Key Insights

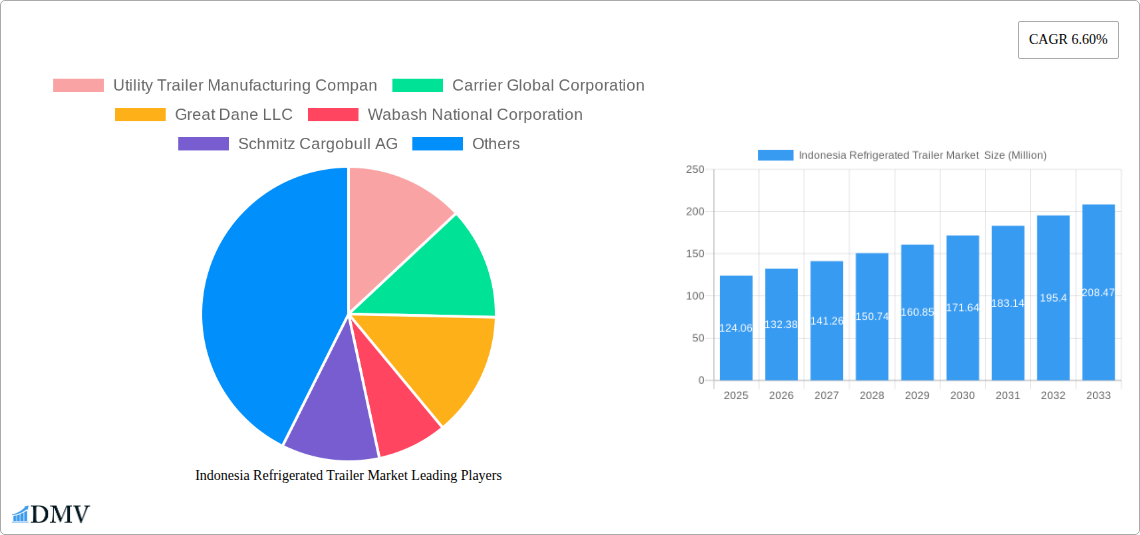

The Indonesian refrigerated trailer market is poised for robust growth, driven by an expanding economy and increasing consumer demand for temperature-sensitive goods. Valued at an estimated USD 124.06 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.60% from 2025 to 2033. This growth is underpinned by the burgeoning demand for chilled and frozen food products, a direct consequence of changing dietary habits, increased urbanization, and a growing middle class with greater purchasing power. Furthermore, the expanding e-commerce sector in Indonesia, particularly for groceries and perishable items, necessitates efficient cold chain logistics, thereby fueling the demand for advanced refrigerated trailers. The government's focus on improving logistics infrastructure and reducing post-harvest losses also acts as a significant catalyst for market expansion.

Indonesia Refrigerated Trailer Market Market Size (In Million)

Key drivers shaping the Indonesian refrigerated trailer market include the rising consumption of dairy products, fruits and vegetables, and seafood, all of which require stringent temperature control during transportation. The increasing sophistication of food processing and retail industries further amplifies the need for reliable and technologically advanced refrigerated trailer solutions. While the market exhibits strong upward momentum, potential restraints such as high initial investment costs for advanced trailers and the availability of skilled technicians for maintenance could pose challenges. However, ongoing technological advancements, the development of more fuel-efficient and eco-friendly trailer models, and increasing government support for cold chain infrastructure are expected to mitigate these challenges, paving the way for sustained market expansion and innovation within Indonesia.

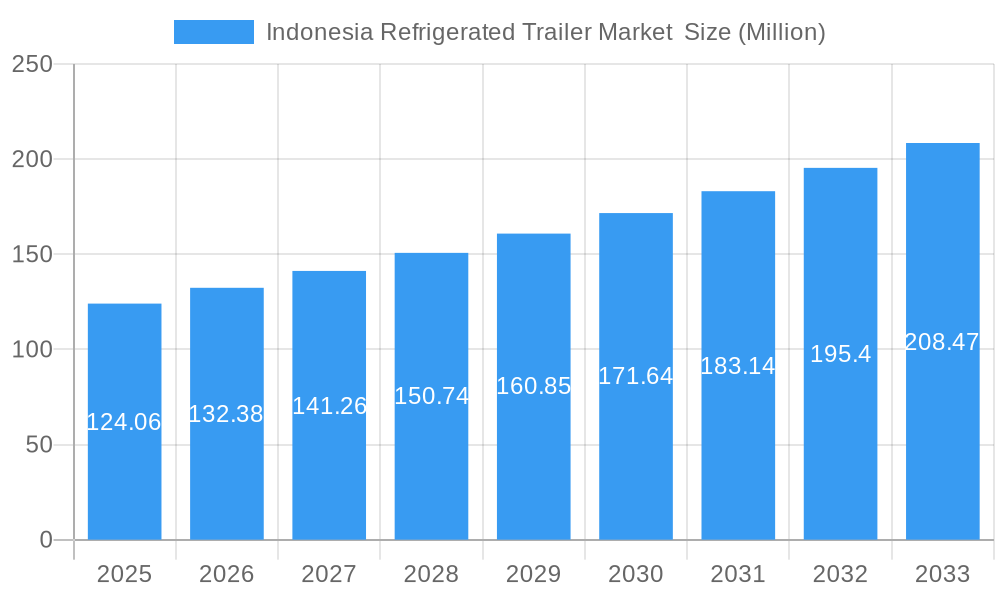

Indonesia Refrigerated Trailer Market Company Market Share

Here's the SEO-optimized report description for the Indonesia Refrigerated Trailer Market:

This comprehensive market research report offers an in-depth analysis of the Indonesia Refrigerated Trailer Market, providing critical insights into its current landscape, historical trends, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning demand for refrigerated transport solutions in Southeast Asia's largest economy.

Discover key market dynamics, including the competitive strategies of industry leaders like Carrier Global Corporation, Wabash National Corporation, and Schmitz Cargobull AG. Explore the impact of technological advancements and evolving consumer preferences on segments such as Frozen Food and Chilled Food, as well as the crucial role of Tandem Axle and Three or More than Three Axle configurations in supporting diverse end-user needs for Dairy Products, Fruits and Vegetables, and Meat and Sea Food.

With detailed coverage of industry developments, including innovations from Thermo King, and an analysis of growth drivers and obstacles, this report equips you with the strategic intelligence needed to navigate the complexities of the Indonesian cold chain logistics sector. Uncover future opportunities, understand market composition, and gain a competitive edge in this rapidly expanding market.

Indonesia Refrigerated Trailer Market Market Composition & Trends

The Indonesia Refrigerated Trailer Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Major companies like Carrier Global Corporation, Great Dane LLC, and Wabash National Corporation are actively investing in product innovation and expanding their distribution networks to capture a larger slice of this growing market. The market's growth is propelled by increasing consumer demand for perishable goods and a growing awareness of food safety regulations, necessitating robust cold chain infrastructure. Regulatory landscapes, while evolving, are generally supportive of investments in modern logistics, encouraging the adoption of advanced refrigerated trailer technologies. Substitute products, such as less sophisticated insulated trailers or specialized reefer trucks, pose a limited threat due to the stringent temperature control requirements for many food categories. End-user profiles reveal a strong demand from the Meat and Sea Food, Dairy Products, and Fruits and Vegetables sectors, all of which rely heavily on uninterrupted cold chains. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate their market presence and acquire technological capabilities. For instance, strategic acquisitions could bolster market share by as much as XX Million. The market’s dynamism is further fueled by ongoing infrastructure development projects aimed at improving logistics efficiency across the archipelago.

Indonesia Refrigerated Trailer Market Industry Evolution

The Indonesia Refrigerated Trailer Market has witnessed a significant evolutionary path driven by a confluence of economic growth, technological advancements, and shifting consumer demands over the historical period (2019–2024) and into the forecast period (2025–2033). Initially, the market was primarily dominated by basic insulated trailers with limited temperature control capabilities, catering mainly to domestic distribution of less sensitive goods. However, the increasing sophistication of consumer preferences and a greater emphasis on food quality and safety have spurred a rapid transformation. The base year (2025) marks a pivotal point where the adoption of advanced refrigerated trailer technologies has become a necessity, not a luxury, for businesses aiming to compete in both domestic and international markets.

Technological advancements have been a primary catalyst for this evolution. Manufacturers have introduced more energy-efficient refrigeration units, advanced telematics for real-time temperature monitoring and tracking, and lighter yet more durable trailer materials. These innovations directly impact operational efficiency and reduce the risk of spoilage, thereby enhancing the overall value proposition of refrigerated logistics. For example, the introduction of lightweight composite materials has led to trailers with higher payload capacities, directly increasing profitability for fleet operators. The growth rate of the Indonesia Refrigerated Trailer Market is projected to be in the range of XX% to XX% annually during the forecast period.

Shifting consumer demands have played an equally crucial role. As Indonesia's middle class expands, so does the demand for a wider variety of perishable goods, including premium dairy products, fresh seafood, and exotic fruits, all of which require precise temperature control throughout their journey from origin to consumer. This has led to a surge in demand for specialized trailers capable of maintaining specific temperature ranges for Frozen Food and Chilled Food segments. The adoption of advanced refrigeration systems, capable of precise temperature management and rapid cooling, has seen a notable increase, with adoption metrics estimated to have risen by XX% from 2019 to 2025. Furthermore, the growing e-commerce sector for groceries and food products necessitates efficient last-mile cold chain logistics, further driving the demand for smaller, more agile refrigerated trailers. The market has also seen an increase in the adoption of multi-temperature trailers, allowing for the simultaneous transport of different types of perishable goods at varying temperatures, thereby optimizing logistics operations and reducing costs for a broader range of end-users. This sustained evolution underscores the dynamic nature of the Indonesia Refrigerated Trailer Market, driven by both technological progress and the ever-changing needs of the Indonesian consumer and business landscape.

Leading Regions, Countries, or Segments in Indonesia Refrigerated Trailer Market

The Indonesia Refrigerated Trailer Market is segmented across various product types, axle configurations, and end-user industries, each exhibiting distinct growth drivers and dominance factors. Within the Product Type segment, Frozen Food currently holds a leading position due to the nation's increasing consumption of frozen meats, seafood, and ready-to-eat meals. The demand for frozen products is bolstered by a growing urban population with busy lifestyles and a desire for convenience. This segment is projected to account for approximately XX% of the total market value in 2025. Chilled Food, while a close second, is experiencing rapid growth driven by the expanding market for fresh dairy products, processed meats, and temperature-sensitive beverages.

Considering Axle Type, Tandem Axle trailers are the most prevalent, offering a balance of carrying capacity and maneuverability essential for the diverse road networks across Indonesia. These trailers are well-suited for long-haul transport and cater to a broad spectrum of end-users. The Three or More than Three Axle segment is gaining traction for heavy-duty applications, particularly for transporting large volumes of frozen goods or catering to specialized industrial needs. Single Axle trailers are primarily utilized for shorter delivery routes and less demanding applications, making them a niche but important part of the market.

In terms of End-User, the Meat and Sea Food industry is a significant driver of demand, owing to the perishable nature of these products and the critical need for stringent temperature control to prevent spoilage and maintain quality. The government's focus on improving cold chain infrastructure for seafood exports further bolsters this segment, contributing an estimated XX% to the market's revenue in 2025. The Dairy Products sector also represents a substantial market share, driven by the increasing consumption of milk, cheese, yogurt, and ice cream, which require consistent refrigeration. Fruits and Vegetables, though traditionally more susceptible to temperature fluctuations, are increasingly transported in refrigerated trailers to extend shelf life and maintain freshness, especially for premium and export-oriented produce. The Other End-Users segment encompasses pharmaceuticals, chemicals, and other temperature-sensitive goods, which, while smaller in volume, represent high-value applications for specialized refrigerated trailers.

Key drivers for the dominance of these segments include:

- Investment Trends: Significant investments in cold storage facilities and logistics infrastructure, particularly in major urban centers and export hubs, directly influence the demand for corresponding refrigerated trailer capacities.

- Regulatory Support: Government initiatives aimed at improving food safety standards and reducing post-harvest losses encourage the adoption of advanced cold chain solutions. For instance, regulations pertaining to the cold chain for meat and seafood exports mandate the use of compliant refrigerated transport.

- Consumer Preferences: The evolving dietary habits and increasing purchasing power of the Indonesian population are directly shaping the demand for a wider range of perishable goods requiring specialized transport.

- Geographical Diversity: Indonesia's archipelagic nature necessitates robust inter-island logistics, driving demand for reliable refrigerated transport solutions for both domestic consumption and international trade.

The interplay of these factors solidifies the leadership of Frozen Food and Meat and Sea Food segments, supported by Tandem Axle configurations, as the core of the Indonesia Refrigerated Trailer Market.

Indonesia Refrigerated Trailer Market Product Innovations

Product innovations within the Indonesia Refrigerated Trailer Market are primarily focused on enhancing energy efficiency, improving temperature control precision, and increasing operational flexibility. Manufacturers are developing lighter yet stronger trailer body materials, such as advanced composite panels, which reduce overall weight, leading to better fuel economy and increased payload capacity. Refrigeration units are becoming more sophisticated, incorporating smart diagnostics and remote monitoring capabilities through telematics, allowing for real-time tracking of temperature and trailer performance. Unique selling propositions include trailers designed for specific cargo types, such as multi-temperature units capable of maintaining distinct temperature zones within a single trailer, catering to the diverse needs of cold chain logistics. For example, innovative designs are emerging that can achieve and maintain temperatures as low as -XX°C for frozen goods while simultaneously holding chilled items at +XX°C, significantly optimizing delivery routes.

Propelling Factors for Indonesia Refrigerated Trailer Market Growth

Several key factors are propelling the growth of the Indonesia Refrigerated Trailer Market. Firstly, the expanding middle class and evolving consumer lifestyles are driving increased demand for perishable goods like fresh produce, dairy, and frozen foods, necessitating robust cold chain logistics. Secondly, government initiatives focused on improving food security, reducing waste, and enhancing export competitiveness are encouraging investments in modern cold chain infrastructure. For instance, policies aimed at supporting the export of agricultural and marine products directly translate to increased demand for refrigerated transport. Thirdly, technological advancements in refrigeration units, such as improved energy efficiency and advanced temperature monitoring systems, are making refrigerated transport more cost-effective and reliable. Lastly, the growth of e-commerce, particularly in the online grocery and food delivery sector, is creating a significant demand for efficient last-mile refrigerated delivery solutions.

Obstacles in the Indonesia Refrigerated Trailer Market Market

Despite the promising growth, the Indonesia Refrigerated Trailer Market faces several obstacles. High initial investment costs for advanced refrigerated trailers and refrigeration units can be a significant barrier for small and medium-sized enterprises (SMEs). Fluctuations in fuel prices and rising operational costs, including maintenance and energy consumption, can impact profitability. Regulatory compliance, particularly concerning vehicle emissions and roadworthiness standards, can also pose challenges. Furthermore, the vast geographical spread of Indonesia and the underdeveloped infrastructure in some remote areas present logistical challenges for maintaining consistent cold chains. Supply chain disruptions, exacerbated by natural disasters or global events, can also impact the availability of essential components and new trailer units, potentially leading to delays and increased costs.

Future Opportunities in Indonesia Refrigerated Trailer Market

The Indonesia Refrigerated Trailer Market is ripe with future opportunities. The burgeoning demand for high-value perishable goods, including organic produce and specialty meats, presents a significant growth avenue. The increasing adoption of e-commerce for food and beverages will continue to fuel the need for efficient last-mile delivery refrigerated solutions. Furthermore, the Indonesian government's focus on developing its logistics infrastructure, particularly for inter-island trade, offers substantial opportunities for fleet expansion and modernization. Emerging markets in less developed regions of Indonesia also represent untapped potential for refrigerated transport services. The integration of IoT and AI technologies in cold chain management offers opportunities for enhanced efficiency, predictive maintenance, and optimized route planning, creating a more intelligent and responsive logistics network.

Major Players in the Indonesia Refrigerated Trailer Market Ecosystem

- Utility Trailer Manufacturing Company

- Carrier Global Corporation

- Great Dane LLC

- Wabash National Corporation

- Schmitz Cargobull AG

- Grey & Adams Ltd

- Trane Technologies Company LLC

- Leonard Truck and Trailer Inc

Key Developments in Indonesia Refrigerated Trailer Market Industry

- September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit, suitable for cargo rail and intermodal applications, enhancing efficiency and versatility in temperature-controlled rail transport.

- April 2022: Thermo King introduced the new Precedent S-750i Trailer, a refrigerated trailer designed for both long-haul and local food distribution, emphasizing improved performance and reliability for modern logistics needs.

Strategic Indonesia Refrigerated Trailer Market Market Forecast

The Indonesia Refrigerated Trailer Market is poised for robust growth, driven by escalating consumer demand for perishable goods, a growing middle class, and supportive government policies aimed at bolstering cold chain infrastructure. The increasing penetration of e-commerce in the food sector further accelerates the need for efficient, temperature-controlled last-mile delivery solutions. Technological advancements, including the adoption of more energy-efficient and telematics-enabled refrigeration units, will enhance operational viability and attract further investment. Future opportunities lie in catering to niche markets for high-value perishables and expanding services into underserved regions, supported by ongoing infrastructure development. The market's trajectory indicates a continued shift towards advanced, reliable, and sustainable cold chain logistics solutions, promising significant returns for stakeholders who can adapt to these evolving demands.

Indonesia Refrigerated Trailer Market Segmentation

-

1. Product Type

- 1.1. Frozen Food

- 1.2. Chilled Food

-

2. Axle Type

- 2.1. Single Axle

- 2.2. Tandem Axle

- 2.3. Three or More than Three Axle

-

3. End-User

- 3.1. Dairy Products

- 3.2. Fruits and Vegetables

- 3.3. Meat and Sea Food

- 3.4. Other End-Users

Indonesia Refrigerated Trailer Market Segmentation By Geography

- 1. Indonesia

Indonesia Refrigerated Trailer Market Regional Market Share

Geographic Coverage of Indonesia Refrigerated Trailer Market

Indonesia Refrigerated Trailer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Expansion of Cold Chain Logistics Across the Region

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost May Affect the Growth

- 3.4. Market Trends

- 3.4.1. Rise in Transportation of Frozen Food Across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Refrigerated Trailer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Food

- 5.1.2. Chilled Food

- 5.2. Market Analysis, Insights and Forecast - by Axle Type

- 5.2.1. Single Axle

- 5.2.2. Tandem Axle

- 5.2.3. Three or More than Three Axle

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Dairy Products

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat and Sea Food

- 5.3.4. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Utility Trailer Manufacturing Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Global Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Great Dane LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wabash National Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schmitz Cargobull AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grey & Adams Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trane Technologies Company LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leonard Truck and Trailer Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Utility Trailer Manufacturing Compan

List of Figures

- Figure 1: Indonesia Refrigerated Trailer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Refrigerated Trailer Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Axle Type 2020 & 2033

- Table 3: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Axle Type 2020 & 2033

- Table 7: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Indonesia Refrigerated Trailer Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Refrigerated Trailer Market ?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the Indonesia Refrigerated Trailer Market ?

Key companies in the market include Utility Trailer Manufacturing Compan, Carrier Global Corporation, Great Dane LLC, Wabash National Corporation, Schmitz Cargobull AG, Grey & Adams Ltd, Trane Technologies Company LLC, Leonard Truck and Trailer Inc.

3. What are the main segments of the Indonesia Refrigerated Trailer Market ?

The market segments include Product Type, Axle Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Expansion of Cold Chain Logistics Across the Region.

6. What are the notable trends driving market growth?

Rise in Transportation of Frozen Food Across the Country.

7. Are there any restraints impacting market growth?

High Maintenance Cost May Affect the Growth.

8. Can you provide examples of recent developments in the market?

September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit. The unit is suitable for cargo rail and intermodal applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Refrigerated Trailer Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Refrigerated Trailer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Refrigerated Trailer Market ?

To stay informed about further developments, trends, and reports in the Indonesia Refrigerated Trailer Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence