Key Insights

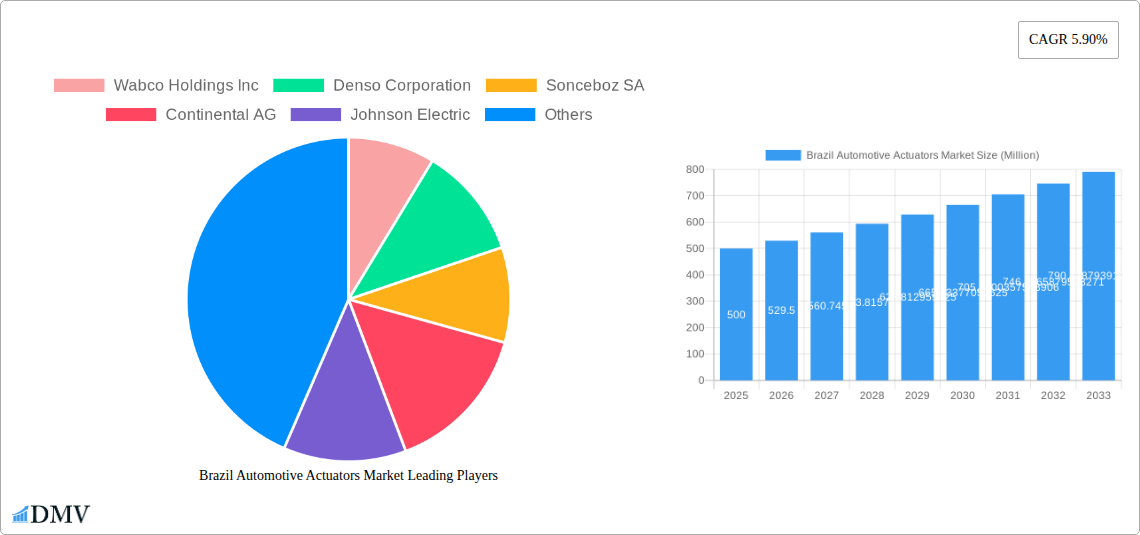

The Brazil automotive actuators market is projected to reach $23576.68 million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 5.6% from 2025. This growth is driven by increasing demand for advanced vehicle safety and comfort features, necessitating sophisticated actuation systems. Government initiatives to enhance automotive safety standards, particularly for brake and closure actuators, and growing consumer preference for improved driving experiences, boosting demand for seat adjustment and throttle actuators, are key drivers. The commercial vehicle segment is experiencing significant expansion due to fleet modernization and a growing logistics sector, increasing the adoption of both electric and hydraulic actuators. Technological advancements and the rising penetration of electric vehicles in Brazil are creating new opportunities for specialized pneumatic and electric actuators.

Brazil Automotive Actuators Market Market Size (In Billion)

Market growth is further supported by trends such as the integration of smart actuators with advanced electronic control units for enhanced performance and efficiency. The adoption of electric actuators is increasing due to their superior precision, faster response times, and lower maintenance requirements. However, challenges include the high cost of research and development for advanced actuator technologies and substantial initial manufacturing investments. Economic volatility and fluctuating currency exchange rates in Brazil may also impact the affordability of imported components, potentially slowing short-term adoption. Despite these challenges, the long-term outlook is positive, driven by continuous innovation, vehicle electrification, and automation.

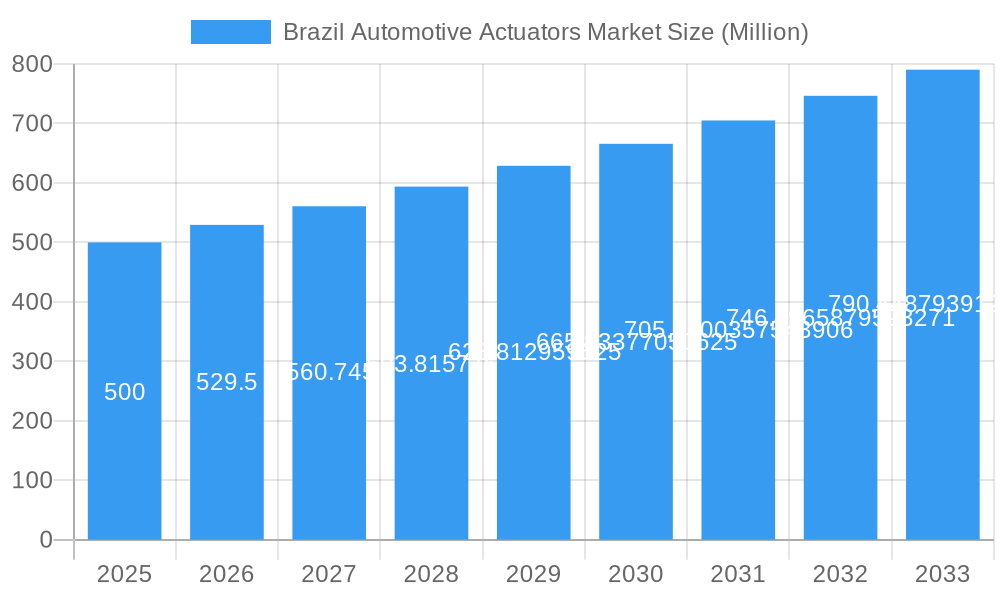

Brazil Automotive Actuators Market Company Market Share

This report provides an in-depth analysis of the Brazil automotive actuators market from 2019-2024, with a forecast to 2033, using 2025 as the base year. It offers comprehensive insights into the automotive actuator market in Brazil, including electric, hydraulic, and pneumatic actuators, by dissecting key segments, identifying growth drivers and challenges, and highlighting crucial industry developments.

Brazil Automotive Actuators Market Market Composition & Trends

The Brazil automotive actuators market exhibits a moderately concentrated landscape, with key players like Robert Bosch GmbH, Continental AG, and Wabco Holdings Inc. dominating market share distribution. Innovation is primarily driven by advancements in electrical actuators, fueled by the increasing demand for sophisticated ADAS (Advanced Driver-Assistance Systems) and enhanced vehicle comfort. The regulatory environment, while evolving, continues to emphasize safety and emissions standards, indirectly influencing actuator technology adoption. Substitute products, such as simpler mechanical linkages, are gradually being phased out in favor of more efficient and precise automotive actuator solutions. End-user profiles are diverse, encompassing major Original Equipment Manufacturers (OEMs) and Tier 1 suppliers catering to both the passenger car segment and the robust commercial vehicle segment in Brazil. Mergers and acquisitions (M&A) activities, valued in the millions, are strategic moves aimed at expanding product portfolios and market reach. For instance, recent M&A deals have focused on integrating specialized throttle actuator, seat adjustment actuator, and brake actuator technologies. Market share distribution indicates a growing dominance of electrical actuators in recent years, reflecting the automotive industry's electrification trend.

Brazil Automotive Actuators Market Industry Evolution

The Brazil automotive actuators market has undergone a significant transformation over the study period of 2019–2033. Initially, the market was heavily reliant on conventional hydraulic and pneumatic actuators, particularly within the commercial vehicle segment which demands robust and durable solutions for applications like braking and suspension. However, the growing imperative for fuel efficiency, emissions reduction, and enhanced driving experiences has catalyzed a pronounced shift towards electrical actuators. This evolution is evident in the market's growth trajectory, which has seen a consistent upward trend, driven by technological advancements in motor control, sensor integration, and power management. The adoption of electric actuators is no longer confined to luxury passenger cars but is rapidly permeating the mainstream segment, including the development of more advanced throttle actuator systems for precise engine management and closure actuator systems for enhanced vehicle safety and convenience. Consumer demand has also played a pivotal role, with drivers increasingly seeking the comfort and safety features enabled by sophisticated actuator technologies. For example, the integration of seat adjustment actuators that offer memory functions and ergonomic profiling has become a key selling point. The market's compound annual growth rate (CAGR) is projected to remain strong throughout the forecast period, underscoring the sustained demand for innovative automotive actuator Brazil solutions. Data suggests a CAGR of approximately xx% from 2025-2033, fueled by continued R&D investment and the increasing complexity of vehicle architectures. The move towards autonomous driving functionalities will further accelerate the adoption of highly responsive and precise actuators.

Leading Regions, Countries, or Segments in Brazil Automotive Actuators Market

Within the Brazil automotive actuators market, the passenger car segment currently holds a leading position, driven by evolving consumer preferences for comfort, safety, and technological integration. This dominance is closely followed by the commercial vehicle segment, which remains a cornerstone of the Brazilian economy and relies heavily on durable and high-performance actuators.

Vehicle Type Dominance:

- Passenger Car: The increasing disposable income, coupled with a growing demand for advanced features like powered tailgates, smart seats, and sophisticated climate control systems, makes the passenger car segment a primary driver. The adoption of throttle actuators for optimized engine performance and emission control is also significant.

- Commercial Vehicle: While often prioritizing cost-effectiveness, the commercial vehicle sector sees substantial demand for reliable brake actuators, suspension actuators, and actuators within transmission systems, crucial for heavy-duty operations and fleet efficiency.

Actuator Type Trends:

- Electrical Actuators: This category is experiencing the most rapid growth. Its precision, energy efficiency, and ability to be integrated with digital control systems make it indispensable for modern automotive features. This is particularly evident in the demand for closure actuators for power doors and tailgates, and sophisticated seat adjustment actuators.

- Hydraulic Actuators: While traditionally strong, especially in heavy-duty applications within the commercial vehicle segment, hydraulic actuators are gradually facing competition from their electrical counterparts due to efficiency and integration advantages.

- Pneumatic Actuators: Primarily used in specific industrial or heavy-duty applications, pneumatic actuators maintain a niche but important presence, particularly in air brake systems for commercial vehicles.

Application Type Drivers:

- Throttle Actuator: Essential for modern engine management and emission control systems, its demand remains robust across both vehicle types.

- Seat Adjustment Actuator: A key driver of comfort and luxury in passenger cars, with increasing adoption in higher-tier commercial vehicles.

- Brake Actuator: A critical safety component, with continuous innovation in electronic braking systems (EBS) driving demand for advanced actuators.

- Closure Actuator: Increasingly popular for power tailgates, doors, and other automated closures, enhancing convenience and safety in passenger cars.

The dominance factors include significant investment trends by global automotive manufacturers in Brazil, a supportive regulatory framework that encourages the adoption of advanced safety technologies, and a burgeoning automotive aftermarket that requires a steady supply of replacement actuators. The ongoing development of smart city initiatives and the increasing focus on vehicle connectivity further bolster the demand for intelligent actuator systems.

Brazil Automotive Actuators Market Product Innovations

The Brazil automotive actuators market is witnessing remarkable product innovations focused on miniaturization, increased efficiency, and enhanced integration capabilities. Developments in brushless DC motor technology are enabling the creation of more compact and powerful electrical actuators for applications like seat adjustment actuators and closure actuators, offering smoother operation and longer lifespans. Advanced sensor integration within actuators is improving precision and feedback, crucial for safety-critical systems like brake actuators and throttle control. The application scope is expanding beyond traditional functions, with innovations emerging in active aerodynamics, advanced suspension systems, and sophisticated cabin environment control, all powered by cutting-edge actuator technology. These advancements are driving performance metrics such as faster response times, reduced power consumption, and improved durability.

Propelling Factors for Brazil Automotive Actuators Market Growth

Several key factors are propelling the Brazil automotive actuators market forward. The increasing sophistication of vehicle designs, driven by consumer demand for comfort, safety, and convenience features, is a primary growth catalyst. The global push towards vehicle electrification and automation necessitates a significant increase in the number and complexity of electrical actuators. Furthermore, evolving emissions regulations and fuel efficiency standards encourage the adoption of precision-controlled actuators like throttle actuators. Government initiatives promoting automotive manufacturing and technology adoption also contribute significantly. The growing aftermarket demand for replacement parts further solidifies market growth.

Obstacles in the Brazil Automotive Actuators Market Market

Despite robust growth prospects, the Brazil automotive actuators market faces certain obstacles. Fluctuations in raw material prices, particularly for rare earth metals used in electric motors, can impact manufacturing costs. Supply chain disruptions, exacerbated by global economic uncertainties and geopolitical factors, can lead to production delays and increased lead times. Intense competition among established players and emerging manufacturers can put pressure on profit margins. Additionally, the transition to new technologies requires significant investment in R&D and skilled labor, posing a challenge for smaller enterprises. The complexity of integrating new actuator systems into existing vehicle platforms can also present technical hurdles.

Future Opportunities in Brazil Automotive Actuators Market

The Brazil automotive actuators market is ripe with future opportunities. The burgeoning electric vehicle (EV) market in Brazil presents a significant growth avenue, as EVs heavily rely on sophisticated electrical actuators for propulsion, braking, and auxiliary systems. The increasing adoption of ADAS (Advanced Driver-Assistance Systems) and the eventual advent of autonomous driving will create demand for highly responsive and intelligent actuators. The aftermarket segment, driven by the large existing vehicle parc, offers sustained revenue streams. Furthermore, the development of smart and connected vehicle features will open doors for actuators that contribute to enhanced user experience and predictive maintenance. Exploring applications in emerging mobility solutions like shared mobility services also presents a promising avenue.

Major Players in the Brazil Automotive Actuators Market Ecosystem

- Wabco Holdings Inc

- Denso Corporation

- Sonceboz SA

- Continental AG

- Johnson Electric

- BorgWarner Inc

- Robert Bosch GmbH

- CTS Corporation

- Hella KGaA Hueck & Co

Key Developments in Brazil Automotive Actuators Market Industry

- 2024: Wabco Holdings Inc. announced advancements in its electronic braking system (EBS) actuators, enhancing safety and performance for commercial vehicles in Brazil.

- 2023/2024: Continental AG invested in expanding its production capacity for electrical actuators in Brazil to meet the growing demand from passenger car manufacturers.

- 2023: Robert Bosch GmbH launched a new generation of compact and high-torque electric motors for advanced throttle actuators and closure actuators in the Brazilian market.

- 2023: Denso Corporation unveiled innovative seat adjustment actuators with integrated memory functions and advanced ergonomic capabilities for premium passenger cars in Brazil.

- 2022/2023: Several Tier 1 suppliers in Brazil focused on developing localized manufacturing capabilities for advanced brake actuators to reduce import dependency and lead times.

Strategic Brazil Automotive Actuators Market Market Forecast

The Brazil automotive actuators market is poised for sustained and robust growth, driven by the insatiable demand for advanced automotive features. The accelerating adoption of electrical actuators across both passenger and commercial vehicle segments, fueled by electrification and automation trends, represents a significant growth catalyst. The ongoing emphasis on safety and emissions compliance will continue to drive innovation in throttle actuator, brake actuator, and other critical systems. Emerging opportunities in the EV sector and the aftermarket segment further underpin a positive market outlook. Strategic investments in R&D and localized manufacturing will be crucial for key players to capitalize on the expanding market potential in Brazil.

Brazil Automotive Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Actuators Type

- 2.1. Electrical actuators

- 2.2. Hydraulic actuators

- 2.3. Pneumatic actuators

-

3. Application Type

- 3.1. Throttle Actuator

- 3.2. Seat Adjustment Actuator

- 3.3. Brake Actuator

- 3.4. Closure Actuator

- 3.5. Other

Brazil Automotive Actuators Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Actuators Market Regional Market Share

Geographic Coverage of Brazil Automotive Actuators Market

Brazil Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Actuators Type

- 5.2.1. Electrical actuators

- 5.2.2. Hydraulic actuators

- 5.2.3. Pneumatic actuators

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Throttle Actuator

- 5.3.2. Seat Adjustment Actuator

- 5.3.3. Brake Actuator

- 5.3.4. Closure Actuator

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wabco Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonceboz SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Continental AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CTS Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hella KGaA Hueck & Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wabco Holdings Inc

List of Figures

- Figure 1: Brazil Automotive Actuators Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Automotive Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Brazil Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 3: Brazil Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Brazil Automotive Actuators Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Brazil Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Brazil Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 7: Brazil Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Brazil Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Actuators Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Brazil Automotive Actuators Market?

Key companies in the market include Wabco Holdings Inc, Denso Corporation, Sonceboz SA, Continental AG, Johnson Electric, BorgWarner Inc, Robert Bosch GmbH, CTS Corporatio, Hella KGaA Hueck & Co.

3. What are the main segments of the Brazil Automotive Actuators Market?

The market segments include Vehicle Type, Actuators Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23576.68 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence