Key Insights

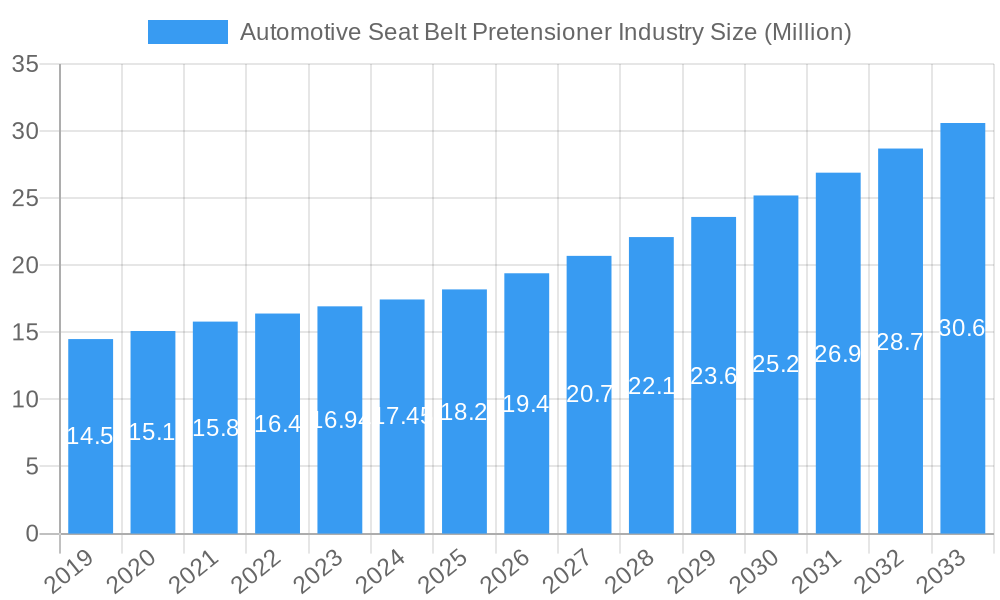

The global Automotive Seat Belt Pretensioner market is projected for robust expansion, currently valued at $16.94 million, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.78% through 2033. This sustained growth is primarily propelled by increasing global vehicle production, a heightened awareness of automotive safety standards, and stringent government regulations mandating advanced restraint systems. The rising demand for passenger cars and commercial vehicles, especially in emerging economies, further fuels market expansion. Technological advancements, such as the development of more sophisticated and lighter pretensioner mechanisms like buckle pretensioners, are also key drivers, enhancing their adoption by Original Equipment Manufacturers (OEMs). The aftermarket segment also presents significant opportunities as vehicles age and require component replacements.

Automotive Seat Belt Pretensioner Industry Market Size (In Million)

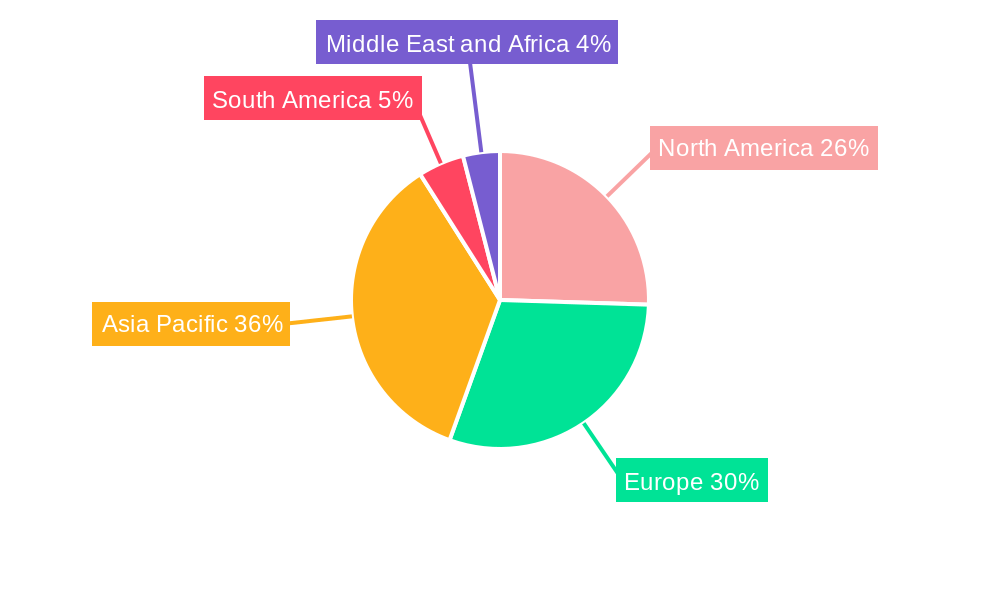

The market exhibits a strong influence from evolving vehicle architectures and the integration of smart safety features. While growth is evident, the market is not without its challenges. High manufacturing costs associated with precision engineering and the need for rigorous testing can present a restraint. However, innovation in materials and manufacturing processes is expected to mitigate some of these cost pressures. Geographically, the Asia Pacific region, particularly China and India, is emerging as a dominant force due to its massive automotive manufacturing base and burgeoning consumer market. North America and Europe continue to be significant markets, driven by established automotive industries and a mature focus on vehicle safety. Key players like Autoliv Inc., Continental AG, and Joyson Safety Systems are at the forefront, investing in research and development to introduce next-generation pretensioner systems that offer improved performance and occupant protection.

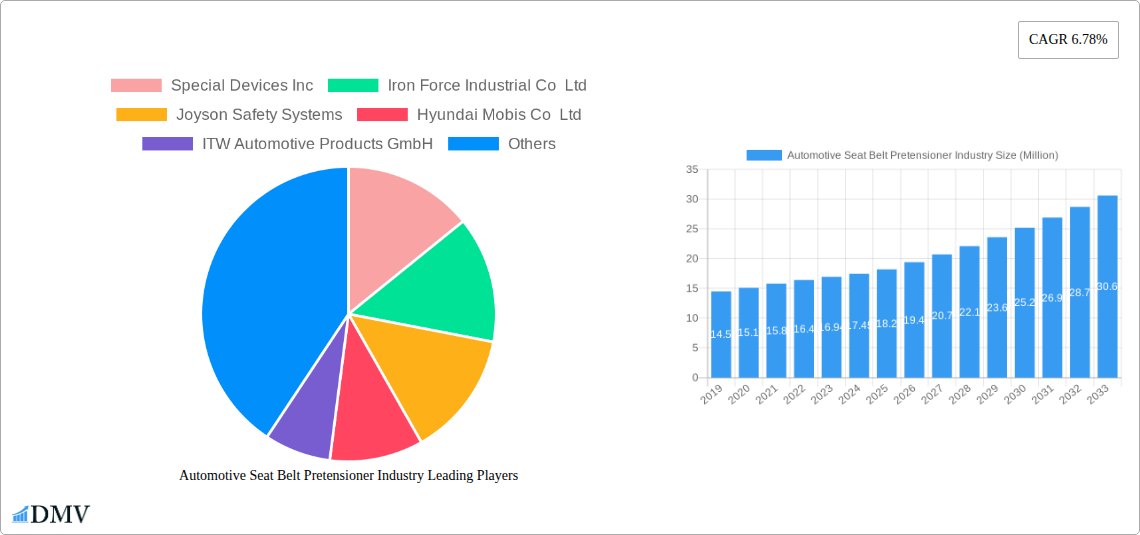

Automotive Seat Belt Pretensioner Industry Company Market Share

Dive into the critical automotive seat belt pretensioner market with our comprehensive report. Spanning from 2019 to 2033, this study offers unparalleled insights into market dynamics, technological advancements, and strategic growth avenues. Based on 2025 as the base and estimated year, with a robust forecast period from 2025 to 2033 and historical data from 2019–2024, this report is essential for stakeholders seeking to navigate the evolving landscape of automotive safety. Discover market size, key trends, competitive strategies, and future projections for automotive safety systems.

Automotive Seat Belt Pretensioner Industry Market Composition & Trends

The automotive seat belt pretensioner industry exhibits a moderate market concentration, driven by a select group of influential players and a growing emphasis on vehicular safety. Innovation is a key catalyst, with continuous research and development aimed at enhancing pretensioner performance, reliability, and integration into advanced vehicle architectures. The regulatory landscape plays a pivotal role, with stringent safety mandates from global automotive safety bodies like NHTSA and Euro NCAP compelling manufacturers to adopt and improve these critical passive safety components. The market is characterized by the dominance of retractor pretensioners and buckle pretensioners, catering to both front and rear seats in passenger cars and commercial vehicles. End-users are primarily OEMs, with a burgeoning aftermarket segment for replacement and upgrade solutions. Mergers and acquisitions (M&A) activities, though not consistently high, often involve strategic consolidation to gain market share or acquire innovative technologies. The total M&A deal value in the historical period is estimated to be around $500 Million.

- Market Share Distribution: Leading companies hold significant portions, with the top 5 players accounting for approximately 60% of the market share in 2025.

- Innovation Catalysts: Focus on lighter materials, faster actuation times, and integration with occupant detection systems.

- Regulatory Landscape: Increasing stringency of crash safety standards worldwide.

- Substitute Products: While no direct substitutes exist for the core function, advanced airbag systems and active seatbelt technologies offer complementary safety enhancements.

- End-User Profiles: OEMs demand high-volume, cost-effective, and technologically advanced solutions, while aftermarket caters to specialized needs and older vehicle models.

- M&A Activities: Strategic acquisitions to enhance product portfolios and expand geographical reach.

Automotive Seat Belt Pretensioner Industry Industry Evolution

The automotive seat belt pretensioner industry has undergone a significant transformation, evolving from basic mechanical devices to sophisticated pyrotechnic and stored-energy systems integral to modern vehicle safety. The market growth trajectory has been consistently upward, fueled by increasing global vehicle production, stricter automotive safety regulations, and a heightened consumer awareness regarding road safety. Over the historical period (2019–2024), the market witnessed a Compound Annual Growth Rate (CAGR) of approximately 5.5%, driven by substantial investments in research and development by major automotive suppliers. Technological advancements have been rapid, moving from single-stage pretensioners to multi-stage systems that can adjust tension based on impact severity. The adoption of advanced pretensioner technologies, such as electronic pretensioners and those integrated with pre-crash sensing systems, is steadily increasing, with an estimated adoption rate of 30% in new passenger vehicles by 2025. Shifting consumer demands for enhanced occupant protection, particularly in the face of rising accident rates and the increasing complexity of vehicle interiors, have further propelled the market. The focus is shifting from mere compliance to proactive safety solutions. The total market revenue for automotive seat belt pretensioners is projected to reach $8,000 Million in 2025, with a projected CAGR of 6.2% during the forecast period (2025–2033). This growth is supported by the increasing integration of these systems across all vehicle segments, from compact cars to heavy-duty commercial vehicles. The evolution of seat belt pretensioner technology also reflects the broader automotive trend towards smarter, more integrated safety systems. Early pretensioners were primarily focused on arresting forward motion during a frontal collision. However, modern systems are designed to manage a wider range of impact scenarios, including side impacts and rollovers, by working in conjunction with other passive and active safety features. The development of lightweight and compact pretensioner units has also been crucial, allowing for easier integration into increasingly confined vehicle spaces without compromising interior design or occupant comfort. Furthermore, the drive towards electric vehicles (EVs) presents new opportunities and challenges. While the fundamental need for seat belt pretensioners remains, the integration within EV architectures, particularly concerning battery placement and structural designs, requires tailored solutions. The industry's ability to adapt to these evolving vehicle platforms will be a key determinant of future growth.

Leading Regions, Countries, or Segments in Automotive Seat Belt Pretensioner Industry

The automotive seat belt pretensioner industry is witnessing significant activity and dominance across various geographical regions and market segments. Asia-Pacific, particularly China and Japan, has emerged as the leading region, driven by its colossal automotive manufacturing base and increasing vehicle penetration rates. The Technology segment is characterized by the strong demand for retractor pretensioners, which account for an estimated 70% of the market share due to their widespread application in both front and rear seating positions. However, buckle pretensioners are gaining traction, especially in applications requiring more precise occupant restraint. In terms of Seat Type, front seats consistently represent the larger market segment, holding approximately 65% of the share, owing to their critical role in occupant safety during frontal collisions. Nevertheless, the demand for advanced pretensioners in rear seats is growing, driven by evolving safety standards for all occupants. The Vehicle Type segment is dominated by passenger cars, which constitute an estimated 80% of the market. However, the commercial vehicles segment is experiencing robust growth, spurred by increasing safety regulations for fleet operators and professional drivers. The End-user Type segment sees OEMs as the primary consumers, accounting for around 90% of the market demand. The aftermarket segment, while smaller, is crucial for vehicle maintenance and upgrades.

- Dominant Region: Asia-Pacific, fueled by China's massive automotive production and strong domestic demand for safety features.

- Key Drivers in Asia-Pacific:

- Investment Trends: Significant investments by both global and local automotive manufacturers in production facilities and R&D.

- Regulatory Support: Government initiatives promoting vehicle safety standards and domestic manufacturing of automotive components.

- Growing Middle Class: Increased purchasing power leading to higher demand for vehicles equipped with advanced safety features.

- Dominant Technology: Retractor Pretensioners are the most prevalent due to their established reliability and cost-effectiveness across a wide range of vehicle applications.

- Dominant Seat Type: Front seats receive priority due to the higher risk of injury in frontal impacts and stricter regulations concerning driver and front passenger safety.

- Dominant Vehicle Type: Passenger cars represent the largest volume due to their sheer numbers in global car parc.

- Dominant End-user Type: OEMs dictate market demand through their vehicle designs and specifications, driving large-scale procurement of pretensioner systems.

Automotive Seat Belt Pretensioner Industry Product Innovations

Product innovation in the automotive seat belt pretensioner industry is focused on enhancing occupant safety and integration capabilities. Innovations include the development of pyrotechnic pretensioners with variable force control, allowing for a more tailored response to different impact severities and occupant sizes. Furthermore, the integration of electronic control units (ECUs) with pretensioner systems enables pre-emptive activation based on sensor data, offering a proactive safety approach. Advances in material science are leading to lighter and more compact pretensioner designs, facilitating easier integration into complex vehicle architectures without compromising interior space or aesthetics. The focus is also on improving the reliability and longevity of these components, ensuring their effectiveness throughout the vehicle's lifespan.

Propelling Factors for Automotive Seat Belt Pretensioner Industry Growth

The automotive seat belt pretensioner industry is propelled by a confluence of powerful factors. Foremost among these is the stringent and continuously evolving global automotive safety regulations, mandating higher levels of occupant protection. Technological advancements, including the development of more sophisticated and efficient pretensioner mechanisms, alongside the increasing integration of these systems with advanced driver-assistance systems (ADAS) and pre-crash sensing technology, act as significant growth catalysts. The rising global vehicle production, particularly in emerging economies, directly translates into increased demand for safety components. Furthermore, a growing consumer awareness and preference for vehicles equipped with advanced safety features, driven by media coverage and personal experiences, fuels the demand for superior occupant protection systems. The economic growth in many regions also contributes to increased vehicle affordability and, consequently, a larger market for vehicles equipped with these vital safety devices.

Obstacles in the Automotive Seat Belt Pretensioner Industry Market

Despite robust growth, the automotive seat belt pretensioner industry faces several obstacles. The high cost of advanced pretensioner systems, particularly those with electronic controls and variable force capabilities, can be a barrier for some vehicle segments and price-sensitive markets. Supply chain disruptions, as witnessed during recent global events, can impact the availability and cost of raw materials and critical components, leading to production delays and increased expenses. The complexity of manufacturing and the need for highly specialized expertise can also pose challenges for new market entrants. Furthermore, the stringent and lengthy certification processes for automotive safety components can slow down the introduction of new technologies. Intense competition among established players and the constant pressure to innovate while maintaining competitive pricing can also be a restraint.

Future Opportunities in Automotive Seat Belt Pretensioner Industry

The automotive seat belt pretensioner industry is poised for significant future opportunities. The increasing penetration of electric vehicles (EVs) presents a unique opportunity for developing tailored pretensioner solutions that can be integrated with EV-specific structural designs and safety architectures. The continued rise of autonomous driving technology, while seemingly reducing the need for driver intervention, actually increases the importance of robust occupant restraint systems to manage unexpected situations. Emerging markets with rapidly growing automotive sectors and developing safety regulations offer substantial untapped potential. Furthermore, the integration of smart technologies, such as seat belt reminder systems with advanced diagnostics and personalized tension adjustments based on occupant biometrics, opens new avenues for innovation and value creation. The aftermarket segment also offers growth potential as older vehicles require component replacements.

Major Players in the Automotive Seat Belt Pretensioner Industry Ecosystem

- Special Devices Inc

- Iron Force Industrial Co Ltd

- Joyson Safety Systems

- Hyundai Mobis Co Ltd

- ITW Automotive Products GmbH

- Tokai Rika Co Ltd

- Hasco Co Ltd

- Continental AG

- Autoliv Inc

- Ashimori Industry Co Ltd

- ZF Friedrichshafen AG

Key Developments in Automotive Seat Belt Pretensioner Industry Industry

- November 2023: Honda Motors initiated a recall of 300,000 Accord and HR-V vehicles due to a missing component in the front seat belt pretensioners, highlighting assembly quality concerns and the critical nature of every part.

- May 2021: Continental Engineering Services announced a strategic collaboration with Tri Eye, focusing on the integration of SWIR imaging systems within Driver Monitoring Systems. This partnership aims to enhance sensing solutions, including precise seat belt detection and user identification, showcasing the trend towards integrated vehicle safety.

- November 2020: Škoda patented the world's first illuminated smart seat belt buckle. This innovative design features a transparent button and utilizes red, green, and white color indicators to signify different usage modes, demonstrating advancements in user interface and safety signaling.

Strategic Automotive Seat Belt Pretensioner Industry Market Forecast

The strategic forecast for the automotive seat belt pretensioner industry is exceptionally promising, driven by a powerful combination of escalating regulatory demands, relentless technological innovation, and a global surge in vehicle production. The growing emphasis on occupant safety across all vehicle types, including the burgeoning electric vehicle segment, ensures sustained demand for advanced pretensioner systems. Opportunities lie in the development of intelligent, adaptive pretensioners that can dynamically adjust to impact scenarios and occupant characteristics, further enhancing safety margins. The expansion of these crucial safety components into emerging markets and the increasing sophistication of aftermarket solutions will also contribute significantly to the market's robust growth trajectory, projecting substantial revenue increases in the coming years.

Automotive Seat Belt Pretensioner Industry Segmentation

-

1. Technology

- 1.1. Retractor Pretensioner

- 1.2. Buckle Pretensioner

-

2. Seat Type

- 2.1. Rear

- 2.2. Front

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. End-user Type

- 4.1. OEM

- 4.2. Aftermarket

Automotive Seat Belt Pretensioner Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Seat Belt Pretensioner Industry Regional Market Share

Geographic Coverage of Automotive Seat Belt Pretensioner Industry

Automotive Seat Belt Pretensioner Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Passenger Car Segment Expected to Hold Majority Share in the Market; Others

- 3.3. Market Restrains

- 3.3.1. Disturbances in Supply Chain; Others

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment Expected to Hold Majority Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Retractor Pretensioner

- 5.1.2. Buckle Pretensioner

- 5.2. Market Analysis, Insights and Forecast - by Seat Type

- 5.2.1. Rear

- 5.2.2. Front

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by End-user Type

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Retractor Pretensioner

- 6.1.2. Buckle Pretensioner

- 6.2. Market Analysis, Insights and Forecast - by Seat Type

- 6.2.1. Rear

- 6.2.2. Front

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by End-user Type

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Retractor Pretensioner

- 7.1.2. Buckle Pretensioner

- 7.2. Market Analysis, Insights and Forecast - by Seat Type

- 7.2.1. Rear

- 7.2.2. Front

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by End-user Type

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Retractor Pretensioner

- 8.1.2. Buckle Pretensioner

- 8.2. Market Analysis, Insights and Forecast - by Seat Type

- 8.2.1. Rear

- 8.2.2. Front

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by End-user Type

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Retractor Pretensioner

- 9.1.2. Buckle Pretensioner

- 9.2. Market Analysis, Insights and Forecast - by Seat Type

- 9.2.1. Rear

- 9.2.2. Front

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by End-user Type

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Automotive Seat Belt Pretensioner Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Retractor Pretensioner

- 10.1.2. Buckle Pretensioner

- 10.2. Market Analysis, Insights and Forecast - by Seat Type

- 10.2.1. Rear

- 10.2.2. Front

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicles

- 10.4. Market Analysis, Insights and Forecast - by End-user Type

- 10.4.1. OEM

- 10.4.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Special Devices Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iron Force Industrial Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joyson Safety Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hyundai Mobis Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ITW Automotive Products GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tokai Rika Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hasco Co Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Continental AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Autoliv Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ashimori Industry Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZF Friedrichshafen AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Special Devices Inc

List of Figures

- Figure 1: Global Automotive Seat Belt Pretensioner Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Seat Type 2025 & 2033

- Figure 5: North America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Seat Type 2025 & 2033

- Figure 6: North America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Seat Belt Pretensioner Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 9: North America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 10: North America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Seat Belt Pretensioner Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Automotive Seat Belt Pretensioner Industry Revenue (Million), by Seat Type 2025 & 2033

- Figure 15: Europe Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Seat Type 2025 & 2033

- Figure 16: Europe Automotive Seat Belt Pretensioner Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Europe Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Europe Automotive Seat Belt Pretensioner Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 19: Europe Automotive Seat Belt Pretensioner Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 20: Europe Automotive Seat Belt Pretensioner Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million), by Technology 2025 & 2033

- Figure 23: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million), by Seat Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Seat Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 29: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 30: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Technology 2025 & 2033

- Figure 33: South America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: South America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Seat Type 2025 & 2033

- Figure 35: South America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Seat Type 2025 & 2033

- Figure 36: South America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: South America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: South America Automotive Seat Belt Pretensioner Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 39: South America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 40: South America Automotive Seat Belt Pretensioner Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million), by Technology 2025 & 2033

- Figure 43: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 44: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million), by Seat Type 2025 & 2033

- Figure 45: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Seat Type 2025 & 2033

- Figure 46: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 47: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 48: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 49: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 50: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 3: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 5: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 8: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 10: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 16: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 18: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 27: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 29: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: India Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: South Korea Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 36: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 37: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 39: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Brazil Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Argentina Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of South America Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Seat Type 2020 & 2033

- Table 45: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 47: Global Automotive Seat Belt Pretensioner Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: United Arab Emirates Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Saudi Arabia Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Automotive Seat Belt Pretensioner Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Seat Belt Pretensioner Industry?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Automotive Seat Belt Pretensioner Industry?

Key companies in the market include Special Devices Inc, Iron Force Industrial Co Ltd, Joyson Safety Systems, Hyundai Mobis Co Ltd, ITW Automotive Products GmbH, Tokai Rika Co Ltd, Hasco Co Ltd *List Not Exhaustive, Continental AG, Autoliv Inc, Ashimori Industry Co Ltd, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Seat Belt Pretensioner Industry?

The market segments include Technology, Seat Type, Vehicle Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Passenger Car Segment Expected to Hold Majority Share in the Market; Others.

6. What are the notable trends driving market growth?

Passenger Car Segment Expected to Hold Majority Share in the Market.

7. Are there any restraints impacting market growth?

Disturbances in Supply Chain; Others.

8. Can you provide examples of recent developments in the market?

In November 2023, Honda Motors has recalled 300,000 Accord and HR-V due to missing a piece in the front seat belt pretensioners. According to the recall notice from the company, front seat belt pretensioners were installed without a rivet during assembly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Seat Belt Pretensioner Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Seat Belt Pretensioner Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Seat Belt Pretensioner Industry?

To stay informed about further developments, trends, and reports in the Automotive Seat Belt Pretensioner Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence