Key Insights

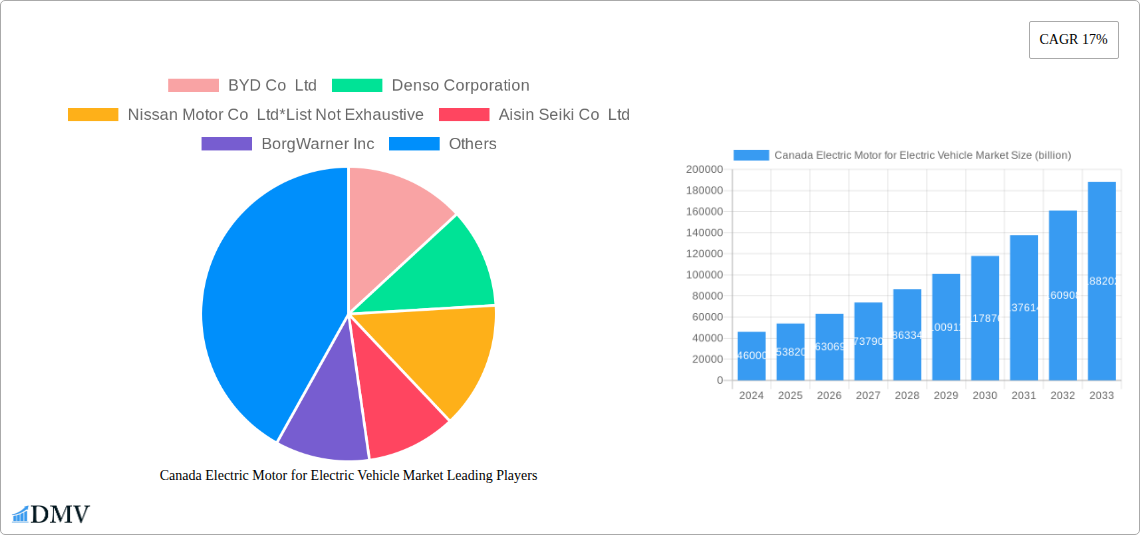

The Canadian electric motor market for electric vehicles (EVs) is experiencing robust growth, propelled by strong government incentives, increasing consumer demand for sustainable transportation, and a rapidly expanding EV charging infrastructure. The market size for electric motors in Canadian EVs is estimated to be USD 46 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 17% during the forecast period of 2025-2033. This significant expansion is primarily driven by the accelerating adoption of Battery Electric Vehicles (BEVs), which are becoming increasingly popular due to their lower running costs and reduced environmental impact. Key players such as BYD Co. Ltd., Denso Corporation, and Tesla Inc. are at the forefront, innovating and expanding their production capabilities to meet this surging demand. The trend towards more powerful and efficient AC motors, alongside advancements in DC motor technology for specific EV applications, is also contributing to market dynamism.

Canada Electric Motor for Electric Vehicle Market Market Size (In Billion)

The Canadian EV motor market is segmented across various vehicle types, including passenger cars and commercial vehicles, reflecting the growing electrification of both personal and fleet transportation. Propulsion types like Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) all contribute to this expansion, with BEVs leading the charge. While the market is fueled by innovation and increasing EV sales, potential challenges include the fluctuating prices of raw materials crucial for motor production and the need for continuous technological advancements to improve motor efficiency and reduce manufacturing costs. Nevertheless, the overall outlook remains highly positive, with sustained investment in research and development and a strong governmental push for EV adoption underpinning this high-growth trajectory in Canada.

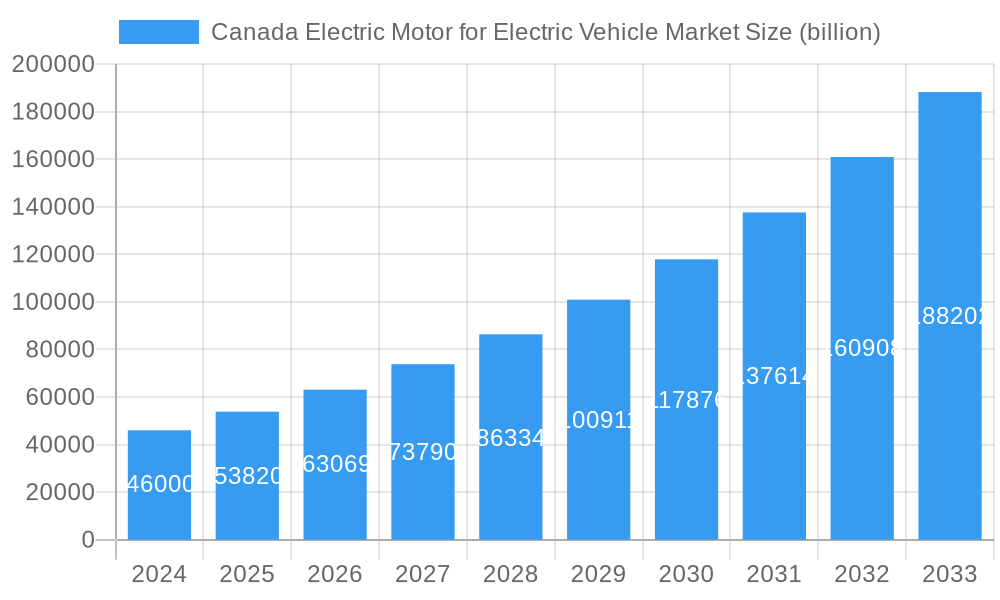

Canada Electric Motor for Electric Vehicle Market Company Market Share

This in-depth report delves into the dynamic Canada electric motor for electric vehicle market, providing a comprehensive outlook for stakeholders from 2019 to 2033. We meticulously analyze the market's composition, trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. The report offers strategic insights for electric vehicle (EV) manufacturers, electric motor suppliers, automotive component providers, and investors navigating this rapidly expanding sector. Our analysis is grounded in historical data from 2019–2024, with a base year of 2025 and forecasts extending to 2033.

Canada Electric Motor for Electric Vehicle Market Market Composition & Trends

The Canada electric motor for electric vehicle market is characterized by a moderate to high concentration, driven by significant innovation in electric powertrain technologies. Key innovation catalysts include advancements in motor efficiency, power density, and the integration of intelligent control systems. The regulatory landscape in Canada, with its strong push towards emission reduction and EV adoption targets, significantly shapes market dynamics, fostering demand for advanced electric motors. Substitute products, while evolving, primarily consist of internal combustion engine (ICE) components, with a diminishing threat as EV technology matures. End-user profiles are diverse, ranging from individual consumers seeking sustainable transportation to fleet operators prioritizing operational efficiency and reduced carbon footprints. Mergers and acquisitions (M&A) activities are anticipated to increase as major players seek to consolidate their market position and acquire cutting-edge technologies. M&A deal values are projected to reach several billion dollars as companies strategically expand their portfolios and capabilities in the Canadian EV motor sector. The market share distribution is influenced by technological leadership, manufacturing capacity, and strategic partnerships, with dominant players holding substantial portions of the market.

Canada Electric Motor for Electric Vehicle Market Industry Evolution

The Canada electric motor for electric vehicle market has witnessed a remarkable evolution, mirroring the global surge in electric mobility. From its nascent stages, the market has transitioned into a robust and dynamic ecosystem, driven by a confluence of technological breakthroughs, supportive government policies, and a growing consumer consciousness towards sustainability. Historically, the period from 2019–2024 saw foundational investments and early adoption of electric vehicles, laying the groundwork for widespread electrification. The base year, 2025, marks a pivotal point where the market is expected to gain significant momentum.

Technological advancements have been the bedrock of this evolution. The transition from traditional AC motors to more efficient and powerful DC motors, and subsequently to advanced AC induction and permanent magnet synchronous motors (PMSM), has been critical. These advancements have led to increased power density, improved energy efficiency, and enhanced performance, addressing key consumer concerns regarding range anxiety and charging times. The market has also seen the development of specialized motor types, such as switched reluctance motors, offering unique advantages in certain applications.

Shifting consumer demands have played an equally crucial role. As awareness of climate change and the benefits of electric vehicles grows, consumer preference has increasingly leaned towards cleaner, more sustainable transportation options. This demand surge has prompted automakers to expand their EV offerings across various segments, from passenger cars to commercial vehicles, thereby escalating the need for sophisticated and reliable electric motors. The adoption rates of Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) have steadily climbed, directly correlating with the demand for a diverse range of electric motor solutions.

The forecast period, 2025–2033, is poised to witness exponential growth. Projections indicate a compound annual growth rate (CAGR) of over 20% for the Canadian electric motor for EV market. This robust growth trajectory is fueled by ongoing research and development, further cost reductions in battery technology, and the continuous expansion of charging infrastructure. The increasing production volumes of EVs by major automotive players, coupled with the entry of new manufacturers, will further solidify the market's expansion. The industry's evolution is a testament to its adaptability and innovation, positioning Canada as a significant player in the global electric vehicle powertrain landscape. The estimated market size for electric motors in Canada for EVs is projected to reach approximately $8.5 billion by 2025, with substantial growth anticipated throughout the forecast period.

Leading Regions, Countries, or Segments in Canada Electric Motor for Electric Vehicle Market

Within the Canada electric motor for electric vehicle market, the Passenger Cars segment, propelled by Battery Electric Vehicles (BEVs), commands a dominant position. This segment's leadership is underpinned by a confluence of factors, including supportive government incentives, increasing consumer demand for personal mobility solutions with a lower environmental impact, and the expanding model availability from global automakers. The Propulsion Type landscape is heavily skewed towards BEVs, reflecting Canada's commitment to zero-emission vehicles. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) also contribute significantly, offering a transitional pathway for consumers and manufacturers alike, thereby maintaining a sustained demand for their respective electric motor requirements.

The dominance of Passenger Cars within the Vehicle Type segmentation is further amplified by the widespread adoption of AC Motors, particularly Permanent Magnet Synchronous Motors (PMSMs), which offer superior efficiency and power density crucial for passenger car performance and range. While Commercial Vehicles are a growing segment, their market share in terms of electric motor demand is currently secondary to passenger cars, though this is expected to change with advancements in heavy-duty EV technology and the electrification of logistics and public transport.

Key drivers for the leadership of Passenger Cars and BEVs include:

- Government Incentives and Regulations: Federal and provincial rebates, tax credits, and stringent emission standards actively encourage the purchase and production of electric passenger vehicles. This policy framework directly translates into increased demand for the electric motors that power them.

- Expanding Charging Infrastructure: The continuous build-out of public and private charging stations across Canada addresses range anxiety, a primary concern for passenger car adoption, thereby boosting sales and, consequently, motor demand.

- Automaker Product Portfolio Expansion: Major automotive manufacturers are prioritizing the launch of new electric passenger car models, ranging from compact cars to SUVs, directly increasing the demand for various types of electric motors.

- Consumer Awareness and Preference: A growing segment of Canadian consumers is actively seeking sustainable transportation, with passenger cars being the most accessible entry point for adopting EVs.

The Motor Type dominance of AC motors, especially PMSMs, is driven by their ability to deliver high torque at low speeds and high power at high speeds, essential for the dynamic performance expected from passenger cars. This technological advantage, combined with decreasing production costs, solidifies their leading position. While DC motors are still present in some applications, the trend is clearly towards more advanced AC motor technologies for optimal EV performance.

Canada Electric Motor for Electric Vehicle Market Product Innovations

Innovations in the Canada electric motor for electric vehicle market are rapidly enhancing performance and efficiency. Companies are developing next-generation AC motors with improved power density and reduced weight, leading to longer EV ranges and better acceleration. Applications are expanding beyond traditional powertrains to include integrated drive units that combine the motor, inverter, and gearbox for streamlined design and cost savings. Performance metrics like peak power output exceeding 300 kW and efficiencies of over 95% are becoming more common. Furthermore, advancements in thermal management systems and the use of novel magnetic materials are crucial for ensuring reliability and longevity in demanding Canadian climate conditions.

Propelling Factors for Canada Electric Motor for Electric Vehicle Market Growth

The Canada electric motor for electric vehicle market is experiencing robust growth driven by several interconnected factors. Government initiatives, including federal and provincial incentives for EV purchases and manufacturing, alongside stringent emissions regulations, are creating a favorable market environment. Technological advancements, such as improved motor efficiency, increased power density, and reduced manufacturing costs for components like rare-earth magnets, are making EVs more competitive and attractive. Furthermore, the expanding charging infrastructure across Canada alleviates range anxiety, encouraging greater consumer adoption of electric vehicles. The increasing commitment from major automotive manufacturers to electrify their lineups further fuels demand for electric motors. Economic factors, including the rising cost of fossil fuels and growing environmental awareness, also contribute to the sustained growth of this market.

Obstacles in the Canada Electric Motor for Electric Vehicle Market Market

Despite its promising trajectory, the Canada electric motor for electric vehicle market faces several obstacles. The initial higher purchase price of EVs compared to their internal combustion engine counterparts remains a barrier for some consumers, even with incentives. Supply chain disruptions, particularly for critical raw materials like rare-earth elements essential for high-performance motors, can lead to production delays and increased costs. The development and expansion of charging infrastructure, especially in remote or less populated areas, still require significant investment to ensure accessibility across the vast Canadian landscape. Furthermore, the need for specialized skills in manufacturing and maintenance of electric vehicle powertrains presents a workforce development challenge.

Future Opportunities in Canada Electric Motor for Electric Vehicle Market

Emerging opportunities in the Canada electric motor for electric vehicle market are substantial. The increasing demand for electric commercial vehicles, including trucks and buses, presents a significant growth avenue as companies aim to decarbonize their fleets. Advancements in battery technology, leading to higher energy density and faster charging capabilities, will further boost EV adoption and, consequently, motor demand. The development of innovative motor designs, such as axial flux motors, offering compact form factors and high power-to-weight ratios, opens new possibilities for vehicle integration. Furthermore, the growing interest in vehicle-to-grid (V2G) technology could create new applications for electric motors and their associated power electronics.

Major Players in the Canada Electric Motor for Electric Vehicle Market Ecosystem

- BYD Co Ltd

- Denso Corporation

- Nissan Motor Co Ltd

- Aisin Seiki Co Ltd

- BorgWarner Inc

- Tesla Inc

- Jing-Jin Electric Technologies Co Ltd

- BAIC Group

- Magna International Inc.

- Sona BLW Precision Forgings

Key Developments in Canada Electric Motor for Electric Vehicle Market Industry

- October 2022: Magna International Inc. announced the expansion of its 48 V hybrid clutch transmission system for Stellantis, including e-motors, further solidifying its presence in electrified powertrain solutions.

- April 2022: Sona BLW Precision Forgings announced a strategic partnership with Enedym Inc. to develop next-generation switched reluctance motors for electric vehicles, with a focus on innovation within Ontario, Canada.

Strategic Canada Electric Motor for Electric Vehicle Market Market Forecast

The strategic forecast for the Canada electric motor for electric vehicle market is overwhelmingly positive, driven by a sustained push towards electrification. Government policies and consumer demand for sustainable transportation will continue to be key growth catalysts. Advancements in motor technology, leading to more efficient, powerful, and cost-effective solutions, will further accelerate EV adoption across passenger and commercial vehicle segments. The expansion of charging infrastructure and ongoing investments in domestic manufacturing capabilities are expected to foster a resilient and expanding market. The market potential is immense, with electric motors forming the very heart of the ongoing automotive revolution in Canada.

Canada Electric Motor for Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion Type

- 2.1. Battery Electric Vehicle

- 2.2. Hybrid Electric Vehicle

- 2.3. Plug-in Hybrid Vehicle

-

3. Motor Type

- 3.1. AC Motor

- 3.2. DC Motor

Canada Electric Motor for Electric Vehicle Market Segmentation By Geography

- 1. Canada

Canada Electric Motor for Electric Vehicle Market Regional Market Share

Geographic Coverage of Canada Electric Motor for Electric Vehicle Market

Canada Electric Motor for Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Subsidies Help Boost Electric Rikshaw Sales in India

- 3.3. Market Restrains

- 3.3.1. Limited Charging Infrastructure and Range Anxiety May Hamper the Growth of Electric Rikshaw Sales in India

- 3.4. Market Trends

- 3.4.1. Rising Demand for Electric Vehicles to Propel the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Electric Motor for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicle

- 5.2.2. Hybrid Electric Vehicle

- 5.2.3. Plug-in Hybrid Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Motor Type

- 5.3.1. AC Motor

- 5.3.2. DC Motor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BYD Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nissan Motor Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aisin Seiki Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BorgWarner Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tesla Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jing-Jin Electric Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAIC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BYD Co Ltd

List of Figures

- Figure 1: Canada Electric Motor for Electric Vehicle Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Electric Motor for Electric Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 4: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 7: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 8: Canada Electric Motor for Electric Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Electric Motor for Electric Vehicle Market?

The projected CAGR is approximately 17%.

2. Which companies are prominent players in the Canada Electric Motor for Electric Vehicle Market?

Key companies in the market include BYD Co Ltd, Denso Corporation, Nissan Motor Co Ltd*List Not Exhaustive, Aisin Seiki Co Ltd, BorgWarner Inc, Tesla Inc, Jing-Jin Electric Technologies Co Ltd, BAIC Group.

3. What are the main segments of the Canada Electric Motor for Electric Vehicle Market?

The market segments include Vehicle Type, Propulsion Type, Motor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 46 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Subsidies Help Boost Electric Rikshaw Sales in India.

6. What are the notable trends driving market growth?

Rising Demand for Electric Vehicles to Propel the Market Growth.

7. Are there any restraints impacting market growth?

Limited Charging Infrastructure and Range Anxiety May Hamper the Growth of Electric Rikshaw Sales in India.

8. Can you provide examples of recent developments in the market?

October 2022: Magna International Inc. announced the expansion of its 48 V hybrid clutch transmission system for the Stellantis, including e-motors. Earlier, the company supplied these systems to the Fiat and Jeep models.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Electric Motor for Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Electric Motor for Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Electric Motor for Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Canada Electric Motor for Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence