Key Insights

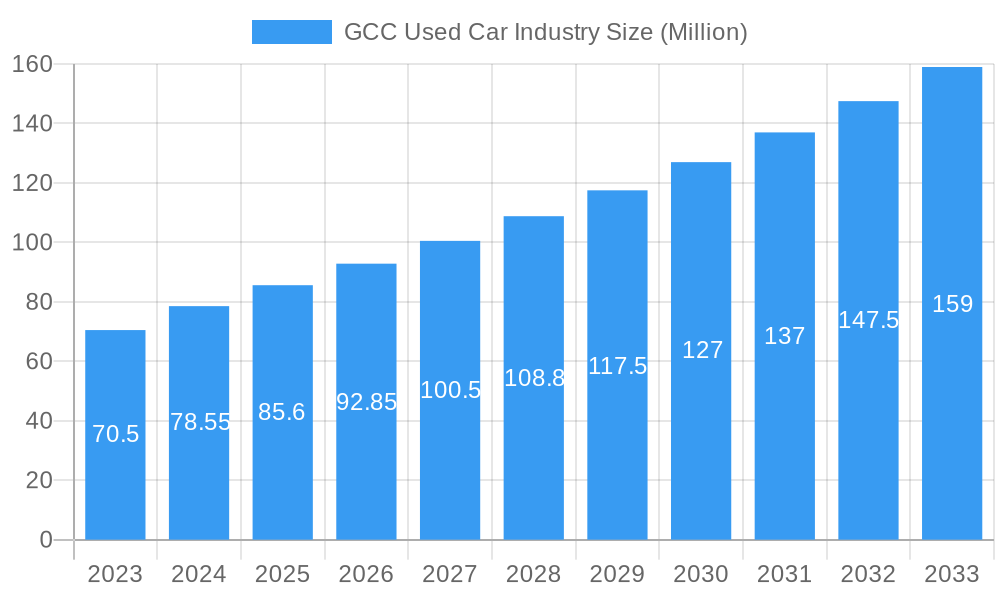

The GCC Used Car Industry is experiencing robust growth, projected to reach a significant market size of $78.55 billion in 2024. This expansion is driven by a confluence of factors, including increasing disposable incomes, a strong preference for value-for-money purchases, and evolving consumer behaviors influenced by digital platforms. The market is further bolstered by a robust CAGR of 8.11%, indicating sustained and dynamic expansion over the forecast period. Key market drivers include the growing demand for affordable mobility solutions, the increasing availability of certified pre-owned vehicles offering greater trust and reliability, and supportive government initiatives promoting vehicle ownership and the automotive sector. The burgeoning online sales channels, coupled with the convenience and transparency they offer, are significantly reshaping the landscape, making pre-owned vehicles more accessible to a wider demographic.

GCC Used Car Industry Market Size (In Million)

The market is segmented across various vehicle types, including popular Hatchbacks, Sedans, SUVs, and MUVs, catering to diverse consumer needs and preferences. Both organized and unorganized vendor types play a crucial role in market dynamics, with organized players increasingly focusing on enhanced customer experience and certified pre-owned programs. The increasing penetration of online sales channels is a dominant trend, simplifying the buying and selling process and expanding geographical reach. While growth is strong, potential restraints such as fluctuating economic conditions, evolving emission regulations that could impact older vehicles, and the need for standardized vehicle inspection and certification processes could pose challenges. However, the inherent affordability and widespread appeal of used cars across the GCC region, coupled with continuous innovation in digital platforms and dealer services, are expected to ensure the industry's upward trajectory.

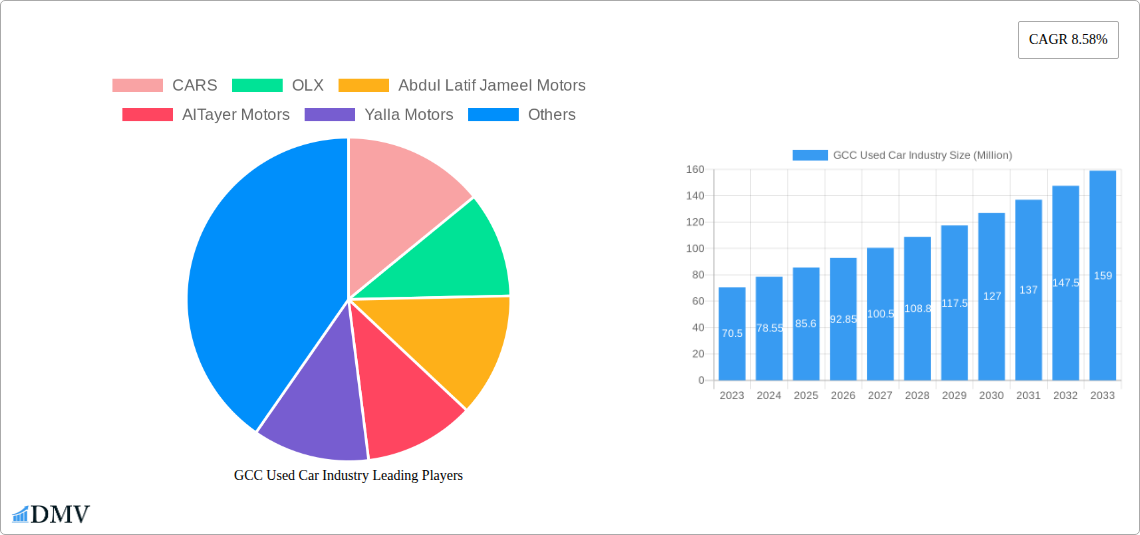

GCC Used Car Industry Company Market Share

GCC Used Car Industry: Market Analysis, Trends, and Future Forecast (2019–2033)

This comprehensive report delves deep into the burgeoning GCC Used Car Industry, a dynamic market projected for substantial growth and transformation. Analyze the competitive landscape, technological innovations, regulatory frameworks, and consumer behaviors that are shaping the pre-owned car market in the Middle East. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers invaluable insights for stakeholders seeking to capitalize on the GCC automotive aftermarket opportunities.

GCC Used Car Industry Market Composition & Trends

The GCC Used Car Industry is characterized by a moderately concentrated market, with a few dominant players and a significant number of unorganized vendors. Innovation is primarily driven by advancements in online sales platforms and enhanced vehicle inspection technologies. Regulatory landscapes are gradually evolving, with governments in countries like the UAE and Saudi Arabia introducing measures to standardize the pre-owned car sector. Substitute products, such as new cars and ride-sharing services, exert moderate pressure, but the affordability and accessibility of used vehicles continue to drive demand. End-user profiles are diverse, ranging from budget-conscious individuals to those seeking premium pre-owned luxury vehicles. Mergers and acquisitions (M&A) activities are on the rise as organized players seek to consolidate market share and enhance operational efficiencies. M&A deal values are estimated to reach over $500 million during the forecast period. The market share distribution indicates that organized vendors are steadily increasing their presence, projected to capture over 40% of the market by 2028.

- Market Concentration: Moderately concentrated with evolving market share.

- Innovation Catalysts: Digitalization of sales, advanced vehicle diagnostics, financing solutions.

- Regulatory Landscape: Increasing standardization, consumer protection initiatives.

- Substitute Products: New vehicles, ride-sharing, public transportation.

- End-User Profiles: Diverse, including first-time buyers, families, luxury car enthusiasts.

- M&A Activities: Growing consolidation, strategic partnerships.

- Market Share Distribution: Organized vendors projected to gain significant traction.

GCC Used Car Industry Industry Evolution

The GCC Used Car Industry has witnessed remarkable evolution, transitioning from a predominantly informal sector to a more organized and tech-driven market. Throughout the historical period (2019–2024), the market experienced a steady annual growth rate of approximately 7%, fueled by increasing disposable incomes and a growing preference for value-for-money automotive solutions. Technological advancements have been a pivotal force, with the proliferation of online platforms like OLX, Yalla Motors, and Dubizzle Motors LLC revolutionizing the way consumers buy and sell pre-owned vehicles. These platforms have enhanced transparency, improved accessibility, and streamlined the transaction process, leading to a significant surge in online sales channels. The estimated year of 2025 marks a significant inflection point, with the market projected to reach a valuation of over $15 billion. The forecast period (2025–2033) anticipates an accelerated growth trajectory, with an average annual growth rate of 8.5%, driven by factors such as expanding urbanization, a growing expatriate population, and the increasing availability of certified pre-owned vehicles from major dealerships like Abdul Latif Jameel Motors, AlTayer Motors, and Al-Futtaim Group. Shifting consumer demands are evident, with a growing appreciation for vehicle history reports, professional inspections, and extended warranty options, all of which contribute to increased consumer confidence in the pre-owned segment. The adoption of AI-powered pricing tools and virtual car showrooms is also on the rise, further enhancing the customer experience and market efficiency.

Leading Regions, Countries, or Segments in GCC Used Car Industry

The GCC Used Car Industry is experiencing significant dominance from specific regions and segments, driven by distinct economic and demographic factors.

Dominant Region: The United Arab Emirates (UAE) stands out as the leading region within the GCC for the used car market. This leadership is underpinned by several key drivers:

- High Expatriate Population: A large and diverse expatriate population with varying income levels creates a consistent demand for affordable and reliable pre-owned vehicles.

- Strong Automotive Culture: The UAE boasts a robust automotive culture, with a high per capita vehicle ownership rate, leading to a steady influx of used cars into the market.

- Advanced Infrastructure: Well-developed road networks, efficient logistics, and a mature e-commerce ecosystem facilitate seamless transactions and vehicle movement.

- Regulatory Support: The UAE has been proactive in establishing frameworks for vehicle inspection, certification, and consumer protection, building trust in the used car market.

- Investment Trends: Significant investment from organized players like Al-Futtaim Group and Al Nabooda Automobiles LLC in digital platforms and dealership networks further bolsters the UAE's market position.

Within the UAE and the broader GCC, certain vehicle types and sales channels are experiencing particularly strong growth. SUVs consistently lead in terms of popularity and sales volume, reflecting consumer preferences for larger, versatile vehicles. The online sales channel is rapidly gaining traction, challenging traditional offline methods, with platforms like CARS and Dubizzle Motors LLC witnessing exponential user engagement. While organized vendors are expanding their reach, the unorganized vendor segment still holds a considerable share, particularly for budget-conscious buyers. However, the trend is shifting towards greater reliance on organized vendors for assurance and specialized services.

Key Drivers for Dominance:

- Investment Trends: Continuous investment in digital infrastructure and dealership expansion by major automotive groups.

- Regulatory Support: Government initiatives promoting transparency and consumer safety in used car transactions.

- Consumer Preferences: High demand for SUVs and a growing acceptance of online purchasing channels.

- Economic Factors: Favorable economic conditions and a large consumer base seeking value.

GCC Used Car Industry Product Innovations

Product innovations in the GCC Used Car Industry are primarily focused on enhancing transparency, trust, and customer convenience. Digital platforms are introducing advanced vehicle inspection reports with detailed condition assessments and high-resolution imagery. The integration of blockchain technology for immutable vehicle history records is a nascent but promising development. Virtual showrooms and augmented reality (AR) tools are emerging, allowing potential buyers to explore vehicles remotely. Performance metrics are improving through sophisticated AI-driven pricing algorithms that provide real-time market valuations, ensuring fair pricing for both buyers and sellers. Unique selling propositions include the availability of certified pre-owned (CPO) programs offering extended warranties and pre-purchase inspections, significantly boosting consumer confidence in the pre-owned segment.

Propelling Factors for GCC Used Car Industry Growth

The GCC Used Car Industry is propelled by several compelling factors. Economically, the increasing affordability of pre-owned vehicles appeals to a broad spectrum of consumers, especially in a region with significant expatriate populations. Technologically, the rapid adoption of online marketplaces and digital tools has revolutionized the buying and selling process, making it more convenient and transparent. Regulatory advancements are also playing a crucial role, with governments implementing measures to enhance consumer protection and standardize the industry, fostering greater trust. Furthermore, the growing demand for SUVs and a preference for value-driven purchases contribute significantly to market expansion.

Obstacles in the GCC Used Car Industry Market

Despite its growth, the GCC Used Car Industry faces several obstacles. Regulatory challenges, though decreasing, still include inconsistencies in consumer protection laws across different GCC countries. Supply chain disruptions, exacerbated by global events, can impact the availability of desirable used car models. Intense competitive pressures from both organized and unorganized players can lead to price wars and reduced profit margins. Furthermore, residual concerns about vehicle history and the authenticity of advertised conditions can deter some potential buyers, leading to a quantifiable impact on market penetration.

Future Opportunities in GCC Used Car Industry

The GCC Used Car Industry is ripe with future opportunities. The expanding digital landscape presents avenues for enhanced online sales models, including subscription-based pre-owned car services and seamless integration of financing and insurance. Emerging markets within the GCC, such as Saudi Arabia, are showing immense potential for growth as their economies diversify. Technological advancements like AI-powered vehicle valuation tools and predictive maintenance analytics offer opportunities for increased efficiency and customer satisfaction. Furthermore, the growing consumer trend towards sustainability and responsible consumption favors the pre-owned car market.

Major Players in the GCC Used Car Industry Ecosystem

- CARS

- OLX

- Abdul Latif Jameel Motors

- AlTayer Motors

- Yalla Motors

- Dubizzle Motors LLC

- Al-Futtaim Group

- Arabian Auto Agency

- Al Nabooda Automobiles LLC

Key Developments in GCC Used Car Industry Industry

- 2023 May: Launch of enhanced vehicle inspection and certification program by Al-Futtaim Group to boost consumer confidence.

- 2023 October: OLX reports a 25% increase in used car listings and sales inquiries across the GCC.

- 2024 February: Yalla Motors introduces AI-powered virtual car tours for its online inventory.

- 2024 June: Dubizzle Motors LLC partners with local financial institutions to offer integrated financing solutions for used car buyers.

- 2024 September: Abdul Latif Jameel Motors expands its certified pre-owned vehicle program across multiple GCC countries.

- 2025 January: Expected regulatory updates in Saudi Arabia to standardize used car sales and import processes.

- 2025 Q2: Projected increase in M&A activity as larger players consolidate their market presence.

Strategic GCC Used Car Industry Market Forecast

The strategic forecast for the GCC Used Car Industry is exceptionally positive, projecting robust growth driven by increasing digitalization and a sustained demand for affordable automotive solutions. Key growth catalysts include the ongoing expansion of online sales channels, the increasing adoption of certified pre-owned programs, and favorable economic conditions across the region. The market potential is significant, with opportunities for innovation in areas such as transparent vehicle history reporting and integrated digital financing. The industry is poised for further consolidation and technological advancement, ensuring a dynamic and expanding pre-owned car market in the Middle East.

GCC Used Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV and MUV

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

-

3. Vendor Type

- 3.1. Organized

- 3.2. Unorganized

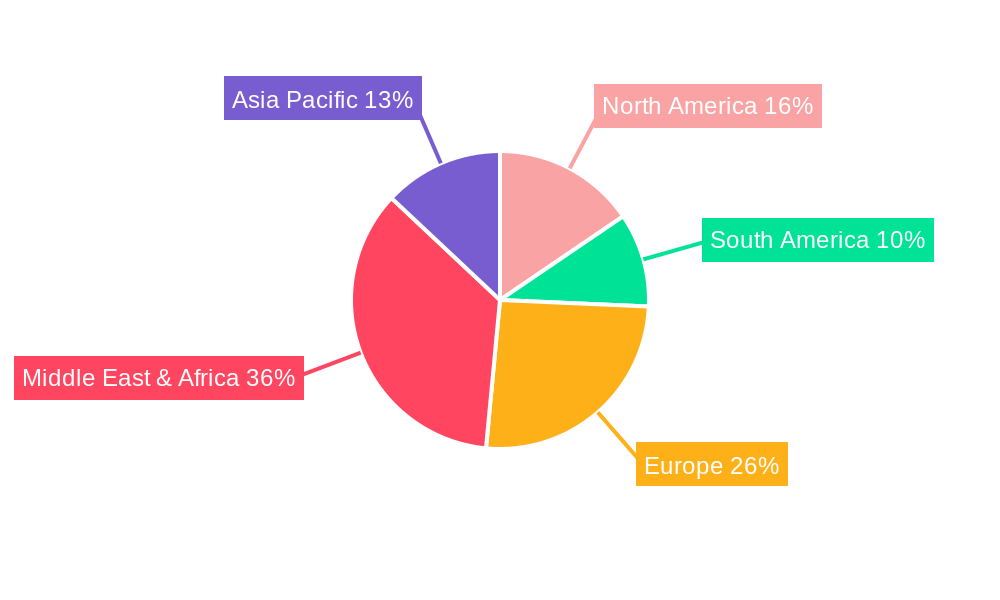

GCC Used Car Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Used Car Industry Regional Market Share

Geographic Coverage of GCC Used Car Industry

GCC Used Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Luxury Cars is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Comparatively Limited Market Transparency May Hinder the Market

- 3.4. Market Trends

- 3.4.1. Hatchback Segment is Expected to Gain Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV and MUV

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchback

- 6.1.2. Sedan

- 6.1.3. SUV and MUV

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Vendor Type

- 6.3.1. Organized

- 6.3.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchback

- 7.1.2. Sedan

- 7.1.3. SUV and MUV

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Vendor Type

- 7.3.1. Organized

- 7.3.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchback

- 8.1.2. Sedan

- 8.1.3. SUV and MUV

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Vendor Type

- 8.3.1. Organized

- 8.3.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchback

- 9.1.2. Sedan

- 9.1.3. SUV and MUV

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Vendor Type

- 9.3.1. Organized

- 9.3.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific GCC Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchback

- 10.1.2. Sedan

- 10.1.3. SUV and MUV

- 10.2. Market Analysis, Insights and Forecast - by Sales Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Vendor Type

- 10.3.1. Organized

- 10.3.2. Unorganized

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CARS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OLX

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abdul Latif Jameel Motors

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AlTayer Motors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yalla Motors

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dubizzle Motors LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al-Futtaim Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arabian Auto Agency*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Nabooda Automobiles LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CARS

List of Figures

- Figure 1: Global GCC Used Car Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America GCC Used Car Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America GCC Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America GCC Used Car Industry Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 5: North America GCC Used Car Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America GCC Used Car Industry Revenue (undefined), by Vendor Type 2025 & 2033

- Figure 7: North America GCC Used Car Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 8: North America GCC Used Car Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America GCC Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Used Car Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: South America GCC Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America GCC Used Car Industry Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 13: South America GCC Used Car Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: South America GCC Used Car Industry Revenue (undefined), by Vendor Type 2025 & 2033

- Figure 15: South America GCC Used Car Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 16: South America GCC Used Car Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America GCC Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Used Car Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 19: Europe GCC Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe GCC Used Car Industry Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 21: Europe GCC Used Car Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 22: Europe GCC Used Car Industry Revenue (undefined), by Vendor Type 2025 & 2033

- Figure 23: Europe GCC Used Car Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 24: Europe GCC Used Car Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe GCC Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Used Car Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa GCC Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa GCC Used Car Industry Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 29: Middle East & Africa GCC Used Car Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Middle East & Africa GCC Used Car Industry Revenue (undefined), by Vendor Type 2025 & 2033

- Figure 31: Middle East & Africa GCC Used Car Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 32: Middle East & Africa GCC Used Car Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Used Car Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific GCC Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific GCC Used Car Industry Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 37: Asia Pacific GCC Used Car Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 38: Asia Pacific GCC Used Car Industry Revenue (undefined), by Vendor Type 2025 & 2033

- Figure 39: Asia Pacific GCC Used Car Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 40: Asia Pacific GCC Used Car Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Used Car Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 3: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 4: Global GCC Used Car Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 7: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 8: Global GCC Used Car Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 14: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 15: Global GCC Used Car Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 21: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 22: Global GCC Used Car Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 34: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 35: Global GCC Used Car Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Used Car Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global GCC Used Car Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 44: Global GCC Used Car Industry Revenue undefined Forecast, by Vendor Type 2020 & 2033

- Table 45: Global GCC Used Car Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Used Car Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Used Car Industry?

The projected CAGR is approximately 8.05%.

2. Which companies are prominent players in the GCC Used Car Industry?

Key companies in the market include CARS, OLX, Abdul Latif Jameel Motors, AlTayer Motors, Yalla Motors, Dubizzle Motors LLC, Al-Futtaim Group, Arabian Auto Agency*List Not Exhaustive, Al Nabooda Automobiles LLC.

3. What are the main segments of the GCC Used Car Industry?

The market segments include Vehicle Type, Sales Channel, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Luxury Cars is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

Hatchback Segment is Expected to Gain Traction.

7. Are there any restraints impacting market growth?

Comparatively Limited Market Transparency May Hinder the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Used Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Used Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Used Car Industry?

To stay informed about further developments, trends, and reports in the GCC Used Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence