Key Insights

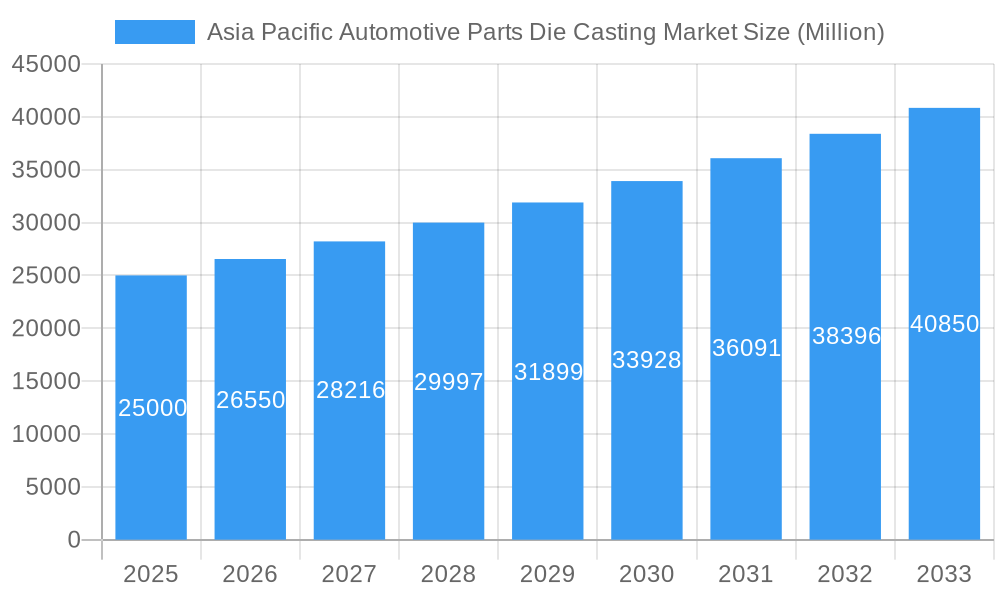

The Asia Pacific automotive parts die casting market is set for significant expansion, driven by strong manufacturing capabilities and increasing vehicle demand across the region. With an estimated market size of $18.37 billion, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 6% from the base year 2025 to 2033. This growth is propelled by the rising production of both internal combustion engine (ICE) vehicles and the rapidly expanding electric vehicle (EV) segment, both requiring complex, precision-cast components. Key growth catalysts include supportive government policies for automotive manufacturing, advancements in die casting technology enhancing efficiency and precision, and the ongoing need for lightweight, durable parts to improve fuel economy and performance. Furthermore, competitive production costs in economies like China and India significantly bolster the region's global position in die casting.

Asia Pacific Automotive Parts Die Casting Market Market Size (In Billion)

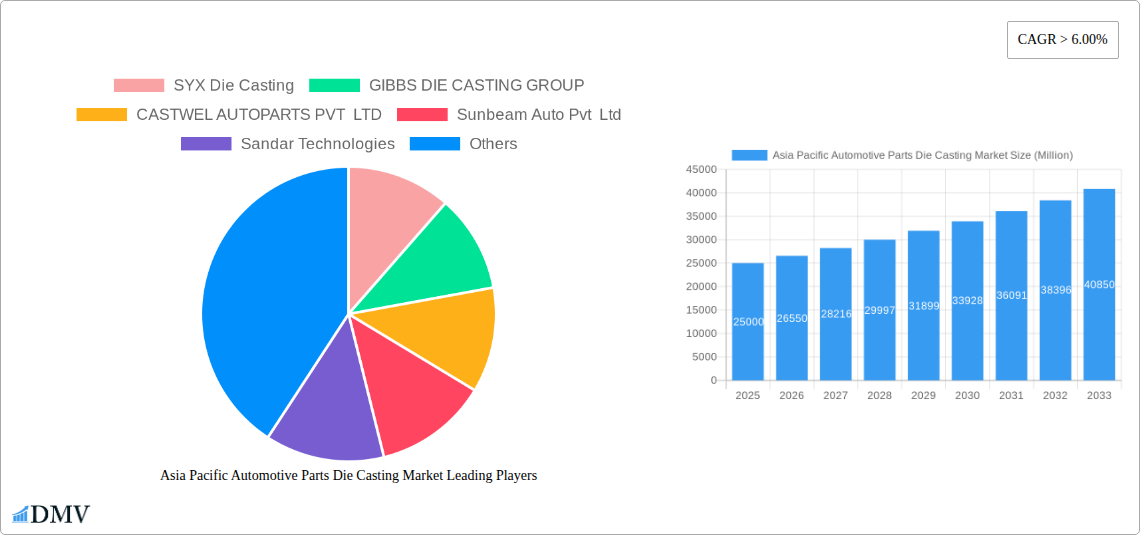

Market segmentation highlights a dynamic interplay of production processes, raw materials, and applications. Pressure die casting remains the predominant method due to its cost-effectiveness and high-volume output. Vacuum and squeeze die casting provide specialized solutions for critical components. Aluminum continues to be the leading raw material, valued for its lightweight properties and recyclability, crucial for meeting emissions standards and supporting the EV trend. Applications encompass essential automotive parts, including body assemblies, engine components, and transmission systems, with a notable increase in demand for components used in EV powertrains and battery enclosures. Leading companies such as SYX Die Casting, GIBBS DIE CASTING GROUP, and Endurance Technologies Ltd are actively investing in research and development and expanding capacity to meet this escalating demand, particularly within major automotive hubs like China, India, Japan, and South Korea.

Asia Pacific Automotive Parts Die Casting Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia Pacific automotive parts die casting market, a vital sector for the global automotive industry. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market structure, industry evolution, regional leadership, product innovation, growth drivers, challenges, future opportunities, key players, and strategic market forecasts. This analysis is essential for stakeholders aiming to understand the current landscape and future trajectory of automotive die casting in Asia Pacific.

Asia Pacific Automotive Parts Die Casting Market Market Composition & Trends

The Asia Pacific automotive parts die casting market is characterized by a moderate to high level of concentration, with leading players such as SYX Die Casting, GIBBS DIE CASTING GROUP, and ALUMINIUM DIE CASTING (CHINA) LTD holding significant market shares. Innovation is a key catalyst, driven by the increasing demand for lightweight components to improve fuel efficiency and reduce emissions. Regulatory landscapes, particularly concerning environmental standards and safety certifications, are continuously evolving and influencing production processes. Substitute products, such as plastic injection molding for certain components, pose a competitive challenge, though die casting offers superior strength and durability for critical automotive parts. End-user profiles range from major Original Equipment Manufacturers (OEMs) to Tier 1 and Tier 2 suppliers, each with specific requirements for precision, quality, and cost-effectiveness. Mergers and acquisitions (M&A) activities are a notable trend, with recent deals valued in the range of tens to hundreds of Million assisting in market consolidation and the expansion of technological capabilities. For instance, recent M&A activities in the region have seen companies investing upwards of $50 Million to acquire specialized die casting facilities.

- Market Concentration: Moderate to High, with key players focusing on economies of scale and technological superiority.

- Innovation Catalysts: Demand for lightweight automotive parts, stringent emission norms, and advancements in electric vehicle (EV) technology.

- Regulatory Landscapes: Increasing focus on environmental compliance, recyclability of materials, and automotive safety standards.

- Substitute Products: While plastic alternatives exist, the superior mechanical properties of die-cast parts ensure continued demand for critical applications.

- End-User Profiles: OEMs, Tier 1 suppliers, and emerging EV manufacturers.

- M&A Activities: Strategic acquisitions aimed at enhancing production capacity, expanding product portfolios, and gaining access to new markets. Deal values are estimated to be in the range of $20 Million to $150 Million for significant transactions.

Asia Pacific Automotive Parts Die Casting Market Industry Evolution

The Asia Pacific automotive parts die casting market has undergone a significant transformation over the historical period (2019-2024) and is poised for substantial growth in the forecast period (2025-2033). Market growth trajectories are being shaped by the burgeoning automotive production across the region, particularly in China and India. Technological advancements have been pivotal, with an increasing adoption of advanced die casting techniques such as vacuum die casting and squeeze die casting to produce higher quality, more complex parts with improved mechanical properties. These advanced processes contribute to a significant reduction in porosity and enhanced surface finish, crucial for modern automotive components. The shift towards electric vehicles (EVs) is a major disrupter and enabler, driving demand for specialized lightweight aluminum and magnesium alloy components for battery casings, motor housings, and structural parts. Consumer demands for more fuel-efficient and environmentally friendly vehicles are directly translating into a higher requirement for lightweighting solutions offered by die casting. For example, the adoption rate of advanced die casting technologies has seen an increase of approximately 15% year-on-year between 2021 and 2024. The market is also witnessing a rise in the use of advanced simulation software for mold design and process optimization, leading to reduced lead times and improved cost-efficiency. The overall market value, which stood at approximately $15,000 Million in 2024, is projected to reach over $25,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.5%. This robust growth is fueled by continuous innovation and the strategic positioning of Asia Pacific as a global automotive manufacturing hub.

Leading Regions, Countries, or Segments in Asia Pacific Automotive Parts Die Casting Market

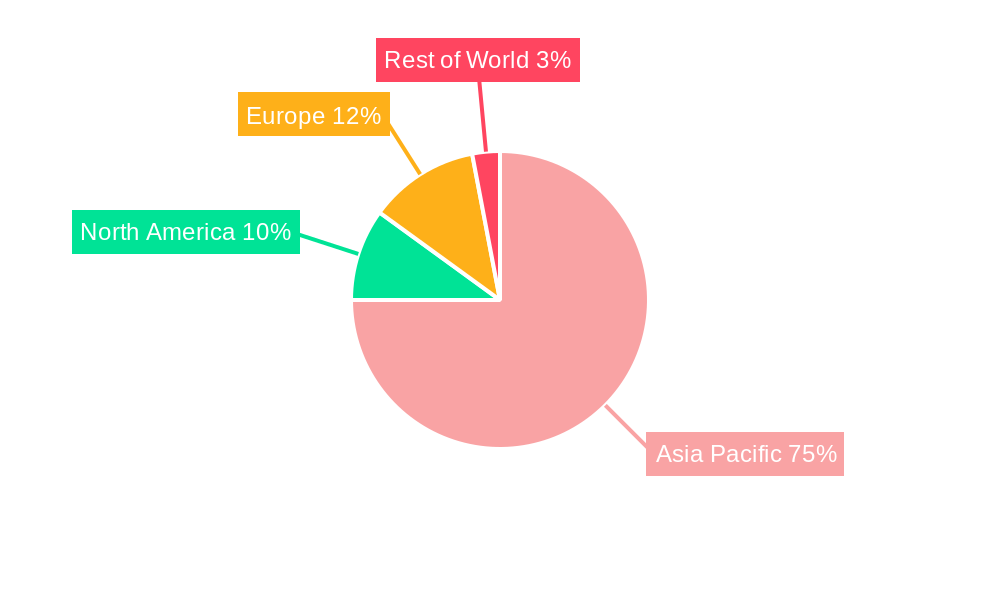

China stands as the undisputed leader in the Asia Pacific automotive parts die casting market, driven by its colossal automotive manufacturing base and significant investments in advanced die casting technologies. The dominance of Pressure Die Casting within the Production Process Type segment is particularly pronounced in China, accounting for over 80% of the total production volume. This is due to its cost-effectiveness and suitability for mass production of a wide range of automotive parts. In terms of Raw Material, Aluminum alloys are the most widely used, comprising an estimated 70% of the market share, owing to their lightweight properties, high strength-to-weight ratio, and excellent recyclability. The Application Type of Engine Parts and Body Assembly collectively represent the largest share, with engine components benefiting from the thermal management and structural integrity offered by die-cast parts, and body assemblies leveraging lightweighting for improved fuel economy.

- Dominant Country: China, with an estimated market share of over 45% in 2025.

- Key Drivers in China: Prolific automotive production, supportive government policies for manufacturing, and significant foreign direct investment in the automotive sector.

- Technological Advancements: Widespread adoption of high-pressure die casting machines and automation in production lines.

- Dominant Production Process Type: Pressure Die Casting.

- Key Drivers: Cost-efficiency for large-scale production, versatility in producing complex geometries, and maturity of the technology.

- Market Share: Expected to hold over 75% of the market in 2025.

- Dominant Raw Material: Aluminum.

- Key Drivers: Lightweighting requirements for fuel efficiency and EV range, excellent mechanical properties, and abundant supply.

- Market Share: Estimated at around 70% in 2025.

- Dominant Application Type: Engine Parts and Body Assembly.

- Key Drivers for Engine Parts: Thermal conductivity, strength, and resistance to high temperatures and pressures.

- Key Drivers for Body Assembly: Lightweighting for improved fuel efficiency and performance.

- Combined Market Share: Projected to exceed 60% in 2025.

India is emerging as a significant growth market, driven by its expanding automotive industry and increasing focus on domestic manufacturing. Japan and South Korea remain crucial, particularly in the production of high-precision components and specialized alloys for advanced automotive applications.

Asia Pacific Automotive Parts Die Casting Market Product Innovations

The Asia Pacific automotive parts die casting market is witnessing a wave of product innovations aimed at enhancing performance, reducing weight, and improving manufacturing efficiency. Advanced aluminum alloys with higher tensile strength and improved corrosion resistance are being developed for critical structural components. Innovations in magnesium alloy die casting are enabling further weight reduction for applications like steering wheel frames and seat frames. The development of near-net-shape casting techniques minimizes post-processing, leading to cost savings and reduced material waste. Furthermore, advancements in mold design and cooling systems are enabling faster cycle times and the production of more intricate part geometries. These innovations are crucial for meeting the evolving demands of the electric vehicle sector, where lightweighting and integrated component design are paramount. For example, novel die-cast battery enclosures are now achieving a weight reduction of up to 30% compared to traditional assemblies.

Propelling Factors for Asia Pacific Automotive Parts Die Casting Market Growth

Several key factors are propelling the growth of the Asia Pacific automotive parts die casting market. The relentless global push for lightweighting in vehicles to improve fuel efficiency and reduce emissions is a primary driver. The burgeoning electric vehicle (EV) market necessitates specialized lightweight components for battery systems, powertrains, and chassis. Supportive government policies across various Asia Pacific nations, encouraging domestic manufacturing and technological advancements in the automotive sector, play a significant role. Furthermore, the increasing per capita income and rising disposable incomes in emerging economies are boosting automotive sales, consequently driving demand for automotive parts. Advancements in die casting technologies, such as automation, precision tooling, and the use of advanced alloys, are enabling the production of higher quality and more complex parts, further stimulating market expansion. The cost-competitiveness of manufacturing in Asia Pacific also attracts global automotive players, creating sustained demand for die-cast components.

Obstacles in the Asia Pacific Automotive Parts Die Casting Market Market

Despite the robust growth, the Asia Pacific automotive parts die casting market faces several obstacles. Fluctuations in raw material prices, particularly for aluminum and magnesium, can impact profit margins and production costs. Stringent environmental regulations related to energy consumption and waste management in die casting processes can necessitate significant investment in compliance. Supply chain disruptions, as witnessed in recent global events, can affect the availability of raw materials and the timely delivery of finished products. Intense competition among a large number of players, including small and medium-sized enterprises, can lead to price pressures and reduce profitability. The skilled labor shortage in specialized die casting operations and the need for continuous upskilling to adapt to new technologies also present a challenge. Finally, geopolitical uncertainties and trade tensions can disrupt export markets and investment flows.

Future Opportunities in Asia Pacific Automotive Parts Die Casting Market

The Asia Pacific automotive parts die casting market is ripe with future opportunities. The continued growth of the electric vehicle (EV) segment presents a massive opportunity for lightweight structural components, battery housings, and motor parts. The increasing demand for advanced driver-assistance systems (ADAS) will drive the need for precisely die-cast sensor housings and electronic component enclosures. The development and adoption of sustainable die casting practices, including increased use of recycled materials and energy-efficient processes, will open new market avenues and cater to environmentally conscious consumers. The expansion of the automotive market in emerging economies within Southeast Asia and beyond offers significant untapped potential. Furthermore, advancements in Industry 4.0 technologies, such as AI-powered quality control and predictive maintenance in die casting operations, will create opportunities for enhanced efficiency and competitiveness. The development of novel alloys with superior properties will also unlock new application possibilities.

Major Players in the Asia Pacific Automotive Parts Die Casting Market Ecosystem

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Key Developments in Asia Pacific Automotive Parts Die Casting Market Industry

- 2023/11: SYX Die Casting announces significant expansion of its high-pressure die casting capacity to meet surging demand for EV components.

- 2024/01: GIBBS DIE CASTING GROUP invests in advanced vacuum die casting technology to enhance precision for complex automotive parts.

- 2024/03: ALUMINIUM DIE CASTING (CHINA) LTD secures a major long-term contract for aluminum die-cast structural components with a leading global OEM.

- 2024/05: Endurance Technologies Ltd reports a substantial increase in its revenue from the die-cast components segment, driven by the automotive industry's recovery.

- 2024/07: CASTWEL AUTOPARTS PVT LTD introduces a new line of lightweight magnesium alloy die-cast parts for automotive interiors.

Strategic Asia Pacific Automotive Parts Die Casting Market Market Forecast

The strategic Asia Pacific automotive parts die casting market forecast indicates robust and sustained growth, driven by the accelerating transition to electric vehicles and the continued emphasis on vehicle lightweighting for improved fuel efficiency. The forecast period (2025–2033) will witness an increased adoption of advanced die casting processes like vacuum and semi-solid die casting to meet the demand for high-precision, complex components. China will continue to dominate, but India and Southeast Asian nations will present significant growth opportunities. The market will benefit from ongoing technological innovations in alloy development and manufacturing automation, ensuring cost-competitiveness and superior product quality. Investments in sustainable practices and the circular economy will become increasingly important. The overall market is projected to expand at a CAGR of approximately 5.5%, reaching an estimated value of over $25,000 Million by 2033.

Asia Pacific Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Others

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Others

-

4. Countries

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Automotive Parts Die Casting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Asia Pacific Automotive Parts Die Casting Market

Asia Pacific Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Aluminium is Expected to Grow With Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Countries

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Asia Pacific Automotive Parts Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 3: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 5: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 7: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 8: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 10: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Automotive Parts Die Casting Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Asia Pacific Automotive Parts Die Casting Market?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Asia Pacific Automotive Parts Die Casting Market?

The market segments include Production Process Type, Raw Material, Application Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Aluminium is Expected to Grow With Highest CAGR.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence