Key Insights

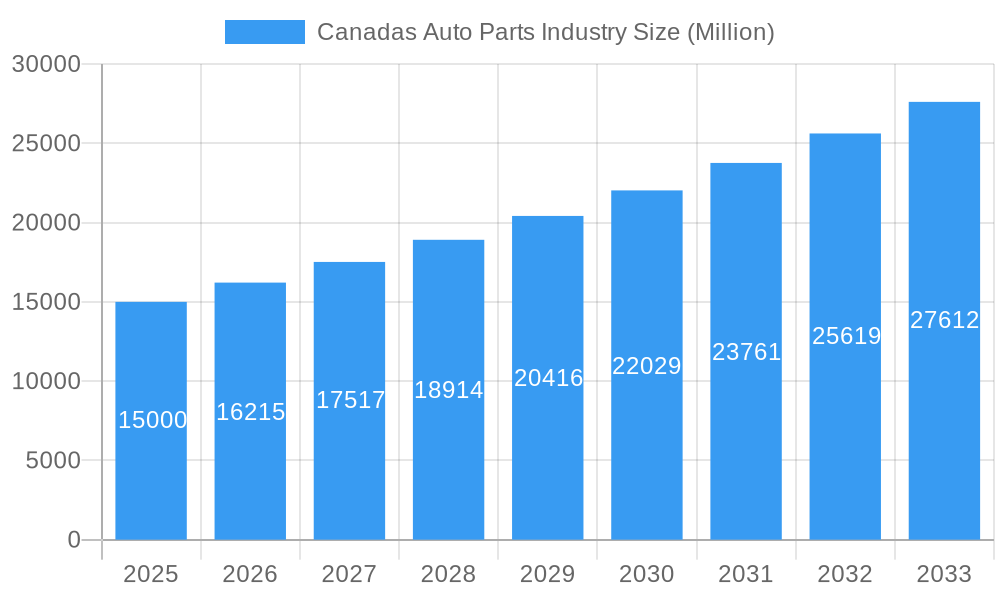

The Canadian auto parts industry is projected for robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 3.2%. Beginning in the base year of 2025, the market size is estimated at 16152.4 million. Key growth drivers include rising demand for lightweight, fuel-efficient components, notably aluminum and magnesium parts, propelled by stringent environmental regulations and evolving consumer preferences. The accelerating production of electric vehicles (EVs) and the consequent need for specialized EV components, such as battery housings and electric motor parts, are also critical catalysts. Innovations in pressure die casting and vacuum die casting technologies are enhancing manufacturing efficiency and precision, aligning with the automotive sector's high-quality standards.

Canadas Auto Parts Industry Market Size (In Billion)

Further market momentum is fueled by the integration of advanced materials and sophisticated manufacturing processes designed to reduce vehicle weight and enhance performance. The increasing complexity of vehicle systems, from advanced driver-assistance systems (ADAS) to sophisticated powertrain components, requires an agile and innovative auto parts supply chain. However, the industry navigates challenges such as volatile raw material prices, particularly for aluminum and magnesium, potential supply chain disruptions, global economic uncertainties, and significant capital investments for advanced manufacturing technologies. Despite these obstacles, the Canadian auto parts sector, with its established expertise in aluminum and zinc die casting and expanding applications in body assembly and engine components, is strategically positioned to leverage the global automotive market's transformation, with a particular emphasis on sustainable and high-performance solutions.

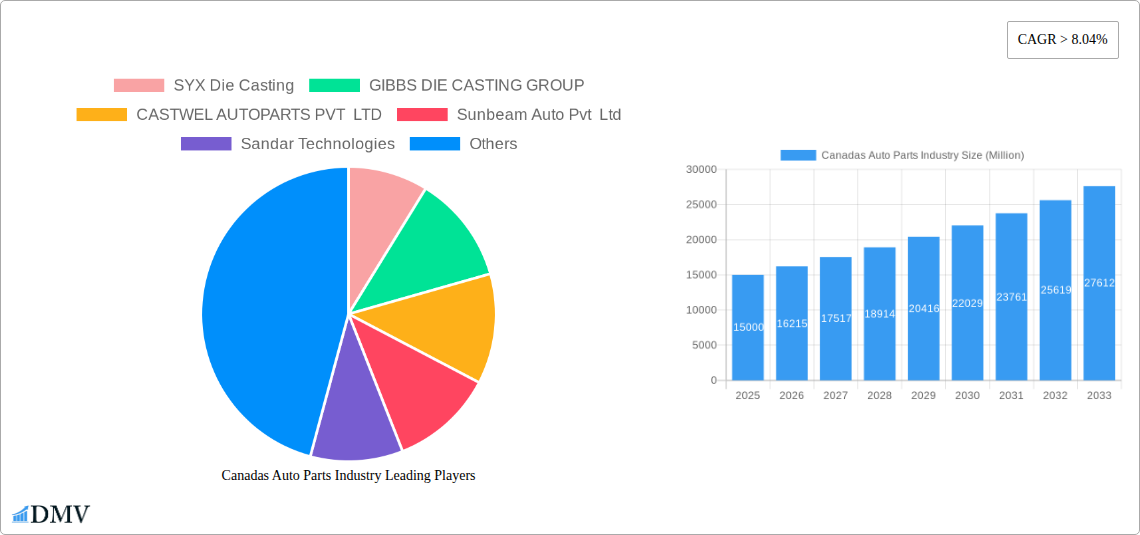

Canadas Auto Parts Industry Company Market Share

Canadas Auto Parts Industry Market Composition & Trends

This comprehensive report delves into the intricate market composition and evolving trends within Canada's dynamic auto parts industry. We analyze market concentration, identifying key players and their respective market share distributions, which are projected to witness significant shifts throughout the study period (2019–2033). Innovation catalysts, such as advancements in die casting technologies and the increasing demand for lightweight materials like aluminum and magnesium, are meticulously explored. The report also examines the regulatory landscapes influencing production and emissions standards, alongside the persistent threat of substitute products and the growing importance of sustainable manufacturing practices. End-user profiles, encompassing automotive manufacturers and aftermarket service providers, are detailed to understand their evolving needs. Furthermore, strategic Mergers & Acquisitions (M&A) activities are evaluated, providing insights into deal values and their impact on market consolidation and competitive dynamics within the Canadian automotive aftermarket. The report highlights how companies like SYX Die Casting and GIBBS DIE CASTING GROUP are strategically positioned to leverage these market forces.

- Market Share Distribution: Analysis of historical and projected market share for key segments and players.

- M&A Deal Values: Quantifiable insights into the financial impact and strategic rationale behind recent and anticipated M&A activities.

- Innovation Drivers: Identification of technologies and materials, such as high-pressure die casting and advanced alloys, pushing industry boundaries.

- Regulatory Impact: Assessment of government policies and their influence on manufacturing processes and product development.

- End-User Demand: Characterization of current and future needs of major automotive OEMs and aftermarket sectors.

Canadas Auto Parts Industry Industry Evolution

The evolution of Canada's auto parts industry is a compelling narrative of adaptation, innovation, and strategic growth, meticulously tracked from 2019 through 2033, with a foundational analysis anchored in the base year of 2025. This report unravels the intricate market growth trajectories, showcasing a steady upward trend driven by both domestic demand and export opportunities. Technological advancements stand as a cornerstone of this evolution, with a particular emphasis on the sophisticated production processes like pressure die casting, vacuum die casting, squeeze die casting, and semi-solid die casting. These advanced methods are crucial for manufacturing intricate components for engine parts, transmission parts, and body assembly, meeting the stringent quality and performance requirements of modern vehicles. Shifting consumer demands, characterized by a growing preference for fuel-efficient vehicles, electric mobility, and advanced safety features, are profoundly reshaping the industry's product portfolio. The adoption metrics for new technologies, such as the increasing integration of lightweight materials like aluminum and magnesium in automotive manufacturing, are meticulously documented, highlighting a significant shift away from traditional heavier materials. The industry's growth rate, projected to maintain a healthy pace in the coming years, is underpinned by substantial investments in research and development and the continuous pursuit of operational efficiencies. Companies such as CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, and Sandar Technologies are actively participating in this evolutionary phase, investing in advanced manufacturing capabilities and exploring new material applications to stay competitive. The industry's ability to respond to these evolving demands, coupled with a commitment to sustainable practices, will define its long-term success and its contribution to the broader Canadian economy.

Leading Regions, Countries, or Segments in Canadas Auto Parts Industry

The Canadian auto parts industry exhibits distinct leadership across various segments, with Pressure Die Casting emerging as a dominant production process type. This segment's supremacy is fueled by its efficiency, precision, and cost-effectiveness in producing complex automotive components. The extensive use of aluminum as a primary raw material further solidifies its leading position, owing to its lightweight properties, corrosion resistance, and recyclability, making it ideal for enhancing fuel efficiency and reducing vehicle emissions. Consequently, Engine Parts and Body Assembly represent the application types experiencing the most significant growth and investment within this leading segment.

Dominant Production Process: Pressure Die Casting

- Key Drivers: High production volumes, intricate part complexity capabilities, excellent surface finish, and cost-efficiency for mass production.

- Investment Trends: Significant capital expenditure in high-tonnage die-casting machines and advanced automation to meet OEM demands for lightweight and high-strength components.

- Regulatory Support: Favorable policies promoting advanced manufacturing and lightweighting initiatives.

- Technological Advancements: Continuous innovation in die design, material flow simulation, and post-casting treatments enhancing performance and durability.

Dominant Raw Material: Aluminum

- Key Drivers: Growing demand for lightweighting to meet stringent fuel economy standards and reduce carbon footprints. Superior strength-to-weight ratio compared to traditional materials. Excellent recyclability contributing to sustainability goals.

- Industry Adoption: Widespread adoption across engine blocks, cylinder heads, chassis components, and body panels.

- Supply Chain Dynamics: Robust domestic and international aluminum supply chains, ensuring consistent availability for manufacturers.

Leading Application Types: Engine Parts & Body Assembly

- Engine Parts: Demand driven by the need for more efficient, compact, and emissions-compliant engine components, often utilizing advanced die-casting techniques for complex geometries.

- Body Assembly: Increasing use of large, single-piece castings (giga castings) for body structures, simplifying assembly, reducing weight, and improving structural integrity.

- Market Trends: Shift towards electric vehicle (EV) powertrain components and advanced driver-assistance systems (ADAS) integration, creating new opportunities within these application types.

The dominance of Pressure Die Casting, fueled by Aluminum and catering to Engine Parts and Body Assembly, creates a powerful synergy within the Canadian auto parts industry, driving innovation and market growth. Companies like ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc, and Endurance Technologies Ltd are pivotal players in this landscape, leveraging these strengths to meet the evolving demands of the automotive sector.

Canadas Auto Parts Industry Product Innovations

The Canadian auto parts industry is a hotbed of product innovation, driven by the relentless pursuit of enhanced performance, reduced weight, and improved sustainability. Advanced die casting techniques, including vacuum die casting and semi-solid die casting, are enabling the creation of increasingly complex and lighter components for engine parts, transmission parts, and body assembly. For instance, the development of intricate aluminum engine blocks using pressure die casting significantly reduces vehicle weight, boosting fuel efficiency. Innovations in magnesium alloy casting are yielding even lighter yet robust chassis components. These advancements, coupled with novel thermal processing methods, are yielding parts with superior mechanical properties and extended lifespans, offering unique selling propositions and solidifying Canada's position as a leader in automotive component manufacturing.

Propelling Factors for Canadas Auto Parts Industry Growth

Several key factors are propelling the growth of Canada's auto parts industry.

- Technological Advancements: Continued investment in advanced die casting technologies like giga casting and automated production lines enhances efficiency and enables the manufacturing of complex, lightweight components.

- Demand for Lightweighting: Stringent fuel economy regulations and the increasing adoption of electric vehicles necessitate the use of lighter materials such as aluminum and magnesium, driving demand for specialized die-cast parts.

- Government Support & Investment: Incentives for advanced manufacturing, research and development, and the establishment of new production facilities, such as Linamar Corporation's giga casting plant, provide a strong growth impetus.

- Strategic Partnerships: Collaborations between established automotive suppliers and technology companies, like the Rheinmetall AG and Xiaomi venture, foster innovation and open new market avenues.

Obstacles in the Canadas Auto Parts Industry Market

Despite its robust growth, the Canadian auto parts industry faces several significant obstacles.

- Supply Chain Volatility: Global disruptions, geopolitical tensions, and fluctuating raw material prices (aluminum, zinc, magnesium) can lead to production delays and increased costs.

- Intensifying Global Competition: Intense competition from lower-cost manufacturing regions poses a continuous challenge to maintaining market share and pricing power.

- Skilled Labor Shortages: A persistent shortage of skilled labor in advanced manufacturing and specialized die casting operations can hinder expansion and technological adoption.

- Evolving Regulatory Landscape: Increasingly stringent environmental regulations and safety standards require continuous investment in compliance and process upgrades, adding to operational expenses.

Future Opportunities in Canadas Auto Parts Industry

The Canadian auto parts industry is poised to capitalize on several emerging opportunities.

- Electric Vehicle (EV) Component Manufacturing: The accelerating global shift towards EVs presents a substantial opportunity for specialized components, including battery housings, motor components, and thermal management systems, all of which can leverage advanced die casting techniques.

- Advanced Lightweight Materials: Continued research and development into novel aluminum, magnesium, and composite alloys will open doors for innovative applications in structural components and performance parts.

- Circular Economy Initiatives: Increased focus on sustainability and recyclability creates opportunities for companies offering end-of-life solutions for automotive parts and utilizing recycled materials in production.

- Smart Manufacturing and Industry 4.0: The adoption of AI, IoT, and automation in production processes can lead to significant efficiency gains, improved quality control, and the development of predictive maintenance solutions.

Major Players in the Canadas Auto Parts Industry Ecosystem

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Key Developments in Canadas Auto Parts Industry Industry

- May 2023: Linamar Corporation announced plans for a significant expansion with a new giga casting facility in Welland, Ontario. This approximately 300,000 square foot plant is expected to create around 200 jobs and will be equipped with three 6,100-ton high-pressure die-cast machines, with the first installation slated for January 2024, signaling a major investment in large-scale casting capabilities.

- April 2023: Rheinmetall AG and Xiaomi formed a strategic partnership focused on the manufacturing of triangular beams for suspension strut mountings and assembly plates. Production, scheduled to commence in 2024, will employ high-pressure die casting and specialized thermal processing techniques. This collaboration will be managed by Rheinmetall's Castings business unit, a joint venture with SAIC group subsidiary HUAYU Automotive Systems (HASCO), highlighting cross-industry alliances and advanced manufacturing integration.

Strategic Canadas Auto Parts Industry Market Forecast

The strategic forecast for Canada's auto parts industry indicates robust growth driven by the increasing demand for lightweight components, advanced manufacturing processes like high-pressure die casting, and the burgeoning electric vehicle market. The significant investments in giga casting facilities and collaborative ventures in advanced materials and production techniques are poised to enhance competitiveness and expand market reach. Furthermore, a growing emphasis on sustainability and the circular economy will unlock new avenues for innovation and specialized manufacturing. These converging factors position the Canadian auto parts industry for sustained expansion and leadership in the global automotive supply chain.

Canadas Auto Parts Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Materials

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Applications

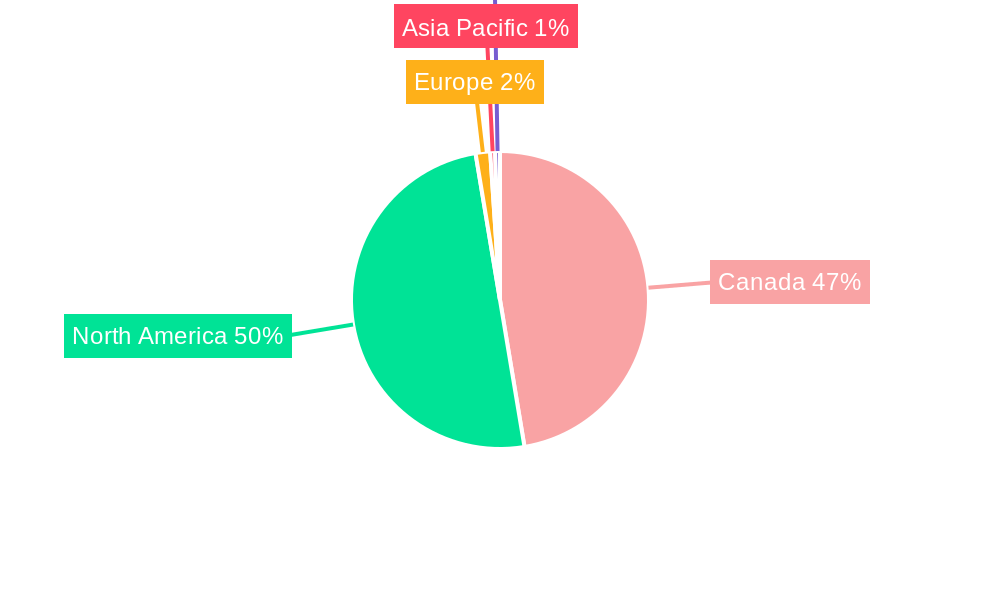

Canadas Auto Parts Industry Segmentation By Geography

- 1. Canada

Canadas Auto Parts Industry Regional Market Share

Geographic Coverage of Canadas Auto Parts Industry

Canadas Auto Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Segment will Drive The Market In Coming Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canadas Auto Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Canadas Auto Parts Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canadas Auto Parts Industry Share (%) by Company 2025

List of Tables

- Table 1: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canadas Auto Parts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 6: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 7: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canadas Auto Parts Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadas Auto Parts Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Canadas Auto Parts Industry?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Canadas Auto Parts Industry?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16152.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Automotive Segment will Drive The Market In Coming Year.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

May 2023: Linamar Corporation unveiled plans for a cutting-edge giga casting facility in Welland, Ontario. Spanning approximately 300,000 square feet, the plant will create employment for around 200 workers. The facility will house three 6,100-ton high-pressure die-cast machines, with the first installation scheduled for January 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadas Auto Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadas Auto Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadas Auto Parts Industry?

To stay informed about further developments, trends, and reports in the Canadas Auto Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence