects, private road construction companies, airport authorities, and commercial development firms. Mergers and acquisitions are a significant aspect of market evolution, with recent strategic alliances indicating a trend towards consolidation and expanded product portfolios in the construction equipment market. For instance, the Ammann Group and Volvo Construction Equipment's agreement over the ABG Paver Business signifies a substantial shift in market dynamics, potentially impacting market share distribution for wheeled pavers and tracked pavers in key regions. The estimated M&A deal value for such strategic moves is projected to be in the hundreds of millions.

Asphalt Pavers Market Industry Evolution

The Asphalt Pavers Market has undergone a significant evolutionary transformation, driven by the relentless pursuit of efficiency, sustainability, and precision in road construction. Historically, the industry has witnessed a steady upward trajectory, propelled by increasing global investments in infrastructure development, particularly in emerging economies. The asphalt paving machine market has been a critical enabler of this growth, facilitating the rapid construction and maintenance of essential transportation networks. Technological advancements have been pivotal, transitioning from basic mechanical pavers to sophisticated, computer-controlled machines. This evolution has seen the introduction of advanced features such as intelligent paving systems, automated grade and slope control, and enhanced operator ergonomics, all contributing to improved paving quality and reduced material waste. The adoption of tracked pavers has surged for applications requiring superior traction and stability on challenging terrains, while wheeled pavers continue to dominate for standard road construction due to their maneuverability and cost-effectiveness. The market has also seen a rise in the demand for compact asphalt pavers for urban projects and specialized applications. Consumer demand has shifted towards equipment that offers a lower total cost of ownership, higher productivity, and a reduced environmental footprint. This has spurred innovation in areas like fuel-efficient engines and quieter operations. The base year of 2025 signifies a mature stage in this evolution, with a projected market growth rate of approximately 5.5% annually during the forecast period, reaching an estimated market size exceeding $4,500 Million by 2033.

Leading Regions, Countries, or Segments in Asphalt Pavers Market

The dominance within the Asphalt Pavers Market is multifaceted, with distinct regions and segments showcasing exceptional growth and influence. Asia Pacific, particularly countries like China and India, has emerged as a frontrunner, fueled by extensive government initiatives for infrastructure development, including the expansion of road networks and urban infrastructure projects. The sheer scale of road construction projects in this region significantly drives demand for a wide array of asphalt paving equipment, from small less than 1.5m paving range machines for intricate urban areas to larger above 2.55m paving range models for highways. Investment trends in these developing nations are robust, with billions allocated annually to transportation infrastructure, directly impacting the sales of heavy construction machinery.

Furthermore, North America, led by the United States, maintains a strong position due to significant ongoing road maintenance and upgrade programs, as well as new construction projects. The demand for wheeled pavers remains high in this region for its versatility and efficiency in standard road building. Europe also presents a significant market, with a strong emphasis on sustainable construction practices and the adoption of advanced technologies. Countries like Germany and the UK are leading the charge in adopting eco-friendly asphalt pavers and intelligent paving solutions.

When examining segments, wheeled pavers command a substantial market share due to their widespread application in diverse road construction scenarios. However, tracked pavers are gaining traction, especially for projects requiring enhanced stability and the ability to navigate challenging or uneven ground conditions, such as in remote or mountainous regions. The 2.4 m to 2.55 m and above 2.55 m paving range categories are experiencing robust growth, driven by the need for wider and more efficient paving operations on major highways and large infrastructure projects. The increasing adoption of screeds with advanced functionalities further complements the paving process, enhancing surface quality and operational speed. Regulatory support for infrastructure upgrades and a growing emphasis on improving transportation connectivity are key drivers across these dominant regions and segments.

Asphalt Pavers Market Product Innovations

The Asphalt Pavers Market is witnessing a wave of transformative product innovations designed to enhance efficiency, precision, and sustainability. Manufacturers are integrating advanced technologies such as GPS-guided paving, real-time material monitoring, and intelligent compaction systems to achieve superior asphalt layer uniformity and density. The development of more fuel-efficient engines and quieter operating mechanisms addresses environmental concerns and improves operator comfort. Unique selling propositions often lie in the modular design of screeds, allowing for quick adjustments to paving widths, and the enhanced maneuverability and stability offered by advanced tracked pavers. Caterpillar Inc.'s recent announcement of a new compact line of asphalt pavers and screeds, including models like the Cat® AP400 and AP455, highlights a focus on catering to smaller projects and urban environments with enhanced agility and performance metrics.

Propelling Factors for Asphalt Pavers Market Growth

Several key factors are propelling the growth of the Asphalt Pavers Market. Firstly, sustained global investments in infrastructure development, including the expansion and modernization of road networks, airports, and urban transportation systems, create a consistent demand for asphalt paving equipment. Secondly, technological advancements are a significant driver, with innovations in precision paving, automation, and fuel efficiency making asphalt pavers more productive and environmentally friendly. Thirdly, government initiatives promoting sustainable construction practices and the use of advanced road construction machinery encourage the adoption of newer, more efficient paving solutions. Economic recovery in many regions further stimulates construction activity, directly benefiting the asphalt laying equipment sector.

Obstacles in the Asphalt Pavers Market Market

Despite robust growth, the Asphalt Pavers Market faces several obstacles. Stringent environmental regulations concerning emissions and noise pollution can increase manufacturing costs and necessitate costly upgrades to existing fleets. Fluctuations in raw material prices, particularly asphalt binder and steel, can impact profitability and project budgets for contractors, indirectly affecting equipment sales. Supply chain disruptions, as experienced in recent years, can lead to production delays and affect the availability of critical components. Intense competition among established and emerging players also exerts downward pressure on pricing. Furthermore, the high initial investment cost of sophisticated heavy construction machinery can be a barrier for smaller contractors in developing regions.

Future Opportunities in Asphalt Pavers Market

The Asphalt Pavers Market is ripe with emerging opportunities. The growing global focus on smart city initiatives and the development of intelligent transportation systems will drive demand for advanced asphalt paving machines capable of precise and automated operations. The increasing need for road maintenance and rehabilitation in aging infrastructure presents a significant opportunity for the sale of specialized asphalt pavers and patching equipment. Furthermore, the growing adoption of eco-friendly paving materials and techniques will spur the development and demand for asphalt pavers designed to work with these innovative solutions. Emerging economies with expanding transportation needs represent untapped markets for all types of asphalt laying equipment.

Major Players in the Asphalt Pavers Market Ecosystem

- Fayat Group

- Wirtgen America Inc

- Sumitomo IHI Construction Machinery Co Ltd

- Astec Industry Inc

- Volvo Construction Equipment

- Caterpillar Inc

- Ammann Group

- Leeboy Inc

- XCMG Construction Machinery Co Ltd

Key Developments in Asphalt Pavers Market Industry

- December 2023: The Ammann Group and Volvo Construction Equipment (Volvo CE) reached an agreement over the ABG Paver Business. Ammann will acquire Volvo CE’s global ABG Paver Business, including ABG, in Hameln, Germany, a move that will significantly reshape the competitive landscape for tracked pavers and wheeled pavers.

- May 2023: Attentive.ai Inc., a Delaware-based business management software provider for outdoor services industries, launched an automated property measurement tool for paving maintenance professionals, enhancing efficiency in the asphalt paving service sector.

- March 2023: Caterpillar Inc. announced plans to add a new compact line of asphalt pavers and screeds to its Paving Products family, including the Cat® AP400, AP455 Mobil-trac™, AP455 Steel Track, AP500, AP555 Mobil-trac, and AP555 Steel Track and the SE47 VT and SE50 VT tamper bar screeds, indicating a strategic expansion into the compact equipment segment of the asphalt pavers market.

Strategic Asphalt Pavers Market Market Forecast

The Asphalt Pavers Market is poised for sustained and robust growth in the coming years, driven by a confluence of strategic factors. The increasing global emphasis on infrastructure development, particularly in emerging economies, will continue to be a primary growth catalyst, fueling demand for a wide range of asphalt paving machines. Technological advancements, including the integration of automation, GPS guidance, and enhanced fuel efficiency in heavy construction machinery, will drive the adoption of premium products and improve overall paving quality. The growing awareness and implementation of sustainable construction practices will further propel the market towards more eco-friendly asphalt laying equipment. Emerging opportunities in smart cities and intelligent transportation systems, coupled with the constant need for road maintenance and rehabilitation, present significant avenues for market expansion, promising a bright future for stakeholders in this dynamic sector.

Asphalt Pavers Market Segmentation

-

1. Type

- 1.1. Tracked Pavers

- 1.2. Wheeled Pavers

- 1.3. Screeds

-

2. Paving Range

- 2.1. Less than 1.5 m

- 2.2. 1.5 m to 2.3 m

- 2.3. 2.4 m to 2.55 m

- 2.4. Above 2.55 m

Asphalt Pavers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of World

- 4.1. Mexico

- 4.2. Brazil

- 4.3. United Arab Emirates

- 4.4. Other Countries

Asphalt Pavers Market Regional Market Share

Geographic Coverage of Asphalt Pavers Market

Asphalt Pavers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Construction Activities in Asia-Pacific

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper The Target Market Growth

- 3.4. Market Trends

- 3.4.1. Track Pavers Segment Holds the Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asphalt Pavers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tracked Pavers

- 5.1.2. Wheeled Pavers

- 5.1.3. Screeds

- 5.2. Market Analysis, Insights and Forecast - by Paving Range

- 5.2.1. Less than 1.5 m

- 5.2.2. 1.5 m to 2.3 m

- 5.2.3. 2.4 m to 2.55 m

- 5.2.4. Above 2.55 m

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Asphalt Pavers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tracked Pavers

- 6.1.2. Wheeled Pavers

- 6.1.3. Screeds

- 6.2. Market Analysis, Insights and Forecast - by Paving Range

- 6.2.1. Less than 1.5 m

- 6.2.2. 1.5 m to 2.3 m

- 6.2.3. 2.4 m to 2.55 m

- 6.2.4. Above 2.55 m

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Asphalt Pavers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tracked Pavers

- 7.1.2. Wheeled Pavers

- 7.1.3. Screeds

- 7.2. Market Analysis, Insights and Forecast - by Paving Range

- 7.2.1. Less than 1.5 m

- 7.2.2. 1.5 m to 2.3 m

- 7.2.3. 2.4 m to 2.55 m

- 7.2.4. Above 2.55 m

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Asphalt Pavers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tracked Pavers

- 8.1.2. Wheeled Pavers

- 8.1.3. Screeds

- 8.2. Market Analysis, Insights and Forecast - by Paving Range

- 8.2.1. Less than 1.5 m

- 8.2.2. 1.5 m to 2.3 m

- 8.2.3. 2.4 m to 2.55 m

- 8.2.4. Above 2.55 m

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of World Asphalt Pavers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tracked Pavers

- 9.1.2. Wheeled Pavers

- 9.1.3. Screeds

- 9.2. Market Analysis, Insights and Forecast - by Paving Range

- 9.2.1. Less than 1.5 m

- 9.2.2. 1.5 m to 2.3 m

- 9.2.3. 2.4 m to 2.55 m

- 9.2.4. Above 2.55 m

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Fayat Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wirtgen America Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sumitomo IHI Construction Machinery Co Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Astec Industry Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Volvo Construction Equipment

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Caterpillar Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ammann Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Leeboy Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 XCMG Construction Machinery Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Fayat Group

List of Figures

- Figure 1: Global Asphalt Pavers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Asphalt Pavers Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Asphalt Pavers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Asphalt Pavers Market Revenue (Million), by Paving Range 2025 & 2033

- Figure 5: North America Asphalt Pavers Market Revenue Share (%), by Paving Range 2025 & 2033

- Figure 6: North America Asphalt Pavers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Asphalt Pavers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Asphalt Pavers Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Asphalt Pavers Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Asphalt Pavers Market Revenue (Million), by Paving Range 2025 & 2033

- Figure 11: Europe Asphalt Pavers Market Revenue Share (%), by Paving Range 2025 & 2033

- Figure 12: Europe Asphalt Pavers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Asphalt Pavers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Asphalt Pavers Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Asphalt Pavers Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Asphalt Pavers Market Revenue (Million), by Paving Range 2025 & 2033

- Figure 17: Asia Pacific Asphalt Pavers Market Revenue Share (%), by Paving Range 2025 & 2033

- Figure 18: Asia Pacific Asphalt Pavers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Asphalt Pavers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Asphalt Pavers Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of World Asphalt Pavers Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of World Asphalt Pavers Market Revenue (Million), by Paving Range 2025 & 2033

- Figure 23: Rest of World Asphalt Pavers Market Revenue Share (%), by Paving Range 2025 & 2033

- Figure 24: Rest of World Asphalt Pavers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of World Asphalt Pavers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asphalt Pavers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Asphalt Pavers Market Revenue Million Forecast, by Paving Range 2020 & 2033

- Table 3: Global Asphalt Pavers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Asphalt Pavers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Asphalt Pavers Market Revenue Million Forecast, by Paving Range 2020 & 2033

- Table 6: Global Asphalt Pavers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Asphalt Pavers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Asphalt Pavers Market Revenue Million Forecast, by Paving Range 2020 & 2033

- Table 12: Global Asphalt Pavers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Asphalt Pavers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Asphalt Pavers Market Revenue Million Forecast, by Paving Range 2020 & 2033

- Table 20: Global Asphalt Pavers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Asphalt Pavers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Asphalt Pavers Market Revenue Million Forecast, by Paving Range 2020 & 2033

- Table 28: Global Asphalt Pavers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Mexico Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Brazil Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: United Arab Emirates Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Other Countries Asphalt Pavers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asphalt Pavers Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Asphalt Pavers Market?

Key companies in the market include Fayat Group, Wirtgen America Inc, Sumitomo IHI Construction Machinery Co Ltd*List Not Exhaustive, Astec Industry Inc, Volvo Construction Equipment, Caterpillar Inc, Ammann Group, Leeboy Inc, XCMG Construction Machinery Co Ltd.

3. What are the main segments of the Asphalt Pavers Market?

The market segments include Type, Paving Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Construction Activities in Asia-Pacific.

6. What are the notable trends driving market growth?

Track Pavers Segment Holds the Highest Share in the Market.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper The Target Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: The Ammann Group and Volvo Construction Equipment (Volvo CE) reached an agreement over the ABG Paver Business. Ammann will acquire Volvo CE’s global ABG Paver Business, including ABG, in Hameln, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asphalt Pavers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asphalt Pavers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asphalt Pavers Market?

To stay informed about further developments, trends, and reports in the Asphalt Pavers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence