Key Insights

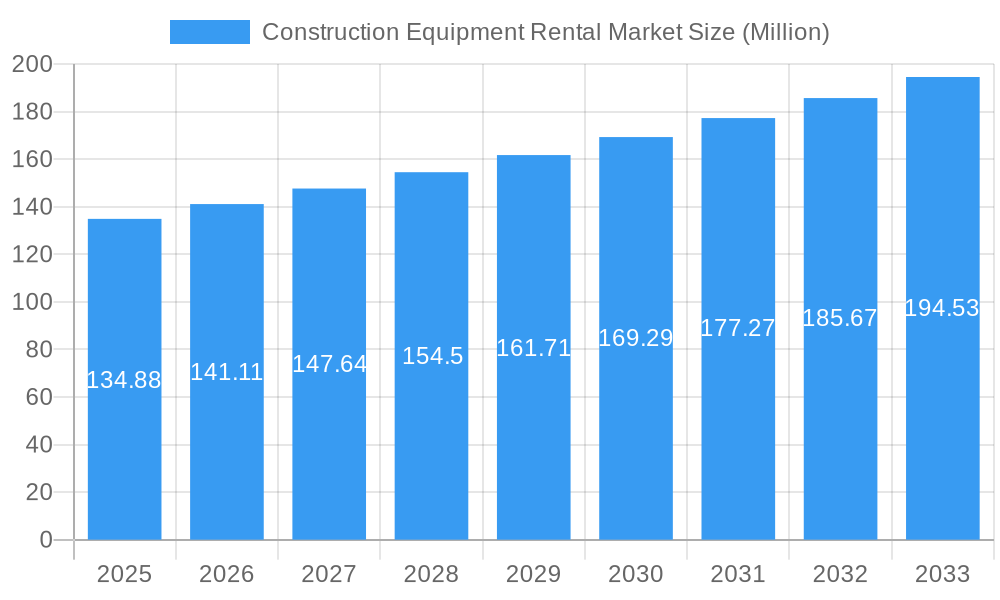

The global Construction Equipment Rental market is poised for robust expansion, projected to reach USD 134.88 million by 2025. This growth is fueled by a steady Compound Annual Growth Rate (CAGR) of 4.85%, indicating a consistent and healthy upward trajectory for the industry. The increasing demand for efficient and cost-effective construction solutions across various infrastructure projects, coupled with the growing trend of project-based equipment acquisition over outright purchase, are primary market drivers. Furthermore, advancements in technology, leading to more sophisticated and fuel-efficient equipment, are attracting a wider customer base. The rental model offers businesses flexibility, reduced capital expenditure, and access to a diverse fleet, making it an attractive proposition for both large enterprises and smaller contractors. The market is also witnessing a surge in demand for specialized equipment to meet the evolving needs of modern construction, from advanced earthmoving machinery to high-capacity material handling solutions.

Construction Equipment Rental Market Market Size (In Million)

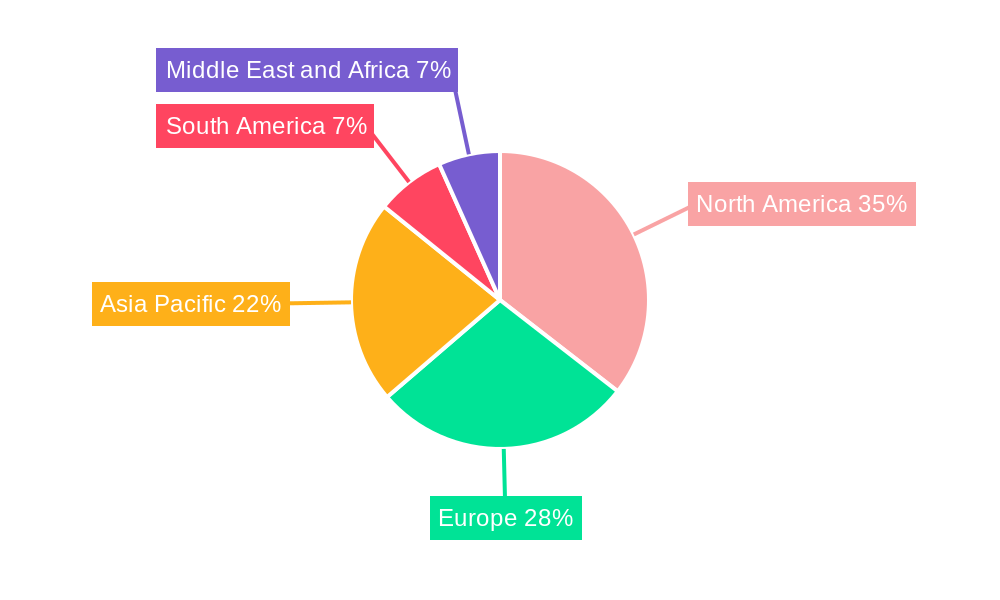

Geographically, North America and Europe are anticipated to dominate the market share due to significant ongoing infrastructure development and a well-established rental culture. The Asia Pacific region, however, is emerging as a key growth engine, driven by rapid urbanization, government investments in infrastructure, and a growing construction sector in countries like China and India. The market segments are diverse, with Earthmoving Equipment, including excavators and loaders, expected to command a significant share. Similarly, Material Handling equipment like cranes and dump trucks are crucial for efficient project execution. In terms of drive type, Internal Combustion (IC) Engines continue to be prevalent, but the adoption of Hybrid Type equipment is gaining traction, driven by environmental regulations and a push towards sustainability. Key players are actively engaged in strategic partnerships, mergers, and acquisitions to expand their fleet, geographical reach, and technological capabilities, further shaping the competitive landscape of the construction equipment rental industry.

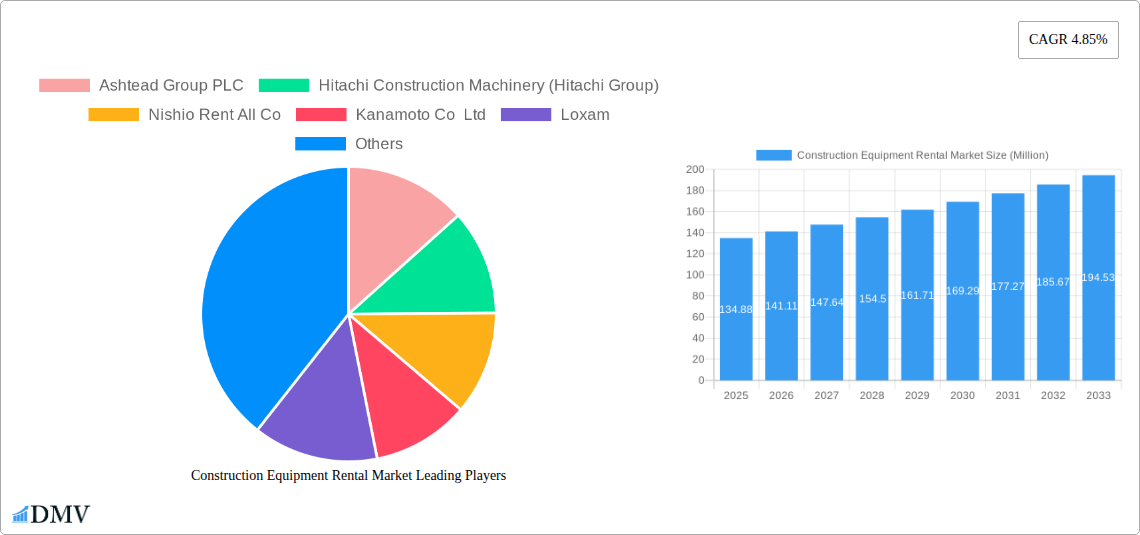

Construction Equipment Rental Market Company Market Share

Construction Equipment Rental Market: Comprehensive Analysis & Strategic Forecast (2019-2033)

Unlock critical insights into the global construction equipment rental market, a booming sector driven by infrastructure development and sustainable construction practices. This in-depth report analyzes market dynamics, rental equipment trends, technological advancements, and strategic growth opportunities from 2019 to 2033, with a base year of 2025. Gain a competitive edge by understanding key drivers, emerging technologies like hybrid construction equipment, and the strategic moves of major players. This report provides a detailed breakdown of the earthmoving equipment rental market, material handling equipment rental, and the dominance of IC engine equipment versus the rise of newer technologies.

Construction Equipment Rental Market Market Composition & Trends

The construction equipment rental market exhibits a moderately concentrated landscape, with leading players like United Rentals, Inc., Ashtead Group PLC, and Loxam holding significant market shares. Innovation is a key catalyst, driven by the demand for efficiency, sustainability, and advanced technology in construction projects. Regulatory frameworks, while varying by region, increasingly emphasize safety standards and environmental compliance, influencing equipment choices and operational practices. Substitute products, primarily outright equipment purchase, present a competitive alternative, but the flexibility and cost-effectiveness of rentals often prevail, especially for project-based needs. End-users span a broad spectrum, including general contractors, specialized construction firms, infrastructure developers, and even DIY enthusiasts. Mergers and acquisitions (M&A) are pivotal in shaping the market, with significant deal values indicating consolidation and expansion strategies. For instance, recent M&A activities aim to broaden service portfolios and geographic reach, contributing to an estimated market value of approximately $150,000 Million in 2025.

- Market Concentration: Moderate, with top players dominating significant market share.

- Innovation Catalysts: Demand for efficiency, sustainability, and advanced technology.

- Regulatory Landscape: Growing emphasis on safety and environmental compliance.

- Substitute Products: Outright equipment purchase.

- End-User Profiles: General contractors, specialized firms, infrastructure developers.

- M&A Activities: Strategic consolidation and expansion, contributing to market growth.

Construction Equipment Rental Market Industry Evolution

The construction equipment rental industry has witnessed a dynamic evolution over the historical period (2019-2024) and is poised for robust growth through the forecast period (2025-2033). This evolution is characterized by a confluence of factors, including surging global infrastructure investment, a growing preference for flexible operational models over capital expenditure, and a paradigm shift towards sustainable construction practices. The market growth trajectory is consistently upward, with projected compound annual growth rates (CAGR) of approximately 7.5% from 2025 to 2033. Technological advancements have been instrumental, with the integration of IoT for fleet management, predictive maintenance, and real-time performance monitoring becoming standard. The introduction of telematics allows for greater operational efficiency, reduced downtime, and enhanced safety protocols. Shifting consumer demands are increasingly focused on eco-friendly solutions. This has spurred the adoption of hybrid and electric construction equipment, catering to stricter emissions regulations and corporate sustainability goals. The demand for specialized equipment, such as advanced excavators, high-capacity cranes, and efficient dump trucks, continues to rise, driven by the complexity of modern construction projects. The online rental platform revolution, exemplified by initiatives like Maxim Marketplace™, has democratized access to equipment and streamlined the rental process, further accelerating market expansion. The estimated market size for the construction equipment rental sector is projected to reach approximately $250,000 Million by 2033, a significant increase from an estimated $150,000 Million in 2025.

Leading Regions, Countries, or Segments in Construction Equipment Rental Market

The construction equipment rental market is dominated by several key regions and segments, each driven by unique economic and developmental factors. North America, particularly the United States, stands out as a leading region due to its extensive infrastructure development initiatives, high levels of private investment in construction, and a mature rental market. The region's strong emphasis on technological adoption and its vast construction project pipeline contribute significantly to its market leadership.

Within the Vehicle Type segment, Earthmoving Equipment commands the largest share. This includes indispensable machinery such as:

- Excavators: Crucial for digging, demolition, and material handling across diverse projects.

- Loaders: Essential for moving materials on-site, from raw materials to debris.

- Backhoes: Versatile machines used for digging trenches and small-scale excavation.

- Other Earthmoving Equipment: Encompassing dozers, graders, and compactors, vital for site preparation and groundwork.

The dominance of earthmoving equipment is attributed to their fundamental role in virtually every phase of construction, from initial site clearing to final grading. Investment trends in new infrastructure, housing, and commercial projects directly correlate with the demand for these essential machines. Regulatory support for infrastructure renewal projects and the ease of use and widespread availability of these equipment types further bolster their market position.

In the Material Handling segment, Cranes are a significant contributor. Their role in lifting and placing heavy materials at height is indispensable for large-scale construction, including high-rise buildings, bridges, and industrial facilities. The increasing trend of constructing taller buildings and more complex infrastructure projects directly fuels the demand for advanced and high-capacity crane rentals. Dump Trucks are equally critical for the efficient transportation of bulk materials on and off construction sites, playing a vital role in the logistical efficiency of large-scale operations.

The Drive Type segment is currently dominated by IC Engine equipment. These machines offer proven reliability, robust performance in demanding conditions, and a wide range of available power options, making them the workhorse of the industry. However, the Hybrid Type segment is experiencing significant growth. Driven by environmental regulations and a push for sustainability, hybrid technology offers reduced fuel consumption, lower emissions, and quieter operation, making them increasingly attractive for urban projects and environmentally sensitive sites. The adoption rate for hybrid equipment, while still lower than IC engines, is projected to accelerate in the coming years as technology matures and costs become more competitive.

Construction Equipment Rental Market Product Innovations

Product innovations in the construction equipment rental market are heavily focused on enhancing efficiency, sustainability, and operator safety. Advanced telematics and IoT integration allow for real-time monitoring of equipment performance, predictive maintenance, and optimized fleet management, reducing downtime and operational costs. The development of hybrid and electric construction equipment is a significant trend, offering reduced emissions, lower fuel consumption, and quieter operation, aligning with growing environmental consciousness and stricter regulations. Innovations in automation and robotics are also emerging, with a focus on improving precision and reducing the need for manual labor in repetitive or hazardous tasks. These advancements are leading to equipment with improved fuel efficiency by up to 20%, extended service life, and enhanced operator comfort and safety features, thereby increasing their appeal to rental customers.

Propelling Factors for Construction Equipment Rental Market Growth

The construction equipment rental market is experiencing robust growth driven by several key factors. A primary driver is the continuous surge in global infrastructure development and urbanization, necessitating a constant demand for construction machinery. The economic advantage of renting over purchasing, particularly for small to medium-sized enterprises (SMEs) and for project-specific needs, significantly boosts rental uptake. Furthermore, the increasing adoption of advanced technologies like telematics and the growing emphasis on sustainability, leading to the demand for hybrid construction equipment, are expanding the rental market's scope. Favorable government policies supporting infrastructure projects and initiatives promoting efficient resource utilization also play a crucial role.

Obstacles in the Construction Equipment Rental Market Market

Despite its strong growth, the construction equipment rental market faces several obstacles. Stringent environmental regulations and evolving emission standards can necessitate significant capital investment in upgrading or replacing fleets, impacting rental companies' profitability. Fluctuations in raw material prices and global supply chain disruptions can lead to increased equipment manufacturing costs and lead times, affecting availability. Intense competition among rental providers, both large corporations and local players, can exert downward pressure on rental rates, squeezing profit margins. Moreover, the high initial cost of advanced and specialized equipment, including hybrid and electric models, can be a barrier to widespread adoption for rental companies.

Future Opportunities in Construction Equipment Rental Market

The construction equipment rental market is brimming with future opportunities. The increasing focus on green building practices and sustainable infrastructure development presents a significant opportunity for rental companies to expand their fleets of eco-friendly and hybrid construction equipment. The growing demand for smart cities and smart infrastructure projects will drive the need for specialized, technologically advanced rental machinery. Expansion into emerging economies with burgeoning construction sectors offers vast untapped potential. Furthermore, the development of integrated rental solutions, including advanced fleet management software and on-demand delivery services, will enhance customer experience and create new revenue streams. The market's value is projected to reach approximately $250,000 Million by 2033, indicating substantial growth potential.

Major Players in the Construction Equipment Rental Market Ecosystem

- Ashtead Group PLC

- Hitachi Construction Machinery (Hitachi Group)

- Nishio Rent All Co

- Kanamoto Co Ltd

- Loxam

- CNH Industrial

- Sumitomo Corp

- H&E Equipment Services Inc

- Liebherr International AG

- HSS Hire Group PLC

- Herc Rentals Inc

- Cramo Oyj

- Caterpillar

- United Rentals Inc

Key Developments in Construction Equipment Rental Market Industry

- December 2023: MyCrane, an online crane rental service based in Dubai, launched its own operations in the United States, opting for direct establishment over franchising. This move signifies a strategic expansion into a key market.

- November 2022: Maxim Crane Works LP introduced Maxim Marketplace™, an online platform for used equipment sales. This initiative aims to refresh its fleet and leverage a cutting-edge online sales channel for its extensive inventory of cranes and support equipment.

- August 2023: Zeppelin expanded its Zeppelin Rental business by acquiring Bauhof Service GmbH. This acquisition bolsters Zeppelin's offerings in Germany, particularly in pump and generator rentals and logistical services for construction sites.

- June 2023: Renta Group made significant strategic acquisitions, including the purchase of My Lift, a Norwegian general rental company. This acquisition added eight depots in Norway and generated NOK 360 million (EUR 30 million) in annual revenue, strengthening Renta Group's Nordic presence.

Strategic Construction Equipment Rental Market Market Forecast

The construction equipment rental market is projected for sustained and significant growth, propelled by a confluence of strategic factors. The continuous global push for infrastructure development, coupled with the increasing adoption of sustainable construction practices, will drive consistent demand for rental machinery. The growing preference for flexible rental solutions over capital expenditure, especially among SMEs and for project-specific needs, will continue to fuel market expansion. Technological advancements, including the integration of telematics, IoT, and the rising adoption of hybrid and electric construction equipment, will not only meet evolving environmental regulations but also enhance operational efficiencies, thereby creating new opportunities. The market is expected to grow substantially, reaching an estimated value of $250,000 Million by 2033, presenting lucrative prospects for stakeholders.

Construction Equipment Rental Market Segmentation

-

1. Vehicle Type

-

1.1. Earthmoving Equipment

- 1.1.1. Backhoe

- 1.1.2. Loaders

- 1.1.3. Excavators

- 1.1.4. Other Earthmoving Equipment

-

1.2. Material Handling

- 1.2.1. Cranes

- 1.2.2. Dump Trucks

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Hybrid Type

Construction Equipment Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Construction Equipment Rental Market Regional Market Share

Geographic Coverage of Construction Equipment Rental Market

Construction Equipment Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost of Construction Equipment

- 3.4. Market Trends

- 3.4.1. ICE Engine is Expected to Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Backhoe

- 5.1.1.2. Loaders

- 5.1.1.3. Excavators

- 5.1.1.4. Other Earthmoving Equipment

- 5.1.2. Material Handling

- 5.1.2.1. Cranes

- 5.1.2.2. Dump Trucks

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Hybrid Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Earthmoving Equipment

- 6.1.1.1. Backhoe

- 6.1.1.2. Loaders

- 6.1.1.3. Excavators

- 6.1.1.4. Other Earthmoving Equipment

- 6.1.2. Material Handling

- 6.1.2.1. Cranes

- 6.1.2.2. Dump Trucks

- 6.1.1. Earthmoving Equipment

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. IC Engine

- 6.2.2. Hybrid Type

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Earthmoving Equipment

- 7.1.1.1. Backhoe

- 7.1.1.2. Loaders

- 7.1.1.3. Excavators

- 7.1.1.4. Other Earthmoving Equipment

- 7.1.2. Material Handling

- 7.1.2.1. Cranes

- 7.1.2.2. Dump Trucks

- 7.1.1. Earthmoving Equipment

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. IC Engine

- 7.2.2. Hybrid Type

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Earthmoving Equipment

- 8.1.1.1. Backhoe

- 8.1.1.2. Loaders

- 8.1.1.3. Excavators

- 8.1.1.4. Other Earthmoving Equipment

- 8.1.2. Material Handling

- 8.1.2.1. Cranes

- 8.1.2.2. Dump Trucks

- 8.1.1. Earthmoving Equipment

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. IC Engine

- 8.2.2. Hybrid Type

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. South America Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Earthmoving Equipment

- 9.1.1.1. Backhoe

- 9.1.1.2. Loaders

- 9.1.1.3. Excavators

- 9.1.1.4. Other Earthmoving Equipment

- 9.1.2. Material Handling

- 9.1.2.1. Cranes

- 9.1.2.2. Dump Trucks

- 9.1.1. Earthmoving Equipment

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. IC Engine

- 9.2.2. Hybrid Type

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa Construction Equipment Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Earthmoving Equipment

- 10.1.1.1. Backhoe

- 10.1.1.2. Loaders

- 10.1.1.3. Excavators

- 10.1.1.4. Other Earthmoving Equipment

- 10.1.2. Material Handling

- 10.1.2.1. Cranes

- 10.1.2.2. Dump Trucks

- 10.1.1. Earthmoving Equipment

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. IC Engine

- 10.2.2. Hybrid Type

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashtead Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi Construction Machinery (Hitachi Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nishio Rent All Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kanamoto Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loxam

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CNH Industrial

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sumitomo Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 H&E Equipment Services Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Liebherr International AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HSS Hire Group PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Herc Rentals Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cramo Oyj

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Caterpillar

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 United Rentals Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ashtead Group PLC

List of Figures

- Figure 1: Global Construction Equipment Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 5: North America Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 11: Europe Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: South America Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: South America Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 23: South America Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: South America Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Drive Type 2025 & 2033

- Figure 29: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Middle East and Africa Construction Equipment Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Construction Equipment Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Global Construction Equipment Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 13: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 22: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 31: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Construction Equipment Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 36: Global Construction Equipment Rental Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 37: Global Construction Equipment Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Construction Equipment Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Equipment Rental Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Construction Equipment Rental Market?

Key companies in the market include Ashtead Group PLC, Hitachi Construction Machinery (Hitachi Group), Nishio Rent All Co, Kanamoto Co Ltd, Loxam, CNH Industrial, Sumitomo Corp, H&E Equipment Services Inc, Liebherr International AG, HSS Hire Group PLC, Herc Rentals Inc, Cramo Oyj, Caterpillar, United Rentals Inc.

3. What are the main segments of the Construction Equipment Rental Market?

The market segments include Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Industry.

6. What are the notable trends driving market growth?

ICE Engine is Expected to Hold the Highest Share.

7. Are there any restraints impacting market growth?

High Maintenance Cost of Construction Equipment.

8. Can you provide examples of recent developments in the market?

December 2023: The online crane rental service based in Dubai, MyCrane, started its own operation in the United States. The company stated that it chose to set up its own operations in the United States rather than appointing a franchisee, as it has done in other locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Equipment Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Equipment Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Equipment Rental Market?

To stay informed about further developments, trends, and reports in the Construction Equipment Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence