Key Insights

The Italian automotive adaptive lighting system market is projected for significant growth, expected to reach $2.9 billion by 2024, with a CAGR of 8.7% through 2033. This expansion is driven by rising consumer demand for advanced safety and driving experience features, alongside government mandates for enhanced road safety. The adoption of sophisticated technologies like LED and matrix headlights, offering superior illumination and adaptability, is a key factor. The increasing popularity of premium and sports vehicle segments, early adopters of these technologies, also contributes substantially. The transition to electric vehicles (EVs), which often integrate advanced lighting systems, further supports market development.

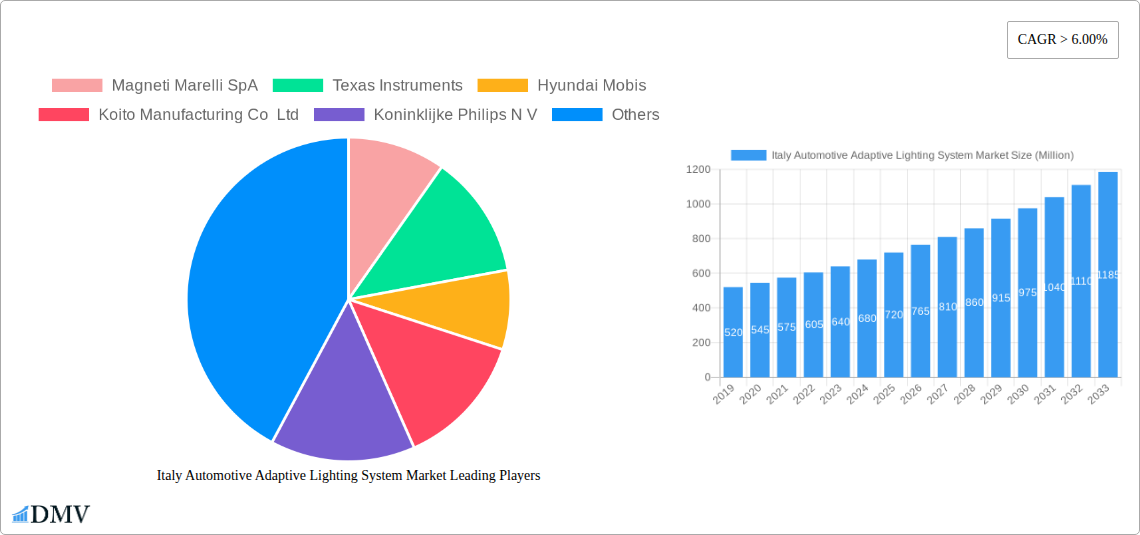

Italy Automotive Adaptive Lighting System Market Market Size (In Billion)

Emerging trends, including the integration of artificial intelligence (AI) and sensor technologies for predictive lighting adjustments and improved pedestrian detection, are shaping the market's future. The aftermarket segment is also anticipated to grow as vehicle owners seek to upgrade existing lighting systems. Potential challenges include the high initial cost and integration complexity of some adaptive lighting technologies, which may impact mass adoption in lower-tier segments. Nevertheless, ongoing innovation, decreasing component costs, and growing consumer awareness of safety benefits are expected to drive sustained market expansion in Italy.

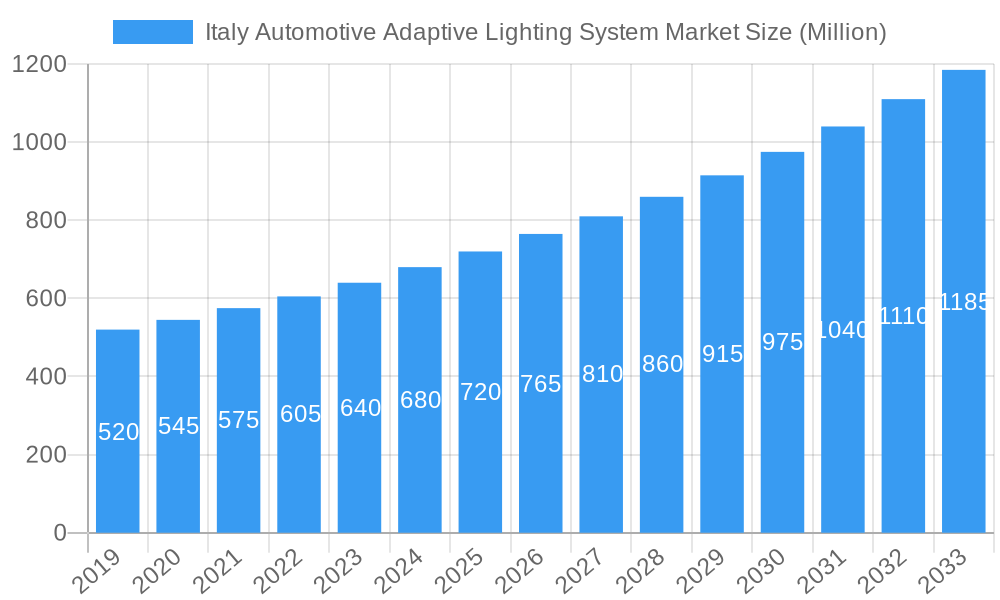

Italy Automotive Adaptive Lighting System Market Company Market Share

This report offers a comprehensive analysis of the Italian automotive adaptive lighting system market, a dynamic sector fueled by technological advancements and increasing demand for superior safety and driving experiences. Discover market dynamics, key players, product innovations, and future growth prospects for adaptive driving beam, matrix LED, smart headlights, and intelligent lighting systems in Italy. Our analysis covers the historical period from 2019 to 2024, with 2024 as the base year, and forecasts up to 2033.

Italy Automotive Adaptive Lighting System Market Market Composition & Trends

The Italy Automotive Adaptive Lighting System market exhibits a moderate level of concentration, with a few key players dominating the landscape while a growing number of emerging companies contribute to innovation. Major catalysts for market growth include stringent automotive safety regulations, the increasing adoption of premium and mid-segment passenger vehicles, and a strong consumer preference for advanced automotive features that enhance visibility and driving comfort. Substitute products, primarily traditional halogen and basic LED lighting systems, are gradually being phased out as manufacturers integrate more sophisticated adaptive lighting solutions. End-user profiles span across discerning car owners seeking enhanced safety and aesthetic appeal, as well as fleet operators aiming to reduce accidents and improve operational efficiency. Mergers and acquisitions (M&A) are expected to play a significant role in market consolidation, with potential deal values estimated in the hundreds of millions of Euros as companies seek to expand their technological capabilities and market reach. The market share distribution is influenced by factors such as technological expertise, patent portfolios, and established supply chain partnerships within the Italian automotive ecosystem.

Italy Automotive Adaptive Lighting System Market Industry Evolution

The Italy Automotive Adaptive Lighting System market has witnessed remarkable evolution, driven by a confluence of technological breakthroughs and evolving consumer expectations. Over the historical period (2019-2024), we observed a steady upward trajectory in the adoption of advanced lighting technologies, moving beyond conventional illumination to sophisticated systems that dynamically adjust to driving conditions. The introduction of adaptive driving beam technology, capable of intelligently illuminating the road ahead without dazzling oncoming traffic, marked a significant milestone. This was further bolstered by the growing integration of matrix LED and intelligent lighting systems, offering unparalleled customization and responsiveness.

Technological advancements, particularly in the realm of sensors, microprocessors, and LED chip efficiency, have been instrumental in this evolution. The base year of 2025 positions the market at a critical juncture, with increasing penetration of these advanced systems across various vehicle segments. The forecast period (2025-2033) is poised for accelerated growth, fueled by innovations like laser headlights and augmented reality integration within lighting systems. Consumer demand is increasingly shifting towards enhanced safety features, with adaptive lighting systems being recognized as a key differentiator in new vehicle purchases. Studies indicate a significant uptick in consumer willingness to pay a premium for advanced lighting solutions, driven by their perceived benefits in reducing accident risks, especially during nighttime driving and in adverse weather conditions.

The market growth trajectory is further supported by the development of sophisticated software algorithms that manage the complex interplay of light beams. These algorithms are becoming more refined, enabling quicker response times and more precise control, thereby enhancing the overall driving experience. Adoption metrics are projected to climb consistently, with a substantial portion of new vehicle production in Italy expected to feature some form of adaptive lighting system by the end of the forecast period. This widespread adoption is not only a testament to technological maturity but also reflects a proactive response from the automotive industry to meet and exceed evolving safety standards and consumer desires for a more intelligent and secure driving environment. The continued investment in research and development by leading automotive lighting manufacturers is a crucial factor in this ongoing industry evolution, promising even more groundbreaking innovations in the coming years.

Leading Regions, Countries, or Segments in Italy Automotive Adaptive Lighting System Market

The Italy Automotive Adaptive Lighting System market is characterized by distinct segment dominance and regional influence. Within the Vehicle Type segmentation, Premium Vehicles are currently leading the adoption of adaptive lighting systems, driven by higher disposable incomes and a greater demand for cutting-edge automotive technology. These vehicles often come equipped with the most advanced smart headlights and intelligent lighting systems as standard features, showcasing the latest innovations in adaptive driving beam and matrix LED technologies. The market share for premium vehicles is substantial, reflecting their role as trendsetters in the automotive industry.

However, the Mid-Segment Passenger Vehicles segment is exhibiting the most significant growth potential. As manufacturing costs decrease and technological integration becomes more streamlined, adaptive lighting systems are increasingly being offered as optional upgrades or even standard on higher trim levels of popular mid-segment models. This expansion is a key driver for overall market growth, making advanced lighting more accessible to a broader consumer base. Sports Cars, while representing a smaller niche, also contribute to the market, often featuring highly specialized and performance-oriented adaptive lighting solutions that enhance both aesthetics and functionality.

In terms of Type, Front lighting systems, encompassing headlights and daytime running lights, hold the largest market share. This is primarily due to their crucial role in illumination and safety during all driving conditions. The development and implementation of adaptive driving beam and matrix LED technologies are most prevalent in front lighting. Rear lighting systems are also important, focusing on indicators, brake lights, and taillights, with growing integration of dynamic signaling and adaptive brake light functions.

Analyzing the Sales Channel Type, the OEM (Original Equipment Manufacturer) channel is overwhelmingly dominant. The integration of adaptive lighting systems is typically decided during the vehicle design and manufacturing phase. Auto manufacturers partner directly with lighting system suppliers to incorporate these technologies into their new vehicle production lines. The Aftermarket segment, while smaller, is gradually growing as consumers seek to upgrade existing vehicles with newer, more advanced lighting solutions or replace damaged components. Investment trends in the OEM segment are robust, driven by automakers' commitment to incorporating advanced safety and convenience features. Regulatory support, particularly from EU directives promoting enhanced automotive safety, directly influences the mandatory or optional inclusion of such technologies, further solidifying the dominance of the OEM channel.

Italy Automotive Adaptive Lighting System Market Product Innovations

Recent product innovations in the Italy Automotive Adaptive Lighting System market are revolutionizing automotive illumination. Manufacturers are increasingly developing compact and energy-efficient matrix LED modules capable of creating highly defined light patterns, significantly improving visibility without causing glare. Furthermore, the integration of AI-powered algorithms allows for predictive adaptive lighting, anticipating road curvature and potential hazards. Applications extend beyond basic illumination, with systems now capable of projecting warnings onto the road surface and assisting drivers with navigation cues. Performance metrics are continuously improving, with faster response times, wider beam angles, and enhanced durability under extreme weather conditions. The unique selling propositions lie in the enhanced safety, improved driving comfort, and the personalized driving experience offered by these advanced solutions.

Propelling Factors for Italy Automotive Adaptive Lighting System Market Growth

The Italy Automotive Adaptive Lighting System market is propelled by a robust set of factors. Technologically, the continuous miniaturization and increased efficiency of LED and laser lighting components, coupled with advancements in sensor technology and processing power, are enabling more sophisticated and cost-effective adaptive systems. Economically, the rising disposable incomes in Italy and the increasing consumer willingness to invest in premium automotive features that enhance safety and driving experience are significant drivers. Regulatory influences, such as stringent EU New Car Assessment Programme (NCAP) safety ratings that incentivize advanced driver-assistance systems (ADAS) including intelligent lighting, are playing a crucial role. The growing demand for vehicles equipped with these advanced features, particularly in the premium and mid-segment passenger vehicle categories, further fuels market expansion.

Obstacles in the Italy Automotive Adaptive Lighting System Market Market

Despite its promising growth, the Italy Automotive Adaptive Lighting System market faces several obstacles. Regulatory challenges, particularly the complexities and harmonization of international standards for adaptive lighting, can slow down widespread adoption. Supply chain disruptions, as witnessed in recent years, can impact the availability of critical components and increase manufacturing costs. Competitive pressures from both established global players and emerging regional manufacturers can lead to price volatility and affect profit margins. The initial high cost of sophisticated adaptive lighting systems can also act as a restraint, particularly for budget-conscious consumers and entry-level vehicle segments. Furthermore, the need for specialized knowledge in installation and maintenance for aftermarket solutions can limit their accessibility.

Future Opportunities in Italy Automotive Adaptive Lighting System Market

The Italy Automotive Adaptive Lighting System market presents several exciting future opportunities. The increasing adoption of electric vehicles (EVs) creates a fertile ground for integrated lighting solutions, as EVs offer greater design flexibility. The development of advanced sensor fusion technologies, combining cameras, lidar, and radar, will enable even more intelligent and proactive adaptive lighting systems. Emerging trends in augmented reality (AR) integration within vehicle lighting offer the potential for dynamic route guidance and hazard warnings projected directly onto the road. Expansion into the commercial vehicle segment, with adaptive lighting tailored for trucks and buses, represents a significant untapped market. Furthermore, the growing demand for personalization and customization in automotive interiors and exteriors will drive innovation in dynamic ambient lighting integrated with adaptive systems.

Major Players in the Italy Automotive Adaptive Lighting System Market Ecosystem

- Magneti Marelli SpA

- Texas Instruments

- Hyundai Mobis

- Koito Manufacturing Co Ltd

- Koninklijke Philips N V

- Osram

- HELLA KGaA Hueck & Co

- Stanley Electric Co Ltd

- Valeo Group

Key Developments in Italy Automotive Adaptive Lighting System Market Industry

- January 2024: Valeo Group unveils its latest generation of matrix LED headlights with enhanced glare-free technology, improving nighttime visibility for premium vehicles.

- November 2023: HELLA KGaA Hueck & Co announces strategic partnerships with key Italian automotive manufacturers to integrate its intelligent lighting solutions into upcoming vehicle models.

- July 2023: Osram introduces a new range of high-efficiency LED chips specifically designed for adaptive lighting systems, promising improved performance and reduced energy consumption.

- March 2023: Magneti Marelli SpA expands its research and development capabilities in adaptive lighting, focusing on AI-driven predictive lighting algorithms.

- December 2022: Koito Manufacturing Co Ltd showcases innovative laser lighting technology for automotive applications, offering a significant leap in illumination range and clarity.

- September 2022: Texas Instruments launches new processors optimized for automotive lighting control, enabling faster processing and more complex adaptive functions.

- April 2022: Hyundai Mobis demonstrates advancements in adaptive driving beam technology, focusing on seamless integration with autonomous driving systems.

- January 2022: Koninklijke Philips N V (Philips Automotive Lighting) introduces new adaptive taillight systems that dynamically adjust brake light intensity based on following vehicle proximity.

- October 2021: Stanley Electric Co Ltd announces increased production capacity for automotive LED components to meet the growing demand for adaptive lighting systems.

Strategic Italy Automotive Adaptive Lighting System Market Market Forecast

The Italy Automotive Adaptive Lighting System market is poised for substantial growth, driven by the persistent demand for enhanced automotive safety and the relentless pace of technological innovation. The forecast period anticipates a significant increase in the adoption of sophisticated adaptive driving beam, matrix LED, and intelligent lighting systems across a wider spectrum of vehicle types, including a strong penetration into mid-segment passenger vehicles. Key growth catalysts include ongoing advancements in LED and laser technology, supportive regulatory frameworks pushing for higher safety standards, and a clear consumer preference for premium automotive features. Strategic investments in research and development by major players, coupled with potential market consolidations through M&A, will further shape the competitive landscape. The market's trajectory indicates a future where adaptive lighting is not just a luxury but an integral component of modern automotive design, contributing significantly to road safety and the overall driving experience in Italy.

Italy Automotive Adaptive Lighting System Market Segmentation

-

1. Vehicle Type

- 1.1. Mid-Segment Passenger Vehicles

- 1.2. Sports Cars

- 1.3. Premium Vehicles

-

2. Type

- 2.1. Front

- 2.2. Rear

-

3. Sales Channel Type

- 3.1. OEM

- 3.2. Aftermarket

Italy Automotive Adaptive Lighting System Market Segmentation By Geography

- 1. Italy

Italy Automotive Adaptive Lighting System Market Regional Market Share

Geographic Coverage of Italy Automotive Adaptive Lighting System Market

Italy Automotive Adaptive Lighting System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Concerns About Road Safety And Government Lighting Requirements To Enhance Demand In The Market

- 3.3. Market Restrains

- 3.3.1. High Cost and Limited Penetration Rate

- 3.4. Market Trends

- 3.4.1. Incorporation of Sensors/ Camerais likely drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Automotive Adaptive Lighting System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Mid-Segment Passenger Vehicles

- 5.1.2. Sports Cars

- 5.1.3. Premium Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front

- 5.2.2. Rear

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magneti Marelli SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Mobis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koito Manufacturing Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke Philips N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HELLA KGaAHueck& Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stanley Electric Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valeo Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Magneti Marelli SpA

List of Figures

- Figure 1: Italy Automotive Adaptive Lighting System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Automotive Adaptive Lighting System Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Italy Automotive Adaptive Lighting System Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Automotive Adaptive Lighting System Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Italy Automotive Adaptive Lighting System Market?

Key companies in the market include Magneti Marelli SpA, Texas Instruments, Hyundai Mobis, Koito Manufacturing Co Ltd, Koninklijke Philips N V, Osram, HELLA KGaAHueck& Co, Stanley Electric Co Ltd, Valeo Group.

3. What are the main segments of the Italy Automotive Adaptive Lighting System Market?

The market segments include Vehicle Type, Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concerns About Road Safety And Government Lighting Requirements To Enhance Demand In The Market.

6. What are the notable trends driving market growth?

Incorporation of Sensors/ Camerais likely drive the Market.

7. Are there any restraints impacting market growth?

High Cost and Limited Penetration Rate.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Automotive Adaptive Lighting System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Automotive Adaptive Lighting System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Automotive Adaptive Lighting System Market?

To stay informed about further developments, trends, and reports in the Italy Automotive Adaptive Lighting System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence