Key Insights

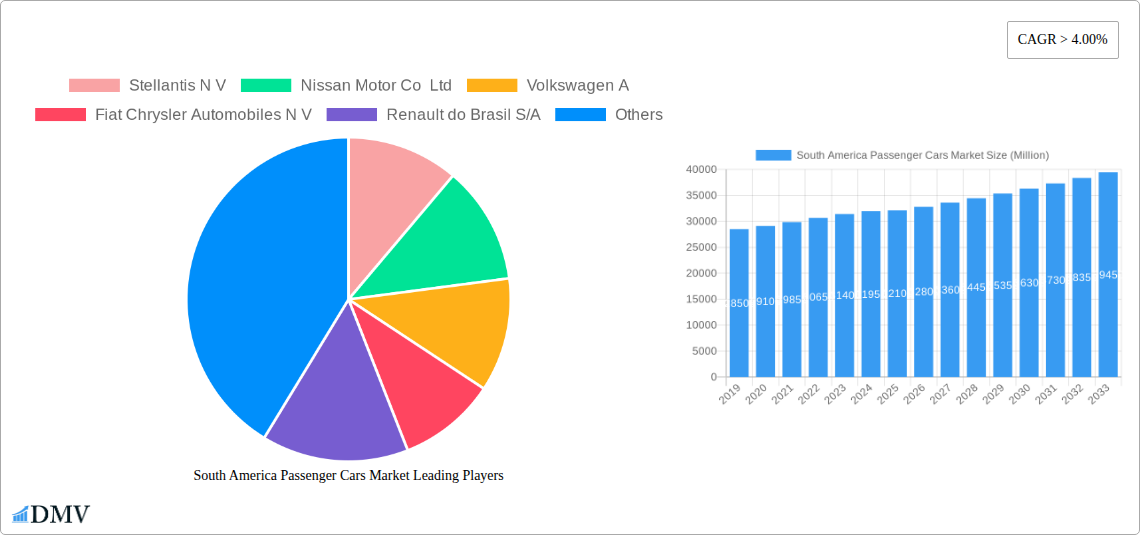

The South America Passenger Cars Market is projected for substantial growth, expected to reach a market size of USD 87.1 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 13% through 2033. Key growth drivers include rising disposable incomes in major economies such as Brazil and Argentina, an expanding middle class, and increasing demand for personal mobility. Evolving consumer preferences are favoring technologically advanced and fuel-efficient vehicles, with a significant shift towards Hybrid and Electric Vehicles (HEVs, PHEVs, BEVs, and FCEVs) fueled by government incentives, environmental awareness, and cost-saving benefits. The demand for versatile vehicle types, particularly Sports Utility Vehicles (SUVs) and Multi-purpose Vehicles (MPVs), continues to rise due to their practicality and comfort. Leading manufacturers like Toyota, Volkswagen, and Stellantis are strategically expanding their product lines and production capacities within the region.

South America Passenger Cars Market Market Size (In Billion)

Despite strong growth potential, the market faces challenges such as economic volatility and currency fluctuations impacting consumer purchasing power. High import duties and taxes can also pose a restraint. Nevertheless, underlying demand for passenger cars remains robust, supported by infrastructure development and increasing urbanization. Technological advancements, including more affordable EV options and sophisticated Internal Combustion Engine (ICE) technologies, are expected to further stimulate market activity. The competitive landscape is dynamic, with global automakers and regional players competing through innovation, partnerships, and localized strategies.

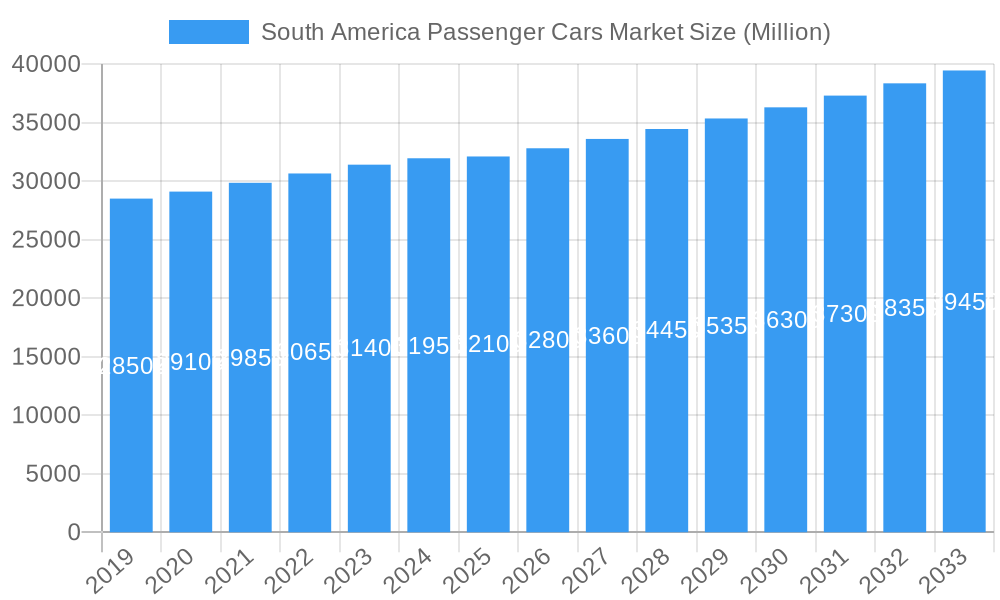

South America Passenger Cars Market Company Market Share

This comprehensive report offers stakeholders in the South America Passenger Cars Market actionable insights from 2019 to 2033, with analysis centered on the 2025 timeframe. It examines historical trends, current market dynamics, and future growth forecasts, dissecting the evolving landscape from the rise of EVs to the enduring presence of ICE vehicles. The report analyzes key industry developments, strategic player maneuvers, market concentration, innovation drivers, regulatory influences, and the competitive ecosystem shaping the future of passenger mobility in South America.

South America Passenger Cars Market Market Composition & Trends

The South America Passenger Cars Market is characterized by a moderate market concentration, with a few automotive giants like Stellantis N.V., Volkswagen A, Toyota Motor Corporation, and GM Motor (Chevrolet) holding significant market share. Innovation catalysts are primarily driven by a growing demand for fuel efficiency, advanced safety features, and increasingly, electric and hybrid vehicle (HEV/PHEV) technology adoption. Regulatory landscapes are evolving, with governments across South America progressively introducing incentives for BEV and PHEV sales and stricter emission standards for ICE (Gasoline, Diesel) vehicles. Substitute products, such as public transportation and ride-sharing services, present a constant competitive pressure, though the personal convenience and flexibility offered by passenger cars maintain their appeal. End-user profiles are diverse, ranging from budget-conscious consumers seeking economical hatchbacks and sedans to families prioritizing space and versatility in MPVs and the rapidly growing segment of SUVs. Merger and acquisition (M&A) activities, while not as prolific as in other mature markets, are strategically focused on gaining market access, enhancing technological capabilities, and consolidating regional presence. For instance, a hypothetical M&A deal value in the range of $500 Million to $1 Billion could reshape the competitive landscape by combining established distribution networks with new technological portfolios. Market share distribution is a key indicator, with a projected shift towards more sustainable propulsion types in the coming years.

South America Passenger Cars Market Industry Evolution

The South America Passenger Cars Market has undergone a significant industry evolution over the historical period of 2019-2024, and this trajectory is projected to accelerate through 2033. Initially dominated by ICE (Gasoline and Diesel) vehicles, the market has witnessed a gradual but persistent shift driven by increasing environmental awareness, fluctuating fuel prices, and supportive government policies aimed at promoting cleaner mobility solutions. Technological advancements have played a pivotal role, with manufacturers introducing more fuel-efficient ICE engines, alongside a growing portfolio of Hybrid and Electric Vehicles (HEV, PHEV, BEV). This transition has been fueled by substantial investments in research and development by leading players such as Hyundai Motor Company and Toyota Motor Corporation. Shifting consumer demands are a primary force behind this evolution. Consumers are increasingly prioritizing not just affordability and reliability, but also features such as connectivity, advanced safety systems, and reduced environmental impact. The rise of the Sports Utility Vehicle (SUV) segment, offering a blend of comfort, practicality, and a commanding driving position, has been a dominant trend, impacting sales across all propulsion types. Furthermore, the penetration of ICE vehicles, while still substantial, is expected to see a gradual decline as HEVs and BEVs gain traction, driven by improving battery technology, expanding charging infrastructure, and favorable tax incentives in key markets. The market is poised for sustained growth, with projected Compound Annual Growth Rates (CAGRs) for passenger cars in the 4-6% range over the forecast period, with the Hybrid and Electric Vehicles segment exhibiting a significantly higher growth rate of 15-20% per annum. The increasing affordability of electric vehicles and the expanding model availability are key indicators of this impending transformation.

Leading Regions, Countries, or Segments in South America Passenger Cars Market

Within the South America Passenger Cars Market, Brazil stands out as the leading country, consistently driving demand and shaping market trends. Its significant population, developing economy, and robust automotive manufacturing base position it as the most crucial market. The dominance is further amplified by its substantial consumption of Sports Utility Vehicles (SUVs), which have become the preferred vehicle configuration for a large segment of Brazilian consumers.

- Key Drivers of Brazil's Dominance:

- Economic Growth and Disposable Income: A growing middle class with increasing disposable income fuels demand for personal mobility solutions.

- Favorable Regulatory Environment for Flex-Fuel Vehicles: Brazil's established infrastructure and consumer acceptance of flex-fuel (ethanol and gasoline) vehicles, exemplified by the Toyota Corolla GR-S, have historically supported its automotive industry and continue to influence powertrain choices.

- Government Incentives for Cleaner Technologies: While historically focused on flex-fuel, there's a growing emphasis on incentives for Hybrid and Electric Vehicles (HEV, PHEV, BEV), signaling a strategic pivot towards sustainable mobility.

- Robust Automotive Manufacturing Hub: Brazil hosts significant manufacturing operations for major global automakers, leading to competitive pricing and wider model availability.

Among the Propulsion Types, ICE (Gasoline) vehicles continue to hold the largest market share due to their established infrastructure and lower upfront costs. However, the Hybrid and Electric Vehicles segment is witnessing the most rapid expansion, with Hybrid Electric Vehicles (HEV) currently leading in adoption due to their balance of efficiency and reduced range anxiety. The adoption of Battery Electric Vehicles (BEV) is on an upward trajectory, fueled by technological advancements and increasing consumer interest in zero-emission transportation.

- Dominance Factors in Propulsion Type:

- ICE (Gasoline): Cost-effectiveness, widespread refueling infrastructure, and extensive model variety remain key advantages.

- Hybrid Electric Vehicles (HEV): Offer a bridge technology, providing improved fuel economy over traditional ICE vehicles without the need for extensive charging infrastructure, making them particularly attractive in regions with developing charging networks.

- Battery Electric Vehicles (BEV): Growth is spurred by falling battery costs, increasing range, government subsidies, and a growing environmental consciousness among consumers.

Within Vehicle Configurations, the Sports Utility Vehicle (SUV) segment exhibits the strongest growth momentum. Its versatility, higher ground clearance, and perceived safety make it a popular choice for a wide array of South American consumers. While Hatchbacks and Sedans continue to command a significant share due to their affordability and practicality for urban commuting, the SUV's appeal is expanding across different price points and engine options, including hybrid and electric variants.

- SUV Segment Dominance Factors:

- Versatility and Lifestyle Appeal: Suited for diverse terrains and family needs.

- Perceived Safety: Higher driving position and robust build contribute to a sense of security.

- Expanding Model Range: Manufacturers are introducing a wider variety of SUVs, from compact to full-size, catering to different budgets and preferences.

South America Passenger Cars Market Product Innovations

Product innovations in the South America Passenger Cars Market are increasingly focused on enhancing fuel efficiency, embracing sustainable propulsion, and integrating advanced connectivity and safety features. The December 2023 debut of the Mustang Mach-E with electric all-wheel drive, standard heated seats, and a heated steering wheel exemplifies the trend towards premium electric offerings with enhanced comfort. Similarly, Toyota's December 2023 introduction of the Corolla GR-S in Brazil, boasting a 2.0-liter Dynamic Force Atkinson flex-cycle engine, highlights ongoing innovation in optimizing ICE technology for local fuel blends while delivering respectable performance. These advancements underscore a market that is actively pursuing a dual strategy of refining existing ICE technology and accelerating the adoption of electric and hybrid powertrains, driven by consumer demand for both performance and sustainability.

Propelling Factors for South America Passenger Cars Market Growth

Several key factors are propelling the South America Passenger Cars Market forward. Economic recovery and rising disposable incomes in key nations like Brazil are increasing consumer purchasing power, driving demand for new vehicles. Government initiatives, including tax incentives and subsidies for Hybrid and Electric Vehicles, are actively encouraging the adoption of cleaner technologies. Furthermore, significant investments in R&D by global automotive giants, as seen in Hyundai's "Strategy 2025" blueprint, are leading to the introduction of more advanced, fuel-efficient, and emission-compliant vehicles. The growing urbanization and the desire for personal mobility also contribute significantly to market expansion.

Obstacles in the South America Passenger Cars Market Market

Despite the growth prospects, the South America Passenger Cars Market faces several obstacles. Volatility in commodity prices, particularly for raw materials used in vehicle manufacturing and battery production, can impact production costs and vehicle pricing. Inadequate charging infrastructure for Electric Vehicles (EVs) remains a significant barrier to widespread adoption in many regions. Economic instability and currency fluctuations in some South American countries can also dampen consumer confidence and purchasing power. Moreover, supply chain disruptions, exacerbated by global events, continue to pose challenges for manufacturers in meeting production targets and maintaining competitive pricing.

Future Opportunities in South America Passenger Cars Market

The South America Passenger Cars Market presents a wealth of future opportunities. The burgeoning demand for SUVs across various segments, from compact to luxury, offers significant growth potential. The increasing consumer interest and government support for Hybrid and Electric Vehicles represent a major opportunity for manufacturers to expand their EV and HEV portfolios, tapping into a rapidly evolving market. Emerging markets within South America, beyond the established ones, also hold untapped potential for market penetration. Furthermore, the development of localized battery production and charging solutions could unlock new revenue streams and address existing infrastructure challenges.

Major Players in the South America Passenger Cars Market Ecosystem

- Stellantis N.V.

- Nissan Motor Co Ltd

- Volkswagen A

- Fiat Chrysler Automobiles N.V.

- Renault do Brasil S/A

- Hyundai Motor Company

- Kia Corporation

- GM Motor (Chevrolet)

- Toyota Motor Corporation

- Ford Motor Company

Key Developments in South America Passenger Cars Market Industry

- December 2023: Mustang Mach-E is available with electric all-wheel drive and has standard heated seats and steering wheel.

- December 2023: Toyota debuts the Corolla GR-S in Brazil. Its 2.0-liter Dynamic Force Atkinson flex cycle engine generates 177 horsepower when running on ethanol and 169 horsepower when running on gasoline, with 21.4 kgfm of torque in both cases.

- December 2023: Hyundai Motor unveiled its "Strategy 2025" blueprint, outlining KRW 61.1 trillion in investments for future technology research and development (R&D) until 2025. The goal is to electrify the majority of new vehicles in key markets such as Korea, the United States, China, and Europe by 2030, with emerging markets such as India and Brazil following suit by 2035.

Strategic South America Passenger Cars Market Market Forecast

The strategic forecast for the South America Passenger Cars Market indicates a robust growth trajectory driven by a confluence of technological advancements, evolving consumer preferences, and supportive policy frameworks. The increasing adoption of Hybrid and Electric Vehicles (HEVs, PHEVs, BEVs), spurred by Hyundai's long-term electrification goals and innovative offerings like the Mustang Mach-E, is set to be a primary growth catalyst. Furthermore, the continuous refinement of ICE (Gasoline, Diesel) technology, as exemplified by Toyota's new flex-fuel engine, will ensure sustained demand from segments prioritizing affordability and existing infrastructure. The market is poised to benefit from increasing disposable incomes and a growing desire for personal mobility, particularly in the highly sought-after SUV segment. This combination of sustainable innovation and continued optimization of traditional powertrains positions the South America Passenger Cars Market for significant expansion and transformation through 2033.

South America Passenger Cars Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. Diesel

- 2.2.2. Gasoline

- 2.2.3. LPG

-

2.1. Hybrid and Electric Vehicles

South America Passenger Cars Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Passenger Cars Market Regional Market Share

Geographic Coverage of South America Passenger Cars Market

South America Passenger Cars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Passenger Cars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. Diesel

- 5.2.2.2. Gasoline

- 5.2.2.3. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stellantis N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volkswagen A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fiat Chrysler Automobiles N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Renault do Brasil S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Motor Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kia Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GM Motor (Chevrolet)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ford Motor Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stellantis N V

List of Figures

- Figure 1: South America Passenger Cars Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Passenger Cars Market Share (%) by Company 2025

List of Tables

- Table 1: South America Passenger Cars Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 2: South America Passenger Cars Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: South America Passenger Cars Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America Passenger Cars Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 5: South America Passenger Cars Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: South America Passenger Cars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Passenger Cars Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Passenger Cars Market?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the South America Passenger Cars Market?

Key companies in the market include Stellantis N V, Nissan Motor Co Ltd, Volkswagen A, Fiat Chrysler Automobiles N V, Renault do Brasil S/A, Hyundai Motor Company, Kia Corporation, GM Motor (Chevrolet), Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the South America Passenger Cars Market?

The market segments include Vehicle Configuration, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

December 2023: Mustang Mach-E is avaiable with electric all-wheel drive and has standard heated seats and steering wheel.December 2023: Toyota debuts the Corolla GR-S in Brazil. Its 2.0-liter Dynamic Force Atkinson flex cycle engine generates 177 horsepower when running on ethanol and 169 horsepower when running on gasoline, with 21.4 kgfm of torque in both cases.December 2023: Hyundai Motor unveiled its "Strategy 2025" blueprint, outlining KRW 61.1 trillion in investments for future technology research and development (R&D) until 2025. The goal is to electrify the majority of new vehicles in key markets such as Korea, the United States, China, and Europe by 2030, with emerging markets such as India and Brazil following suit by 2035.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Passenger Cars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Passenger Cars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Passenger Cars Market?

To stay informed about further developments, trends, and reports in the South America Passenger Cars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence