Key Insights

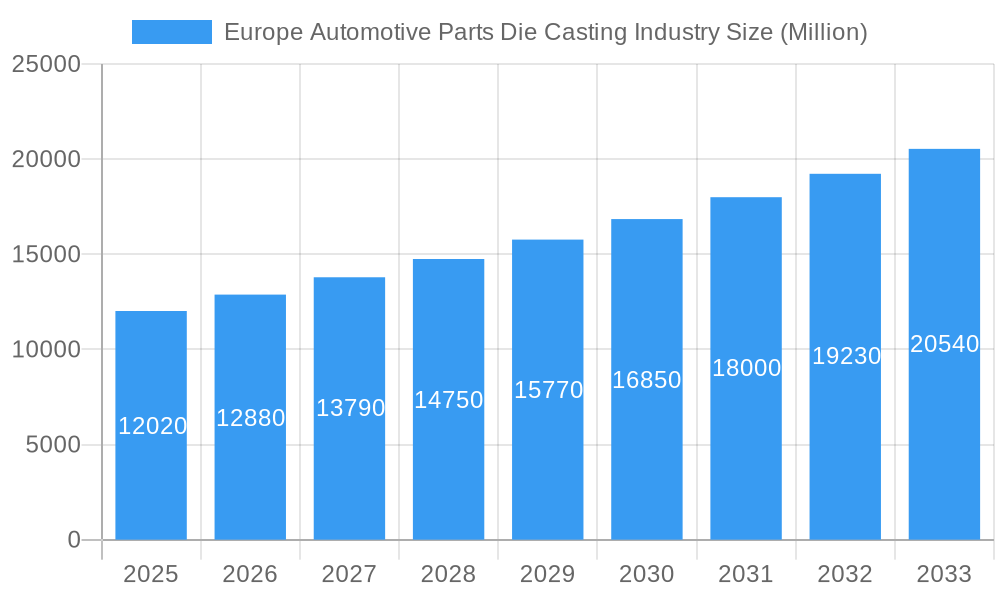

The European automotive parts die casting market is poised for robust growth, projected to reach a significant market size of approximately €12.02 billion in 2025. This expansion is driven by a compelling Compound Annual Growth Rate (CAGR) of 7.28%, indicating a dynamic and expanding industry throughout the forecast period of 2025-2033. Key growth engines for this market include the increasing demand for lightweight and complex automotive components, driven by stringent fuel efficiency regulations and the growing adoption of electric vehicles (EVs) which rely heavily on precisely engineered, weight-optimized parts. Furthermore, advancements in die casting technologies, such as sophisticated vacuum die casting techniques that enhance component strength and reduce porosity, are contributing to higher adoption rates for specialized applications. The rising production volumes of modern vehicles, particularly those with advanced powertrain systems and structural integrity requirements, directly fuel the demand for high-quality die-cast parts.

Europe Automotive Parts Die Casting Industry Market Size (In Billion)

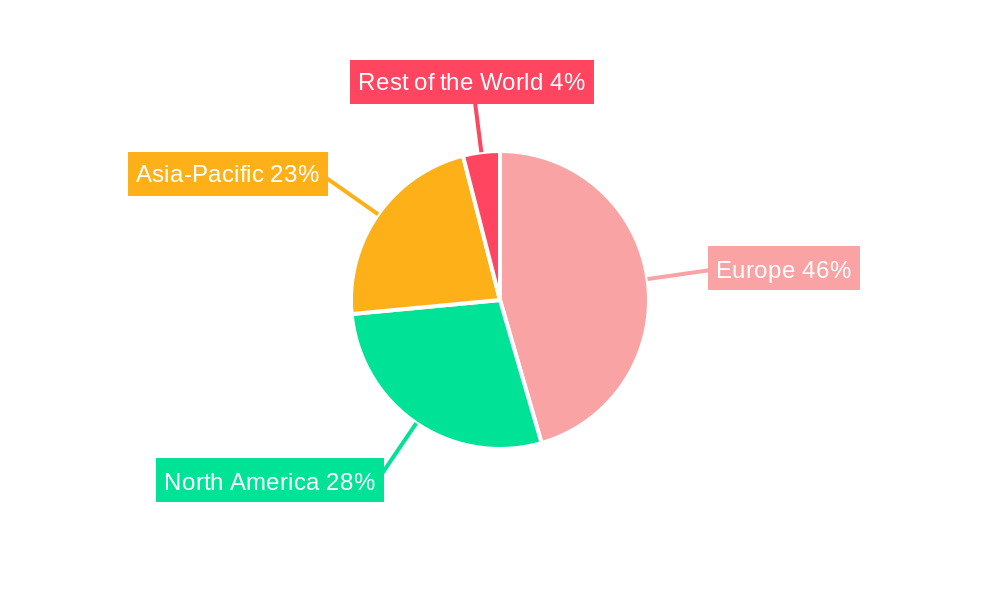

The market is segmented across various production processes, metal types, and application areas, each exhibiting unique growth trajectories. Pressure Die Casting continues to dominate due to its efficiency and cost-effectiveness for high-volume production, while Vacuum Die Casting is gaining traction for premium applications demanding superior mechanical properties. Aluminum alloys remain the prevalent metal type due to their excellent strength-to-weight ratio, critical for vehicle lightweighting initiatives, alongside increasing interest in specialized zinc alloys for specific component needs. Engine parts and transmission components are substantial application segments, directly tied to vehicle production, with structural parts emerging as a high-growth area, especially with the integration of advanced safety features and chassis designs. Geographically, Europe, with its strong automotive manufacturing base, particularly Germany, the United Kingdom, and France, will continue to be the epicenter of this market's activity, reflecting substantial regional investment and production capabilities.

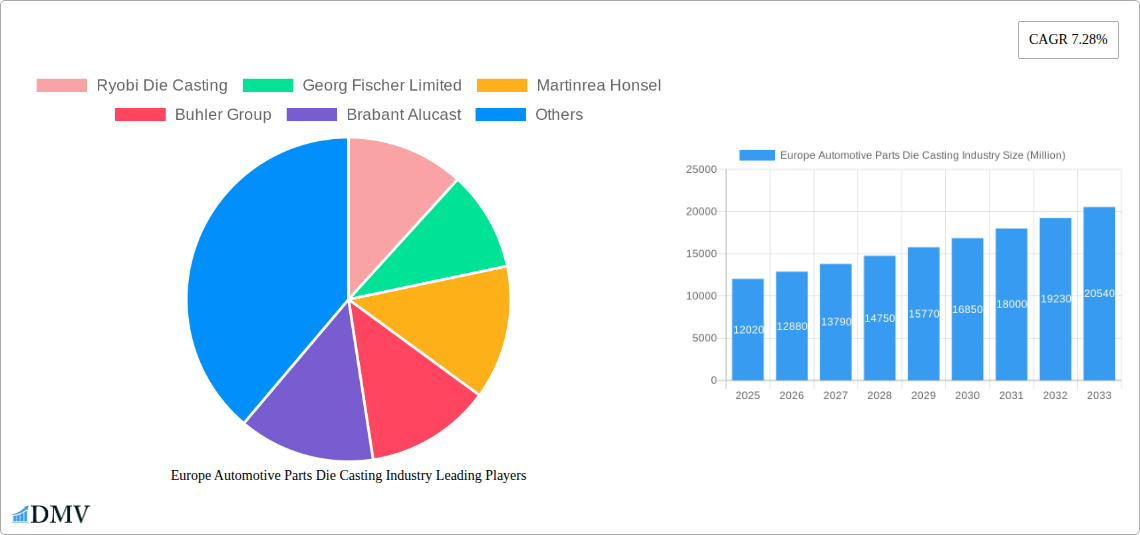

Europe Automotive Parts Die Casting Industry Company Market Share

Europe Automotive Parts Die Casting Industry Market Composition & Trends

The Europe automotive parts die casting industry is characterized by a dynamic market composition, driven by intense innovation and a complex regulatory landscape. Market concentration is evident with key players dominating significant market shares, estimated to be over 70% held by the top five entities. Innovation is spurred by the relentless pursuit of lightweighting and enhanced performance, with a notable focus on advanced die casting techniques like Vacuum Die Casting. The regulatory environment, particularly stringent emission standards and growing mandates for electric vehicle (EV) components, significantly influences production processes and material choices. Substitute products, while present in specific applications, struggle to match the cost-effectiveness and performance attributes of high-pressure die-cast parts for critical automotive components. End-user profiles are evolving, with a pronounced shift towards Original Equipment Manufacturers (OEMs) prioritizing suppliers capable of high-volume, precision manufacturing for both internal combustion engine (ICE) vehicles and the burgeoning EV sector. Mergers and acquisitions (M&A) activities, valued in the hundreds of millions, are shaping the industry, with deal values averaging EUR 150 Million for strategic acquisitions aimed at expanding technological capabilities and market reach.

- Market Share Distribution: Top 5 players hold >70% of the market share.

- M&A Deal Values: Average EUR 150 Million for strategic acquisitions.

- Innovation Catalysts: Lightweighting, EV component demand, emission standards.

- Regulatory Impact: Significant influence on production processes and material selection.

Europe Automotive Parts Die Casting Industry Industry Evolution

The Europe automotive parts die casting industry has undergone a profound transformation, evolving from its traditional roots in internal combustion engine (ICE) component manufacturing to embracing the rapid expansion of electric mobility. Over the study period of 2019–2033, the industry's growth trajectory has been significantly influenced by technological advancements and shifting consumer demands. During the historical period (2019–2024), the market witnessed steady growth driven by the established automotive sector, with annual growth rates hovering around 3%. The base year (2025) sets the stage for accelerated evolution, with an anticipated growth rate of approximately 4.5% for the estimated year (2025), reflecting the increasing integration of die-cast components in next-generation vehicles.

Technological advancements have been paramount. The adoption of Pressure Die Casting remains dominant due to its efficiency and cost-effectiveness for high-volume production, accounting for an estimated 85% of all die-cast parts. However, the growing demand for complex, high-performance components for EVs has fueled the expansion of Vacuum Die Casting technologies. This advanced process offers superior mechanical properties and surface finishes, crucial for applications like battery enclosures and electric motor housings. Adoption metrics for vacuum die casting are projected to increase by 15% annually from 2025 to 2033.

Shifting consumer demands, primarily driven by environmental concerns and the quest for greater fuel efficiency (or extended range for EVs), have reshaped the industry's focus. The demand for lightweight aluminum alloys has surged, now representing over 90% of the metal types used, displacing heavier traditional materials. This trend is directly linked to the automotive industry's imperative to reduce vehicle weight, thereby enhancing fuel economy and performance. Furthermore, the electrification of powertrains has created a substantial new market for die-cast structural parts, battery components, and motor housings, where precision and reliability are non-negotiable. The industry's ability to adapt to these evolving demands, particularly the transition to EV-specific components, has been critical to its sustained growth and relevance. The forecast period (2025–2033) is poised for continued robust growth, with an expected compound annual growth rate (CAGR) of over 5%, underscoring the industry's pivotal role in the future of automotive manufacturing.

Leading Regions, Countries, or Segments in Europe Automotive Parts Die Casting Industry

Germany stands as the undisputed leader in the Europe automotive parts die casting industry, driven by a confluence of factors including a highly developed automotive manufacturing base, a strong emphasis on technological innovation, and robust government support for advanced manufacturing. The country consistently accounts for an estimated 35% of the total European market share in automotive die casting production. This dominance is further solidified by the presence of major automotive OEMs and their Tier-1 suppliers, who are continuously investing in cutting-edge die casting technologies.

Within Germany, the Pressure Die Casting process type holds significant sway, representing approximately 80% of its total die casting output. This is attributed to the high-volume production requirements of established automotive models, where efficiency and cost-effectiveness are paramount. However, there is a discernible and accelerating trend towards Vacuum Die Casting, particularly for components destined for electric vehicles (EVs). This shift is driven by the increasing demand for superior mechanical properties and intricate designs required for battery systems, electric motor housings, and advanced powertrain components. While currently accounting for a smaller but rapidly growing segment, Vacuum Die Casting's market share within Germany's die casting output is projected to grow by over 12% annually through the forecast period.

Aluminum remains the dominant metal type, constituting over 95% of all die-cast automotive parts produced in Germany. Its lightweight properties are crucial for meeting increasingly stringent fuel efficiency standards and enhancing the range of EVs. Zinc and other metal types, while used in niche applications like smaller, intricate components or specific powertrain elements, represent a significantly smaller portion of the overall market.

In terms of Application Type, Engine Parts historically held the largest share. However, the automotive industry's transformation is rapidly altering this landscape. While engine parts will continue to be relevant for the remaining ICE fleet, Structural Parts and Transmission Components, particularly those designed for EVs, are emerging as the fastest-growing segments. These components, such as battery trays, chassis elements, and advanced transmission housings, demand high precision and structural integrity, pushing the boundaries of die casting capabilities. The demand for these EV-related structural and transmission components is expected to drive a CAGR of over 6% for these segments within Germany.

- Dominant Region/Country: Germany, accounting for approximately 35% of the European market share.

- Key Production Process Type: Pressure Die Casting (approx. 80% of German output), with significant and growing adoption of Vacuum Die Casting.

- Dominant Metal Type: Aluminum (over 95% of output).

- Fastest-Growing Application Types: Structural Parts and Transmission Components, driven by EV demand.

- Key Drivers for Dominance:

- Strong OEM presence and investment.

- Technological leadership and R&D focus.

- Skilled workforce and advanced manufacturing infrastructure.

- Government incentives for advanced manufacturing and EV adoption.

Europe Automotive Parts Die Casting Industry Product Innovations

The Europe automotive parts die casting industry is a hotbed of product innovation, continually pushing the boundaries of what's possible. Companies are developing ultra-lightweight aluminum alloy components for critical structural elements, aiming to reduce vehicle weight by up to 15% without compromising safety. Innovations in Vacuum Die Casting enable the production of intricate, single-piece battery enclosures for EVs, offering enhanced thermal management and improved safety. Performance metrics are significantly enhanced through advancements in die design and process control, leading to improved fatigue strength and surface finish, crucial for high-stress engine and transmission parts. Unique selling propositions include the ability to cast complex geometries with tight tolerances, reducing the need for secondary machining operations and thereby lowering production costs by an estimated 10-12%.

Propelling Factors for Europe Automotive Parts Die Casting Industry Growth

The Europe automotive parts die casting industry's growth is propelled by several interconnected factors. The accelerating transition towards electric vehicles (EVs) is a primary driver, creating immense demand for lightweight aluminum components such as battery enclosures, motor housings, and structural elements. Stringent European Union regulations mandating reduced CO2 emissions also push OEMs to adopt lighter materials and more efficient powertrain components, both of which benefit die casting. Furthermore, continuous technological advancements in die casting processes, including improvements in Vacuum Die Casting and advanced alloys, enable the production of more complex, higher-performance parts, thereby expanding application possibilities. Investments in advanced manufacturing technologies and automation are also increasing production efficiency and capacity, contributing to sustained growth.

Obstacles in the Europe Automotive Parts Die Casting Industry Market

Despite robust growth, the Europe automotive parts die casting industry faces several significant obstacles. The increasing complexity and demand for highly specialized EV components necessitate substantial upfront investment in new tooling and machinery, which can be a considerable barrier for smaller players. Supply chain disruptions, particularly concerning the availability and price volatility of raw materials like aluminum, pose a continuous challenge, impacting production costs and lead times. Moreover, intense global competition, especially from lower-cost manufacturing regions, puts pressure on pricing and profit margins. Navigating the evolving regulatory landscape, including potential new material restrictions or recycling mandates, requires constant adaptation and investment.

Future Opportunities in Europe Automotive Parts Die Casting Industry

The future for the Europe automotive parts die casting industry is replete with exciting opportunities. The continued exponential growth of the EV market will undoubtedly fuel demand for a wide array of specialized die-cast components, from battery thermal management systems to advanced powertrain integration parts. Emerging technologies like 3D printing of dies and advanced simulation software present opportunities to optimize production processes and accelerate innovation cycles. Furthermore, the industry can leverage its expertise in lightweighting to cater to other burgeoning sectors such as aerospace and sustainable energy solutions. The increasing focus on circular economy principles also presents an opportunity to develop advanced recycling and remanufacturing processes for die-cast components.

Major Players in the Europe Automotive Parts Die Casting Industry Ecosystem

- Ryobi Die Casting

- Georg Fischer Limited

- Martinrea Honsel

- Buhler Group

- Brabant Alucast

- DGS Druckguss Systeme

- Nemak

- Dynacast

- Rheinmetall Automotive

Key Developments in Europe Automotive Parts Die Casting Industry Industry

- September 2022: Rheinmetall AG (Rheinmetall) secured a new EUR 20 Million (USD 23.6 Million) order for its cutting-edge air-divert valve, the Turbo Bypass Valve (TBV) Gen 6, further solidifying its position as a key player in the industry. This order adds to the series of recent successful orders received by the Group subsidiary. Production of the TBV Gen 6 will be carried out at Pierburg's Neuss, Germany, plant.

- May 2022: GF Casting Solutions, a division of Georg Fischer, announced its commitment to enhance the development of electric vehicle (EV) products and services. Leveraging its expertise and artificial intelligence (AI), the company aims to facilitate customers' transition to electric drive engines and e-mobility. By utilizing AI, GF Casting Solutions can deliver high-quality products that contribute positively to the environment.

Strategic Europe Automotive Parts Die Casting Industry Market Forecast

The strategic forecast for the Europe automotive parts die casting industry is exceptionally positive, driven by the undeniable momentum of electric vehicle adoption and the industry's inherent capacity for innovation. The relentless pursuit of lightweighting, coupled with tightening emissions regulations, will continue to propel demand for high-performance aluminum die-cast components. Investments in advanced manufacturing technologies and process optimization, particularly in areas like Vacuum Die Casting, will further enhance competitive advantages. Emerging opportunities in new mobility solutions and potentially other industrial sectors offer avenues for diversification and sustained growth, positioning the industry as a critical enabler of future automotive and industrial advancements.

Europe Automotive Parts Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Vacuum Die Casting

- 1.2. Pressure Die Casting

- 1.3. Other Production Process Types

-

2. Metal Type

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Other Metal Types

-

3. Application Type

- 3.1. Engine Parts

- 3.2. Transmission Components

- 3.3. Structural Parts

- 3.4. Other Application Types

Europe Automotive Parts Die Casting Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Russia

- 1.6. Rest of Europe

Europe Automotive Parts Die Casting Industry Regional Market Share

Geographic Coverage of Europe Automotive Parts Die Casting Industry

Europe Automotive Parts Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Commercial Vehicle Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Parts Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Vacuum Die Casting

- 5.1.2. Pressure Die Casting

- 5.1.3. Other Production Process Types

- 5.2. Market Analysis, Insights and Forecast - by Metal Type

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Other Metal Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Engine Parts

- 5.3.2. Transmission Components

- 5.3.3. Structural Parts

- 5.3.4. Other Application Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ryobi Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Georg Fischer Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Martinrea Honsel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Buhler Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brabant Alucast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DGS Druckguss Systeme*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nemak

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rheinmetall Automotive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ryobi Die Casting

List of Figures

- Figure 1: Europe Automotive Parts Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Parts Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Metal Type 2020 & 2033

- Table 3: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 6: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Metal Type 2020 & 2033

- Table 7: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Russia Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Parts Die Casting Industry?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Europe Automotive Parts Die Casting Industry?

Key companies in the market include Ryobi Die Casting, Georg Fischer Limited, Martinrea Honsel, Buhler Group, Brabant Alucast, DGS Druckguss Systeme*List Not Exhaustive, Nemak, Dynacast, Rheinmetall Automotive.

3. What are the main segments of the Europe Automotive Parts Die Casting Industry?

The market segments include Production Process Type, Metal Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand.

6. What are the notable trends driving market growth?

Increasing Demand from the Commercial Vehicle Segment.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: Rheinmetall AG (Rheinmetall) secured a new EUR 20 million (USD 23.6 million) order for its cutting-edge air-divert valve, the Turbo Bypass Valve (TBV) Gen 6, further solidifying its position as a key player in the industry. This order adds to the series of recent successful orders received by the Group subsidiary. Production of the TBV Gen 6 will be carried out at Pierburg's Neuss, Germany, plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Parts Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Parts Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Parts Die Casting Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Parts Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence