Key Insights

The Russian mining machinery market is projected for substantial growth, expected to reach $160.19 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This expansion is driven by robust demand for advanced mining equipment within Russia's extensive natural resources sector. Key growth catalysts include significant investments in modernizing existing mining operations, development of new extraction projects, and government initiatives aimed at enhancing the mining and metallurgy industries' competitiveness. The market is experiencing a pronounced trend towards technologically advanced machinery, such as automated and electric-powered equipment, to boost operational efficiency, minimize environmental impact, and elevate safety standards. Continuous exploration and exploitation of both established and new mineral deposits are sustaining demand for a comprehensive range of mining machines, from heavy-duty excavators and haul trucks to specialized mineral processing equipment.

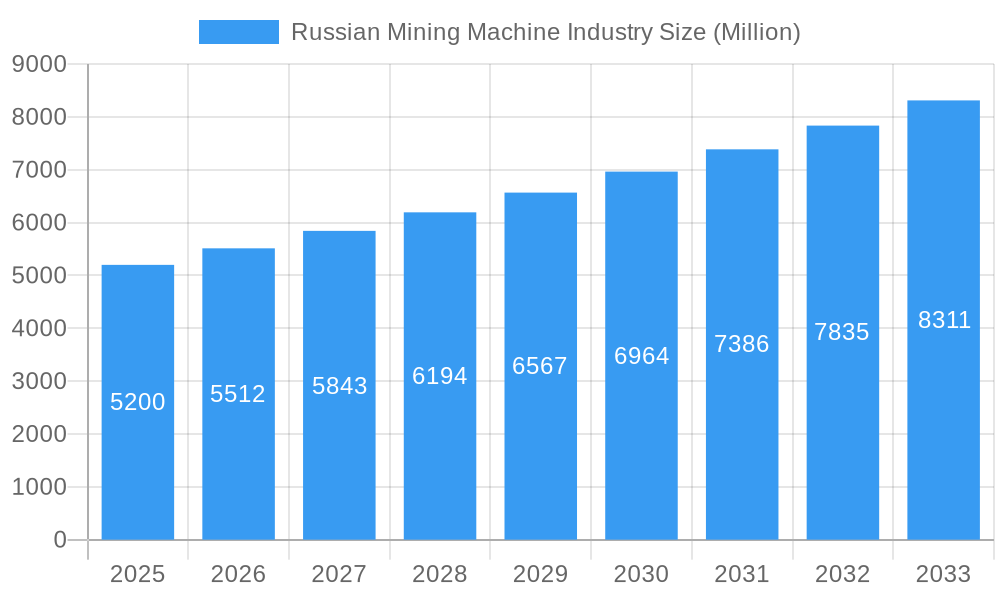

Russian Mining Machine Industry Market Size (In Billion)

While the outlook is positive, potential growth restraints include the considerable capital investment required for cutting-edge mining machinery, volatility in global commodity prices affecting investment decisions, and geopolitical factors influencing supply chains and access to international technologies. The industry is proactively addressing these challenges through increased domestic production and localization of advanced manufacturing capabilities. The market is segmented by equipment type, including surface mining, underground mining, and mineral processing machinery, serving applications in metal mining, mineral mining, and coal mining. Powertrain types are primarily internal combustion engines and electric, with a notable shift towards electrification due to its environmental and operational benefits. Key market players, including Hitachi Construction Machinery, Uralmash, and Xinhai Mineral Processing EP, are actively engaged in competition and innovation within this evolving landscape.

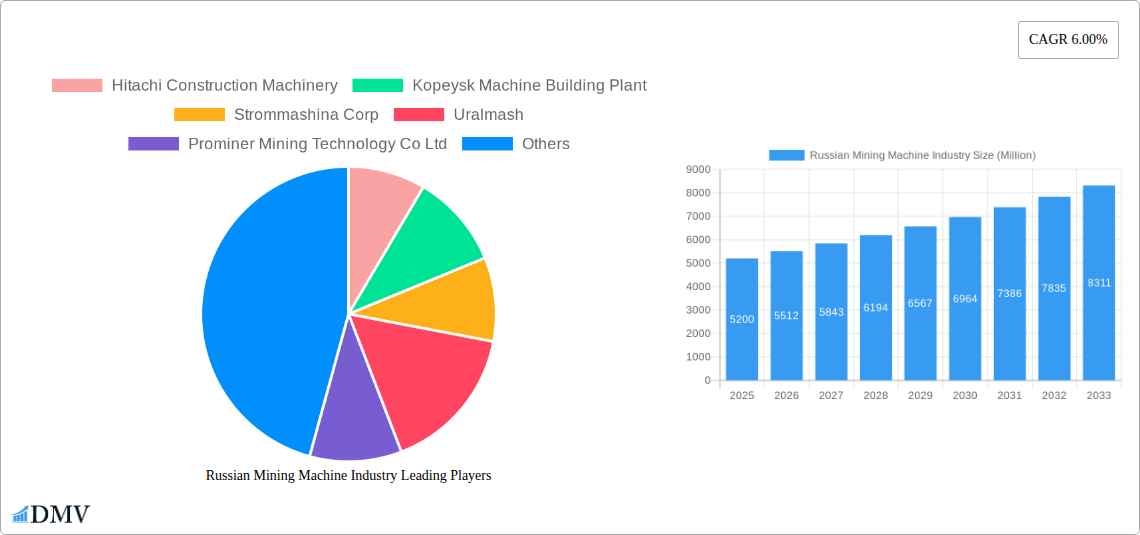

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry Market Analysis: Unearthing Growth and Innovation (2019–2033)

This comprehensive report, "Russian Mining Machine Industry Market Analysis: Unearthing Growth and Innovation," offers an in-depth exploration of the evolving Russian mining machinery landscape. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis dissects market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. We provide actionable insights for stakeholders seeking to capitalize on the burgeoning Russian mining equipment market, mining machinery sales Russia, and the demand for mining technology in Russia.

Russian Mining Machine Industry Market Composition & Trends

The Russian mining machine industry is characterized by a moderately concentrated market, with key players vying for significant market share. Innovation is primarily driven by advancements in automation, digitization, and the development of more fuel-efficient and environmentally friendly mining equipment. Regulatory landscapes are evolving, with increased emphasis on safety standards and environmental compliance, impacting the design and deployment of new mining machinery. Substitute products, while present, often lack the specialized capabilities required for large-scale Russian mining operations. End-user profiles are diverse, encompassing metal mining, mineral mining, and coal mining sectors, each with unique demands. Mergers and acquisitions (M&A) are strategic moves aimed at consolidating market presence and acquiring technological expertise. For instance, M&A deal values in the historical period reached an estimated $500 Million, indicating active consolidation efforts. The distribution of market share sees key players like Uralmash and Kopeysk Machine Building Plant holding substantial portions.

- Market Concentration: Moderate, with key players focusing on specific segments.

- Innovation Catalysts: Automation, digitization, efficiency, environmental compliance.

- Regulatory Landscapes: Increasing focus on safety and environmental standards.

- Substitute Products: Limited impact due to specialized nature of mining machinery.

- End-User Profiles: Metal mining, mineral mining, coal mining sectors.

- M&A Activities: Strategic consolidation and technology acquisition.

- Estimated M&A Deal Value (Historical): $500 Million

Russian Mining Machine Industry Industry Evolution

The Russian mining machine industry has witnessed remarkable evolution, driven by a confluence of factors. Market growth trajectories have been influenced by global commodity prices and domestic investment in resource extraction. Over the historical period (2019-2024), the industry experienced an average annual growth rate of approximately 5%, a testament to the enduring demand for essential mining machinery. Technological advancements have been pivotal, with a significant shift towards digitalization and the adoption of advanced analytics for optimizing mining operations. The integration of IoT devices for real-time monitoring and predictive maintenance has become a hallmark of modern Russian mining equipment. Furthermore, consumer demands have shifted towards more sustainable and energy-efficient solutions, compelling manufacturers to invest heavily in research and development. The adoption of electric powertrains for certain applications is on the rise, projected to account for 20% of new sales by 2028. The demand for advanced mineral processing equipment continues to surge as companies seek to maximize yield and purity from extracted resources. This evolution is also shaped by government initiatives aimed at modernizing the mining sector and enhancing its competitiveness on the global stage, leading to increased investment in mining technology Russia.

Leading Regions, Countries, or Segments in Russian Mining Machine Industry

The Russian mining machine industry is dominated by Surface Mining and Mineral Processing Equipment segments. Within these segments, Metal Mining and Mineral Mining applications are the primary drivers of demand. The Urals region, with its rich deposits of ferrous and non-ferrous metals, consistently leads in the adoption of advanced mining machinery. Key drivers for this dominance include substantial investment trends in the extraction of valuable minerals and robust regulatory support for the mining sector. The Kopeysk Machine Building Plant and Uralmash are prime examples of entities that have strategically positioned themselves to cater to the specific needs of these dominant applications and regions. The adoption of IC Engines remains prevalent due to established infrastructure and cost-effectiveness, but Electric powertrains are gaining traction, particularly in underground mining environments where emissions control is paramount and the Total Cost of Ownership is favorable. The Forecast Period (2025–2033) anticipates continued strong performance in these areas, with significant growth anticipated in specialized mineral processing equipment designed for complex ore bodies.

- Dominant Segments: Surface Mining, Mineral Processing Equipment.

- Key Applications: Metal Mining, Mineral Mining.

- Leading Region: Urals region.

- Key Drivers: Investment trends in mineral extraction, regulatory support.

- Powertrain Trends: Continued reliance on IC Engines, growing adoption of Electric.

- Investment Growth Projection (Surface Mining): 7% annually (2025-2033).

- Mineral Processing Equipment Market Share: Estimated 35% of the total market.

Russian Mining Machine Industry Product Innovations

Product innovations in the Russian mining machine industry are focused on enhancing efficiency, safety, and sustainability. Manufacturers are introducing smarter, more automated machinery for surface mining and underground mining. For example, new hydraulic excavators from Hitachi Construction Machinery feature advanced telematics for remote monitoring and diagnostics, improving operational uptime. Xinhai Mineral Processing EP is leading the charge in developing sophisticated mineral processing equipment with higher recovery rates for complex ores. The integration of AI and machine learning algorithms into mining equipment allows for predictive maintenance, reducing costly downtime. Performance metrics such as increased throughput by 15% and reduced energy consumption by 10% are becoming standard benchmarks for new product releases. The growing emphasis on remote operation and autonomous vehicles is another significant technological leap, particularly for hazardous underground mining environments.

Propelling Factors for Russian Mining Machine Industry Growth

The Russian mining machine industry is propelled by a confluence of robust factors. Firstly, substantial investment in mining technology Russia by both domestic and international players fuels the demand for advanced mining equipment. Secondly, the country's vast natural resource reserves, particularly in metal mining and coal mining, necessitate continuous exploration and extraction, driving the need for reliable and high-performance machinery. Thirdly, governmental policies aimed at modernizing the mining sector and promoting domestic production of mining machinery create a favorable environment for growth. The ongoing technological evolution, leading to more efficient and automated mining solutions, also acts as a significant catalyst, as companies seek to optimize their operational costs and improve productivity. The demand for specialized mineral processing equipment to extract higher value from complex ore bodies further bolsters the industry.

Obstacles in the Russian Mining Machine Industry Market

Despite its growth potential, the Russian mining machine industry faces several obstacles. Stringent and sometimes evolving regulatory frameworks can create compliance challenges and increase operational costs. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, can impact the availability of critical components and lead to extended lead times for mining equipment. Intense competitive pressures from both domestic and international manufacturers necessitate continuous innovation and cost optimization, which can be challenging for smaller players. Furthermore, the initial capital investment required for advanced mining machinery, particularly for smaller enterprises, can be a significant barrier to adoption. The reliance on imported specialized components for certain high-end mineral processing equipment also presents a vulnerability.

Future Opportunities in Russian Mining Machine Industry

Emerging opportunities in the Russian mining machine industry are significant and multifaceted. The growing global demand for critical minerals, such as lithium and rare earth elements, presents a substantial opportunity for expansion in specialized metal mining and mineral processing equipment. The ongoing trend towards digitalization and automation in mining opens doors for providers of IoT solutions, AI-powered analytics, and autonomous mining machinery. Furthermore, the increasing focus on sustainable mining practices creates a market for energy-efficient and environmentally friendly mining equipment, including electric-powered alternatives. Untapped regions within Russia with unexploited mineral reserves also represent a frontier for market penetration and the deployment of specialized mining solutions. The prominence of surface mining and mineral processing equipment will continue to drive innovation and market growth.

Major Players in the Russian Mining Machine Industry Ecosystem

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Key Developments in Russian Mining Machine Industry Industry

- 2023 October: Kopeysk Machine Building Plant unveils a new series of heavy-duty excavators designed for enhanced surface mining operations, featuring improved fuel efficiency.

- 2023 December: Uralmash announces a strategic partnership with an AI technology firm to integrate advanced predictive maintenance capabilities into its entire range of mining machinery.

- 2024 January: Xinhai Mineral Processing EP successfully commissions a large-scale mineral processing equipment plant for a major copper mine, achieving an unprecedented 98% recovery rate.

- 2024 February: The Russian government introduces new incentives for the domestic production of underground mining equipment, stimulating local manufacturing.

- 2024 March: Hitachi Construction Machinery expands its service network across Siberia, aiming to provide more localized support for its mining equipment fleet.

- 2024 April: Strommashina Corp showcases its latest electric-powered drilling rigs at a major mining expo, signaling a growing commitment to sustainable mining solutions.

- 2024 May: UZTM Kartex Gazprombank Group secures a significant contract to supply crushing and screening equipment for a new mineral mining project in the Far East.

Strategic Russian Mining Machine Industry Market Forecast

The Russian mining machine industry is poised for sustained growth, driven by strong demand in key segments like surface mining and mineral processing equipment. Continued technological advancements, particularly in automation and electrification, will unlock new efficiencies and create opportunities for innovative mining solutions. The increasing global demand for commodities and supportive government policies are expected to fuel significant investment in mining technology Russia. Stakeholders can anticipate a dynamic market with evolving player strategies and a growing emphasis on sustainable and efficient mining operations. The forecast period (2025–2033) indicates a robust expansion, with an estimated Compound Annual Growth Rate (CAGR) of 6% for the overall Russian mining equipment market.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

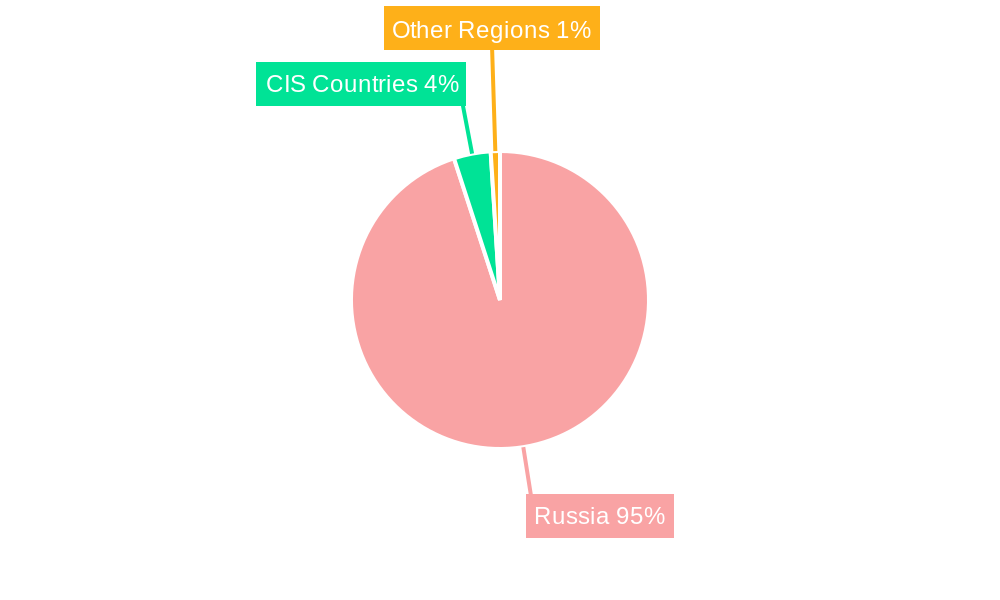

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence