Key Insights

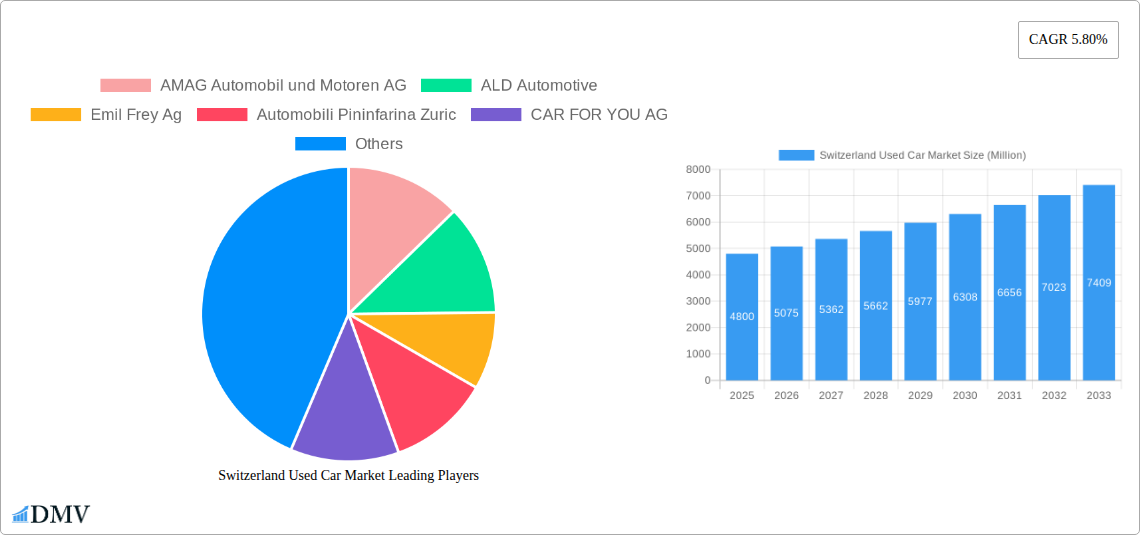

The Switzerland Used Car Market is poised for robust expansion, projected to reach an estimated USD 4.80 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.80% anticipated from 2025 through 2033. This sustained growth is underpinned by a confluence of favorable market drivers and evolving consumer behaviors. A significant driver is the increasing affordability of pre-owned vehicles, offering a cost-effective alternative to new car purchases, particularly for budget-conscious buyers and younger demographics. Furthermore, the growing acceptance and availability of certified pre-owned programs by organized vendors are enhancing consumer trust and confidence in the used car market. The shift towards more sustainable transportation also plays a crucial role, with a rising demand for used electric vehicles (EVs) and hybrid models as their initial depreciation makes them more accessible to a wider audience. This trend is further amplified by government incentives and growing environmental awareness among consumers. The market's segmentation reveals a dynamic landscape, with Sport Utility Vehicles (SUVs) and Sedans dominating sales volumes due to their versatility and widespread appeal. Organized vendors are increasingly capturing market share from unorganized players, driven by their superior service offerings, warranty programs, and transparent sales processes.

Switzerland Used Car Market Market Size (In Billion)

The trajectory of the Switzerland Used Car Market is also shaped by significant trends and certain restraints that warrant attention. A prominent trend is the digitalization of the used car sales process, with online platforms and mobile applications revolutionizing how consumers research, compare, and purchase vehicles. This digital shift enhances convenience and expands reach for both buyers and sellers. Another key trend is the increasing preference for flexible ownership models, such as leasing and subscription services, which are extending to the pre-owned segment, offering greater adaptability for consumers. The growing emphasis on vehicle condition and maintenance history, coupled with advanced diagnostic tools, contributes to increased buyer confidence. However, the market faces certain restraints, including the lingering perception of risk associated with buying used vehicles, despite improvements in quality and transparency. Fluctuations in the new car market and supply chain disruptions can also indirectly impact used car pricing and availability. Economic uncertainties and evolving regulations concerning vehicle emissions could also influence future market dynamics. Despite these challenges, the overarching demand for value and the continuous innovation within the industry, particularly from key players like AMAG Automobil und Motoren AG and ALD Automotive, are expected to propel the Switzerland Used Car Market forward.

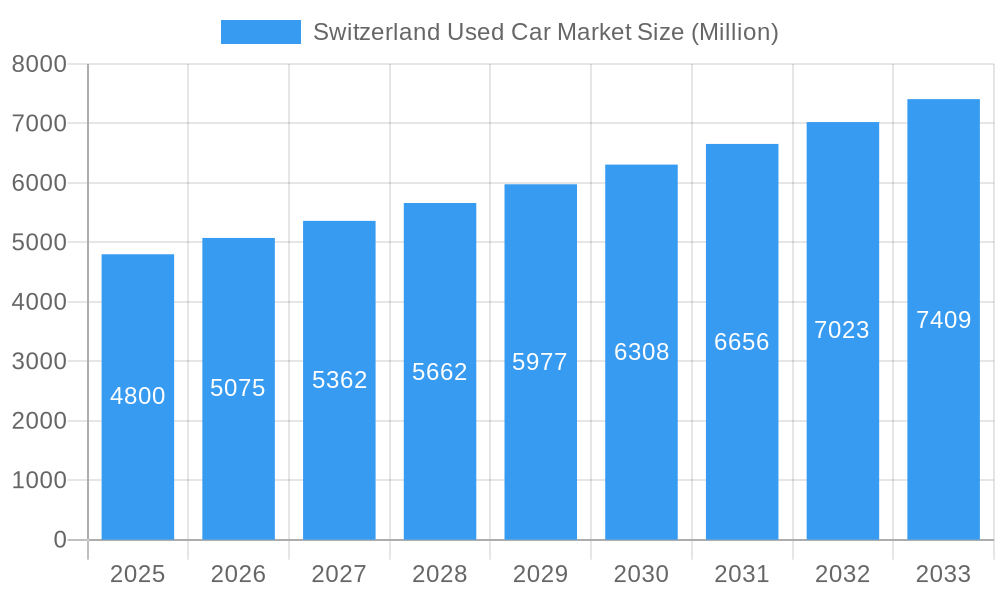

Switzerland Used Car Market Company Market Share

This in-depth report provides a definitive analysis of the Switzerland Used Car Market, offering critical insights for stakeholders, investors, and industry professionals. With a comprehensive study period spanning 2019-2033, including historical data (2019-2024), a base year of 2025, and an estimated year of 2025, this report details market dynamics, growth drivers, emerging opportunities, and competitive landscapes. Leveraging high-ranking keywords such as "Switzerland used cars," "pre-owned vehicles Switzerland," "used car market analysis," "automotive industry Switzerland," and "used car trends," this report ensures maximum visibility and valuable data for navigating this dynamic sector. The analysis encompasses various vehicle types, vendor categories, and fuel types, alongside key industry developments and strategic forecasts, making it an indispensable resource for understanding the present and future of the Swiss used car market.

Switzerland Used Car Market Market Composition & Trends

The Switzerland Used Car Market is characterized by a moderate level of concentration, with key players like AMAG Automobil und Motoren AG, ALD Automotive, and Emil Frey AG holding significant market share. The market's innovation is driven by increasing demand for affordable mobility solutions, evolving consumer preferences towards sustainable and electric vehicles, and advancements in digital sales platforms. Regulatory landscapes, though generally stable, are influenced by emission standards and consumer protection laws, impacting the resale value and accessibility of certain vehicle types. Substitute products, such as new car financing schemes and ride-sharing services, present a competitive pressure, but the inherent cost-effectiveness and wider availability of used cars maintain their strong market position. End-user profiles are diverse, ranging from budget-conscious individuals and families to businesses seeking cost-effective fleet solutions. Mergers and acquisitions (M&A) activities, while not dominant, are strategic, focusing on consolidation of dealership networks and enhancement of digital service offerings. For instance, a projected M&A deal value of xx Million in the coming years could reshape market dynamics. The market share distribution sees Organized vendors contributing approximately 75% of transactions, while Unorganized vendors account for the remaining 25%.

Switzerland Used Car Market Industry Evolution

The evolution of the Switzerland Used Car Market is a testament to its resilience and adaptability. Over the study period, from 2019 to the projected 2033, the market has witnessed a steady growth trajectory, driven by a confluence of economic factors, technological advancements, and shifting consumer demands. During the historical period (2019-2024), the market saw an average annual growth rate of approximately 3.5%, primarily fueled by a robust economy and a persistent demand for reliable transportation. The estimated year of 2025 is anticipated to see a growth rate of around 4.0%, indicating a sustained recovery and expansion post-pandemic. Technological advancements have played a pivotal role in reshaping the industry. The proliferation of online car marketplaces and digital inspection tools has significantly enhanced transparency and accessibility for buyers, leading to an increased adoption rate of online purchasing for used vehicles, estimated at 40% by 2025. This digital transformation has streamlined the buying and selling process, reducing transaction times and geographical limitations.

Furthermore, shifting consumer demands have become a crucial factor in the market's evolution. There is a discernible trend towards more fuel-efficient and environmentally conscious vehicles. Consequently, the demand for used hybrid and electric vehicles (EVs) has seen a substantial surge, with adoption rates projected to reach 15% of the used car market by 2028, up from less than 5% in 2019. This shift is influenced by government incentives for EVs, rising fuel prices, and growing environmental awareness among the populace. The market has also seen an increasing preference for SUVs and compact cars, catering to diverse lifestyle needs, from family transportation to urban commuting. The resale value of well-maintained, low-mileage vehicles, particularly those with desirable features and eco-friendly powertrains, has remained strong, further bolstering the attractiveness of the used car market. The average transaction price for a used car is expected to increase by 5% annually, reaching an estimated xx Million in 2025, reflecting both inflation and the increasing demand for higher-quality pre-owned vehicles. The integration of advanced driver-assistance systems (ADAS) in newer used car models is also becoming a significant selling point, appealing to safety-conscious buyers.

Leading Regions, Countries, or Segments in Switzerland Used Car Market

The dominance within the Switzerland Used Car Market is multifaceted, with distinct segments showcasing robust performance. Among vehicle types, Sport Utility Vehicles (SUVs) are emerging as the frontrunner, capturing an estimated 35% of the used car market share by 2025. This ascendancy is driven by their versatility, perceived safety, and suitability for both urban and rural environments, appealing to families and active individuals alike. Hatchbacks follow closely, holding a substantial 25% market share, owing to their practicality, fuel efficiency, and affordability, making them ideal for urban commuters and budget-conscious buyers. Sedans, though a traditional segment, maintain a significant presence with a 20% share, appreciated for their comfort and driving dynamics. Multi-Purpose Vehicles (MUVs) cater to larger families and specific commercial needs, accounting for approximately 10% of the market.

In terms of vendor type, the Organized segment commands a significant lead, projected to hold 75% of the market by 2025. This dominance is attributed to the trust, warranty offerings, and professional service associated with established dealerships and certified pre-owned programs. Key drivers for this segment include robust investment in digital platforms by large automotive groups, rigorous inspection and refurbishment processes, and a customer-centric approach that prioritizes transparency and reliability. Unorganized vendors, while offering competitive pricing, represent the remaining 25%, often serving niche markets or catering to price-sensitive buyers who are less concerned with formal guarantees.

Fuel type analysis reveals a dynamic shift. Gasoline vehicles continue to hold the largest share, estimated at 50% in 2025, due to their established infrastructure and wide availability. However, Diesel vehicles, though declining, still represent a notable 20%, particularly for long-distance travel and specific commercial applications. The most significant growth is witnessed in the Electric vehicle segment, projected to capture 15% of the used car market by 2025, driven by increasing EV adoption, falling battery costs, and government incentives. "Other Fuel Types," including hybrids, represent the remaining 15%, a segment poised for further expansion as hybrid technology becomes more mainstream in the used car market. Regulatory support for emissions reduction and the increasing availability of used EVs are key drivers for the electric and hybrid segments' growth. Investment trends are shifting towards digital infrastructure for organized vendors and the procurement of higher-quality, low-emission used vehicles across all segments.

Switzerland Used Car Market Product Innovations

Product innovations in the Switzerland Used Car Market are increasingly focused on enhancing the digital purchasing experience and extending the lifecycle of vehicles. Online platforms are integrating advanced virtual inspection tools, augmented reality (AR) features for vehicle visualization, and AI-powered pricing algorithms to provide transparent and accurate valuations. Furthermore, there's a growing emphasis on offering certified pre-owned programs with extended warranties and roadside assistance, mimicking the confidence typically associated with new car purchases. Performance metrics being highlighted include vehicle condition reports, mileage accuracy, and the availability of comprehensive service histories. Unique selling propositions often revolve around the meticulous refurbishment of vehicles, ensuring they meet stringent quality standards, and the provision of tailored financing and insurance packages directly through online portals, making the entire transaction seamless and efficient.

Propelling Factors for Switzerland Used Car Market Growth

Several key factors are propelling the growth of the Switzerland Used Car Market. Technologically, the widespread adoption of online car marketplaces and digital tools has significantly enhanced transparency and accessibility, simplifying the buying and selling process. Economically, the affordability of used cars compared to new vehicles, coupled with rising inflation and new car prices, makes pre-owned options more attractive for a broader consumer base. Regulatory influences, while sometimes creating challenges, also indirectly support the used car market by encouraging the resale of compliant and well-maintained vehicles. For example, stricter emissions standards for new vehicles can increase demand for newer used cars that meet these criteria. The increasing availability of certified pre-owned programs from manufacturers also builds consumer confidence.

Obstacles in the Switzerland Used Car Market Market

Despite its growth, the Switzerland Used Car Market faces several obstacles. Regulatory challenges can arise from evolving emissions standards that might devalue older vehicles or require specific compliance checks for resale. Supply chain disruptions, though less pronounced than for new cars, can still impact the availability of certain popular models or replacement parts, leading to price fluctuations. Competitive pressures are significant, not only from other used car dealers but also from the burgeoning new car subscription models and the expanding used car market in neighboring countries. Quantifiable impacts include potential delays in inventory replenishment and the need for continuous adaptation of pricing strategies to remain competitive. The perceived risk associated with buying a used car, despite improved transparency, also remains a barrier for some consumers.

Future Opportunities in Switzerland Used Car Market

Future opportunities in the Switzerland Used Car Market lie in several key areas. The rapidly growing demand for electric and hybrid used vehicles presents a significant avenue for growth, with an increasing supply of off-lease and trade-in EVs. The expansion of digital sales channels, incorporating enhanced virtual reality (VR) and AI-driven customer support, offers a chance to reach a wider audience and streamline the online buying experience. Furthermore, the development of innovative financing and leasing models specifically tailored for the used car segment could unlock new customer bases. Opportunities also exist in offering value-added services such as comprehensive vehicle history reporting and extended warranty packages that address consumer concerns about pre-owned vehicle reliability.

Major Players in the Switzerland Used Car Market Ecosystem

- AMAG Automobil und Motoren AG

- ALD Automotive

- Emil Frey AG

- Automobili Pininfarina Zurich

- CAR FOR YOU AG

- ELSIB AUTOS

- Auto Kunz AG

- CARS FOR ALL

Key Developments in Switzerland Used Car Market Industry

- July 2023: Noviv Mobility AG entered into a collaboration with Zurich Insurance Group in Switzerland. This partnership enables the company to provide comprehensive insurance protection to its Business-to-Business (B2B) consumers.

- March 2023: Emil Frey AG joined forces with iptiQ, a prominent business-to-business (B2B) digital insurer, to introduce a digital insurance solution called Emily Frey Protect. This strategic move offers insurance services for both new and used car buyers.

Strategic Switzerland Used Car Market Market Forecast

The strategic forecast for the Switzerland Used Car Market points towards sustained growth, driven by an increasing consumer appetite for cost-effective and sustainable mobility solutions. The expanding supply of nearly-new and certified pre-owned electric vehicles, coupled with the continuous refinement of digital sales platforms, will be key growth catalysts. The market is poised to benefit from technological integrations that enhance transparency and customer confidence, such as advanced vehicle diagnostics and virtual showrooms. Furthermore, the evolving economic landscape and a growing environmental consciousness among consumers will continue to favor the pre-owned vehicle sector, presenting significant opportunities for market expansion and innovation in the coming years.

Switzerland Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Switzerland Used Car Market Segmentation By Geography

- 1. Switzerland

Switzerland Used Car Market Regional Market Share

Geographic Coverage of Switzerland Used Car Market

Switzerland Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decline in New Car Sales

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Rising Trend of Digitalization to Enhance the Growth of Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AMAG Automobil und Motoren AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALD Automotive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emil Frey Ag

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Automobili Pininfarina Zuric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CAR FOR YOU AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ELSIB AUTOS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Auto Kunz AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CARS FOR ALL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AMAG Automobil und Motoren AG

List of Figures

- Figure 1: Switzerland Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Switzerland Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Switzerland Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Switzerland Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Switzerland Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Switzerland Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Switzerland Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Switzerland Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Switzerland Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Used Car Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Switzerland Used Car Market?

Key companies in the market include AMAG Automobil und Motoren AG, ALD Automotive, Emil Frey Ag, Automobili Pininfarina Zuric, CAR FOR YOU AG, ELSIB AUTOS, Auto Kunz AG, CARS FOR ALL.

3. What are the main segments of the Switzerland Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Decline in New Car Sales.

6. What are the notable trends driving market growth?

Rising Trend of Digitalization to Enhance the Growth of Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

July 2023: Noviv Mobility AG entered into a collaboration with Zurich Insurance Group in Switzerland. This partnership enables the company to provide comprehensive insurance protection to its Business-to-Business (B2B) consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Used Car Market?

To stay informed about further developments, trends, and reports in the Switzerland Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence